Indonesia Gaming Market Outlook to 2028

Region:Asia

Author(s):Mukul

Product Code:KROD8208

October 2024

98

About the Report

Indonesia Gaming Market Overview

- The Indonesia gaming market is valued at USD 600 million, based on a five-year historical analysis. This growth is primarily driven by the increasing penetration of smartphones and widespread access to affordable internet services. The shift towards digital platforms for entertainment and social interaction, especially after the pandemic, has bolstered the gaming industry in the region. Additionally, the rise of mobile gaming, fueled by both local and global developers, has significantly contributed to the market's expansion.

- In terms of geographic dominance, cities like Jakarta and Surabaya are the leading hubs for gaming in Indonesia. These cities are characterized by a tech-savvy young population with rising disposable incomes, alongside strong investment in technology infrastructure. Jakarta, being the country's capital, benefits from the concentration of gaming companies, both local and international, while Surabaya has established itself as a key e-sports hub, drawing in a large gamer base through tournaments and digital innovation.

- Indonesias new Personal Data Protection (PDP) law, enacted in 2022, regulates data collection and storage, significantly impacting online gaming platforms. Companies are now required to adhere to strict guidelines on user data protection. According to government reports, failure to comply with these regulations can lead to penalties ranging from fines to temporary shutdowns, making compliance critical for gaming platforms operating in Indonesia.

