India Space Launch Services Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD1629

November 2024

85

About the Report

India Space Launch Services Market Overview

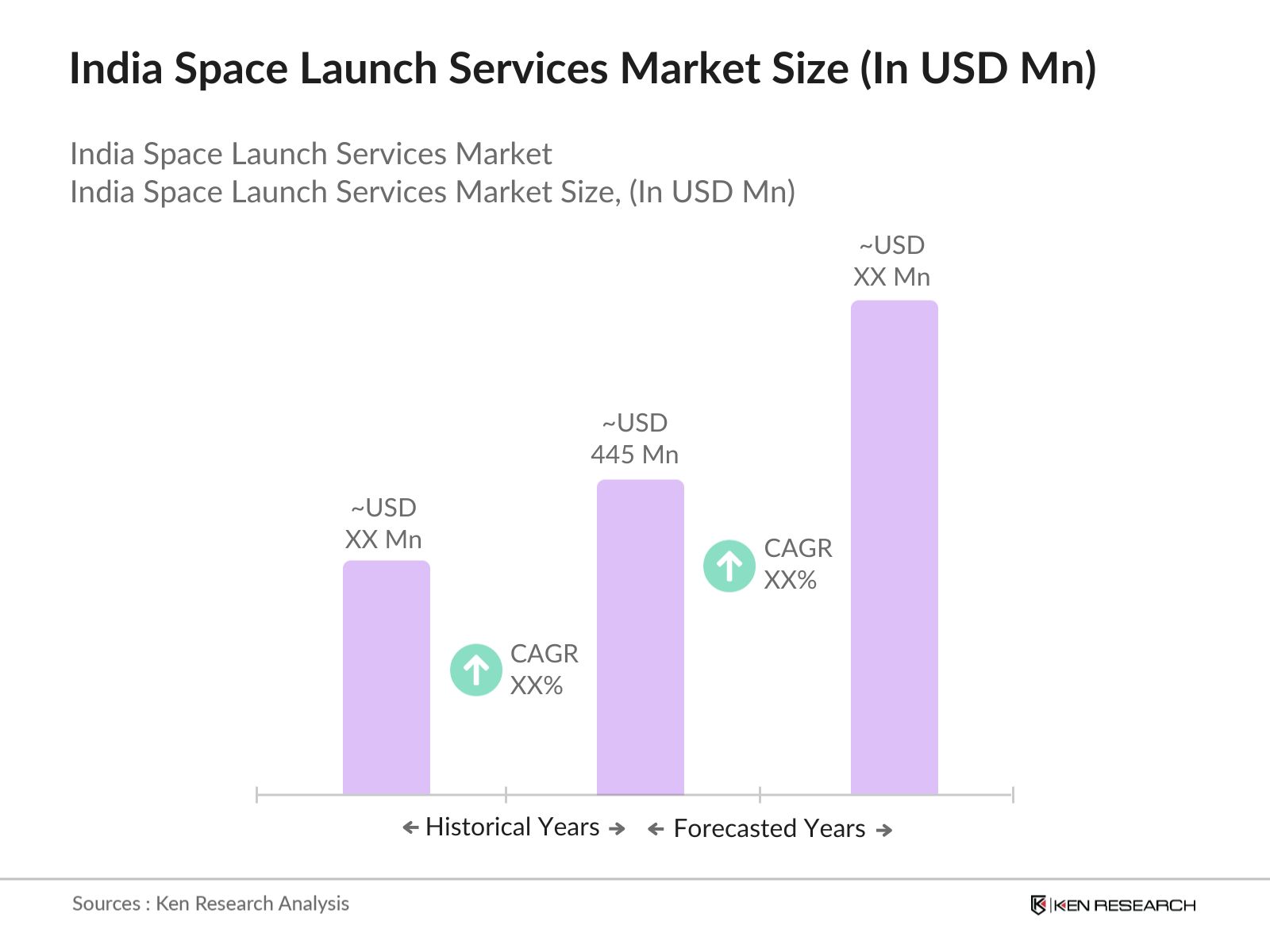

- The India Space Launch Services market, valued at USD 445 million, benefits from an increasing demand for low-Earth orbit (LEO) satellite deployments and rising international collaborations with entities such as NASA and the European Space Agency. The surge in private sector participation has further driven growth as companies like Skyroot Aerospace and Agnikul Cosmos bring innovative solutions to space transportation. This market expansion is heavily supported by the Indian governments policies that encourage foreign direct investment and partnerships with private players to bolster national space capabilities.

