India Retail Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD9110

December 2024

98

About the Report

India Retail Market Overview

- The India retail market is valued at USD 1.4 trillion based on a five-year historical analysis, driven by rapid urbanization, increased disposable income, and the growing trend of e-commerce. The market's expansion has been strongly supported by the rise in internet penetration and the increasing adoption of digital payment systems. Consumers are shifting towards organized retail formats, which offer more convenience and diverse product offerings. This growth is further propelled by the entry of international retailers and the rise of homegrown brands capitalizing on the vast consumer base.

- The Indian retail market is dominated by metropolitan cities such as Mumbai, Delhi, and Bengaluru due to their high population density, modern infrastructure, and affluent consumer bases. These cities boast advanced retail ecosystems, including malls, luxury outlets, and high street stores, which are supported by strong purchasing power and a tech-savvy population. Additionally, these cities are hubs for both organized and e-commerce retail, driven by the presence of global brands and large domestic players that use these cities as launch pads for expansion into the broader market.

- The implementation of the Goods and Services Tax (GST) has simplified Indias tax structure, benefiting the retail sector by reducing the overall tax burden. According to the Central Board of Indirect Taxes and Customs (CBIC), GST collections from the retail sector contributed over INR 1.5 trillion in 2024, reflecting strong consumer spending. GST has also streamlined the movement of goods across states, reducing logistical challenges and improving supply chain efficiency.

India Retail Market Segmentation

By Retail Format: The market is segmented by retail format into organized retail, unorganized retail, online retail, and hybrid retail (omni-channel). Organized retail has gained significant traction due to consumer preferences for structured shopping environments, quality assurance, and diverse product availability. The dominance of organized retail is primarily driven by mall culture in urban areas and the increased presence of global brands. This segment is supported by higher disposable income, evolving consumer behavior, and the demand for a better shopping experience.

