Indonesia Meat Substitutes Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD2603

October 2024

83

About the Report

Indonesia Meat Substitutes Market Overview

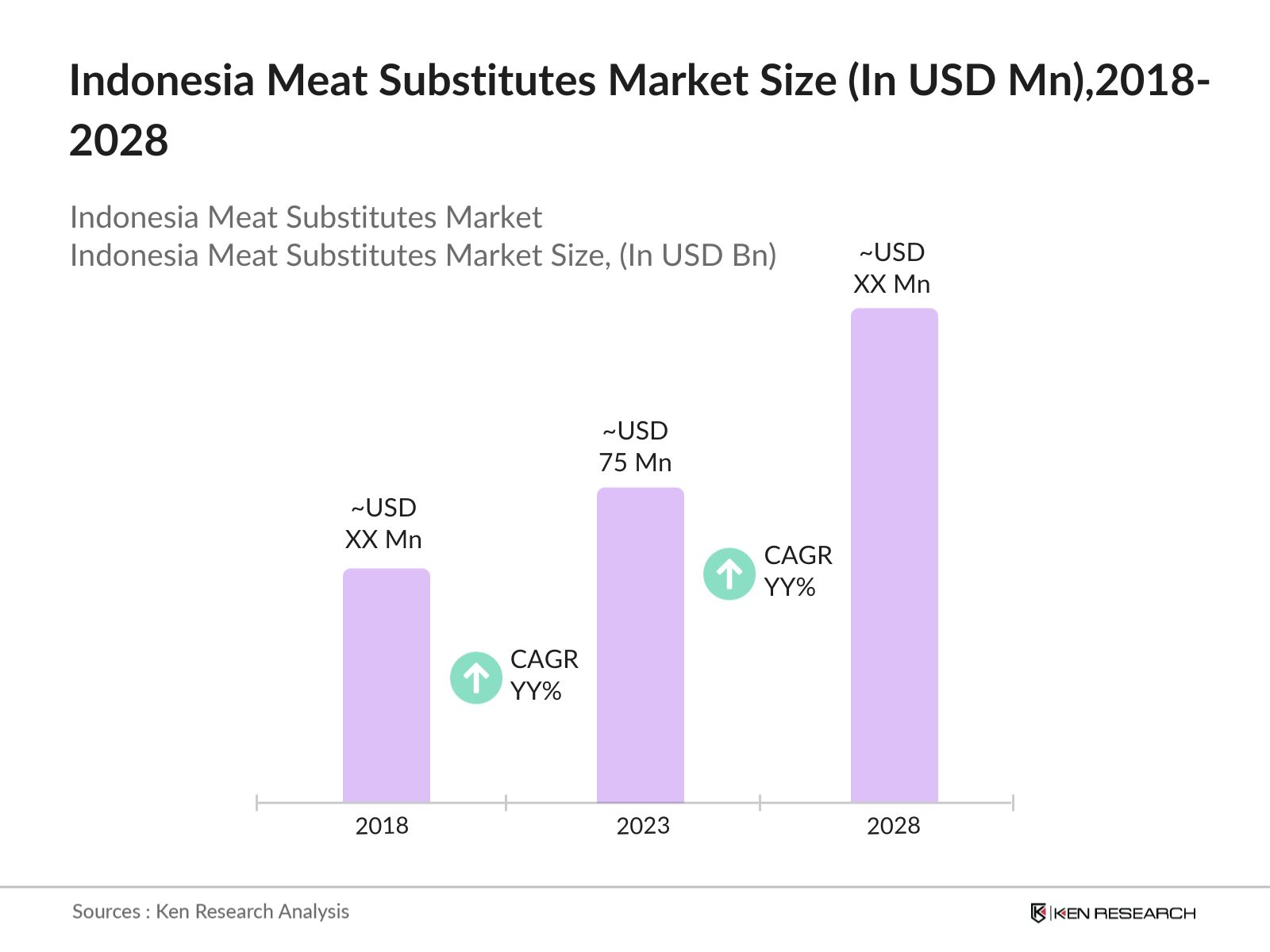

- The Indonesia meat substitutes market reached a valuation of USD 75 million in 2023, driven by rising health awareness, growing environmental concerns, and a shift towards plant-based diets. Consumers in urban areas, particularly Jakarta and Surabaya, are increasingly adopting meat substitutes as part of healthier lifestyles and ethical eating trends.

