India Pet Food Market Outlook to 2030

Region:Asia

Author(s):Sanjna Verma

Product Code:KROD309

June 2024

100

About the Report

India Pet Food Market Overview

- In 2023, India Pet Food Market was valued at USD 0.53 Bn, driven by the rising pet ownership rates, increased disposable incomes, and the humanization of pets, where pet owners treat their pets as family members, thereby willing to spend more on high-quality and specialized pet food products.

- The key players in the India pet food market include Mars Petcare, Nestlé Purina Petcare, Royal Canin, Himalaya Drug Company and Drools. These companies dominate the market due to their extensive distribution networks, strong brand recognition, and continuous product innovations.

- In 2023, Mars Petcare announced an investment of USD 100 million to expand its manufacturing plant in Hyderabad, India. This expansion is expected to double the production capacity and introduce new product lines catering to the growing demand in the region.

India Pet Food Current Market Analysis:

- Pet owners are increasingly treating their pets as family members, leading to higher spending on pet food that offers better nutrition and health benefits. This trend is evident from the growing sales of premium and organic pet food products.

- The growth of the pet food market in India has had several positive impacts, including the creation of employement in manufacturing, distribution, and retail sectors. It has also spurred growth in related industries such as veterinary services, pet grooming, and pet accessories.

- The northern region of India, particularly Delhi-NCR, has been dominating the pet food market. This region's dominance is because of higher disposable incomes, greater awareness of pet health, and a higher concentration of urban populations.

India Pet Food Market Segmentation:

By Pet Type: Pet food market is segmented by pet type into dogs, cats & others. In 2023, Dogs hold the largest share due to their higher population compared to cats and other pets. Dogs are traditionally viewed as companions and guard animals, leading to a larger population and higher demand for dog food. The smaller breeds are perceived as requiring less food compared to some cat breeds.

