India Used Car Financing Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD9487

December 2024

96

About the Report

India Used Car Financing Market Overview

- The India Used Car Financing Market is valued at USD 8 billion, reflecting significant growth driven by rising demand for affordable transportation and an increasing preference for second-hand vehicles. The market has seen robust growth due to several factors, including the shift in consumer behavior post-pandemic, where affordability and financial constraints have led many to consider used cars over new ones.

- In the market, major urban areas such as Mumbai, Delhi, and Bengaluru dominate due to their large populations, higher per capita income, and urban congestion that leads to greater demand for private vehicles. The availability of multiple financing options and the growing role of Non-Banking Financial Companies (NBFCs) in these regions contribute to their dominance. Furthermore, these cities host a larger number of certified pre-owned car dealerships and have stronger infrastructure to support digital lending platforms.

- The Indian government has been actively promoting financial inclusion, with over 475 million bank accounts opened under the Pradhan Mantri Jan Dhan Yojana (PMJDY) by 2024. This initiative increases access to formal credit channels, allowing a broader section of the population to avail of loans for used car purchases.

India Used Car Financing Market Segmentation

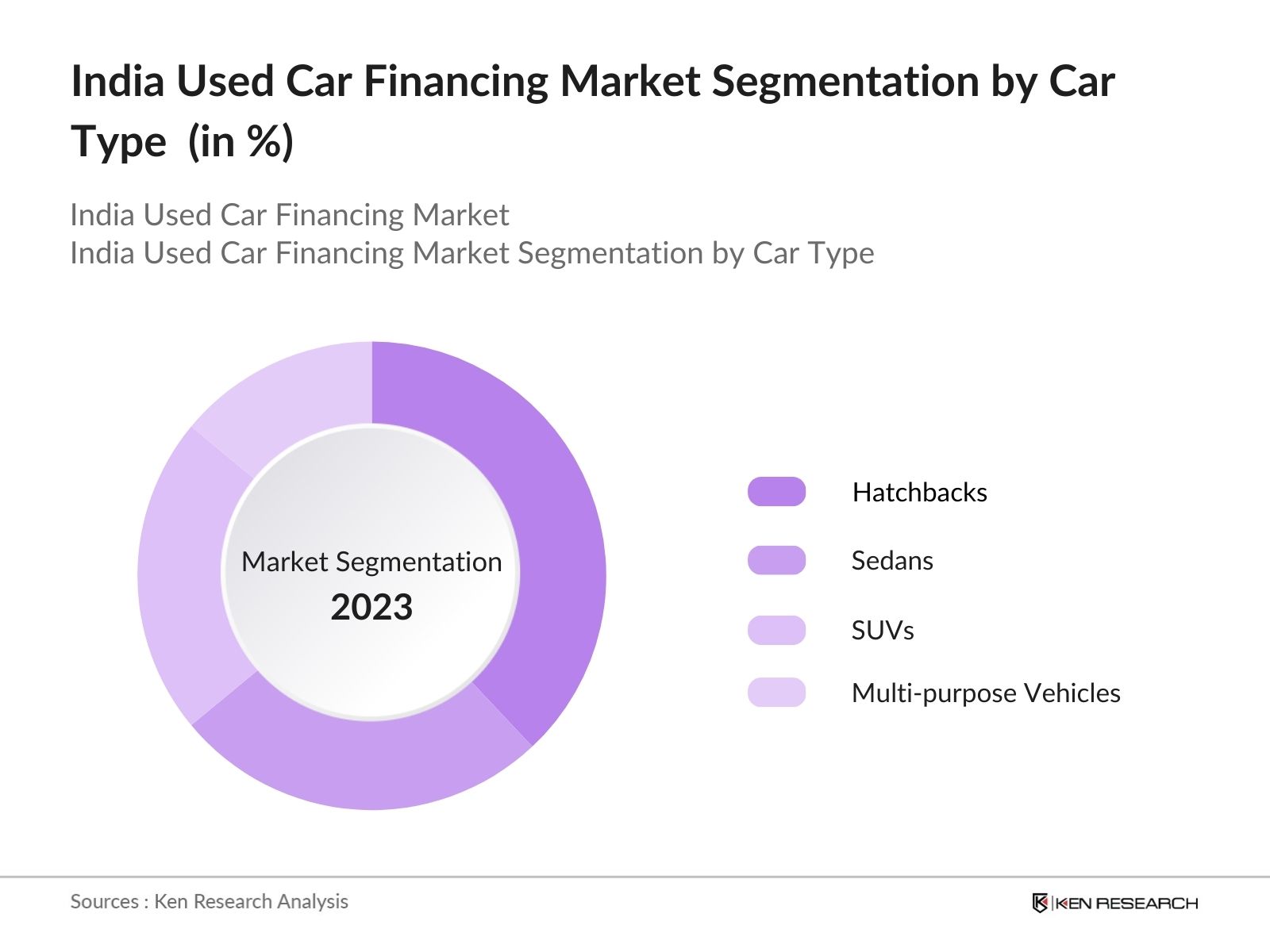

By Car Type: The market is segmented by car type into hatchbacks, sedans, SUVs, and multi-purpose vehicles (MPVs). Hatchbacks hold a dominant market share in this segment, owing to their affordability, fuel efficiency, and smaller size, which suits congested city environments. Consumers prefer hatchbacks due to their lower maintenance costs and easier maneuverability in urban traffic, making them an ideal choice for first-time buyers seeking affordable transportation options.