- South India, particularly cities like Bengaluru and Hyderabad, plays a dominant role in the market. Bengaluru is home to ISRO headquarters and many related research facilities, while Hyderabad hosts a growing number of private aerospace companies. This dominance is due to established infrastructure, skilled technical workforce, and strong government support, making these cities central hubs for space launch development and services.

- Indias policy allows up to 100% FDI in satellite and space technology manufacturing under the government route, inviting more foreign players to invest in Indias space sector. Since 2023, FDI inflows for the space sector have grown significantly, backed by favorable investment conditions.

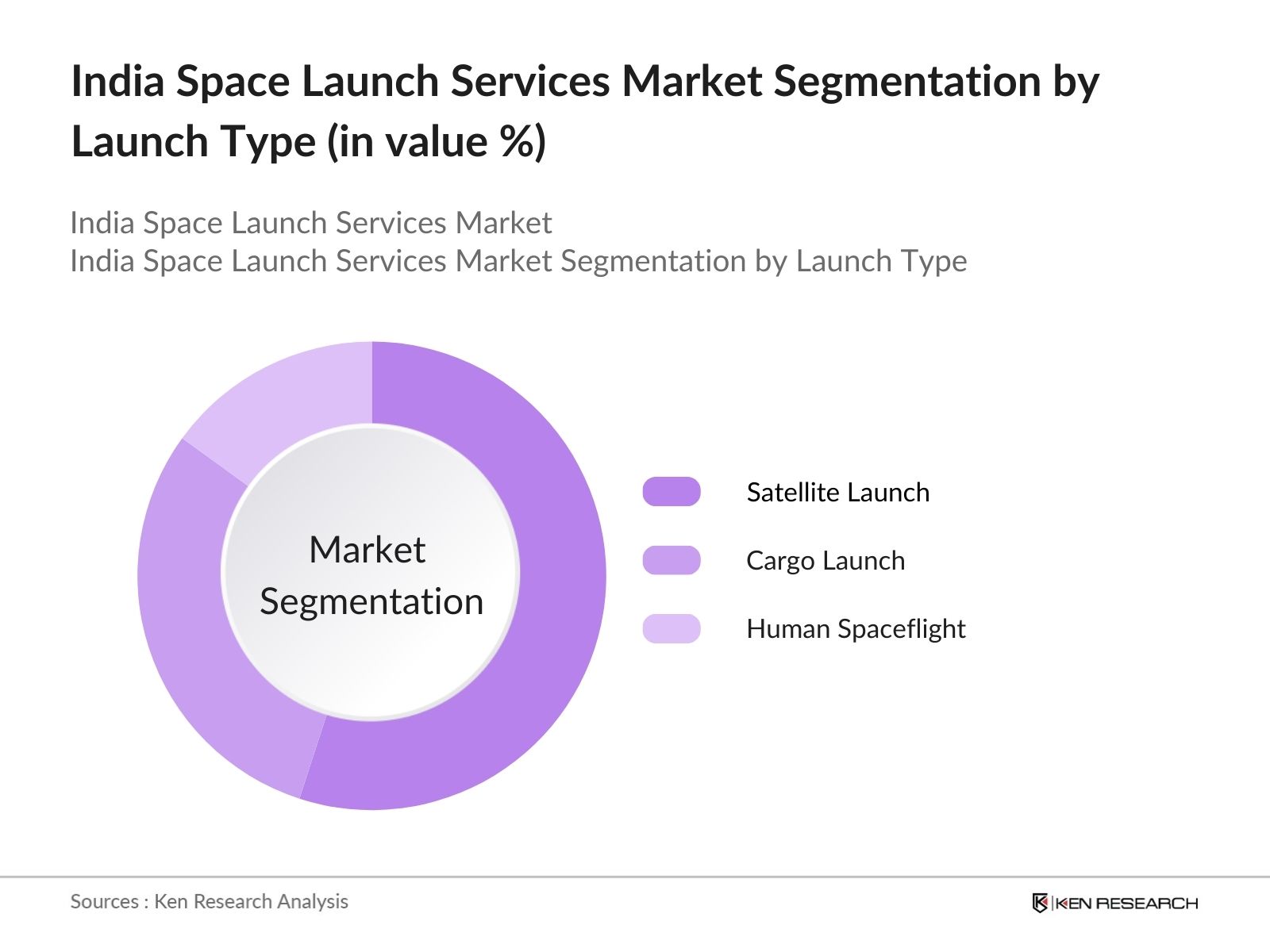

India Space Launch Services Market Segmentation

- By Launch Type: The market is segmented by launch type into satellite launches, cargo launches, and human spaceflights. Recently, satellite launches hold a dominant market share in this segment due to high demand for telecommunications, Earth observation, and navigation satellites. With significant government investments in enhancing satellite-based services, including initiatives to monitor climate and bolster telecommunications, this segments growth has been steady. Partnerships with international space agencies further amplify satellite launch demand.

