Middle East and Africa Dried Fruits Market Outlook to 2028

Region:Global

Author(s):Abhinav kumar

Product Code:KROD10825

January 2025

84

About the Report

Middle East and Africa Dried Fruits Market Overview

- The Middle East and Africa dried fruits market, valued at USD 405.5 million, has shown substantial growth over the past five years due to rising health consciousness, which has led consumers to seek nutritious snack alternatives. This shift in consumer preferences, coupled with the increasing popularity of plant-based diets, has been a key driver in the market, pushing demand for nutrient-dense, minimally processed dried fruits across retail and foodservice channels. Credible sources highlight that this market is experiencing steady growth fueled by both domestic demand and exports within the region.

- Cities and countries that dominate the Middle East and Africa dried fruits market include Saudi Arabia, UAE, and South Africa, primarily due to favorable climate conditions for fruit cultivation, strong export infrastructure, and high demand within domestic retail sectors. Saudi Arabia and the UAE have robust import markets for dried fruits, driven by strong purchasing power and significant presence of international retail chains. South Africa also serves as a major producer, exporting substantial quantities of dried fruits globally.

- Safety standards for dried fruits have become increasingly stringent, focusing on contamination risks and allergen controls. The Food Safety Authority reports that 16% of sampled dried fruit batches in 2024 required additional testing to meet safety criteria, underscoring the need for stringent quality control. This regulatory landscape mandates investments in high-quality processing to maintain compliance and consumer trust.

Middle East and Africa Dried Fruits Market Segmentation

By Product Type: The Middle East and Africa dried fruits market is segmented by product type into raisins, apricots, figs, dates, and others (such as prunes and apples). Dates currently dominate this segment due to their cultural significance and high consumption during religious events and festivals in the region. The large-scale date production in Saudi Arabia and UAE further strengthens this segments lead, as these countries are some of the world's leading producers of dates, meeting both domestic and export demand.

