India Stationery Market Outlook to 2028

Region:Asia

Author(s):Rajat Galav

Product Code:KROD7580

March 2025

80-100

About the Report

India Stationery Market Outlook to 2028

- The India Stationery Market is valued at USD 2.5 billion as per our historic 5 year analysis, driven by rapid urbanization, educational expansion, and increased corporate sector growth. The demand for stationery products is predominantly fueled by growing school enrollments, an expanding office workforce, and higher consumer spending on premium stationery items. Moreover, government policies and initiatives focusing on educational infrastructure are also contributing to the market's robust expansion.

- Cities such as Delhi, Mumbai, Bangalore, and Pune dominate the India Stationery Market due to their concentration of educational institutions, corporate offices, and retail infrastructure. These urban centers account for a significant share of overall stationery consumption due to higher disposable incomes, a thriving student population, and the presence of leading retailers. Moreover, these cities benefit from better access to modern distribution networks, making them primary hubs for both retail and online sales of stationery products.

- In 2023, the Indian government introduced new regulations under the Bureau of Indian Standards (BIS) for the manufacturing and quality certification of stationery products. These regulations mandate that all stationery items, including paper products and writing instruments, meet specific safety and environmental standards. The move aims to ensure higher quality, reduce hazardous material usage, and promote eco-friendly production practices across the industry.