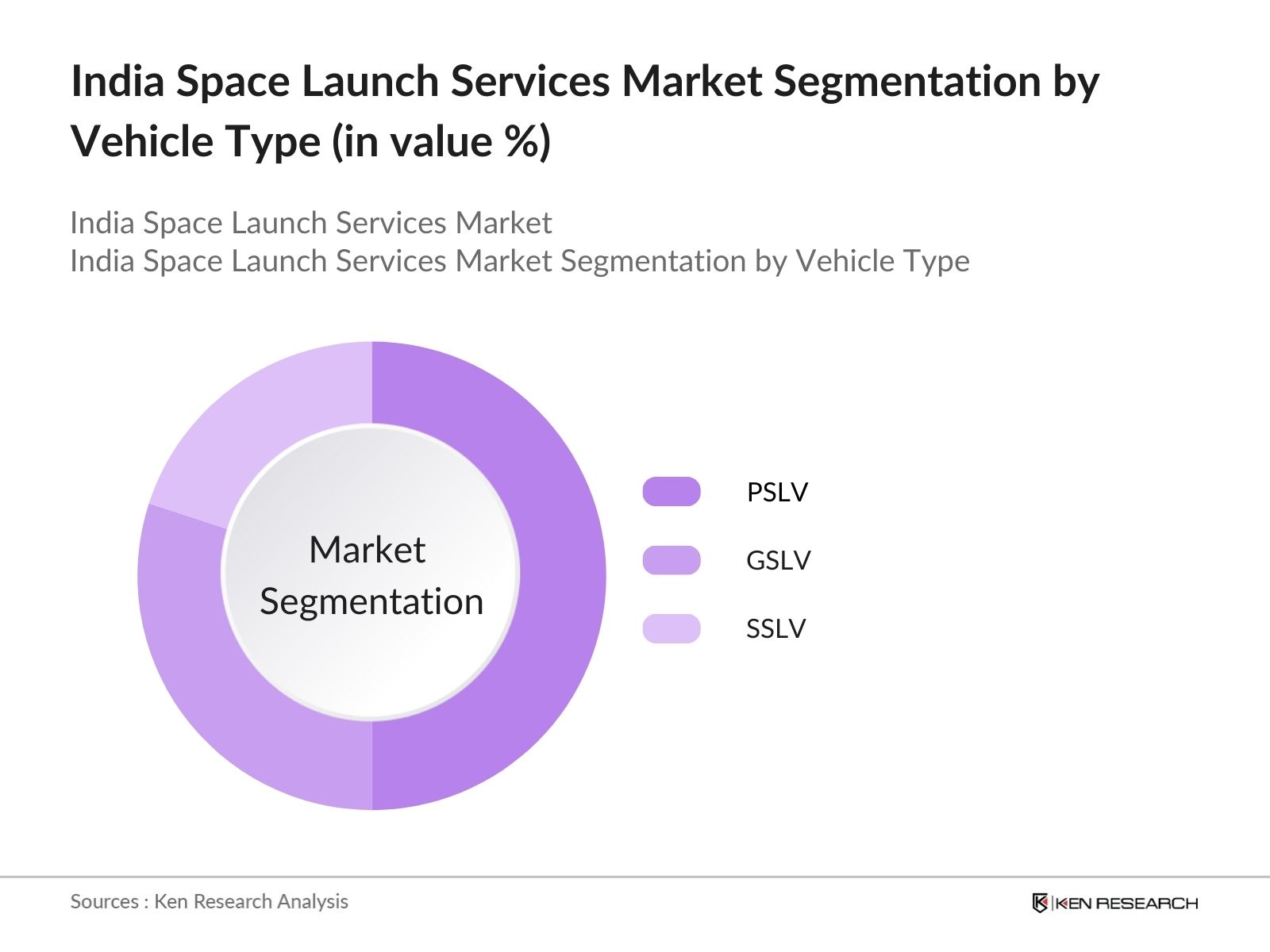

- By Vehicle Type: Vehicle types in the India Space Launch Services market include Polar Satellite Launch Vehicle (PSLV), Geosynchronous Satellite Launch Vehicle (GSLV), and Small Satellite Launch Vehicle (SSLV). PSLV remains the market leader under vehicle type segmentation due to its high reliability and versatility in launching various satellite payloads. PSLV's proven track record, including over 50 successful launches, solidifies its position as the preferred choice, especially for LEO missions. Its capability to carry multiple satellites in a single launch further strengthens its dominance.

