Indonesia Electric Vehicle (EV) Market Outlook to 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD2370

December 2024

93

About the Report

Indonesia Electric Vehicle (EV) Market Overview

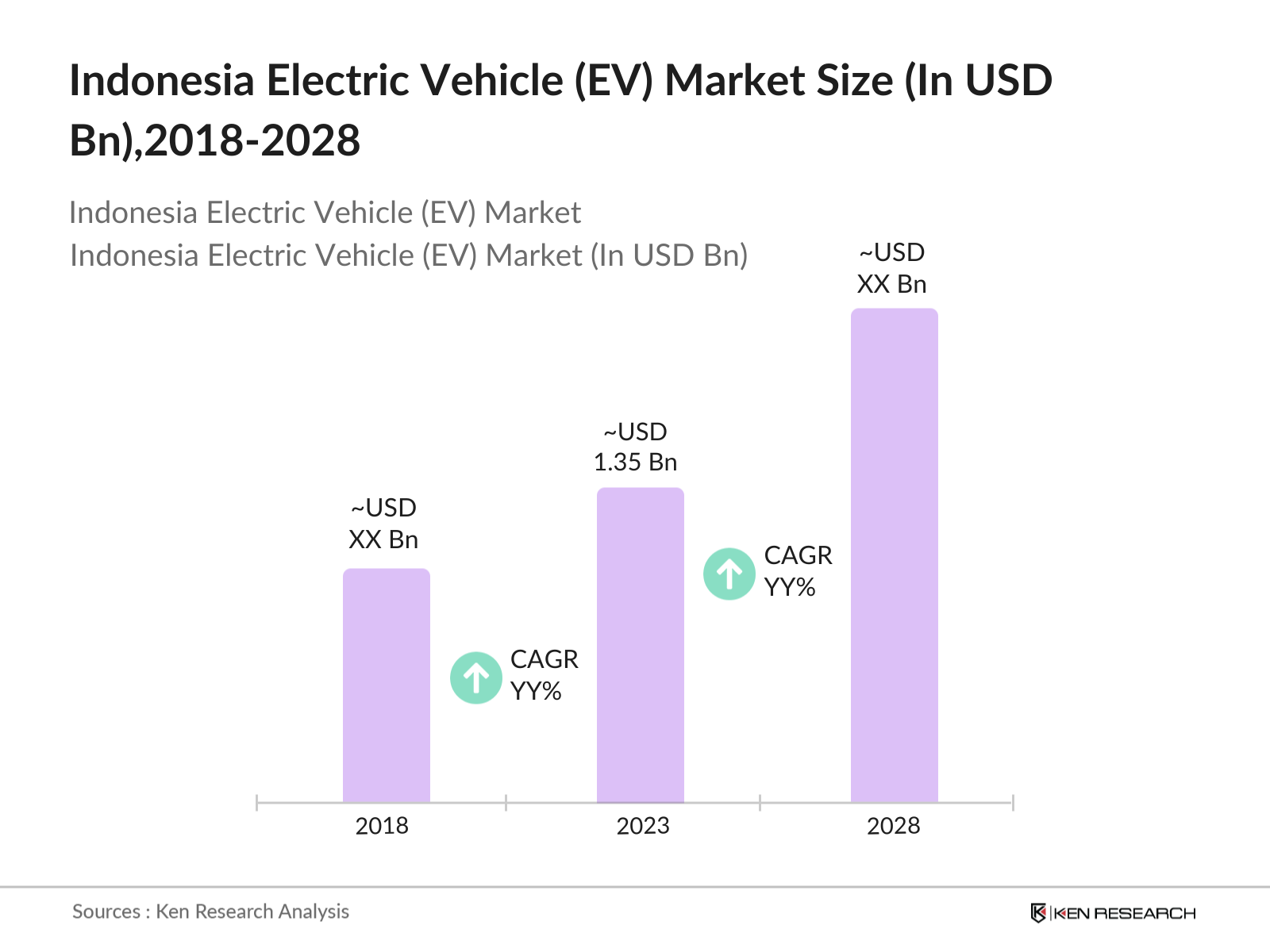

- The Indonesia Electric Vehicle (EV) market size reached US 1.35 billion in 2023, driven by the increasing demand for sustainable and eco-friendly mobility solutions, supported by government policies promoting the adoption of electric vehicles. Rising concerns over environmental pollution, coupled with fuel price fluctuations, have motivated the shift from conventional internal combustion engine (ICE) vehicles to EVs.

