India Vaccine Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD7814

December 2024

90

About the Report

India Vaccine Market Overview

- The India Vaccine Market is currently valued at USD 98 billion, driven by a comprehensive vaccination infrastructure supported by government-led initiatives and a robust demand for immunization. The five-year historical analysis indicates a steady CAGR of 8.2% between 2018 and 2023. This growth is fueled by the increasing prevalence of both infectious and non-communicable diseases, alongside advancements in vaccine development, ensuring sustained demand across the country. Market expansion is further supported by high levels of public and private investments in R&D for new vaccine formulations and effective distribution networks, which enhance accessibility across both urban and rural areas.

- Key urban regions, particularly Delhi, Mumbai, and Bangalore, dominate the vaccine market in India. This dominance is largely attributed to a higher awareness regarding immunization programs, an established healthcare infrastructure, and the presence of major medical facilities and research institutes. Additionally, these cities benefit from stronger public-private partnerships and substantial government funding, which facilitate vaccine distribution and awareness. These regions have emerged as major vaccine demand centers, where both national and international organizations actively promote immunization coverage.

- Indias Universal Immunization Program (UIP) aims to cover every child under five, encompassing approximately 27 million infants and 30 million pregnant women annually. With government backing, UIP remains a pivotal driver of vaccine demand, supported by INR 12,300 crore in funding for 2024, focusing on eliminating vaccine-preventable diseases across the country.

