Indonesia Alcoholic Beverages Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD4594

October 2024

93

About the Report

Indonesia Alcoholic Beverages Market Overview

- The Indonesia Alcoholic Beverages Market is valued at USD 1.9 billion, based on a five-year historical analysis. The market is primarily driven by the rising disposable income of Indonesia's middle class, increased urbanization, and the growth of the tourism sector. These factors are contributing to the expanding demand for alcoholic beverages, especially beer and premium wine.

- The key regions dominating the market include Bali, Java, and Jakarta. Balis dominance is largely due to its status as a top global tourism destination, attracting millions of international visitors annually, many of whom contribute to high alcohol consumption. Java and Jakarta follow suit, driven by high urban populations and growing nightlife scenes.

- The Indonesian government has implemented strict regulations on the sale of alcoholic beverages, particularly in convenience stores and other small outlets. In 2022, the Ministry of Trade reinforced regulations banning the sale of alcohol in minimarkets and limiting it to licensed venues such as hotels, restaurants, and bars. This initiative aims to reduce the accessibility of alcohol, particularly to underage consumers.

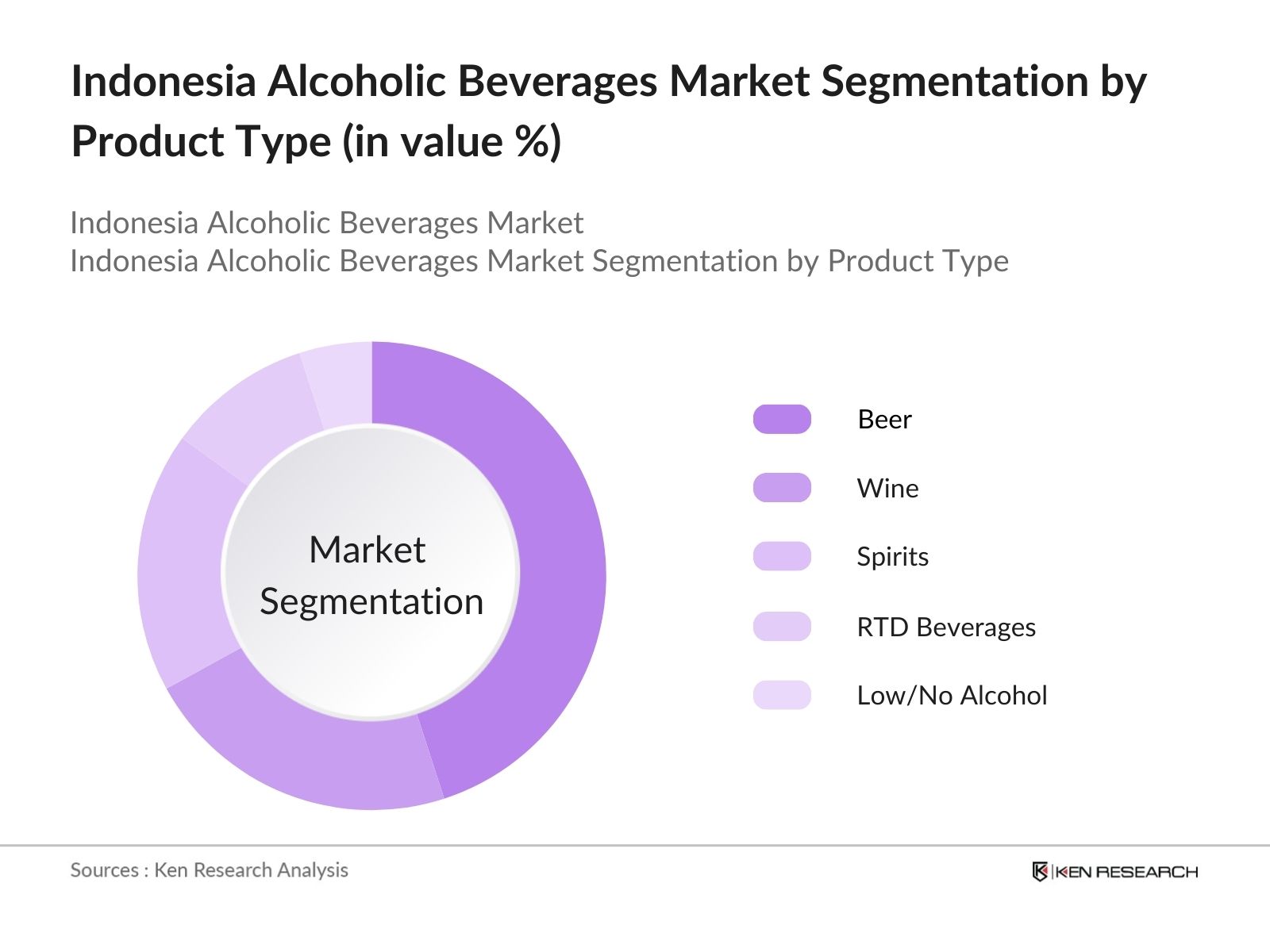

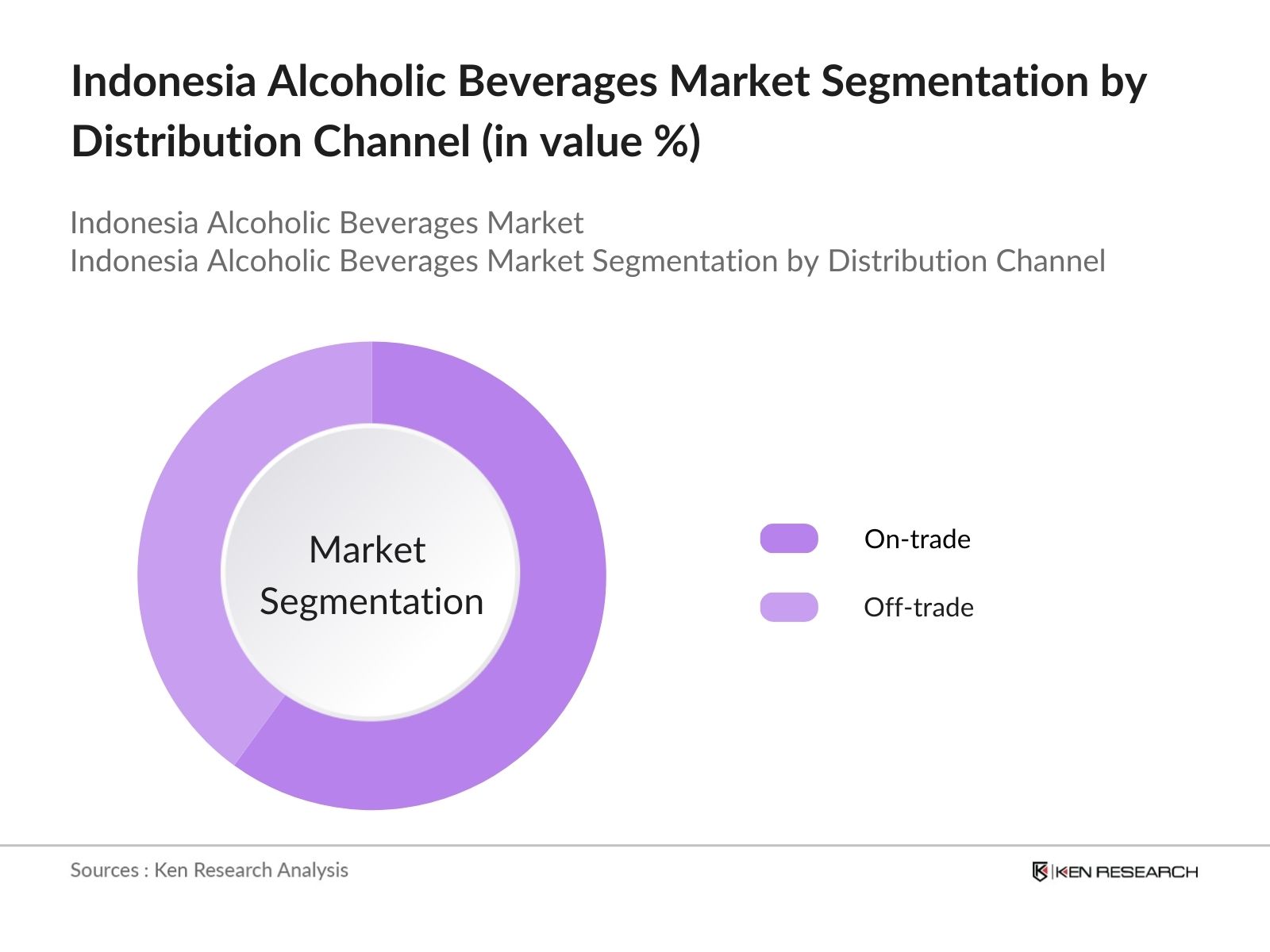

Indonesia Alcoholic Beverages Market Segmentation

By Product Type: The market is segmented by product type into beer, wine, spirits, ready-to-drink (RTD) alcoholic beverages, and low/no-alcoholic beverages. Beer has held the dominant market share under this segmentation, owing to its widespread popularity and affordable pricing. Brands such as Bintang and Bali Hai have maintained a strong consumer base, further bolstered by aggressive marketing and distribution across both urban and rural regions.

