India Women Innerwear Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD6288

November 2024

80

About the Report

India Women Innerwear Market Overview

- The India Women Innerwear market is valued at USD 3 Billion, based on a five-year historical analysis. This market is driven by increasing consumer awareness of body positivity and self-expression, coupled with rising disposable income among urban populations. The penetration of e-commerce and organized retail has made innerwear more accessible, boosting overall market growth. Additionally, the focus on product innovation and comfort, including premium brands, has pushed demand forward in key urban areas.

- Cities like Mumbai, Delhi, and Bangalore dominate the market due to their high concentration of working women and rising urbanization. These metropolitan areas have seen a greater demand for premium innerwear products due to increased exposure to global fashion trends and a growing preference for comfortable yet stylish innerwear. The strong presence of e-commerce platforms and specialized innerwear retailers also contributes to the dominance of these cities in the market.

- The Indian government has launched various initiatives, such as the Skill India Mission, aimed at enhancing textile sector skills. As of 2024, over 5 lakh individuals received specialized training in fabric design and manufacturing, directly benefiting the innerwear sector. This has resulted in a better-skilled workforce, reducing production delays and improving product quality across the industry.

India Women Innerwear Market Segmentation

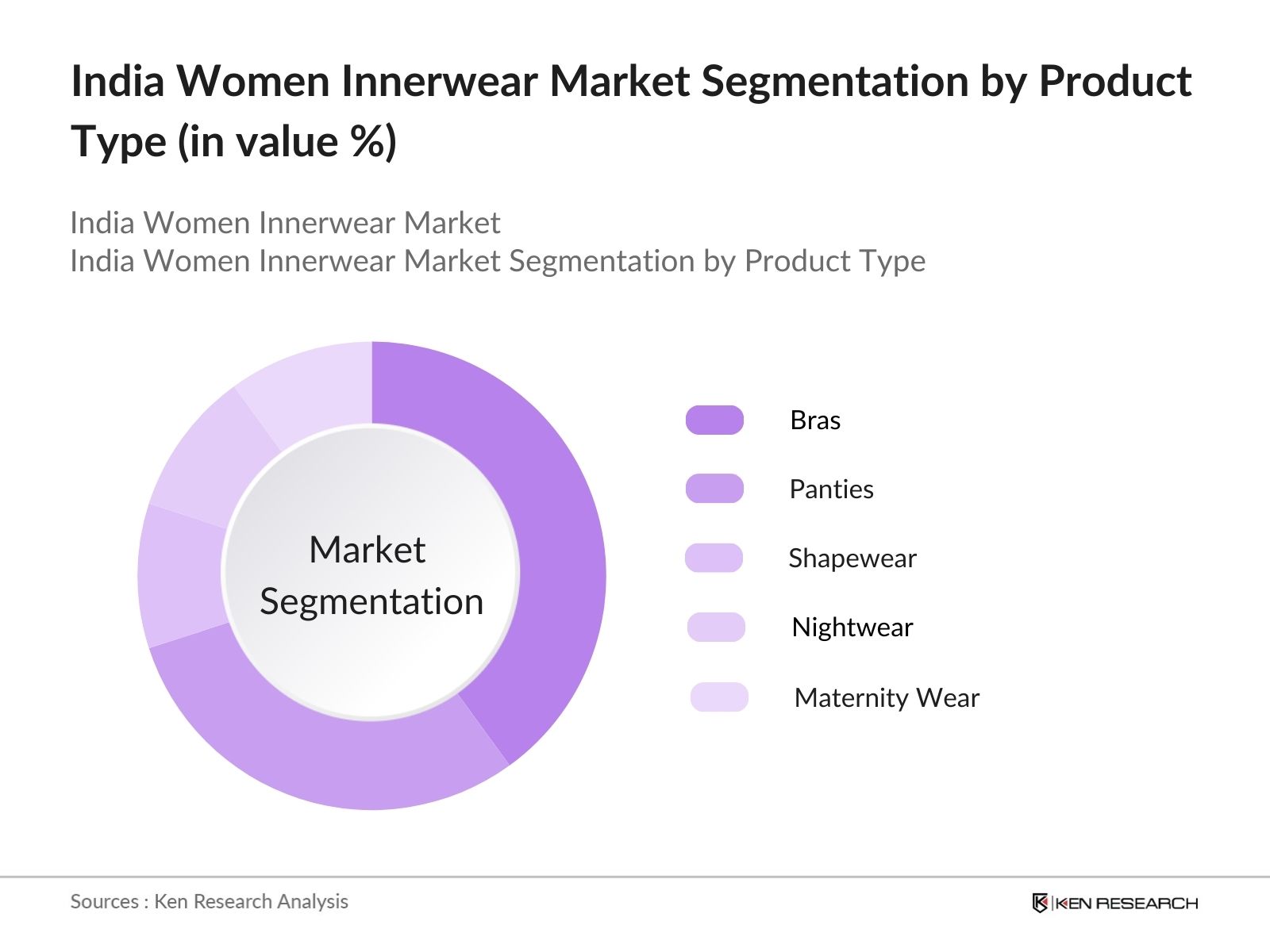

- By Product Type: The India Women Innerwear market is segmented by product type into bras, panties, shapewear, nightwear, and maternity wear. Among these, bras dominate the market share, primarily due to their essential role in womens everyday attire. With a range of types availablesuch as full-cup bras, t-shirt bras, sports bras, and plunge brasthis segment is seeing significant demand driven by growing awareness about body comfort and support, as well as product innovation in terms of fabric, fit, and design. Additionally, the adoption of advanced materials, including microfiber and organic cotton, has propelled the popularity of premium bras in urban areas.

