India Lithium Ion Cell and Battery Market Outlook to 2023

By Type of Battery (LFP, NMC, LCO, MCA and Others), By Application (Consumer Appliances, Telecom Towers and Services, Industrial Application, Automotive and Others) and By Power Capacity

Region:Asia

Product Code:KR730

December 2018

133

About the Report

Market Overview

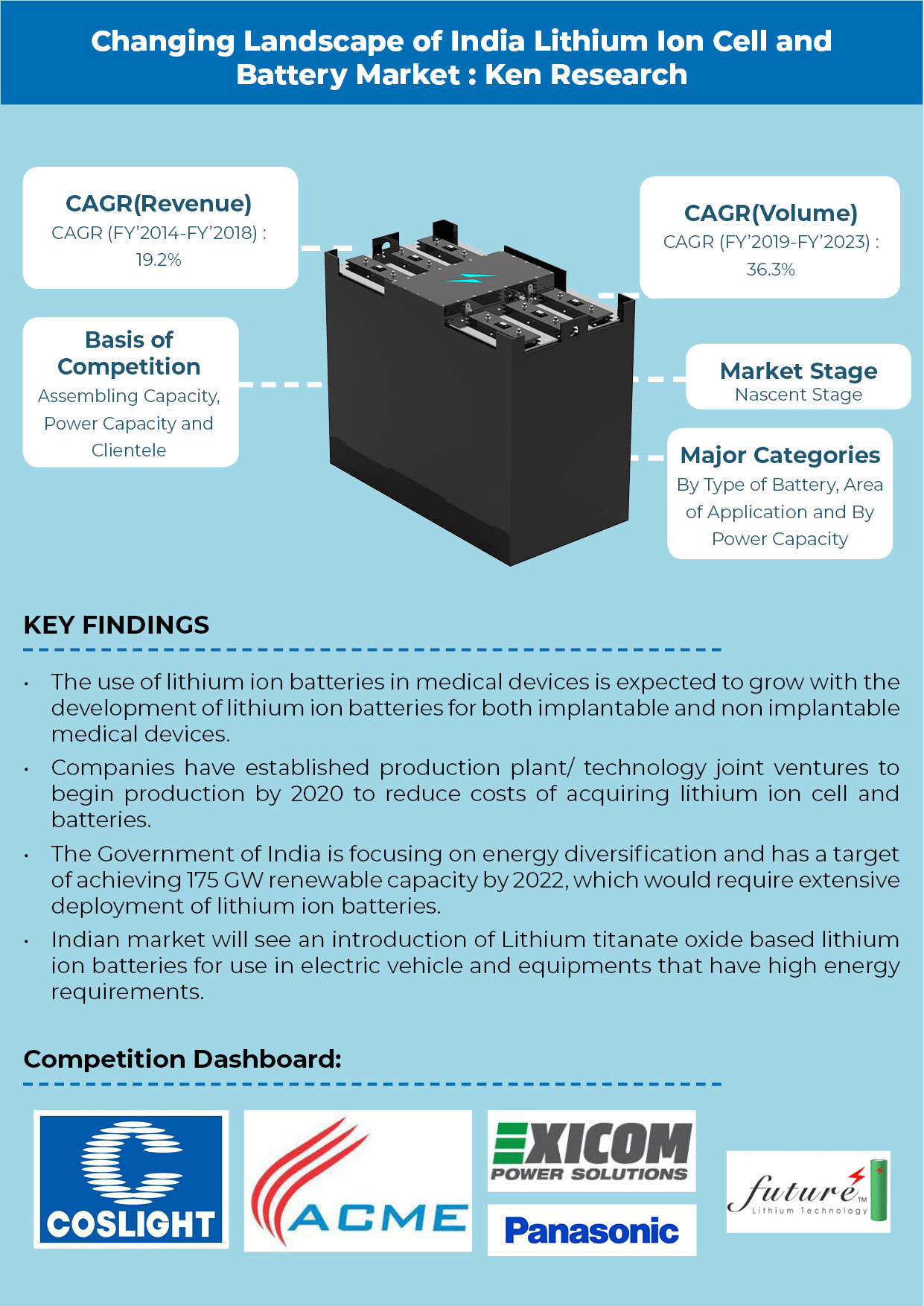

Market Stage: The import driven India Lithium Ion Cell and Battery Market is at its nascent stage. The companies have just started making footprints in India, and are showing great future potential. Currently, the market is categorized as an assembling market where lithium ion cells are imported and lithium ion batteries are assembled through software and hardware BMS.