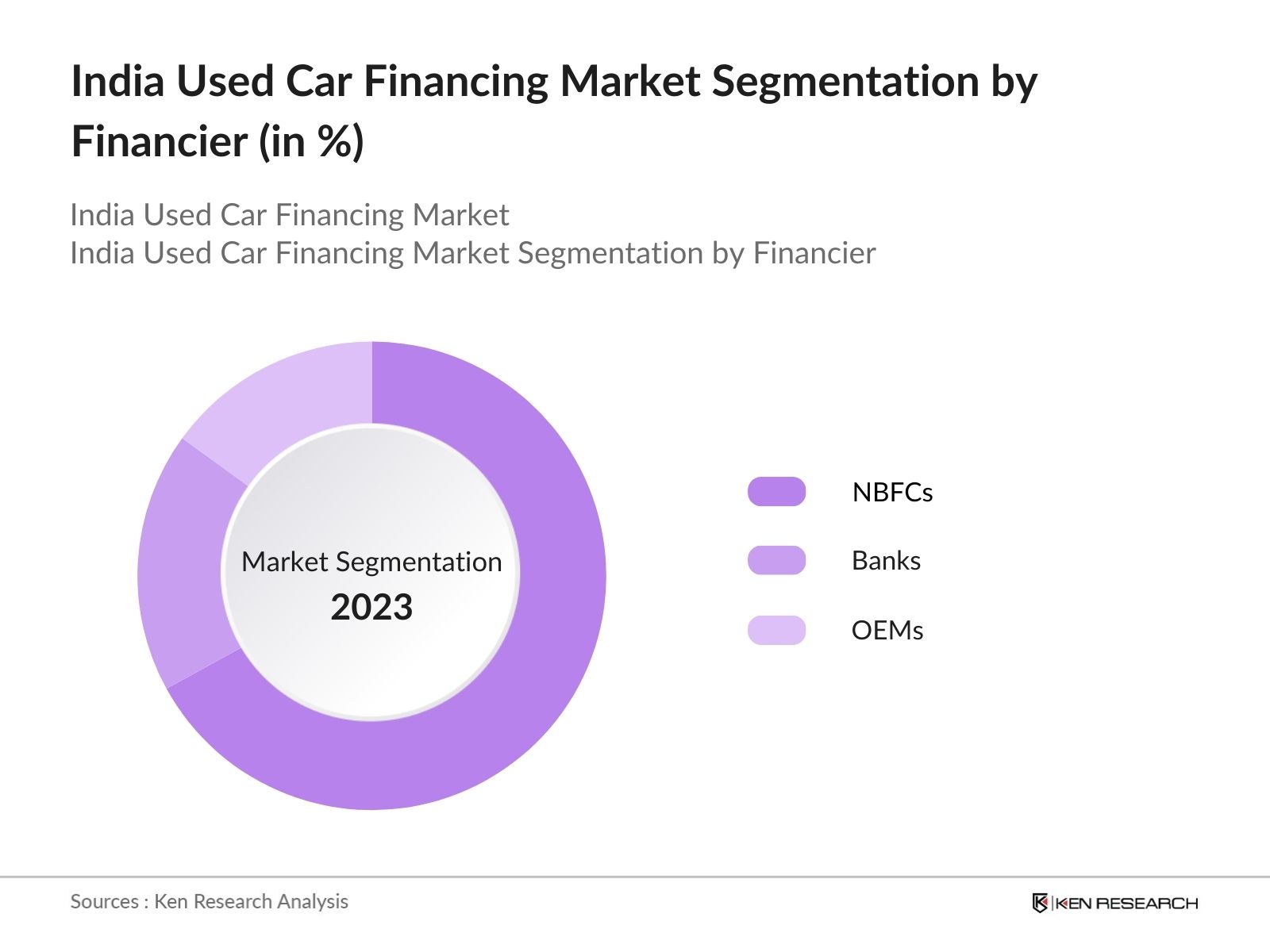

By Financier: The market is also segmented by financier type into OEMs, banks, and NBFCs. NBFCs dominate this segment due to their flexible lending policies and quicker loan disbursement processes, which attract a significant portion of buyers. Unlike traditional banks, NBFCs provide easier access to credit for customers with lower credit scores, contributing to their dominance in the used car financing space.

