Indonesia Courier, Express, and Parcel (CEP) Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD4641

December 2024

84

About the Report

Indonesia CEP Market Overview

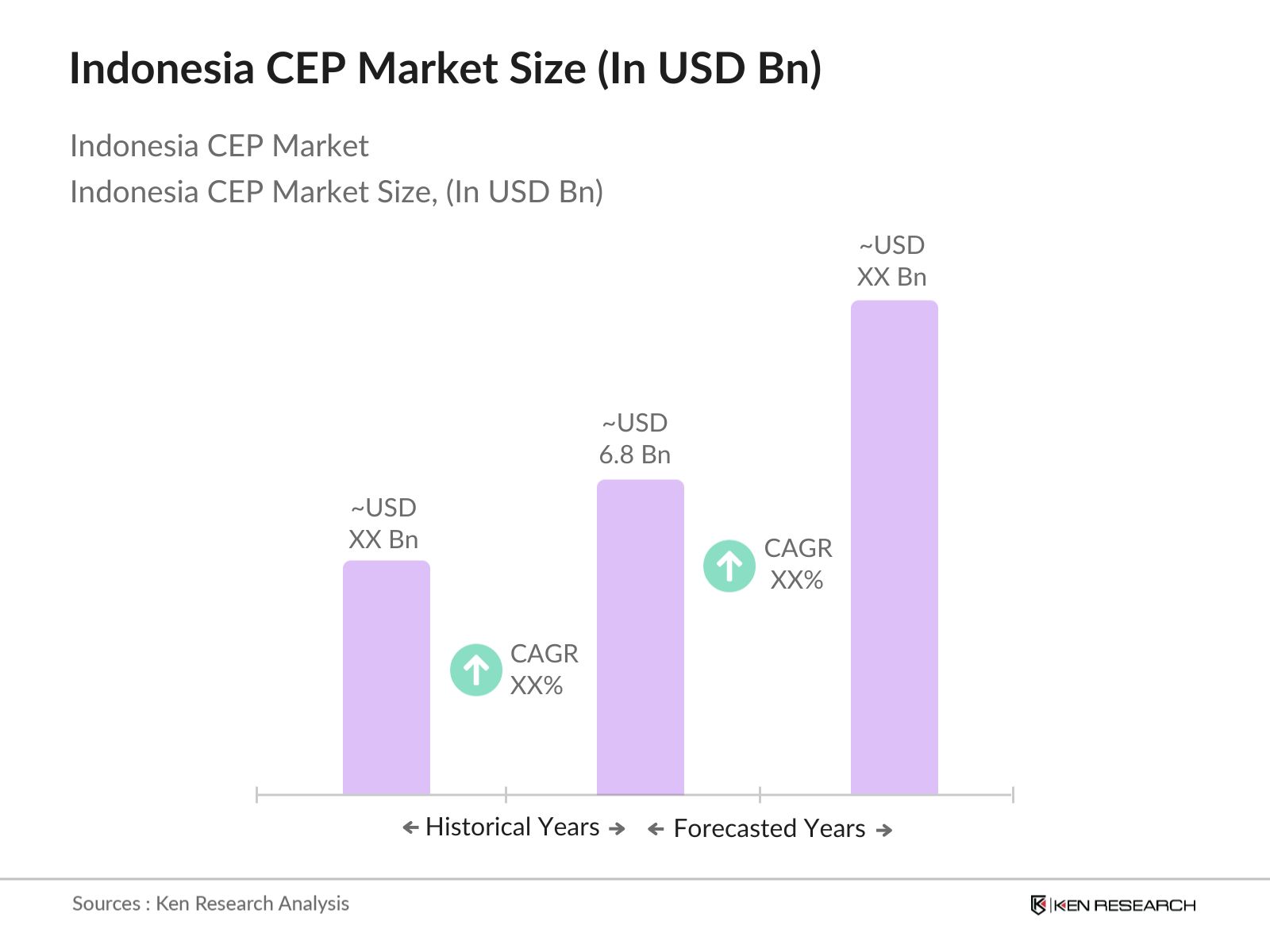

- The , Express and Parcel (CEP) market is valued at USD 6.8 billion based on a five-year historical analysis. The market has experienced growth driven by the boom in e-commerce, increasing demand for faster deliveries, and the rise of digital platforms. Companies are enhancing their logistics capabilities to meet consumer expectations for quicker delivery options. Additionally, the growth of Indonesia's urban population has pushed up demand for last-mile deliveries, especially in cities like Jakarta and Surabaya, fuelling the overall market size.

