Middle East & Africa Robot Vacuum Cleaner Market Outlook to 2030

Region:Global

Author(s):Sanjna

Product Code:KROD4058

November 2024

83

About the Report

Middle East & Africa Robot Vacuum Cleaner Market Overview

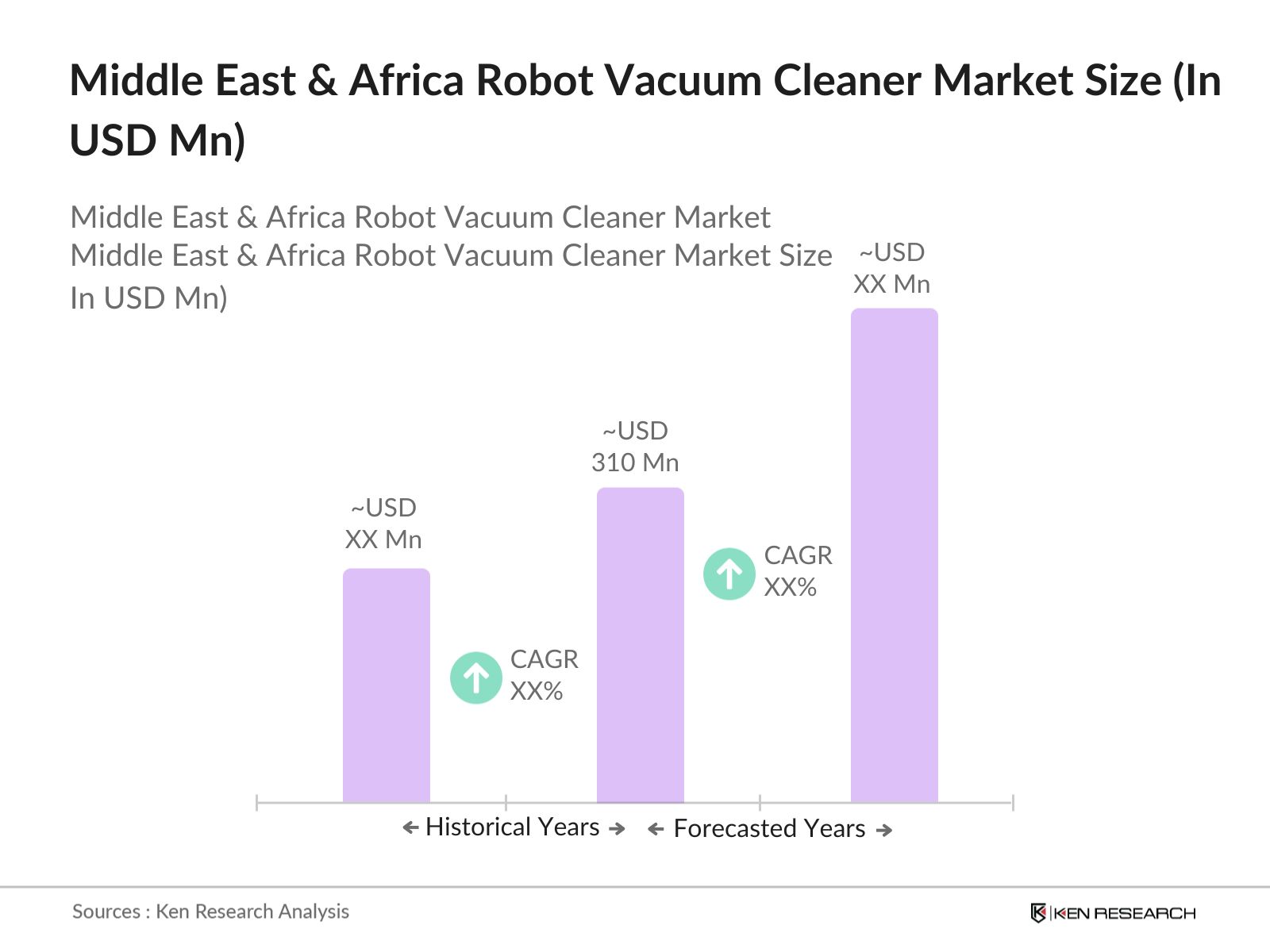

- The Middle East & Africa robot vacuum cleaner market is valued at USD 310 million, based on a five-year historical analysis. The markets growth is driven primarily by the increasing demand for smart home solutions across urban households. As disposable income rises in countries such as the United Arab Emirates and Saudi Arabia, consumers are showing a growing preference for technologically advanced and time-saving home cleaning solutions.

