Middle East & Africa E-Commerce Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD4694

December 2024

91

About the Report

Middle East & Africa E-Commerce Market Overview

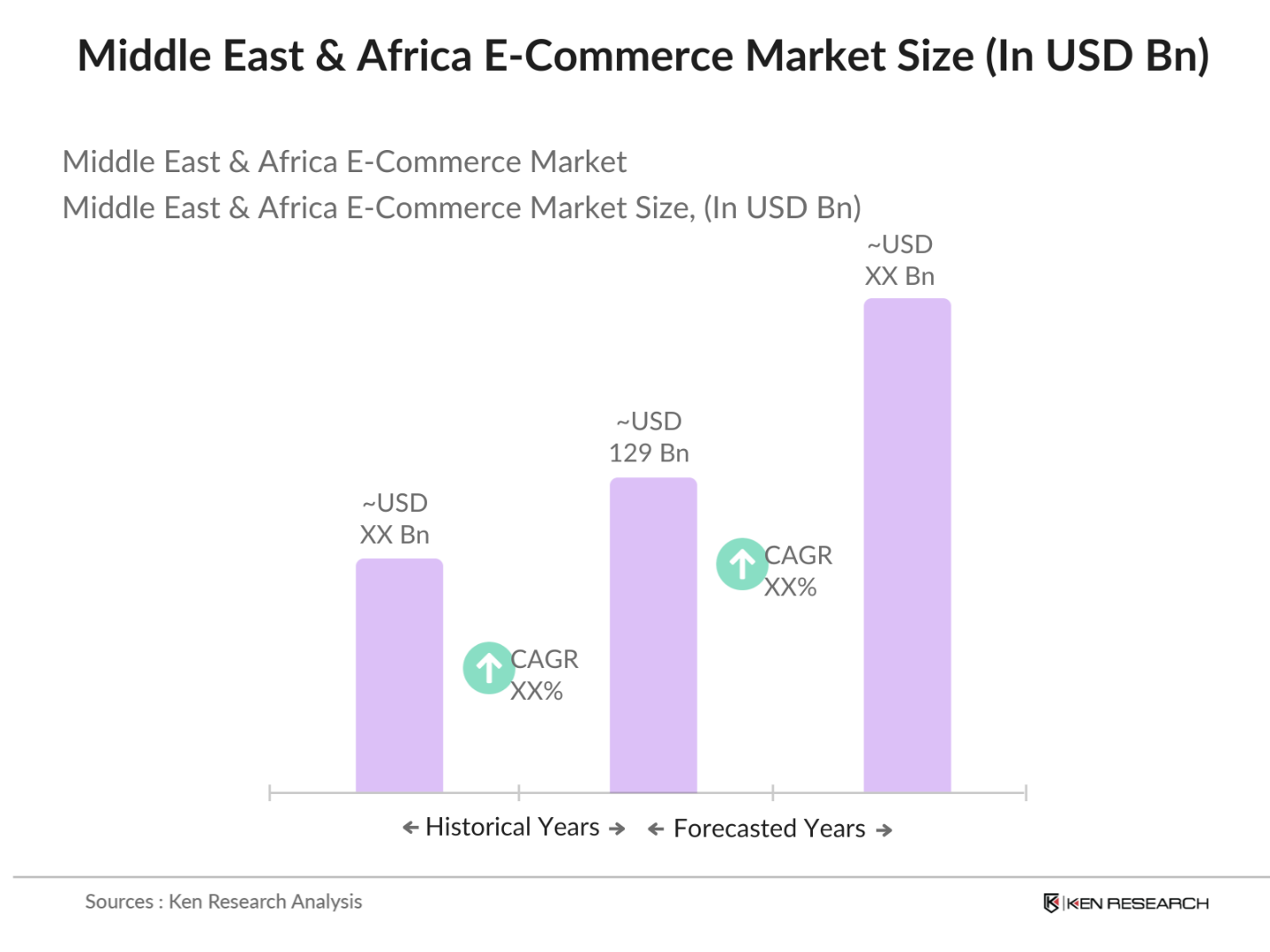

- The Middle East & Africa (MEA) e-commerce market is valued at USD 129 billion based on a five-year historical analysis. The market is driven by increased internet penetration, mobile commerce growth, and a rise in online shopping behaviors among millennials and Gen Z. With expanding infrastructure and a growing preference for digital payments, the MEA region has become a key player in the global e-commerce ecosystem. The adoption of secure payment gateways and digital wallets has further contributed to the steady market growth.

