India Traction Motor Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD507

January 2025

96

About the Report

India Traction Motor Market Overview

- The India Traction Motor Market has experienced notable growth, this is reflected by Global Traction Motor Market reaching a valuation of USD 7.2 billion in 2023, driven by the growing adoption of electric vehicles (EVs), significant investments in railway electrification, and government initiatives promoting sustainable transportation.

- Key players in the market include Bharat Heavy Electricals Limited (BHEL), Crompton Greaves, Siemens India, Alstom India, and ABB India. These companies are renowned for their robust technological capabilities, extensive product portfolios, and strong distribution networks.

- In 2023, Indian Railways and Bharat Heavy Electricals Limited (BHEL) entered a partnership aimed at developing energy-efficient traction motors for locomotives. This initiative is part of a broader effort to modernize the existing fleet of conventional DC traction motor-driven electric locomotives.

- States like Delhi and Uttar Pradesh, dominates the traction motor market due to higher industrial activities, significant investments in metro rail projects, and the growing adoption of electric vehicles in urban areas. The region's infrastructure development and government support further enhance its leading position in the market.

India Traction Motor Market Segmentation

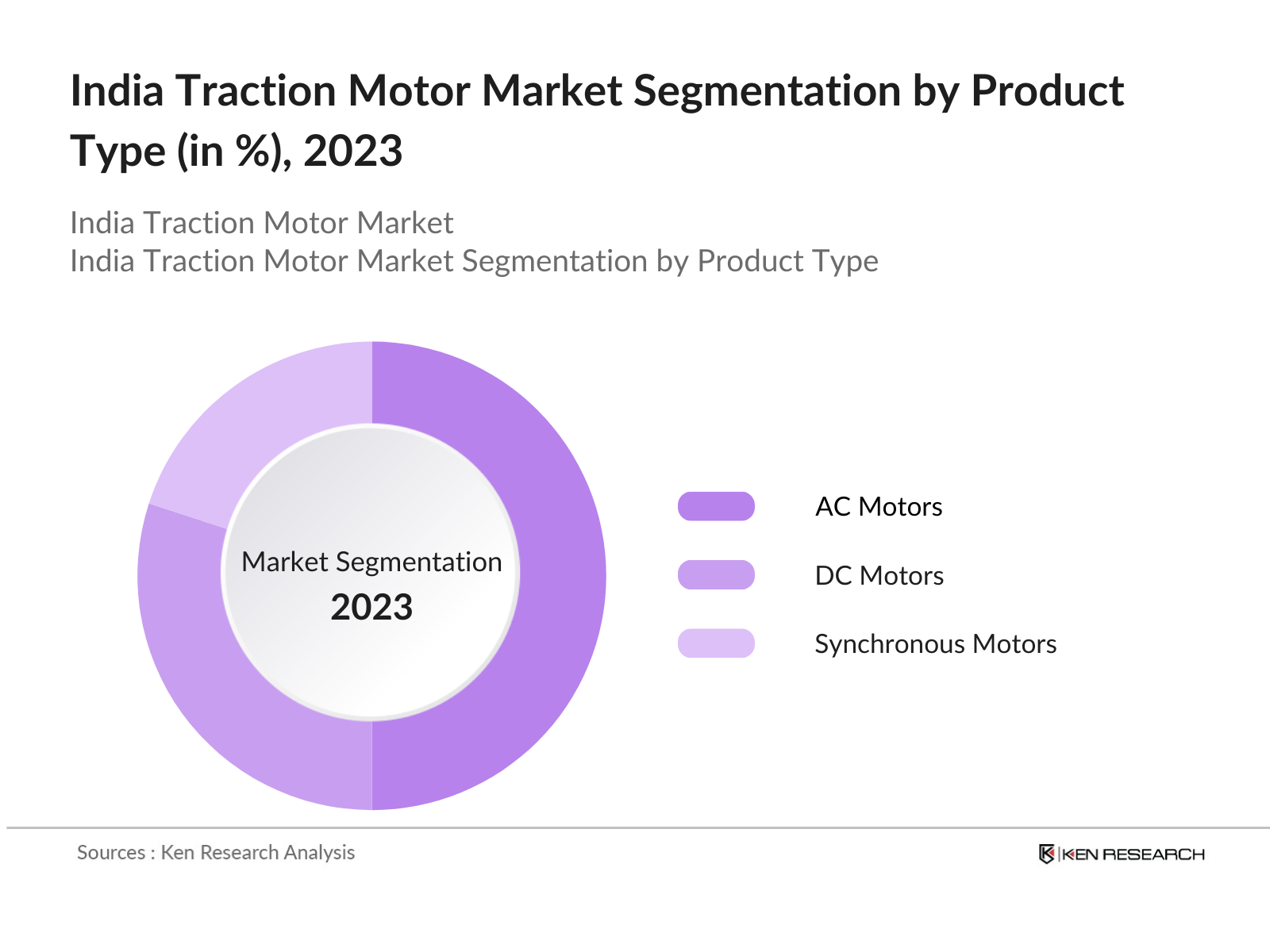

By Product Type: The India Traction Motor Market is segmented by product type into AC Motors, DC Motors, and Synchronous Motors. In 2023, AC Motors dominated the market due to their high efficiency, reliability, and widespread use in electric vehicles and railway systems. The preference for AC Motors is driven by their ability to handle higher power loads and their lower maintenance requirements, making them ideal for heavy-duty applications.

By Application: The market is segmented by application into Railways, Electric Vehicles, and Industrial Machinery. In 2023, the Railways segment held the largest market share, driven by the Indian government's extensive investments in electrifying the railway network. This focus on reducing carbon emissions and enhancing energy efficiency has made railways a significant consumer of traction motors, especially with the push towards modernization and infrastructure upgrades.

By Region: The India Traction Motor Market is regionally segmented into North, South, East, and West India. In 2023, the Northern region led the market due to its higher concentration of industrial activities, extensive metro rail projects, and significant government investments in infrastructure development. The region's strategic importance in India's transportation network also contributes to its dominance.

India Traction Motor Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Bharat Heavy Electricals |

1964 |

New Delhi, India |

|

Crompton Greaves |

1937 |

Mumbai, India |

|

Siemens India |

1922 |

Mumbai, India |

|

Alstom India |

1996 |

Bengaluru, India |

|

ABB India |

1949 |

Bengaluru, India |

- In July 2024, Alstom announced a significant expansion in India to meet the growing demand for advanced railway solutions. CEO Henri Poupart-Lafarge stated that the company has already invested over 300 million euros. Alstom's new manufacturing facility in Coimbatore, expected to be operational by the end of 2024, will produce critical components for metro projects across India, creating over 500 jobs.