- Dominant countries in this region include the UAE, Saudi Arabia, and South Africa. These nations dominate due to their advanced infrastructure, higher disposable incomes, and greater adoption of smart home devices. The UAE and Saudi Arabia lead in smart home technology investments, while South Africa's growth is propelled by the increasing penetration of e-commerce platforms, making robot vacuum cleaners more accessible to a wider range of consumers. These factors have contributed to these nations' leading roles in the market.

- The expansion of e-commerce platforms across the Middle East and Africa is making robot vacuum cleaners more accessible to consumers. Data from the IMF highlights that internet penetration rates in Africa are projected to reach over 50% by the end of 2024, supported by increased investment in telecommunications infrastructure. Platforms like Jumia in Africa and Noon in the Middle East have seen a surge in online orders for home appliances, making robot vacuum cleaners more widely available. This has broadened access to these products, particularly in urban areas.

Middle East & Africa Robot Vacuum Cleaner Market Segmentation

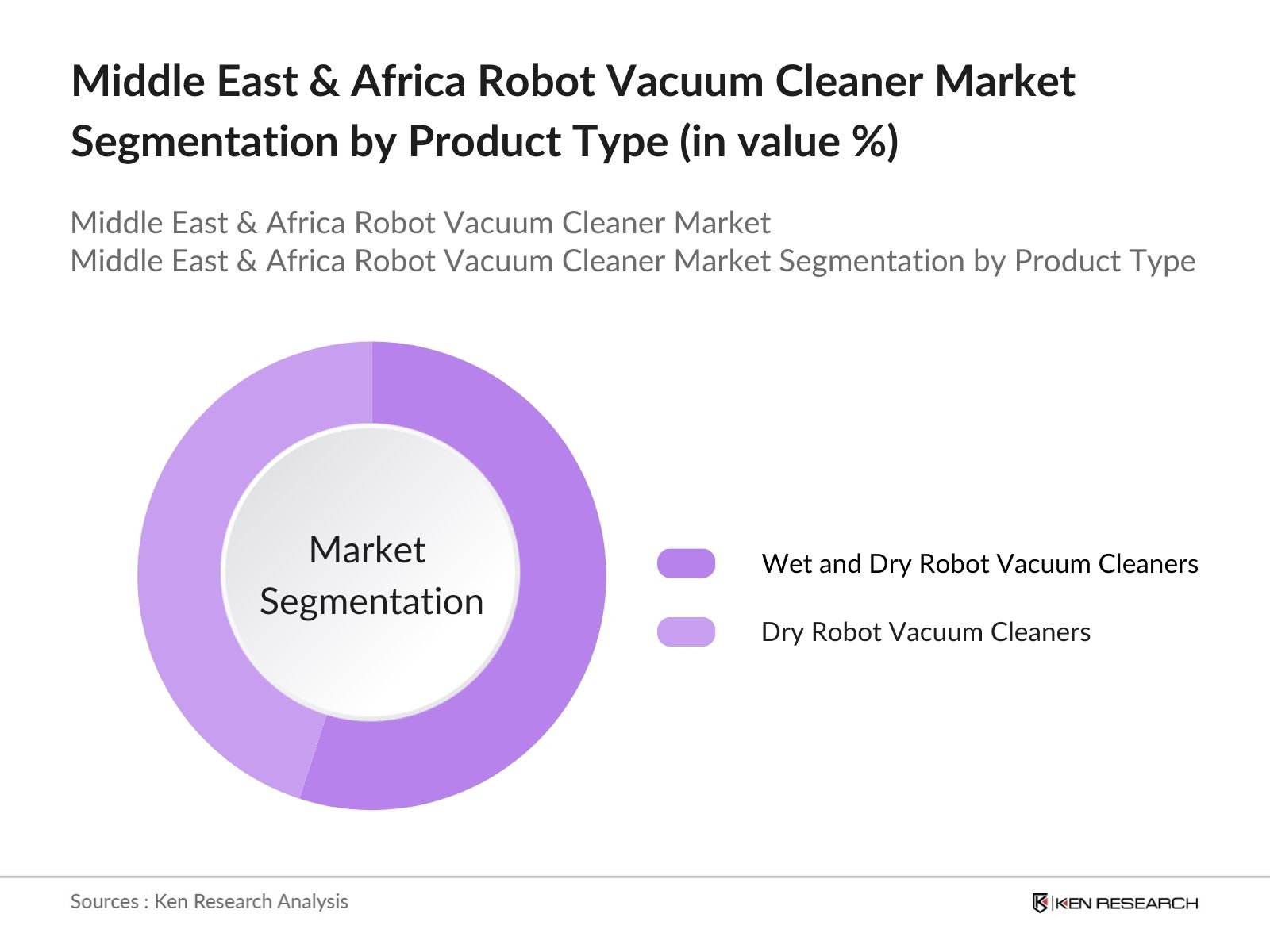

By Product Type: The Middle East & Africa robot vacuum cleaner market is segmented by product type into wet and dry robot vacuum cleaners and dry-only vacuum cleaners. Recently, wet and dry robot vacuum cleaners have dominated the market share in terms of product type due to their versatility in handling both liquid and solid debris. Consumers prefer this product type as it allows for a more thorough cleaning, particularly in regions with dust-heavy environments, such as the Gulf nations. The ability to both vacuum and mop has made these devices essential in maintaining clean homes without manual intervention.