- Key players in the Indonesia meat substitutes market include Green Rebel, Tahu Tempe, Unilever (The Vegetarian Butcher), Beyond Meat, and Quorn Foods. These companies dominate the market due to their innovative product offerings, strong marketing strategies, and expanding distribution networks, which include partnerships with supermarkets and online platforms.

- Major cities leading meat substitute consumption in Indonesia include Jakarta and Surabaya. Jakarta, being the largest city with a highly urbanized population, has seen a significant rise in vegan and flexitarian consumers, making it the epicenter of meat substitutes demand in the country.

- In 2023, the market for meat substitutes, including tempeh, is experiencing significant growth driven by increasing consumer awareness of health and sustainability. Tempeh, a traditional Indonesian fermented soybean product, is gaining attention as a nutritious and environmentally friendly protein source

Indonesia Meat Substitutes Market Segmentation

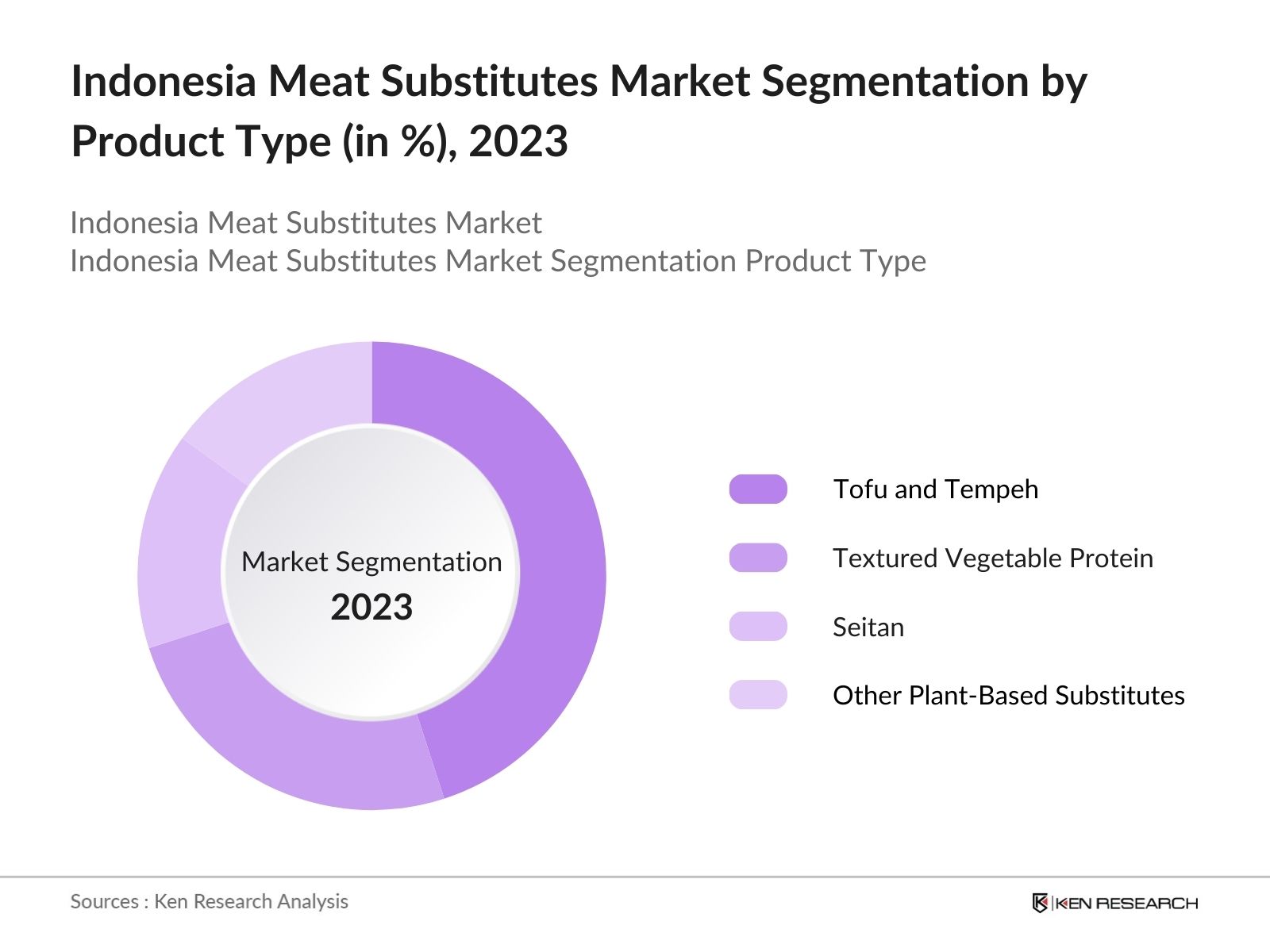

By Product Type: The Indonesia meat substitutes market is segmented by product type into tofu and tempeh, textured vegetable protein (TVP), seitan, and other plant-based substitutes. In 2023, tofu and tempeh dominated the market due to their longstanding cultural significance in Indonesian cuisine and their widespread consumption in both urban and rural areas. The versatility of tofu and tempeh in traditional dishes has sustained their high demand.