- Countries such as the UAE, Saudi Arabia, South Africa, and Nigeria dominate the MEA e-commerce market. These countries have emerged as leaders due to a combination of high smartphone penetration, robust internet infrastructure, and favorable regulatory environments that support e-commerce. The UAE and Saudi Arabia, in particular, benefit from high consumer spending and a culture of digital-first shopping, while Nigeria and South Africa are seeing a surge in e-commerce due to the increasing use of mobile devices and the growing middle class.

- Social commerce has grown rapidly in the region, with platforms like Instagram and WhatsApp becoming popular for online purchases. In Nigeria, over 40 million people used social media platforms for e-commerce in 2023, according to the Nigerian Communications Commission. The influence of social media influencers, particularly in the fashion and beauty industries, has spurred this trend, offering new avenues for brands to reach younger audiences.

Middle East & Africa E-Commerce Market Segmentation

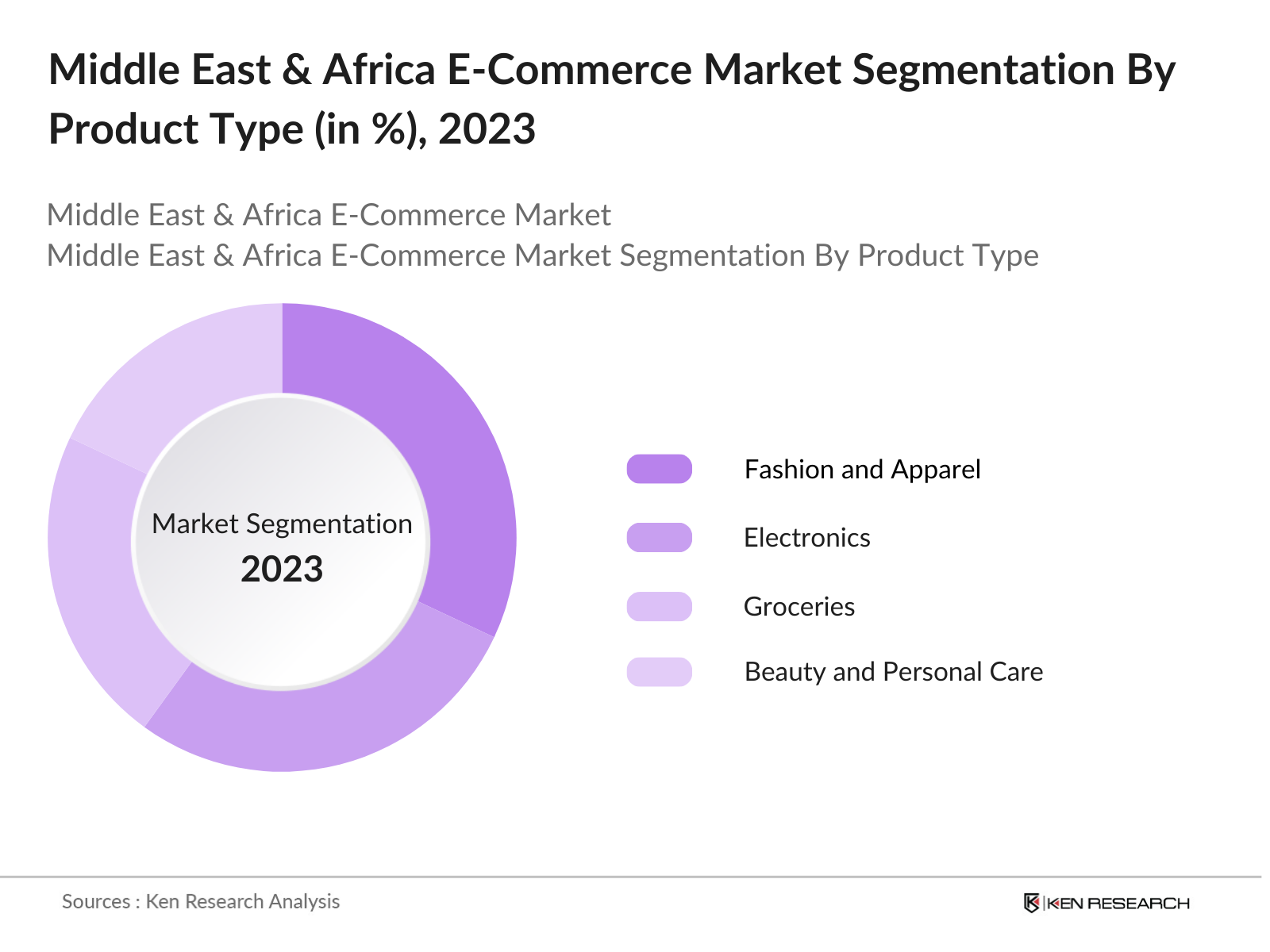

By Product Type: The Middle East & Africa e-commerce market is segmented by product type into fashion and apparel, electronics, groceries, and beauty and personal care. Fashion and apparel hold the dominant market share within this segment due to the strong demand for international brands, coupled with the rise of local designers offering online shopping. The increasing influence of social media and fashion influencers has propelled this segment forward, making it a crucial growth area for e-commerce platforms.