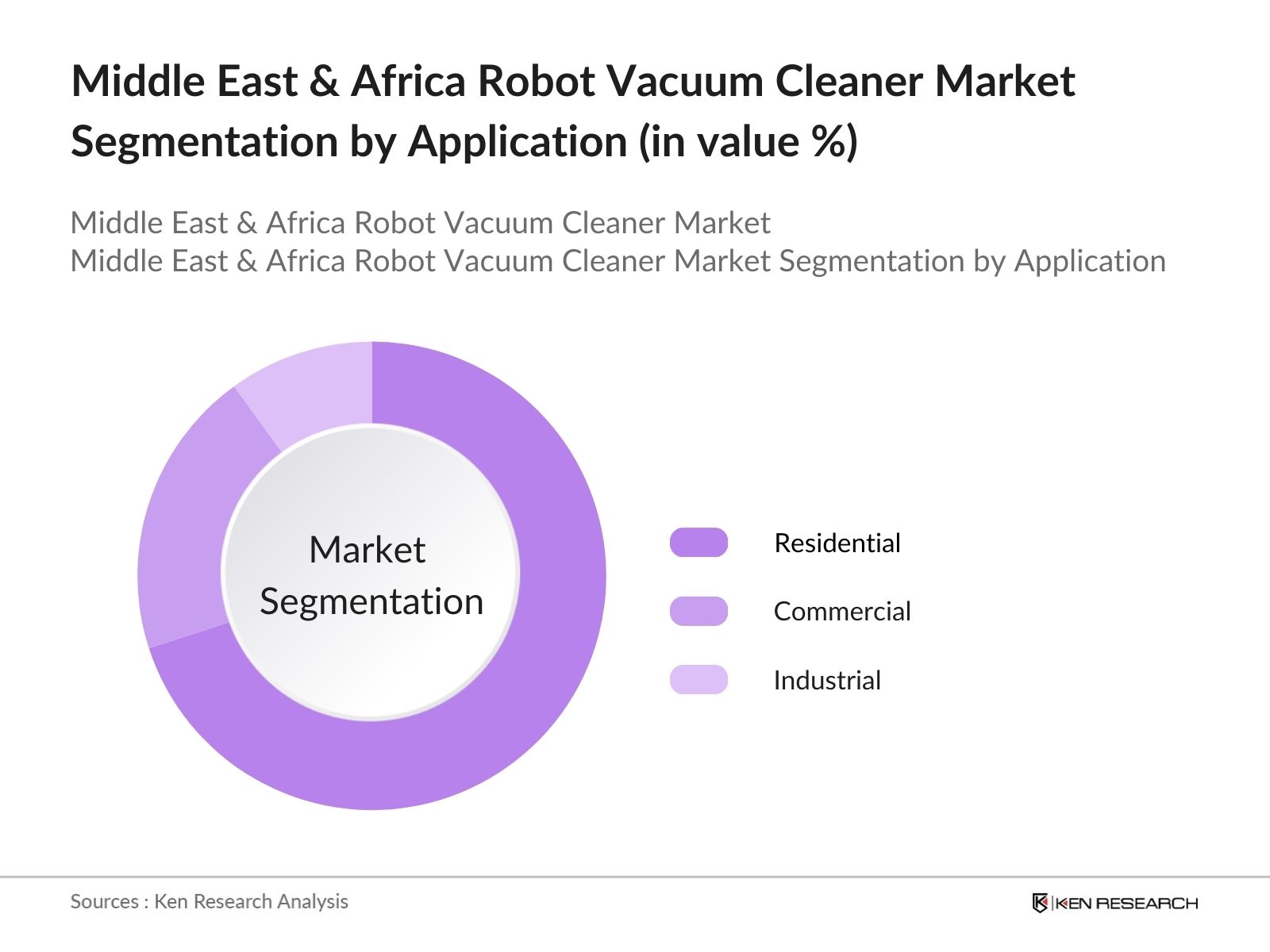

By Application: The market is also segmented by application into residential, commercial, and industrial uses. The residential segment holds a dominant position in terms of market share due to the rising trend of smart homes and increasing disposable income among urban households. In regions like the UAE and Saudi Arabia, where the smart home industry is flourishing, robot vacuum cleaners have become an integral part of daily home cleaning routines. With consumers seeking convenience and automation in their homes, this segment continues to dominate the market.

Middle East & Africa Robot Vacuum Cleaner Market Competitive Landscape

The Middle East & Africa robot vacuum cleaner market is dominated by key players who contribute to shaping the competitive landscape through strategic alliances, product innovations, and strong distribution networks. Companies like iRobot Corporation, Xiaomi Corporation, and Samsung Electronics dominate the market through their established brand presence and continuous product development. These players, alongside regional brands, are driving competition by enhancing the capabilities of their products, such as AI integration and improved battery life. This competition is further intensified by the growing popularity of e-commerce, providing wider market access to smaller players.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Technology Focus |

Product Portfolio |

Distribution Networks |

R&D Investments |

Market Presence |

Strategic Initiatives |

|

iRobot Corporation |

1990 |

Bedford, USA |

- |

- |

- |

- |

- |

- |

- |

|

Xiaomi Corporation |

2010 |

Beijing, China |

- |

- |

- |

- |

- |

- |

- |

|

Samsung Electronics |

1969 |

Suwon, South Korea |

- |

- |

- |

- |

- |

- |

- |

|

Ecovacs Robotics |

1998 |

Suzhou, China |

- |

- |

- |

- |

- |

- |

- |

|

Dyson Ltd. |

1991 |

Malmesbury, UK |

- |

- |

- |

- |

- |

- |

- |

Middle East & Africa Robot Vacuum Cleaner Market Analysis

Growth Drivers