- Prominent players in the Indonesian EV market include Hyundai Motors, Wuling Motors, Toyota, Daihatsu, and local manufacturer Gesits. These companies are leading the push toward electric mobility in Indonesia. Hyundai, for instance, has established a significant EV production facility in Cikarang, West Java, while Wuling Motors is driving the market with affordable EV models, contributing to the rapid adoption of electric vehicles across the country.

- The joint venture between Foxconn and Indika Energy, called PT Foxconn Indika Motor (FIM), was established on September 22, 2022. This partnership focuses on manufacturing commercial electric vehicles and batteries, aiming to create a comprehensive electric vehicle ecosystem in Indonesia, leveraging the country's abundant natural resources. The establishment of this joint venture followed a memorandum of understanding signed earlier in 2022.

- Cities like Jakarta, Bandung, and Surabaya dominate the Indonesian EV market due to their established infrastructure and significant urban population. Jakarta, as the nation's capital and economic hub, leads the market, driven by its advanced EV charging network and heightened focus on reducing traffic congestion and pollution. Bandung and Surabaya similarly benefit from developed transportation infrastructure and a growing demand for cleaner mobility solutions.

Indonesia Electric Vehicle (EV) Market Segmentation

The Indonesia Electric Vehicle (EV) Market is segmented into further categories:

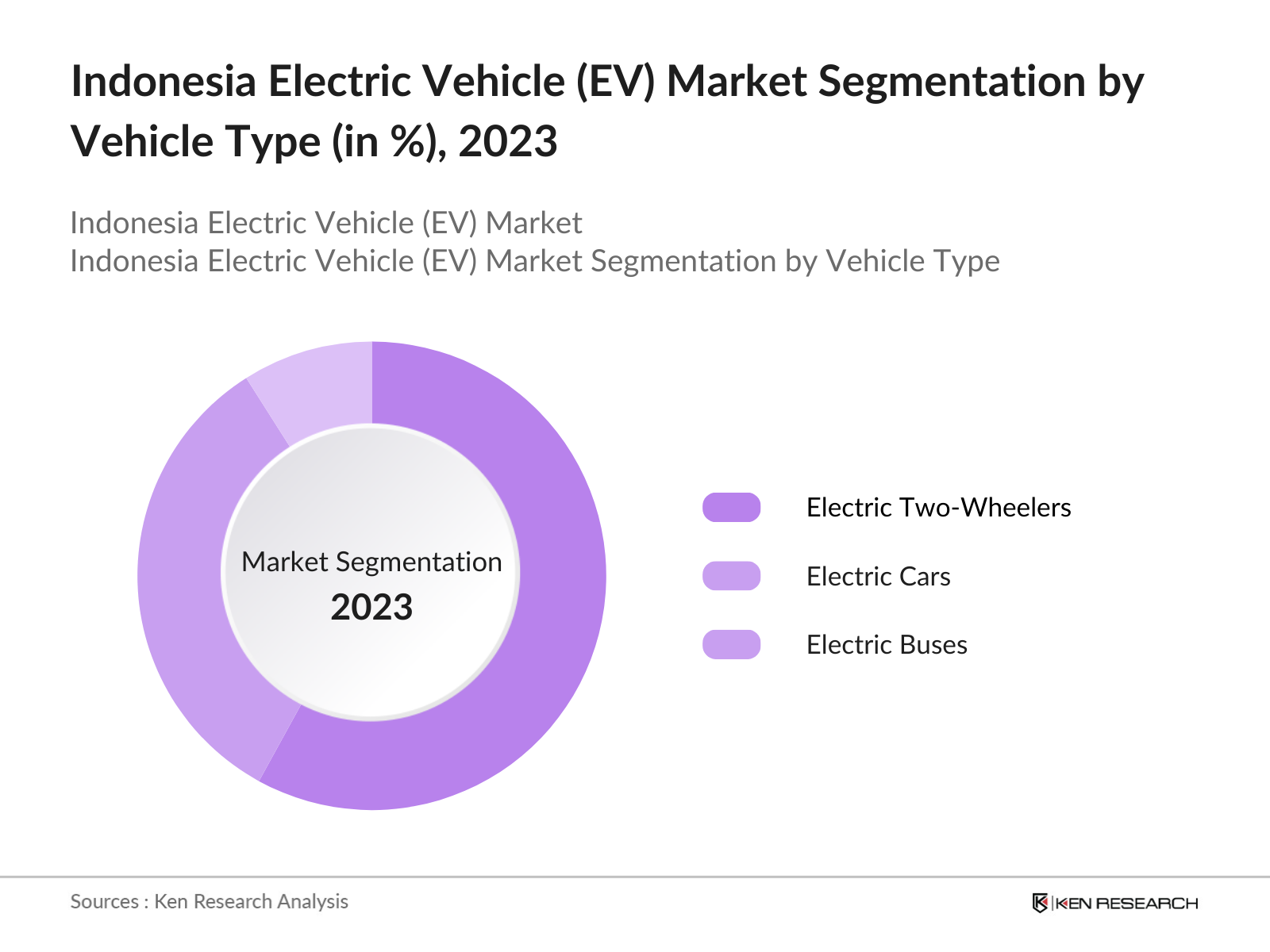

By Vehicle Type: The Indonesian EV market is segmented into electric two-wheelers, electric cars, and electric buses. In 2023, electric two-wheelers led the market due to rising demand for cost-effective and efficient transportation solutions in urban areas. These vehicles are favored for their affordability and ease of maneuvering through congested city streets. Additionally, government subsidies aimed at promoting electric motorbikes have further fueled the growth of this segment.

