KSA Sugar Market Outlook to 2030

Region:Middle East

Author(s):Naman Rohilla

Product Code:KROD2155

November 2024

99

About the Report

KSA Sugar Market Overview

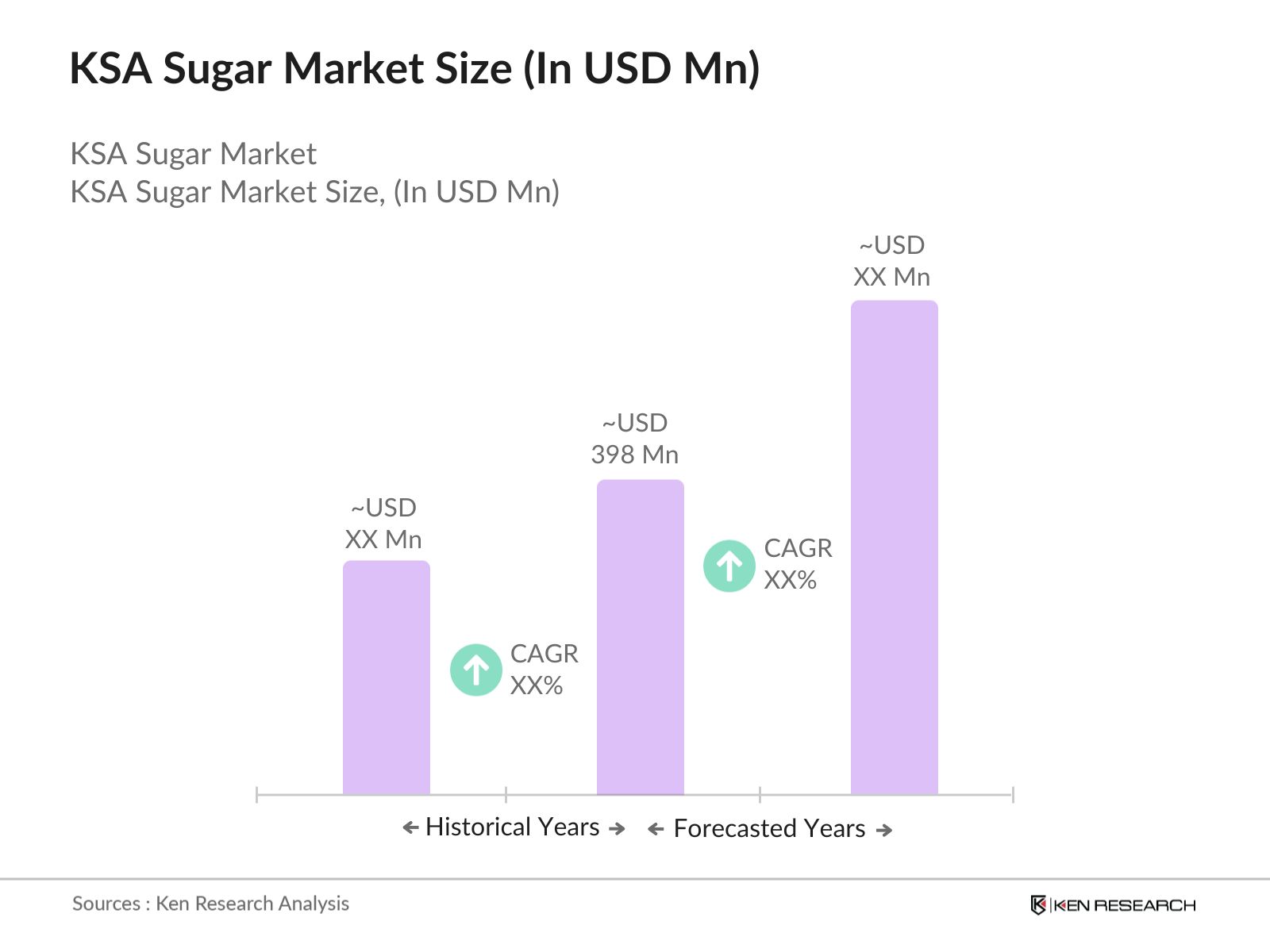

- The KSA sugar market was valued at USD 398 million, driven by growing domestic consumption, the expanding food and beverage industry, and government initiatives to improve local production capacities. The market has been supported by the increased demand for sugar from various sectors, including processed foods, beverages, and the hospitality industry. Additionally, the countrys ongoing efforts to reduce dependency on sugar imports and boost self-sufficiency have further propelled market growth.