Market Segmentation

The Lithium Nickel Manganese Cobalt (Li-NMC) contributes a fair share to the industry. It is used for power tools, medical instruments, electric power trains, electric vehicles and other industrial applications. It is capable of high charge and discharge currents but has low specific energy and modest service life.

Lithium Cobalt Oxide (LCO) batteries are mainly used in cell phones, laptops, digital cameras and wearable products. Most companies producing portable electronics prefer using LCO based cells. Lithium Cobalt Oxide batteries has high specific energy with moderate load capabilities and modest service life.

Lithium Nickel Cobalt Aluminum Oxide (NCA) batteries contribute the least. It is used in medical devices, industrial applications, electric power trains and others. Currently, the lithium ion batteries based on NCA are not so widely used in India, but are gaining significant popularity and expected to gain a considerable market share in the future.

By Area of Application: Laptops and tablets, mobile phones, power banks, drone, small household use power tools and UPS (consumer electronics) are the major segments using li-ion batteries in India. The demand for lithium ion batteries in India majorly comes from the push from telecom sector to power telecom towers and other services in the country. The lithium-ion batteries have more than double the life of traditional lead-acid batteries and are helping providers cut costs to store each unit of electricity. Application Li-ion batteries are now being used instead of conventional batteries in larger industrial application including UPS and energy storage systems. The shift to lithium ion batteries is due to the technological capabilities and also because of their customizable property where in the number of cells in the battery can be adjusted based on the energy requirement. Automotive sector is the sector with the highest potential to grow and outweigh all other sectors in terms of lithium ion battery usage, though currently has the lowest share. The increased initiatives taken up by the government and growing public awareness about pollution, electric vehicle segment is expected to pick up pace in the future.

Competitive Landscape

Future Outlook

Key Topics Covered in the Report

- Executive Summary

- Research Methodology

- Ecosystem in India Lithium Ion Cell and Battery Market – Supply Side

- Ecosystem in India Lithium Ion Cell and Battery Market – Demand Side

- Global Lithium Ion Cell and Battery Market

- India Battery Market Overview

- India Lithium Ion Cell and Battery Market

- Value Chain Analysis for Lithium Ion Battery Market in India

- India Lithium Ion Cell and Battery Market Size, FY’2014-FY’2018

- India Lithium Ion Cell and Battery Market Segmentation, FY’2014-FY’2018

- Investment Model in India Lithium Ion Cell and Battery Market

- Trade Scenario in India Lithium Ion Cell and Battery Market

- SWOT Analysis of India Lithium Ion Cell and Battery Market

- Trends and Developments in India Lithium Ion Cell and Battery Market

- SWOT Analysis of India Lithium Ion Cell and Battery Market

- Issues and Challenges in India Lithium Ion Cell and Battery Market

- Regulatory Framework for India Lithium Ion Cell and Battery Market

- Decision Making Parameters for Buyer of Lithium Ion Batteries in India

- Competitive Landscape for India Lithium Ion Cell and Battery Market

- Company Profiles of Major Companies

- Lithium Ion Battery Importer Profile

- India Lithium Ion Cell and Battery Market Future Outlook and Projections, FY’2019 – FY’2023

- Analyst Recommendations

Products

Key Target Audience

- Distributors of Batteries

- Telecom Companies

- Manufacturers of Electric Vehicles

- Importers of Batteries

- Governmental Departments

Time Period Captured in the Report:

- Historical Period - FY’2014 - FY’2018

- Forecast Period - FY’2019 - FY’2023

Companies

Key Segments Covered

Market Segmentation

- Type of Battery (LFP, NMC, LCO, NCA and Others)

- Area of Application (Consumer, Telecom Services,

- Industrial Application, Automotive and Others)

- Power Capacity (0-3,000mAh, 3,000-10,000mAh, 10,000-60,000mAh, 60,000 mAh and above)

Companies Covered:

- Exicom Power Solutions

- Coslight India Telecom Private Limited

- Future Hi Tech Batteries

- Panasonic India Private Limited

- Delta Power Solutions India Private Limited

- ACME Cleantech Solutions Limited

Table of Contents

1. Executive Summary

India Battery Market Overview

India Lithium Ion Cell and Battery Market Overview And Market Size

India Lithium Ion Cell and Battery MarketSEgementation

Competitive Landscape of Major Players in India Lithium Ion Cell and Battery Market