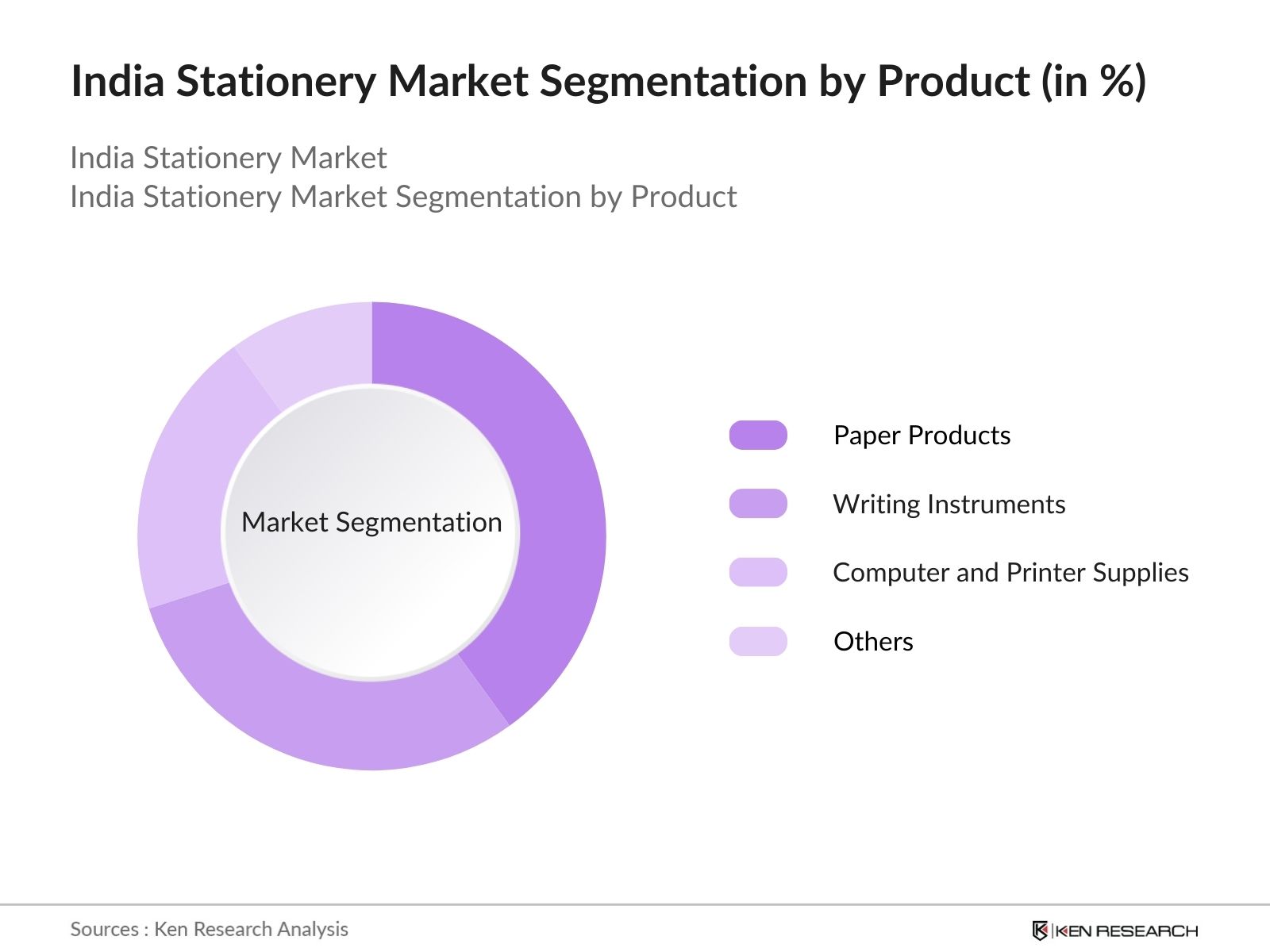

India Stationery Market Segmentation

- By Product Type : The India Stationery Market is segmented by product type into paper products, writing instruments, computer and printer supplies, and others. In the paper products segment, notebooks and writing pads contribute to the dominant market share. The increasing number of schools and offices fuels the demand for paper products, as they remain essential for day-to-day operations. Writing instruments, especially pens and pencils, hold a substantial share, driven by the cultural preference for physical writing.

- By Distribution Channel : The distribution channels for stationery in India include stationery and book shops, supermarkets and hypermarkets, online sales, and others. The online channel has shown significant growth in recent years due to the increasing preference for e-commerce platforms. Stationery and book shops, however, continue to hold a major share due to their physical presence and long-established trust among consumers.

India Stationery Market Competitive Landscape

The India Stationery Market is dominated by a few key players, each holding a significant portion of the market share. These players include both domestic manufacturers and global brands that have established themselves as leaders in the industry. Leading companies like ITC Limited, Navneet Education, and Kokuyo Camlin have cemented their positions through innovation and an extensive distribution network.

India Stationery Industry Analysis

Growth Drivers

- EdTech Integration : With Indias EdTech market projected to reach USD 10 billion by 2025, theres a growing demand for high-quality stationery among students using hybrid learning models. The increased use of personalized planners, revision cards, and subject-specific notebooks reflects a shift toward organized and premium stationery products tailored for digital-native learners.

- Educational Infrastructure Expansion : Total enrolment in higher education has increased to nearly 4.33 crore in FY22 from 4.14 crore in FY21 and 3.42 crore in FY15 (an increase of 26.5 per cent since FY15). This surge has directly influenced the demand for stationery products, as more students require notebooks, pens, and other supplies. With India aiming to achieve universal education, the educational sector's growth will continue to fuel stationery consumption.

- Corporate Sector Growth : India's corporate sector has expanded significantly, with over 1.2 million companies registered by 2023, a 15% increase compared to previous years. This growth, particularly in IT, education, and finance, has created a rising demand for office stationery products. As businesses scale, their need for supplies like pens, paper, and filing systems continues to rise.

Challenges

- Digitalization Impact : 45% of paper printed in offices ends up trashed by the end of the day, highlighting opportunities for further reductions through digital processes. This shift towards digital platforms for communication and documentation has slowed the demand for traditional stationery products. The increasing adoption of digital tools for education and work further exacerbates this decline, leaving the stationery market under pressure.

- Import Dependence : India imported 5,201 shipments of stationery items between March 2023 and February 2024, marking a growth rate of 31% compared to the preceding year. This dependence affects the local production ecosystem, leading to higher costs and reduced market competitiveness. Local manufacturers face challenges due to price competition and supply chain dependencies on global markets.

Future Outlook

Over the next 5 years, the India Stationery Market is expected to show consistent growth, driven by the expansion of the educational sector, an increase in the number of offices, and the rising demand for personalized stationery products. E-commerce will continue to play a pivotal role in shaping consumer purchasing behaviour, expanding the reach of stationery products across urban and rural regions.

Opportunities

- E Commerce Growth : By 2027, India's e-commerce sector is projected to reach USD 300 billion, reflecting significant growth driven by increasing internet penetration, rising disposable incomes, and a growing middle class. This represents a substantial increase from the USD 84 billion recorded in 2022. This growth has opened new sales channels for stationery products, enabling manufacturers and retailers to reach a wider audience.

- Product Innovation : Product innovations, which include biodegradable pens and recycled notebooks, cater to the rising demand for sustainable products. As environmental consciousness grows, product innovation offers significant growth opportunities in the stationery sector, attracting eco-conscious consumers. A Delhi-based startup with INR 16 lakhs govt grant sold 1-2 million biodegradable pens in 2024, showcasing the growing demand for sustainable stationery products.

