KSA Automotive Market Outlook to 2027

Driven by rising influx of women drivers and domestic manufacturing in the KSA

Region:Middle East

Author(s):Mukul Biradar and Ritika Garg

Product Code:KR1313

April 2023

88

About the Report

The report provides a comprehensive analysis of the potential of Automotive Market in KSA. The report covers an overview and genesis of the industry, market size in terms of units sold.

Its market segmentations include by Vehicle Type, by SUVs Type, by Sedan Type, by Vehicle OEMs, by Region and by Entities; growth enablers and drivers; challenges and bottlenecks; trends driving adoption trends; regulatory framework; end-user analysis, industry analysis, competitive landscape including competition scenario and market shares of major players. The report concludes with future market projections of each market segmentation and analyst recommendations.

Market Overview:

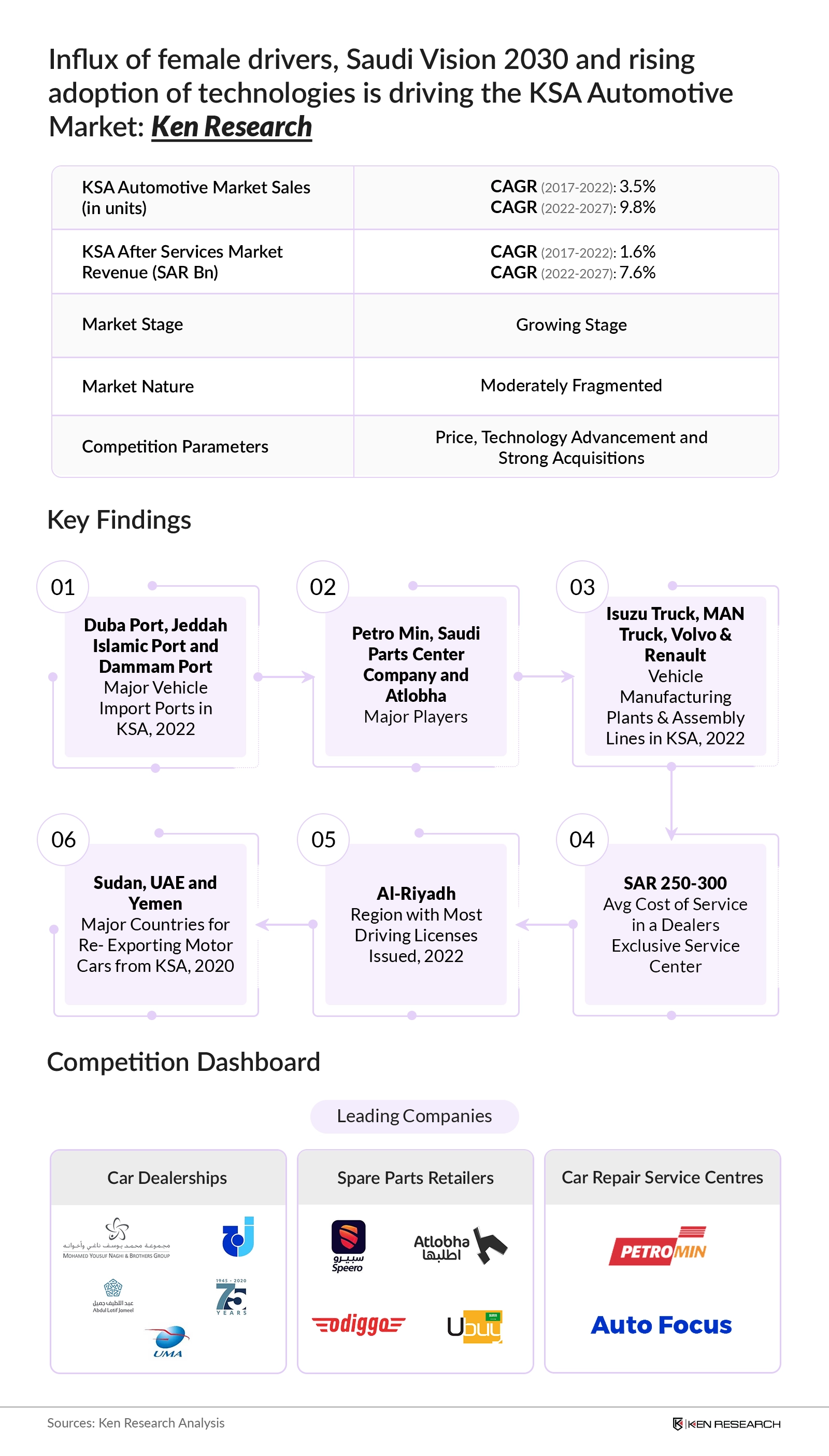

According to Ken Research estimates, the Market Size of KSA Automotive has shown increasing trend from 2017 to 2022. However, drop was observed in 2020. This is owing to pandemic. Market Size of KSA Automotive Market is expected to show increasing trend from 2022 to 2027 at CAGR of 9.8%. This is owing to Growing Car Demand, Government Impetus, Trade Liberalizations and Changing Demographics.

- A shift to preventive approach will enable new opportunity & growth via innovative service models.

- Domestic manufacturing & export set to redefine spare parts opportunity in KSA with Tires, batteries, lubricants, wiper plates set to take the front seat.

- Growth will be driven by booming used car & leasing industry & e-retail of parts.

Key Trends by Market Segment:

By Entities: Branded workshops centers are able to earn highest revenue in the industry even after only making a small proportion in the market in terms of volume. This is possible as they continue to provide innovative services & form strategic partnerships.