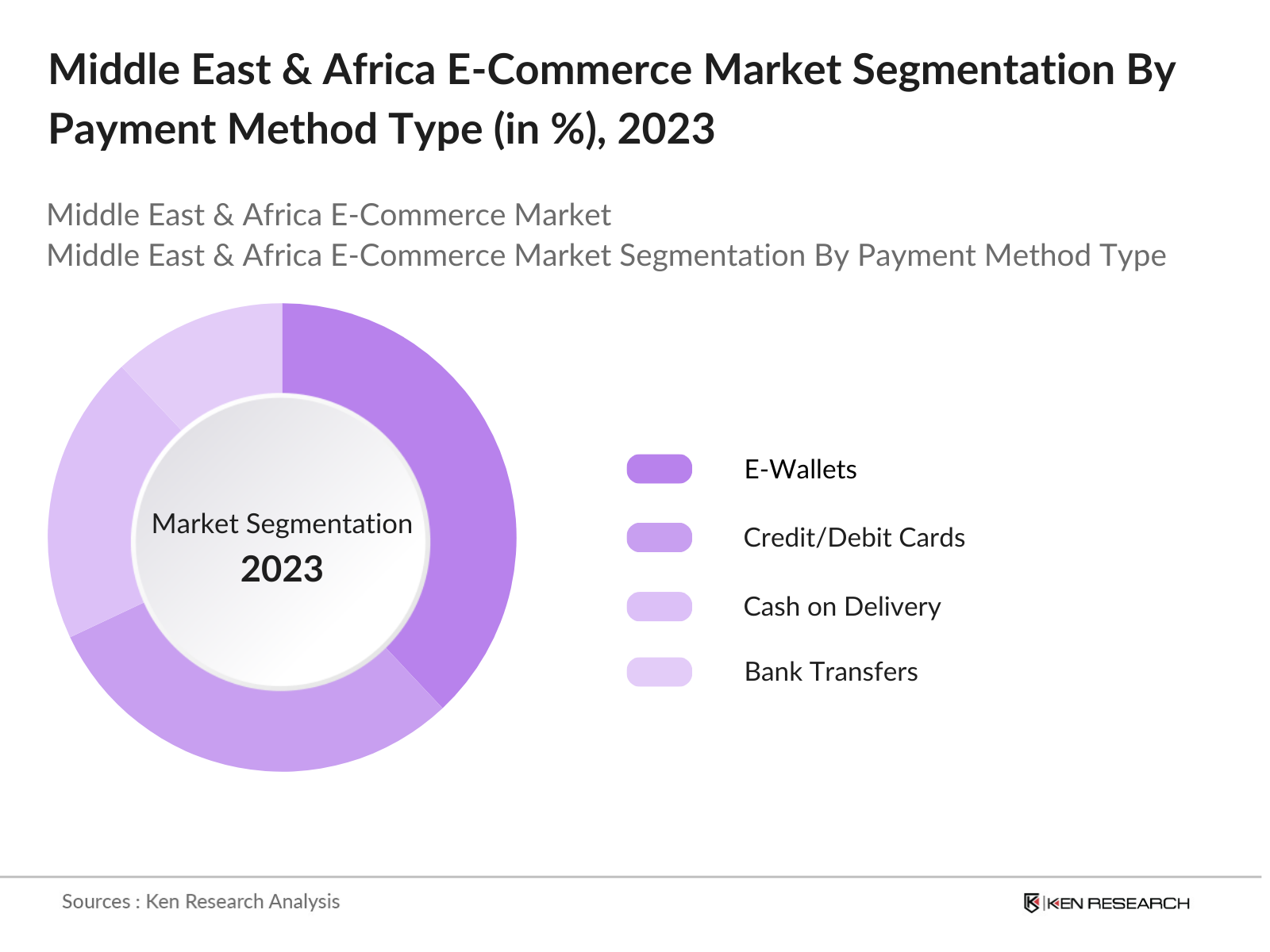

By Payment Method: The MEA e-commerce market is also segmented by payment methods into credit/debit cards, e-wallets, cash on delivery, and bank transfers. E-wallets have seen rapid adoption in the region and currently dominate the market share due to their ease of use and the growing number of fintech solutions in the region. Secure and convenient, e-wallets are increasingly favored over traditional methods, especially among younger consumers who prefer mobile-based payment systems.

