Indonesia Power Tools Market Outlook to 2023

By Type of Technology (Electric Power Tools, Pneumatic Power Tools and Hydraulic Power Tools); By Channel of Distribution (Dealer Network, Direct Sales and Online Sales) and By Region (Java, Sumatra, Kalimantan, Sulawesi and Others)

Region:Asia

Product Code:KR768

March 2019

106

About the Report

The report titled "Indonesia Power Tools Market Outlook to 2023 - By Type of Technology (Electric Power Tools, Pneumatic Power Tools and Hydraulic Power Tools); By Channel of Distribution (Dealer Network, Direct Sales and Online Sales) and By Region (Java, Sumatra, Kalimantan, Sulawesi and Others)" provides a comprehensive analysis on the Power Tools industry of Indonesia. The report covers various aspects including an introduction to the Indonesia power tools market, value chain, stakeholders in the Indonesia power tools market ecosystem, market size by revenue (2013-2018), overall power tools market segmentation by type of technology, by region and by channel of distribution, further segmentation of electric power tools market by product, by corded and cordless tools, by application and by category of product, competition scenario in the electric power tools industry, shares and company profiles of major players, trade scenario, growth drivers, trends and developments, issues and challenges in the power tools market, decision making parameters, snapshot on pneumatic power tools industry and hydraulic power tools industry. The report also includes the future outlook for the market (2019-2023) including estimated market revenue, overall power tools market segmentation by type of technology, by region and by the channel of distribution and electric power tools market segmentation by corded and cordless tools and by an application. The report is useful for manufacturers of power tools and new entrants in the sector to align their market-centric strategies according to ongoing and expected trends in the future.

