KSA Residential AC Market Outlook to 2028

Region:Middle East

Author(s):Sanjna Verma

Product Code:KROD1183

December 2024

84

About the Report

KSA Residential AC Market Overview

- KSA Residential AC Market was valued at USD 517 million in 2023. The growth is driven by the increasing urbanization and rising disposable income of the middle-class population. Additionally, the harsh climate of Saudi, with temperatures often exceeding 40 degrees Celsius, has heightened the demand for efficient cooling solutions, thus boosting the market for residential air conditioners.

- Key players in the KSA residential AC market include LG Electronics, Samsung Electronics, Gree Electric Appliances Inc., Daikin Industries, and Carrier Global Corporation. These companies dominate the market due to their extensive distribution networks, strong brand presence, and a broad range of product offerings tailored to the climatic conditions and energy efficiency requirements of the region.

- In 2021, LG Electronics, in collaboration with Al Hassan Ghazi Ibrahim Shaker Co., is enhancing its air conditioning production facility in Riyadh, Saudi Arabia. This upgrade involves the integration of advanced robotics and AI technology to boost production capacity and operational efficiency, positioning LG-Shaker to lead the competitive AC market in the region.

- Riyadh, Jeddah, and Dammam are the dominant cities in the KSA residential AC market due to their large population size, high levels of urbanization, and extreme climatic conditions. These cities experience prolonged periods of high temperatures, necessitating the widespread use of air conditioners. Additionally, rapid infrastructure development and the growth of residential real estate in these cities further fuel the demand for residential air conditioning units.

KSA Residential AC Market Segmentation

The KSA Residential AC Market can be segmented based on several factors:

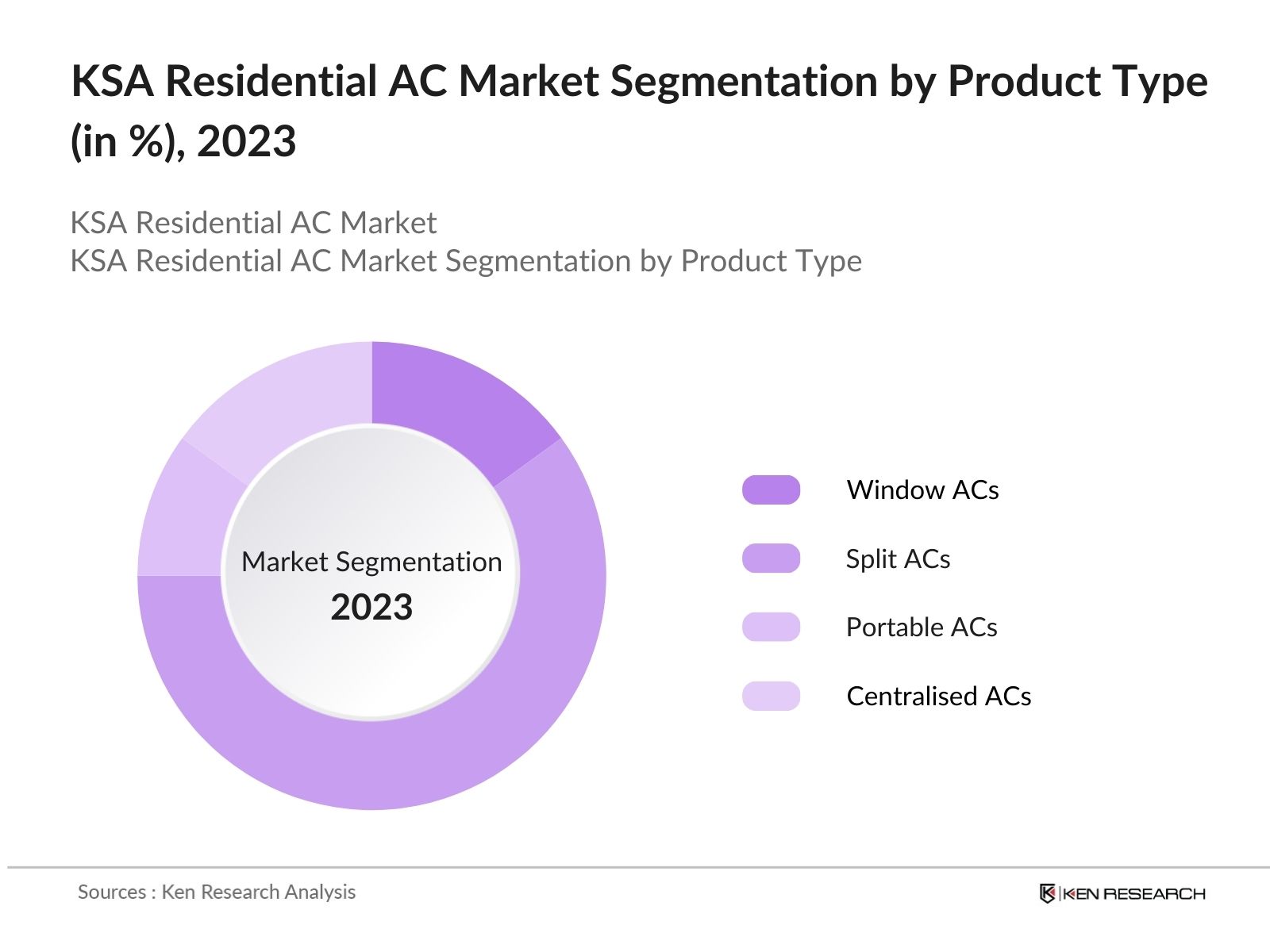

By Product Type: KSA Residential AC market is segmented by product type into window ACs, split ACs, portable ACs, and centralized ACs. In 2023, split ACs held a dominant market share due to their higher energy efficiency and quieter operation compared to window ACs. Split ACs are preferred in modern residential constructions because they offer better aesthetics and do not obstruct windows or external walls.

By Technology: KSA Residential AC Market is also segmented by technology into inverter and non-inverter ACs. Inverter ACs have the largest market share in 2023 due to their energy efficiency, which aligns with the governments energy conservation goals under Vision 2030. Inverter technology allows the air conditioner to adjust its power based on the ambient temperature, resulting in significant energy savings.

By Region: KSA Residential AC Market is segmented into the Central, Western, Eastern, Northern, and Southern regions. The Central region, particularly Riyadh, holds the largest market share in 2023 due to its high population density, extensive urbanization, and economic development. Riyadhs extreme summer temperatures and growing construction activities in both residential and commercial sectors further drive the demand for residential air conditioners

KSA Residential AC Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

LG Electronics |

1958 |

Seoul, South Korea |

|

Samsung Electronics |

1969 |

Suwon, South Korea |

|

Gree Electric Appliances |

1991 |

Zhuhai, China |

|

Daikin Industries |

1924 |

Osaka, Japan |

|

Carrier Global Corporation |

1915 |

Palm Beach, USA |

- Haier Electronics Group: At 2024 Haier Smart Home Middle East and Africa dealer conference in Cairo, Haier emphasized its commitment to the Middle East and Africa, showcasing high-end products tailored to local consumer needs. This included a focus on smart home solutions and innovative air conditioning technologies, which are gaining traction in the Saudi market.

- Toshiba Carrier Corporation: In 2022, Carrier completed its acquisition of Toshiba's global residential and light commercial HVAC business, including Toshiba Carrier Corporation. This acquisition, valued at approximately $900 million, aims to enhance Carrier's position in the rapidly growing variable refrigerant flow (VRF) and heat pump markets, which are crucial for energy efficiency and sustainability initiatives.

KSA Residential AC Industry Analysis

KSA Residential AC Market Growth Drivers:

- Increase in Residential Construction Projects: The residential construction sector in Saudi Arabia has seen significant growth. There are over 5,200 ongoing construction projects in Saudi Arabia, valued at approximately USD 819 billion. Subsequently, the market for residential ACs is set to expand as more housing units are developed, particularly in urban areas like Riyadh and Jeddah, where the climate necessitates effective cooling solutions.