By Vehicle Type: Passenger Cars continue to dominate the imports by volume followed by motorcycles and trucks in 2021.

Competitive Landscape:

Future Outlook:

Market Size of KSA Automotive is expected to show increasing trend from 2022 to 2027. This is owing to Growing Car Demand, Government Impetus, Trade Liberalizations and Changing Demographics. Post-pandemic the demand for automotive is boosted. This is because Domestic manufacturing & export set to redefine spare parts opportunity in KSA with Tires, batteries, lubricants, wiper plates set to take the front seat.

Scope of the Report

|

KSA Automotive Market |

|

|

KSA Automotive Market Segmentation |

|

|

By Vehicle Type |

SUV Sedans Pick-up Trucks Full Size Vans MPV Sports |

|

By SUVs Type |

Small SUVs Large SUVs |

|

By Sedan Type |

Large Medium Small Mini |

|

By Vehicle OEMs |

Toyota Hyundai Changan Nissan KIA MG Mazda Isuzu Geely Chevrolet Others |

|

By Region |

Central Eastern Northern Southern & Western |

|

KSA Automotive Import Segmentation |

|

|

By Vehicle Type |

Passenger Cars Trucks Buses & SPV Imports Motorcycle |

|

KSA Aftermarket Services Market Segmentation |

|

|

By Entities |

Branded Workshops Agency Repair (Dealerships) Un-Organized Workshops |

Products

Key Target Audience

- KSA Car Dealerships

- KSA Automotive Industry

- KSA Automotive Workshops

- KSA Spare Parts Retailers

- KSA Automotive Logistic Service Providers

- KSA Car Rental Players

- KSA Car Leasing Players

- KSA ERP Service Providers

- KSA Ports Authority

Time Period Captured in the Report:

- Historical Period: 2017-2022

- Base Year: 2022

- Forecast Period: 2022-2027

Companies

Major Players Mentioned in the Report:

Car Dealerships:

- AJL

- Yusuf Naghi

- Juffali

- UMA

Spare Parts Retailers:

- Speero

- Atlobha

- Odiggo

- Ubuy

Car Repair Service Centers:

- Petromin

- Auto Focus

Table of Contents

1. Country overview Saudi Arabia

1.1 Saudi Arabia Country Overview

2. Saudi Arabia Auto Industry Overview

2.1 Ecosystem of Automotive Industry in KSA

2.2 SWOT Analysis of KSA Automotive Industry

2.3 PESTEL Analysis of KSA Automotive Industry

3. Saudi Arabia Imports & Sales Industry Overview (Distributors & Dealerships)

3.1 Automotive Imports & Sales Industry Ecosystem

3.2 Value Chain Analysis of KSA Automotive Imports & Sales

3.3 Annual Automotive Imports Traffic for Major KSA Ports (2022)

3.4 Analysis of Imported Goods & Major Countries Importing in KSA, (2017-2021)

3.5 Value & Volume of Vehicles Imported in KSA, (2017-2021)

3.6 Segmentation of Imports on the basis of Vehicle type, KSA (2021)

3.7 Automotive Vehicle Manufacturing Clusters Analysis, KSA (2022)

3.8 New Motor Vehicle Sales, KSA (2017-2022)

3.9 Analysis of Re – Exports of Vehicles from KSA (2016-2020)

3.10 Market Segmentation of Automotive Sales on the basis of Region, KSA (2022)

3.11 Demographics of KSA Citizens Supporting Automotive Industry, (2022)

3.12 Segmentation of Vehicle Sales on the basis of Brands & Vehicle Type, KSA (2022)

3.13 Market share of International OEMs in New Vehicle Sales, KSA (2022)

3.14 Competition Analysis of Automotive Imports & Sales Industry, KSA (2022)

3.15 Profiles of Major Dealerships & Distributors

3.16 Business Model & Revenue Stream of Importers/Distributors/Dealerships

4. Trends & Developments in Automotive Vehicle Industry

4.1 Analysis of Updated Import Process

4.2 Challenges related to VAT & Custom duty Increment

4.3 Vision 2030 Program

4.4 Key Trends Re – Shaping Automotive Industry

4.5 Vehicle Sales and Automotive Industry Future, KSA (2022-2027)

5. Saudi Arabia Automotive Aftermarket Spare parts Industry

5.1 KSA Aftermarket Industry Ecosystem

5.2 Spare Parts Business Framework (White label Parts)

5.3 KSA Major Dealership/ Agency Spare Parts Providers (Cross-Comparison)

5.4 KSA Major Offline Spare Parts Providers (Cross-Comparison)

5.5 KSA Major Online Spare Parts Providers (Cross-Comparison)

6. Saudi Arabia Automotive Aftermarket Service Industry

6.1 KSA Aftermarket Industry Ecosystem

6.2 Spare Parts Business Framework (White label Parts)

6.3 KSA Major Dealership/ Agency Spare Parts Providers (Cross-Comparison)

6.4 KSA Major Offline Spare Parts Providers (Cross-Comparison)

6.5 KSA Major Online Spare Parts Providers (Cross-Comparison)

7. Saudi Arabia Automotive Aftermarket Service Industry

7.1 Entity Relationship Analysis in KSA Aftermarket Service Industry

7.2 Quick Service Center Business Model

7.3 KSA Aftermarket Service Industry Overview

7.4 Market Segmentation & Competition Analysis of KSA Aftermarket Services

7.5 Organized Sector v/s Unorganized Sector of KSA Aftermarket Services

7.6 Organized Aftermarket Service Ecosystem

7.7 Major Agency Repair (Dealerships) & Branded Workshop

7.8 Major Branded Workshops & Service Centers, Total Care Services (Cross-Comparison)

7.9 Major Branded Workshops & Service Centers, Quick Lube (Cross-Comparison)

7.10 Major Branded Workshops & Service Centers, Car Spas (Cross-Comparison)

7.11 Major Agency Repair (Dealership) Service Centers (Repair & Cleaning Service) (Cross-Comparison)

7.12 Major Unorganized Service Center Across KSA

7.13 Road Accident Statistics for Saudi Arabia (2022)

8. Future Trends of Aftermarket Spare Parts & Service Industry

8.1 Disruptions due in Traditional Practices

8.2 Exports and Domestic Manufacturing Enabled via Numerous Incentives

8.3 KSA Aftermarket Industry Future Outlook (2027)

9. Market Opportunities and Analyst Recommendations

9.1 Best Practices for the Quick Service Center Operations

9.2 Trends Affecting Automotive Industry Supply Chain and Providing Innovation and Digitized Workspace

10. Research Methodology

Disclaimer

Contact Us

Research Methodology

Step:- 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:- 2 Market Building:

Collating statistics on cars sales over the years, penetration of dealerships and service centers ratio to compute revenue generated for automotive. We will also review spare arts providers statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:- 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:- 4 Research output:

Our team will approach multiple automotive providing channels and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from automotive providers.

Frequently Asked Questions

01 How big is KSA Automotive Market?

KSA has shown an increasing trend between 2017-2022 & has grown at a CAGR of 3.5%

02 How many cars were sold in KSA?

In 2022, almost 61,650,000 passenger cars & commercial vehicles were sold in KSA

03 Who are the major players in KSA Automotive Market?

3M Saudi Arabia, Continental Middle East, DENSO Corporation are some major players in KSA Automotive Market.

04 What is the future of KSA Automotive Market?

KSA Automotive Market is expected to grow at 9.8% in the forecast year 2022-2027

05 Why is KSA Automotive Market growing?

Labour availability, technological advancements & government support through policies like Vision 2030 drives growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.