- Key players in the KSA sugar market include Savola Group, United Sugar Company, Olayan Group, and Al Reef Sugar Refinery. These companies have strengthened their position in the market through strategic investments in refining technology, efficient supply chain management, and a focus on meeting domestic demand.

- The Western region of Saudi Arabia, particularly Jeddah, led the sugar market due to its substantial industrial capacity, favourable logistics infrastructure, and proximity to key port cities. This regions dominance is further supported by large-scale sugar refining facilities that cater to both domestic and export demands.

- In 2023, United Sugars Corporation was renamed to United Sugar Producers and Refiners Cooperative. The newly formed United Sugar Producers and Refiners Cooperative reported record sales in 2023, selling 62 million hundredweight of sugar, which is the highest amount ever sold by the cooperative.

KSA Sugar Market Segmentation

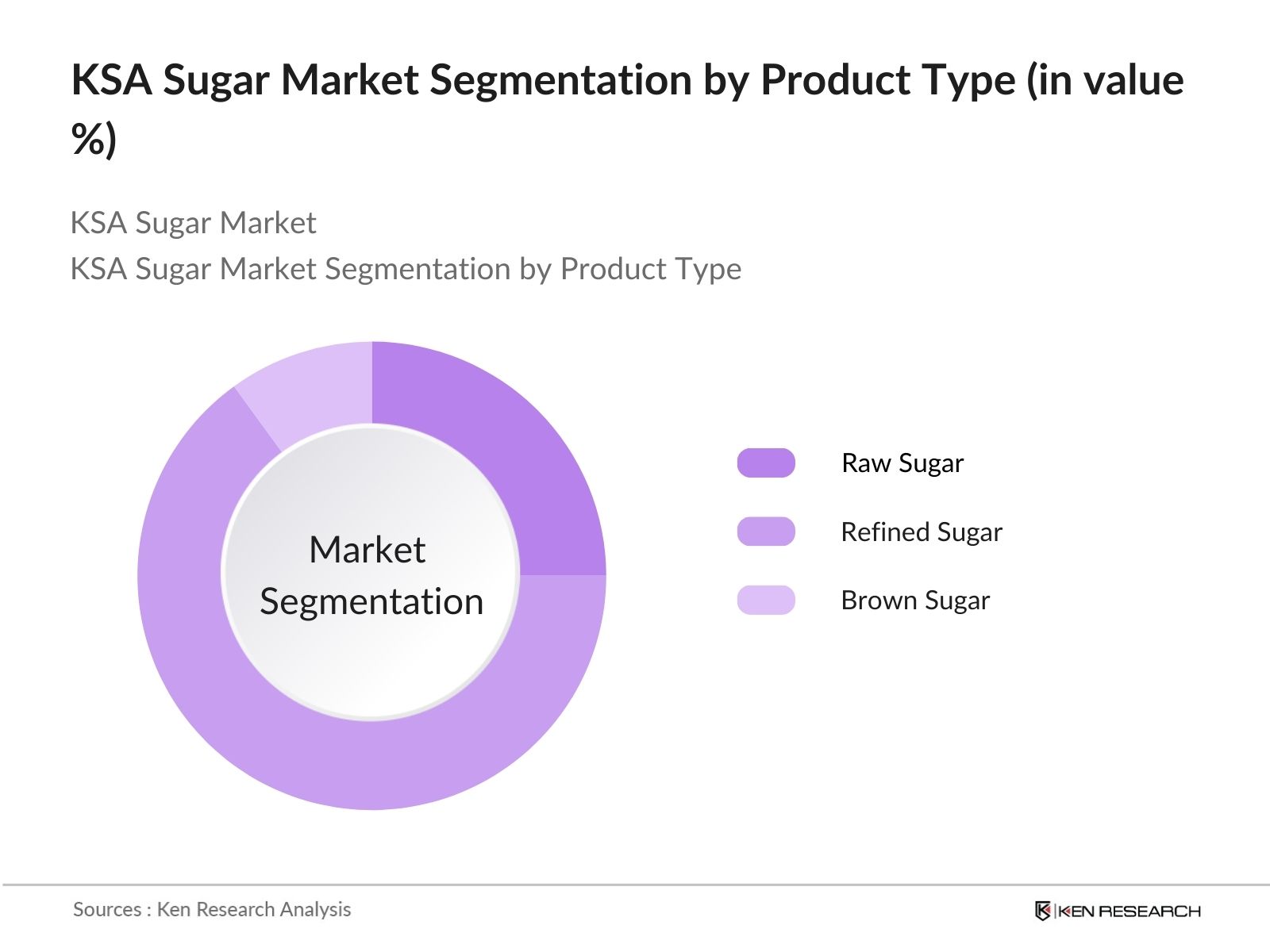

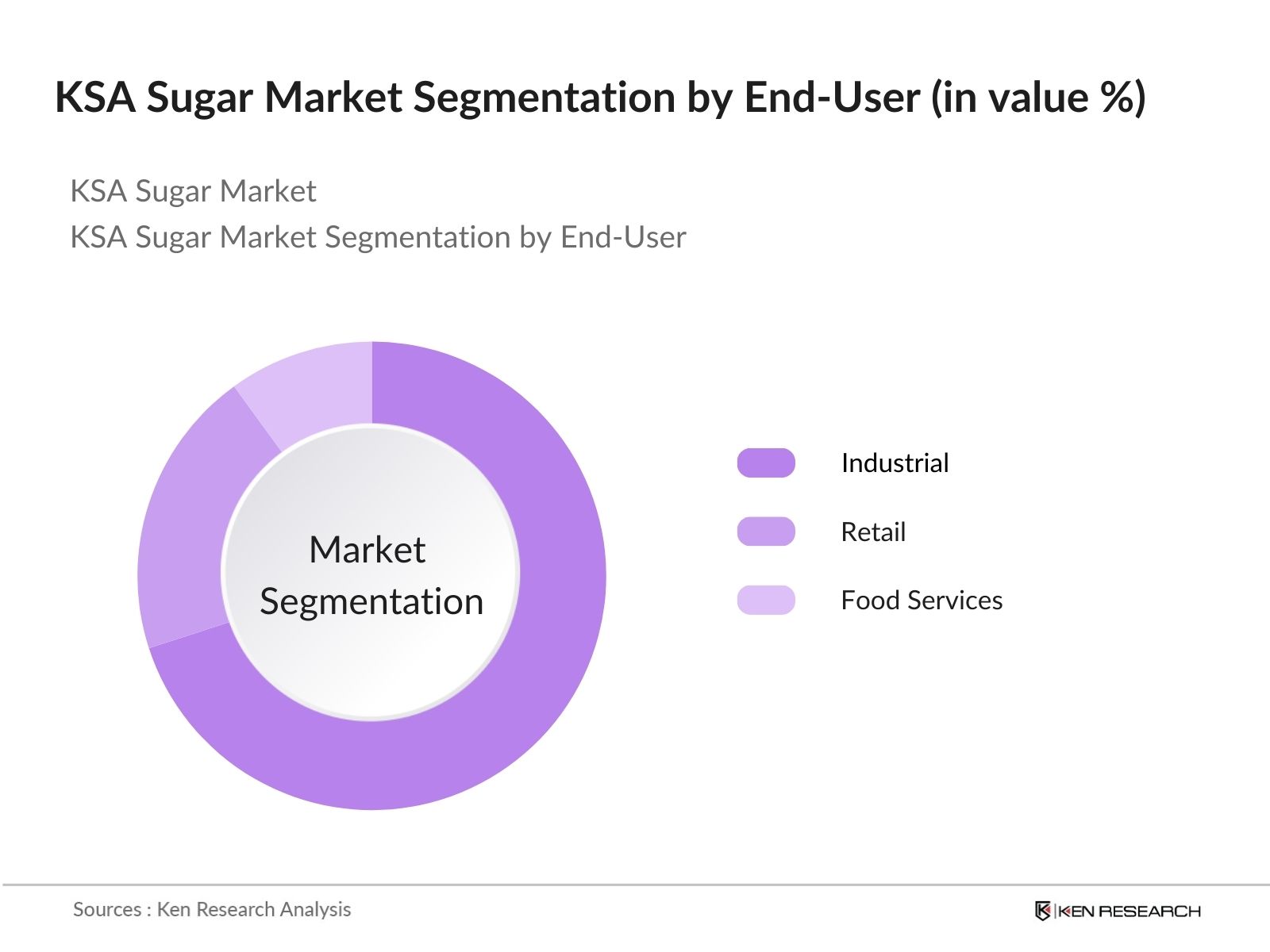

The KSA sugar market is segmented by product type, end-user, and region.

- By Product Type: The market is segmented into raw sugar, refined sugar, and brown sugar. In 2023, refined sugar dominated the market due to its widespread application in the food and beverage industries.

- By End-User: The market is segmented by end-user into industrial, retail, and food services. In 2023, the industrial segment dominated the market, accounting for the largest share due to the substantial use of sugar in the manufacturing of processed foods and beverages.