- Rising Temperatures and Climatic Conditions: The demand for electricity in Saudi Arabia peaks during the summer due to air conditioning needs. Electricity generation can reach up to 60 GW on hot summer days, compared to only 23 GW in winter. Each 1 C increase in temperature requires an additional 1.18 GW of electricity generation. These conditions necessitate the use of air conditioners to maintain indoor comfort levels, thereby bolstering the market.

- Increased Awareness and Adoption of Energy-Efficient Solutions:

Saudi Arabia's total oil production increased by 14% in 2022, reaching 578 million tonnes, although it saw a 7% decrease in the first nine months of 2023. This push towards energy efficiency is not only helping reduce the overall energy consumption of households but also driving the growth of the residential AC market in Saudi Arabia.

KSA Residential AC Market Challenges:

- Supply Chain Disruptions: The global supply chain disruptions have had a lingering effect on the residential AC market in Saudi Arabia. The disruptions led to a shortage of key components like compressors and microcontrollers, resulting in extended lead times and increased production costs for manufacturers. These disruptions have led to price volatility and delays in product availability, affecting both retailers and consumers.

- Regulatory and Compliance Challenges: Non-compliance with these standards can result in fines and the removal of non-compliant products from the market. These regulations, while beneficial for reducing energy consumption, have increased the burden on manufacturers to innovate and adapt, potentially slowing down the introduction of new models.

KSA Residential AC Market Government Initiatives:

- Saudi Energy Efficiency Program (SEEP): Saudi Energy Efficiency Program (SEEP) was launched in 2012 under the auspices of the Saudi Energy Efficiency Center (SEEC). Its primary goal is to enhance energy efficiency across the Kingdom, focusing on three major sectors: buildings, transportation, and industry, which collectively account for over 90% of the country's energy consumption. This will affect entry of energy efficient air-conditioners in the country.

- Vision 2030 Housing Program: The Vision 2030 Housing Program was officially launched in 2016 as part of Saudi Arabia's Vision 2030 initiative. The Vision 2030 Housing Program aims to increase the percentage of home ownership among Saudi families to 70% by 2030. This large-scale construction drive is expected to increase the demand for residential air conditioning units significantly.

KSA Residential AC Future Market Outlook

KSA Residential AC Market is poised for substantial growth over the next five years, driven by a combination of increasing construction activities, government initiatives promoting energy efficiency, and the rising demand for advanced cooling solutions.

Future Trends

- Growth in Smart AC Technology: By 2028, there will be a substantial increase in the adoption of smart air conditioning systems in Saudi Arabia. These systems, which can be controlled remotely and integrated with home automation platforms, will cater to the tech-savvy and energy-conscious consumers in the region.

- Expansion of Local Manufacturing Capabilities: In response to the Saudi governments push for local content and economic diversification under Vision 2030, major AC manufacturers are expected to expand their local manufacturing capabilities. This shift towards local production will not only reduce costs and lead times but also create employment opportunities and contribute to the countrys economic growth.

Scope of the Report

Products

Key Target Audience Organizations and Entities who can benefit by Subscribing This Report:

- Property Management Companies

- Residential Construction Companies

- HVAC Installation and Maintenance Companies

- Energy Auditing Companies

- Architectural Companies

- Investment & Venture Capitalist Firms

- Government and Regulatory Bodies (Saudi Energy Efficiency Center)

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

- LG Electronics

- Samsung Electronics

- Gree Electric Appliances Inc.