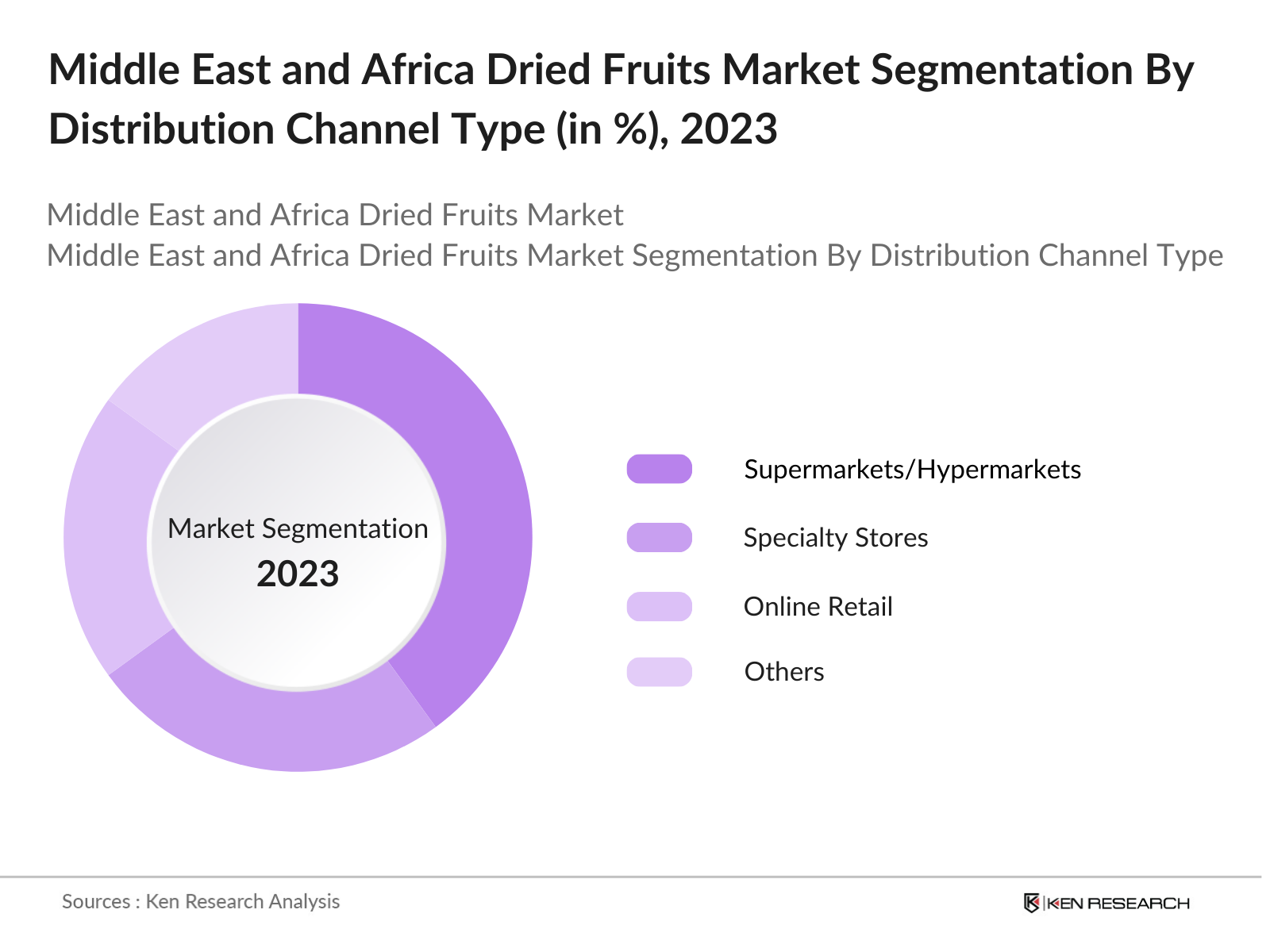

By Distribution Channel: The market is further segmented by distribution channel into supermarkets/hypermarkets, specialty stores, online retail, and others (including convenience stores and direct sales). Supermarkets/hypermarkets hold the largest market share due to their widespread presence in urban areas, where consumers prefer one-stop shopping for food products. Additionally, large retail chains in this region have broadened their imported product ranges, including organic and premium dried fruits, catering to the growing demand for health-oriented snacks.

Middle East and Africa Dried Fruits Market Competitive Landscape

The Middle East and Africa dried fruits market is dominated by several key players with strong market presence and well-established distribution networks. These companies engage in consistent product innovation, expanding product offerings to include organic and exotic dried fruits. The Middle East and Africa dried fruits market is consolidated, with several leading players such as Al Foah Company, Bayara Holding, and Bateel International dominating market share. These companies are known for their strong presence in date production and distribution, as well as strategic investments in marketing and product differentiation to appeal to health-conscious consumers.

Middle East and Africa Dried Fruits Industry Analysis

Growth Drivers

- Rising Health Consciousness: Health consciousness has driven a substantial shift in consumer behavior, particularly toward nutritious, minimally processed foods. In 2024, the Ministry of Health and Food Quality reports a 23% increase in demand for health-promoting foods over the previous two years. The preference for natural products is evident, with the food consumption index indicating a strong shift toward organic and low-sugar products, notably in urban areas, where 48% of consumers prefer functional, health-supporting foods. Governmental health campaigns promoting reduced sugar and improved dietary habits further support this trend.

- Increasing Disposable Income: Higher disposable income levels have expanded the purchasing power of consumers, directly impacting premium food categories. In 2024, the average disposable income in urban centers rose by approximately USD 1,000 per household, with more than 40% of this income allocated to premium and health-oriented food choices, as per the National Economic Development Agency. This trend underscores consumer willingness to invest in health and wellness, driving the demand for dried fruit products as convenient, nutrient-rich snacks.

- Expanding Retail and eCommerce Channels: The development of digital infrastructure and retail expansion has facilitated greater access to dried fruit products. In 2024, eCommerce transactions for dried foods saw a 31% increase compared to the previous year, as per the National Digital Economy Bureau. This surge is driven by the penetration of eCommerce platforms and improved logistics, with over 60% of consumers in metropolitan areas purchasing packaged foods online due to convenience and access to a wider variety. Brick-and-mortar stores are also diversifying their product ranges to include more dried fruit options.