- By Region: The market is geographically segmented into North, South, East, and West Saudi Arabia. In 2023, the Western region led the market, driven by the regions strong industrial base and well-established refining infrastructure.

KSA Sugar Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Savola Group |

1979 |

Jeddah, Saudi Arabia |

|

United Sugar Company |

1995 |

Jeddah, Saudi Arabia |

|

Olayan Group |

1947 |

Khobar, Saudi Arabia |

|

Al Reef Sugar Refinery |

2010 |

Riyadh, Saudi Arabia |

|

Al Khaleej Sugar Co. |

1995 |

Dubai, UAE |

- Al Reef Sugar Refinery Co.: Al Reef Sugar Refinery Co. is set to begin construction on its SAR 1.2 billion Jizan refinery, with a 1 million ton capacity, creating 500 jobs. The project aligns with Saudi Vision 2030 to boost food security and local production.

- Al Khaleej Sugar Co.: Al Khaleej Sugar Co. aims to increase production at its Jebel Ali refinery to 1.5 million tons in 2023, up from 600,000 tons in 2022. The refinery's normal capacity is 1.5 million tons, with 85% of production exported, primarily to East Africa and the Middle East.

KSA Sugar Market Analysis

KSA Sugar Market Growth Drivers:

- Rising Demand from Food and Beverage Industry: The food and beverage industry in Saudi Arabia is a major consumer of sugar, accounting for a substantial portion of the country's total sugar consumption. In 2021, per capita sugar consumption reached 28.9 kg in Saudi Arabia, indicating a substantial demand for sugar across various food and beverage products..