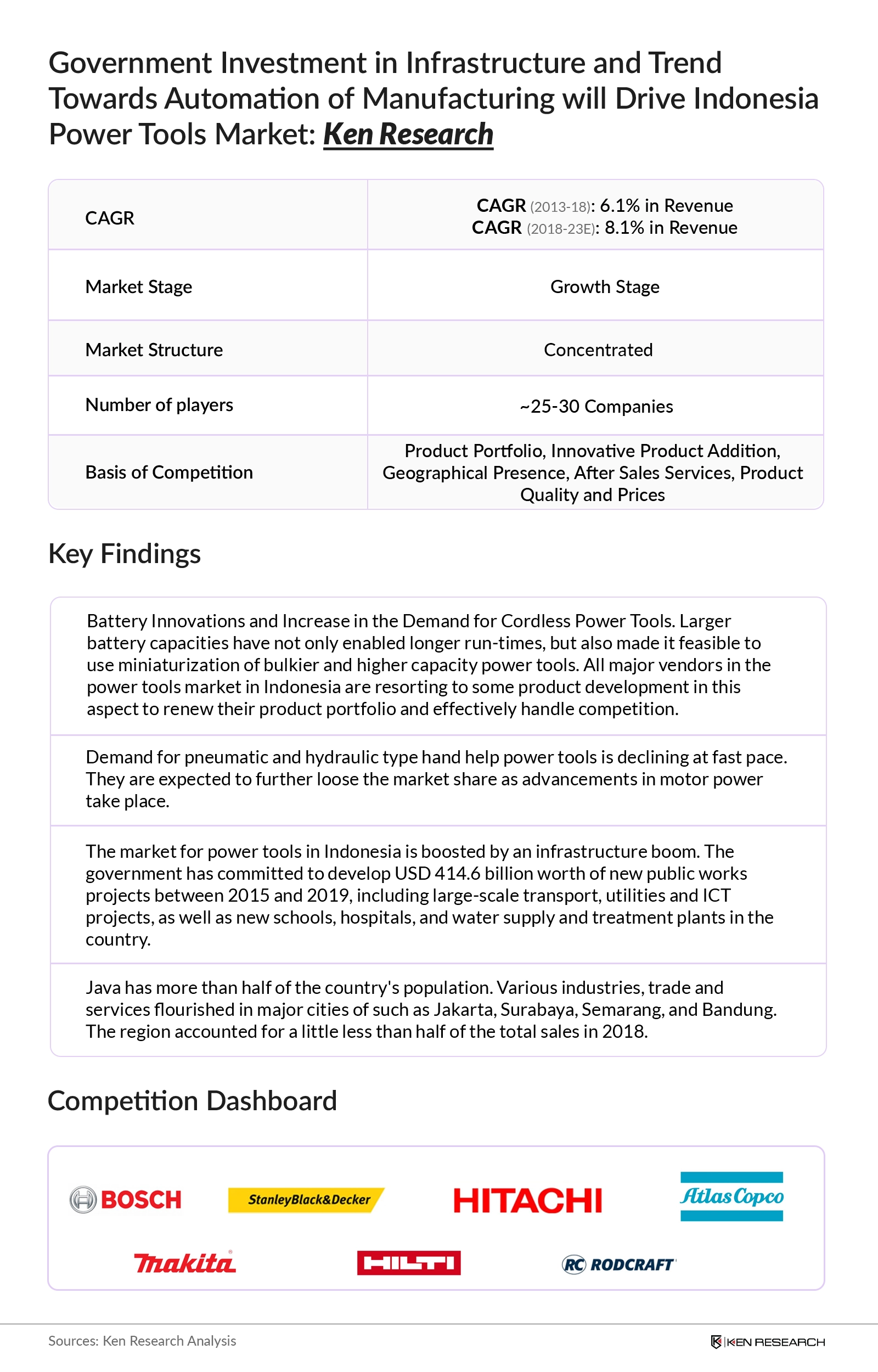

Market Size: The market for power tools in Indonesia is in its growth stage. There is hardly any local manufacturing for power tools in the country and they are mostly imported from countries such as China, Japan, Germany, and others. The growth in the power tools industry was supported by the growth of the construction and manufacturing industry in the country. Indonesia’s construction industry benefitted from President Widodo’s infrastructure development agenda, which is part of the National Medium-Term Development Plan (RPJMN), running from 2015 to 2019. Another key growth driver was the investment in infrastructure projects which correlates to the higher requirement of the electric power tools. The Indonesian government has allocated IDR 410.7 trillion for its infrastructure budget in 2018 that represents a 5.8% y-o-y increase.

Market Segmentation: Electric power tools dominated the market of power tools in Indonesia followed by pneumatic power tools and hydraulic power tools in 2018. The price of electric power tools is generally lower than other categories of power tools owing to the low cost of production. This has resulted in an increase in the number of units sold in the last five years. In 2018, the dealer network had the highest revenue share followed by direct sales and online sales. An essential reason behind the same was that the dealer network has higher accessibility to consumers than the companies. Additionally, dealers may also provide a fair comparison among different brands of the same product. End users use this as a parameter to make final purchases. Java Island contributed the largest market share to the overall revenues of the power tools market in Indonesia in 2018. This was followed by Sumatra, Kalimantan, Sulawesi and other regions including New Guinea, Maluku Islands, and others. Java has more than half of the country’s population. The huge population in the area has led to a surge in construction activities and infrastructure projects there, thus driving the demand for power tools in the area.

In the electric power tools market, the electric grinders had the largest revenue share followed by electric drills, electric saws, electric hammers and others in 2018. Corded power tools remain the dominant market driver due to their robustness and low price. The construction industry contributed the largest share in the electric power tools market. The manufacturing sector had the second largest share followed by other applications such as small workshops, DIY, carpentry and others.

Competitive Landscape: The Indonesia electric power tools market is moderately concentrated with the top 4 players accounting for the majority of the market share by revenue. Makita had the highest market share in the electric power tools market and is followed by Bosch, Hitachi and Stanley Black and Decker. Within the premium category of electric power tools, Makita had the largest share followed by Bosch, Dewalt, and others including Hilti, Metabo, and others. In the medium category of electric power tools, Makita’s brand Maktec had the largest market share followed by Bosch, Hitachi, Stanley Black and Decker and others including Metabo, Modern, and others.

Future Outlook: The future outlook of the industry is positive and the industry is estimated to grow at a positive CAGR during 2018- 2023. The market share of online sales is expected to double in this period. This is because companies are expanding to online sales as a channel of distribution so as to achieve greater market penetration. The market for cordless power tools is expected to increase in the coming years with the increase in consumer knowledge about usage and safety of the cordless power tools as compared to the corded tools. Moreover, the Indonesian government is trying to speed up infrastructure development across the Indonesian nation giving the sector a significant boost.

Key Topics Covered in the Report

- Introduction of Indonesia Power Tools Market

- Value Chain

- Stakeholders in Indonesia Power Tools Market Ecosystem

- Market Size by Revenue (2013-2018)

- Overall Power Tools Market Segmentation by Type of Technology, by Region and by Channel of

Distribution - Segmentation of Electric Power Tools Market by Product, by Corded and Cordless Tools, by

Application and by Category of Product - Competition Scenario in the Electric Power Tools Industry

- Shares and Company Profiles of Major Players in the Market

- Trade Scenario in the Power Tools Market

- Growth Drivers, Trends and Developments in the Power Tools Market

- Issues and Challenges in the Power Tools Market

- Decision Making Parameters

- Porter Five Forces

- Snapshot on Pneumatic Power Tools Industry

- Snapshot on Hydraulic Power Tools Industry

- Future Outlook for the Market (2019-2023) Including Estimated Market Size in Terms of Revenue,

- Overall Power Tools Market Segmentation by Type of Technology, by Region and by Channel of

- Distribution and Electric Power Tools Market Segmentation by Corded and Cordless Tools and by

- Application.