India Vaccine Market Segmentation

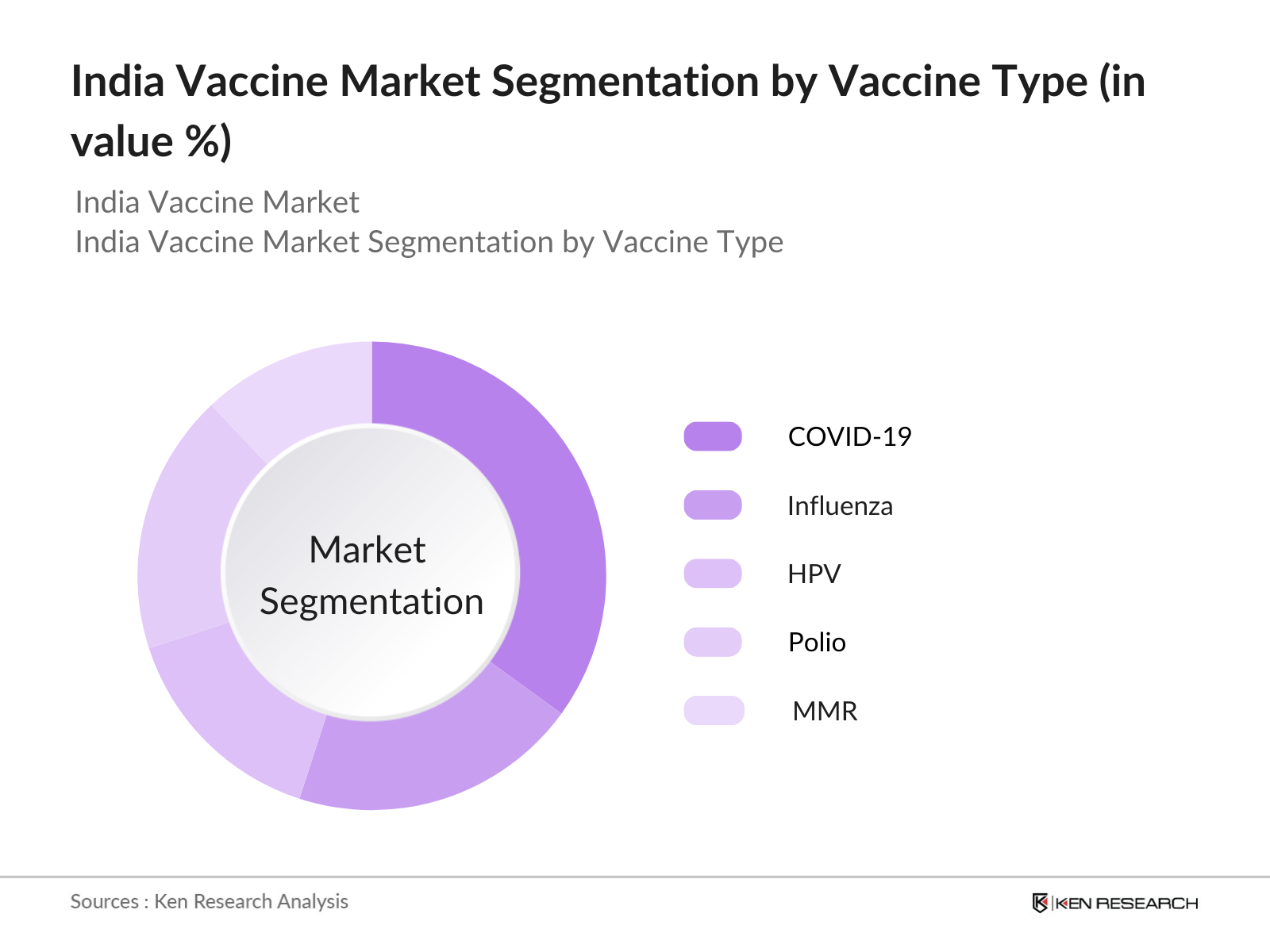

By Vaccine Type: The Market is segmented by vaccine type into COVID-19 vaccine, influenza vaccine, HPV vaccine, polio vaccine, and MMR vaccine. Recently, COVID-19 vaccines hold a significant market share in India under this segmentation due to extensive government-led vaccination campaigns and free vaccination drives across the country. The availability of multiple COVID-19 vaccines, such as Covishield, Covaxin, and Sputnik V, has allowed widespread access, making it a dominant segment in the vaccine type category. Continuous efforts to reach every demographic have also solidified its leading position in the market.