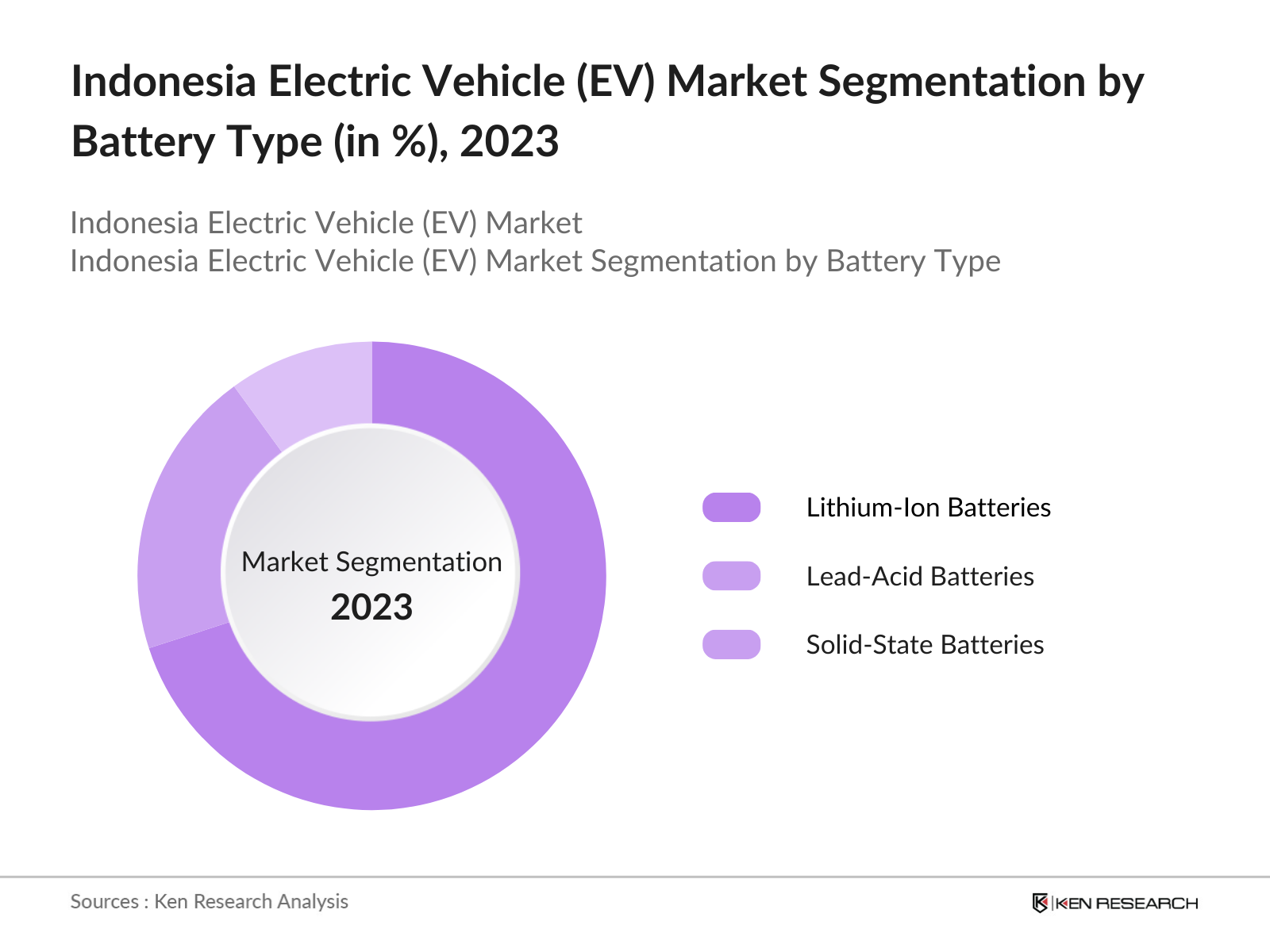

By Battery Type: The Indonesian EV market is segmented by battery type into lithium-ion batteries, lead-acid batteries, and solid-state batteries. In 2023, lithium-ion batteries dominated the market, driven by their superior energy density, longer lifespan, and faster charging capabilities. Investments from key players like LG Chem and CATL in local battery production have further strengthened the adoption of lithium-ion batteries, aligning with Indonesia's strategic focus on leveraging its abundant nickel reserves for domestic battery manufacturing.

By Region: The Indonesian EV market is segmented into North, South, East, and West regions. In 2023, the West region led the market, driven by its high population density, higher disposable incomes, and well-developed infrastructure. Cities like Jakarta and Bandung in this region benefit from an extensive network of EV charging stations and government-backed smart city initiatives, which have accelerated the adoption of electric vehicles across the area.

Indonesia Electric Vehicle (EV) Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Hyundai Motors |

1967 |

Seoul, South Korea |

|

Wuling Motors |

2002 |

Liuzhou, China |

|

Toyota |

1937 |

Toyota City, Japan |

|

Daihatsu |

1907 |

Ikeda, Japan |

|

Gesits |

2018 |

Jakarta, Indonesia |

- Hyundai Motors: In 2023, Hyundai expanded its EV production facility in Cikarang, with a capacity to produce 150,000 units per year. This plant, established in 2022, is part of Hyundai's broader strategy to make Indonesia its hub for EV manufacturing in Southeast Asia. The company also launched its popular IONIQ 5 model in the Indonesian market, further cementing its market leadership.

- Wuling Motors: Wuling Motors has indeed become a significant player in the Indonesian EV market, particularly with the launch of the Wuling Air EV in 2022. Priced competitively at IDR 250 million (approximately USD 16,500), it has rapidly gained popularity, becoming one of the best-selling electric cars in Indonesia. By September 2023, Wuling had sold over 10,000 units of the Air EV in Indonesia.

Indonesia Electric Vehicle (EV) Market Analysis

Indonesia Electric Vehicle (EV) Market Growth Drivers

- Abundance of Nickel Reserves for EV Batteries: Indonesia possesses the largest nickel reserves globally, which are crucial for EV battery production, particularly for lithium-ion batteries that rely on nickel as a key component. The Indonesian government has focused on localizing EV battery manufacturing by utilizing this resource. In 2023, nickel production surged to 1.2 million metric tons, fueled by investments from foreign companies like LG Chem and Contemporary Amperex Technology (CATL). This local production of nickel will continue to drive the growth of the Indonesian EV market in the coming years.