By Distribution Channel: The market is segmented by distribution channels into on-trade (bars, restaurants, hotels) and off-trade (supermarkets, liquor stores, online platforms). On-trade distribution channels dominate the market primarily due to the thriving tourism and hospitality sectors, particularly in regions like Bali and Jakarta. Tourists and locals frequent bars, restaurants, and nightclubs, where alcohol consumption is integral to the overall experience.

Indonesia Alcoholic Beverages Market Competitive Landscape

The market is characterized by intense competition, with both local and international players vying for market dominance. Local brands like Multi Bintang Indonesia (Bintang Beer) and Hatten Wines have a solid consumer base, thanks to their affordable offerings and strong brand loyalty. International players such as Diageo and Heineken also hold market shares due to their premium product lines and extensive distribution networks.

|

Company Name |

Establishment Year |

Headquarters |

Product Range |

Market Presence |

Revenue |

Production Capacity |

Distribution Network |

Brand Reputation |

Sustainability Initiatives |

|

Multi Bintang Indonesia |

1931 |

Jakarta |

|||||||

|

Hatten Wines |

1994 |

Bali |

|||||||

|

Bali Hai Brewery |

1975 |

Bali |

|||||||

|

Diageo Indonesia |

1997 |

Jakarta |

|||||||

|

Heineken Indonesia |

1929 |

Jakarta |

Indonesia Alcoholic Beverages Market Analysis

Market Growth Drivers

- Rising Tourism Sector: Indonesias tourism sector has been a key driver for the alcoholic beverages market. In 2024, Indonesia is expected to receive over 17 million international tourists, primarily in regions like Bali, where alcohol consumption is widely accepted. The hospitality sector, which includes hotels, resorts, and restaurants, has seen a steady demand for alcoholic beverages. This demand is fueled by tourists seeking luxury experiences. The Indonesian Ministry of Tourism has invested over IDR 15 trillion in infrastructure projects to support the tourism industry, enhancing accessibility to areas with a high demand for alcoholic products.

