Malaysia Automotive Aftermarket Service Market Outlook to 2028

Region:Asia

Author(s):Aditi Tewari, Rhythm, Rajat

Product Code:KR1475

February 2025

98

About the Report

Malaysia Automotive Aftermarket Service Market Overview

- The Malaysia Automotive Aftermarket Service Market service market is valued at MYR 33.9 bn, based on a five-year historical analysis. This growth is primarily driven by the increasing vehicle population, aging vehicles requiring frequent maintenance, and rising consumer awareness about the importance of regular vehicle servicing.

- Kuala Lumpur and Johor Bahru are key markets due to their high vehicle density and well-established automotive infrastructure. These cities have a significant concentration of vehicles, leading to a higher demand for maintenance and repair services. Additionally, numerous service centers and a robust supply chain in these urban areas contribute to their dominance in the automotive aftermarket service sector.

Malaysia Automotive Aftermarket Service Market Segmentation

Malaysia Automotive Aftermarket Service Market is divided into further segments:

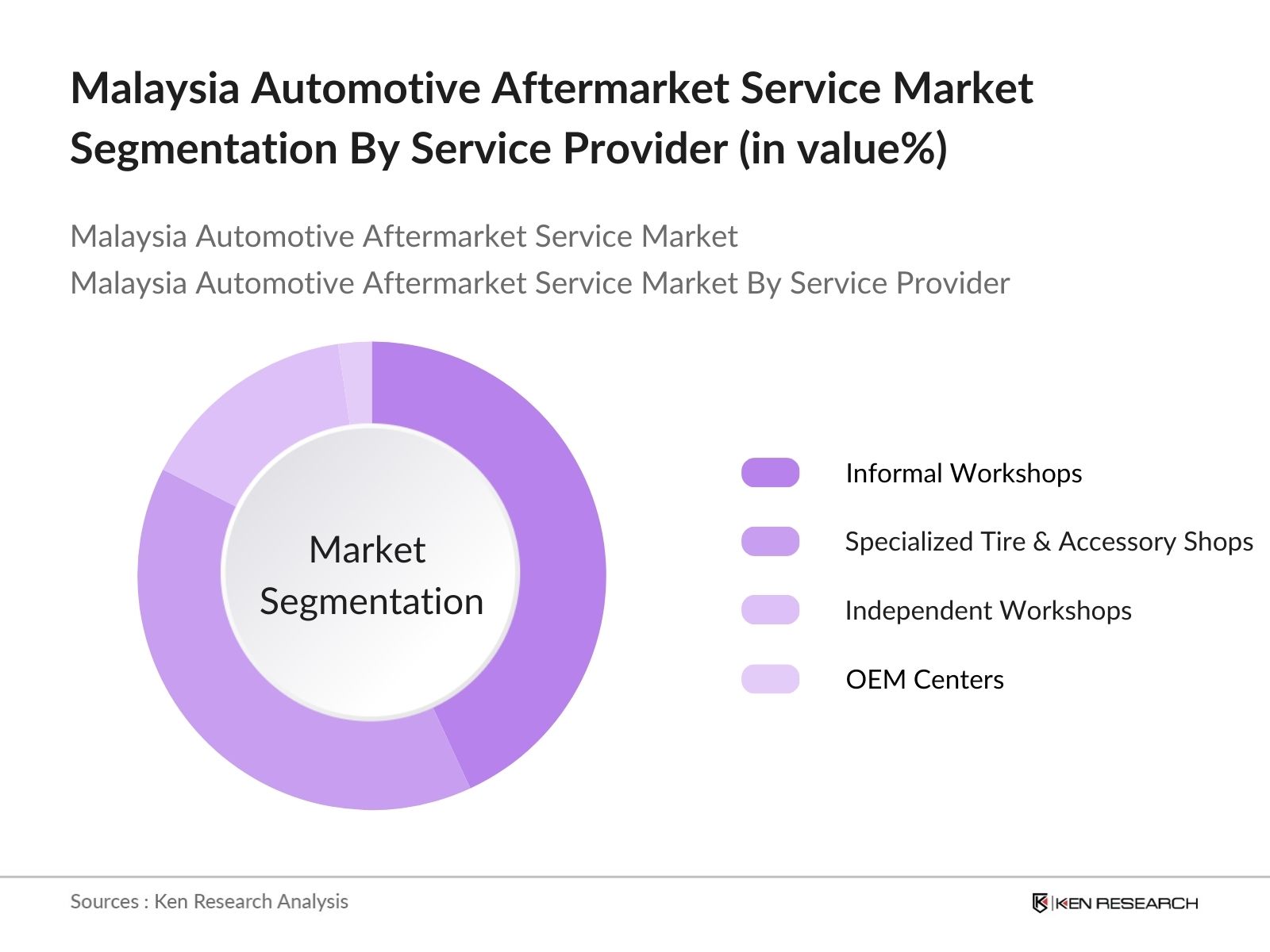

- By Service Provider: The Malaysia Automotive Aftermarket Service Market service market can be segmented by Service Provider into Informal Workshops, Specialized Tire & Accessory Shops, Independent Workshops, and OEM Centers. Informal workshops lead the market due to their affordability and widespread presence, particularly in suburban and rural areas. These workshops typically offer basic maintenance and repair services at lower prices compared to formal establishments, making them a popular choice among budget-conscious consumers.

- By Service Type: The Malaysia Automotive Aftermarket Service Market service market can be segmented by Service type Maintenance and Repair, Parts Replacement, Oil & Lubricant Change, Car Wash & Detailing, Tire Replacement & Servicing, and others (Roadside Assistance, Battery Services, etc.). Maintenance and repair services dominate the market due to the necessity of periodic servicing for vehicle longevity. These services encompass a wide range of activities, including engine oil filter changes, brake fluid replacements, battery checks, fuel filter changes, spark plug replacements, and radiator coolant services.

Malaysia Automotive Aftermarket Service Market Competitive Landscape

The Malaysia Automotive Aftermarket Service Market service market is characterized by the presence of major global and local automotive companies. These companies have established a strong presence in the market through their extensive service networks, technological advancements, and customer-oriented service offerings.

Malaysia Automotive Aftermarket Service Industry Analysis

Market Growth Drivers

- No End-of-Life Vehicle (ELV) Policy: The absence of an End-of-Life Vehicle (ELV) policy in Malaysia has resulted in a growing number of older cars on the road. As vehicles age, they typically require more frequent maintenance and repairs. Older cars are more prone to mechanical issues, leading to a heightened demand for servicing within the automotive aftermarket.

