Saudi Arabia Warehousing Market Outlook to 2027

Driven by Government Support, demand for E-Commerce and Infrastructure Investment in the country

Region:Middle East

Author(s):Sayantan Chakraborty

Product Code:KR1333

June 2023

88

About the Report

The report provides a comprehensive analysis of the potential of Warehousing Industry in KSA. The report covers an overview and genesis of the industry, and market size in terms of revenue generated.

The report has market segmentation which includes segments by Market Segmentation by Ownership, City, End User by Revenues and more; growth enablers and drivers; challenges and bottlenecks; trends driving adoption trends; regulatory framework; end-user analysis, industry analysis, competitive landscape including competition scenario and market shares of major players. The report concludes with each market segmentation's future projections and analyst recommendations.

Market Overview:

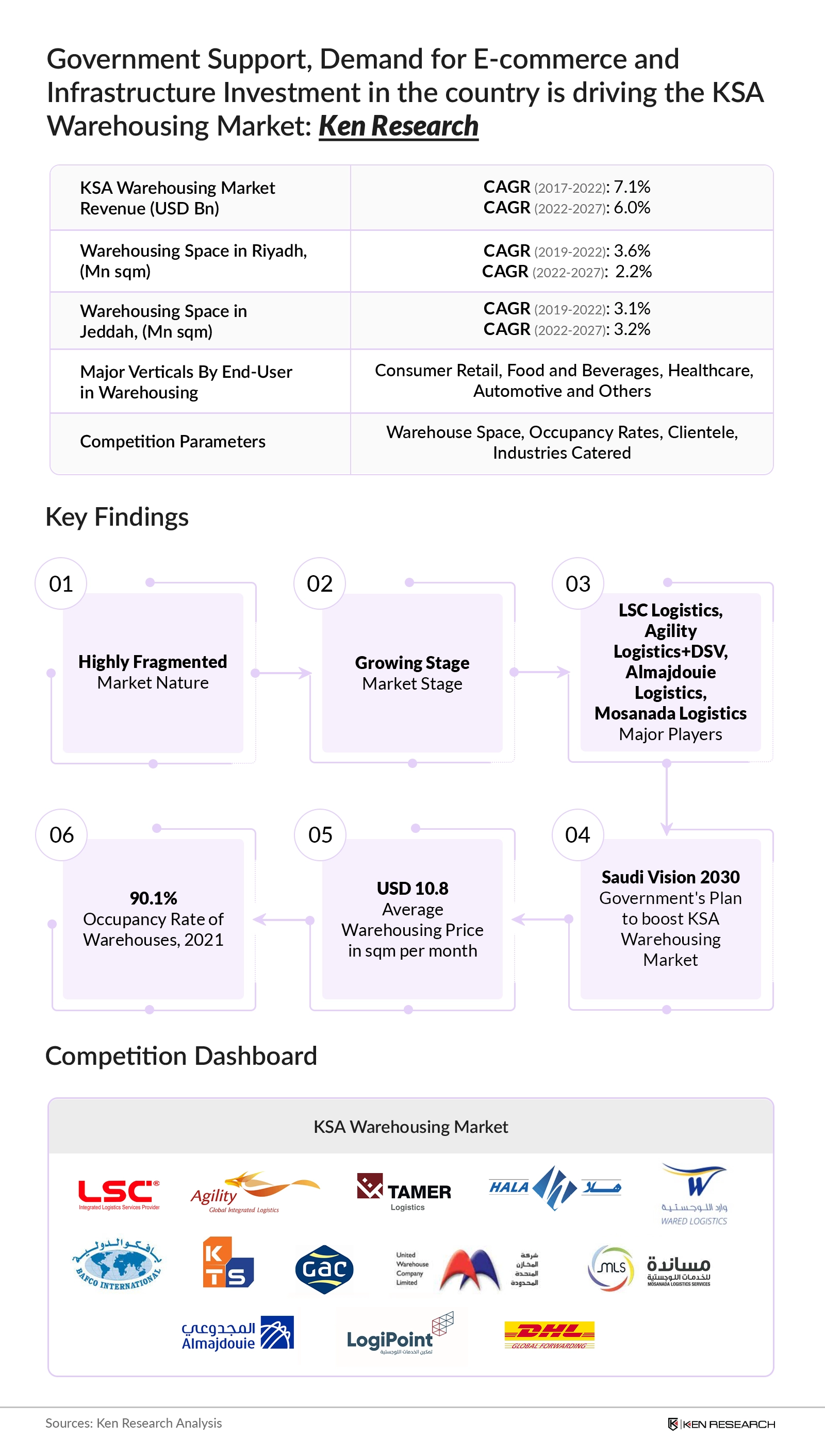

According to Ken Research estimates, the Market Size of KSA Warehousing has shown an increasing trend from 2017 to 2022. KSA's strategic location as a gateway between Europe, Asia, and Africa makes it an attractive hub for trade. The country has been actively promoting foreign trade and industrialization, attracting international companies to set up manufacturing facilities and distribution centers. This leads to an increased to support import, export, and local supply chains.