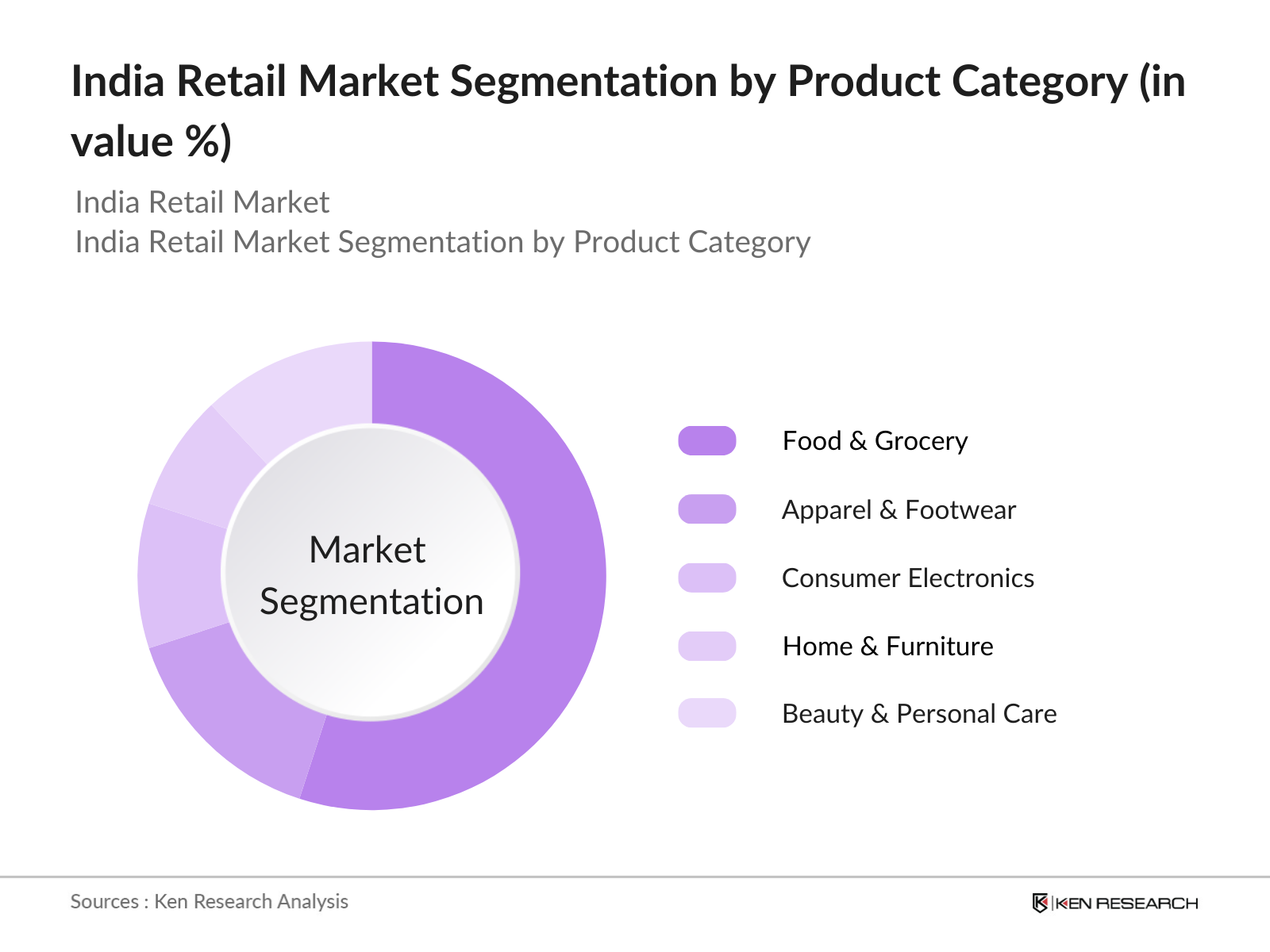

By Product Category: The market is also segmented by product category into food & grocery, apparel & footwear, consumer electronics, home & furniture, and beauty & personal care. Among these, the food & grocery segment leads the market due to the daily necessity of such products and the rapid expansion of hypermarkets and supermarkets. The strong distribution network for groceries, coupled with the penetration of e-commerce platforms like BigBasket and Grofers, has fueled this segments growth.

India Retail Market Competitive Landscape

The India retail market is dominated by a few key players that exert significant influence on the market dynamics. Large conglomerates such as Reliance Retail, Aditya Birla Retail, and Tata Trent lead the organized retail space, while e-commerce giants like Amazon India and Flipkart dominate the online retail market. This consolidation of power in the hands of a few players highlights the substantial investments these companies have made in infrastructure, supply chain management, and technology, enabling them to cater to India's large and diverse consumer base.

|

Company Name |

Establishment Year |

Headquarters |

No. of Stores |

Revenue (INR Cr) |

Key Retail Format |

Technology Adoption |

Expansion Strategy |

|

Reliance Retail |

2006 |

Mumbai |

|||||

|

Future Group |

1987 |

Mumbai |

|||||

|

Tata Trent |

1998 |

Mumbai |

|||||

|

Amazon India |

2013 |

Bengaluru |

|||||

|

Flipkart |

2007 |

Bengaluru |

India Retail Industry Analysis

Growth Drivers

- Increase in Disposable Income: India has experienced a steady rise in per capita income, which has contributed to increased purchasing power. According to the Reserve Bank of India (RBI), the countrys per capita income rose to INR 1,72,000 (USD 2,120) in 2024 from INR 1,58,000 (USD 1,940) in 2022. This growth in income is directly linked to an expanding middle class that spends more on retail products, from groceries to luxury goods, fueling the growth of the retail sector. The disposable income increase supports consumer spending on lifestyle products, electronics, and apparel, key categories in India's retail market.

- Rising Internet Penetration and E-commerce: India's e-commerce sector has grown significantly due to increased internet penetration, with over 700 million internet users in 2024, according to the Telecom Regulatory Authority of India (TRAI). More than 65% of these users now shop online, driven by the convenience of e-commerce platforms and availability of diverse products. E-commerce giants like Flipkart and Amazon have expanded their operations into smaller cities, ensuring broader market access. This trend has enabled growth in online retail sales, which accounted for approximately 12% of the total retail market in 2024.

- Urbanization and Shift Toward Modern Retail Formats: As of 2024, India's urban population stands at 493 million, with continued urbanization fueling the growth of organized retail. The Ministry of Housing and Urban Affairs indicates that urbanization has brought more people into proximity with modern retail formats like shopping malls and hypermarkets, encouraging greater consumer spending. Cities like Mumbai, Delhi, and Bengaluru have witnessed substantial retail infrastructure development, offering consumers a broader range of shopping experiences in high-end malls and retail centers, contributing to the overall growth of the retail sector.

Market Challenges

- High Real Estate Costs in Urban Centers: Retailers in urban India face rising real estate costs, particularly in cities like Mumbai, where retail space can cost upwards of INR 25,000 per square foot. This high cost is a barrier to the expansion of brick-and-mortar stores, especially for smaller retailers and new entrants. The Department of Economic Affairs reports that these inflated prices affect profitability and make it difficult for retailers to secure prime locations, particularly in highly competitive markets such as Delhi and Bengaluru.

