India Recycled Plastics Market Outlook to 2028

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD4946

December 2024

95

About the Report

India Recycled Plastics Market Overview

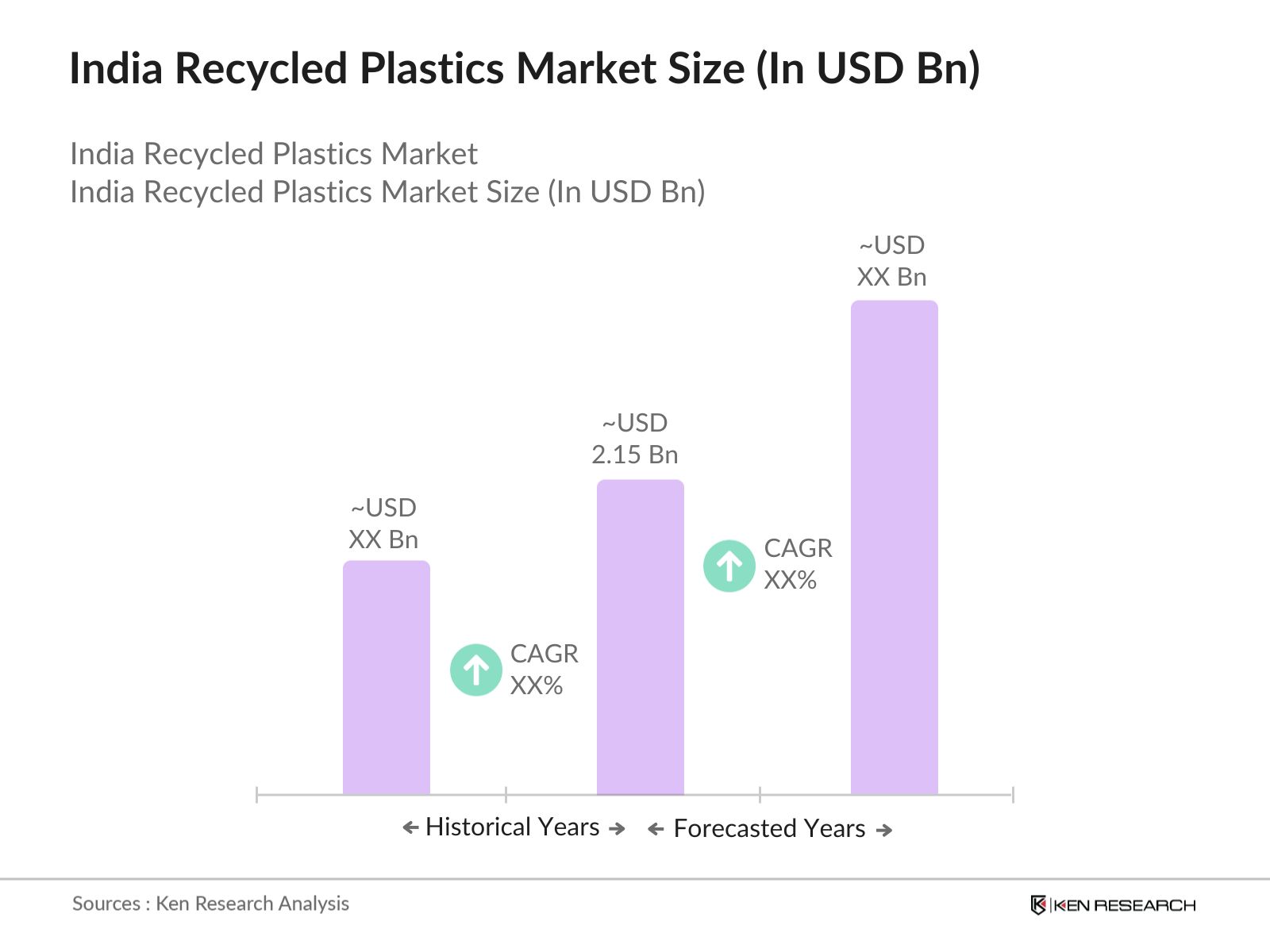

- The India Recycled Plastics Market is projected to experience a significant shift towards sustainability, currently valued at USD 2.15 Bn, driven by the rising emphasis on environmental conservation and government regulations. In 2024, the market for recycled plastics is expected to grow rapidly due to the increasing use of recycled materials in industries like packaging, construction, and automotive. As per the Central Pollution Control Board (CPCB), India generates around 3.3 million metric tonnes of plastic waste annually, with about 60% being recycled, showcasing the countrys potential in expanding the recycled plastics sector.