- There has been a significant rise in the number of 3PL companies in the country over the years. A rising number of logistic companies are shifting to renting out warehouses and fleet from 3PLs, thus leading to the growth of 3PLs in the country.

- KSA Warehousing Association (SLA) has begun piloting the use of Automated Guided Vehicles (AGVs) with local robotics firm Hope Technik in a third-party Warehousing (3PL) warehouse. It will help not only to reduce cost but also to minimize human errors and reduce time lags.

Key Trends by Market Segment:

By Ownership: Owned Companies dominated in Warehouse Market in Saudi Arabia, 2022.

By City: Jeddah has remained the most popular location for mainly due to supportive infrastructure, availability of manpower, location near the tourist cities of Mecca and Medina and city itself being a port city.

Competitive Landscape:

Saudi Arabia warehousing market is highly fragmented with many organized and unorganized small players concentrated in major cities like Riyadh, Jeddah and Dammam. Some of the top players are LSC Logistics, Agility Logistics, and Almajdouie Logistics.

Future Outlook:

Market Size of KSA Warehousing is expected to show an increasing trend from 2022 to 2027. The rapid shift of the distribution of food products from traditional markets toward supermarkets and convenience stores is increasing the need for reefer trucks as major distributors hire 3PL for shipping via insulated trucks. There are important elements that have fueled the expansion of cold storage facilities and cold storage logistics in Saudi Arabia including the adoption of advanced technologies like automation and WMS () to improve functionality and efficiency.

Scope of the Report

|

KSA Warehousing Market Segmentation |

|

|

By Ownership |

Owned 3PL |

|

By City |

Riyadh Jeddah Others including Damam and more |

|

By End-Users |

Consumer Retail Food and Beverages Healthcare Automotive Others |

|

By Business Model |

Industrial/Retail Warehouses CFS/ICD Warehouses Cold Storage Agriculture and Other Warehouses |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

E-commerce Companies

Third-Party Logistic Providers

Potential Market Entrants

Freight Forwarding Companies

Warehousing Companies

Cold Storage Companies

Industry Associations

Consulting Agencies

Government Bodies & Regulating Authorities

Time Period Captured in the Report:

Historical Period: 2017-2022

Base Year: 2022

Forecast Period: 2022-2027

Companies

Major Players Mentioned in the Report:

LSC Logistics

Agility Logistics+DSV

Almajdouie Logistics

Mosanada Logistics

Tamer Logistics

BAFCO International Logistics and Shipping Co.

Hala Supply Chain

United Warehousing Co.