- Jakarta and Surabaya are the dominant cities in the Indonesia CEP market due to their dense population, higher e-commerce penetration, and extensive infrastructure development. Jakarta, as the country's capital and economic hub, plays a pivotal role in generating CEP demand, with substantial volumes of parcel deliveries driven by online retail and business transactions. Surabaya follows closely as a key logistics centre in Eastern Indonesia, benefiting from its strategic location and expanding commercial activity.

- The Indonesian government’s postal service regulations impact the express delivery services offered by CEP providers. According to the Ministry of Communication and Informatics, the government has introduced new rules mandating strict parcel tracking systems and defined delivery time windows, especially for e-commerce shipments. This ensures transparency and quality in the CEP sector, requiring companies to upgrade their technological infrastructure to comply with these rules. These regulations are intended to enhance customer trust and reduce delivery time discrepancies, fostering a more efficient logistics network across the country.

Indonesia CEP Market Segmentation

- By Service Type: Indonesia's CEP market is segmented by service type into Courier, Express, and Parcel services. Express services have a dominant market share in the country’s service type segmentation, driven by increasing demand for quick deliveries, especially in urban areas. This is largely due to the surge in e-commerce, where customers prefer same-day or next-day delivery for convenience. Many service providers have integrated express delivery options to stay competitive and meet consumer expectations for faster logistics.

- By End-User: The CEP market in Indonesia is further segmented by end-user industries such as e-commerce, retail, BFSI, and manufacturing. E-commerce dominates the end-user segmentation due to the rapid growth of online shopping platforms like Tokopedia, Shopee, and Bukalapak. The demand for efficient and fast delivery services is a direct result of the expansion of these platforms, making e-commerce a key driver in the CEP market.

Indonesia CEP Market Competitive Landscape

The Indonesia CEP market is dominated by a mix of local and international players. Companies like J&T Express, TIKI, and Pos Indonesia have a strong local presence, while global firms such as DHL and FedEx also compete aggressively in the space. The competitive landscape is shaped by the need for technological advancements, operational efficiency, and strategic partnerships with e-commerce platforms.

|

Company |

Established |

Headquarters |

No. of Delivery Points |

Fleet Size |

Regional Coverage |

Tech Integration |

E-commerce Partnerships |

Revenue (USD Bn) |

Employees |

|

J&T Express |

2015 |

Jakarta |

- |

- |

- |

- |

- |

- |

- |

|

TIKI |

1970 |

Jakarta |

- |

- |

- |

- |

- |

- |

- |

|

Pos Indonesia |

1746 |

Bandung |

- |

- |

- |

- |

- |

- |

- |

|

DHL Express Indonesia |

1969 |

Jakarta |

- |

- |

- |

- |

- |

- |

- |

|

SiCepat |

2014 |

Jakarta |

- |

- |

- |

- |

- |

- |

- |

Indonesia CEP Market Analysis

Indonesia CEP Market Growth Drivers

- E-commerce expansion: The rapid expansion of Indonesia’s e-commerce sector is driving growth in the Courier, Express, and Parcel (CEP) market. With over 209 million internet users in 2024, the country’s online shopping landscape is flourishing. Data from the World Bank shows that Indonesia's internet penetration has reached 76%, enabling millions to shop online. In 2023, e-commerce transactions reached 3.2 billion, leading to a surge in parcel deliveries. The growing demand for fast, efficient delivery services is pushing the CEP market forward, especially as platforms like Tokopedia and Shopee experience continuous growth in online sales volumes.

- Urbanization: Indonesia's urban population is set to exceed 157 million in 2024, according to IMF data. This urban shift is heavily concentrated in major cities like Jakarta, Surabaya, and Bandung, driving the need for efficient express delivery services. Increased consumer expectations for fast and reliable deliveries, particularly in urban areas, have been a major driver for the CEP sector. The demand for express delivery has been further bolstered by increased disposable incomes in these metropolitan regions, with the GDP per capita projected to surpass $5,000 in 2024, increasing demand for premium, expedited shipping solutions.

- Digitalization: Indonesia is witnessing a wave of digital transformation across various sectors, including logistics. In 2024, nearly 97 million Indonesians are utilizing digital payment platforms, according to the Bank Indonesia report. Digital platforms are streamlining CEP operations with real-time tracking, automated sorting systems, and AI-driven route optimization. Additionally, Indonesia’s logistics sector has benefitted from the rise of fintech solutions that facilitate smoother cross-border transactions, reducing delays in customs clearance. The increased reliance on these tech-driven solutions is transforming the CEP market by reducing delivery times and enhancing customer experiences.

