Indonesia Food Market Outlook to 2028

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD5933

November 2024

91

About the Report

Indonesia Food Market Overview

- The Indonesia Food Market is valued at USD 250 billion based on a comprehensive five-year historical analysis. This valuation is driven by the increasing demand for processed and ready-to-eat food products, alongside a rise in middle-class disposable income. Additionally, the growing urban population has been instrumental in the market's expansion, as more consumers seek convenience in meal preparation, contributing to the overall growth of the industry.

- Java, the most populous island in Indonesia, dominates the food market. It is home to key metropolitan hubs such as Jakarta, Surabaya, and Bandung, which serve as economic powerhouses. These cities are at the forefront of demand due to their high population density, consumer spending power, and access to well-established supply chains.

- In 2024, the Indonesian government launched the National Food Security Program to increase domestic food production and reduce dependency on food imports. This initiative involves expanding the cultivation of key staples such as rice, corn, and soybeans, to produce an additional 3.5 million tons of food crops annually. The program also includes subsidies for local farmers and investments in agricultural technology to enhance productivity.

Indonesia Food Market Segmentation

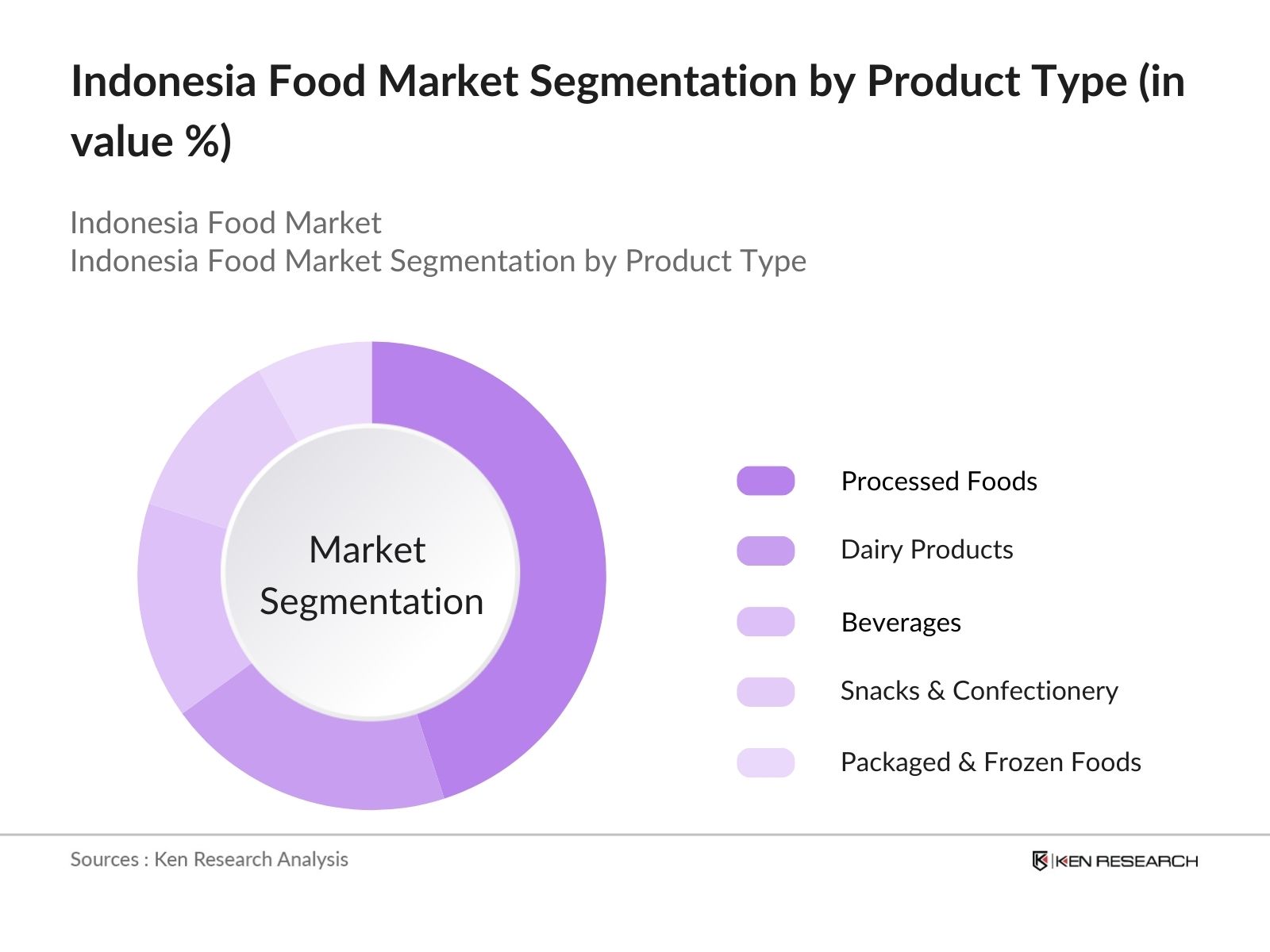

By Product Type: The market is segmented by product type into processed foods, dairy products, beverages, snacks & confectionery, and packaged & frozen foods. Recently, processed foods have dominated the market, owing to their convenience and longer shelf life, which cater to the increasing number of working professionals and urban dwellers. The rise in food processing technologies and government support for local food manufacturing industries has enhanced the availability and affordability of processed foods, making it the preferred choice for many consumers.

By Distribution Channel: The market is segmented by distribution channel into supermarkets/hypermarkets, e-commerce, specialty stores, and convenience stores. Supermarkets/hypermarkets hold the largest market share due to their widespread presence in both urban and semi-urban areas. These stores provide a one-stop shopping experience, offering a variety of food products at competitive prices. Furthermore, their ability to handle bulk purchases and cater to different consumer needs has solidified their position as the dominant distribution channel.

Indonesia Food Market Competitive Landscape

The market is dominated by several key players who have established strong brand loyalty, extensive distribution networks, and innovative product offerings. The market is highly competitive, with both local and international companies vying for consumer attention.