- Growing Adoption of Smart Home Devices: The adoption of smart home devices has been steadily increasing in the Middle East and Africa, with countries like the UAE reporting a rise in the use of IoT devices. According to the World Bank, urbanization levels in the region have surpassed 60% in 2023, driving the demand for smart solutions, including robotic vacuum cleaners. The UAE governments smart city initiatives and the Saudi Vision 2030 plan further promote the adoption of smart technologies. These initiatives, combined with increasing internet penetration rates (over 85% in the UAE), are fostering smart home device growth, including robot vacuum cleaners.

- Increasing Disposable Income in Urban Areas: Rising disposable income, particularly in urban areas of the Middle East, is boosting demand for advanced household appliances like robot vacuum cleaners. According to IMF data, per capita income in Saudi Arabia and the UAE exceeded $25,000 in 2023, reflecting an increased capacity for middle-class households to invest in home automation. The higher income levels are particularly evident in urban centers like Riyadh and Dubai, where consumers seek innovative and time-saving home devices. This growing wealth is driving household investments in robotic cleaning technologies.

- Demand for Time-Saving Solutions in Households: In fast-paced urban environments across the Middle East and Africa, there is growing demand for time-saving household solutions like robot vacuum cleaners. n Egypt, the overall unemployment rate was reported at 6.5% in mid-2024. This is driving demand for automated home solutions that reduce the time spent on cleaning. Robot vacuum cleaners are seen as a practical solution, and their convenience appeals to the middle-class working population.

Challenges

- Limited Battery Capacity in High-Cost Devices: A significant challenge in the robot vacuum cleaner market in the Middle East and Africa is the limited battery capacity, particularly in high-end models. According to government energy consumption standards from South Africas Department of Energy, many devices still require regular recharging, which reduces their efficiency in larger homes. With an average battery runtime of about 90 minutes, many households in urban areas like Johannesburg are hesitant to invest in these devices, as they may not meet their cleaning needs in a single charge.