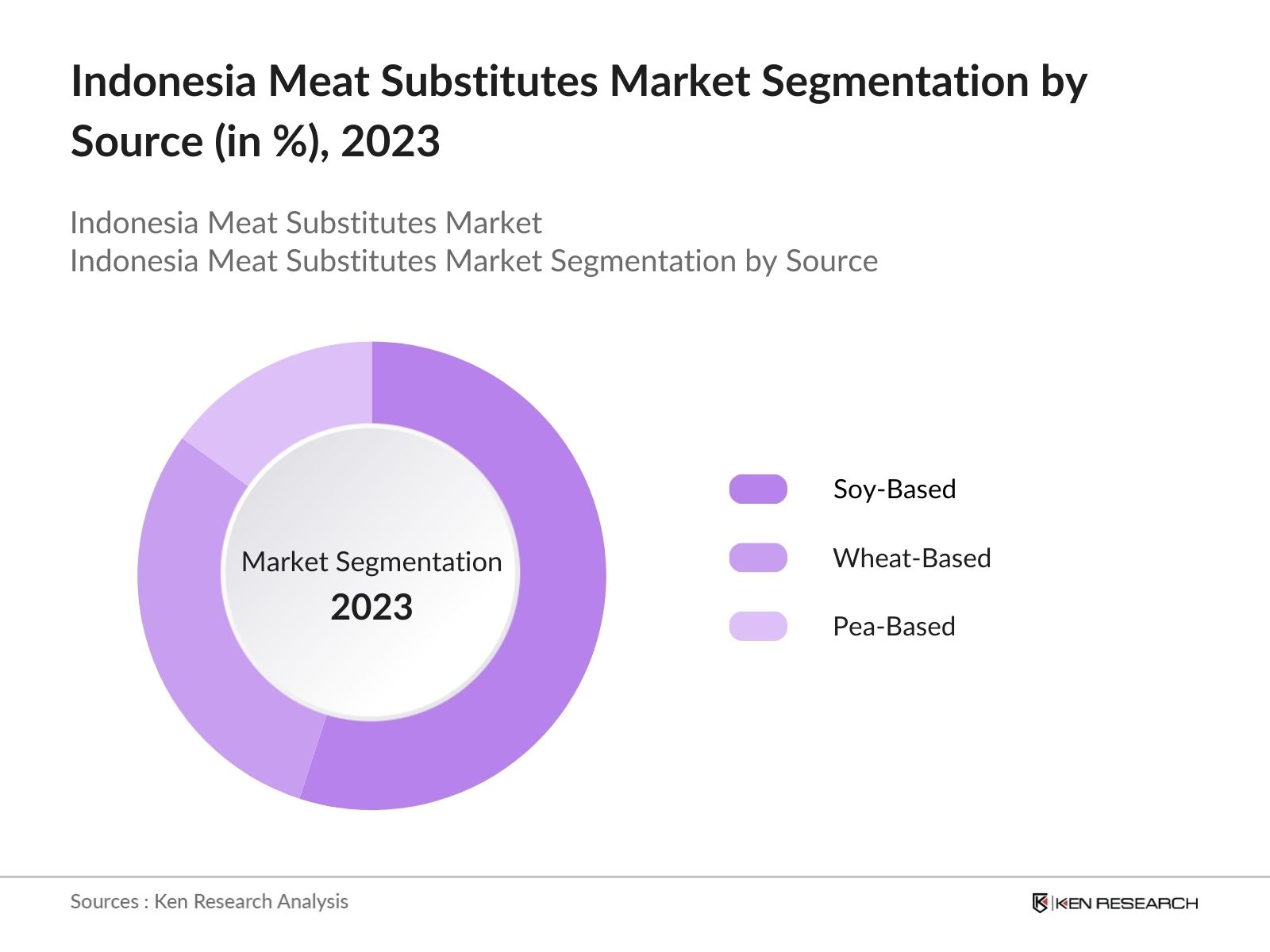

By Source: The Indonesia meat substitutes market is further segmented by source into soy-based, wheat-based, and pea-based substitutes. In 2023, soy-based dominated the market due to the widespread availability and affordability of soybeans in Indonesia, which form the basis of local products like tempeh and tofu. Soys nutritional profile and cultural acceptance have further strengthened its position in the market.

By Region: The Indonesia meat substitutes market is segmented into North, South, East, and West regions. In 2023, the North region, which includes Jakarta, dominated the market due to the high population density and consumer preference for healthier diets. The growing number of plant-based restaurants and retail stores in this region has contributed to its leadership in the market.

Indonesia Meat Substitutes Market Competitive Landscape

|

Company |

Established Year |

Headquarters |

|

Green Rebel |

2020 |

Jakarta |

|

Tahu Tempe |

1998 |

Jakarta |

|

Unilever (The Vegetarian Butcher) |

1929 |

Jakarta |

|

Beyond Meat |

2009 |

El Segundo, USA |

|

Quorn Foods |

1985 |

Stokesley, UK |

- Green Rebel: In June 2023, Green Rebel announced partnerships withStarbucks MalaysiaandNando's Singapore, introducing a special meatless menu that aligns with the rising flexitarian trend in the region. This initiative aims to cater to the growing demand for plant-based alternatives among consumers, including expatriates and locals. Additionally, Green Rebel is preparing for aSeries A funding roundexpected to raise between$8 to $10 millionfor further expansion into markets like Europe and the U.S.

Indonesia Meat Substitutes Industry Analysis

Indonesia Meat Substitutes Market Growth Drivers

- Rising Health Awareness and Demand for Plant-Based Alternatives: Growing awareness of lifestyle-related diseases such as obesity, heart disease, and diabetes is driving the demand for healthier food options in Indonesia. According to a report from the Ministry of Health, more than 8.3 million Indonesians were diagnosed with heart conditions in 2023. Consumers are increasingly turning to plant-based diets as a way to manage their health, boosting the demand for meat substitutes across urban centers.

- Increasing Availability Through E-Commerce Platforms: The rise of e-commerce has played a key role in making meat substitutes more accessible to Indonesian consumers. In 2023, the Ministry of Trade reported that online grocery sales increased by USD 1.8 billion compared to 2021, with plant-based products accounting for a significant portion of this growth. Companies are leveraging digital platforms to reach consumers in both urban and rural areas, further driving the market's expansion.