Middle East & Africa E-Commerce Market Competitive Landscape

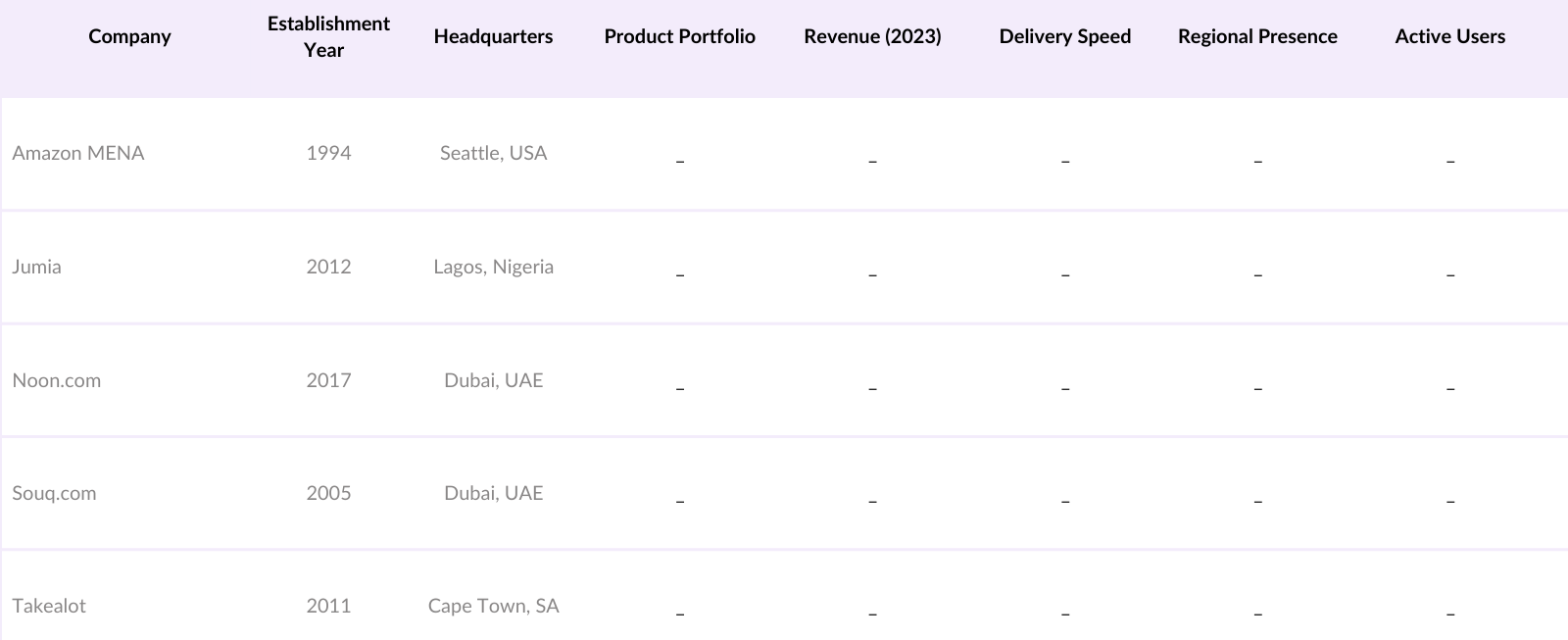

The MEA e-commerce market is dominated by a few key players, including both regional and international giants. These companies have established a strong presence in the market through strategic partnerships, acquisitions, and extensive logistical networks. Local players such as Jumia have capitalized on regional knowledge, while international brands like Amazon have leveraged their global expertise to capture a significant share of the market.

Middle East & Africa E-Commerce Industry Analysis

Growth Drivers

- Digital Transformation: The Middle East & Africa region has witnessed a surge in mobile commerce due to widespread smartphone use, with 1.2 billion mobile subscribers as of 2022, according to the GSMA. Cloud computing usage has also grown, particularly in regions like the UAE and South Africa, which have established robust cloud infrastructure. Additionally, e-wallet usage, driven by local fintech solutions, has reached 47 million users in the region as per the World Bank, making digital payments and online shopping more accessible. Government efforts to digitize economies, such as Saudi Arabias Vision 2030, have further accelerated this transformation.

- Increasing Smartphone Penetration: Smartphone penetration in the Middle East & Africa is expected to reach over 850 million users in 2024. Countries like Nigeria and Egypt have led this expansion, with Nigeria alone having 100 million active smartphone users by 2023, according to the Nigerian Communications Commission. This increasing penetration facilitates broader access to e-commerce platforms, as mobile devices become the primary means of online shopping across the region. Additionally, mobile broadband subscriptions have surpassed 60% of the population in key markets like South

- Rising Internet Access: Internet access has expanded significantly across the region, with 4G network availability covering over 70% of the population in many countries. As of 2023, broadband penetration in the Middle East & Africa stood at approximately 560 million users, with rapid rollouts of 5G in countries like Saudi Arabia, which has achieved 95% 4G/5G coverage. Governments in the region are investing heavily in broadband.

Market Challenges

- Logistical and Infrastructure Barriers: The Middle East & Africa face significant challenges in last-mile delivery, particularly in rural areas where road infrastructure is underdeveloped. According to the African Development Bank, over 35% of roads in Sub-Saharan Africa are unpaved, leading to delays and increased delivery costs. In addition, warehousing capabilities are limited, with only 7% of available warehousing space being considered modern or equipped for e-commerce fulfillment in markets like Nigeria.

- Regulatory and Taxation Constraints: Countries in the Middle East & Africa have introduced varying VAT and customs duties that complicate e-commerce operations. For instance, the implementation of VAT in the Gulf Cooperation Council (GCC) states in 2018 added 5% to the cost of goods. Customs procedures in countries like Nigeria also slow down delivery times, where clearance can take up to 10 days due to inefficient processing systems, according to the Nigerian Customs Service.

