MEA Boat and Ship MRO Market Outlook to 2030

Region:Global

Author(s):Yogita Sahu

Product Code:KROD5387

December 2024

82

About the Report

MEA Boat and Ship MRO Market Overview

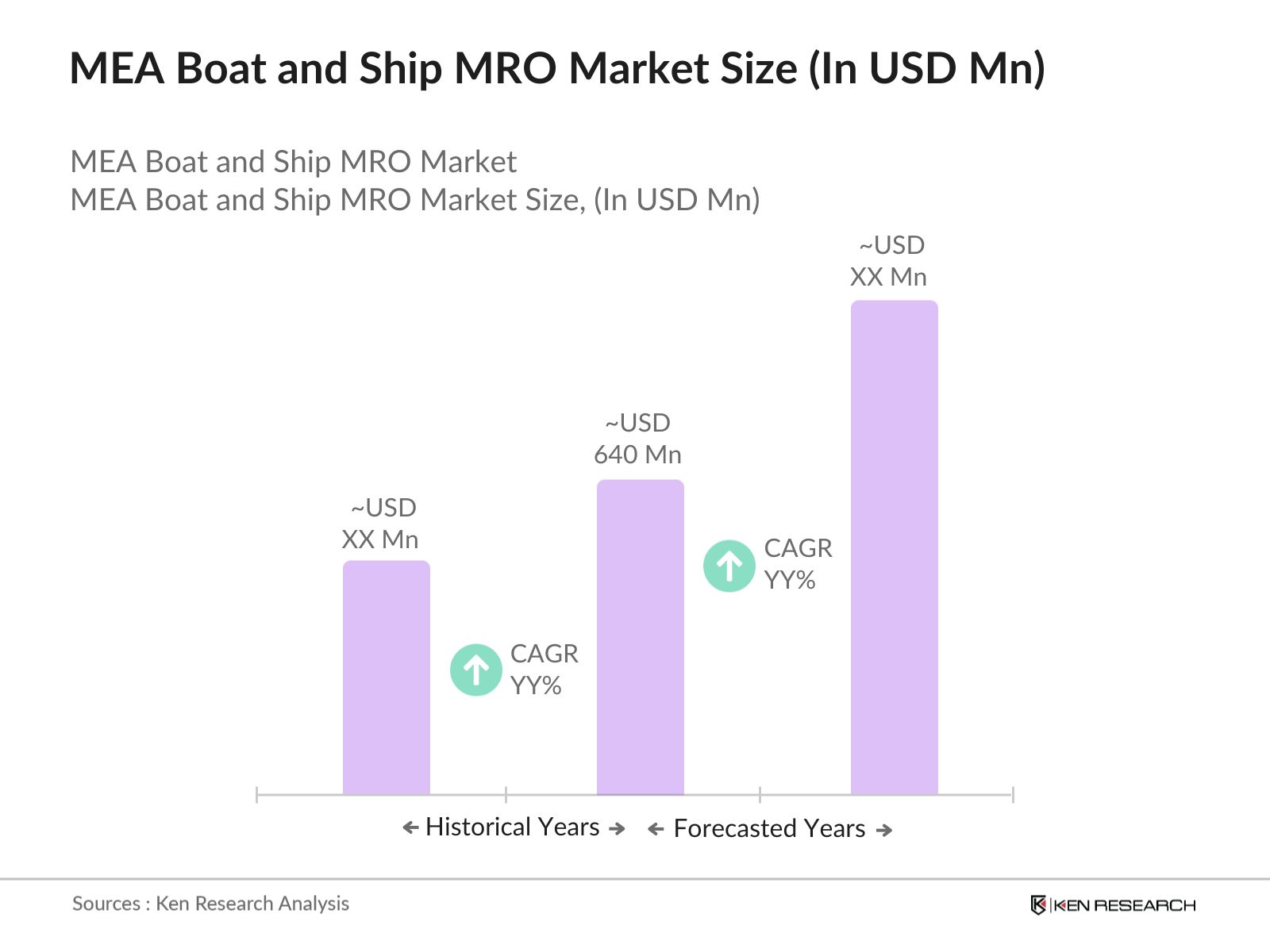

- The MEA Boat and Ship MRO market is valued at USD 640 million, driven by the expansion of maritime trade and a growing demand for maintenance services due to the aging fleet of vessels. Governments in the region, particularly in the UAE and Saudi Arabia, have heavily invested in naval and maritime infrastructure, fueling the growth of MRO services.

- The market is primarily dominated by the UAE and Saudi Arabia due to their strategic geographic locations as maritime hubs and robust port infrastructures. The UAE, home to Jebel Ali Port, attracts significant MRO activities with its advanced facilities and skilled workforce. Meanwhile, Saudi Arabias investments in Vision 2030 and naval fleet expansion further consolidate its leadership in the market.

- The UAE government has developed maritime clusters, such as the Dubai Maritime City, spanning over 2.5 million square meters. These clusters aim to centralize maritime services, including MRO facilities, to enhance efficiency and attract global maritime businesses.