- In 2023, Siemens Mobility, a separately managed company of Siemens AG, was awarded a 3 billion project by Indian Railways to design, manufacture, commission and test 1,200 electric freight locomotives of 9,000 horsepower each.This is the single largest locomotive order in the history of Siemens Mobility and Siemens India.

India Traction Motor Industry Analysis

India Traction Motor Market Growth Drivers

- Government Initiatives for Electrification: The Indian government has implemented several initiatives to promote the adoption of electric vehicles (EVs), which directly drives the traction motor market. As of July 2023, a total of832,824 electric vehicles (EVs)have been sold under the FAME-II scheme since its inception in April 2019.

- Rising Demand for Energy Efficiency: The push for energy efficiency in industrial applications is a significant growth driver for the traction motor market. By 2030, the Indian government aims to reduce energy consumption by 20% across various sectors, including manufacturing and transportation. This initiative is expected to increase the demand for energy-efficient motors, which are essential for meeting stringent energy performance standards.

- Infrastructure Development and Urbanization: India is undergoing extensive infrastructure development, particularly in urban areas, which is expected to bolster the traction motor market. The government's investment in infrastructure projects, such as the 111 lakh crore National Infrastructure Pipeline, aims to enhance connectivity and public transportation systems. This investment is projected to increase the demand for electric buses and trains

India Traction Motor Market Challenges

- Supply Chain Disruptions: The traction motor market faces challenges due to supply chain disruptions, particularly in the availability of critical raw materials. The ongoing global semiconductor shortage has impacted the production of electric vehicles, leading to delays in motor manufacturing. In 2024, it is expected that the semiconductor supply will remain constrained.

- High Manufacturing Costs: The production of traction motors requires advanced materials and technologies, leading to high manufacturing costs. In 2024, the prices of essential metals like copper and aluminum are projected to remain volatile, with copper prices expected to hover around 800 per kg. This price instability can significantly impact the cost structure for manufacturers, making it challenging to offer competitive pricing in the market.

India Traction Motor Market Government Initiatives

- National Motor Replacement Programme (NMRP): Launched by Energy Efficiency Services Limited (EESL), the NMRP aims to replace inefficient motors with high-efficiency IE3 motors. By 2025, the program is expected to have replaced over 1 million inefficient motors, resulting in significant energy savings estimated at 4,000 GWh annually.

- Production-Linked Incentive (PLI) Scheme: The Production Linked Incentive (PLI) Scheme for the automotive sector, initiated in November 2020, aims to boost domestic manufacturing and attract significant investments by offering incentives based on production output. It has garnered proposed investments of 67,690 crore from 85 approved applicants, creating nearly 29,000 jobs as of March 2024.