Wared Logistics

Kanoo Terminal

Logipoint

DHL Global Forwarding

GAC

Table of Contents

1. Executive Summary

1.1 Executive Summary for Saudi Arabia Warehousing Market Outlook to 2027

2. Country Overview of Saudi ArabiaÂ

2.1 Saudi Arabia Country Overview

2.2 Saudi Arabia Population Analysis

3. Saudi Arabia Warehousing Market Overview and Genesis

3.1 Overview of Saudi Arabia’s Logistics Sector

3.2 Popular Economic Zones in Saudi Arabia

3.3 Industry Ecosystem- Saudi Arabia Warehousing Industry

3.4 Business Cycle and Genesis of Saudi Arabia Warehousing Market

4. Saudi Arabia Warehousing Market Size, 2022

4.1 Saudi Arabia Warehousing Market Size, 2017-2022

5. Saudi Arabia Warehousing Market Segmentations, 2022

5.1 Saudi Arabia Warehouse Market Segmentation by Business Model, 2022

5.2 Saudi Arabia Warehouse Market Segmentation by End Users, 2022Â

5.3 Saudi Arabia Warehouse Market Segmentation by Area and by 3PL/Owned, 2022

5.4 Saudi Arabia Warehouse Market Segmentation by Regions, 2022

5.5 Space Segmentation By Type of Warehouses in Riyadh: Demand Side, 2019-2022

5.6 Riyadh Warehousing Supply-Demand Gap Analysis,2019-2022

5.7 Space Segmentation By Type of Warehouses in Jeddah: Supply Side, 2019-2022

5.8 Space Segmentation By Type of Warehouses in Jeddah: Demand Side, 2019-2022

5.9 Jeddah Warehousing Supply-Demand Gap Analysis, 2019-2022Â

6. Industry Analysis of Saudi Arabia Warehousing Market

6.1 Trends and Developments of Saudi Arabia Warehousing Market

6.2 Issues and Challenges of Saudi Arabia Warehousing Market

6.3 Warehouse Registration Application through GAZT Portal

6.4 Bonded Warehouses in Saudi Arabia

6.5 Commercial Models in Saudi Arabia Warehousing Market

6.6 Government Warehouse Rules and Procedures        Â

6.7 Modern Warehousing Technologies Ecosystem in Saudi Arabia Warehousing Market

6.8 Evolution of Warehousing Technology Automation

6.9 Major Digitalization Milestones Achieved by the Saudi Government

6.10 Impact of COVID-19 on Saudi Arabia Logistics

7. End User Analysis of Saudi Arabia Warehousing Market

7.1 Decision Making Parameters of End Users in Saudi Arabia Warehousing Market

7.2 Analysis of End Users in Saudi Arabia Warehousing Market

7. Competition Framework

7.3 Cross Comparison between Major Warehousing Companies in Saudi Arabia

8. Future Outlook and Market Size for Saudi Arabia Warehousing Market 2022-2027

8.1 Saudi Arabia Warehousing Market Future Market Size and Projections, 2022-2027

9. Future Outlook and Market Segmentations for Saudi Arabia Warehousing Market, 2022-2027

9.1 Saudi Arabia Warehousing Market Future Segmentation on the basis of Business Model andÂ

End Users, 2022-2027

9.2 Saudi Arabia Warehousing Market Future Segmentation on the basis of City, Ownership,Â

and Type, 2022-2027

9.3 Space Segmentation By Type of Warehouses in Riyadh: Supply Side, 2022-2027

9.4 Space Segmentation By Type of Warehouses in Riyadh: Demand Side, 2022-2027

9.5 Riyadh Warehousing Supply-Demand Gap Analysis, 2022-2027Â

9.6 Space Segmentation By Type of Warehouses in Jeddah: Supply Side, 2022-2027

9.7 Space Segmentation By Type of Warehouses in Jeddah: Demand Side, 2022-2027

9.8 Jeddah Warehousing Supply-Demand Gap Analysis, 2022-2027Â

10. Analyst Recommendations

10.1 Cluster Analysis: KSA Warehousing Market

10.2 Recommendations for setting up a warehouse in Saudi Arabia

10.3 Ansoff’s Matrix

10.4 Ansoff’s Matrix– Market Penetration

10.5 Ansoff’s Matrix– Product DevelopmentÂ

10.6 Ansoff’s Matrix– Market Development

10.7 Ansoff’s Matrix– Diversification

11. Research Methodology

11.1 Market Definitions

11.2 Methodology Used for Primary, Secondary and Sanity Checking

11.3 Limitations and Future Conclusions

12. Appendix

12.1 Logistics Infrastructure in Saudi Arabia: Airports

12.2 Logistics Infrastructure in Saudi Arabia: Seaports

12.3 Logistics Infrastructure in Saudi Arabia: Road Network

12.4 Logistics Infrastructure in Saudi Arabia: Rail Network

Disclaimer Contact UsResearch Methodology

Step: 1Â Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on Warehousing over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Warehousing services. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research output:

Our team will approach multiple Warehousing and warehousing services providing channels and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Warehousing and warehousing providers.

Frequently Asked Questions

01 What is the Study Period of this Market Report?

The KSA Warehousing Market is covered from 2017–2027 in this report, including a forecast for 2022-2027.

02 What is the Future Growth Rate of the KSA Warehousing Market?

The KSA Warehousing Market is expected to witness a CAGR of ~6.9% over the next years.

03 What are the Key Factors Driving the KSA Warehousing Market?

Rising Cold Chain and Retail Industry, Technological Development along with Government Policies and Increase in Purchasing Power of Customers are likely to fuel the growth in the KSA Warehousing Market.

04 Which is the largest ownership Type Segment within the KSA Warehousing Market?

The self-ownership type segment held the largest share of the KSA Warehousing Market in 2022.

05 Who are the Key Players in the KSA Warehousing Market?

LSC Logistics, Agility Logistics, Almajdouie Logistics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.