Indonesia Gaming Market Segmentation

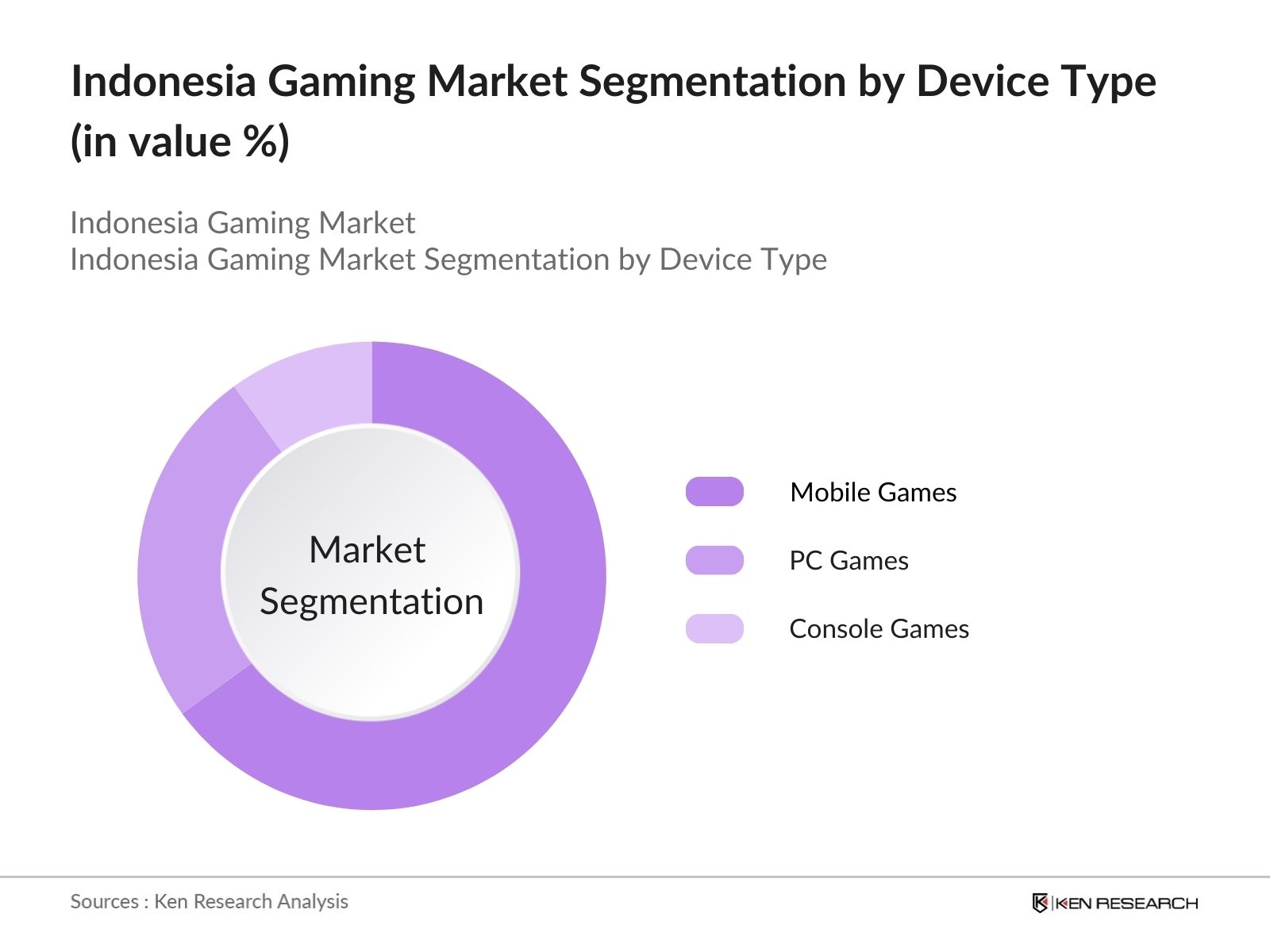

- By Device Type: The Indonesia gaming market is segmented by device type into mobile games, PC games, and console games. Currently, mobile games dominate the market share due to the affordability and accessibility of smartphones in Indonesia. With a majority of the population having access to low-cost mobile devices and data plans, mobile gaming has experienced rapid adoption across both urban and rural areas. This has been further fueled by game developers focusing on mobile platforms, offering free-to-play models with in-game purchases, which cater to the large base of casual gamers in Indonesia.

- By Game Genre: The gaming market in Indonesia is also segmented by genre into action, adventure, role-playing games (RPG), strategy, and sports. Among these, action games lead in market share, largely due to their popularity among younger demographics and the engaging nature of such games. Games such as "Free Fire" and "PUBG Mobile" are immensely popular, with action-oriented gameplay appealing to competitive players. The rise of e-sports has further cemented the dominance of this genre, with many action-based games being featured in tournaments and live streams.

Indonesia Gaming Market Competitive Landscape

The Indonesia gaming market is dominated by several key players, both local and international. The competition in this space is primarily driven by innovation in game development, distribution channels, and player engagement strategies. Companies such as Garena Indonesia and Tencent Holdings have established a strong foothold by catering to both casual and professional gamers, while local companies like Agate International focus on culturally relevant content, further strengthening their position in the market.

|

Company Name |

Establishment Year |

Headquarters |

No. of Active Users |

Revenue (in USD Mn) |

Platform (Mobile/PC/Console) |

E-sports Engagement |

Key Partnerships |

|

Garena Indonesia |

2009 |

Jakarta, Indonesia |

|||||

|

Tencent Holdings Ltd. |

1998 |

Shenzhen, China |

|||||

|

Agate International |

2009 |

Bandung, Indonesia |

|||||

|

PT. Maingames Indonesia |

2013 |

Jakarta, Indonesia |

|||||

|

LYTO |

2003 |

Jakarta, Indonesia |

Indonesia Gaming Industry Analysis

Growth Drivers

- Rapid Smartphone Penetration: Indonesia has seen significant smartphone adoption, with over 350 million mobile connections by 2023, surpassing the population itself. This rapid penetration, driven by affordability and availability, has opened the gaming sector to a large user base. The widespread use of smartphones fuels the popularity of mobile games, supported by government-backed infrastructure improvements in rural areas. Indonesias digital economy is projected to contribute heavily to GDP, and smartphones will remain central to this growth. Data from the World Bank notes that Indonesias GDP per capita has increased to $4,291 in 2022, further supporting this trend.

- Growing Internet Connectivity: The expansion of internet infrastructure has driven internet penetration in Indonesia to approximately 212 million users by 2023. This growth is further supported by the Palapa Ring project, which brings high-speed internet to remote regions, enhancing access to digital content, including gaming. World Bank data indicates that Indonesia invested $22 billion in digital infrastructure between 2020 and 2023, reinforcing internet coverage, which is essential for gaming platforms that depend on strong online connectivity.

- Government Support for Digital Economy: The Indonesian government is heavily promoting the digital economy, with gaming as a core component. Initiatives like the "100 Smart Cities" project and the National Digital Literacy Movement enhance the digital landscape, driving gaming consumption. As per the Ministry of Communication and Information, Indonesias digital economy is estimated to contribute over $130 billion to GDP by 2024, with gaming playing a significant role. Government incentives have also focused on tech startup ecosystems, promoting the development of local games.