India Used Car Financing Market Competitive Landscape

The market is moderately fragmented, with several key players from various sectors, including OEMs, NBFCs, and banks, competing for market share. The market is characterized by the presence of strong regional players and a few dominant national brands.

|

Company Name |

Established Year |

Headquarters |

No. of Loans Issued |

No. of Branches |

Key Partnerships |

Loan Approval Time (Avg) |

Interest Rate Range |

Digital Loan Services |

|

Mahindra Finance |

1991 |

Mumbai |

||||||

|

Maruti Suzuki True Value |

2001 |

Gurgaon |

||||||

|

Sundaram Finance Ltd. |

1954 |

Chennai |

||||||

|

Poonawalla Fincorp |

2009 |

Pune |

||||||

|

Cholamandalam Finance |

1978 |

Chennai |

India Used Car Financing Market Analysis

Market Growth Drivers

- Increasing Demand for Personal Mobility: In India, the growing demand for personal mobility has driven the need for used cars, especially in rural and semi-urban areas. With more than 350 million registered vehicles in India as of 2023, the increasing volume of used cars in circulation offers significant opportunities for used car financing.

- Expanding Middle-Class Population: Indias middle-class population is projected to grow by an additional 50 million individuals by 2024, increasing the demand for used cars as a cost-effective mobility solution. This rise in the population looking for affordable financing options directly impacts the used car financing market.

- Affordable Financing Options: As of 2024, India has witnessed a rise in financial products targeting the used car market. Financial institutions are offering competitive interest rates, flexible repayment options, and low down payment schemes, thus driving market growth. The growing number of used car finance providersover 15 prominent players in the markethas led to enhanced competition, benefiting consumers with lower interest rates and better loan products.

Market Challenges

- Lack of Credit Access in Rural Areas: As of 2024, nearly 70% of Indias population resides in rural areas, but only 30% of financing options are available in these regions. The lack of financial literacy and infrastructure in these areas limits credit access, slowing the growth of the used car financing market.

- Depreciating Value of Used Cars: The depreciation of used car values is a major challenge for lenders. The value of a used car can drop significantly in just a few years, which increases the risk for finance companies if borrowers default on their loans. In 2023, it was reported that the average value of a 5-year-old car in India depreciates by over INR 150,000, which affects the amount that can be financed and the risk that lenders are willing to take.

India Used Car Financing Market Future Outlook

The India Used Car Financing industry is expected to experience continued growth over the next five years, driven by increasing consumer demand for affordable transportation and the expansion of digital lending platforms.

Future Market Opportunities

- Growth in Financing Penetration in Rural Markets: Rural India is expected to see a 20% increase in financing penetration for used cars by 2029, driven by government initiatives and the entry of more banks and NBFCs into rural areas. With improved access to formal credit, more rural customers will be able to purchase used cars, contributing to the overall growth of the used car financing market.

- Expansion of Digital Loan Platforms: By 2029, the use of digital loan platforms for used car financing is expected to expand, with an estimated 60% of all used car loans being disbursed through digital channels. This growth will be driven by advancements in technology and increasing consumer trust in online financial transactions.

Scope of the Report

|

Car Type |

Hatchbacks Sedans SUVs MPVs |

|

Financier |

OEMs Banks NBFCs |

|

Fuel Type |

Petrol Diesel Electric & Hybrid |

|

Digital Loan Platforms |

E-loans Online Car Financing Portals |

|

Regional |

North India South India West India East India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Dealerships

OEMs (Maruti Suzuki, Tata Motors)

Financial Institutions (NBFCs, Banks)

Government and Regulatory Bodies (RBI, Ministry of Finance)

Venture Capital and Private Equity Firms

Car Leasing and Rental Companies

Digital Loan Service Providers

Banks and Financial Institution

Companies

Players Mentioned in the Report:

Mahindra Finance

Maruti Suzuki True Value

Sundaram Finance Ltd.