- Supportive government policies: The Indonesian government has implemented a robust framework of incentives and regulations to stimulate electric vehicle (EV) adoption. For instance, the government has reduced import tariffs on EV components and introduced tax holidays for manufacturers. In 2023, the government provided subsidies of up to IDR 7 million (approximately USD 470) for electric two-wheelers, which has significantly influenced consumer purchasing decisions.

- Expansion of Charging Infrastructure: Indonesias PLN plans to build 31,000 EV charging stations by 2025, as announced in 2023. This initiative supports the growing EV market and focuses on urban areas like Jakarta and Surabaya. The expansion is expected to reduce range anxiety and make EV ownership more feasible, especially in traffic-heavy regions. This development is critical to accelerating EV adoption across the country.

Indonesia Electric Vehicle (EV) Market Challenges

- Underdeveloped Charging Infrastructure Outside Major Cities: While major cities like Jakarta and Surabaya are seeing progress in EV charging infrastructure, rural and less-developed regions remain underserved. This uneven distribution of charging stations limits the adoption of EVs in non-urban areas, hindering growth outside key metropolitan regions and making long-distance travel challenging for EV users.

- Limited EV Production Capacity: Despite attracting foreign investment, Indonesia's EV production capacity is still in its early stages. Local manufacturers primarily focus on two-wheelers, leaving a gap in affordable electric car production. This limitation may hinder the countrys goal of becoming a regional EV hub and meeting future demand. Expanding production infrastructure is crucial to support both local and export markets.

Indonesia Electric Vehicle (EV) Market Government Initiatives

- Regulation on Minimum Local Content for EVs: In 2023, the Indonesian government mandated that electric vehicles produced locally must meet minimum local content requirements to qualify for subsidies. This regulation aims to boost domestic industries and reduce reliance on imports. It is expected to stimulate growth in the EV supply chain, especially in battery production, assembly, and parts manufacturing, attracting international investments into the market.

- Partnership with Foreign Investors for Battery Development: Indonesia has partnered with foreign companies to build a strong battery production industry. In 2023, Indonesia announced a significant joint venture between Foxconn and PT Industri Baterai Indonesia (IBC) aimed at establishing a large battery production facility. This initiative is part of Indonesia's broader strategy to leverage its vast nickel reserves to enhance its role in the global electric vehicle (EV) supply chain, ultimately aiming to lower EV battery costs and, consequently, the prices of electric vehicles.

Indonesia Electric Vehicle (EV) Market Outlook

As the Indonesian Electric Vehicle (EV) market continues to evolve, several key trends are expected to shape its trajectory by 2028. With continued government support, technological advancements, and infrastructure developments, the EV market is poised for rapid growth over the next five years.

Future Trends:

- Battery Technology Advancements Will Drive Cost Reductions: Over the next five years, advancements in battery technology are expected to lower the cost of electric vehicles in Indonesia. By 2028, solid-state batteries are projected to enter mass production, offering longer ranges and faster charging times compared to current technologies. These improvements will make EVs more attractive to consumers and help align their upfront cost with that of ICE vehicles, promoting broader market adoption.

- Expansion of Charging Infrastructure in Rural Areas: As the Indonesian EV market grows, efforts will shift to installing EV charging stations in rural areas. By 2028, this expansion will facilitate long-distance travel and encourage EV adoption outside urban centers. Enhancing infrastructure in less-developed regions will help bridge the gap in regional EV adoption and promote broader use across the country.

Scope of the Report

|

By Vehicle Type |

Electric Two-Wheelers Electric Cars Electric Buses |

|

By Battery Type |

Lithium-Ion Batteries Lead-Acid Batteries Solid-State Batteries |

|

By Region |

North South East West |

Products

Key Target Audience:

Electric Vehicle Manufacturers

Battery Manufacturers

Automobile Dealerships

Transportation and Logistic Companies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (BKPM)

Public and Private Transportation Operators

Automotive Parts Suppliers

Energy and Utility Providers

Technology and Software Providers for EVs

Electric Vehicle Charging Infrastructure Providers

Financial Institutions and Leasing Companies

Companies

Players Mentioned in the Report:

Hyundai Motors

Wuling Motors

Toyota

Daihatsu

Gesits

Mitsubishi Motors

Tesla

BYD

Honda

Nissan

Kia Motors

VinFast

CATL (Contemporary Amperex Technology Co. Ltd.)