- Increasing Consumer Spending: The middle class in Indonesia is expanding, contributing to the growth of the alcoholic beverages market. By 2024, Indonesia's consumer spending on non-essential items, including alcohol, is projected to reach IDR 6,800 trillion. With an increasing number of people able to afford premium alcoholic products, there has been a shift in consumer preferences toward higher-quality and branded alcoholic beverages. This rise in disposable income is supported by a robust economy, with GDP expected to exceed IDR 21,000 trillion in 2024, according to the World Bank.

- Government Relaxation in Alcohol Sales Regulations: In regions with high tourist activity, the Indonesian government has introduced measures to relax alcohol sales restrictions. For instance, Bali and other tourism hotspots have witnessed the relaxation of regulations under the special economic zones framework in 2022. This has allowed for more widespread alcohol sales in tourist-heavy areas, boosting consumption. According to government reports, Bali saw alcohol sales rise by 18 million liters in 2023, driven by policy changes that increased the number of legal outlets selling alcohol.

Market Challenges

- Religious and Cultural Constraints: Despite its growing market, Indonesia faces cultural and religious challenges in the sale and consumption of alcoholic beverages. Around 87% of the Indonesian population follows Islam, which discourages alcohol consumption. As a result, the government imposes strict controls on alcohol sales in certain regions, particularly in conservative provinces such as Aceh. These restrictions have led to uneven market penetration, limiting opportunities for alcoholic beverage companies in religiously conservative areas.

