India Suitcase Market Outlook to 2028

Region:Asia

Author(s):Shreya

Product Code:KROD8486

November 2024

91

About the Report

India Suitcase Market Overview

The India Suitcase Market is valued at USD 1.8 billion, driven by rising disposable income, increased travel frequency, and evolving consumer preferences towards stylish and functional luggage. The market is supported by the growth of domestic and international tourism and an increasing reliance on durable, lightweight materials for ease of mobility. Leading brands in India are capitalizing on consumer demand for durable and versatile suitcases that align with lifestyle and fashion trends, contributing significantly to the markets current valuation.

Major urban centers like Mumbai, Delhi, and Bengaluru lead the suitcase market in India. These cities, with their high travel demand and significant concentration of business travelers, generate a strong consumer base for premium suitcase brands. Additionally, the presence of high-income groups, increasing e-commerce penetration, and a growing number of shopping malls support this dominance. Such cities act as primary markets for premium and mid-tier brands, setting purchasing trends that influence the overall market dynamics in India.

Indias suitcase market is influenced by the countrys import and export policies, especially as the government aims to reduce reliance on imports through initiatives like Make in India. In 2023, import duties on certain types of suitcase materials were raised by 10%, impacting the cost of imported components. Such policies encourage local manufacturing, with more brands sourcing materials domestically, which in turn supports the domestic suitcase market.

India Suitcase Market Segmentation

By Material Type: The Market is segmented by material type into Polycarbonate, Polyester, Aluminum, Leather, and Other Synthetic Materials. Recently, Polycarbonate has achieved dominance in the material segmentation due to its lightweight nature, high durability, and resistance to wear. These properties make polycarbonate ideal for frequent travelers who prioritize practicality without compromising aesthetics, thus enhancing its demand within the market.