- Complex Regulatory Environment: India's regulatory framework for retail, particularly foreign direct investment (FDI), presents hurdles for businesses. As of 2024, multi-brand retail FDI is capped at 51%, and international retailers must comply with local sourcing norms that require 30% of goods to be sourced from domestic suppliers. According to the Ministry of Commerce, these regulations complicate entry for foreign players, deterring investment and creating barriers for global retail chains seeking to expand in Indias diverse market.

India Retail Market Future Outlook

Over the next five years, the India retail market is poised for significant growth driven by multiple factors, including increasing digitization, favorable government policies like the introduction of GST, and the continuous growth of e-commerce platforms. Retailers are expected to further integrate omni-channel strategies to cater to both online and offline consumers, with an emphasis on customer experience and personalization. Additionally, rural penetration and the expansion of organized retail formats into Tier-II and Tier-III cities will open new avenues for growth.

Future Market Opportunities

- Private Labels and Cost Efficiency: The rise of private labels in retail chains offers an opportunity for retailers to enhance profit margins. Private labels, which accounted for 10% of retail sales in 2024 according to the Confederation of Indian Industry (CII), allow retailers to offer high-margin products at competitive prices. Retailers such as Big Bazaar and DMart have capitalized on this trend, driving up consumer preference for store brands, especially in categories like groceries and home essentials.

- Franchising and Collaborative Retail Models: Franchising is emerging as a viable model for expanding retail operations, especially in smaller towns and rural areas. The Franchise India Report notes that India had over 200,000 retail franchises by 2024, supported by the low cost of entry and collaborative retail models. This allows brands to scale quickly while minimizing operational risks, offering a strategic pathway for both domestic and international retailers to expand their market presence.

Scope of the Report

|

Retail Format |

Organized Retail Unorganized Retail Online Retail Hybrid Retail |

|

Product Category |

Food & Grocery Apparel & Footwear Consumer Electronics Home & Furniture Beauty & Personal Care |

|

Region |

North India South India West India East India |

|

Store Size |

Small Format Stores Medium Format Stores Large Format Stores |

|

Consumer Demographics |

Millennials Generation Z Urban Consumers Rural Consumers |

Products

Key Target Audience

Retail Chains and Hypermarket Operators

FMCG Manufacturers

Logistics and Supply Chain Companies

E-commerce Platforms

Real Estate Developers

Investor and Venture Capitalist Firms

Banks and Financial Institutes

Government and Regulatory Bodies (Department for Promotion of Industry and Internal Trade, FDI Regulatory Committees)

Retail Technology Providers

Companies

Major Players

Reliance Retail

Future Group

Tata Trent

DMart (Avenue Supermarts Ltd.)

Amazon India

Flipkart

Aditya Birla Retail

BigBasket

Godrej Natures Basket

Shoppers Stop

Walmart India

Paytm Mall

Spencers Retail

V-Mart Retail

Pepperfry

Table of Contents

India Retail Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

India Retail Market Size (In INR Crore)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

India Retail Market Analysis

3.1. Growth Drivers (Per Capita Income, E-commerce Adoption, Urbanization, Consumer Behavior Shifts, Organized Retail Growth)