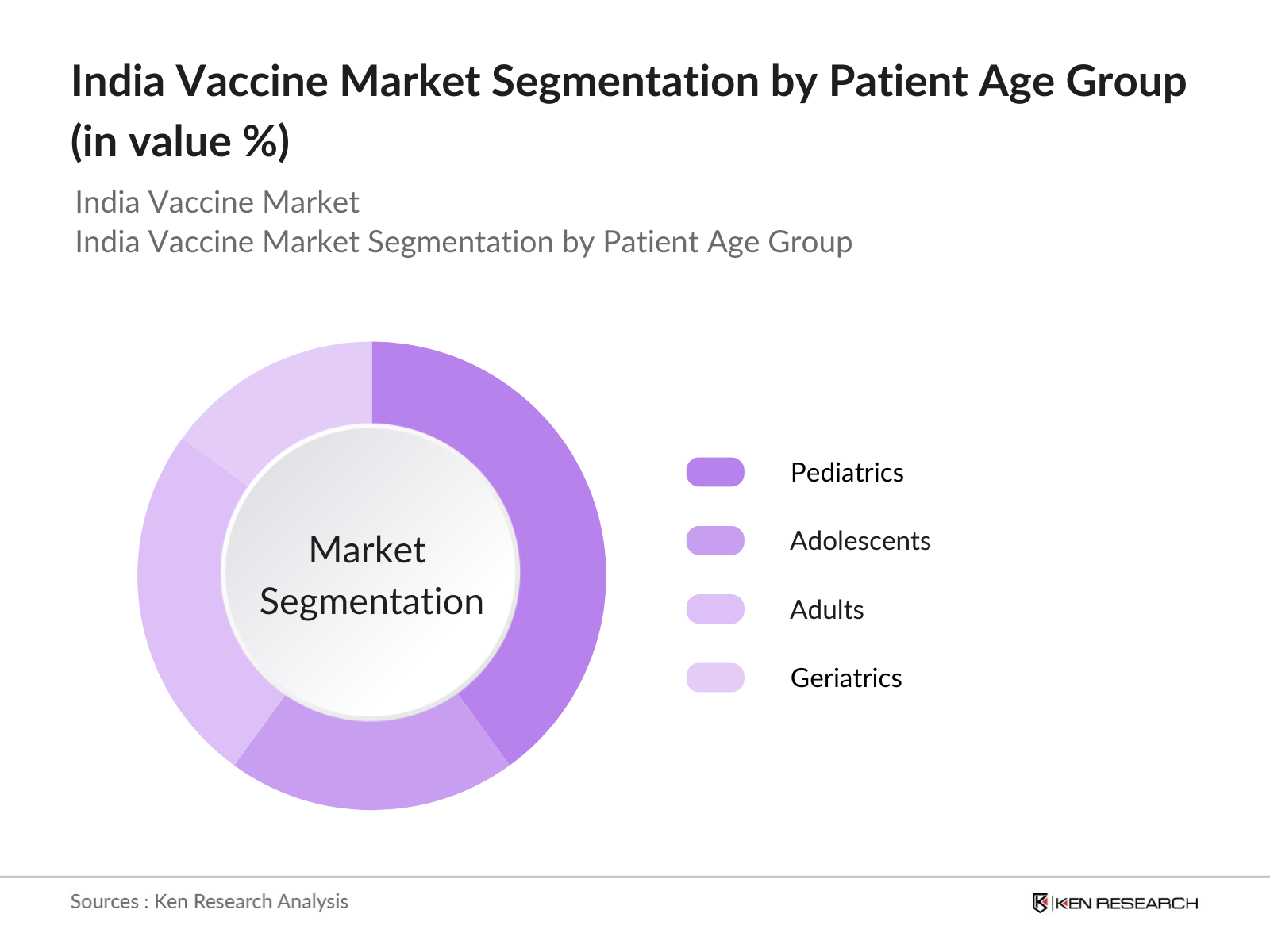

By Patient Age Group: The market is further segmented by patient age group into pediatrics, adolescents, adults, and geriatrics. Pediatrics dominate this segment due to the national immunization programs focused on preventing diseases among children under five years. The high coverage rates of vaccines like polio, BCG, and DPT among infants, driven by the Universal Immunization Programme, make pediatrics the leading segment. Enhanced healthcare outreach in rural areas also contributes to the prevalence of pediatric immunization, ensuring higher market demand in this age group.

India Vaccine Market Competitive Landscape

The India Vaccine Market is led by major domestic and international players, each contributing unique strengths in production, distribution, and R&D. The market is characterized by the consolidation of leading manufacturers with significant resources for large-scale vaccine production, resulting in high market competition. The market is dominated by local manufacturers with a competitive advantage due to their established production facilities and partnerships with government programs and global health agencies.

|

Company Name |

Establishment Year |

Headquarters |

Vaccine Portfolio |

R&D Spend (INR) |

Production Capacity |

Regional Presence |

Strategic Partnerships |

Quality Certifications |

Recent Collaborations |

|

Serum Institute of India |

1966 |

Pune, India |

|||||||

|

Bharat Biotech |

1996 |

Hyderabad, India |

|||||||

|

Dr. Reddys Laboratories |

1984 |

Hyderabad, India |

|||||||

|

Panacea Biotec |

1984 |

New Delhi, India |

|||||||

|

Biological E Limited |

1953 |

Hyderabad, India |

India Vaccine Industry Analysis

Growth Drivers

- Increased Immunization Programs: India's extensive immunization programs have reached millions, with the Universal Immunization Program (UIP) covering over 27 million newborns annually as of 2023, according to Ministry of Health and Family Welfare data. These programs, which have brought down vaccine-preventable disease rates significantly, are supported by national expenditure, increasing to INR 12,300 crore in 2024. Immunization rates for diseases like measles reached around 95% coverage, significantly reducing infection rates. The UIP expansion also incorporates newer vaccines, including rotavirus and pneumococcal conjugate vaccines, further driving demand for vaccines in India.

- Government Vaccination Policies: The Indian governments vaccination policies support universal coverage by mandating vaccinations for 12 diseases under the UIP, covering over 88% of the target population by 2023. Government investments have been substantial, with INR 5,000 crore allocated specifically for cold-chain equipment to enhance vaccine distribution. The introduction of initiatives like Mission Indradhanush, which aimed to cover unvaccinated children, significantly boosted immunization rates and supported vaccine demand across states. This structured approach has contributed to reducing child mortality and curbing disease outbreaks in India.

