Middle East & Africa Military Market Outlook to 2028

Region:Global

Author(s):Sanjna

Product Code:KROD10892

December 2024

98

About the Report

Middle East & Africa Military Market Overview

- The Middle East & Africa Military Market holds a valuation of USD 135 billion, supported by substantial government defense investments aimed at fortifying national security and enhancing regional stability. This markets growth is propelled by the region's commitment to developing and modernizing its military forces, particularly with evolving defense needs like cybersecurity and border surveillance systems.

- The Gulf Cooperation Council (GCC) nations, particularly Saudi Arabia and the UAE, stand as dominant players in the Middle East & Africa Military Market. These countries positions are reinforced by their high defense spending, aimed at counteracting regional threats and achieving strategic military objectives. Additionally, Israels advanced defense technology and South Africas focus on both national security and defense exports contribute to their respective positions in the market.

- The focus on indigenous production is evident in several regional policies. For instance, Saudi Arabia invested $3 billion in domestic defense manufacturing in 2023 as part of its Vision 2030 initiative. The UAE also allocated $2 billion towards developing indigenous production facilities, aiming to reduce reliance on foreign suppliers. These initiatives highlight an increasing preference for local production capabilities.

Middle East & Africa Military Market Segmentation

By Equipment Type: The Middle East & Africa Military Market is segmented by equipment type into armored vehicles, naval vessels, drones & UAVs, missile systems, and cyber defense solutions. Notably, armored vehicles hold a significant market share in the equipment segment, driven by heightened military demand to counter regional threats and enhance border security. Saudi Arabia and the UAE, in particular, have invested in modernizing their armored fleets, contributing to this segment's growth.

By Technology: This market is further segmented by technology into surveillance and reconnaissance, communication systems, command and control systems, artificial intelligence in military applications, and biometric security. Surveillance and reconnaissance technology leads in this segment due to the regions focus on enhancing situational awareness and improving response times to potential threats. Countries like Israel have advanced significantly in this area, providing a benchmark for defense capabilities in the region.

Middle East & Africa Military Market Competitive Landscape

The Middle East & Africa Military Market is characterized by the presence of global defense contractors and key regional players, all vying to leverage technological advancements and strategic partnerships. Major players dominate due to their established networks and specialized products tailored to meet the security demands of the region.

Middle East & Africa Military Market Analysis

Growth Drivers

- Geopolitical Tensions: In the Middle East and Africa, ongoing geopolitical tensions and conflicts have necessitated heightened military preparedness, driving an increased demand for defense equipment. For example, Saudi Arabia allocated $69 billion to defense in 2023, underscoring its focus on security amid regional tensions. Similarly, the United Arab Emirates prioritized defense, with the Ministry of Defense earmarking $23 billion in 2024, specifically to bolster air and missile defense systems due to emerging threats.

- Government Defense Spending: Countries in the region are prioritizing military budgets to reinforce national security frameworks. In 2024, Egypt allocated $10 billion to its defense sector, aimed at enhancing naval and air capabilities, reflecting its commitment to safeguarding territorial integrity. South Africa also increased its defense expenditure to $4.2 billion in 2023, focusing on cybersecurity initiatives to combat rising cyber threats. This consistent government funding shows a sustained commitment to military investment despite budgetary constraints.

- Rise in Cybersecurity Needs: The region's digital transformation has led to increased vulnerabilities, driving demand for cybersecurity solutions within the military sector. In 2024, Saudi Arabia allocated $3.6 billion toward cybersecurity as part of its defense spending, reflecting its focus on cyber resilience. Additionally, Israels cybersecurity sector received $2 billion in government support, highlighting the critical need for digital defense solutions in military operations.

Challenges

- Budget Constraints: Despite defense priorities, several countries face fiscal constraints that limit military funding. For instance, Nigerias defense budget in 2024 was capped at $2.5 billion due to competing public service needs, curtailing expansion in air and naval capacities. Likewise, Ethiopias budget allocation for defense stands at $1.8 billion, impacted by economic reforms focusing on education and healthcare. These constraints highlight the trade-offs many nations face in prioritizing defense against other public services.

- Technological Adaptability: Rapid advancements in military technology challenge many countries in the Middle East and Africa, which lack the infrastructure to fully integrate such innovations. In 2024, a report from the UAE Ministry of Defense noted that only 15% of its defense technology aligns with AI-driven systems due to limited expertise and support infrastructure. Egypt also faces challenges, with less than 20% of its defense equipment incorporating modern sensor technologies.

Middle East & Africa Military Market Future Outlook

The Middle East & Africa Military Market is poised for robust growth over the next five years, driven by increased government spending, advancements in military technology, and a heightened focus on cybersecurity and border protection. Emerging technologies such as artificial intelligence in military applications and autonomous systems are expected to create significant opportunities for defense contractors and solution providers in the region.

Market Opportunities

- Emerging Defense Technologies (AI, Drones): Emerging defense technologies like AI and drone warfare present substantial opportunities. The UAE allocated $1.5 billion to AI-integrated military technology in 2024, reflecting a strategic pivot to modern warfare. Israels Ministry of Defense invested $800 million in autonomous drones, focusing on border surveillance applications. These investments show a significant shift towards adopting advanced technologies in response to evolving defense needs.

