Indonesia Logistics and Warehousing Market Outlook to 2023

Driven by Infrastructure Spending for Airport and Seaports Albeit by Poor Existing Road Network

Region:Asia

Product Code:KR763

March 2019

327

About the Report

Click on the Link for Updated Report on Indonesia Logistics Market Outlook to 2027

The report titled "Indonesia Logistics and Warehousing Market Outlook to 2023 - Driven by Infrastructure Spending for Airport and Seaports Albeit by Poor Existing Road Network" covers logistics infrastructure, value chain analysis, the overall market size in terms of revenue; segmentation by service mix for logistics and warehousing market, segmentation by mode of service, mode of freight, flow corridors, end users, third party logistics and integrated logistics for freight forwarding market; segmentation by air and ground express, domestic and international shipments, delivery period, intra city and inter-city shipments, market structure, region and offshore & on-shore shipments for courier and parcel market; segmentation by delivery period for e-commerce logistics market; segmentation by service mix for third party logistics market; segmentation by business model, geography, type of warehouses, third party logistics & integrated logistics and end users for warehousing market; segmentation by cold storage & cold transport and products for cold chain market; industry norms and regulations, trends and developments, issues and challenges, recent mergers and acquisitions, matrix of major companies, competitive scenario, company profiles and cross comparison with other logistics markets. The report concludes with market projection and analyst recommendations highlighting the major opportunities and cautions for the logistics market.

Indonesia Logistics and Warehousing Market: Indonesia logistics and warehousing market displayed a consistent growth during the period 2013 to 2018. The growing E-commerce sector and rising demand for express and third-party logistics (3PL) in the country were witnessed to drive the Indonesia logistics market. In addition to this, Indonesia was ranked at 71st position in the LPI index of World Bank in 2016 but moved up to 60th position in 2018, also indicating a positive outlook for the industry. The market has increased owing to high domestic consumption and the efforts of the government to boost infrastructure. The investments in infrastructure and technology have impacted the Indonesia logistics market positively. The government also launched over 15 regulatory reforms to reduce red tape and improve inter-ministerial coordination in the country.

Indonesia Freight Forwarding Market: The freight forwarding market witnessed robust growth over the last five years. The key contributive factors include the rising demand for air and sea freight logistics across the country. In addition to this, the freight forwarding market was bolstered by a high demand for food, beverages and automotive products. Growth in International trade (Imports volume growing from 141 million tons to 160 million tons) has stimulated regional integration, removal of trade barriers, coupled with the rise in containerization levels and expansion in key external drivers of the industry such as economic, demographic and consumer drivers, have led to growth in demand for transportation. For Sea Freight, the majority of the revenues come from International shipments. Major flow corridors include China, India, South Korea, Japan, and Malaysia. Major Companies offering sea freight services within Indonesia include DHL, Kuehne+Nagel, DB Schenker, Panalpina, Samudera Shipping and others. The leading companies in this market include DHL, Kuehne + Nagel, Panalpina, CEVA Logistics, DB Schenker, First Logistics, Pandu Logistics, and others.

Indonesia Warehousing Market: Indonesia warehousing market displayed tremendous growth during the period 2013-2018. The growth in the warehousing market was primarily due to expanding the FMCG sector, an increase in imported goods, increasing government expenditure on improving infrastructure and far-sighted government regulations. Warehousing has become increasingly sophisticated with the provision of advanced IT solutions for warehouse management, although non-IT problems such as traffic jams, lack of ports and others hamper the delivery of goods. Presently, contemporary warehouses function more than just a good storage facility.

Indonesia Courier and Parcel Market including E-commerce Logistics: The courier and parcel market of Indonesia witnessed a steady growth over the past five years. The key contributive factors for the growing market included the rising demand for perishable items that require express delivery services. Despite the high cost of express delivery services, express logistics acquired a share of 5.9% in the Indonesia logistics industry as of 2018. During the period 2013-2018, the country also witnessed increasing smartphone users, internet users and the lifestyle of people which also contributed to the growth of the courier and parcel market. The leading companies in this market include JNE, Indonesia Post, J&T, DHL, RPX, Kerry Logistics, and others.

The E-commerce logistics market significantly grew during the period 2013 to 2018. The cost of logistics services in the E-commerce space declined by the year 2018. A growing number of online app-based companies were witnessed to expand into all the regions of Indonesia, particularly through a franchise. Additionally, these online firms were observed spending in huge amount towards bringing out major technological advancements within this segment. Express logistics is a premium segment of the logistics industry as it majorly involves time-sensitive shipments of goods via multi-modal transportation primarily through air and road freight transport mediums.