|

Company Name |

Year of Establishment |

Headquarters |

Product Portfolio |

Revenue (USD bn) |

Market Share |

Sustainability Initiatives |

R&D Investments |

|

Indofood Sukses Makmur |

1968 |

Jakarta, Indonesia |

|||||

|

PT Mayora Indah |

1977 |

Jakarta, Indonesia |

|||||

|

Nestl Indonesia |

1971 |

Jakarta, Indonesia |

|||||

|

Garudafood Putra Putri Jaya |

1990 |

Jakarta, Indonesia |

|||||

|

Wings Food |

1948 |

Jakarta, Indonesia |

Indonesia Food Market Analysis

Market Growth drivers

- Rising Health Consciousness: Indonesian consumers are showing a marked shift toward healthier eating habits, reflected in the increasing demand for organic and natural food products. In 2024, organic food sales have seen a surge in major urban areas like Jakarta and Surabaya, driven by a growing awareness of health-related issues such as diabetes and obesity. As a result, local supermarkets and online food retailers are expanding their organic food selections to meet the increasing consumer demand for healthier alternatives, including fresh fruits, vegetables, and minimally processed foods.

- Expansion of E-Commerce Platforms for Food Products: The growth of e-commerce platforms in Indonesia has greatly facilitated the food market, making it easier for consumers to access a wide variety of products. In 2024, Indonesia recorded over 100 million e-commerce users, with a significant portion of this user base purchasing food and beverages online. Major players like Tokopedia and Shopee have integrated grocery and food delivery services into their platforms, resulting in a rise in the sale of packaged and processed foods to both urban and rural consumers.

- Increasing Middle-Class Spending on Convenience Foods: With the middle-class population in Indonesia projected to reach 140 million by 2025, spending on convenience foods such as ready-to-eat meals, frozen foods, and snacks is witnessing robust growth. In 2024, the demand for convenience food is supported by an increase in dual-income households, where both partners work and have less time to prepare meals, leading to increased consumption of pre-packaged and easy-to-cook meals.

Market Challenges

- Supply Chain Disruptions: Indonesias food market faces challenges related to supply chain inefficiencies, particularly in transporting perishable goods like fruits and vegetables. In 2024, logistical issues such as inadequate cold storage facilities have resulted in post-harvest losses of up to 20 million tons of food, particularly in rural and remote areas. This has increased the cost of fresh food items, reducing their availability to the broader population.