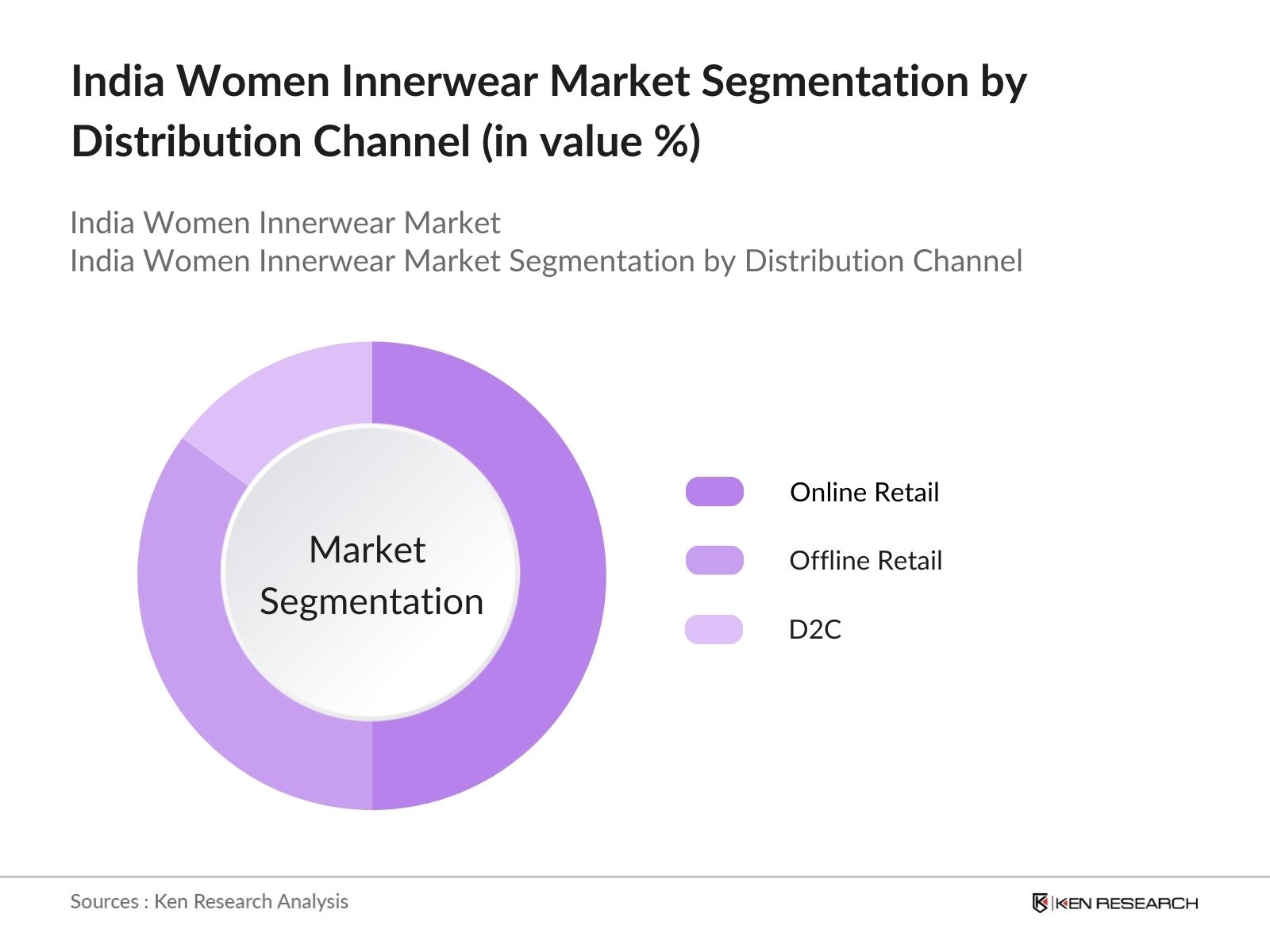

- By Distribution Channel: India Women Innerwear market is also segmented by distribution channels into online retail, offline retail, and direct-to-consumer (D2C). The online retail segment is gaining traction due to the convenience of shopping from home, access to a variety of brands, and the availability of competitive pricing. Platforms such as Zivame, Myntra, and Amazon India offer seamless return policies and a broad array of choices, further boosting the popularity of online channels. Moreover, tier 2 and tier 3 cities are now contributing to a significant portion of online sales, where traditional offline retailers have limited reach.

India Women Innerwear Market Competitive Landscape

The India Women Innerwear market is highly competitive, dominated by a mix of local and international players. Key players such as Jockey, Zivame, Clovia, and Enamor have established strong brand recognition and extensive distribution networks, contributing to their market leadership. These companies invest heavily in product innovation, digital marketing, and consumer engagement, allowing them to capture a significant portion of the growing demand for quality and stylish innerwear. Additionally, new entrants in the premium segment are expanding the competitive landscape, focusing on offering organic and sustainable products.

|

Company |

Establishment Year |

Headquarters |

Product Range |

Revenue |

Sustainability Initiatives |

R&D Investment |

Online Presence |

Distribution Network |

|

Jockey India |

1876 |

Bangalore |

- | - | - | - | - | - |

|

Zivame |

2011 |

Bangalore |

- | - | - | - | - | - |

|

Clovia |

2013 |

Noida |

- | - | - | - | - | - |

|

Enamor |

2001 |

Bangalore |

- | - | - | - | - | - |

|

Amante |

1990 |

Colombo |

- | - | - | - | - | - |

India Women Innerwear Market Analysis

Market Growth Drivers