Indonesia Third Party Logistics Market: the 3PL market has gained widespread importance over the years as more organizations globally are outsourcing their logistics activities to 3PL service providers. Therefore, by outsourcing logistics activities, various organizations have been able to achieve improved delivery performance and customer satisfaction. The market observed a growth in the outsourcing of logistics requirements which helps companies to focus on their core area of business and reduces the additional cost of operations. The growth in the market also encouraged the emergence of several new players.

Indonesia Cold Chain Market: Indonesia's cold chain market was observed to grow notably over the last five years. This is primarily due to the rising population leading to the corresponding increment in the demand for food and beverages. The market demand, particularly for seafood and meat products in the country, was also on the rise. Additionally, the majority of the cold chain revenue in the country was observed to come from cold storage requirements.

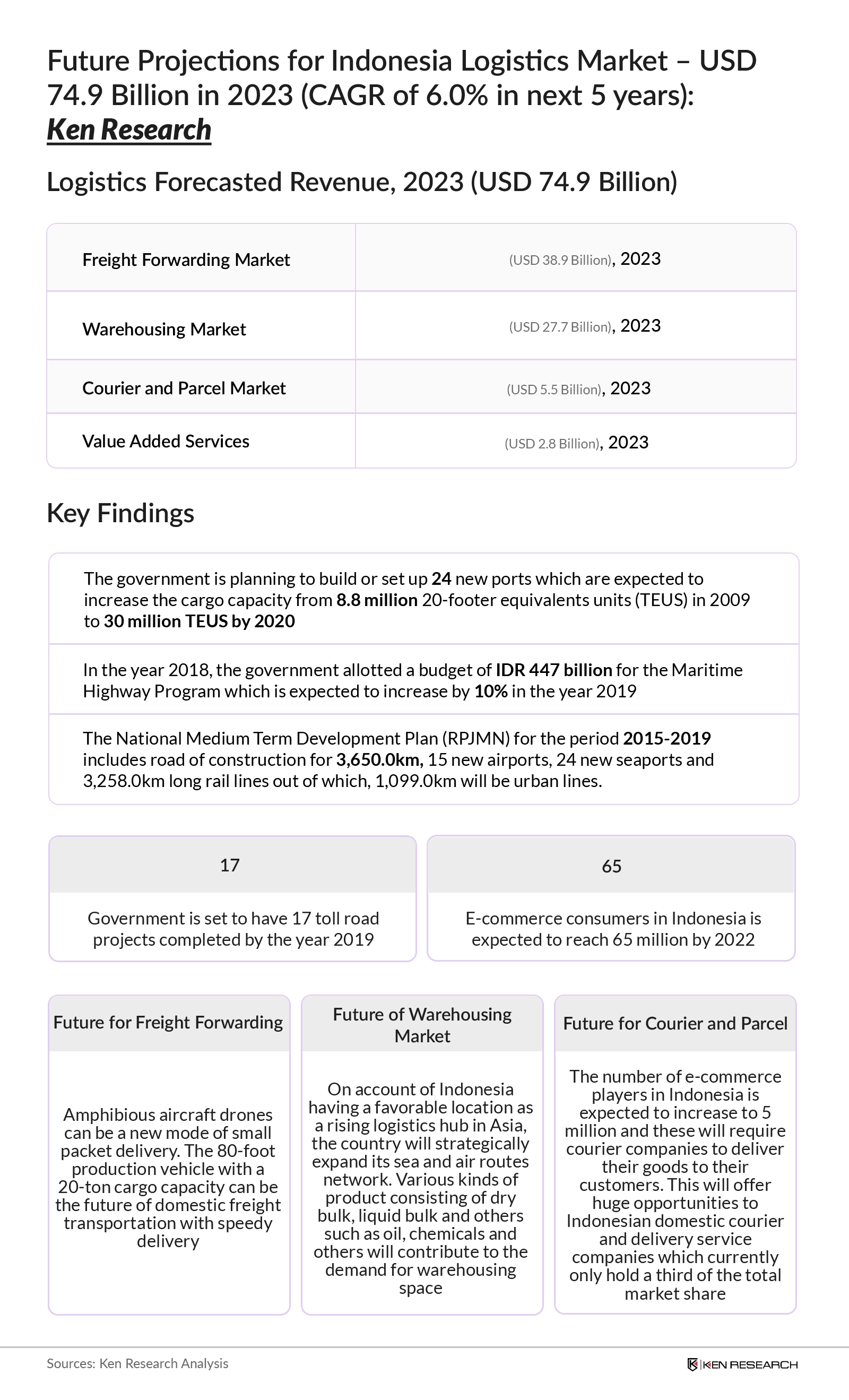

Indonesia Logistics Market Future Outlook and Projections: Indonesia logistics market is projected to grow consistently during the forecast period 2018-2023 owing to the country’s plans to turn itself into the logistics hub for entire Southeast Asia. The key growth drivers for the market include increasing year on year investment by the government to improve the state of infrastructure in the country such as road & rail networks, airports, and seaports. It is also anticipated to encourage new players to enter the market and existing players to expand their current market share. Indonesia logistics industry revenue is expected to increase at a CAGR of 6.0% from 2018 to 2023E owing to the country’s plans to turn in a logistics hub.

Key Topics Covered in the Report

- Executive Summary

- Research Methodology

- Logistics Infrastructure in Indonesia Logistics Market

- Value Chain Analysis for Indonesia Logistics Market

- Indonesia Logistics and Warehousing Market

- Indonesia Freight Forwarding Market

- Indonesia Courier and Parcel Market

- Indonesia E-Commerce Logistics Market

- Indonesia Third-Party Logistics (3PL) Market