- Increase in Domestic Demand for Automobiles: Domestic demand is driven by Malaysias growing middle class (~14 million in 2023, annual growth rate 1.09%). The aging vehicle fleet necessitates regular maintenance and repairs, leading to increased patronage of service centers. Consumers are becoming more aware of the importance of regular servicing to ensure vehicle longevity and safety.

- Promotions and Offers by Service Providers: Discounts of up to 20-30%, value-added services, and extended warranty of up to 2 years are being used as promotional strategies by aftermarket service providers. The automotive aftermarket in Malaysia is characterized by a diverse range of service providers, including multi-brand workshops and OEM centers.

Market Challenges

- Dependence on Imports for Spare Parts: Dependence on imports makes Malaysia's automotive aftermarket industry susceptible to global supply chain issues, leading to delays in obtaining parts and fluctuating costs. Reliance on imported components can result in increased prices for parts and services, while also hindering the development of local manufacturing.

- Regulatory and Compliance Challenges: Imported vehicles and spare parts must follow strict regulations under the 1996 Environmental Quality regulations in Malaysia, set by the Ministry of International Trade & Industry (MITI). Compliance requirements such as PUSKAPOM car inspection need to be followed, adding to operational challenges for service providers.

Malaysia Automotive Aftermarket Service Future Market Outlook

Over the next five years, the Malaysia Automotive Aftermarket Service Market service market is expected to show significant growth reaching a market size of MYR 50.4 Bn by 2028  driven by continuous government support, advancements in vehicle technology, and increasing consumer demand for reliable and efficient maintenance services. The government's initiatives to promote energy-efficient vehicles and the adoption of advanced automotive technologies are anticipated to create new opportunities for service providers.

driven by continuous government support, advancements in vehicle technology, and increasing consumer demand for reliable and efficient maintenance services. The government's initiatives to promote energy-efficient vehicles and the adoption of advanced automotive technologies are anticipated to create new opportunities for service providers.

Market Opportunities

- Expanding Automotive Sector: Malaysia, a longstanding leader in Southeast Asias automotive industry, is expected to strengthen its role in the regions economic landscape. With the sector already contributing around 4% of the countrys GDP (approximately MYR 37.5 billion) and employing over 700,000 people, further growth is anticipated. Increasing awareness of routine vehicle maintenance, combined with the continued absence of an ELV policy, will likely drive higher automotive ownership and frequent visits to service centers in the coming years.