- Increasing Penetration of Organized Retail and E-Commerce The growth of organized retail and e-commerce in India has significantly boosted the womens innerwear market, especially in urban and semi-urban areas. In 2024, organized retail accounted for nearly 40 million units sold, providing a structured supply chain, standardized pricing, and high availability of premium products. E-commerce giants have capitalized on this by offering wide product selections and attractive pricing options, targeting younger consumers. This shift has increased the accessibility of various brands, with over 20 million women purchasing innerwear online in 2024 alone.

- Growing Awareness of Body Positivity and Self-Expression There has been a growing shift in societal attitudes toward body positivity and self-expression, leading to increased demand for diverse innerwear options that cater to different body types and preferences. In 2024, more than 15 million women in India expressed a preference for innerwear designed for comfort and style, reflecting a move towards self-expression through fashion. This trend has driven brands to expand their product lines to offer inclusive sizes and fashionable options, with nearly 100 new brands entering the market catering to this demand in 2024.

- Rising Awareness of Comfort and Wellness With an increasing focus on wellness and comfort, consumers are more inclined to invest in quality innerwear that prioritizes comfort over mere fashion. The demand for cotton-based, breathable fabrics grew by over 10 million units in 2024, driven by the desire for innerwear that supports all-day comfort. Brands are introducing ranges that emphasize comfort with features like seamless designs, non-padded options, and elasticated waistbands, making them a preferred choice among working women and homemakers alike.

Market Challenges

- Price Sensitivity and Competition from Unorganized Players A significant challenge in the Indian women's innerwear market is the presence of unorganized players, which dominate nearly 60% of the market by volume as of 2024. These players offer products at significantly lower prices, creating price sensitivity among consumers. Organized brands, which sell innerwear priced between 500 and 2,000 per unit, face stiff competition from local vendors who sell products at 100 to 300. This price gap has made it difficult for organized players to capture lower-income segments, particularly in rural areas.