- Health Concerns: Indonesia's government has launched campaigns warning about the health risks of alcohol consumption, which has impacted consumer behavior. The Ministry of Health reported that in 2023, alcohol-related diseases were responsible for over 15,000 hospital admissions. These health campaigns have led to a decrease in alcohol consumption in certain demographics, particularly among older and more health-conscious consumers. This has prompted many consumers to reduce their alcohol intake or switch to non-alcoholic alternatives.

Indonesia Alcoholic Beverages Market Future Outlook

Over the next five years, the Indonesia Alcoholic Beverages industry is expected to experience steady growth, driven by continuous urbanization, the expansion of tourism, and the increasing popularity of premium alcoholic beverages. The growing middle class is also expected to shift consumer preferences toward higher-quality, premium brands, particularly in the wine and spirits segments.

Future Market Opportunities

- Expansion into Rural Markets: Over the next five years, alcohol producers will increasingly target rural areas as infrastructure projects improve accessibility. The Indonesian government has announced plans to build over 25,000 kilometers of rural roads by 2029, facilitating the distribution of alcoholic beverages to previously underserved regions. This expansion is expected to boost sales by providing new market opportunities in remote areas.

- Increased Focus on Sustainability: Sustainability will become a key focus for the Indonesian alcohol industry over the next five years. By 2029, over 80% of alcohol production facilities are expected to adopt renewable energy sources such as solar and wind power to reduce their environmental impact. The governments push for greener industrial practices will drive this shift, supported by tax incentives for companies that meet environmental standards.

Scope of the Report

|

By Service Type |

Transportation Services Warehousing and Distribution Inventory Management Value-Added Services Freight Forwarding |

|

By Industry Vertical |

E-commerce Retail and Consumer Goods Healthcare and Pharmaceuticals Automotive Oil & Gas |

|

By Mode of Transportation |

Road Transportation Air Transportation Sea Transportation Rail Transportation |

|

By Logistics Solution |

Dedicated Contract Logistics Non-Asset-Based 3PL Integrated 3PL Solutions Domestic Distribution Services |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Alcoholic Beverage Manufacturers

Tourism and Hospitality Industry

Government and Regulatory Bodies (Ministry of Industry, Ministry of Trade)

Packaging and Labeling Companies

Investments and Venture Capitalist Firms

Banks and Financial Institutions

Private Equity Firms

Companies

Players Mentioned in the Report:

Multi Bintang Indonesia

PT Delta Djakarta Tbk

Hatten Wines

Bali Hai Brewery

Sababay Winery

Plaga Wine

Sampoerna Strategic

Guinness Indonesia

Diageo Indonesia

Pernod Ricard Indonesia

PT Langgeng Makmur Industri

PT Mandiri Graha Nusantara

Carlsberg Indonesia

Heineken Indonesia

Lion Brewery Ceylon

Table of Contents

1. KSA 3PL Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA 3PL Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA 3PL Market Analysis

3.1. Growth Drivers

3.1.1. Rise of E-commerce

3.1.2. Government Vision 2030 Initiatives

3.1.3. Foreign Direct Investment (FDI) Influx

3.1.4. Infrastructure Expansion

3.2. Market Challenges

3.2.1. High Logistics Costs

3.2.2. Dependence on Oil Industry

3.2.3. Regulatory Framework and Bureaucracy

3.3. Opportunities

3.3.1. Digitalization in Logistics

3.3.2. Cross-Border Trade Enhancements

3.3.3. Expansion of Free Economic Zones

3.3.4. Customized 3PL Solutions for SMEs

3.4. Trends

3.4.1. Green Logistics and Sustainability Practices

3.4.2. Implementation of AI and IoT in Supply Chains

3.4.3. Shift towards Omni-Channel Fulfillment

3.4.4. Increased Demand for Cold Chain Logistics

3.5. Government Regulation

3.5.1. Vision 2030 Logistics Development Plan

3.5.2. Zakat, Tax, and Customs Authority Regulations

3.5.3. Logistics License Regulations

3.5.4. Saudi Ports Authority Initiatives

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. KSA 3PL Market Segmentation (Market-Specific Metrics: In Value % and Volume)