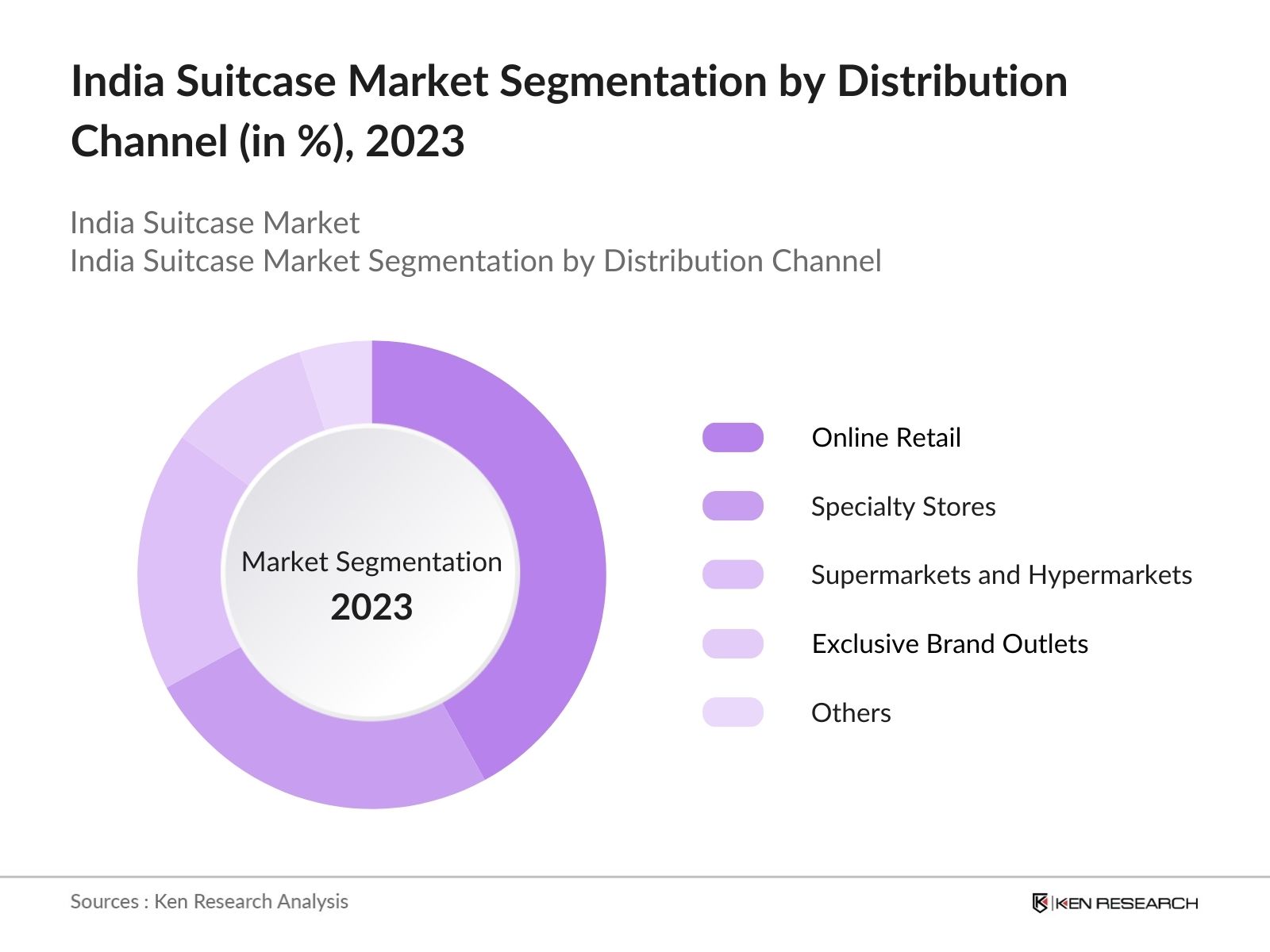

By Distribution Channel: Segmentation by distribution channel includes Online Retail, Specialty Stores, Supermarkets and Hypermarkets, Exclusive Brand Outlets, and Others. Online Retail leads this segment due to its convenience, variety of choices, and frequent discount offers, attracting a large customer base. The rise in internet penetration and the success of e-commerce platforms like Amazon and Flipkart in India have made online retail a primary choice for suitcase purchases.

India Suitcase Market Competitive Landscape

The India Suitcase Market is primarily dominated by several established companies with a strong presence in both the offline and online channels. The competitive landscape highlights a few major players with a combination of local and international brands that control significant market shares. "The India Suitcase Market is characterized by the presence of prominent players like Samsonite India Pvt Ltd., VIP Industries Ltd., and American Tourister, who lead in innovation, brand loyalty, and strategic partnerships with retail chains.

|

Company |

Establishment Year |

Headquarters |

Product Range |

Key Consumer Segment |

Manufacturing Locations |

Distribution Channels |

Brand Positioning |

|

Samsonite India Pvt Ltd. |

1910 |

Mumbai |

|||||

|

VIP Industries Ltd. |

1971 |

Mumbai |

|||||

|

American Tourister |

1933 |

Delhi |

|||||

|

Safari Industries Ltd. |

1974 |

Mumbai |

|||||

|

Delsey India |

1946 |

Delhi |

India Suitcase Industry Analysis

Growth Drivers

Rising Disposable Income: Indias per capita income has steadily increased, reaching USD 2,500 in 2023 according to the World Bank, leading to greater consumer purchasing power and demand for lifestyle goods, including suitcases. As disposable income grows, more middle-class consumers are able to invest in premium travel gear, further supporting market growth. The countrys household consumption expenditure was estimated at USD 1.8 trillion in 2023, a clear indication of increased discretionary spending in both urban and semi-urban areas. This surge in income is directly tied to higher suitcase sales, especially in branded and durable options that appeal to a more affluent customer base.

Expansion of E-commerce Platforms: Indias e-commerce sector witnessed exponential growth, recording around 2 billion online transactions in 2023 as reported by government data. This rapid expansion provides an ideal platform for suitcase manufacturers to reach a wider audience across urban and rural India. With online retail channels increasing customer access to diverse suitcase brands, consumers are more inclined to purchase luggage online for better variety and discounts. This trend is amplified by the governments support of digital infrastructure, helping tier-II and tier-III cities access these platforms and contribute to the suitcase markets growth.

Increasing Domestic and International Travel: Domestic tourism within India accounted for over 2 billion trips in 2023, supported by increased domestic flights and budget-friendly travel options, as noted by the Ministry of Tourism. International travel among Indian citizens also rose, with 15 million overseas trips taken last year, demonstrating a strong demand for travel accessories, including suitcases. As travel normalizes post-pandemic, families and individuals increasingly seek durable, high-capacity luggage for convenience. These statistics underscore a robust demand for suitcases and travel gear designed to cater to frequent travelers.