LG Chem

Foxconn

Table of Contents

01. Indonesia Electric Vehicle (EV) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Indonesia Electric Vehicle (EV) Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Indonesia Electric Vehicle (EV) Market Analysis

3.1. Growth Drivers

3.1.1. Nickel Reserves and Battery Production

3.1.2. Government Subsidies and Incentives

3.1.3. Expansion of Charging Infrastructure

3.2. Challenges

3.2.1. High Initial Cost of EVs

3.2.2. Limited Charging Infrastructure in Rural Areas

3.2.3. Limited Domestic Production Capacity

3.3. Opportunities

3.3.1. Investment in Local EV Production

3.3.2. Growth in Electric Two-Wheelers

3.3.3. Expansion of Public Transport Electrification

3.4. Trends

3.4.1. Partnerships for Charging Infrastructure

3.4.2. Increasing Local Production of EV Components

3.4.3. Rise in Two-Wheeler EV Sales

3.5. Government Initiatives

3.5.1. Subsidies for EV Purchases

3.5.2. Local Content Requirements for EV Production

3.5.3. Partnerships for Battery Production

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

04. Indonesia Electric Vehicle (EV) Market Segmentation, 2023

4.1. By Vehicle Type (in Value %)

4.1.1. Electric Two-Wheelers

4.1.2. Electric Cars

4.1.3. Electric Buses

4.2. By Battery Type (in Value %)

4.2.1. Lithium-Ion Batteries

4.2.2. Lead-Acid Batteries

4.2.3. Solid-State Batteries

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

05. Indonesia Electric Vehicle (EV) Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. Hyundai Motors

5.1.2. Wuling Motors

5.1.3. Toyota

5.1.4. Daihatsu

5.1.5. Gesits

5.1.6. Mitsubishi Motors

5.1.7. Tesla

5.1.8. BYD

5.1.9. Honda

5.1.10. Nissan

5.1.11. Kia Motors

5.1.12. VinFast

5.1.13. CATL (Contemporary Amperex Technology Co. Ltd.)

5.1.14. LG Chem

5.1.15. Foxconn

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

06. Indonesia Electric Vehicle (EV) Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

07. Indonesia Electric Vehicle (EV) Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

08. Indonesia Electric Vehicle (EV) Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

09. Indonesia Electric Vehicle (EV) Market Future Segmentation, 2028

9.1. By Region (in Value %)

9.2. By Vehicle Type (in Value %)

9.3. By Battery Type (in Value %)

9.4. By Application (in Value %)

10. Indonesia Electric Vehicle (EV) Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Consumer Behavior Analysis

10.3. Marketing Strategies

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on the Indonesia Electric Vehicle (EV) Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for the Indonesia Electric Vehicle (EV) Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple Electric Vehicle (EV) and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Electric Vehicle (EV).

Frequently Asked Questions

01. How big is the Indonesia Electric Vehicle (EV) market?

The Indonesia Electric Vehicle market was valued at USD 1.35 billion in 2023, driven by government subsidies, local production of batteries, and increasing consumer demand for eco-friendly transportation options.

02. What are the challenges in the Indonesia Electric Vehicle market?

The key challenges in the Indonesia EV market include high initial costs of electric vehicles, underdeveloped charging infrastructure in rural areas, and limited domestic production capacity. These factors restrict the widespread adoption of EVs, especially outside major cities.

03. Who are the major players in the Indonesia Electric Vehicle market?

Major players in the Indonesian EV market include Hyundai Motors, Wuling Motors, Toyota, Daihatsu, and local manufacturer Gesits. These companies are leading the market through investments in production facilities and strong product offerings tailored for the Indonesian market.

04. What are the growth drivers of the Indonesia Electric Vehicle market?

Growth drivers include the abundance of nickel reserves for EV battery production, government subsidies and incentives, and the rapid expansion of EV charging infrastructure in major cities like Jakarta and Surabaya.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.