- Increasing Per Capita Sugar Consumption: Per capita sugar consumption in Saudi Arabia reached 28.9 kg in 2021, potentially increasing due to changing dietary habits and urbanization. Studies found that 45.8% of female students consumed sweets daily, while 40% of university students drank soft drinks once daily, with 27.5% consuming them two or more times daily.

- Population Growth: Saudi Arabia's population increased from 24 million in 2010 to 32.2 million in 2022, reflecting a growth rate of 34.2%. By 2030, the population is projected to reach around 36 million. This growth drives higher sugar demand due to increased consumption of food and beverages.

KSA Sugar Market Challenges:

- Dependence on Sugar Imports: Saudi Arabia continues to rely heavily on sugar imports, with over 1.8 million metric tons imported in 2023 to meet domestic demand. This dependency exposes the market to fluctuations in global sugar prices and potential supply chain disruptions, affecting local producers and consumers alike.

- Climate Impact on Sugarcane Cultivation: Saudi Arabias arid climate poses major challenges for large-scale sugarcane cultivation. The country experiences a projected decline in precipitation, which can lead to reduced agricultural productivity. A study indicates that a mere 1-degree Celsius increase in average temperature can decrease crop yields by 525%.

KSA Sugar Market Government Initiatives:

- Agricultural Development Fund (ADF): In 2023, the Agricultural Development Fund (ADF) introduced two initiatives worth SAR 2.5 billion to support farmers and enhance food security. This funding aims to facilitate local agricultural production and improve supply chains, contributing to the country's food security strategy.