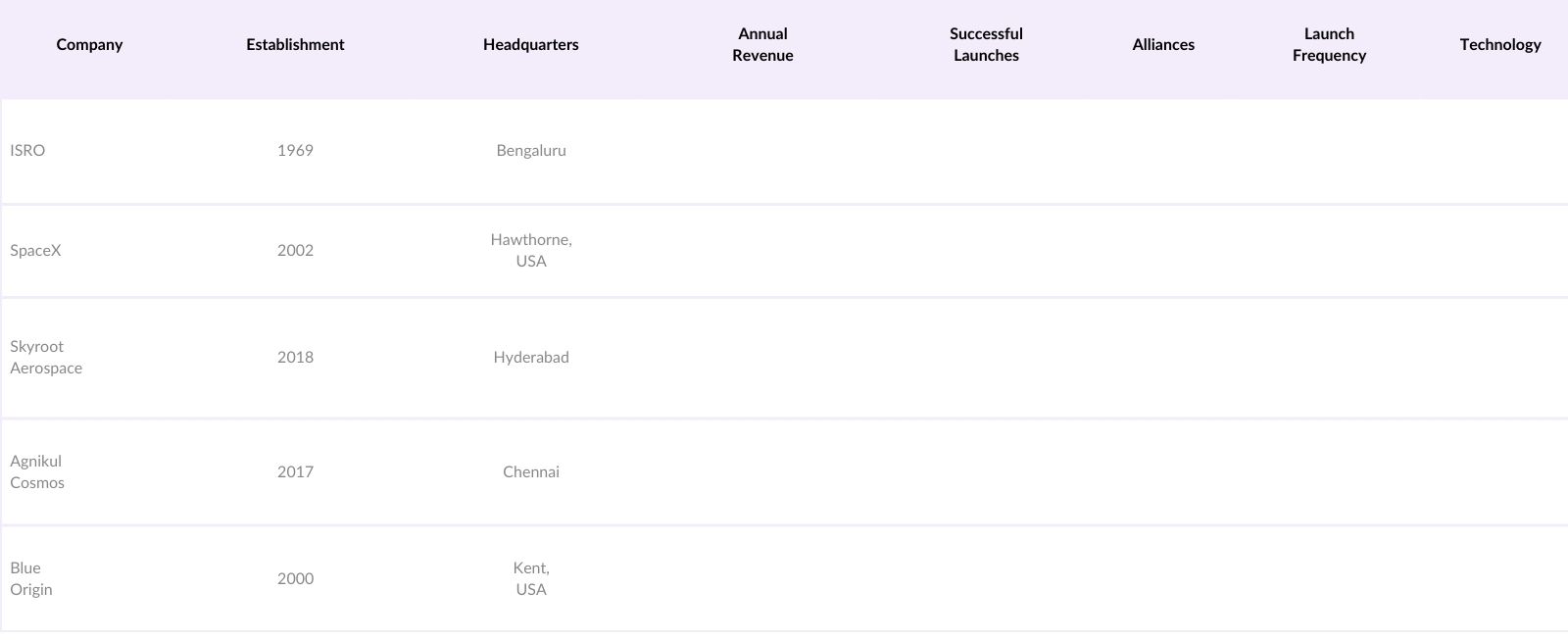

India Space Launch Services Market Competitive Landscape

The India Space Launch Services market is led by key players known for their strategic alliances and extensive operational portfolios. ISRO remains the primary player, while emerging private entities like Skyroot and Agnikul Cosmos are gaining traction with innovative small satellite launch solutions. Additionally, established international players contribute significantly, highlighting a competitive landscape driven by technological capability and strategic partnerships.

India Space Launch Services Market Analysis

Growth Drivers

- Government Programs & Initiatives: Indias government has been prioritizing space development through extensive policies and funding increases, especially through the Department of Space (DoS) and ISRO, which received 13,700 crore in 2024 from the central budget. This funding primarily supports PSLV and GSLV programs, aimed at boosting India's self-reliance in satellite launches. Furthermore, the National Space Promotion and Authorization Center (IN-SPACe) was established to encourage private participation, accelerating development and commercialization in the sector.