- Indonesia Warehousing Market

- Indonesia Cold Chain Market

- Industry Norms and Regulations in Indonesia Logistics Market

- Trends and Developments in Indonesia Logistics and Warehousing Market

- Issues and Challenges in Indonesia Logistics Market

- Recent Mergers and Acquisitions in Indonesia Logistics Market

- Matrix of Major Companies in Indonesia Logistics Market

- Indonesia Logistics Market Future Outlook and Projections

- Analyst Recommendations

- Macroeconomic Factors Affecting Indonesia Logistics Market

Products

Key Target Audience

- Logistics Companies

- Warehousing Companies

- Cold Chain Companies

- Courier and Parcel Companies

- Express Logistics Companies

- E-Commerce Logistics Companies

- E-Commerce Companies

- Logistics Association

- Government Association

- Investors and Private Equity Companies

Companies

Companies Covered:

Freight Forwarding and Warehousing Market:

- DHL

- Kuehne Nagel

- Panalpina

- CEVA Logistics

- PT. Synergy First Logistics

- Pandu Logistics

- DB Schenker

- CKB Logistics

- PT. Salam Pacific Indonesia Logistics

- Linc Group

- Samudera Shipping Line Ltd.

- Maersk Line

- Agility Logistics

- Trans Pratama Logistics

- Itochu Logistics

- Kamadjaja Logistics

- CJ Logistics

- Prima Cargo

- FedEx

- Yusen Logistics Co. Ltd.

- JAS Worldwide

- Indonesia Ocean Truck

- PT. Mitra Intertrans

- GPI Logistics

- APL Logistics

- Pt. LV Logistics Indonesia

Table of Contents

1. Executive Summary

2. Research Methodology

2.1. Market Definitions

2.2. Abbreviations

2.3. Market Size and Modeling

3. Logistics Infrastructure in Indonesia Logistics Market

3.1. Airports

3.2. Seaports

3.3. Road Network

3.4. Rail Network

4. Value Chain Analysis for Indonesia Logistics Market

5. Indonesia Logistics and Warehousing Market

5.1. Indonesia Logistics and Warehousing Market Overview and Genesis

5.1.1. Genesis

5.1.2. Market

5.2. Indonesia Logistics and Warehousing Market Size, 2013-2018

5.3. Indonesia Logistics and Warehousing Market Segmentation

5.3.1. By Service Mix (Freight Forwarding, Warehousing, Courier and Parcel Activities and Value Added Services), 2018

5.4. Cross Comparison of Indonesia Logistics and Warehousing Market with Philippines, Vietnam and Singapore Logistics Market

