India Lithium-ion Battery Market Outlook to 2028

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD3849

December 2024

94

About the Report

India Lithium-ion Battery Market Overview

- The India Lithium-ion Battery market is valued at approximately USD 4.2 billion, driven by the rapid adoption of electric vehicles (EVs), consumer electronics, and renewable energy storage systems. With the government's push towards reducing carbon emissions and promoting clean energy, the demand for Lithium-ion batteries has seen growth. Key initiatives, such as the National Electric Mobility Mission Plan (NEMMP) and the Production-Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) battery manufacturing, have played a pivotal role in boosting the market. The market has also benefitted from technological advancements in battery efficiency and increased energy density, further driving demand for high-performance batteries.

- In India, Western and Northern regions dominate the Lithium-ion battery market, primarily due to the high concentration of automotive and electronics manufacturing hubs. Cities like Pune, Bangalore, and Delhi have emerged as key players in driving demand for Lithium-ion batteries, strong industrial bases and supportive government policies promoting EV adoption. The availability of infrastructure, skilled workforce, and proximity to key industrial centers has solidified these regions as leaders in the market. Additionally, Gujarat has seen investment in battery manufacturing facilities, further cementing the regions role in the sector.

- The FAME II (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) scheme, introduced by the Indian government in 2019, has allocated 10,000 crore (approx. $1.4 billion) to promote electric vehicles (EVs). This funding has been utilized to provide subsidies for EV purchases, which includes support for battery-powered vehicles. As of 2023, over 780,000 EVs were registered under the scheme, with Lithium-ion batteries being the primary energy storage solution in these vehicles. FAME II has also extended its support to EV infrastructure, fostering the growth of charging stations, further driving the demand for Lithium-ion batteries.

India Lithium-ion Battery Market Segmentation

By Battery Type: India's Lithium-ion battery market is segmented by battery type into Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Iron Phosphate (LFP), Lithium Cobalt Oxide (LCO), and solid-state Lithium-ion batteries.

Among these, Lithium Nickel Manganese Cobalt Oxide (NMC) has gained a dominant market share due to its superior energy density, making it highly suited for electric vehicles. NMC batteries offer a balance between energy capacity and lifespan, which makes them a preferred choice for automotive applications. Additionally, the rising demand for longer-range EVs is pushing manufacturers to opt for NMC batteries as they provide enhanced performance over other types.