- Rising Purchasing Power and Economic Growth: Malaysias GDP per capita, adjusted for purchasing power parity, has been experiencing steady growth. As economic conditions improve and the standard of living rises, consumer spending on vehicle servicing and aftermarket services is expected to increase. This upward trend will enhance demand for premium vehicle maintenance, spare parts, and technologically advanced automotive services.

Scope of the Report

|

Segment |

Sub-Segments |

|---|---|

|

Service Provider Type |

Informal Workshops Specialized Tire & Accessory Shops Independent Workshops OEM Centers |

|

Service Type |

Maintenance and Repair Parts Replacement Oil & Lubricant Change Car Wash & Detailing Tire Replacement & Servicing Others (Roadside Assistance, Battery Services, etc.) |

|

Region |

Central South North East East Coast |

Products

Key Target Audience

- Automotive Manufacturers

- Automotive Spare Parts Suppliers

- Multi-Brand Car Service Companies

- OEM Car Service Providers

- Fleet Operators and Leasing Companies

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of International Trade & Industry (MITI), Road Transport Department Malaysia (JPJ), Malaysian Investment Development Authority (MIDA))

- Technology Solution Providers

Companies

Players Mentioned in the Market

- Mercedes-Benz Malaysia Sdn. Bhd

- Mitsubishi Motors Malaysia Sdn. Bhd

- Bermaz Motor Sdn. Bhd (Mazda)

- Edaran Tan Chong Motor Sdn. Bhd (Nissan)

- GVT Sdn. Bhd

Table of Contents

1. Executive Summary

1.1 Executive Summary: Malaysia Automotive Aftermarket Service Market Service Industry

2. Market Overview and Genesis of Malaysia Automotive Aftermarket Service Market Service Industry

2.1 Market Overview of Malaysia Automotive Aftermarket Service Market Service Industry

2.2 Ecosystem of Malaysia Automotive Aftermarket Service Market Service Industry

2.3 Value Chain Analysis of Malaysia Automotive Aftermarket Service Market Service Industry

2.4 Operating Model for Branded and OEM Workshops in Malaysia

2.5 Operating Model for Independent Workshops in Malaysia

3. Market Sizing of Malaysia Automotive Aftermarket Service Market Service Industry

3.1 Market Sizing of Malaysia Automotive Aftermarket Service Market Service Industry, 2019-2028F

4. Market Segmentation of Malaysia Automotive Aftermarket Service Market Service Industry

4.1 Market Segment Analysis: Number of Centers by Service Provider, 2024-2028F

4.2 Market Segment Analysis: Revenue by Service Provider, 2024-2028F

4.3 Market Segment Analysis: Revenue by Service Type, 2024-2028F

4.4 Market Segment Analysis: Revenue by Vehicle Type, 2024-2028F

4.5 Market Segment Analysis: Revenue by Region, 2024-2028F

4.6 Market Segment Analysis: Number of Centers by Region, 2024-2028F

4.7 Market Segment Analysis: Revenue by Location Type, 2024-2028F

5. Consumer Behavior Analysis of Malaysia Automotive Aftermarket Service Market Service Industry

5.1 Preferences in Automotive Aftermarket Services

5.2 Factors Influencing Choice of Service Provider

5.3 Analysis of Service Frequency and Expenditure Patterns

6. Industry Analysis of Malaysia Automotive Aftermarket Service Market Service Industry

6.1 Growth Drivers in Malaysia Automotive Aftermarket Service Market Service Market

6.2 Key Restraints and Challenges in Malaysia Automotive Aftermarket Service Market Service Market

6.3 Opportunities in Malaysia Automotive Aftermarket Service Market Service Industry

6.4 Porter Five Forces Analysis of Malaysia Automotive Aftermarket Service Market Service Industry

6.5 SWOT Analysis of Malaysia Automotive Aftermarket Service Market Service Industry

6.6 PESTEL Analysis of Malaysia Automotive Aftermarket Service Market Service Industry

6.7 Technological Innovations in the Malaysia Automotive Aftermarket Service Market Service Industry

6.8 Regulatory Requirements & Government Initiatives Impacting the Malaysia Automotive Aftermarket Service Market Service Market