- Private Sector Partnerships: Partnerships with the private sector are expanding in the military domain, especially in manufacturing and R&D. Saudi Arabia signed agreements worth $1.2 billion with private firms in 2023 to localize production of military equipment. Similarly, Nigeria engaged in a $600 million partnership with private defense companies to manufacture armored vehicles domestically. These collaborations are designed to strengthen local production and reduce dependency on foreign suppliers.

Scope of the Report

|

Segment |

Sub-Segments |

|

Equipment Type |

Armored Vehicles Naval Vessels Drones & UAVs Missile Systems Cyber Defense Solutions |

|

Application |

National Defense Law Enforcement Border Security Intelligence Gathering Public Security |

|

Technology |

Surveillance and Reconnaissance Communication Systems Command and Control Systems Artificial Intelligence in Military Biometric Security |

|

End-User |

Government Defense Contractors Intelligence Agencies Private Security Firms Homeland Security |

|

Region |

North Africa Gulf Cooperation Council (GCC) Sub-Saharan Africa Levant Region Horn of Africa |

Products

Key Target Audience

- Defense Ministries (Ministry of Defense UAE, Ministry of Defense KSA)

- Border Security Agencies (Saudi Border Guard, UAE Border Control)

- Homeland Security Divisions

- Military R&D Departments

- Private Security Firms

- Government Defense Contractors

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (African Union Peace and Security Council)

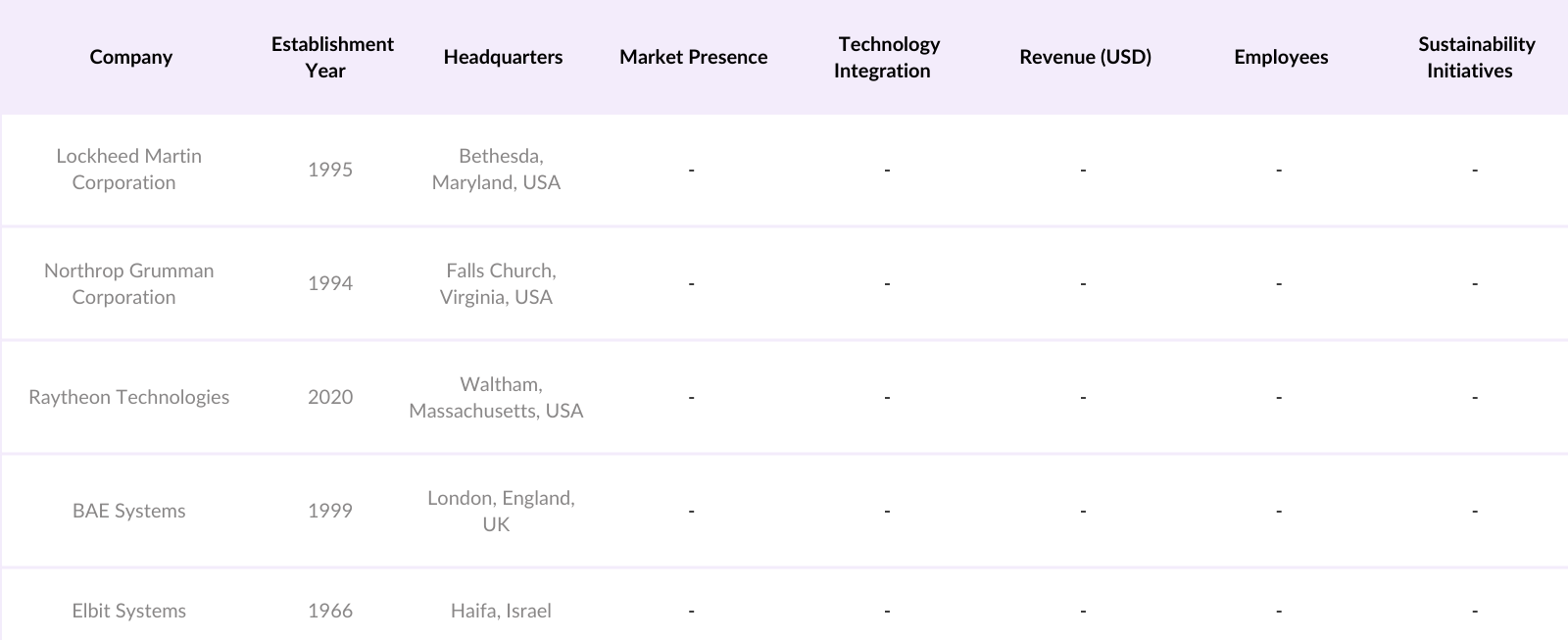

Companies

Players Mentioned in the Report

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies

- BAE Systems

- Elbit Systems

- Thales Group

- Leonardo S.p.A.