Middle East & Africa E-Commerce Market Future Outlook

Over the next five years, the MEA e-commerce market is expected to show significant growth, driven by rising smartphone penetration, growing internet access, and increasing demand for digital payment methods. The integration of artificial intelligence (AI) and machine learning (ML) in e-commerce platforms will enable better customer insights and more personalized shopping experiences. Additionally, improvements in logistics infrastructure and the expansion of omnichannel retail strategies will further accelerate growth in the region. The market's expansion will also be fueled by the growth of cross-border e-commerce, as more consumers look for international brands that may not be readily available in local markets. Governments across the region are beginning to offer support for digital economies, which will encourage new market entrants and foster competition, ultimately benefiting consumers.

Opportunities

- Emergence of E-Wallets and Fintech Innovations: E-wallets have gained significant traction in the region, with over 290 million mobile money accounts across Sub-Saharan Africa as of 2023, according to the GSMA. Local fintech innovations such as Egypts Fawry and Kenyas M-Pesa are expanding rapidly, providing an opportunity for e-commerce platforms to integrate digital payment solutions. With the Central Bank of Egypt reporting a 60% increase in e-wallet transactions in 2023, this trend supports the growth of e-commerce by making transactions more secure and convenient.

- Expansion of Omnichannel Strategies: The adoption of omnichannel strategies is increasing as retailers blend online and offline experiences to meet customer demands. In the UAE, 45% of retail businesses adopted omnichannel solutions in 2023, according to the Dubai Chamber of Commerce. The integration of physical stores with digital platforms provides consumers with more flexible shopping options, particularly in urban centers. Retailers in Egypt, South Africa, and Kenya have also embraced this trend, using click-and-collect models to streamline the customer experience.

Scope of the Report

|

Product Type |

Fashion and Apparel Electronics and Appliances Beauty and Personal Care Groceries and FMCG Home and Furniture |

|

Payment Method |

Credit/Debit Cards Cash on Delivery E-Wallets Bank Transfers |

|

Business Model |

B2C B2B C2C |

|

End-User |

Individual Consumers SMEs Large Enterprises |

|

Region |

GCC North Africa East Africa West Africa Southern Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Dubai Department of Economic Development, Nigerian Communications Commission)

Retailers and E-Commerce Industries

Payment Gateway Companies

Logistics and Supply Chain Companies

Technology Industries

E-Wallet and Fintech Companies

Telecom Companies

Companies

Players Mentioned in the Report

Amazon MENA

Jumia Technologies

Noon.com

Souq.com

Takealot

Carrefour UAE (Majid Al Futtaim)

Clicks Group

Zando (South Africa)

eBay MENA

Ubuy

Table of Contents

1. Middle East & Africa E-Commerce Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Middle East & Africa E-Commerce Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Middle East & Africa E-Commerce Market Analysis

3.1. Growth Drivers

3.1.1. Digital Transformation

3.1.2. Increasing Smartphone Penetration

3.1.3. Rising Internet Access

3.1.4. Youth Demographic

3.1.5. Cross-Border Trade

3.2. Market Challenges

3.2.1. Logistical and Infrastructure Barriers

3.2.2. Regulatory and Taxation Constraints

3.2.3. Trust and Security Concerns

3.2.4. High Cost of Payment Gateways

3.3. Opportunities

3.3.1. Emergence of E-Wallets and Fintech Innovations

3.3.2. Expansion of Omnichannel Strategies

3.3.3. Potential for AI & Machine Learning in Personalization

3.3.4. Growth of B2B E-Commerce

3.4. Trends

3.4.1. Rise of Social Commerce

3.4.2. Adoption of Same-Day Delivery Models

3.4.3. Proliferation of Direct-to-Consumer (D2C) Brands

3.4.4. Use of Big Data and Analytics for Customer Insights

3.5. Government Regulation

3.5.1. Data Protection and Privacy Laws (GDPR-style regulations, country-specific mandates)

3.5.2. E-Commerce Laws (digital transaction laws, consumer rights protection)

3.5.3. Cross-Border Trade Agreements (regional trade pacts, e-commerce agreements)

3.5.4. Support for SME E-Commerce Growth (subsidies, tax incentives)

3.6. SWOT Analysis

3.7. Stake Ecosystem (marketplace operators, payment gateway providers, logistics providers, SME merchants)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Middle East & Africa E-Commerce Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Fashion and Apparel