7. Competition Landscape of Key Players in the Malaysia Automotive Aftermarket Service Market Service Industry

7.1 Competition Overview of Malaysia Automotive Aftermarket Service Market Service Industry

7.2 Market Share Analysis of Major OEM Players in the Malaysia Automotive Aftermarket Service Market Service Industry

7.3 Market Share Analysis of Major Independent Players in the Malaysia Automotive Aftermarket Service Market Service Industry

7.4 Cross Comparison of Major OEM Automotive Aftermarket Service Providers in Malaysia

7.5 Cross Comparison of Major Independent Automotive Aftermarket Service Providers in Malaysia

8. Analyst Recommendations

8.1 Sales Strategies

8.2 Portfolio Expansion & Technology Integration

8.3 Case Studies

Disclaimer

Conatct Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders in the Malaysia Automotive Aftermarket Service Market Service Market. This step is underpinned by extensive desk research, utilizing government portals, company reports, and industry articles to gather comprehensive industry-level information. The primary objective is to identify and define critical variables that influence market dynamics.

Step 2: Market Analysis and Data Collection

In this phase, historical data is compiled and analyzed, assessing market penetration, revenue generation, and service center density. The analysis also incorporates a top-down and bottom-up approach, ensuring accuracy in revenue estimates. Additionally, secondary research sources such as company websites, magazines, and trade publications provide industry insights.

Step 3: Primary Research and Expert Consultation

Market hypotheses are validated through Computer-Assisted Telephonic Interviews (CATI) with OEMs, independent workshops, spare distributors, and other industry stakeholders. These interviews offer insights into market trends, challenges, and opportunities, directly from key industry participants. Companies contacted for primary research include Perodua Auto Corporation Sdn. Bhd, Proton Holdings Berhad, UMW Toyota Motor Sdn Bhd, Honda Malaysia Sdn. Bhd, Mercedes-Benz Malaysia Sdn. Bhd, Mitsubishi Motors Malaysia Sdn. Bhd, Bermaz Motor Sdn. Bhd (Mazda), Edaran Tan Chong Motor Sdn. Bhd (Nissan), AMIM Holdings Sdn Bhd (Ford), Hyundai-Sime Darby Motors Sdn. Bhd, Chery Auto Malaysia Sdn. Bhd (Janecoo), and others such as GoMechanic and My Tukar.

Step 4: Sanity Checking and Data Validation

The collected data undergoes a rigorous cross-sanity check between primary and secondary sources. Secondary sources such as government statistics, company filings, and industry trade reports are used to verify findings. The analysis is further refined by identifying the total number of cars serviced and the average invoice generated, ensuring a high degree of accuracy and reliability.

Frequently Asked Questions

01. How big is the Malaysia Automotive Aftermarket Service Market Service Market?

The Malaysia Automotive Aftermarket Service Market Service Market was valued at MYR 33.9 bn, driven by increasing vehicle ownership, the absence of an End-of-Life Vehicle (ELV) policy, and growing consumer demand for maintenance and repair services.

02. What are the key challenges in the Malaysia Automotive Aftermarket Service Market Service Market?

Challenges in the Malaysia Automotive Aftermarket Service Market Service Market include a high reliance on imported spare parts, leading to fluctuating costs and supply chain issues. Regulatory compliance requirements, increasing competition among independent service providers, and the need for skill upgrades to service electric vehicles also pose significant hurdles.

03. Who are the major players in the Malaysia Automotive Aftermarket Service Market Service Market?

Key players in the Malaysia Automotive Aftermarket Service Market Service Market include Perodua Auto Corporation Sdn. Bhd, Proton Holdings Berhad, UMW Toyota Motor Sdn Bhd, Honda Malaysia Sdn. Bhd, Mercedes-Benz Malaysia Sdn. Bhd, Mitsubishi Motors Malaysia Sdn. Bhd, Bermaz Motor Sdn. Bhd (Mazda), Edaran Tan Chong Motor Sdn. Bhd (Nissan), and Hyundai-Sime Darby Motors Sdn. Bhd.

04. What are the growth drivers of the Malaysia Automotive Aftermarket Service Market Service Market?

The Malaysia Automotive Aftermarket Service Market Service Market is propelled by the increasing number of aging vehicles, rising disposable incomes, the governments incentives for local automotive production, and technological adoption in service centers. Digital platforms for service bookings and diagnostic solutions further enhance market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.