- Saudi Food Security Strategy: The Saudi Food Security Strategy aims to boost local agricultural production and reduce food import dependency. In 2023, the Agricultural Development Fund approved SAR 1.5 billion to support various sectors, including sugar, as part of a broader SAR 37.5 billion plan for sustainable agriculture.

KSA Sugar Market Future Market Outlook

The KSA sugar market is poised for steady growth over the next five years, driven by the rising demand for processed foods, beverages, and confectionery products. Government initiatives aimed at increasing domestic production and reducing reliance on imports will further enhance market growth.

Future Market Trends:

- Adoption of Low-Calorie Sugar Alternatives: In the coming years, consumer preference for healthier food options is expected to drive demand for low-calorie sugar alternatives in Saudi Arabia. This trend aligns with Vision 2030 health objectives, which aim to improve public health and reduce sugar consumption, prompting companies to introduce new product lines catering to health-conscious consumers.

- Expansion of Sugar Refining Capacity: Over the next five years, Saudi Arabia is expected to expand its sugar refining capacity through private and public investments. The Durrah Sugar Factory, inaugurated in 2023 with a capacity of 900,000 tons annually, reflects the commitment to increasing domestic production and reducing reliance on imported sugar.

Scope of the Report

|

By Product Type |

Raw Sugar Refined Sugar Brown Sugar |

|

By End-User |

Industrial Retail Food Services Hospitality Sector |

|

By Technology |

Conventional Refining Advanced Refining Technologies Renewable Energy-Based Refining |

|

By Form |

Granulated Sugar Powdered Sugar Liquid Sugar |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies

Banks and Financial Institutes

Investors and Venture Capitalists

Food and beverage manufacturers

Supply chain management companies

Sugarcane Products Companies

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Savola Group

United Sugar Company

Olayan Group

Al Reef Sugar Refinery

Al Khaleej Sugar Co.

Al Ghurair Resources

Tate & Lyle

Cargill, Inc.

Louis Dreyfus Company (LDC)

Sdzucker AG

Mitr Phol Sugar Corporation

ED&F Man

Nordzucker AG

Bajaj Hindusthan Sugar Ltd.

Wilmar International Limited

Table of Contents

1. KSA Sugar Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, market dynamics)

1.4. Market Segmentation Overview

2. KSA Sugar Market Size (in USD Billion)

2.1. Historical Market Size (Market progression, consumption rates, and production capacities)

2.2. Year-on-Year Growth Analysis (Volume growth, export-import data)

2.3. Key Market Developments and Milestones (Investments, technological advancements, capacity expansions)

3. KSA Sugar Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Domestic Demand from the Food and Beverage Industry (Usage rates in food processing, manufacturing statistics)

3.1.2. Expanding Population and Per Capita Consumption (Population growth, consumption rates per region)

3.1.3. Government Policies Supporting Local Production (Subsidies, sugarcane cultivation plans)

3.1.4. Technological Upgrades in Refining Processes (Automation, use of renewable energy)

3.2. Restraints

3.2.1. Heavy Dependence on Imports (Import volumes, global price impact)

3.2.2. Impact of Climate on Agricultural Productivity (Sugarcane yield variability, climate projections)

3.2.3. Fluctuations in Global Sugar Prices (Impact on production and imports)

3.3. Opportunities

3.3.1. Expansion of Refining Capacity (New projects, investment announcements)

3.3.2. Introduction of Low-Calorie and Sugar Alternatives (Consumer trends, market demand)

3.3.3. Growing Demand for Sugar in the Hospitality and Retail Sectors (Retail expansion, market entry opportunities)

3.4. Trends

3.4.1. Rise of Health-Conscious Consumption and Low-Calorie Products (Demand for healthy alternatives, market innovations)