4.1.2. Electronics and Appliances

4.1.3. Beauty and Personal Care

4.1.4. Groceries and FMCG

4.1.5. Home and Furniture

4.2. By Payment Method (In Value %)

4.2.1. Credit/Debit Cards

4.2.2. Cash on Delivery

4.2.3. E-Wallets

4.2.4. Bank Transfers

4.3. By Business Model (In Value %)

4.3.1. B2C

4.3.2. B2B

4.3.3. C2C

4.4. By End-User (In Value %)

4.4.1. Individual Consumers

4.4.2. SMEs

4.4.3. Large Enterprises

4.5. By Region (In Value %)

4.5.1. GCC

4.5.2. North Africa

4.5.3. East Africa

4.5.4. West Africa

4.5.5. Southern Africa

5. Middle East & Africa E-Commerce Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Amazon MENA

5.1.2. Jumia Technologies

5.1.3. Noon.com

5.1.4. Souq.com

5.1.5. Zando (South Africa)

5.1.6. Takealot.com

5.1.7. Carrefour UAE (Majid Al Futtaim)

5.1.8. eBay MENA

5.1.9. Konga (Nigeria)

5.1.10. Kilimo Markets

5.1.11. Wadi.com

5.1.12. Ubuy

5.1.13. AliExpress (Middle East and Africa presence)

5.1.14. Spinneys

5.1.15. Clicks

5.2. Cross Comparison Parameters

5.2.1. Revenue

5.2.2. Geographical Presence

5.2.3. Transaction Volume

5.2.4. Active User Base

5.2.5. Product Portfolio

5.2.6. Logistics Network

5.2.7. Payment Methods Accepted

5.2.8. Number of Employees

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Middle East & Africa E-Commerce Market Regulatory Framework

6.1. Data Privacy Regulations

6.2. Cross-Border Taxation Policies

6.3. E-Commerce Licensing Procedures

7. Middle East & Africa E-Commerce Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (improvements in infrastructure, growth of digital payments)

8. Middle East & Africa E-Commerce Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Payment Method (In Value %)

8.3. By Business Model (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Middle East & Africa E-Commerce Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involved identifying key market variables, such as market size, growth drivers, and competitive dynamics. This was achieved through desk research and consultations with e-commerce specialists and industry stakeholders across the MEA region.

Step 2: Market Analysis and Construction

In this step, we gathered historical data on market transactions, revenue generation, and user adoption rates. These data points were analyzed to understand the key trends and establish market baselines for different regions and segments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews with experts from various e-commerce platforms, fintech providers, and logistics companies. These insights were instrumental in refining the data and ensuring the report's accuracy.

Step 4: Research Synthesis and Final Output

The final synthesis of the research involved cross-verifying data from multiple sources, including government reports, industry insights, and financial filings from key companies. The result is a comprehensive market analysis covering all aspects of the e-commerce landscape in MEA.

Frequently Asked Questions

01. How big is the Middle East & Africa e-commerce market?

The Middle East & Africa e-commerce market is valued at USD 129 billion, driven by increasing smartphone usage, digital payment solutions, and rising consumer demand for online shopping.

02. What are the challenges in the MEA e-commerce market?

Challenges in the MEA e-commerce market include logistical barriers, such as last-mile delivery, regulatory complexities in cross-border trade, and low levels of trust in online payments among certain consumer segments.

03. Who are the major players in the MEA e-commerce market?

The major players include Amazon MENA, Jumia, Noon.com, Souq.com, and Takealot. These companies have established strong brand presence, robust logistics networks, and diverse product offerings.

04. What are the growth drivers of the MEA e-commerce market?

Key growth drivers include increasing smartphone penetration, the rise of digital payment methods like e-wallets, and growing internet access in previously underserved regions. Additionally, a youthful population is fueling demand for online shopping.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.