- High Initial Purchase Costs: The high initial purchase cost of robot vacuum cleaners remains a barrier to adoption, particularly in African markets. According to data from the World Bank, the average monthly income in Nigeria is around $2,000, which makes the purchase of a high-end robotic cleaner an expensive proposition for many consumers. This issue is compounded by additional import duties and taxes on electronic devices, raising prices even further in certain regions. As a result, consumer adoption remains limited in lower-income urban areas.

Middle East & Africa Robot Vacuum Cleaner Market Future Outlook

Middle East & Africa robot vacuum cleaner market is expected to witness robust growth, driven by the increasing adoption of smart home technologies, improvements in AI and IoT, and the availability of advanced features like mopping and voice assistance in robotic cleaners. The expansion of e-commerce platforms and the growing demand for automation in household chores are also expected to play a critical role in the markets future development. The market is poised to benefit from technological advancements and rising consumer demand for time-efficient cleaning solutions.

Market Opportunities

- Integration of AI and IoT Technology: The integration of AI and IoT technologies in robot vacuum cleaners presents significant opportunities for market growth in the Middle East and Africa. According to data from the UAEs Ministry of Industry and Advanced Technology, smart homes equipped with IoT devices are becoming more common in cities like Dubai and Abu Dhabi. The use of AI-driven navigation and mapping technologies in vacuum cleaners enhances their efficiency, making them more appealing to tech-savvy consumers in the region. This technological advancement supports the growing demand for automated home solutions.

- Potential Growth in Hospitality and Healthcare Sectors: There is substantial opportunity for robot vacuum cleaners in the hospitality and healthcare sectors across the Middle East and Africa. According to World Bank reports, the number of hotel rooms in Dubai alone surpassed 150,000 in 2023, and many hotels are turning to robotic cleaners to enhance operational efficiency. Similarly, the healthcare sector, with over 100 new hospitals opening in the Gulf region by 2024, is increasingly adopting automated cleaning technologies to maintain hygiene standards, presenting a lucrative market for robot vacuum manufacturers.

Scope of the Report

|

Segment |

Sub-segments |

|

Product Type |

Wet and Dry Robot Vacuum Cleaners |

|

Dry Robot Vacuum Cleaners |

|

|

Application |

Residential |

|

Commercial |

|

|

Industrial |

|

|

Technology |

Laser Guided |

|

Camera Based |

|

|

Ultrasonic Sensors |

|

|

Distribution Channel |

Online Stores |

|

Offline Stores (Hypermarkets, Specialty Stores) |

|

|

Region |

GCC |

|

South Africa |

|

|

North Africa |

|

|

Sub-Saharan Africa |

Products

Key Target Audience

Robot Vacuum Cleaner Manufacturers

Residential and Commercial Real Estate Developers

Technology Solution Providers

Smart Home Technology Integrators

Energy Efficiency and Sustainability Companies

E-commerce Platforms

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Gulf Standards Organization, South African Bureau of Standards)

Companies

Players Mentioned in the Report

iRobot Corporation

Xiaomi Corporation

Samsung Electronics

Ecovacs Robotics

Dyson Ltd.

Neato Robotics

Panasonic Corporation

LG Electronics

SharkNinja Operating LLC

Miele

Table of Contents

1. Middle East & Africa Robot Vacuum Cleaner Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Middle East & Africa Robot Vacuum Cleaner Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Middle East & Africa Robot Vacuum Cleaner Market Analysis

3.1. Growth Drivers

3.1.1. Growing Adoption of Smart Home Devices

3.1.2. Increasing Disposable Income in Urban Areas

3.1.3. Demand for Time-Saving Solutions in Households

3.1.4. Expansion of E-commerce Platforms

3.2. Market Challenges (Battery Life, Initial Investment Costs, Consumer Awareness)

3.2.1. Limited Battery Capacity in High-Cost Devices

3.2.2. High Initial Purchase Costs

3.2.3. Lack of Consumer Awareness in Low-Penetration Areas

3.2.4. Limited Penetration in Rural Areas

3.3. Opportunities (Technological Advancements, Regional Customization, Partnerships)

3.3.1. Integration of AI and IoT Technology

3.3.2. Regional-Specific Customizations to Meet Local Preferences

3.3.3. Partnerships with Regional Distributors

3.3.4. Potential Growth in Hospitality and Healthcare Sectors

3.4. Trends (AI Integration, IoT Connectivity, Premium Segment Growth)

3.4.1. AI-Powered Navigation and Mapping

3.4.2. Internet of Things (IoT) Connectivity in Smart Homes

3.4.3. Rising Demand for Premium Robotic Cleaners with Advanced Features

3.4.4. Adoption of Eco-Friendly and Energy-Efficient Models

3.5. Government Regulations (Import Duties, Energy Standards, Product Certifications)

3.5.1. Import Tariffs and Regulations on Electronic Devices

3.5.2. Energy Consumption Standards and Compliance Requirements

3.5.3. Product Safety and Environmental Certifications

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Distributors, Retailers, Consumers)