- Major cities such as Delhi, Mumbai, and Bangalore dominate the market due to their higher levels of industrialization and urbanization. These cities house key industries like automotive, FMCG, and construction, which are the major consumers of recycled plastics. Additionally, these cities benefit from more developed recycling infrastructures, making them pivotal in driving the overall demand for recycled materials.

- The Plastic Waste Management Rules in India aim to regulate plastic waste by holding producers, importers, and brand owners accountable for waste collection and recycling under the Extended Producer Responsibility (EPR) framework. These rules ban specific single-use plastics, mandate segregation at the source, and promote recycling methods like energy recovery and road construction. Municipal bodies oversee waste management, while the rules also phase out non-recyclable multi-layered plastic packaging.

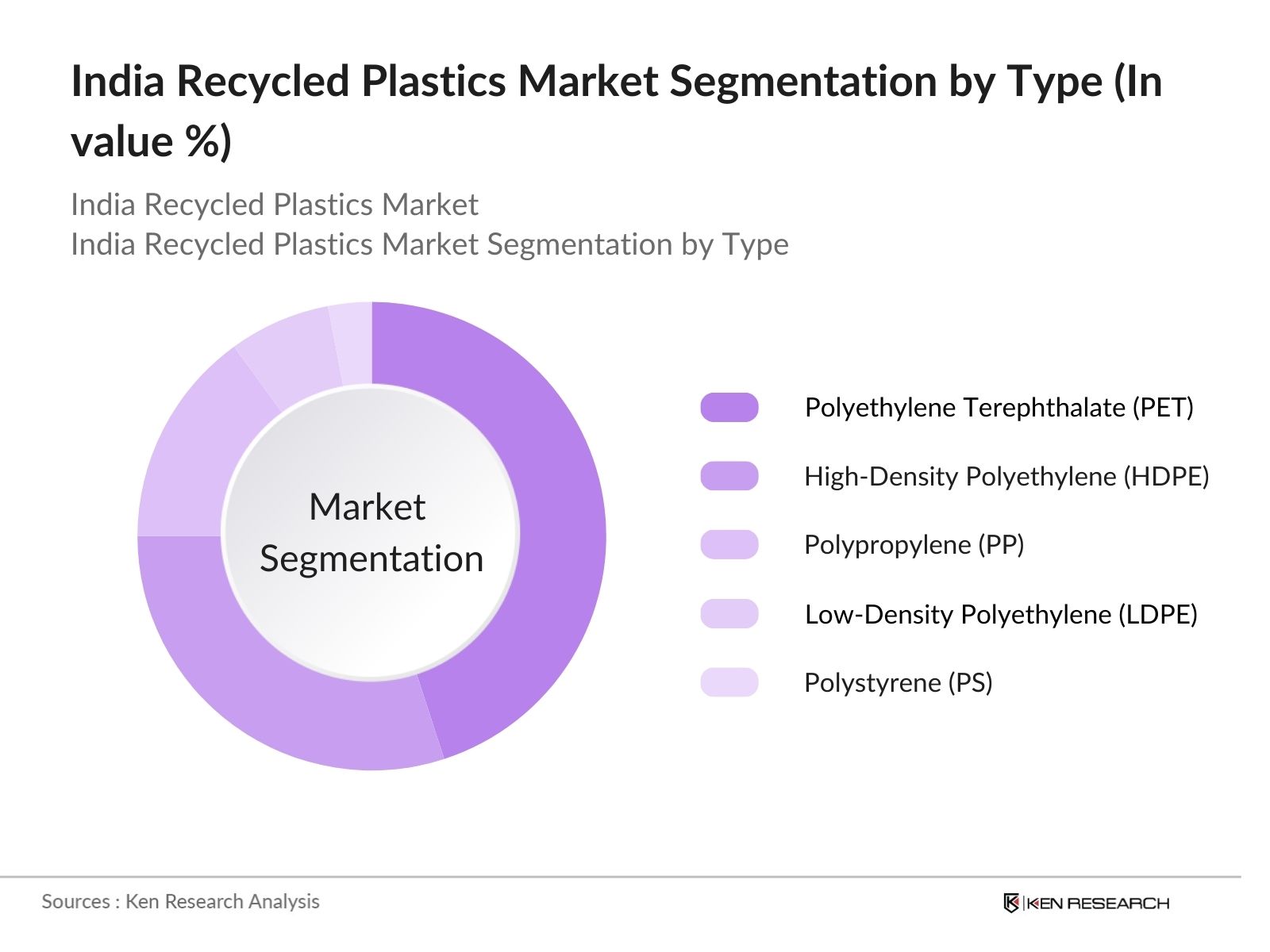

India Recycled Plastics Market Segmentation

- By Type of Plastic: The Market is segmented into Polyethylene Terephthalate (PET), High-Density Polyethylene (HDPE), polypropylene, low density polyethylene, and others. PET holds the largest market share due to its extensive use in packaging and beverage containers. In 2024, the demand for recycled PET is expected to grow as major FMCG companies aim to reduce their carbon footprint by using more recycled packaging materials. HDPE is also witnessing growth, particularly in the construction sector where it is used in pipes and other building materials. Other plastic types such as Polypropylene (PP) are being increasingly adopted by the automotive and textile industries.

- By End-User: The market is further segmented into Packaging, Automotive, consumer goods, electrical and electronics, and Construction industries. The packaging sector dominates the market, with companies focusing on sustainable packaging solutions to meet consumer and regulatory demands. Automotive manufacturers are increasingly incorporating recycled plastics in vehicle interiors and components to reduce environmental impact and meet international sustainability standards. The construction industry is also witnessing a surge in demand for recycled plastics, especially in applications like roofing materials, insulation, and flooring.

India Recycled Plastics Market Competitive Landscape

The India Recycled Plastics Market is highly fragmented, with a mix of small-scale recyclers and large multinational companies contributing to the overall supply. Key players such as Reliance Industries, Plast India, and Pet Polymer Recycling are dominating the market, driving innovations in recycling technology and material recovery processes.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (Approx.) |