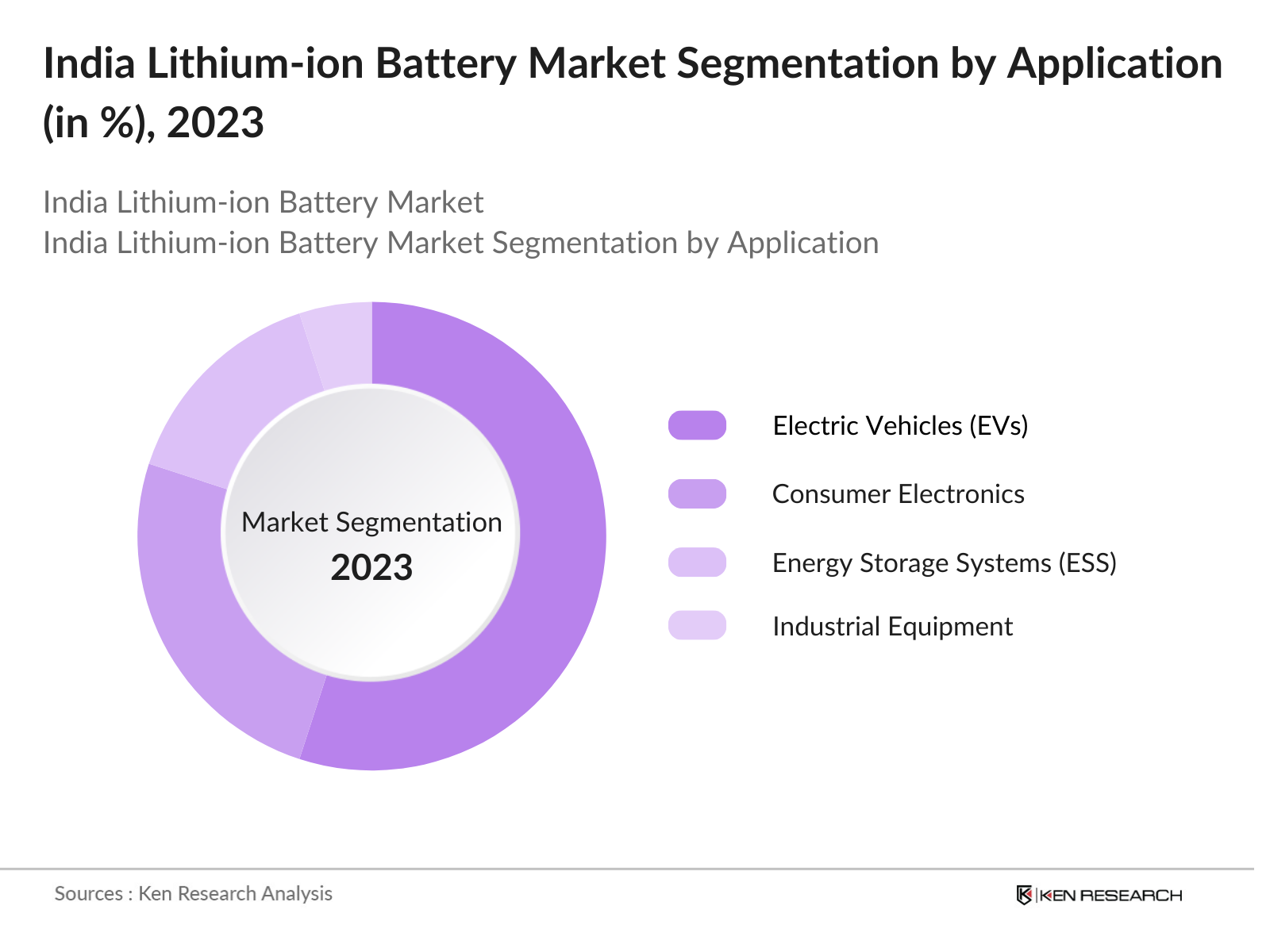

By Application: The market is also segmented by application into Electric Vehicles (EVs), Consumer Electronics, Energy Storage Systems (ESS), and Industrial Equipment.

Electric Vehicles (EVs) are the dominant sub-segment due to the growing focus on clean transportation and government policies aimed at reducing air pollution. The high energy density of Lithium-ion batteries makes them ideal for use in EVs, which has led to a surge in demand. With the Indian government offering tax incentives and subsidies under the FAME II scheme, EV sales have soared, driving the demand for Lithium-ion batteries in this application.

India Lithium-ion Battery Market Competitive Landscape

The India Lithium-ion Battery market is highly competitive, with several domestic and international players operating in the space. The market is dominated by a few key players who have established manufacturing capabilities and supply chain networks. Companies such as Tata Chemicals, Amara Raja, and Exide have ramped up production to meet the growing demand, particularly in the EV segment. Meanwhile, international players like LG Chem and Panasonic have also expanded their presence through partnerships with Indian firms.

|

Company Name |

Establishment Year |

Headquarters |

Product Portfolio |

R&D Investments |

Global Reach |

Strategic Partnerships |

Sustainability Initiatives |

|

Tata Chemicals |

1939 |

Mumbai, India |

- |

- |

- |

- |

- |

|

Amara Raja Batteries |

1985 |

Tirupati, India |

- |

- |

- |

- |

- |

|

Exide Industries |

1947 |

Kolkata, India |

- |

- |

- |

- |

- |

|

LG Chem |

1947 |

Seoul, South Korea |

- |

- |

- |

- |

- |

|

Panasonic |

1918 |

Osaka, Japan |

- |

- |

- |

- |

- |

India Lithium-ion Battery Industry Analysis

India Lithium-ion Battery Market Growth Drivers

- Increasing Adoption in Electric Vehicles (EVs): The adoption of Lithium-ion batteries in India's electric vehicle (EV) sector has been a growth driver, with 1.8 million EVs on Indian roads by 2023, according to data from the Ministry of Road Transport and Highways. Lithium-ion batteries are essential due to their energy density and lightweight properties, making them a preferred choice in EVs. Government subsidies under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME II) scheme provide direct financial support to EV buyers, contributing to higher battery demand.

- Demand in Energy Storage Systems (ESS): The demand for Lithium-ion batteries in Energy Storage Systems (ESS) in India is rapidly increasing. According to the Ministry of Power, the country is targeting 450 GW of renewable energy capacity by 2030, which requires efficient storage solutions. In 2022, India had installed 1,600 MWh of battery energy storage systems, utilizing Lithium-ion batteries to stabilize the grid. The government's push for renewable energy integration highlights the rising need for ESS, which is projected to further rise by 2025 due to the expansion of renewable projects.

- Supportive Government Policies for Green Energy: India's government policies play a vital role in promoting Lithium-ion battery adoption. The Production-Linked Incentive (PLI) scheme for battery manufacturing, introduced in 2021, allocates $2.4 billion to incentivize domestic battery production. This policy aims to reduce the country's dependence on imports and boost local manufacturing capabilities. Moreover, the National Electric Mobility Mission Plan (NEMMP) and FAME II initiatives provide subsidies to manufacturers and buyers, further driving the Lithium-ion battery market's growth.