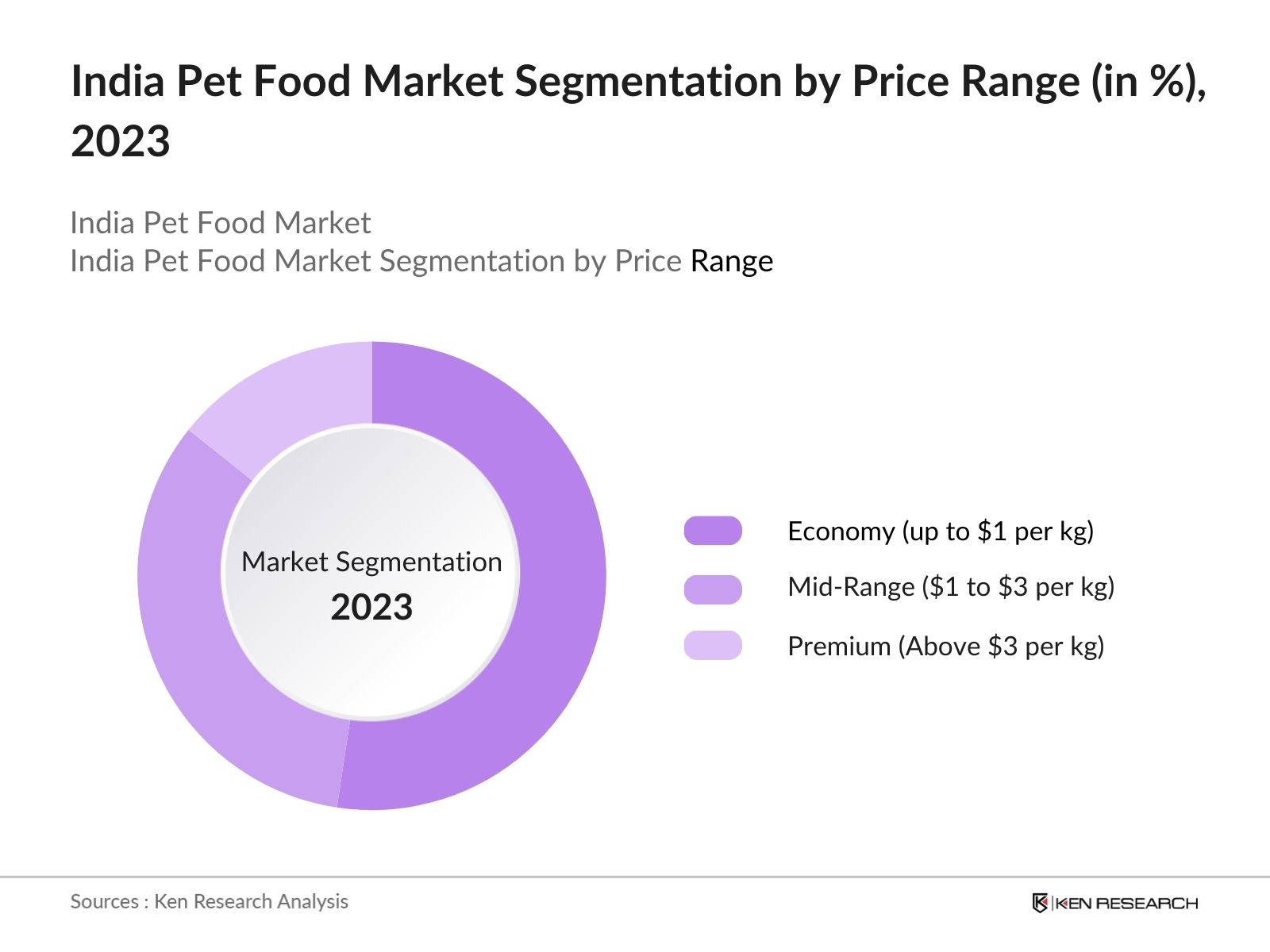

By Price Range: The market is divided into economy (up to $1 per kg), mid-range ($1 to $3 per kg) and premium segments (Above $3 per kg). In 2023, Economy segment holds the largest share due to price sensitivity. While disposable incomes are rising in India, a large segment of the population still has limited financial resources. Economy pet food provides a more accessible option for these pet owners to ensure their pets receive basic nutrition.

By Distribution Channel: By distribution channels, the market is segmented into online & offline channels. In 2023, Offline stores have dominated the market. Many pet owners, particularly new pet owners, prefer to physically examine pet food packaging and ingredients before purchase. Offline stores allow them to touch, read labels, and compare products side-by-side.

India Pet Food Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Mars Petcare |

1935 |

McLean, Virginia, USA |

|

Nestlé Purina Petcare |

1894 |

St. Louis, Missouri, USA |

|

Royal Canin |

1968 |

Aimargues, France |

|

Himalaya Drug Company |

1930 |

Bengaluru, India |

|

Drools |

2010 |

Kolkata, India |

- In 2023, Mars Petcare announced an investment of USD 100 million to expand its manufacturing plant in Hyderabad, India. This expansion aims to double the production capacity and introduce new product lines catering to the growing demand for pet food in the region.

- In 2023, Himalaya Drug Company launched a new range of herbal pet food products, leveraging their expertise in herbal healthcare. This new product line is designed to cater to the growing demand for natural and organic pet food options among health-conscious pet owners.

- Drools introduced a new line of grain-free pet food products in 2023, targeting pets with food allergies and promoting better digestive health. This new product line is formulated without grains, which are known to cause allergic reactions in some pets.

India Pet Food Industry Analysis

India Pet Food Growth Drivers

- Increasing Pet Ownership: The rising trend of pet ownership in India significantly boosts the demand for pet food. Till 2024, 31 million pet dogs and 2.4 million pet cats in India. With a growing number of households adopting pets, the pet food industry is experiencing robust growth.

- Rising Disposable Income: The increase in disposable income among Indian households has directly impacted the pet food market. The Reserve Bank of India reported that the per capita income reached INR 172,000 annually. Higher disposable income means that families have more financial resources to spend on pet care, including premium and specialized pet food products.

- E-commerce Expansion: The rapid expansion of e-commerce platforms has revolutionized the pet food market in India. There are 8,177 e-commerce companies in India with pet food being one of the fastest-growing categories. Online platforms like Amazon, Flipkart, and specialized pet stores such as Heads Up for Tails have made it easier for pet owners to access a wide range of pet food products, including international brands that were previously unavailable in local markets.

India Pet Food Market Challenges

- High Import Duties: High import duties on pet food products pose a significant challenge in the Indian market. This tariff barrier impacts the availability and affordability of premium international brands, limiting choices for pet owners who seek high-quality, specialized diets for their pets. The high costs associated with importing these products often result in higher retail prices, which can deter potential buyers and limit market growth.

- Lack of Awareness: Despite increasing awareness, a substantial portion of the Indian population remains unaware of the nutritional needs of pets. This lack of knowledge leads to suboptimal feeding practices, where pets are often fed homemade food or leftovers that do not meet their nutritional needs.

- Supply Chain Issues: Logistics and distribution challenges, especially in rural and semi-urban areas, pose significant hurdles for the pet food market in India. These inefficiencies include inadequate infrastructure, high transportation costs, and fragmented supply chains, which can lead to delays and increased costs for pet food manufacturers and distributors.

India Pet Food Government Initiatives

- Animal Welfare Board of India (AWBI) Schemes: In 2021, the AWBI launched the "Pet Animal Welfare Fund" to support initiatives that improve pet care standards and raise awareness about proper pet nutrition. This fund has facilitated various programs and campaigns that educate pet owners about the importance of providing balanced and nutritious diets to their pets, thereby driving demand for commercial pet food products.

- Make in India Initiative: Launched in 2014, the Make in India initiative encourages domestic manufacturing across various sectors, including pet food. This initiative has led to increased investment in local pet food production, reducing reliance on imports and making pet food products more affordable and accessible to consumers. This growth in local manufacturing is expected to continue, fostering the development of the pet food market.