R&D Expenditure |

Number of Employees |

Market Innovation |

Major Contracts |

Product Portfolio |

|

Manjushree Technopack Limited |

1983 |

Bangalore, India |

||||||

|

Recykal |

2016 |

Hyderabad, India |

||||||

|

Gravita India Limited |

1992 |

Jaipur, India |

||||||

|

The Shakti Plastic Industries |

1969 |

Mumbai, India |

||||||

|

Recykal |

2016 |

Hyderabad, India |

India Recycled Plastics Industry Analysis

Growth Drivers

- Corporate Sustainability Goals (FMCG and Automotive Sectors): FMCG giants like Hindustan Unilever and automakers like Tata Motors have set corporate sustainability goals that push for 30% usage of recycled plastics in their operations by 2024. The company has set a target to achieve 2,600 metric tonnes of annual recycled plastic usage in its packaging portfolio by 2024, which aligns with its sustainability goals. This sector represents over 40 million units of production annually, with packaging contributing heavily to waste. These goals align with India's national recycling objectives and drive demand for recycled plastics in packaging and automotive components. Large corporations are pushing the demand for PET and HDPE, which are increasingly being used in secondary packaging and automotive interiors.

- Consumer Demand for Eco-Friendly Packaging: With rising environmental consciousness, Indian consumers are increasingly seeking eco-friendly packaging options. Data from 2024 shows that themajority of urban consumers prefer recycled or biodegradable packaging for consumer goods. This shift has led FMCG and e-commerce companies to adopt recycled plastics for packaging at an accelerating rate, with projections showing a demand of nearly amillion tonnes of recycled PET for consumer goods packaging. The plastic ban on single-use plastics across major cities also supports this trend.

- Expansion of Recycling Infrastructure: Public-private partnerships (PPPs) are expanding Indias recycling infrastructure. As of 2024, 150 plastic recycling plants were operational, with investments of over a million in the previous year. These partnerships, supported by both central and state governments, focus on technological upgrades to increase plastic recovery rates. Recent projects in Mumbai and Delhi aim to process hundreds of tonnes of plastic waste daily. This infrastructure growth is crucial as urban areas generate around 26,000 tonnes of plastic waste every day.