- Changing Consumer Preferences: There is a notable shift in consumer preferences towards convenient and packaged food options due to busier lifestyles and smaller household sizes. This trend is encouraging the consumption of processed meat substitutes, which are perceived as convenient and quick meal solutions.

Indonesia Meat Substitutes Market Challenges

- Low Consumer Awareness in Rural Areas: While urban areas like Jakarta and Surabaya have seen a surge in the adoption of plant-based diets, rural regions remain largely unaware of the benefits of meat substitutes. A survey conducted by the Indonesian Institute of Sciences in 2023 found that 70% of rural respondents had limited knowledge of plant-based alternatives, indicating a significant gap in awareness and education about the health and environmental benefits of these products.

- Limited Cold Chain Infrastructure: The distribution of meat substitutes across Indonesia is hindered by outdated cold chain infrastructure. According to a report by the Indonesian Ministry of Trade, 40% of cold storage facilities in the country were outdated in 2023, leading to inefficiencies in transporting perishable plant-based products. This has posed a significant challenge for companies looking to expand their reach to regions outside Java and Sumatra.

Government Initiatives in the Indonesia Meat Substitutes Market

- Soybean Self-Sufficiency Program: Launched by the Ministry of Agriculture, this program aims to increase local soybean production to reduce dependency on imports. By 2025, the government targets producing 2.5 million tons of soybeans, which will benefit companies that rely on soy-based products like tofu and tempeh.

- Integrated Planting Management of Rice: This initiative focuses on improving rice productivity through sustainable practices, such as intermittent water-saving irrigation. While primarily aimed at rice, the principles of sustainable agriculture promoted through this program can also support the broader adoption of sustainable practices in the cultivation of soybeans and other crops used in meat substitutes.

Indonesia Meat Substitutes Market Future Outlook

The Indonesia Meat Substitutes Market is projected to grow steadily over the next five years, driven by the rising health consciousness of consumers, government initiatives promoting sustainability, and the increasing availability of plant-based alternatives.

Future Market Trends

-

Increased Product Innovation and Variety: Over the next five years, Manufacturers are expected to diversify their product offerings by introducing plant-based seafood alternatives and dairy-free products. This innovation will cater to the evolving dietary preferences of Indonesian consumers, particularly in urban areas, where there is a growing demand for diverse and health-conscious food options.

- Expansion of Distribution Networks: Over the next five years, companies will focus on expanding their distribution channels to reach underserved markets in rural and semi-urban areas. Improved cold-chain infrastructure and partnerships with e-commerce platforms will help make meat substitutes more widely available across Indonesia.

By Product

|

By Product |

Tofu and Tempeh Textured Vegetable Protein Seitan Other Plant-Based Substitutes |

|

By Source |

Soy-Based Wheat-Based Pea-Based |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Food and beverage manufacturers

Government and regulatory bodies (Ministry of Agriculture, Ministry of Health)

Plant-based food producers

Supermarkets and retail chains

E-commerce platforms

Investors and venture capital firms

Industrial processors

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report

Green Rebel

Tahu Tempe

Unilever (The Vegetarian Butcher)

Beyond Meat

Quorn Foods

Sasa Gourmet

Kalbe Nutritionals

Japfa Ltd.

Otsuka Foods

Heavenly Blush

Love Earth Foods

Table of Contents

1.Indonesia Meat Substitutes Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2.Indonesia Meat Substitutes Market Size (in USD Mn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3.Indonesia Meat Substitutes Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Awareness and Plant-Based Diets