Scope of the Report

|

Segment |

Sub-Segment |

|---|---|

|

By Product Type |

Paper Products |

|

Writing Instruments |

|

|

Computer and Printer Supplies |

|

|

Others |

|

|

By Application |

Educational Sector |

|

Corporate Sector |

|

|

Others |

|

|

By Distribution Channel |

Stationery and Book Shops |

|

Supermarkets and Hypermarkets |

|

|

Online |

|

|

Others |

|

|

By Region |

North |

|

West |

|

|

South |

|

|

East |

Products

Key Target Audience

- Retail Chain Operators

- Distributors and Wholesalers

- E-commerce Platforms (Amazon, Flipkart)

- Educational Institutions (Schools, Universities)

- Corporate Offices

- Government Agencies (Ministry of Education, Ministry of Commerce)

- Investment and Venture Capitalist Firms

- Regulatory Bodies (Bureau of Indian Standards)

Companies

Major Players

- ITC Limited

- Navneet Education Limited

- Kokuyo Camlin Limited

- Hindustan Pencils Pvt. Ltd.

- DOMS Industries Pvt. Ltd.

Table of Contents

1. India Stationery Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Stationery Market Size

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Stationery Market Analysis

3.1. Growth Drivers

3.1.1. EdTech Integration

3.1.2. Educational Infrastructure Expansion

3.1.3. Corporate Sector Growth

3.1.4. Government Initiatives

3.2. Restraints

3.2.1. Digitalization Impact

3.2.2. Import Dependence

3.2.3. Environmental Concerns

3.3. Opportunities

3.3.1. E-commerce Growth

3.3.2. Product Innovation

3.3.3. Export Potential

3.4. Trends

3.4.1. Premiumization

3.4.2. Customization

3.4.3. Sustainability Focus

3.5. Government Regulation

3.5.1. Bureau of Indian Standards Regulations

3.5.2. Goods and Services Tax

3.5.3. Environmental Policies

3.5.4. Trade Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Stationery Market Segmentation

4.1. By Product Type

4.1.1. Paper Products

4.1.2. Writing Instruments

4.1.3. Computer and Printer Supplies

4.1.4. Others

4.2. By Application

4.2.1. Educational Sector

4.2.2. Corporate Sector

4.2.3. Others

4.3. By Distribution Channel

4.3.1. Stationery and Book Shops

4.3.2. Supermarkets and Hypermarkets

4.3.3. Online

4.3.4. Others

4.4. By Region

4.4.1. North India

4.4.2. West and Central India

4.4.3. South India

4.4.4. East India

5. India Stationery Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ITC Limited

5.1.2. Navneet Education Limited

5.1.3. Kokuyo Camlin Limited

5.1.4. Hindustan Pencils Pvt. Ltd.

5.1.5. DOMS Industries Private Limited

5.2. Cross Comparison Parameters

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investors Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Stationery Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. India Stationery Market Future Market Size

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Stationery Market Future Market Segmentation

8.1. By Product Type

8.2. By Application

8.3. By Distribution Channel

8.4. By Region

9. India Stationery Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the critical factors that influence the India Stationery Market. This is done by collecting data from primary and secondary sources, including government reports, industry publications, and interviews with stakeholders such as manufacturers and retailers.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data to understand the market trends and the contribution of different product types and distribution channels. We assess the market penetration and distribution strategies of major players to create an accurate market model.

Step 3: Hypothesis Validation and Expert Consultation

We validate market hypotheses through consultations with industry experts and practitioners. These consultations provide operational and financial insights, which are crucial for refining the data and ensuring accuracy.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the collected data to provide actionable insights. This includes integrating product trends, consumer behavior data, and competitive analysis to generate a comprehensive report on the India Stationery Market.

Frequently Asked Questions

01. How big is India Stationery Market?

The India Stationery Market is valued at USD 2.5 billion, driven by the expanding educational sector, corporate growth, and strong consumer demand for both basic and premium stationery items.

02. What are the growth drivers of India Stationery Market?

Growth drivers include the expanding school enrollments, growing corporate sector, and increasing disposable incomes. E-commerce's rapid expansion and government initiatives to improve educational infrastructure also play a significant role.

03. What are the challenges in India Stationery Market?

Challenges include digitalizations impact on paper product demand, environmental concerns regarding paper use, and the dependency on imported materials, which could affect supply chain reliability and costs.

04. Who are the major players in the India Stationery Market?

Key players in the India Stationery Market include ITC Limited, Navneet Education Limited, Kokuyo Camlin Limited, Hindustan Pencils Pvt. Ltd., and DOMS Industries Pvt. Ltd. These companies dominate through strong brand presence and extensive distribution networks.

05. What are the future prospects for the India Stationery Market?

The India Stationery Market is expected to grow significantly due to increased urbanization, higher disposable incomes, and the continued demand for educational and office supplies. E-commerce platforms will drive consumer engagement and product accessibility.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.