- Complex Sizing and Standardization Issues One of the major challenges faced by the industry is the lack of standardization in sizing, leading to high return rates in online sales. In 2024, online retailers reported that nearly 30% of innerwear purchases were returned due to sizing issues, costing companies over 10 crore in logistical expenses. The lack of consistency in sizes across brands has led to consumer dissatisfaction, particularly in e-commerce, where customers rely on accurate sizing charts. This remains a critical issue in building customer trust and loyalty.

India Women Innerwear Market Future Outlook

Over the next five years, the India Women Innerwear market is expected to exhibit consistent growth, driven by the expansion of online retail, increasing disposable incomes, and evolving consumer preferences for comfort and style. Furthermore, the rising demand for premium innerwear and sustainable materials is anticipated to create lucrative opportunities for both established players and new entrants. The market will likely see increased investment in research and development, leading to innovation in fabric technology and customized solutions catering to diverse body types.

Market Opportunities

- Demand for Premium and Luxury Innerwear: The demand for premium and luxury innerwear is expected to grow rapidly, driven by increased awareness of product quality and comfort. In 2024, premium innerwear sales accounted for 3,000 crore, with demand growing in metropolitan cities such as Delhi, Mumbai, and Bangalore. Consumers are showing an increasing preference for brands that offer a mix of aesthetics, comfort, and sustainability. Brands like Enamor and Amante have expanded their product portfolios in the premium segment, seeing nearly 20% year-on-year growth in this category.

- Expanding Markets in Tier 2 and Tier 3 Cities: The innerwear market in Indias Tier 2 and Tier 3 cities represents a significant growth opportunity. In 2024, these cities accounted for over 25 million consumers purchasing innerwear annually. Growing digital penetration and rising disposable income in these regions have made premium products more accessible, with e-commerce platforms reporting an 18% rise in innerwear sales from non-metro cities. This presents brands with a vast opportunity to cater to the burgeoning middle class in these markets.

Scope of the Report

|

By Product Type |

Bras Panties Shapewear Nightwear Maternity Wear |

|

By Distribution Channel |

Online Retail Offline Retail Direct-to-Consumer (D2C) |

|

By Fabric Type |

Cotton Lace Satin Microfiber |

|

By Price Range |

Economy Mid-Range Premium |

|

By Age Group |

16-25 Years 26-40 Years 41-55 Years above 55 Years |

|

By Region |

North South East West |

Products

Key Target Audience

Innerwear Manufacturers

Retailers and Distributors

E-Commerce Platforms

Fashion Brands

Textile Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Textile Ministry of India)

Sustainability Advocates and Organizations

Companies

Players Mentioned in the Report:

Jockey India

Zivame

Clovia

Enamor

Amante

PrettySecrets

H&M

Bwitch

Van Heusen Innerwear

Lovable Lingerie

Table of Contents

1. India Women Innerwear Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Women Innerwear Market Size (In INR Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Women Innerwear Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Urbanization and Changing Lifestyles

3.1.2 Growing Awareness of Body Positivity and Self-Expression

3.1.3 Rise in Disposable Income and Consumer Spending (Segmented by Rural and Urban Markets)

3.1.4 Increasing Penetration of Organized Retail and E-Commerce

3.2 Market Challenges

3.2.1 Price Sensitivity and Competition from Unorganized Players

3.2.2 Complex Sizing and Standardization Issues

3.2.3 Supply Chain and Raw Material Price Fluctuations (Textile and Fabric Costs)

3.2.4 Socio-Cultural Barriers and Changing Consumer Preferences

3.3 Opportunities

3.3.1 Demand for Premium and Luxury Innerwear

3.3.2 Expanding Markets in Tier 2 and Tier 3 Cities (Geographic Opportunity)

3.3.3 Focus on Sustainable and Eco-friendly Materials (Organic Cotton, Recycled Fabrics)

3.3.4 Growth in Online Sales and Direct-to-Consumer (D2C) Channels

3.4 Trends

3.4.1 Shift Toward Comfort and Athleisure Innerwear

3.4.2 Increased Investment in Product Innovation and R&D (Fabric Technology)

3.4.3 Customized Innerwear (Size-Inclusive and Personalized Products)

3.4.4 Emergence of Local Brands Competing with Global Players

3.5 Government Regulations

3.5.1 Textile Standards and Compliance for Innerwear

3.5.2 Impact of GST and Other Tax Reforms on Pricing

3.5.3 Trade Regulations on Import of Raw Materials (Cotton, Lace)

3.5.4 Certification Standards for Sustainable and Organic Fabrics

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. India Women Innerwear Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Bras (Full Cup, Plunge, T-Shirt, Sports Bras)