6. Indonesia Freight Forwarding Market

6.1. Indonesia Freight Forwarding Market Overview

6.2. Indonesia Freight Forwarding Market Size by Revenues, 2013-2018

6.3. Indonesia Freight Forwarding Market Segmentation

6.3.1. By Mode of Service (Road Freight, Sea Freight, Air Freight, and Rail Freight) 2013-2018

6.3.2. By Mode of Freight (Domestic and International Freight Forwarding), 2018

6.3.3. By Flow Corridors (Asian Countries, North American Countries, European Countries and Others), 2018

6.3.4. By End Users (Food and Beverages, Automotive, Retail, Manufacturing, and Others), 2018

6.3.5. By 3PL and Integrated Logistics, 2018

6.4. Competitive Scenario in Indonesia Freight Forwarding Market

6.5. Company Profiles of Major Players in Indonesia Freight Forwarding Market

6.5.1. DHL

6.5.2. Kuehne Nagel

6.5.3. Panalpina

6.5.4. CEVA Logistics

6.5.5. PT. Synergy First Logistics

6.5.6. Pandu Logistics

6.5.7. DB Schenker

6.5.8. CKB Logistics

6.5.9. PT. Salam Pacific Indonesia Logistics (SPIL)

6.5.10. Linc Group

6.5.11. Samudera Shipping Line LTD

6.5.12. Maersk Line

6.5.13. Agility Logistics

6.5.14. Trans Pratama Logistics

6.5.15. Itochu Logistics

6.5.16. Kamadjaja Logistics

6.5.17. CJ Logistics

6.5.18. Prima Cargo

6.5.19. FedEx

6.5.20. Yusen Logistics Co. Ltd.

6.5.21. Other Companies (JAS Worldwide, Indonesia Ocean Truck, PT. Mitra Intertrans, GPI Logistics, APL Logistics and Pt. LV Logistics Indonesia)

6.6. Indonesia Freight Forwarding Market Future Outlook and Projections, 2018-2023E

6.6.1. By Mode of Service (Road Freight, Sea Freight, Air Freight, and Rail Freight), 2023E

6.6.2. By Mode of Freight (Domestic and International Freight Forwarding), 2023E

7. Indonesia Courier and Parcel Market

7.1. Indonesia Courier and Parcel Market Overview and Genesis

7.2. Value Chain Analysis in Indonesia Courier and Parcel Market

7.3. Indonesia Courier and Parcel Market Size by Revenue, 2013-2018

7.4. Indonesia Courier and Parcel Market Segmentation, 2018

7.4.1. By Air and Ground Express, 2018

7.4.2. By Domestic and International Shipments, 2018

7.4.3. By Delivery Period (One Day Delivery, Two Day Delivery, Three Day Delivery and More Than Three Day Delivery), 2018

7.4.4. By Intra City and Inter City, 2018

7.4.5. By Market Structure (B2B, B2C and C2C Segments), 2018

7.4.6. By Region (Greater Jakarta, West Java, East Java, Sumatra and Others), 2018

7.4.7. By Onshore and Offshore Shipments, 2018

7.5. Competitive Landscape in Indonesia Courier and Parcel Market

7.5.1. Competition Scenario in Indonesia Courier and Parcel Market

7.6. Company Profiles of Major Players in Indonesia Courier and Parcel Market

7.6.1. PT. POS Indonesia

7.6.2. JNE

7.6.3. Kerry Logistics

7.6.4. Nippon Express

7.6.5. J&T Express

7.7. Pricing Analysis for Indonesia Courier and Parcel Market

7.8. Indonesia Courier and Parcel Market Future Outlook and Projections, 2018-2023E

7.8.1. By Ground Express and Air Express, 2023E

7.8.2. By International and Domestic Shipments, 2023

8. Indonesia E-Commerce Logistics Market

8.1. Indonesia E-Commerce Logistics Market Overview and Genesis

8.2. Indonesia E-Commerce Market Size, 2013-2018

8.2.1. By Revenue, Number of E-Commerce Orders and Logistics Cost, 2013-2018

8.3. Indonesia E-Commerce Logistics Market Segmentations, 2018

8.3.1. By Delivery Period (Same Day Delivery, Next Day Delivery, Two Day Delivery and Three Day Delivery)

8.4. Competitive Landscape in Indonesia E-Commerce Logistics Market

8.4.1. Competition Scenario in Indonesia E-Commerce Logistics Market

8.4.2. Company Profiles of Major Players in Indonesia E-Commerce logistics Market

8.4.3. Market Share of Major Players (JNE, J&T, Indonesia Post, Lazada Express, Sicepat, Ninja Van and Others) Operating in Indonesia E-Commerce Logistics Market, 2018