- Price Volatility in Raw Materials: The Indonesian food industry has experienced fluctuating prices for essential raw materials such as rice, wheat, and palm oil, affecting both producers and consumers. For instance, the price of rice reached an average of IDR 12,000 per kilogram in 2024, impacting affordability for low-income groups. Such price volatility is influenced by factors like weather conditions, import dependencies, and global commodity price trends.

Indonesia Food Market Future Outlook

Over the next five years, the Indonesia Food industry is expected to witness growth, driven by increasing urbanization, a growing middle-class population, and the expansion of e-commerce platforms. The government's focus on food security and self-sufficiency will further stimulate domestic production and reduce reliance on imports.

Future Market Opportunities

- Growth in Plant-Based Food Products: Over the next five years, the demand for plant-based food products is expected to increase significantly as more consumers in Indonesia embrace vegetarian and vegan diets. By 2029, the plant-based food market is projected to generate substantial revenues, driven by increased consumer awareness of the environmental and health benefits of plant-based diets.

- Adoption of Smart Agriculture Technologies: In the next five years, the Indonesian food industry is likely to see widespread adoption of smart agriculture technologies, such as drones and IoT-based farming systems. These technologies are expected to increase agricultural productivity by reducing input costs and improving crop yields, thereby boosting the availability of locally produced food.

Scope of the Report

|

By Product Type |

Processed Foods Dairy Products Beverages Snacks & Confectionery Packaged & Frozen Foods |

|

By Distribution Channel |

Supermarkets/Hypermarkets E-Commerce Specialty Stores Convenience Stores |

|

By Consumer Segment |

Urban Consumers Rural Consumers Health-Conscious Consumers Convenience Seekers |

|

By Packaging Type |

Rigid Packaging Flexible Packaging Sustainable Packaging |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

- Food and Beverage Manufacturers

- Retail and Distribution Companies

- Government and Regulatory Bodies (Indonesian Ministry of Agriculture, Indonesian National Agency of Drug and Food Control)

- Banks and Financial Institution

- Packaging Solution Providers

- Investments and Venture Capitalist Firms

- Sustainable Food Technology Companies

- Private Equity Firms

Companies

Players Mentioned in the Report:

- Indofood Sukses Makmur

- PT Mayora Indah

- Nestl Indonesia

- Garudafood Putra Putri Jaya

- Wings Food

- Heinz ABC Indonesia

- Orang Tua Group

- PT Ultrajaya Milk Industry

- Unilever Indonesia

- PT Kalbe Farma Tbk

- PT KFC Indonesia

- Indofood CBP Sukses Makmur

- Mondelez International Indonesia

- PT Nippon Indosari Corpindo

- Sari Roti

Table of Contents

Indonesia Food Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

Indonesia Food Market Size (in USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

Indonesia Food Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Local Demand for Processed Foods