MEA Boat and Ship MRO Market Segmentation

By MRO Type: The market is segmented by MRO type into engine MRO, component MRO, dry dock MRO, modifications, and others. Recently, engine MRO has dominated this segment, attributed to the increasing complexity and need for regular servicing of modern marine engines. Advances in propulsion systems, such as hybrid engines, have also heightened the focus on engine-specific maintenance, making it a critical area within MRO services.

By Vessel Type: The market is segmented by vessel type into boats, yachts, commercial vessels, naval vessels, and offshore support vessels. Commercial vessels hold the largest market share due to their extensive use in transporting goods across regional and international waters. Their frequent operations and reliance on well-maintained engines and hulls contribute significantly to the demand for MRO services.

MEA Boat and Ship MRO Market Competitive Landscape

The market is characterized by several key players, both regional and global. Companies like Wrtsil Corporation and Rolls-Royce Holdings dominate the landscape with advanced MRO solutions, while regional players benefit from localized expertise.

MEA Boat and Ship MRO Market Analysis

Market Growth Drivers

- Expansion of Maritime Trade Routes: The Middle East and Africa (MEA) region has witnessed an increase in maritime trade activities. The Port of Jebel Ali in the UAE handled over 14 million TEUs (Twenty-Foot Equivalent Units) in 2023, reflecting its pivotal role in global shipping. This surge in trade necessitates robust Maintenance, Repair, and Overhaul (MRO) services to ensure vessel reliability and efficiency.

- Aging Fleet Requiring Maintenance: A substantial portion of the commercial shipping fleet operating in the MEA region comprises vessels over 15 years old. For instance, the average age of tankers in the region is around 17 years. Older vessels demand more frequent and comprehensive MRO services to comply with safety standards and maintain operational efficiency.

- Government Investments in Naval Infrastructure: Governments in the MEA region are investing heavily in naval capabilities. Saudi Arabia allocated over USD 20 billion in 2023 towards naval modernization programs, including the procurement of new vessels and the enhancement of existing ones. Such investments drive the demand for MRO services to support and sustain the expanded naval fleet.

Market Challenges

- High Operational Costs: The cost of conducting MRO services in the MEA region is substantial. Dry docking a medium-sized vessel can cost between USD 500,000 to USD 1 million, depending on the scope of work. These high expenses can deter shipowners from undertaking necessary maintenance, risking vessel performance and safety.

- Regulatory Compliance Hurdles: The maritime industry in the MEA region is subject to stringent international regulations. Compliance with standards set by the International Maritime Organization (IMO) requires significant investment in MRO activities. Non-compliance can result in penalties, detentions, and loss of business opportunities.

MEA Boat and Ship MRO Market Future Outlook

Over the next five years, the MEA Boat and Ship MRO industry is expected to see consistent growth due to increasing investment in maritime infrastructure and advancements in digital MRO solutions. The rising use of sustainable technologies and the incorporation of artificial intelligence in maintenance diagnostics will further propel market expansion, addressing the challenges of operational efficiency and environmental compliance.

Future Market Opportunities

- Integration of Artificial Intelligence (AI) in MRO Services: Over the next five years, the market will witness increased adoption of AI for predictive maintenance. AI-based algorithms will analyze real-time operational data, allowing MRO providers to anticipate component failures and optimize repair schedules.

- Increased Focus on Decarbonization: Driven by IMO's 2050 decarbonization targets, the MEA market will see a shift toward eco-friendly maintenance practices. For example, the development of low-carbon ship coatings and bio-lubricants is expected to become a norm in MRO services. Facilities in key regions like the UAE and Saudi Arabia will adopt greener technologies, processing up to 60% of their annual maintenance work using sustainable methods by 2029.

Scope of the Report

|

MRO Type |

Engine MRO |

|

Component MRO |

|

|

Dry Dock MRO |

|

|

Modifications |

|

|

Other MRO Types |

|

|

Vessel Type |

Boats |

|

Yachts |

|

|

Commercial Vessels |

|

|

Naval Vessels |

|

|

Offshore Support Vessels |

|

|

Application |

Private |

|

Commercial |

|

|

Defense |

|

|

Service Provider |

Original Equipment Manufacturers (OEMs) |

|

Independent Service Providers |

|

|

In-house Maintenance Teams |

|

|

Region |

United Arab Emirates |

|

Saudi Arabia |

|

|

South Africa |

|

|

Egypt |

|

|

Nigeria |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Maritime Equipment Manufacturers

Naval and Maritime Fleet Operators

Logistics and Shipping Companies

Offshore Oil and Gas Companies

Vessel Owners and Operators

Government and Regulatory Bodies (e.g., UAE Ministry of Energy and Infrastructure)

Port Authorities

Investors and Venture Capitalist Firms

Companies

Players Mentioned in the Report:

Wrtsil Corporation

Rolls-Royce Holdings

Damen Shipyards Group

ABB Ltd.