4.1. By Service Type (In Value %)

4.1.1. Transportation Services

4.1.2. Warehousing and Distribution

4.1.3. Inventory Management

4.1.4. Value-Added Services (Packaging, Labeling, etc.)

4.1.5. Freight Forwarding

4.2. By Industry Vertical (In Value %)

4.2.1. E-commerce

4.2.2. Retail and Consumer Goods

4.2.3. Healthcare and Pharmaceuticals

4.2.4. Automotive

4.2.5. Oil & Gas

4.3. By Mode of Transportation (In Value %)

4.3.1. Road Transportation

4.3.2. Air Transportation

4.3.3. Sea Transportation

4.3.4. Rail Transportation

4.4. By Logistics Solution (In Value %)

4.4.1. Dedicated Contract Logistics

4.4.2. Non-Asset-Based 3PL

4.4.3. Integrated 3PL Solutions

4.4.4. Domestic Distribution Services

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. KSA 3PL Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Agility Logistics

5.1.2. DHL Supply Chain

5.1.3. Ceva Logistics

5.1.4. Aramex

5.1.5. Bahri Logistics

5.1.6. Al Majdouie Group

5.1.7. FedEx Express

5.1.8. Kuehne + Nagel

5.1.9. Naqel Express

5.1.10. GWC Logistics

5.1.11. Almajdouie De Rijke Logistics

5.1.12. Hala Supply Chain Services

5.1.13. Expeditors International

5.1.14. Panalpina World Transport

5.1.15. BDP International

5.2. Cross Comparison Parameters (Market-Specific Metrics: Number of Employees, Fleet Size, Warehouse Space, Contract Value, Customer Base, Domestic vs International Operations, Service Specialization, Regional Market Penetration)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Collaborations

5.8. Private Equity and Venture Capital Funding

6. KSA 3PL Market Regulatory Framework

6.1. Saudi Customs Laws

6.2. Warehouse Compliance Regulations

6.3. Certification Requirements (ISO, HACCP, etc.)

6.4. Free Trade and Economic Zone Regulations

7. KSA 3PL Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA 3PL Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Industry Vertical (In Value %)

8.3. By Mode of Transportation (In Value %)

8.4. By Logistics Solution (In Value %)

8.5. By Region (In Value %)

9. KSA 3PL Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Competitive Strategy Recommendations

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involves mapping the ecosystem, including all key stakeholders in the Indonesia Alcoholic Beverages Market. This is done through extensive desk research and proprietary databases to gather industry-level data. The goal is to define the primary market variables that drive trends in alcoholic consumption, such as consumer demographics and product preferences.

Step 2: Market Analysis and Construction

Historical data on market size, sales, and revenue generation is compiled and analyzed to understand past market performance. A detailed analysis is carried out to examine the penetration rates of various alcoholic beverages across different regions in Indonesia.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are developed based on preliminary data analysis and are validated through interviews with key market players, including manufacturers, distributors, and retailers. This step provides first-hand insights that refine the market forecast and validate assumptions.

Step 4: Research Synthesis and Final Output

In this phase, insights from manufacturers, retailers, and consumers are integrated into the final market report. This ensures that the report provides a comprehensive and validated outlook on the Indonesia Alcoholic Beverages Market, with accurate data projections.

Frequently Asked Questions

01 How big is the Indonesia Alcoholic Beverages Market?

The Indonesia Alcoholic Beverages market is valued at USD 1.9 billion, driven by increasing disposable income, urbanization, and tourism growth.

02 What are the challenges in the Indonesia Alcoholic Beverages Market?

Challenges in the Indonesia Alcoholic Beverages market include stringent government regulations, high taxation, and cultural and religious restrictions that limit alcohol consumption in certain regions.

03 Who are the major players in the Indonesia Alcoholic Beverages Market?

Key players in the Indonesia Alcoholic Beverages market include Multi Bintang Indonesia, Hatten Wines, Bali Hai Brewery, Diageo Indonesia, and Heineken Indonesia.

04 What are the growth drivers of the Indonesia Alcoholic Beverages Market?

The Indonesia Alcoholic Beverages market is driven by rising disposable incomes, increasing urbanization, expanding tourism, and the growing demand for premium and craft beverages.

05 What are the key trends in the Indonesia Alcoholic Beverages Market?

Key trends in the Indonesia Alcoholic Beverages market include the rise of ready-to-drink beverages, increasing demand for low/no alcoholic beverages, and the growing popularity of e-commerce channels for alcohol sales.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.