4.1.2 Panties (Briefs, Thongs, Hipsters, Boyshorts)

4.1.3 Shapewear (Bodysuits, Waist Cinchers, Control Briefs)

4.1.4 Nightwear (Chemises, Pajamas, Camisoles)

4.1.5 Maternity Wear (Nursing Bras, Maternity Briefs)

4.2 By Distribution Channel (In Value %)

4.2.1 Online Retail

4.2.2 Offline Retail (Department Stores, Specialty Stores, Supermarkets)

4.2.3 Direct-to-Consumer (D2C)

4.3 By Fabric Type (In Value %)

4.3.1 Cotton

4.3.2 Lace

4.3.3 Satin

4.3.4 Microfiber

4.4 By Price Range (In Value %)

4.4.1 Economy

4.4.2 Mid-Range

4.4.3 Premium

4.5 By Age Group (In Value %)

4.5.1 16-25 Years

4.5.2 26-40 Years

4.5.3 41-55 Years

4.5.4 Above 55 Years

4.6 By Region (In Value %)

4.6.1. North

4.6.2. South

4.6.3. East

4.6.4. West

5. India Women Innerwear Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Jockey India

5.1.2 Clovia

5.1.3 Zivame

5.1.4 Enamor

5.1.5 Amante

5.1.6 Shyaway

5.1.7 Triumph International

5.1.8 Hanesbrands Inc.

5.1.9 Lux Industries

5.1.10 VIP Clothing

5.1.11 Van Heusen Innerwear

5.1.12 Lovable Lingerie

5.1.13 PrettySecrets

5.1.14 Bwitch

5.1.15 H&M

5.2 Cross Comparison Parameters (Revenue, Product Range, Market Position, Brand Awareness, Online vs Offline Sales, Product Innovation, Distribution Network, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity Investments

5.8 New Product Launches

6. India Women Innerwear Market Regulatory Framework

6.1 Textile Quality and Compliance Standards

6.2 Import and Export Regulations for Raw Materials

6.3 Ethical Trade Certifications (Fair Trade, Organic Certification)

6.4 Government Subsidies and Incentives for Textile Manufacturing

7. India Women Innerwear Future Market Size (In INR Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Women Innerwear Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Fabric Type (In Value %)

8.4 By Price Range (In Value %)

8.5 By Age Group (In Value %)

8.6 By Region (In Value %)

9. India Women Innerwear Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Behavior Analysis

9.3 White Space Opportunity Analysis

9.4 Branding and Marketing Initiatives

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involved constructing an ecosystem map encompassing all major stakeholders within the India Women Innerwear market. Extensive desk research and proprietary databases were utilized to gather comprehensive industry-level information, identifying key variables such as consumer preferences, retail dynamics, and product innovations influencing market growth.

Step 2: Market Analysis and Construction

In this phase, historical data for the India Women Innerwear market was analyzed, focusing on market penetration, distribution channels, and revenue generation. Service quality statistics and key performance indicators from various industry players were assessed to ensure reliable revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through direct consultations with industry experts from major innerwear brands. These consultations provided valuable insights into the market dynamics, product trends, and future growth opportunities, refining the market data and projections.

Step 4: Research Synthesis and Final Output

The final phase included direct engagement with manufacturers and retailers to acquire detailed insights into product performance, sales trends, and consumer behavior. This interaction complemented the statistical data, ensuring a comprehensive, validated analysis of the India Women Innerwear market.

Frequently Asked Questions

01. How big is the India Women Innerwear market?

The India Women Innerwear market is valued at USD 3 billion, driven by rising urbanization, increasing disposable incomes, and growing consumer awareness about body positivity and comfort.

02. What are the challenges in the India Women Innerwear market?

Challenges in the India Women Innerwear market include high price sensitivity, competition from unorganized players, and supply chain disruptions, particularly in fabric sourcing.

03. Who are the major players in the India Women Innerwear market?

Major players in the India Women Innerwear market include Jockey India, Zivame, Clovia, Enamor, and Amante, known for their extensive product offerings, strong brand presence, and innovation in innerwear.

04. What are the growth drivers of the India Women Innerwear market?

The India Women Innerwear market is driven by increased consumer awareness about comfort and style, rising disposable incomes, the penetration of e-commerce, and product innovation in terms of fabric and design.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.