3.1.2. Increasing E-commerce Accessibility

3.1.3. Government Support for Sustainable Agriculture

3.2. Restraints

3.2.1. Limited Consumer Awareness in Rural Areas

3.2.2. High Production Costs

3.2.3. Inadequate Cold Chain Infrastructure

3.3. Opportunities

3.3.1. Product Innovation and Diversification

3.3.2. Expanding Distribution Channels

3.3.3. Growing Urbanization and Changing Consumer Preferences

3.4. Trends

3.4.1. Rising Demand for Sustainable and Ethical Products

3.4.2. Growth of Plant-Based Snacks and Ready-to-Eat Products

3.4.3. Development of Plant-Based Seafood Alternatives

3.5. Government Regulation

3.5.1. Soybean Self-Sufficiency Program (2023)

3.5.2. Integrated Planting Management of Rice (2023)

3.5.3. National Environmental Sustainability Initiatives

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4.Indonesia Meat Substitutes Market Segmentation, 2023

4.1. By Product (in Value %)

4.1.1. Tofu and Tempeh

4.1.2. Textured Vegetable Protein (TVP)

4.1.3. Seitan

4.1.4. Other Plant-Based Substitutes

4.2. By Source (in Value %)

4.2.1. Soy-Based

4.2.2. Wheat-Based

4.2.3. Pea-Based

4.3. By Region (in Value %)

4.3.1. North Indonesia

4.3.2. South Indonesia

4.3.3. East Indonesia

4.3.4. West Indonesia

5.Indonesia Meat Substitutes Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Green Rebel

5.1.2. Tahu Tempe

5.1.3. Unilever (The Vegetarian Butcher)

5.1.4. Beyond Meat

5.1.5. Quorn Foods

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6.Indonesia Meat Substitutes Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7.Indonesia Meat Substitutes Market Regulatory Framework

7.1. Food Safety and Production Regulations

7.2. Compliance Requirements

7.3. Certification Processes

8.Indonesia Meat Substitutes Market Future Size (in USD Mn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9.Indonesia Meat Substitutes Market Future Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Source (in Value %)

9.3. By Region (in Value %)

10.Indonesia Meat Substitutes Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

11.Disclaimer

12.Contact Us

Research Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all major entities within the Indonesia Meat Substitutes Market by referring to multiple secondary and proprietary databases. This step involves conducting desk research to gather detailed industry-level information, focusing on market dynamics, key players, product types, and regional distributions.

Step 2: Market Building

Compiling statistics on the Indonesia Meat Substitutes Market over recent years, including production volumes, market share data, and regional segmentation. Additionally, data from government reports on regulations, infrastructure investments, and industry trends are incorporated to compute revenue generated in the market.

Step 3: Validating and Finalizing

Building market hypotheses and conducting Computer-Assisted Telephonic Interviews (CATIs) with industry experts from leading plant-based companies and related sectors. This step ensures validation of gathered statistics and refinement of market insights.

Step 4: Research Output

Our team engages with plant-based food producers, distributors, and government bodies in Indonesia to understand the dynamics of the supply chain, consumer demand, and emerging technologies in the sector. This bottom-up approach ensures validation of data and that the research output is comprehensive.

Frequently Asked Questions

1.How big is the Indonesia Meat Substitutes Market?

The Indonesia meat substitutes market was valued at USD 75 million in 2023, fueled by increasing health consciousness, heightened environmental awareness, and a growing preference for plant-based diets. Urban consumers, especially in cities like Jakarta and Surabaya, are increasingly incorporating meat substitutes into their diets, aligning with healthier living and ethical eating trends.

2.What are the challenges in the Indonesia Meat Substitutes Market?

Challenges include the high cost of importing key ingredients such as soybeans, limited consumer awareness in rural areas, and inadequate cold-chain infrastructure, which affects the distribution and storage of plant-based products across the country.

3.Who are the major players in the Indonesia Meat Substitutes Market?

Key players in the market include Green Rebel, Tahu Tempe, Unilever (The Vegetarian Butcher), Beyond Meat, and Quorn Foods. These companies are leading the market through product innovation, strategic partnerships, and expanding distribution channels.

4.What are the growth drivers of the Indonesia Meat Substitutes Market?

Growth drivers include rising health consciousness due to lifestyle-related diseases, government support for sustainable agriculture, and the increasing availability of plant-based products through e-commerce platforms and retail chains.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.