- Daikin Industries

- Carrier Global Corporation

- Trane Technologies

- Midea Group

- Toshiba Carrier Corporation

- Panasonic Corporation

- Hisense Group

- Fujitsu General Limited

- Haier Electronics Group

- York (Johnson Controls)

- Mitsubishi Electric Corporation

- Electrolux AB

Table of Contents

1. KSA Residential Air Conditioning Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

2. KSA Residential Air Conditioning Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Residential Air Conditioning Market Analysis

3.1. Growth Drivers

3.1.1. Increase in Residential Construction Projects

3.1.2. Rising Temperatures and Climatic Conditions

3.1.3. Increased Awareness and Adoption of Energy-Efficient Solutions

3.1.4. Technological Advancements in Energy Efficiency

3.2. Restraints

3.2.1. Supply Chain Disruptions

3.2.2. Regulatory and Compliance Challenges

3.2.3. Environmental Concerns and Regulations

3.3. Opportunities

3.3.1. Adoption of Smart ACs

3.3.2. Expansion into Underdeveloped Regions

3.3.3. Demand for Energy-efficient and Sustainable Solutions

3.4. Trends

3.4.1. Integration of IoT in Air Conditioning Systems

3.4.2. Growing Popularity of Inverter ACs

3.4.3. Increasing Demand for Air Purification Features

3.5. Government Regulation

3.5.1. Saudi Energy Efficiency Program (SEEP)

3.5.2. Vision 2030 Housing Program

3.5.3. Environmental Protection Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. KSA Residential Air Conditioning Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Split ACs

4.1.2. Window ACs

4.1.3. Portable ACs

4.1.4. Central ACs

4.2. By Cooling Capacity (in Value %)

4.2.1. Below 1 Ton

4.2.2. 1 Ton - 2 Ton

4.2.3. Above 2 Ton

4.3. By Distribution Channel (in Value %)

4.3.1. Online

4.3.2. Offline (Retail Stores, Hypermarkets, etc.)

4.4. By Technology (in Value %)

4.4.1. Non-Inverter

4.4.2. Inverter

4.5. By Region (in Value %)

4.5.1. Central

4.5.2. Western

4.5.3. Northern

4.5.4. Southern

4.5.5. Eastern

5. KSA Residential Air Conditioning Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1 LG Electronics

5.1.2 Samsung Electronics

5.1.3 Gree Electric Appliances Inc.

5.1.4 Daikin Industries

5.1.5 Carrier Global Corporation

5.1.6 Trane Technologies

5.1.7 Midea Group

5.1.8 Toshiba Carrier Corporation

5.1.9 Panasonic Corporation

5.1.10 Hisense Group

5.1.11 Fujitsu General Limited

5.1.12 Haier Electronics Group

5.1.13 York (Johnson Controls)

5.1.14 Mitsubishi Electric Corporation

5.1.15 Electrolux AB

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. KSA Residential Air Conditioning Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

7. KSA Residential Air Conditioning Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. KSA Residential Air Conditioning Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. KSA Residential Air Conditioning Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Cooling Capacity (in Value %)

9.3. By Distribution Channel (in Value %)

9.4. By Technology (in Value %)

9.5. By Region (in Value %)

10. KSA Residential Air Conditioning Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on KSA Residential AC Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for KSA Residential AC Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple Residential AC suppliers and distributors companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Residential AC suppliers and distributors companies.

Frequently Asked Questions

01 How big is KSA Residential AC Market?

KSA Residential AC Market was valued at USD 517 million in 2023. The growth is driven by the increasing urbanization and rising disposable income of the middle-class population. Additionally, the harsh climate of Saudi, with temperatures often exceeding 40 degrees Celsius, has heightened the demand for efficient cooling solutions

02 What are the growth drivers of the KSA Residential AC Market?

Growth drivers of the KSA Residential AC Market include the increase in residential construction projects, rising temperatures leading to higher demand for cooling solutions, and increased awareness and adoption of energy-efficient appliances supported by government initiatives like the Saudi Energy Efficiency Program.

03 What are challenges in KSA Residential AC Market?

Challenges in the KSA Residential AC Market include high initial costs of energy-efficient models, supply chain disruptions affecting the availability of components, and strict regulatory requirements for energy efficiency standards. These factors collectively pose hurdles for market growth and consumer adoption.

04 Who are major players in the KSA Residential AC Market?

Major players in the KSA Residential AC Market include LG Electronics, Samsung Electronics, Gree Electric Appliances, Daikin Industries, and Carrier Global Corporation. These companies dominate the market with their extensive product range, strong distribution networks, and commitment to energy-efficient solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.