India Lithium-ion Battery Market Challenges

- High Costs of Raw Materials (Cobalt, Lithium): The prices of raw materials like Lithium and Cobalt are a critical challenge for the Indian Lithium-ion battery market. The price of Lithium, which stood at $74,000 per tonne in 2022, has surged due to global supply shortages, while Cobalt prices have remained elevated at $70,000 per tonne. India relies heavily on imports of these materials, making it vulnerable to global price fluctuations, which increases production costs and discourages localization of battery manufacturing.

- Limited Supply Chain Infrastructure: Indias underdeveloped supply chain for Lithium-ion battery production poses challenges. In 2023, the country imported 80% of the required battery components, with minimal local manufacturing of anodes, cathodes, and other essential parts. The lack of infrastructure for large-scale production leads to longer lead times and higher production costs. Efforts are underway to improve domestic capabilities, but the supply chain remains a bottleneck for scaling up production.

India Lithium-ion Battery Market Future Outlook

Over the coming years, the India Lithium-ion Battery market is expected to witness growth. This growth is driven by government support for clean energy initiatives, continuous advancements in battery technology, and the rising adoption of electric vehicles. The increasing demand for renewable energy storage systems is also expected to play a crucial role in the market's expansion. As more industries move towards sustainable energy solutions, the demand for efficient and high-performance Lithium-ion batteries will continue to rise.

- Growth of Electric Vehicle Charging Infrastructure: India is rapidly expanding its EV charging infrastructure to support the growing fleet of electric vehicles. In 2023, the country had approximately 6,000 public EV charging stations, with plans to increase this number to 22,000 by 2025, as per the Ministry of Power. The development of these facilities is crucial for the mass adoption of EVs, further driving demand for Lithium-ion batteries. This infrastructure push presents a opportunity for battery manufacturers to partner with charging station developers.

- Localization of Battery Manufacturing: The localization of Lithium-ion battery manufacturing in India is gaining momentum, with several initiatives by the government and private sector to reduce import dependence. In 2023, Tata Chemicals announced plans to set up a 10 GWh battery manufacturing plant in Gujarat. Additionally, the government's PLI scheme has allocated $2.4 billion to incentivize local battery production. By 2025, India is expected to have a substantial increase in domestic battery production capacity, providing opportunities for local businesses and reducing foreign import reliance.

Scope of the Report

|

Battery Type |

NMC LFP LCO Solid-State Lithium-ion |

|

Application |

EVs Consumer Electronics ESS Industrial |

|

End-User |

Automotive Consumer Goods Power Aerospace |

|

Power Capacity |

0-3000 mAh 3000-5000 mAh Above 5000 mAh |

|

Region |

Northern India Western India Southern India Eastern India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

- Electric Vehicle Induatries

- Consumer Electronics Companies

- Energy Storage System Industries

- Automotive OEMs

- Renewable Energy Companies

- Government and Regulatory Bodies (Ministry of Heavy Industries, Department of Science and Technology)

- Investments and Venture Capitalist Firms

- Battery Recycling Companies

Companies

Players Mentioned in the Report:

- Tata Chemicals

- Amara Raja Batteries

- Exide Industries

- LG Chem

- Panasonic

- Reliance Industries

- Hero Electric

- Mahindra Electric

- BYD Company

- Blue Energy Motors

Table of Contents

1. India Lithium-ion Battery Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Lithium-ion Battery Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Lithium-ion Battery Market Analysis