India Lithium Ion Cell and Battery Market Future Outlook

2. Research Methodology

2.1. Market Definitions

2.2. Abbreviations

2.3. Market Sizing and Modeling

Research Methodology

Limitations

Variables (Dependent And Independent)

Multi Factor Based Sensitivity Model

Final Conclusion

3. Ecosystem In India Lithium Ion Cell and Battery Market- Supply Side

4. Ecosystem In India Lithium Ion Cell and Battery Market- Demand Side

5. Global Lithium Ion Cell and Battery Landscape

6. India Battery Market Overview

7. India Lithium Ion Cell and Battery Market

7.1. India Lithium Ion Cell and Battery Market Overview

8. Value Chain Analysis for Lithium Ion Battery Market in India

8.1. Assembly Process of Lithium Ion Battery Packs

9. India Lithium Ion Cell and Battery Market Size, FY’2014 – FY’2018

9.1. By Revenue, FY’ 2014 - FY’ 2018

10. India Lithium Ion Cell and Battery Market Segmentation, FY’ 2018

10.1. By Type of Battery (LFP, NMC, LCO, NCA and Others), FY’ 2018

10.2. By Area of Application (Consumer Appliances, Telecom Towers and Services, Industrial Application, Automotive and Others), FY’ 2018

Consumer Appliances Application, FY’ 2018

Automotive Application, FY’ 2018

Industrial Application, FY’ 2018

Other Applications (Medical Devices, Aerospace and Defense Sector and Marine Sector), FY’ 2018

10.3. By Power Capacity (0-3,000 mAh, 3,000-10,000 mAh, 10,000-60,000 mAh, 60,000 and above mAh), FY’ 2018

11. Investment Model in India Lithium Ion Cell and Battery Market

Certification Requirements

Location Prefernce

Assumptions

Plant Size

Cost Split

Fixed Cost

Machinery Cost

Raw Material Cost

Manpower

Total Recurring Expenditure

Working Capital Requirement

Total Capital investment

Funding Analysis

Cost of Production Per Annum

Turn Over Per Annum

Profitability Analysis

12. Trade Scenario in India Lithium Ion Cell and Battery Market

By Exports, FY’2014 – FY’2018

By Imports, FY’2013 – FY’2018

Import Duty

13. SWOT Analysis of India Lithium Ion Cell and Battery Market

14. Trends and Developments in India Lithium Ion Cell and Battery Market

Emerging Joint Ventures in The country

Increased initiatives by the governemnt

Goods and Service Tax Reduced on Lithium Ion Batteries

Transfer of Li-Ion Cell Technology By Isro

Steady Progress of India’s Electronic Vehicle Market

Growth of Energy Storage Systems

Growing Demand For Consumer Electronics Operating on Li-ion Batteries

Growth In End User Industry

15. Issues and Challenges in India Lithium Ion Cell and Battery Market

Lithium Ion Ore Resource Scarcity

Lack of Battery Charging Infrastructure

Environmental Concerns

Increasing Imports of Lithium Ion Cells are resulting in Increased trade deficits

Hike In Custom Duties

16. Regulatory Framework for Lithium Ion Battery Market in India

Setting Up A Plant

Bureau of Indian Standards

Small Scale Industries (SSI) Registration

Import-Export Regulations

Applications and Usage

17. Decision Making Parameters for Buyer of Lithium Ion Batteries in India

18. Competitive Landscape of India Lithium Ion Cell and Battery Market

Market share of players Supplying lithium ion batteries to automotive industry, FY’2018

Market share of players Supplying lithium ion batteries to Telecom Sector for Telecom grids and services, FY’2018

Market share of players Supplying lithium ion batteries For Consumer Appliances

19. Company Profiles of Major Players in India Lithium Ion Cell and Battery Market

19.1. Exicom Power Solutions

19.2. Coslight India Telecom Pvt. Ltd

19.3. Future Hi-Tech Batteries

19.4. Panasonic India Private Limited

19.5. Delta Power Solutions India Private Limited

19.6. ACME Cleantech Solutions Limited

20. Lithium Ion Battery Importer Profile

21. India Lithium Ion Cell and Battery Market Future Outlook and Projections, FY’2019 – FY’2023

21.1. India Lithium Ion Battery Market Size, FY’2019 – FY’2023

21.2. By Application (Automotive Application, Industrial Application, Consumer Appliances, Telecom Towers, and Others), FY’2023

Consumer Appliances Application

Automotive Application

Industrial Application

Future Developments

22. Analyst Recommendations

Disclaimer

Contact Us

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.