Market Challenges

- High Cost of Recycling Technology: India faces significant challenges in scaling advanced recycling technologies due to high capital investment requirements. Establishing a modern pyrolysis plant, for instance, requires substantial financial resources, which limits the adoption of chemical recycling techniques. The cost of maintaining such facilities and importing necessary equipment adds further strain to the recycling industry. This dependence on imported technology and the high operational costs makes it difficult for India to transition fully from traditional mechanical recycling methods to more advanced, sustainable solutions.

- Lack of Standardization in Recycling Processes: Indias recycling industry faces challenges due to a lack of standardization in recycling processes, affecting the quality and consistency of recycled plastics. The Bureau of Indian Standards (BIS) has been slow in implementing uniform guidelines for recycling facilities, which leads to variations in the quality of recycled materials. This inconsistency hampers the adoption of recycled plastics across key industries, such as FMCG and automotive, where material uniformity is critical for manufacturing. Without clear standards, manufacturers face difficulties in integrating recycled plastics into their production processes.

India Recycled Plastics Market Future Outlook

The India Recycled Plastics Market is expected to continue its positive growth trajectory, supported by government initiatives, corporate sustainability efforts, and rising consumer demand for eco-friendly products. The expansion of recycling infrastructure, coupled with advancements in recycling technology, is expected to increase plastic waste recovery rates, boosting the supply of recycled plastics. By 2028, Indias recycled plastics market is anticipated to become one of the largest globally, driven by both domestic and export demand for sustainable materials.

Future Market Opportunities

- Adoption of Recycled Plastics in Construction: The use of recycled plastics in the construction industry is gaining momentum, with applications in green building materials. In 2024, India saw the construction of over millionsof square meters of green building projects using recycled plastics for components like insulation and composite panels. The governments push for sustainable urban development, including the Smart Cities Mission, is opening new avenues for recycled plastics. This sector holds significant potential as India plans to add 100 new smart cities by 2030.

- Expansion of Chemical Recycling Technologies: India is expanding its chemical recycling capabilities as industries look for alternatives to traditional mechanical recycling. In 2024, India imported over thousands of tonnes of advanced chemical recycling equipment, primarily for pyrolysis and depolymerization processes. These technologies enable the breakdown of complex plastic waste into reusable materials, which increases the scope of recycling. Several new facilities are being planned in Maharashtra and Gujarat to cater to industrial plastic waste recycling.

Products

Key Target Audience

- Packaging Manufacturers

- Automotive Manufacturers

- Construction Companies

- Consumer Goods Producers

- Electrical & Electronics Manufacturers

- Investors and Venture Capitalist Firms

- Banks and Financial Institutions

- Government and Regulatory Bodies (Central Pollution Control Board, Ministry of Environment, Forest and Climate Change)

Companies

Major Players Mentioned in the Report

- Reliance Industries

- Plast India

- Pet Polymer Recycling

- Jindal Poly Films

- Banyan Nation

- Ramky Reclamation and Recycling Ltd

- Hindustan Coca-Cola Beverages (HCCB)

- Uflex Ltd

- Clear Path Recycling

- Polycycle Industries

- Shakti Plastics Industries

- ECO Recycling Ltd (ECORECO)

- Innovative Recycling Pvt Ltd

- Motherson Sumi Systems Ltd

- Plastiblends India Ltd

Table of Contents

01 India Recycled Plastics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02 India Recycled Plastics Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03 India Recycled Plastics Market Analysis

3.1. Growth Drivers

3.1.1. Government Initiatives for Plastic Waste Management (Plastic Waste Management Rules)

3.1.2. Corporate Sustainability Goals (FMCG and Automotive Sectors)

3.1.3. Consumer Demand for Eco-Friendly Packaging

3.1.4. Expansion of Recycling Infrastructure (Public-Private Partnerships)

3.2. Market Challenges

3.2.1. High Costs of Advanced Recycling Technologies

3.2.2. Lack of Standardization in Recycling Processes

3.2.3. Limited Consumer Awareness in Rural Areas

3.2.4. Plastic Waste Segregation Issues

3.3. Opportunities

3.3.1. Adoption of Recycled Plastics in Construction (Green Building Materials)

3.3.2. Expansion of Chemical Recycling Technologies

3.3.3. Export of Recycled Plastics to Global Markets

3.3.4. Circular Economy Practices in Industrial Applications

3.4. Trends

3.4.1. Adoption of Recycled PET in Beverage and Packaging Sectors

3.4.2. Growth of Recycled HDPE in the Automotive Industry

3.4.3. Use of Recycled Plastics in Consumer Goods

3.4.4. Investment in Plastic Recovery Facilities

3.5. Government Regulation

3.5.1. Plastic Waste Management Rules

3.5.2. Extended Producer Responsibility (EPR) Implementation

3.5.3. Mandatory Recycling Quotas for Industries

3.5.4. Incentives for Adoption of Recycled Plastics in Manufacturing

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Recycling Plants, Collection Centers, Government Agencies)