India Traction Motor Future Market Outlook

The India Traction Motor Market is expected to grow significantly by 2028 along with a respectable CAGR from 2023 to 2028, driven by increasing technological advancements & expansion of online retail.

Future Trends

- Expansion of Electric Vehicle Infrastructure: By 2028, the Indian government is projected to invest 20,000 crore in expanding EV charging infrastructure, significantly enhancing the accessibility and convenience of electric vehicles. This investment is expected to facilitate a substantial increase in EV adoption, with projections indicating that the number of electric vehicles on Indian roads could exceed 10 million by 2028.

- Increased Focus on Sustainability: Sustainability will become a central theme in the traction motor market by 2028, with manufacturers increasingly adopting eco-friendly practices in production. It is expected that around 50% of traction motors will be produced using sustainable materials and processes, aligning with global sustainability goals.

Scope of the Report

|

By Product Type |

AC Motors DC Motors Synchronous Motors |

|

By Application |

Railways Electric Vehicles Industrial Machinery |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities who can benefit by Subscribing This Report:

Electric Vehicle Manufacturers

Railway Operators

Government & Regulatory Bodies (e.g., Ministry of Heavy Industries)

Electric Motor Manufacturers

Automotive OEMs

Railway Equipment Suppliers

Investments and Venture Capitalist Firms

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report

Bharat Heavy Electricals Limited (BHEL)

Crompton Greaves

Siemens India

Alstom India

ABB India

Toshiba India

Bombardier Transportation

Schneider Electric India

Toshiba Mitsubishi-Electric Industrial Systems

WEG Industries

Nidec Corporation

Hitachi India

Bharat Bijlee Limited

Ashok Leyland

Kirloskar Electric Company

Table of Contents

1. India Traction Motor Market Overview

1.1 India Traction Motor Market Taxonomy

2. India Traction Motor Market Size (in USD Mn), 2018-2023

3. India Traction Motor Market Analysis

3.1 India Traction Motor Market Growth Drivers

3.2 India Traction Motor Market Challenges and Issues

3.3 India Traction Motor Market Trends and Development

3.4 India Traction Motor Market Government Regulation

3.5 India Traction Motor Market SWOT Analysis

3.6 India Traction Motor Market Stake Ecosystem

3.7 India Traction Motor Market Competition Ecosystem

4. India Traction Motor Market Segmentation, 2023

4.1 India Traction Motor Market Segmentation by Product Type (in value %), 2023

4.2 India Traction Motor Market Segmentation by Application (in value %), 2023

4.3 India Traction Motor Market Segmentation by Region (in value %), 2023

5. India Traction Motor Market Competition Benchmarking

5.1 India Traction Motor Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Traction Motor Future Market Size (in USD Mn), 2023-2028

7. India Traction Motor Future Market Segmentation, 2028

7.1 India Traction Motor Market Segmentation by Product Type (in value %), 2028

7.2 India Traction Motor Market Segmentation by Application (in value %), 2028

7.3 India Traction Motor Market Segmentation by Region (in value %), 2028

8. India Traction Motor Market Analysts Recommendations

8.1 India Traction Motor Market TAM/SAM/SOM Analysis

8.2 India Traction Motor Market Customer Cohort Analysis

8.3 India Traction Motor Market Marketing Initiatives

8.4 India Traction Motor Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building

Collating statistics on India Traction Motor Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Traction Motor Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output

Our team will approach multiple traction motor companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from traction motor companies.

Frequently Asked Questions

01 How big is the India Traction Motor Market?

The India Traction Motor Market has experienced notable growth, this is reflected by Global Traction Motor Market reaching a valuation of USD 7.2 billion in 2023., driven by the growing adoption of electric vehicles (EVs), significant investments in railway electrification, and government initiatives promoting sustainable transportation.

02 What are the challenges in the India Traction Motor Market?

Challenges in the India Traction Motor Market include high costs of advanced technology, regulatory complexities, and the need for significant infrastructure development. Additionally, the market faces competition from international players with established global supply chains.

03 Who are the major players in the India Traction Motor Market?

Major players in the India Traction Motor Market include Bharat Heavy Electricals Limited (BHEL), Crompton Greaves, Siemens India, Alstom India, and ABB India. These companies are leading due to their strong manufacturing capabilities, technological expertise, and extensive distribution networks.

04 What are the growth drivers of the India Traction Motor Market?

The growth of the India Traction Motor Market is driven by the government's focus on electric mobility, increasing demand for electric vehicles, and expanding railway electrification projects. Additionally, technological advancements in motor efficiency and performance are propelling market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.