3.1.1. Increase in Disposable Income

3.1.2. Rising Internet Penetration and E-commerce

3.1.3. Urbanization and Shift Toward Modern Retail Formats

3.1.4. Expansion of Organized Retail Chains

3.2. Market Challenges (Supply Chain Issues, Infrastructure Gaps, Regulatory Complexity, Consumer Fragmentation)

3.2.1. Supply Chain Inefficiencies

3.2.2. High Real Estate Costs in Urban Centers

3.2.3. Complex Regulatory Environment

3.3. Opportunities (Rural Market Penetration, Omni-channel Strategies, Private Label Growth, Franchise Opportunities)

3.3.1. Expanding into Tier-II and Tier-III Cities

3.3.2. Increasing Adoption of Omni-channel Retailing

3.3.3. Private Labels and Cost Efficiency

3.3.4. Franchising and Collaborative Retail Models

3.4. Trends (Technology Integration, Experience-driven Retail, Consumer Personalization, Green Retail Initiatives)

3.4.1. Integration of AI and Big Data in Retail

3.4.2. Growth of Experience-driven Shopping (Pop-up stores, Events, and Concept Stores)

3.4.3. Increasing Consumer Personalization in Retail

3.4.4. Rise of Sustainable and Green Retail Initiatives

3.5. Government Regulation (FDI in Retail, GST Impact, Local Sourcing Norms, Licensing Procedures)

3.5.1. FDI Norms and Reforms for Multi-brand Retail

3.5.2. GST and Taxation Impact on Retail

3.5.3. Local Sourcing Regulations for International Retailers

3.6. SWOT Analysis

3.7. Retail Stakeholder Ecosystem (Suppliers, Distributors, Retailers, Logistics Providers)

3.8. Porters Five Forces

3.9. Competitive Ecosystem

India Retail Market Segmentation

4.1. By Retail Format (In Value %)

4.1.1. Organized Retail

4.1.2. Unorganized Retail

4.1.3. Online Retail (E-commerce)

4.1.4. Hybrid Retail (Omni-channel)

4.2. By Product Category (In Value %)

4.2.1. Food & Grocery

4.2.2. Apparel & Footwear

4.2.3. Consumer Electronics

4.2.4. Home & Furniture

4.2.5. Beauty & Personal Care

4.3. By Region (In Value %)

4.3.1. North

4.3.2. South

4.3.3. West

4.3.4. East

4.4. By Store Size (In Value %)

4.4.1. Small Format Stores (Below 500 Sq. Ft.)

4.4.2. Medium Format Stores (5001000 Sq. Ft.)

4.4.3. Large Format Stores (Above 1000 Sq. Ft.)

4.5. By Consumer Demographics (In Value %)

4.5.1. Millennials

4.5.2. Generation Z

4.5.3. Urban Consumers

4.5.4. Rural Consumers

India Retail Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Reliance Retail

5.1.2. Future Group

5.1.3. Aditya Birla Retail

5.1.4. DMart (Avenue Supermarts Ltd.)

5.1.5. Tata Trent

5.1.6. Amazon India

5.1.7. Flipkart

5.1.8. BigBasket

5.1.9. Spencers Retail

5.1.10. Godrej Natures Basket

5.1.11. Shoppers Stop

5.1.12. Walmart India

5.1.13. Paytm Mall

5.1.14. V-Mart Retail

5.1.15. Pepperfry

5.2 Cross Comparison Parameters (No. of Employees, Store Count, Revenue, Retail Format, Market Share, Growth Strategies, Technology Adoption, Customer Satisfaction Rating)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7 Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

India Retail Market Regulatory Framework

6.1. FDI Norms in Retail

6.2. GST Impact on Retailers

6.3. E-commerce Guidelines

6.4. Consumer Protection Laws

India Retail Market Future Market Size (In INR Crore)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

India Retail Market Future Market Segmentation

8.1. By Retail Format (In Value %)

8.2. By Product Category (In Value %)

8.3. By Region (In Value %)

8.4. By Store Size (In Value %)

8.5. By Consumer Demographics (In Value %)

India Retail Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Analysis

9.3. Marketing Strategies

9.4. White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the entire retail ecosystem in India, covering major retail formats, product categories, and consumer segments. Desk research is carried out to identify key trends, growth drivers, and market challenges by leveraging a range of secondary databases and proprietary sources to provide an exhaustive view of market dynamics.

Step 2: Market Analysis and Construction

In this phase, we aggregate historical market data, focusing on consumer behavior, purchasing trends, and retail format evolution. This data is analyzed to identify market penetration levels and the economic impact of retail on GDP. In-depth analysis is conducted to estimate market revenue across segments, ensuring accuracy and reliability.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding the growth trajectory, technology adoption, and consumer preferences are formulated and validated through interviews with industry experts. Telephone interviews with executives of major retail firms provide firsthand insights, further refining the research outputs and confirming key findings.

Step 4: Research Synthesis and Final Output

The final stage of research involves synthesizing the collected data and insights into a comprehensive report. This includes collaboration with major stakeholders such as retail chains, e-commerce platforms, and technology providers to ensure a holistic view of the market, while also validating projections and conclusions.

Frequently Asked Questions

01. How big is the India Retail Market?

The India retail market is valued at USD 1.4 trillion, driven by factors such as increased consumer spending, urbanization, and the rise of organized retail formats. E-commerce platforms are also playing a crucial role in the market's expansion.

02. What are the challenges in the India Retail Market?

Challenges in the India retail market include supply chain inefficiencies, high real estate costs, and regulatory complexities. The market also faces infrastructure issues, especially in rural areas, and fierce competition between organized and unorganized retail formats.

03. Who are the major players in the India Retail Market?

Key players in the India retail market include Reliance Retail, Future Group, Tata Trent, Amazon India, and Flipkart. These companies dominate due to their expansive distribution networks, technological advancements, and strong consumer engagement strategies.

04. What are the growth drivers of the India Retail Market

The primary growth drivers in the India retail market include rising disposable income, urbanization, the expansion of organized retail formats, and the rapid growth of e-commerce. Additionally, digital payments and technological integration in retail are boosting market efficiency and consumer satisfaction.

05. What are the trends in the India Retail Market?

Key trends in the India retail market include the adoption of omni-channel strategies, the rise of experience-driven retail, and an increased focus on sustainability. Retailers are also leveraging big data and AI for consumer insights and personalized shopping experiences.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.