Market Challenges

Price Sensitivity: Indias suitcase market faces significant price sensitivity, especially in tier-II and tier-III cities, where consumers prioritize affordability. The average Indian households monthly expenditure in these regions is around USD 230, according to the National Sample Survey Office. As a result, brands must navigate competitive pricing to attract these value-conscious consumers. Low-cost options from unbranded and local manufacturers often capture this segment, intensifying competition for larger brands that need to find cost-effective ways to offer quality at affordable prices.

Competition from Local Manufacturers: Local manufacturers, who can offer suitcases at prices up to 30% lower than branded alternatives, dominate Indias suitcase market. This competitive pricing is possible due to lower production costs and limited compliance with quality standards, particularly in semi-urban and rural areas. According to the Ministry of Micro, Small, and Medium Enterprises (MSME), there are around 63 million small-scale manufacturers, many of whom produce travel goods, thus providing substantial competition to larger suitcase brands.

India Suitcase Market Future Outlook

The India Suitcase Market is anticipated to witness sustained growth, propelled by rising travel activities, both business and leisure. Increasing urbanization, a shift towards premium products, and the integration of technology in luggage design will further enhance the markets scope. The introduction of smart suitcases, equipped with GPS tracking and digital locks, represents a promising trend that is expected to gain consumer traction among tech-savvy travelers.

Future Market Opportunities

Expansion in Tier-II and Tier-III Cities: Tier-II and tier-III cities in India are witnessing a steady increase in consumer spending, with cities like Indore and Jaipur reporting over 20 million new middle-income households in 2023. These cities represent untapped markets for suitcase manufacturers, with rising demands for budget-friendly yet durable luggage options. As infrastructure and digital access improve, manufacturers can leverage these cities for expansion by offering products that appeal to the aspirational lifestyle in these regions.

Introduction of Smart: he introduction of smart suitcases has shown strong potential. In 2023, around 150 million Indians used wearable technology, indicating an increasing interest in tech-integrated products. Smart suitcases featuring GPS, USB charging, and weight sensors are particularly appealing to business travelers. The governments push for digital innovation, with schemes like Digital India, further supports this segment's growth, enabling wider acceptance of advanced travel accessories.

Scope of the Report

|

Segments |

Sub-Segments |

|

Material Type |

Polycarbonate Polyester Aluminum Leather Other Synthetic Materials |

|

Product Type |

Hard-shell Suitcases Soft-shell Suitcases Expandable Suitcases |

|

Distribution Channel |

Online Retail Specialty Stores Supermarkets and Hypermarkets Exclusive Brand Outlets Others |

|

Consumer Segment |

Leisure Travelers Business Travelers Students Backpackers |

|

Size Type |

Cabin Size Medium Size Large Size |

Products

Key Target Audience

- Investor and Venture Capitalist Firms

- Government and Regulatory Bodies (Bureau of Indian Standards, Ministry of Commerce and Industry)

- Retail Chains and Distribution Partners

- Luggage Manufacturers and Suppliers

- E-commerce Platforms

- Corporate Travel Agencies

- High-Net-Worth Individuals (HNIs)

- Export-Import Businesses

Companies

Major Players

- Samsonite India Pvt Ltd.

- VIP Industries Ltd.

- American Tourister

- Safari Industries Ltd.

- Delsey India

- Carlton

- Wildcraft

- Fastrack

- Tommy Hilfiger Luggage

- Hidesign

- Kamiliant

- Swiss Gear

- Da Milano

- Skybags

- Aristocrat

Table of Contents

1. India Suitcase Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Key Market Drivers (Consumer Preferences, Travel Frequency, Tourism Growth)

1.4 Market Segmentation Overview

2. India Suitcase Market Size (In INR Crores)

2.1 Historical Market Size Analysis

2.2 Year-on-Year Market Growth Analysis

2.3 Key Market Developments and Milestones

3. India Suitcase Market Dynamics

3.1 Growth Drivers

3.1.1 Rising Disposable Income

3.1.2 Expansion of E-commerce Platforms

3.1.3 Increasing Domestic and International Travel

3.2 Market Challenges

3.2.1 Price Sensitivity

3.2.2 Competition from Local Manufacturers

3.2.3 Raw Material Cost Volatility

3.3 Opportunities

3.1 Expansion in Tier-II and Tier-III Cities

3.2 Introduction of Smart Suitcases

3.3 Collaborations with Airlines and Hospitality Brands

3.4 Trends

3.4.1 Demand for Lightweight and Durable Materials

3.4.2 Customization and Personalization

3.4.3 Growth in Eco-friendly Suitcases

3.5 Government Regulations

3.5.1 Import and Export Policies

3.5.2 Compliance with Quality Standards

3.5.3 Incentives for Sustainable Manufacturing

4. India Suitcase Market Competitive Landscape

4.1 Detailed Profiles of Major Companies

Samsonite India Pvt Ltd.