8.4.4. Major E-commerce Companies (Shopee, Tokopedia, Lazada and Others) in Indonesia, 2018

8.5. Indonesia E-Commerce Logistics Market Future Outlook and Projections, 2018-2023E

8.5.1. By Delivery Period (Same Day Delivery, Next Day Delivery, Two Day Delivery and Three Day Delivery), 2023E

9. Indonesia Third Party Logistics (3PL) Market

9.1. Indonesia Third Party Logistics (3PL) Market Overview and Genesis

9.2. Value Chain Analysis for Indonesia 3PL Market

9.3. Indonesia Third Party Logistics (3PL) Market Size, 2013-2018

9.4. Indonesia 3PL Market Segmentations, 2018

9.4.1. By Service Mix (Freight Forwarding and Warehousing)

9.5. Issues and Challenges Faced by Companies in Indonesia Third Party Logistics (3PL) Market

9.6. Comparison of Indonesia with Global 3PL Market, 2016-2018

9.7. Competitive Landscape in Indonesia Third Party Logistics (3PL) Market

9.7.1. Competition Scenario in Indonesia Third Party Logistics (3PL) Market

9.8. Indonesia Third Party Logistics (3PL) Market Future Outlook and Projections, 2018-2023E

9.8.1. By Service Mix (Freight Forwarding and Warehousing), 2018-2023E

10. Indonesia Warehousing Market

10.1. Indonesia Warehousing Market Overview and Genesis

10.2. Value Chain Analysis for Indonesia Warehousing Market

10.3. Indonesia Warehousing Market Size by Revenues, 2013-2018

10.4. Indonesia Warehousing Market Segmentation

10.4.1. By Business Model (Industrial and Retail, Container Freight and Cold Storage), 2018

10.4.2. By Geography (Greater Jakarta, Surabaya, Makassar and Others), 2018

10.4.3. By Type of Warehouses (Bounded, Open, Temperature Controlled and Cold Storage), 2018

10.4.4. By 3PL and Integrated Warehouses, 2018

10.4.5. By End Users (Food and Beverages, Automotive, Consumer Retail, Healthcare and Others), 2018

10.5. Competitive Landscape in the Indonesia Warehousing Market

10.5.1. Competition Scenario in the Indonesia Warehousing Market

10.6. Indonesia Warehousing Market Future Outlook and Projections, 2018-2023E

10.6.1. By Business Model (Industrial / Retail / Agriculture, Container Freight and Cold Storage), 2023E

11. Indonesia Cold Chain Market

11.1. Introduction to the Indonesia Cold Chain Market

11.2. Indonesia Cold Chain Market Size, 2013-2018

11.3. Indonesia Cold Chain Market Segmentation, 2018

11.3.1. By Cold Storage and Cold Transport, 2018

11.3.2. By Products (Seafood Processing Plant, Red Meat, Poultry Chicken, Processed Dairy Food, Horticulture and Cold Chain (Rent to Logistics) and Confectionary, Fruits and Vegetables and Others), 2017-2018

11.4. Competitive Landscape in Indonesia Cold Chain Market

11.4.1. Cross Comparison of Multiple Cold Storage Firms (Maersk Line, PT Wahana Cold Storage, Mega Cold Storage, MGM Bosco Logistics and GAC) Operating in the Indonesia Cold Chain Market

11.5. Indonesia Cold Chain Market Future Outlook and Projections, 2018-2023E

11.5.1. By Cold Storage and Cold Transportation, 2023E

12. Industry Norms and Regulations in Indonesia Logistics Market

12.1. Key Industry Norms for Indonesia Logistics Market

12.2. Economic Policy Packages by Indonesian Government, 2015-2018

13. Trends and Developments in Indonesia Logistics and Warehousing Market

13.1. Logistics Reform Loan Launched by the World Bank for Indonesia

13.2. Growing Retail Sector of Indonesia

13.3. Increasing International Collaborations

13.4. Surging E-Commerce Logistics

13.5. Rising Trade Scenario of Indonesia

13.6. Increasing Infrastructure Investment

14. Issues and Challenges in Indonesia Logistics Market

14.1. Regulatory Issues in Indonesia

14.2. High Red Tapism

14.3. Scarcity of Skilled Labor

14.4. Insufficient Infrastructure

14.5. High Cost of Logistics

14.6. Excessive Shipping Time

15. Recent Mergers and Acquisitions in Indonesia Logistics Market, 2015-2018

16. Matrix of Major Companies in Indonesia Logistics Market

17. Indonesia Logistics Market Future Outlook and Projections, 2018-2023E

17.1 Indonesia Logistics Market Segmentation by Services (Freight Forwarding, Warehousing, Courier and Parcel Activities and Value Added Services), 2018-2023E

17.2. Milestones (Phase I, II and III) for Indonesia Logistics Market

18. Analyst Recommendations for Indonesia Logistics and Warehousing Market

19. Macroeconomic Factors Affecting Indonesia Logistics Market

19.1. Volume of Imports, 2013-2023E

19.2. Volume of Exports, 2013-2023E

19.3. Infrastructure Cost, 2013-2023E

19.4. Gasoline Prices, 2013-2023E

Disclaimer

Contact Us

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.