- Cost-Effective Launch Solutions: India has become a global leader in cost-effective space launches, offering satellite launches for a fraction of the cost in Western countries. For instance, a typical satellite launch by ISRO costs around 100 crore, which is significantly lower compared to global averages exceeding 500 crore. This cost efficiency is attracting commercial and international clients, positioning India competitively in the global space market.

- Demand for Satellite-Based Services: Indias satellite-based services market is expanding, driven by demands for telecommunications, broadcasting, and remote sensing. Over 200 satellites in orbit support essential services, and the demand for more launches is backed by government programs like Digital India and Smart Cities, where satellite services are crucial. The current demand for space-based internet solutions has also seen a notable rise, driving launch frequencies.

Market Challenges

High Initial Infrastructure Costs: Building infrastructure for launch facilities and satellite construction remains capital-intensive, with each launch facility costing an estimated 1,000 crore or more. Additionally, investments in R&D, skilled workforce, and technology advancements increase the financial barriers for new entrants, which can limit market growth.

Regulatory Compliance and Licensing: The complex regulatory framework and licensing requirements remain significant barriers. For instance, launching satellites requires compliance with the Space Activities Bill and approval from the Department of Space, which can take several months to complete, creating delays and potentially deterring new players in the market.

India Space Launch Services Market Future Outlook

Over the next five years, the India Space Launch Services market is expected to experience significant growth, primarily driven by sustained government support, advancements in reusable launch technologies, and heightened demand for satellite-based services. The market is likely to expand further with increasing private sector involvement and initiatives to develop low-cost, high-frequency launch solutions tailored for small satellite missions, positioning India as a global space hub.

Market Opportunities

- International Collaborations and Partnerships: India is actively pursuing partnerships with countries like France, the US, and Japan, focusing on satellite launches, deep-space exploration, and lunar missions. The Indo-French joint program has led to significant technology transfer, with France contributing over 500 crore in resources and expertise to Indian space missions (Source).

- Rise of Small Satellite Launches: The demand for small satellite launches, estimated at over 2,000 by 2025 globally, presents a huge opportunity. Indias PSLV is particularly well-suited for small satellite deployments, making it a favorable choice for commercial small satellite operators globally, thus offering growth avenues for Indias launch services.

Scope of the Report

Products

Key Target Audience

Private Space Companies

Satellite Manufacturers

Telecommunications Providers

Defense Agencies (DRDO, MoD)

Aerospace Investors and Venture Capitalists

Banks and Financial Institutes

Government and Regulatory Bodies (ISRO, NSIL, DoS)

Research and Development Institutions

Space and Satellite Service Providers

Companies

Players Mention in the Report:

ISRO

SpaceX

Arianespace

Rocket Lab

United Launch Alliance

NewSpace India Limited (NSIL)