VIP Industries Ltd.

Safari Industries (India) Ltd.

American Tourister

Skybags

Delsey India

Aristocrat

Carlton

Kamiliant

Fastrack

Hidesign

Tommy Hilfiger Luggage

Swiss Gear

Wildcraft

Da Milano

4.2 Cross Comparison Parameters (Manufacturing Locations, Market Reach, Price Range, Customer Segments, Product Variety, Revenue Contribution from Online Sales, Warranty Policies, and Return Rates)

4.3 Market Share Analysis

4.4 Strategic Initiatives (Product Launches, Regional Expansion)

4.5 Mergers and Acquisitions

4.6 Investment and Funding Analysis

5. India Suitcase Market Segmentation

5.1 By Material Type (In Value %)

Polycarbonate

Polyester

Aluminum

Leather

Other Synthetic Materials

5.2 By Product Type (In Value %)

Hard-shell Suitcases

Soft-shell Suitcases

Expandable Suitcases

5.3 By Distribution Channel (In Value %)

Online Retail

Specialty Stores

Supermarkets and Hypermarkets

Exclusive Brand Outlets

Others

5.4 By Consumer Segment (In Value %)

Leisure Travelers

Business Travelers

Students

Backpackers

5.5 By Size Type (In Value %)

Cabin Size

Medium Size

Large Size

5.6 India Suitcase Market Regulatory Framework

Import and Export Duties on Luggage

Standards and Certifications (ISI, Bureau of Indian Standards)

Compliance with Environmental Norms

Anti-dumping Laws on Imported Goods

5.7 India Suitcase Market Future Growth Factors

Emerging Market Needs

Influence of Lifestyle and Fashion Trends

Sustainability and Recycling Initiatives

5.8 India Suitcase Market Analysts Recommendations

TAM/SAM/SOM Analysis

Consumer Segmentation Insights

Regional Targeting Strategies

White Space Opportunity Analysis (Underpenetrated Consumer Segments, Unserved Regions)

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we outline critical factors such as consumer demand, product durability, pricing sensitivity, and regional distribution. An ecosystem map is constructed based on extensive desk research from reliable industry databases to define variables impacting market dynamics.

Step 2: Market Analysis and Construction

Historical data from the last five years is compiled, analyzing penetration rates across urban and rural markets. Data points like product availability in retail versus online channels and consumer purchasing preferences are included to ensure precise revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Industry-specific hypotheses are validated through CATIs and in-depth interviews with executives from major luggage companies. Insights from these consultations are invaluable for corroborating and refining data, particularly regarding market segmentation and consumer trends.

Step 4: Research Synthesis and Final Output

The final step involves integrating the bottom-up and top-down data, directly engaging with leading luggage brands to gather additional data on product sales, manufacturing, and distribution. This consolidated data provides a validated and comprehensive market analysis.

Frequently Asked Questions

How big is the India Suitcase Market?

The India Suitcase Market is valued at USD 1.8 billion, bolstered by increasing disposable income and heightened travel activities, making it a high-growth sector.

What are the challenges in the India Suitcase Market?

Key challenges in the India Suitcase Market include price sensitivity, intense competition from local manufacturers, and fluctuations in raw material costs, which impact the profitability of premium brands.

Who are the major players in the India Suitcase Market?

Leading companies in the India Suitcase Market like Samsonite, VIP Industries, American Tourister, and Delsey dominate the market, driven by their extensive product portfolios and established brand loyalty.

What drives the growth of the India Suitcase Market?

Growth in the India Suitcase Market is driven by factors such as increased domestic and international travel, rising disposable income, and the adoption of durable and eco-friendly materials in suitcase manufacturing.

How is the market segmented in the India Suitcase Market?

The India Suitcase Market is segmented based on material type (e.g., polycarbonate, polyester) and distribution channel (e.g., online retail, specialty stores), catering to a variety of consumer needs and preferences.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.