Market Restraints

- Limited Payment Gateway Options: Despite the gaming boom, limited payment gateway options remain a challenge. Indonesia's fintech ecosystem is still evolving, with only 60% of the population having access to formal financial services as of 2023, according to World Bank data. This limits players ability to purchase premium content in games. Moreover, rural areas are underbanked, slowing the growth of online transactions in gaming .

- High Competition from Global Players: Indonesias gaming market faces stiff competition from international developers. Global giants such as Tencent and Activision dominate the market, often overshadowing local game developers. The World Bank reported that Indonesia imported $14 billion worth of digital services in 2022, which includes gaming-related software. The dominance of these foreign firms limits opportunities for local game developers, who struggle to compete on the same scale .

Indonesia Gaming Market Future Outlook

Over the next five years, the Indonesia gaming market is expected to experience steady growth, driven by the continuous rise in internet penetration, smartphone adoption, and the growing popularity of e-sports. As the Indonesian government continues to invest in digital infrastructure and technology-driven innovation, the gaming industry is well-positioned to capitalize on this momentum. Moreover, advancements in mobile technology, particularly the adoption of 5G networks, will further enable seamless gaming experiences, fueling market growth. As a result, both casual and professional gaming segments are likely to witness significant expansion.

Market Opportunities

- Expansion of Mobile Gaming: Mobile gaming is expanding rapidly, with over 120 million mobile gamers in Indonesia as of 2023. The Ministry of Communication and Information forecasts this number to grow as internet and smartphone penetration increase. The trend towards casual mobile gaming creates vast opportunities for developers targeting this segment. Telecom companies are also rolling out packages specifically designed for mobile gamers, further facilitating growth .

- Rise of E-Sports and Online Streaming Platforms: E-Sports is gaining substantial traction in Indonesia, with the government recognizing it as a legitimate sport under the National Sports Committee. Indonesia hosted the Asian Games E-Sports demonstration event in 2018, and by 2023, E-Sports viewership had surged to over 10 million in the country. The rise of online streaming platforms such as YouTube and Twitch has further boosted this trend, creating more monetization opportunities for players and game developers.

Scope of the Report

|

By Device Type |

Mobile Games, PC Games, Console Games |

|

By Game Genre |

Action, Adventure, RPG, Strategy, Sports |

|

By Revenue Model |

Free-to-Play, Pay-to-Play, Subscription |

|

By Distribution Channel |

Online Platforms, Retail |

|

By Region |

Java, Sumatra, Bali, Kalimantan, Sulawesi |

Products

Key Target Audience

- Game Developers

- Mobile Service Providers

- E-Sports Event Organizers

- Government and Regulatory Bodies (Ministry of Communication and Information Technology, Ministry of Tourism and Creative Economy)

- Telecommunications Companies

- Advertising and Marketing Agencies

- Investor and Venture Capitalist Firms

- Streaming and Content Platforms

Companies

Players Mentioned in the Report:

- Garena Indonesia

- Tencent Holdings Ltd.

- Agate International

- PT. Maingames Indonesia

- LYTO

- NetEase, Inc.

- PT. Gajah Games

- Xindong Network

- Razer Inc.

- Ubisoft Entertainment

- Electronic Arts

- GOGAME

- Garena (SEA)

- PT. Megaxus Infotech

- PT. ION Games

Table of Contents

1. Indonesia Gaming Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Gaming Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Gaming Market Analysis

3.1. Growth Drivers

3.1.1. Rapid Smartphone Penetration

3.1.2. Growing Internet Connectivity

3.1.3. Government Support for Digital Economy

3.1.4. Rising Disposable Income and Millennial Population

3.2. Market Challenges

3.2.1. Limited Payment Gateway Options

3.2.2. High Competition from Global Players

3.2.3. Local Language Barriers in Game Development

3.3. Opportunities

3.3.1. Expansion of Mobile Gaming

3.3.2. Rise of E-Sports and Online Streaming Platforms

3.3.3. Collaboration with Telecom Companies for 5G Integration

3.4. Trends

3.4.1. Increased Adoption of Augmented Reality (AR) and Virtual Reality (VR)

3.4.2. Growth of Indie Game Developers

3.4.3. In-game Advertising and Monetization Models

3.5. Government Regulation

3.5.1. Digital Economy Blueprint

3.5.2. Data Privacy Regulations (PDP Law)

3.5.3. Content Rating Systems and Game Classification

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Indonesia Gaming Market Segmentation