Antrix Corporation

Blue Origin

Virgin Orbit

Skyroot Aerospace

Agnikul Cosmos

Lockheed Martin

Boeing Defense, Space & Security

Northrop Grumman Innovation Systems

Roscosmos

Table of Contents

1. India Space Launch Services Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Growth Rate and Emerging Dynamics

1.4. Market Segmentation Overview

2. India Space Launch Services Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Developments and Strategic Milestones

3. India Space Launch Services Market Analysis

3.1. Growth Drivers

3.1.1. Government Programs & Initiatives

3.1.2. Cost-Effective Launch Solutions

3.1.3. Demand for Satellite-Based Services

3.1.4. Increasing Commercialization of Space

3.2. Market Challenges

3.2.1. High Initial Infrastructure Costs

3.2.2. Regulatory Compliance and Licensing

3.2.3. Limited Launch Windows

3.2.4. Technological Barriers

3.3. Opportunities

3.3.1. International Collaborations and Partnerships

3.3.2. Rise of Small Satellite Launches

3.3.3. Development of Reusable Launch Vehicles

3.4. Trends

3.4.1. Shift to Private Sector Involvement

3.4.2. Use of Indigenous Technology

3.4.3. Global Partnerships for Space Exploration

3.5. Government Regulation and Policies

3.5.1. Space Policy and Guidelines

3.5.2. Foreign Direct Investment Regulations

3.5.3. Defense and Security Considerations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

4. India Space Launch Services Market Segmentation

4.1. By Launch Type [In Value %]

4.1.1. Satellite Launch

4.1.2. Cargo Launch

4.1.3. Human Spaceflight

4.2. By Vehicle Type [In Value %]

4.2.1. Polar Satellite Launch Vehicle (PSLV)

4.2.2. Geosynchronous Satellite Launch Vehicle (GSLV)

4.2.3. Small Satellite Launch Vehicles (SSLV)

4.3. By Payload Capacity [In Value %]

4.3.1. Light Payload (Up to 500 Kg)

4.3.2. Medium Payload (500 Kg to 2000 Kg)

4.3.3. Heavy Payload (Above 2000 Kg)

4.4. By End User [In Value %]

4.4.1. Commercial Entities

4.4.2. Government Agencies

4.4.3. Defense Organizations

4.4.4. Research Institutions

4.5. By Region [In Value %]

4.5.1. North

4.5.2. South

4.5.3. West

4.5.4. East

5. India Space Launch Services Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Indian Space Research Organization (ISRO)

5.1.2. SpaceX

5.1.3. Arianespace

5.1.4. Rocket Lab

5.1.5. United Launch Alliance (ULA)

5.1.6. NewSpace India Limited (NSIL)

5.1.7. Antrix Corporation

5.1.8. Blue Origin

5.1.9. Virgin Orbit

5.1.10. Skyroot Aerospace

5.1.11. Agnikul Cosmos

5.1.12. Lockheed Martin Corporation

5.1.13. Boeing Defense, Space & Security

5.1.14. Northrop Grumman Innovation Systems

5.1.15. Roscosmos

5.2. Cross Comparison Parameters [Headquarters, No. of Successful Launches, Revenue, Launch Success Rate, Technology Strength, Alliances, No. of Vehicles Operated, Frequency of Launches]

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment and Funding Analysis

5.7. Government Grants and Incentives

5.8. Private Equity and Venture Capital Investments

6. India Space Launch Services Market Regulatory Framework

6.1. Space Activity Policy

6.2. Foreign Direct Investment in Space Sector

6.3. Compliance Requirements

6.4. Licensing and Certification Processes

7. India Space Launch Services Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Influencing Future Growth

8. India Space Launch Services Future Market Segmentation

8.1. By Launch Type [In Value %]

8.2. By Vehicle Type [In Value %]

8.3. By Payload Capacity [In Value %]

8.4. By End User [In Value %]

8.5. By Region [In Value %]

9. India Space Launch Services Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Target Market Strategies

9.3. Market Entry and Expansion Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase entails constructing a comprehensive framework covering stakeholders in the India Space Launch Services Market. Key variables influencing market trends are identified through in-depth desk research, including primary and secondary databases to form a baseline understanding.

Step 2: Market Analysis and Construction

Historical data analysis is performed, examining growth drivers, technology penetration, and sector challenges. Market performance is measured by examining launch frequencies, successful missions, and public-private collaboration metrics, ensuring a robust data foundation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses undergo validation through in-depth interviews with sector experts, including representatives from ISRO and private aerospace firms, to validate revenue and operational trends. Insights obtained help refine and corroborate market data for accuracy.

Step 4: Research Synthesis and Final Output

In the final phase, direct consultations with leading companies in the space sector supplement our data, ensuring comprehensive coverage. Cross-validation with government statistics confirms the findings, which are synthesized into a final, data-backed analysis of the India Space Launch Services Market.

Frequently Asked Questions

01. How big is the India Space Launch Services Market?

The India Space Launch Services market is valued at USD 445 million, with expansion driven by private sector engagement, global partnerships, and rising demand for LEO satellites.

02. What challenges exist in the India Space Launch Services Market?

Challenges in India Space Launch Services market include high launch costs, stringent regulatory barriers, and limited infrastructure, which complicates mission scalability and high-frequency operations.

03. Who are the major players in the India Space Launch Services Market?

Key players in India Space Launch Services market include ISRO, SpaceX, Skyroot Aerospace, and Agnikul Cosmos, who dominate the market due to their technological prowess, government backing, and strong alliances.

04. What are the growth drivers in the India Space Launch Services Market?

India Space Launch Services Market Growth is propelled by rising satellite demand, international collaborations, and government support, particularly in developing indigenous technology and promoting private sector involvement.

05. What trends are shaping the India Space Launch Services Market?

Key trends in India Space Launch Services market include the rise of reusable launch technology, micro-launch services for small satellites, and increased demand for dual-use government-commercial satellite deployments.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.