3.8. Porters Five Forces (Bargaining Power of Buyers, Supplier Power, Threat of New Entrants)

3.9. Competition Ecosystem

4. Middle East & Africa Robot Vacuum Cleaner Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Wet and Dry Robot Vacuum Cleaners

4.1.2. Dry Robot Vacuum Cleaners

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.3. By Technology (In Value %)

4.3.1. Laser Guided

4.3.2. Camera Based

4.3.3. Ultrasonic Sensors

4.4. By Distribution Channel (In Value %)

4.4.1. Online Stores

4.4.2. Offline Stores (Hypermarkets, Specialty Stores)

4.5. By Region (In Value %)

4.5.1. GCC

4.5.2. South Africa

4.5.3. North Africa

4.5.4. Sub-Saharan Africa

5. Middle East & Africa Robot Vacuum Cleaner Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. iRobot Corporation

5.1.2. Neato Robotics

5.1.3. Ecovacs Robotics

5.1.4. Dyson Ltd.

5.1.5. Xiaomi Corporation

5.1.6. LG Electronics

5.1.7. Samsung Electronics

5.1.8. Panasonic Corporation

5.1.9. SharkNinja Operating LLC

5.1.10. Miele

5.2. Cross Comparison Parameters (No. of Employees, Revenue, Product Offerings, Distribution Networks, Technology Focus, Market Presence, Innovation Pipeline, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Middle East & Africa Robot Vacuum Cleaner Market Regulatory Framework

6.1. Import and Export Regulations

6.2. Energy Efficiency Standards

6.3. Safety and Performance Certifications

7. Middle East & Africa Robot Vacuum Cleaner Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Middle East & Africa Robot Vacuum Cleaner Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Middle East & Africa Robot Vacuum Cleaner Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the major stakeholders in the Middle East & Africa robot vacuum cleaner market, including manufacturers, distributors, and end-users. This was done through comprehensive desk research leveraging secondary and proprietary databases to gain insights into market dynamics and consumer behavior.

Step 2: Market Analysis and Construction

In this step, historical data was analyzed to assess the adoption of robot vacuum cleaners in key regions. Parameters like household penetration rates and technological advancements were studied to estimate the markets revenue generation. This process also involved evaluating sales data from both online and offline distribution channels.

Step 3: Hypothesis Validation and Expert Consultation

Market experts, including manufacturers and retailers, were consulted via telephone interviews and online surveys. Their input helped to validate assumptions about market drivers, challenges, and opportunities. This step also provided qualitative insights into emerging trends and customer preferences.

Step 4: Research Synthesis and Final Output

In the final stage, insights from key manufacturers were synthesized with quantitative data from desk research to finalize the market analysis. This step ensured that the analysis provided a comprehensive, accurate, and reliable outlook on the future of the Middle East & Africa robot vacuum cleaner market.

Frequently Asked Questions

01. How big is the Middle East & Africa Robot Vacuum Cleaner Market?

The Middle East & Africa robot vacuum cleaner market was valued at USD 450 million in 2023, driven by increasing consumer demand for smart home solutions and growing disposable income.

02. What are the challenges in the Middle East & Africa Robot Vacuum Cleaner Market?

Challenges in Middle East & Africa robot vacuum cleaner market include high initial investment costs, limited battery life in many models, and a lack of consumer awareness in certain regions, particularly rural areas where smart technology adoption is low.

03. Who are the major players in the Middle East & Africa Robot Vacuum Cleaner Market?

Key players in Middle East & Africa robot vacuum cleaner market include iRobot Corporation, Xiaomi Corporation, Samsung Electronics, Ecovacs Robotics, and Dyson Ltd. These companies dominate the market through product innovation and strong distribution networks.

04. What are the growth drivers of the Middle East & Africa Robot Vacuum Cleaner Market?

Growth drivers in Middle East & Africa robot vacuum cleaner market include rising disposable incomes, increasing urbanization, and the widespread adoption of smart home devices. The market is also driven by technological advancements such as AI-powered navigation and IoT connectivity.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.