4.1. By Device Type (In Value %)

4.1.1. Mobile Games

4.1.2. PC Games

4.1.3. Console Games

4.2. By Game Genre (In Value %)

4.2.1. Action

4.2.2. Adventure

4.2.3. Role-Playing Games (RPG)

4.2.4. Strategy

4.2.5. Sports

4.3. By Revenue Model (In Value %)

4.3.1. Free-to-Play

4.3.2. Pay-to-Play

4.3.3. Subscription

4.4. By Distribution Channel (In Value %)

4.4.1. Online Platforms

4.4.2. Retail

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Bali

4.5.4. Kalimantan

4.5.5. Sulawesi

5. Indonesia Gaming Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Garena Indonesia

5.1.2. Agate International

5.1.3. Tencent Holdings Ltd.

5.1.4. NetEase, Inc.

5.1.5. PT. Maingames Indonesia

5.1.6. LYTO

5.1.7. GOGAME

5.1.8. Garena (SEA)

5.1.9. PT. Gajah Games

5.1.10. PT. Megaxus Infotech

5.1.11. PT. ION Games

5.1.12. Xindong Network

5.1.13. Razer Inc.

5.1.14. Electronic Arts

5.1.15. Ubisoft Entertainment

5.2. Cross Comparison Parameters

5.2.1. Revenue (In USD Mn)

5.2.2. Headquarters Location

5.2.3. Number of Active Users

5.2.4. Product Portfolio (Mobile, PC, Console)

5.2.5. Partnerships with Telecom or Tech Firms

5.2.6. E-sports Involvement

5.2.7. Localized Content

5.2.8. Investment in AR/VR Technologies

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Gaming Market Regulatory Framework

6.1. Game Content Regulations

6.2. Taxation Policies on In-App Purchases

6.3. Compliance with Data Privacy Laws

6.4. Certification and Approval Process for Game Developers

7. Indonesia Gaming Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Gaming Market Future Segmentation

8.1. By Device Type (In Value %)

8.2. By Game Genre (In Value %)

8.3. By Revenue Model (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Indonesia Gaming Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Player Engagement Strategies

9.3. Monetization Strategies

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step in our research process involved mapping the Indonesia gaming ecosystem. This included identifying key stakeholders, such as game developers, service providers, telecom operators, and regulatory bodies. Extensive desk research was conducted to define the primary variables that influence the market, including device adoption rates, gaming preferences, and regulatory policies.

Step 2: Market Analysis and Construction

We gathered historical data on the Indonesian gaming market, focusing on key metrics such as device penetration, game genre popularity, and the ratio of free-to-play to pay-to-play games. These statistics provided a foundation for assessing the markets size, growth trajectory, and user engagement levels.

Step 3: Hypothesis Validation and Expert Consultation

Our research hypotheses were validated through consultations with industry experts, including game developers, publishers, and e-sports organizers. These interviews provided insights into market dynamics, emerging trends, and future growth drivers, ensuring the robustness of our findings.

Step 4: Research Synthesis and Final Output

In the final stage, we synthesized the research data with insights from consultations, validating key market metrics through cross-referencing primary and secondary sources. This comprehensive approach allowed us to produce an accurate and data-driven analysis of the Indonesia gaming market.

Frequently Asked Questions

1. How big is the Indonesia Gaming Market?

The Indonesia gaming market was valued at USD 600 million, driven by the rapid penetration of smartphones, affordable internet access, and the growing popularity of mobile gaming.

2. What are the challenges in the Indonesia Gaming Market?

Challenges include limited payment gateway options, high competition from global players, and language barriers in game development, which hinders local developers from fully capitalizing on market opportunities.

3. Who are the major players in the Indonesia Gaming Market?

Key players in the market include Garena Indonesia, Tencent Holdings Ltd., Agate International, and LYTO. These companies dominate due to their established user bases, strategic partnerships, and focus on mobile platforms.

4. What are the growth drivers of the Indonesia Gaming Market?

The market is driven by the growing adoption of smartphones, increased internet access, government support for the digital economy, and the rise of e-sports and online gaming tournaments.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.