3.4.2. Integration of Renewable Energy in Sugar Production (Solar power, carbon footprint reduction)

3.4.3. Evolving Consumer Preferences (Shift in demand for specialty sugars and alternatives)

4. KSA Sugar Market Segmentation (by Key Parameters)

4.1. By Product Type (in Value %)

4.1.1. Raw Sugar

4.1.2. Refined Sugar

4.1.3. Brown Sugar

4.2. By End-User (in Value %)

4.2.1. Industrial (Food and beverage manufacturers, pharmaceuticals)

4.2.2. Retail (Supermarkets, e-commerce platforms)

4.2.3. Food Services (Hotels, restaurants, catering)

4.2.4. Hospitality Sector (Hotels, tourist spots)

4.3. By Technology (in Value %)

4.3.1. Conventional Refining

4.3.2. Advanced Refining Technologies (Use of smart technologies, automation)

4.3.3. Renewable Energy-Based Refining (Solar and bioenergy utilization)

4.4. By Form (in Value %)

4.4.1. Granulated Sugar

4.4.2. Powdered Sugar

4.4.3. Liquid Sugar

4.5. By Region (in Value %)

4.5.1. North Saudi Arabia

4.5.2. South Saudi Arabia

4.5.3. East Saudi Arabia

4.5.4. West Saudi Arabia

5. KSA Sugar Market Cross Comparison

5.1. Detailed Profiles of Major Companies (Operational and financial parameters)

5.1.1. Savola Group

5.1.2. United Sugar Company

5.1.3. Olayan Group

5.1.4. Al Reef Sugar Refinery

5.1.5. Al Khaleej Sugar Co.

5.1.6. Al Ghurair Resources

5.1.7. Tate & Lyle

5.1.8. Cargill, Inc.

5.1.9. Louis Dreyfus Company (LDC)

5.1.10. Sdzucker AG

5.1.11. Mitr Phol Sugar Corporation

5.1.12. ED&F Man

5.1.13. Nordzucker AG

5.1.14. Bajaj Hindusthan Sugar Ltd.

5.1.15. Wilmar International Limited

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Market Share)

6. KSA Sugar Market Competitive Landscape

6.1. Market Share Analysis (Key players market share by volume and revenue)

6.2. Strategic Initiatives (Expansion, diversification strategies)

6.3. Mergers and Acquisitions (Recent mergers, financial impact)

6.4. Investment Analysis

6.4.1. Private Equity Investments

6.4.2. Government Grants (Investment in the sugar sector)

6.4.3. Public-Private Partnerships (New collaborations for refinery projects)

7. KSA Sugar Market Regulatory Framework

7.1. Sugar Import Policies (Regulations, tariffs)

7.2. Government Incentives for Local Production (Subsidies, food security initiatives)

7.3. Compliance and Certification Standards (Saudi food and safety standards)

8. KSA Sugar Market Future Size (in USD Billion)

8.1. Future Market Size Projections (Volume and value growth)

8.2. Key Factors Driving Future Market Growth (Expansion of domestic refining, population growth, consumer trends)

9. KSA Sugar Market Future Segmentation

9.1. By Product Type (in Value %)

9.2. By End-User (in Value %)

9.3. By Technology (in Value %)

9.4. By Form (in Value %)

9.5. By Region (in Value %)

10. KSA Sugar Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Available Market, Serviceable Obtainable Market)

10.2. Customer Cohort Analysis (Food and beverage manufacturers, retailers, investors)

10.3. Marketing Initiatives (Brand positioning, digital marketing strategies)

10.4. White Space Opportunity Analysis (Identifying untapped areas for growth)

Research Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step: 2 Market Building

Collating statistics on the KSA Sugar market over the years and analyzing the penetration of products as well as the ratio of suppliers to compute the revenue generated for the market. We will also review product quality statistics to ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts from different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our research team approaches multiple sugar manufacturers and suppliers to understand product segments, sales trends, consumer preferences, and other parameters. This supports us in validating the statistics derived from the bottom-up approach of these sugar manufacturers and suppliers.

Frequently Asked Questions

01. How big is the KSA Sugar Market?

The KSA sugar market was valued at USD 398 million, driven by increasing domestic consumption and government efforts to boost local production.

02. Who are the major players in the KSA Sugar market?

Key players in the KSA sugar market include Savola Group, United Sugar Company, Olayan Group, and Al Reef Sugar Refinery.

03. What are the growth drivers of the KSA Sugar market?

Growth drivers of the KSA sugar market include rising demand from the food and beverage industry, government support for local production, and increasing per capita sugar consumption in the country.

04. What are the KSA Sugar market challenges?

Challenges in the KSA sugar market include dependence on sugar imports, fluctuations in global sugar prices, and the impact of climate conditions on local sugarcane cultivation.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.