- Rising Healthcare Awareness: Awareness campaigns on immunization have contributed to an 11% rise in vaccine uptake between 2022 and 2024, as reported by the Ministry of Health. Media outreach and collaboration with NGOs have reached rural and urban populations alike, significantly reducing misinformation on vaccines. This increase in healthcare awareness, combined with educational drives on disease prevention, has driven more families to seek vaccinations, supporting market demand.

Market Challenges

- Cold Chain and Distribution Infrastructure: India's vast geographic spread presents challenges in maintaining an effective cold chain, critical for vaccine potency. Only about 65% of vaccine doses reach rural regions in optimal condition, despite government spending of INR 5,000 crore to improve cold storage facilities. The governments commitment to upgrading infrastructure is ongoing, but rural accessibility issues continue to affect vaccination rates in remote areas.

- Vaccine Hesitancy: While the vaccine acceptance rate has improved, vaccine hesitancy remains a concern, particularly in rural and marginalized communities. Survey data from 2023 indicated that around 22% of families in certain regions expressed concerns about vaccine safety. Educational campaigns by the Ministry of Health are attempting to combat misinformation, but challenges in trust and understanding continue to impact the vaccination rate.

India Vaccine Market Future Outlook

Over the next five years, the India Vaccine Market is projected to maintain robust growth, driven by continued government investment, the expansion of private vaccination clinics, and advancements in biotechnology. The demand for vaccines, particularly new formulations targeting emerging health concerns, is expected to grow significantly. The proliferation of research in DNA and RNA vaccine technologies, along with expanded healthcare access in rural regions, will further shape the future trajectory of the market.

Future Market Opportunities

- Export Expansion: India exported vaccines worth USD 1.7 billion in 2023, capturing a significant share of global demand, particularly in Africa and Asia. Government export incentives and partnerships with international health bodies have opened new markets, with expectations for a consistent rise in demand for Indian vaccines due to cost-effectiveness and reliability. Strengthening diplomatic ties is anticipated to expand market opportunities in regions lacking local vaccine manufacturing.

- Integration with Digital Health Records: The integration of vaccination data into digital health records is enhancing record-keeping and tracking. This initiative, spearheaded by Indias National Health Authority, has helped over 40 million individuals update their vaccination records in digital format by 2024, facilitating better access to immunization history. Digital record-keeping aids in monitoring immunization coverage and planning targeted interventions, thus supporting a more effective healthcare system.

Scope of the Report

|

Vaccine Type |

COVID-19 Influenza HPV Polio MMR |

|

Patient Age Group |

Pediatrics Adolescents Adults Geriatrics |

|

Distribution Channel |

Public Private Hospitals/Clinics Retail Pharmacies |

|

Route of Administration |

Oral Intramuscular Subcutaneous Intravenous |

|

Region |

North South East West |

Products

Key Target Audience

Healthcare Providers

Pharmaceutical Distributors

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Health and Family Welfare, Drugs Controller General of India)

Private Hospitals and Clinics

Banks and Financial institutes

Public Health Organizations

Vaccine Manufacturers and Researchers

Immunization Program Managers

Companies

Major Players

Serum Institute of India

Bharat Biotech

Dr. Reddys Laboratories

Panacea Biotec

Biological E Limited

Zydus Cadila

Indian Immunologicals Ltd.

GlaxoSmithKline Pharmaceuticals

Pfizer India

Sanofi India

Hester Biosciences

AstraZeneca India

Novavax Inc.

Merck India

Abbott India

Table of Contents

India Vaccine Market Overview

Definition and Scope

Market Taxonomy

Industry Growth Rate

Market Segmentation Overview

India Vaccine Market Size (In INR Bn)

Historical Market Size Analysis

Year-on-Year Growth Analysis

Key Market Developments and Milestones

India Vaccine Market Analysis

Growth Drivers

Increasing Immunization Programs

Government and Private Sector Collaborations

Rising Awareness of Preventable Diseases

Expansion of Healthcare Infrastructure

Market Challenges

High Cost of Vaccine Development

Cold Chain and Logistics Issues

Regulatory Barriers

Opportunities

Technological Advancements in Vaccine Manufacturing

Investment in R&D for Novel Vaccines

Expanding Market for Adult Immunization

Trends

Adoption of mRNA Vaccine Technology

Integration with Digital Health Platforms

Increasing Public-Private Partnerships in Vaccine Distribution

Government Regulation

Immunization Program Regulations

Quality Standards for Vaccine Manufacturing

Vaccine Import and Export Compliance

Public-Private Funding Initiatives

SWOT Analysis

Stakeholder Ecosystem

Porters Five Forces Analysis

Competition Ecosystem

India Vaccine Market Segmentation

By Vaccine Type (In Value %)