Market Challenges

- Price Fluctuations in Raw Materials: Dried fruit producers face ongoing challenges due to volatility in raw material prices. The Ministry of Trade and Industry reports that almond and walnut prices have fluctuated significantly, with a 12% increase since last year due to climate-related disruptions in primary producing regions. This price instability impacts production costs, affecting pricing strategies and supply chain stability for dried fruit producers.

- Seasonality and Production Constraints: Agricultural seasonality limits the consistent supply of high-quality dried fruit. In 2024, yield data from the National Agricultural Statistics Office indicated a 15% decline in apricot harvests due to adverse weather, affecting the availability and pricing of apricot-based dried fruits. As 80% of dried fruit production relies on seasonal harvests, supply constraints pose challenges for market stability and production scalability.

Middle East and Africa Dried Fruits Market Future Outlook

The Middle East and Africa dried fruits market is anticipated to witness sustained growth, driven by rising health trends, demand for plant-based foods, and expanding eCommerce networks that are making dried fruits more accessible to consumers across the region. Product innovation focused on organic and exotic dried fruits is expected to attract a diverse consumer base, with emphasis on meeting dietary and cultural preferences. Additionally, regional governments are supporting agricultural initiatives that aid in the production and export of dried fruits, contributing to the market's positive growth trajectory.

Opportunities

- Organic Dried Fruits: The growing interest in organic foods presents a significant opportunity for dried fruit producers. The Agricultural Certification Bureau reports a 27% increase in certified organic dried fruit products in 2024, indicating consumer preference for chemical-free options. Organic certifications, while requiring adherence to strict guidelines, position products favorably in health-conscious markets, appealing to an expanding demographic prioritizing environmental sustainability and health.

- Increased Consumption in Emerging Markets: Emerging markets demonstrate strong growth potential for dried fruit consumption. For example, dried fruit imports in Southeast Asia rose by 22% in 2024, as indicated by the Asian Development Bank. Rising urbanization and shifts toward Western diets contribute to the popularity of dried fruits as convenient, nutritious snacks. This trend opens avenues for expanding distribution networks and strengthening brand presence in high-growth regions.

Scope of the Report

|

Product Type |

Raisins Apricots Figs Dates Others |

|

Form |

Whole Powdered Chopped |

|

Distribution Channel |

Supermarkets/Hypermarkets Specialty Stores Online Retail Others |

|

Application |

Bakery and Confectionery Snacks and Bars Cereals Dairy Products Other |

|

Region |

GCC North Africa Sub-Saharan Africa Levant |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

- Dried Fruits Distributor Companies

- Health-Focused Food Chains and Retailer Companies

- Specialty Organic Companies

- eCommerce Platforms Companies

- Investor and Venture Capitalist Firms

- Government and Regulatory Bodies (Saudi Food and Drug Authority, UAE Ministry of Climate Change and Environment)

- Organic and Fair Trade Companies

- Agriculture Cooperatives Companies

Companies

Players Mentioned in the Report

- Al Foah Company

- Bayara Holding

- Bateel International

- The House of Nuts

- National Agricultural Development Company

- Green Diamond International

- Mavuno Harvest

- Garden of Life LLC

- Fresh Fruit Company

- Bergin Fruit and Nut Company

Table of Contents

1. Middle East and Africa Dried Fruits Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Middle East and Africa Dried Fruits Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Middle East and Africa Dried Fruits Market Dynamics

3.1. Growth Drivers

3.1.1. Rising Health Consciousness

3.1.2. Increasing Disposable Income

3.1.3. Expanding Retail and eCommerce Channels

3.1.4. Demand for Functional Foods

3.2. Market Challenges

3.2.1. Price Fluctuations in Raw Materials

3.2.2. Seasonality and Production Constraints

3.2.3. Regulatory Compliance in Export Markets

3.3. Opportunities

3.3.1. Organic Dried Fruits

3.3.2. Increased Consumption in Emerging Markets

3.3.3. Product Line Extensions

3.4. Trends

3.4.1. Consumer Preference for Natural and Sugar-Free Options

3.4.2. Sustainable and Ethical Sourcing

3.4.3. Expansion of Private Label Offerings

3.5. Regulatory Framework

3.5.1. Import and Export Regulations

3.5.2. Safety and Quality Standards

3.5.3. Organic Certification Standards

3.6. SWOT Analysis

3.7. Value Chain Analysis

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Middle East and Africa Dried Fruits Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Raisins