3.1.2 Expansion of E-Commerce and Food Delivery

3.1.3 Rising Awareness of Nutritional Products

3.1.4 Government Incentives for Local Production

3.2 Market Challenges

3.2.1 Supply Chain Disruptions due to Regional Policies

3.2.2 Rising Raw Material Costs

3.2.3 Stringent Import Regulations

3.2.4 Lack of Cold Storage Infrastructure

3.3 Opportunities

3.3.1 Growth in Organic and Health-Conscious Food Segments

3.3.2 Export Opportunities to Southeast Asian Markets

3.3.3 Expansion in Functional Foods and Nutraceuticals

3.3.4 Rising Popularity of Ready-to-Eat Meals

3.4 Trends

3.4.1 Shift Toward Plant-Based and Alternative Proteins

3.4.2 Integration of Sustainable Packaging Solutions

3.4.3 Growth in Private Label Products

3.4.4 Adoption of Smart Farming Technologies

3.5 Government Regulations

3.5.1 Import and Export Restrictions

3.5.2 Food Safety Standards and Certification

3.5.3 Nutritional Labeling Regulations

3.5.4 National Initiatives for Agricultural Sustainability

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

Indonesia Food Market Segmentation

4.1 By Product Type (in Value %)

4.1.1 Processed Foods

4.1.2 Dairy Products

4.1.3 Beverages

4.1.4 Snacks & Confectionery

4.1.5 Packaged & Frozen Foods

4.2 By Distribution Channel (in Value %)

4.2.1 Supermarkets/Hypermarkets

4.2.2 E-Commerce

4.2.3 Specialty Stores

4.2.4 Convenience Stores

4.3 By Consumer Segment (in Value %)

4.3.1 Urban Consumers

4.3.2 Rural Consumers

4.3.3 Health-Conscious Consumers

4.3.4 Convenience Seekers

4.4 By Packaging Type (in Value %)

4.4.1 Rigid Packaging

4.4.2 Flexible Packaging

4.4.3 Sustainable Packaging

4.5 By Region (in Value %)

4.5.1 Java

4.5.2 Sumatra

4.5.3 Kalimantan

4.5.4 Sulawesi

4.5.5 Papua

Indonesia Food Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Indofood Sukses Makmur

5.1.2 PT Mayora Indah

5.1.3 Nestl Indonesia

5.1.4 PT Nippon Indosari Corpindo

5.1.5 Garudafood Putra Putri Jaya

5.1.6 Wings Food

5.1.7 Heinz ABC Indonesia

5.1.8 Sari Roti

5.1.9 Orang Tua Group

5.1.10 PT Ultrajaya Milk Industry

5.1.11 Unilever Indonesia

5.1.12 PT Kalbe Farma Tbk

5.1.13 PT KFC Indonesia

5.1.14 Indofood CBP Sukses Makmur

5.1.15 Mondelez International Indonesia

5.2 Cross Comparison Parameters

Revenue, Market Share, Product Portfolio, Sustainability Initiatives, Supply Chain Efficiency, Consumer Reach, Digital Transformation, R&D Investments

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants

5.8 Private Equity Investments

Indonesia Food Market Regulatory Framework

6.1 Food Safety Standards

6.2 Labeling and Certification Processes

6.3 Import and Export Compliance Requirements

Indonesia Food Future Market Size (in USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

Indonesia Food Market Future Segmentation

8.1 By Product Type (in Value %)

8.2 By Distribution Channel (in Value %)

8.3 By Consumer Segment (in Value %)

8.4 By Packaging Type (in Value %)

8.5 By Region (in Value %)

Indonesia Food Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 White Space Opportunity Analysis

9.3 Marketing Initiatives

9.4 Innovation & Product Development Recommendations

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, a comprehensive ecosystem map was created, encompassing all key stakeholders within the Indonesia Food Market. Secondary databases, industry reports, and proprietary databases were utilized to gather insights into the markets growth dynamics and consumer behavior trends.

Step 2: Market Analysis and Construction

Historical data pertaining to the market was compiled and analyzed, assessing factors like product penetration, consumer demand, and distribution channel efficiency. The analysis focused on key performance indicators (KPIs) that directly influence market revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market segmentation, growth drivers, and consumer trends were developed. These were validated through expert consultations, using both in-person interviews and CATIs with industry professionals from major food production and distribution companies.

Step 4: Research Synthesis and Final Output

The final phase involved engagement with key food producers and retailers to acquire detailed insights into product innovations, consumer preferences, and sales data. This feedback was incorporated into a bottom-up approach to ensure an accurate and validated market analysis.

Frequently Asked Questions

01. How big is the Indonesia Food Market?

The Indonesia food market was valued at USD 250 billion in 2023, driven by rising consumer demand for convenience food, increased urbanization, and advancements in food technology.

02. What are the challenges in the Indonesia Food Market?

Challenges in the Indonesia food market include supply chain inefficiencies, rising costs of raw materials, and stringent import regulations. These issues create operational hurdles for food manufacturers and distributors.

03. Who are the major players in the Indonesia Food Market?

Key players in the Indonesia food market include Indofood Sukses Makmur, PT Mayora Indah, Nestl Indonesia, Garudafood Putra Putri Jaya, and Wings Food. These companies dominate due to their extensive distribution networks and strong brand presence.

04. What are the growth drivers in the Indonesia Food Market?

Growth drivers in the Indonesia food market include the rise in processed food consumption, the expansion of e-commerce platforms, and government support for local food production. The increasing awareness of health and nutrition also boosts demand for specific food segments like dairy and beverages.

05. What are the trends in the Indonesia Food Market?

Trends in the Indonesia food market include the shift towards sustainable food packaging, increasing demand for plant-based and alternative proteins, and the growth of ready-to-eat meal segments.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.