- Rheinmetall AG

- Denel SOC Ltd

- Paramount Group

Table of Contents

1. Middle East & Africa Military Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Drivers and Restraints Overview

1.4 Military Sector Segmentation

2. Middle East & Africa Military Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Milestones and Developments

3. Middle East & Africa Military Market Analysis

3.1 Growth Drivers

3.1.1 Geopolitical Tensions

3.1.2 Government Defense Spending

3.1.3 Rise in Cybersecurity Needs

3.1.4 Regional Cooperation Agreements

3.2 Market Challenges

3.2.1 Budget Constraints

3.2.2 Technological Adaptability

3.2.3 Regulatory Compliance (Export Controls, Import Barriers)

3.3 Opportunities

3.3.1 Emerging Defense Technologies (AI, Drones)

3.3.2 Private Sector Partnerships

3.3.3 Growing Demand for Border Security

3.4 Trends

3.4.1 Shift Towards Cyber Warfare

3.4.2 Emphasis on Homeland Security

3.4.3 Focus on Air Defense Systems

3.5 Government Regulation

3.5.1 Import and Export Regulations

3.5.2 Licensing Requirements

3.5.3 Investment in Indigenous Defense Production

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. Middle East & Africa Military Market Segmentation

4.1 By Equipment Type (In Value %)

4.1.1 Armored Vehicles

4.1.2 Naval Vessels

4.1.3 Drones & UAVs

4.1.4 Missile Systems

4.1.5 Cyber Defense Solutions

4.2 By Application (In Value %)

4.2.1 National Defense

4.2.2 Law Enforcement

4.2.3 Border Security

4.2.4 Intelligence Gathering

4.2.5 Public Security

4.3 By Technology (In Value %)

4.3.1 Surveillance and Reconnaissance

4.3.2 Communication Systems

4.3.3 Command and Control Systems

4.3.4 Artificial Intelligence in Military

4.3.5 Biometric Security

4.4 By End-User (In Value %)

4.4.1 Government

4.4.2 Defense Contractors

4.4.3 Intelligence Agencies

4.4.4 Private Security Firms

4.4.5 Homeland Security

4.5 By Region (In Value %)

4.5.1 North Africa

4.5.2 Gulf Cooperation Council (GCC)

4.5.3 Sub-Saharan Africa

4.5.4 Levant Region

4.5.5 Horn of Africa

5. Middle East & Africa Military Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Lockheed Martin Corporation

5.1.2 Northrop Grumman Corporation

5.1.3 Raytheon Technologies

5.1.4 BAE Systems

5.1.5 Thales Group

5.1.6 Leonardo S.p.A.

5.1.7 Rheinmetall AG

5.1.8 Elbit Systems

5.1.9 Denel SOC Ltd

5.1.10 Paramount Group

5.2 Cross Comparison Parameters (R&D Investment, Product Innovation, Market Reach, Client Base, Annual Revenue, Indigenous Production Capabilities, Strategic Partnerships, Military Certifications)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Middle East & Africa Military Market Regulatory Framework

6.1 Defense Procurement Standards

6.2 Arms Control Regulations

6.3 Export and Import Licensing

7. Middle East & Africa Military Future Market Size (In USD Mn)

7.1 Projected Market Size

7.2 Key Drivers of Future Market Growth

8. Middle East & Africa Military Market Analysts Recommendations

8.1 TAM/SAM/SOM Analysis

8.2 Strategic Partnerships for Market Entry

8.3 Market Penetration Strategies

8.4 Gap Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This step involved mapping the ecosystem to include all significant stakeholders in the Middle East & Africa Military Market. Desk research, using reliable secondary databases, helped identify the primary factors influencing the market dynamics, such as regulatory frameworks and spending patterns.

Step 2: Market Analysis and Construction

This phase included the compilation and examination of historical data on the market, focusing on defense budgets, procurement trends, and regional investments. This data was used to verify market penetration and to calculate the revenue generation for core market segments.

Step 3: Hypothesis Validation and Expert Consultation

After developing initial hypotheses, we conducted interviews with military industry professionals, ensuring an accurate interpretation of market statistics. This expert consultation provided insights into emerging trends and strategic market needs.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing data from direct interactions with defense contractors, validating the information gathered from our bottom-up approach to create a comprehensive analysis of the Middle East & Africa Military Market.

Frequently Asked Questions

01. How big is the Middle East & Africa Military Market?

The Middle East & Africa Military Market is valued at USD 135 billion, reflecting high government defense spending and a focus on regional security.

02. What are the major challenges in the Middle East & Africa Military Market?

Key challenges in Middle East & Africa Military Market include budget constraints, regulatory barriers, and the complexity of integrating advanced technologies into existing systems.

03. Who are the major players in the Middle East & Africa Military Market?

Dominant players in Middle East & Africa Military Market include Lockheed Martin, Northrop Grumman, Raytheon Technologies, BAE Systems, and Elbit Systems.

04. What are the growth drivers for the Middle East & Africa Military Market?

Middle East & Africa Military Market is driven by geopolitical tensions, a rise in defense spending, and an emphasis on strengthening cybersecurity and border protection capabilities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.