Indonesia CEP Market Challenges

- Infrastructure gaps: Indonesia’s vast archipelago consists of over 17,000 islands, posing logistical challenges, particularly for last-mile delivery in remote areas. Despite ongoing infrastructure investments, rural areas remain underserved, making it difficult for CEP operators to maintain consistent delivery times. The World Bank estimates that only 60% of Indonesia's roads are paved, complicating transport, particularly in Eastern Indonesia. Moreover, limited accessibility in certain regions continues to escalate operational costs, resulting in delayed deliveries. These infrastructure gaps make it challenging for CEP companies to expand seamlessly across the nation.

- Rising competition from regional players: Indonesia's CEP market is increasingly fragmented, with numerous regional players intensifying competition. According to data from the Indonesian Logistics Association, the number of active logistics companies has grown by 15% in the past two years, particularly driven by small and medium-sized enterprises entering the sector. As these players offer more localized solutions, especially in second-tier cities, larger players are facing difficulties in maintaining market share. This fragmentation not only increases pricing pressures but also forces established players to innovate continuously, driving up operational costs in the race for market dominance.

Indonesia CEP Market Future Outlook

Over the next five years, the Indonesia CEP market is expected to show growth, driven by continuous e-commerce expansion, logistical advancements, and increasing demand for express deliveries. As businesses scale their operations to accommodate higher delivery volumes, the CEP market is likely to see increased investments in technology, including AI, automation, and real-time tracking systems. Moreover, initiatives to expand infrastructure and improve road networks will further support the market's growth.

Indonesia CEP Market Opportunities

- Automation in logistics: Automation technologies are creating new growth avenues for Indonesia’s CEP market. AI-powered warehouses, automated sorting systems, and robotics are transforming the logistics landscape by reducing errors and improving efficiency. Data from the Ministry of Industry shows that 25% of logistics companies in Indonesia have adopted automation in their processes as of 2024. These technologies enable companies to handle higher volumes of parcels with fewer resources, thereby reducing operational costs and improving delivery speeds, particularly during peak seasons like Harbolnas (National Online Shopping Day).

- Expansion into tier-2 and tier-3 cities: With Jakarta and other major cities nearing delivery saturation, tier-2 and tier-3 cities in Indonesia offer untapped potential for the CEP market. Over 60 million Indonesians reside in these regions, where e-commerce penetration is growing rapidly, according to data from the Statistics Indonesia agency. These underserved regions offer opportunities for CEP companies to expand their services. As the government continues to invest in regional infrastructure, access to these cities is improving, creating a new growth frontier for express deliveries, particularly in e-commerce.

Scope of the Report

|

By Service Type |

Courier Express Parcel |

|

By End-User |

E-commerce Retail BFSI Manufacturing |

|

By Delivery Channel |

B2B B2C C2C |

|

By Delivery Speed |

Same-day Next-day Standard |

|

By Region |

Java Sumatra Kalimantan Bali & Nusa Tenggara Papua |

Products

Key Target Audience

E-commerce companies

Logistics service providers

Retail businesses

Manufacturing industries

Banks and Financial Institutions

Government and regulatory bodies (Kementerian Perhubungan, Badan Pengawas Keuangan)

Investor and venture capitalist firms

Technology providers (AI and data analytics solutions for logistics)

Companies

Indonesia CEP Market Major Players

J&T Express

TIKI

Pos Indonesia

DHL Express Indonesia

SiCepat

Ninja Van

SAP Express

FedEx Indonesia

Lalamove

GrabExpress

Gojek Logistics

Anteraja

Aramex

Deliveree

First Logistics

Table of Contents

1. Indonesia CEP Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics (Consumer demand patterns, e-commerce growth, logistical infrastructure)

1.4. Key Market Milestones and Developments

2. Indonesia CEP Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Current Market Size (Regional demand distribution)

2.3. Growth Analysis (Shift from traditional logistics to express services)

2.4. Key Industry Events and Milestones (Growth of digital platforms, impact of pandemic)

3. Indonesia CEP Market Analysis

3.1. Growth Drivers

3.1.1. E-commerce expansion (Increase in online shopping)

3.1.2. Urbanization (Growth in demand for express deliveries in metropolitan areas)

3.1.3. Digitalization (Emergence of tech-enabled logistics solutions)

3.1.4. Growing SME sector

3.2. Market Challenges

3.2.1. Infrastructure gaps (Last-mile delivery complexities, geographic challenges)

3.2.2. Rising competition from regional players (Market fragmentation)

3.2.3. Regulatory barriers (Customs and taxation issues)

3.3. Opportunities

3.3.1. Automation in logistics

3.3.2. Expansion into tier-2 and tier-3 cities (Underserved regions)

3.3.3. Strategic partnerships with e-commerce players

3.4. Market Trends

3.4.1. On-demand delivery services (Same-day and next-day delivery)

3.4.2. Integration of AI and data analytics in logistics

3.4.3. Adoption of electric delivery vehicles (Green logistics initiatives)

3.5. Government Regulations

3.5.1. Postal service regulations (Impact on express services)

3.5.2. Customs policies and import/export duties

3.5.3. Environmental regulations for transport vehicles

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Collaborations between courier services, e-commerce platforms, and fintech)