- National Livestock Mission (NLM): The National Livestock Mission (NLM), launched in 2014, aims to improve livestock production, including pet animals. Under the NLM, various programs have been implemented to enhance the quality of animal nutrition, including pets. In 2021, the Ministry of Agriculture allocated INR 500 crore towards initiatives that support the development of high-quality pet food products.

India Pet Food Future Market Outlook

The Indian pet food market is expected to witness continued robust growth in the coming years, driven by the aforementioned factors. With rising pet ownership, increasing disposable incomes, and growing urbanization, the demand for pet food is expected to surge.

Future Market Trends

- Premiumization of Pet Food: The trend towards premiumization will reshape the Indian pet food market. Pet owners are increasingly opting for high-quality, nutritious, and specialized diets that cater to specific health needs of their pets, such as grain-free, organic, and hypoallergenic formulas.

- Customization and Personalization: Customization and personalization of pet food are emerging as significant trends in the market. This trend is leading to the introduction of bespoke pet food solutions, where ingredients and formulations are personalized based on factors such as age, breed, weight, and health conditions.

- Sustainability and Eco-Friendly Products: Sustainability will become a crucial factor in the pet food industry. This trend is driven by increasing environmental awareness among consumers who seek products that minimize ecological impact.

Scope of the Report

|

By Pet Type |

Dogs Cats Others |

|

By Price Range |

Economy Mid-Range Luxury |

|

By Distribution Channel |

Offline Online |

Products

Key Target Audience – Organizations and Entities who can benefit by Subscribing This Report:

Pet Food Manufacturers

Pet Food Distributors

Pet Food Ingredient Suppliers

Pet Food Industry Associations

Pet Insurance Companies

Veterinary Clinics & Hospitals

Logistics & Delivery Companies

Banks & Financial Institutions

Government Bodies (FSSAI, Ministry of Agriculture & Family Welfare)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Mars Petcare

Nestle Purina

Royal Canin

Hill’s Pet Nutrition

Farmina Pet Foods

Drools Pet Food Pvt. Ltd.

Himalaya Companion Care

Pedigree

Whiskas

IAMS

Arden Grange

Natural Balance

Orijen

Acana

Purepet

Taste of the Wild

Canine Creek

Fidèle

Choostix

Goodies

Table of Contents

1. India Pet Food Market Overview

1.1 India Pet Food Market Taxonomy

2. India Pet Food Market Size (in USD Bn), 2018-2023

3. India Pet Food Market Analysis

3.1 India Pet Food Market Growth Drivers

3.2 India Pet Food Market Challenges and Issues

3.3 India Pet Food Market Trends and Development

3.4 India Pet Food Market Government Regulation

3.5 India Pet Food Market SWOT Analysis

3.6 India Pet Food Market Stake Ecosystem

3.7 India Pet Food Market Competition Ecosystem

4. India Pet Food Market Segmentation, 2023

4.1 India Pet Food Market Segmentation by Pet Type, By Value, (In %), 2023

4.2 India Pet Food Market Segmentation by Price Range, By Value, (In %), 2023

4.3 India Pet Food Market Segmentation by Distribution Channel, By Value (In %), 2023

5. India Pet Food Market Competition Benchmarking

5.1 India Pet Food Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Pet Food Future Market Size (in USD Bn), 2023-2028

7. India Pet Food Future Market Segmentation, 2028

7.1 India Pet Food Market Segmentation by Pet Type, By Value, (In %), 2028

7.2 India Pet Food Market Segmentation by Price Range, By Value, (In %), 2028

7.3 India Pet Food Market Segmentation by Distribution Channel, By Value (In %), 2028

8. India Pet Food Market Analysts’ Recommendations

8.1 India Pet Food Market TAM/SAM/SOM Analysis

8.2 India Pet Food Market Customer Cohort Analysis

8.3 India Pet Food Market Marketing Initiatives

8.4 India Pet Food Market White Space Opportunity Analysis

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step: 2 Market Building:

Collating statistics on India pet food market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India pet food market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step: 4 Research Output:

Our team will approach multiple pet food companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from pet food companies.Â

Â

Frequently Asked Questions

01 How big is the Indian pet food market?

The Indian pet food market was at USD 0.53 Bn in 2023, driven by the rising pet ownership rates, increased disposable incomes, and the humanization of pets, where pet owners treat their pets as family members.

02 What factors drive the Indian pet food market?

Rising pet ownership, increasing disposable incomes, growing online retail & humanization of pets are key drivers.

03 Which is the most dominant segment in the India Pet Food market?

The largest segment is pet food for dogs, accounting for majority of the market share due to the higher dog population.

04 What are challenges in India Pet Food Market?

Price sensitivity, local competition, limited cold chain infrastructure, and evolving regulations are key challenges.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.