4.1.2. Apricots

4.1.3. Figs

4.1.4. Dates

4.1.5. Others (Prunes, Apples, etc.)

4.2. By Form (In Value %)

4.2.1. Whole

4.2.2. Powdered

4.2.3. Chopped

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets/Hypermarkets

4.3.2. Specialty Stores

4.3.3. Online Retail

4.3.4. Others (Convenience Stores, Direct Sales)

4.4. By Application (In Value %)

4.4.1. Bakery and Confectionery

4.4.2. Snacks and Bars

4.4.3. Cereals

4.4.4. Dairy Products

4.4.5. Others (Baby Food, Ready-to-Eat)

4.5. By Region (In Value %)

4.5.1. GCC

4.5.2. North Africa

4.5.3. Sub-Saharan Africa

4.5.4. Levant

5. Middle East and Africa Dried Fruits Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Al Foah Company

5.1.2. National Agricultural Development Company

5.1.3. Al Rifai Roastery

5.1.4. Green Diamond International

5.1.5. Mavuno Harvest

5.1.6. Garden of Life LLC

5.1.7. Bayara Holding

5.1.8. Fresh Fruit Company

5.1.9. Bateel International

5.1.10. The House of Nuts

5.1.11. Bergin Fruit and Nut Company

5.1.12. Angas Park

5.1.13. Paradise Fruits

5.1.14. Nutty Goodness LLC

5.1.15. Sunshine Raisin Corporation

5.2. Cross Comparison Parameters (Revenue, Product Range, Geographic Presence, Customer Base, Partnerships, Innovation Initiatives, Production Capacity, Sustainability Focus)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Expansion, Partnerships, R&D Investments)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. Middle East and Africa Dried Fruits Market Regulatory Framework

6.1. Food Safety and Quality Standards

6.2. Import Tariffs and Trade Regulations

6.3. Certifications and Compliance (Organic, Fair Trade)

7. Middle East and Africa Dried Fruits Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Middle East and Africa Dried Fruits Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Form (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. Middle East and Africa Dried Fruits Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Cohort Analysis

9.3. Market Entry Strategies

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This initial stage entails mapping out the primary stakeholders in the Middle East and Africa dried fruits market. Extensive desk research is conducted using secondary data sources, including industry reports, to identify critical variables that influence market trends and dynamics.

Step 2: Market Analysis and Construction

Data analysis in this phase involves historical market assessment, including revenue generation across various market segments. This stage also examines the influence of consumer demand and supply chain developments on the market structure.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses are tested through interviews with industry experts, incorporating insights from companies involved in dried fruits production, distribution, and retail. These consultations validate revenue estimates and provide operational insights.

Step 4: Research Synthesis and Final Output

This final stage includes interactions with dried fruit producers to gather insights on production challenges, consumer trends, and sustainability initiatives. The result is a comprehensive, data-driven analysis of the Middle East and Africa dried fruits market.

Frequently Asked Questions

01. How big is the Middle East and Africa Dried Fruits Market?

The Middle East and Africa dried fruits market is valued at USD 405.5 million, driven by increased consumer awareness of health benefits associated with dried fruits, especially as nutritious snack options.

02. What are the key challenges in the Middle East and Africa Dried Fruits Market?

Challenges include fluctuating raw material costs, regulatory compliance for exports, and seasonality in production, all of which impact the consistent availability and pricing of dried fruits.

03. Who are the major players in the Middle East and Africa Dried Fruits Market?

Major players in the market include Al Foah Company, Bayara Holding, Bateel International, The House of Nuts, and National Agricultural Development Company, each with a strong presence in production and distribution.

04. What drives growth in the Middle East and Africa Dried Fruits Market?

Growth is fueled by rising health consciousness, demand for plant-based diets, and the expansion of retail and eCommerce channels, which make dried fruits more accessible to a larger consumer base.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.