Hempel Group

MAN Energy Solutions

Hyundai Heavy Industries

Daewoo Shipbuilding & Marine Engineering

MTU Friedrichshafen

Siemens AG

Table of Contents

1. MEA Boat and Ship MRO Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. MEA Boat and Ship MRO Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. MEA Boat and Ship MRO Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Maritime Trade Routes

3.1.2. Aging Fleet Requiring Maintenance

3.1.3. Government Investments in Naval Infrastructure

3.1.4. Rising Demand for Offshore Support Vessels

3.2. Market Challenges

3.2.1. Limited Skilled Workforce

3.2.2. High Operational Costs

3.2.3. Regulatory Compliance Hurdles

3.3. Opportunities

3.3.1. Technological Advancements in MRO Services

3.3.2. Strategic Partnerships and Joint Ventures

3.3.3. Development of Specialized Repair Facilities

3.4. Trends

3.4.1. Adoption of Predictive Maintenance Techniques

3.4.2. Integration of Digital Platforms for MRO Management

3.4.3. Emphasis on Sustainable and Eco-friendly Practices

3.5. Government Regulations

3.5.1. Maritime Safety Standards

3.5.2. Environmental Compliance Requirements

3.5.3. Incentives for Local MRO Service Providers

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. MEA Boat and Ship MRO Market Segmentation

4.1. By MRO Type (In Value %)

4.1.1. Engine MRO

4.1.2. Component MRO

4.1.3. Dry Dock MRO

4.1.4. Modifications

4.1.5. Other MRO Types

4.2. By Vessel Type (In Value %)

4.2.1. Boats

4.2.2. Yachts

4.2.3. Commercial Vessels

4.2.4. Naval Vessels

4.2.5. Offshore Support Vessels

4.3. By Application (In Value %)

4.3.1. Private

4.3.2. Commercial

4.3.3. Defense

4.4. By Service Provider (In Value %)

4.4.1. Original Equipment Manufacturers (OEMs)

4.4.2. Independent Service Providers

4.4.3. In-house Maintenance Teams

4.5. By Region (In Value %)

4.5.1. United Arab Emirates

4.5.2. Saudi Arabia

4.5.3. South Africa

4.5.4. Egypt

4.5.5. Nigeria

5. MEA Boat and Ship MRO Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Wrtsil Corporation

5.1.2. Rolls-Royce Holdings

5.1.3. MAN Energy Solutions

5.1.4. Hyundai Heavy Industries

5.1.5. Damen Shipyards Group

5.1.6. Daewoo Shipbuilding & Marine Engineering

5.1.7. ABB Ltd.

5.1.8. MTU Friedrichshafen

5.1.9. Kongsberg Gruppen

5.1.10. GE Marine

5.1.11. Hempel Group

5.1.12. Siemens AG

5.1.13. Bureau Veritas

5.1.14. Keppel Offshore & Marine

5.1.15. BAE Systems

5.2. Cross Comparison Parameters (Revenue, Headquarters, Inception Year, Number of Employees, Market Share, Regional Presence, R&D Investments, Product Offerings)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. MEA Boat and Ship MRO Market Regulatory Framework

6.1. Maritime Safety Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. MEA Boat and Ship MRO Future Market Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. MEA Boat and Ship MRO Future Market Segmentation

8.1. By MRO Type (In Value %)

8.2. By Vessel Type (In Value %)

8.3. By Application (In Value %)

8.4. By Service Provider (In Value %)

8.5. By Country (In Value %)

9. MEA Boat and Ship MRO Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research begins with mapping the key stakeholders in the MEA Boat and Ship MRO market. This includes detailed desk research across proprietary databases, ensuring the identification of critical variables driving the market.

Step 2: Market Analysis and Construction

Historical data is compiled to assess market trends and the penetration of MRO services. A thorough evaluation of service quality and stakeholder relationships is conducted to ensure robust market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Industry-specific hypotheses are validated through interviews with experts from shipyards, MRO providers, and port authorities. This approach ensures accurate alignment of the data with real-world insights.

Step 4: Research Synthesis and Final Output

The final report synthesizes quantitative and qualitative data from various sources, offering actionable insights into market segmentation, growth drivers, and competitive dynamics.

Frequently Asked Questions

01. How big is the MEA Boat and Ship MRO Market?

The MEA Boat and Ship MRO market is valued at USD 640 million, driven by maritime trade expansion and increasing fleet maintenance requirements.

02. What are the challenges in the MEA Boat and Ship MRO Market?

Challenges in the MEA Boat and Ship MRO market include a limited skilled workforce, high operational costs, and stringent regulatory compliance requirements, which can hinder operational efficiency and profitability.

03. Who are the major players in the MEA Boat and Ship MRO Market?

Key players in the MEA Boat and Ship MRO market include Wrtsil Corporation, Rolls-Royce Holdings, Damen Shipyards, ABB Ltd., and Hempel Group, known for their innovation and strategic initiatives.

04. What are the growth drivers of the MEA Boat and Ship MRO Market?

The MEA Boat and Ship MRO market is propelled by advancements in predictive maintenance technologies, increasing maritime trade, and significant investments in naval and commercial fleet expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.