Poonawalla Fincorp

Cholamandalam Finance

Tata Capital

HDFC Bank

ICICI Bank

Axis Bank

State Bank of India

Table of Contents

India Used Car Financing Market Overview

Definition and Scope

Market Taxonomy

Market Dynamics Overview

India Used Car Financing Market Size (In USD Bn)

Historical Market Size

Year-on-Year Growth Analysis

Market Drivers (Consumer Demand, Regulatory Changes, Growth in Organized Sector)

Market Restraints (High Interest Rates, Regulatory Hurdles)

India Used Car Financing Market Segmentation

By Car Type (In Value %)

Hatchbacks

Sedans

Sports Utility Vehicles (SUVs)

Multi-purpose Vehicles (MPVs)

By Financier (In Value %)

Original Equipment Manufacturers (OEMs)

Banks

Non-Banking Financial Companies (NBFCs)

By Fuel Type (In Value %)

Petrol

Diesel

Electric & Hybrid

By Region (In Value %)

North

East

West

South

India Used Car Financing Market Analysis

Growth Drivers

Increase in Car Ownership (Rising Demand)

Shift Toward Used Cars (Affordability, Value for Money)

Rise of Digital Financing Platforms (Convenience)

Impact of Regulatory Changes (BS-VI, GST Revisions)

Market Challenges

High Financing Rates

Regulatory Compliance Issues

Limited Availability of Loans for Older Cars

Trust Issues in Used Car Market (Lack of Transparency)

Opportunities

Emergence of Electric Vehicle (EV) Financing

Growing Role of NBFCs in Expanding Credit Access

Partnerships Between OEMs and Financiers

Untapped Rural Markets

Trends

Digital Transformation in Auto Finance (E-loans)

Growth of Certified Pre-Owned Programs

Rise in Subscription Models and Leasing

Regulatory Framework

Financing Regulations by Reserve Bank of India (RBI)

GST and Tax Benefits on Used Cars

Emission Norms Impacting Vehicle Financing

India Used Car Financing Market Competitive Landscape

Detailed Profiles of Major Companies

Maruti Suzuki True Value

Mahindra Finance

Tata Capital

HDFC Bank

ICICI Bank

Axis Bank

Kotak Mahindra Bank

Sundaram Finance Ltd.

Poonawalla Fincorp

CHOLAMANDALAM

Toyota Trust

Blue Carz

TSM Cars

Magma Fincorp

Droom Credit

Cross Comparison Parameters (Loan Approval Time, Interest Rates, No. of Financing Options, Down Payment Requirements, Maximum Loan Tenure, Eligibility Requirements, Digital Loan Processing, Partnership with OEMs)

Market Share Analysis

Strategic Initiatives (Joint Ventures, New Financing Programs, Digital Loan Platforms)

Mergers and Acquisitions

Venture Capital Funding and Private Equity Investments

India Used Car Financing Market Regulatory Framework

RBI Guidelines for Auto Financing

Compliance with BS-VI and Impact on Financing

Taxation Reforms and GST on Used Cars

India Used Car Financing Future Market Size (In USD Bn)

Future Market Size Projections

Key Factors Driving Future Market Growth

India Used Car Financing Future Market Segmentation

By Car Type (In Value %)

By Financier (In Value %)

By Fuel Type (In Value %)

By Digital Loan Platforms (In Value %)

By Region (In Value %)

India Used Car Financing Market Analyst Recommendations

TAM/SAM/SOM Analysis

White Space Opportunities in Financing

Strategic Growth Areas

Recommendations for Market Penetration

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In this phase, we construct a comprehensive map of the India Used Car Financing Market by identifying major stakeholders, including OEMs, financial institutions, and car dealerships. Extensive desk research and analysis of proprietary databases help outline the critical variables that influence the market.

Step 2: Market Analysis and Construction

Using historical data, we evaluate market penetration, the role of financiers, and revenue generation across key segments. This phase also involves assessing the availability of financing options and the impact of regulatory frameworks on the market.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market dynamics are validated through interviews with industry experts from NBFCs, OEMs, and banks. These insights help refine data accuracy and provide real-time operational insights.

Step 4: Research Synthesis and Final Output

The final phase involves collaborating with car financiers to gain insights into loan performance, customer preferences, and financing trends. This ensures a thorough and validated analysis of the India Used Car Financing Market.

Frequently Asked Questions

01. How big is the India Used Car Financing Market?

The India Used Car Financing Market is valued at USD 8 billion, driven by rising consumer demand for affordable personal vehicles and an expanding used car segment.

02. What are the major challenges in the India Used Car Financing Market?

Challenges in the India Used Car Financing Market include high interest rates, regulatory compliance issues, and the presence of unorganized market players, which often limit transparency and consumer trust in the sector.

03. Who are the major players in the India Used Car Financing Market?

Key players in the India Used Car Financing Market include Mahindra Finance, Maruti Suzuki True Value, Sundaram Finance Ltd., Poonawalla Fincorp, and Cholamandalam Finance. These companies dominate due to their strong presence and extensive lending networks.

04. What are the growth drivers of the India Used Car Financing Market?

The India Used Car Financing Market is driven by increasing demand for affordable transportation, the rising cost of new vehicles, and the expansion of digital lending platforms that simplify the financing process.

05. How has digitization impacted the India Used Car Financing Market?

Digitization has streamlined the financing process by introducing online platforms that offer quicker loan approval, digital documentation, and e-signatures, making it easier for consumers to access loans.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.