Inactivated Vaccines

Live Attenuated Vaccines

mRNA Vaccines

Subunit Vaccines

By Disease Type (In Value %)

COVID-19

Influenza

Polio

Measles

Hepatitis

By Distribution Channel (In Value %)

Government Hospitals

Private Clinics

Online Pharmacies

Retail Pharmacies

By End User (In Value %)

Pediatric

Adult

Geriatric

By Region (In Value %)

North

South

East

West

India Vaccine Market Competitive Analysis

Detailed Profiles of Major Companies

Serum Institute of India

Bharat Biotech

Biological E. Limited

Panacea Biotec

Zydus Cadila

Indian Immunologicals Ltd.

Haffkine Bio-Pharmaceutical Corporation

GlaxoSmithKline India

Pfizer India

Sanofi India

Novartis India

Johnson & Johnson India

Merck India

AstraZeneca India

Biocon Limited

Cross Comparison Parameters (Market Presence, Revenue, Production Capacity, R&D Investment, Geographic Reach, Regulatory Approvals, Supply Chain Infrastructure, Partnerships and Alliances)

Market Share Analysis

Strategic Initiatives

Mergers and Acquisitions

Investment Analysis

Government Grants and Funding Programs

Venture Capital and Private Equity Investments

India Vaccine Market Regulatory Framework

Vaccine Approval Process

National Regulatory Authorities

Vaccine Safety and Quality Standards

Guidelines for Cold Chain and Logistics

Future Growth Factors

Strategic Market Developments

Projected Industry Innovations

India Vaccine Market Analyst Recommendations

TAM/SAM/SOM Analysis

Customer Cohort Analysis

Market Expansion Strategies

White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research methodology begins with identifying key variables influencing the India Vaccine Market. This includes analyzing factors like government initiatives, disease prevalence, and healthcare infrastructure, using credible sources like government health reports and proprietary databases.

Step 2: Market Analysis and Construction

In this phase, historical data regarding vaccine production, distribution, and uptake rates are compiled and analyzed. This analysis incorporates data points such as vaccine availability by region and immunization coverage to understand market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

The data is validated by consulting industry experts through interviews, focusing on the operational and logistical aspects of vaccine distribution in India. Insights from these consultations help in refining data accuracy and comprehensiveness.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing research findings and presenting a comprehensive, validated analysis of the India Vaccine Market. The report is verified through multiple rounds of feedback from stakeholders to ensure its relevance to industry professionals.

Frequently Asked Questions

01. How big is the India Vaccine Market?

The India Vaccine Market is currently valued at USD 98 billion, with demand driven by high vaccination rates, government initiatives, and emerging health concerns.

02. What are the key growth drivers in the India Vaccine Market?

Key drivers in the India Vaccine Market include government-led immunization programs, rising healthcare awareness, and advancements in vaccine production technology.

03. Which regions dominate the India Vaccine Market?

Urban centers like Delhi, Mumbai, and Bangalore dominate the India Vaccine Market due to their strong healthcare infrastructure and high awareness levels regarding immunization programs.

04. Who are the major players in the India Vaccine Market?

Major players in the India Vaccine Market include Serum Institute of India, Bharat Biotech, and Dr. Reddys Laboratories, known for their extensive production capabilities and established distribution networks.

05. What are the challenges in the India Vaccine Market?

Challenges in the India Vaccine Market include vaccine hesitancy, limited cold chain infrastructure, and regulatory hurdles impacting distribution and accessibility.

06. What innovations are shaping the future of the India Vaccine Market?

New developments in the India Vaccine Market include DNA and RNA-based vaccines and advanced cold chain solutions, improving vaccine efficacy and expanding accessibility across India.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.