3.1. Growth Drivers (Market-specific parameters: Electrification, Energy Storage, Policy Support)

3.1.1. Increasing Adoption in Electric Vehicles (EVs)

3.1.2. Demand in Energy Storage Systems (ESS)

3.1.3. Supportive Government Policies for Green Energy

3.1.4. Technological Advancements in Battery Efficiency

3.2. Market Challenges (Market-specific parameters: Supply Chain, Material Costs, Recycling)

3.2.1. High Costs of Raw Materials (Cobalt, Lithium)

3.2.2. Limited Supply Chain Infrastructure

3.2.3. Recycling and Environmental Concerns

3.2.4. Dependence on Imports for Raw Materials

3.3. Opportunities (Market-specific parameters: Localization, Infrastructure, Technological Innovation)

3.3.1. Growth of Electric Vehicle Charging Infrastructure

3.3.2. Localization of Battery Manufacturing

3.3.3. Technological Innovations in Battery Chemistry

3.3.4. Expanding Role in Renewable Energy Storage

3.4. Trends (Market-specific parameters: Solid-State Batteries, Battery-as-a-Service)

3.4.1. Rise in Demand for Solid-State Lithium-ion Batteries

3.4.2. Battery-as-a-Service (BaaS) Model

3.4.3. Integration of IoT in Battery Management Systems (BMS)

3.4.4. Growth in Portable Power Applications

3.5. Government Regulations (Market-specific parameters: FAME II, PLI Scheme, Battery Recycling Guidelines)

3.5.1. FAME II Scheme for Electric Mobility

3.5.2. Production-Linked Incentive (PLI) Scheme for Battery Manufacturing

3.5.3. Draft Guidelines on Lithium-ion Battery Recycling

3.5.4. Tax Incentives for Renewable Energy Storage Solutions

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Lithium-ion Battery Market Segmentation

4.1. By Battery Type (In Value %)

4.1.1. Lithium Nickel Manganese Cobalt Oxide (NMC)

4.1.2. Lithium Iron Phosphate (LFP)

4.1.3. Lithium Cobalt Oxide (LCO)

4.1.4. Solid-State Lithium-ion Batteries

4.2. By Application (In Value %)

4.2.1. Electric Vehicles (EVs)

4.2.2. Consumer Electronics

4.2.3. Energy Storage Systems (ESS)

4.2.4. Industrial Equipment

4.3. By End-User (In Value %)

4.3.1. Automotive

4.3.2. Consumer Goods

4.3.3. Power Sector

4.3.4. Aerospace & Defense

4.4. By Power Capacity (In Value %)

4.4.1. 0-3000 mAh

4.4.2. 3000-5000 mAh

4.4.3. Above 5000 mAh

4.5. By Region (In Value %)

4.5.1. Northern India

4.5.2. Western India

4.5.3. Southern India

4.5.4. Eastern India

5. India Lithium-ion Battery Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Amara Raja Batteries

5.1.2. Exide Industries

5.1.3. Tata Chemicals

5.1.4. Reliance Industries

5.1.5. Adani Group

5.1.6. Panasonic

5.1.7. LG Chem

5.1.8. BYD Company

5.1.9. Samsung SDI

5.1.10. Tata Motors

5.1.11. Mahindra Electric

5.1.12. Hero Electric

5.1.13. Blue Energy Motors

5.1.14. Luminous Power Technologies

5.1.15. Okaya Power Group

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Product Portfolio, Revenue, Global Market Reach, R&D Investments, Sustainability Initiatives, Strategic Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. India Lithium-ion Battery Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. India Lithium-ion Battery Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Lithium-ion Battery Future Market Segmentation

8.1 By Battery Type (In Value %)

8.2 By Application (In Value %)

8.3 By End-User (In Value %)

8.4 By Power Capacity (In Value %)

8.5 By Region (In Value %)

9. India Lithium-ion Battery Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing an ecosystem map encompassing all major stakeholders within the India Lithium-ion Battery Market. Extensive desk research was conducted using proprietary databases to gather information on key variables, including demand drivers and supply chain factors.

Step 2: Market Analysis and Construction

This phase involved compiling and analyzing historical data, assessing market penetration, and evaluating key performance indicators. A comprehensive assessment of market dynamics was conducted to ensure the accuracy of market size and growth forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through telephonic interviews with industry experts. These consultations provided operational insights and helped refine data accuracy related to the Lithium-ion Battery market.

Step 4: Research Synthesis and Final Output

The final phase involved engaging with manufacturers and industry experts to verify data through the bottom-up approach. This included collecting insights into product performance, market trends, and consumer preferences to provide a validated analysis of the market.

Frequently Asked Questions

01. How big is the India Lithium-ion Battery Market?

The India Lithium-ion Battery market is valued at USD 4.2 billion, driven by the demand for electric vehicles and energy storage systems.

02. What are the challenges in the India Lithium-ion Battery Market?

Challenges include high raw material costs, supply chain bottlenecks, and limited domestic manufacturing capacity, leading to a dependency on imports.

03. Who are the major players in the India Lithium-ion Battery Market?

Key players in the market include Tata Chemicals, Amara Raja Batteries, Exide Industries, LG Chem, and Panasonic, with investments in production and R&D.

04. What are the growth drivers of the India Lithium-ion Battery Market?

Growth drivers include the governments push for electric vehicles, renewable energy adoption, and increasing consumer demand for efficient energy storage systems.

05. How is the Indian government supporting the Lithium-ion Battery Market?

The government has launched the Production-Linked Incentive (PLI) scheme and various subsidies under the National Electric Mobility Mission Plan (NEMMP) to boost battery manufacturing and adoption.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.