3.8. Porters Five Forces (Supplier power, buyer power, competitive rivalry)

3.9. Competition Ecosystem (Cross-border vs. domestic players)

4. Indonesia CEP Market Segmentation

4.1. By Service Type (In Value %) 4.1.1. Courier

4.1.2. Express

4.1.3. Parcel

4.2. By End-User (In Value %) 4.2.1. E-commerce

4.2.2. Retail

4.2.3. BFSI

4.2.4. Manufacturing

4.3. By Delivery Channel (In Value %) 4.3.1. Business-to-Business (B2B)

4.3.2. Business-to-Consumer (B2C)

4.3.3. Consumer-to-Consumer (C2C)

4.4. By Delivery Speed (In Value %) 4.4.1. Same-day delivery

4.4.2. Next-day delivery

4.4.3. Standard delivery

4.5. By Region (In Value %) 4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Bali and Nusa Tenggara

4.5.5. Papua

5. Indonesia CEP Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. J&T Express

5.1.2. TIKI

5.1.3. Pos Indonesia

5.1.4. DHL Express Indonesia

5.1.5. Ninja Van

5.1.6. SiCepat

5.1.7. GrabExpress

5.1.8. Gojek Logistics

5.1.9. Lalamove

5.1.10. SAP Express

5.1.11. FedEx Indonesia

5.1.12. Aramex

5.1.13. Deliveree

5.1.14. Anteraja

5.1.15. First Logistics

5.2. Cross Comparison Parameters

(No. of Delivery Points, Operational Regions, Fleet Size, Technology Integration, Partnerships, Pricing Models, Customer Service, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships with e-commerce platforms, Tech integration)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Incentives

6. Indonesia CEP Market Regulatory Framework

6.1. Logistics and Transport Regulations

6.2. Cross-border Trade Laws

6.3. Certification and Compliance Requirements

6.4. Data Protection and Privacy Laws in Logistics

7. Indonesia CEP Future Market Size (In USD Bn)

7.1. Projected Market Size

7.2. Key Drivers for Future Growth (Digitalization, Expansion of e-commerce, Policy support)

8. Indonesia CEP Future Market Segmentation

8.1. By Service Type

8.2. By End-User

8.3. By Delivery Channel

8.4. By Delivery Speed

8.5. By Region

9. Indonesia CEP Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunity Identification

9.3. Market Penetration Strategy

9.4. Customer Acquisition Strategies

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

We begin by mapping the ecosystem of the Indonesia CEP market, including all key stakeholders such as logistics service providers, e-commerce platforms, and end-users. This is done through comprehensive desk research, utilizing both proprietary and secondary databases to identify critical factors influencing the market.

Step 2: Market Analysis and Construction

In this phase, historical data related to Indonesia's CEP market is gathered, with a focus on market penetration and the relationship between service providers and their clients. Additionally, data on fleet sizes, delivery points, and regional coverage are analyzed to ensure the accuracy of the findings.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about the market's trajectory are developed and validated through interviews with industry experts and players in the logistics field. This approach ensures the accuracy of market estimates and future trends.

Step 4: Research Synthesis and Final Output

Finally, the research findings are compiled, synthesizing both quantitative and qualitative data. Feedback from CEP providers on their operational challenges and growth prospects is integrated to provide a complete market outlook.

Frequently Asked Questions

01. How big is the Indonesia CEP Market?

The Indonesia CEP market is valued at USD 6.8 billion, driven by increasing demand for express deliveries and e-commerce growth.

02. What are the challenges in the Indonesia CEP Market?

Indonesia CEP market challenges include infrastructure gaps, particularly in last-mile delivery, and rising competition from both local and international players, making it harder for smaller firms to scale.

03. Who are the major players in the Indonesia CEP Market?

Indonesia CEP market players include J&T Express, TIKI, Pos Indonesia, DHL Express Indonesia, and SiCepat. These companies lead due to their extensive network and technological integration.

04. What are the growth drivers of the Indonesia CEP Market?

Indonesia CEP market growth is fueled by the surge in e-commerce, urbanization, and technological advancements in logistics, including the use of AI and automation to optimize delivery processes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.