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem (Market Leaders, Emerging Players, Regional Players)

04 India Recycled Plastics Market Segmentation

4.1. By Type of Plastic (In Value %)

4.1.1. Polyethylene Terephthalate (PET)

4.1.2. High-Density Polyethylene (HDPE)

4.1.3. Polypropylene (PP)

4.1.4. Low-Density Polyethylene (LDPE)

4.1.5. Polystyrene (PS)

4.2. By End-User Industry (In Value %)

4.2.1. Packaging

4.2.2. Automotive

4.2.3. Construction

4.2.4. Consumer Goods

4.2.5. Electrical and Electronics

05 India Recycled Plastics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Reliance Industries

5.1.2. Plast India

5.1.3. Pet Polymer Recycling

5.1.4. Jindal Poly Films

5.1.5. Polycycle Industries

5.1.6. Clear Path Recycling

5.1.7. Plastiblends India Ltd

5.1.8. Banyan Nation

5.1.9. ECO Recycling Ltd (ECORECO)

5.1.10. Hindustan Coca-Cola Beverages (HCCB)

5.1.11. Ramky Reclamation and Recycling Ltd

5.1.12. Uflex Ltd

5.1.13. Shakti Plastics Industries

5.1.14. Innovative Recycling Pvt Ltd

5.1.15. Motherson Sumi Systems Ltd

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Recycled Plastic Volume, Production Capacity, End-User Industries, Global Footprint)

5.3. Market Share Analysis

5.4. Strategic Initiatives (New Recycling Facilities, Expansion Plans, Strategic Partnerships)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Venture Capital and Private Equity Investments

06 India Recycled Plastics Market Regulatory Framework

6.1. Plastic Waste Management Rules

6.2. Extended Producer Responsibility (EPR) Obligations

6.3. Industry-Specific Recycling Quotas

6.4. Certifications and Compliance Requirements

07 India Recycled Plastics Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08 India Recycled Plastics Future Market Segmentation

8.1. By Type of Plastic (In Value %)

8.1.1. Polyethylene Terephthalate (PET)

8.1.2. High-Density Polyethylene (HDPE)

8.1.3. Polypropylene (PP)

8.1.4. Low-Density Polyethylene (LDPE)

8.1.5. Polystyrene (PS)

8.2. By End-User Industry (In Value %)

8.2.1. Packaging

8.2.2. Automotive

8.2.3. Construction

8.2.4. Consumer Goods

8.2.5. Electrical and Electronics

09 India Recycled Plastics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Market Entry Strategies

9.3. Innovation and R&D Focus Areas

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Recycled Plastics Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Recycled Plastics Market. This includes assessing market penetration, the ratio of recycled plastic materials across industries, and revenue generation. An evaluation of service quality statistics will also be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through interviews with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple plastic recycling companies to acquire detailed insights into product segments, production performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India Recycled Plastics Market.

Frequently Asked Questions

01. How big is the India Recycled Plastics Market?

The India Recycled Plastics Market is valued at USD 2.15 billion and is driven by growing demand for sustainable materials across key industries such as packaging, automotive, and construction.

02. What are the challenges in the India Recycled Plastics Market?

Challenges in the India Recycled Plastics Market include high costs of advanced recycling technologies, lack of standardization in recycling processes, and limited consumer awareness, particularly in rural areas.

03. Who are the major players in the India Recycled Plastics Market?

Key players in the India Recycled Plastics Market include Reliance Industries, Plast India, Pet Polymer Recycling, Jindal Poly Films, and Banyan Nation. These companies dominate due to their established recycling infrastructure and advanced technologies.

04. What are the growth drivers of the India Recycled Plastics Market?

Growth drivers in the India Recycled Plastics Market include government initiatives for plastic waste management, corporate sustainability goals, and increasing consumer demand for eco-friendly packaging and construction materials.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.