Products

Key Target Audience

- Construction Companies

- Real Estate Developers

- Infrastructure Engineering, Procurement, and Construction Contractors

- Manufacturing Companies

- Private Equity Ventures

Time Period Captured in the Report:

- Historical Period- 2013-2018

- Future Forecast - 2019-2023

Companies

Key Segments Covered

Power Tools Market Segmentation

By Type of Technology

- Electric Power Tools

- Pneumatic Power Tools

- Hydraulic Power Tools

By Channel of Distribution

- Dealer Network

- Direct Sales

- Online Sales

By Region

- Java

- Sumatra

- Kalimanthan

- Sulawesi

- Others

- Electric Power Tools Market Segmentation

By Product

- Electric Grinders

- Electric Drills

- Electric Saws

- Electric Hammers

- Others

By Corded and Cordless Tools

- Corded Tools

- Cordless Tools

- By Application

- Construction industry

- Manufacturing industry

- Others

By Price Category

- Premium Category

- Medium Category

- Lower Category

Table of Contents

1. Executive Summary

1.1. Indonesia Power Tools Market Size and Overview

1.2. Indonesia Power Tools Market Segmentation

1.3. Indonesia Electric Power Tools Market Segmentation

1.4. Indonesia Electric Power Tools Market Competitive Landscape

1.5. Trends, Developments, Issues and Challenges

1.6. Future Analysis and Projections

2. Research Methodology

2.1. Market Definitions

2.2. Abbreviations

2.3. Market Sizing and Modeling

Research Methodology

Approach - Market Sizing

Variables Dependent And Independent

Multifactor Based Sensitivity Model

Limitations

Final Conclusion

3. Indonesia Power Tools Market

3.1. Market Overview

3.2. Indonesia Power Tools Value Chain Analysis

3.3. Stakeholders in Indonesia Power Tools Market Ecosystem

4. Indonesia Power Tools Market Size, 2013- 2018

5. Indonesia Power Tools Market Segmentation, 2018

5.1. By Type of Technology (Electric, Pneumatic and Hydraulic

5.2. By Region (Java, Sumatra, Kalimantan, Sulawesi and Others)

5.3. By Distribution Channel (Direct Sales, Dealer Network and Online Sales)

6. Indonesia Electric Power Tools Market Segmentation, 2018

6.1. By Products (Grinders, Drills, Saws, Hammers and Others)

6.2. By Corded and Cordless Power Tools

6.3. By Application (Construction, Manufacturing and Others)

6.4. By Price Class (Premium, Medium and Lower)

7. Snapshot on Indonesia Pneumatic Power Tools Market, 2018

8. Snapshot on Indonesia Hydraulic Power Tools Market, 2018

9. Porter Five Forces Analysis of Indonesia Power tools Market

10. Decision Making Parameters in Indonesia Power Tools Market

11. Competitive Landscape

Market Share of Major Players, 2018

Market Share of Major Players in Premium Category, 2018

Market Share of Major Players in Medium Category, 2018

11.1. Company Profiles of Major Players

11.1.1. Stanley Black and Decker

11.1.2. Makita

11.1.3. Bosch

11.1.4. Hitachi

11.1.5. Hilti

12. Trade Scenario of Power Tools in Indonesia

13. Trends, Developments and Growth Drivers in Indonesia Power Tools Market

14. Issues and Challenges in Indonesia Power Tools Market

15. Indonesia Power Tools Market Future Projections, 2018- 2023

15.1. By Type of Technology (Electric, Pneumatic and Hydraulic Power Tools), 2018- 2023

15.1.1. By Corded and Cordless Electric Power Tools, 2018- 2023

15.1.2. Electric Power Tools Market By Application (Construction, Manufacturing and Others), 2018- 2023

15.2. By Region (Java, Sumatra, Kalimantan, Sulawesi and Others), 2018- 2023

15.3. By Distribution Channel (Direct Sales, Dealer Network and Online Sales), 2018- 2023

16. Analyst Recommendations

Disclaimer

Contact Us

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.