New Zealand Logistics Market Outlook to 2026

Driven by Massive Logistics Infrastructure Investment, Flourishing ECommerce Industry, and Increasing Competition among domestic players

Region:Asia

Author(s):Rishabh Verma

Product Code:KR1312

April 2023

94

About the Report

The report provides a comprehensive analysis of the potential of Logistics Market in New Zealand. The report covers an overview and genesis of the industry, market size in terms of revenue generated.

The report has market segmentation which include segments by types of freight, type of , by service mix, by end-users and by domestic and international shipments; growth enablers and drivers; challenges and bottlenecks; trends driving adoption trends; regulatory framework; end-user analysis, industry analysis, competitive landscape including competition scenario and market shares of major players. The report concludes with future market projections of each market segmentation and analyst recommendations.

Market Overview:

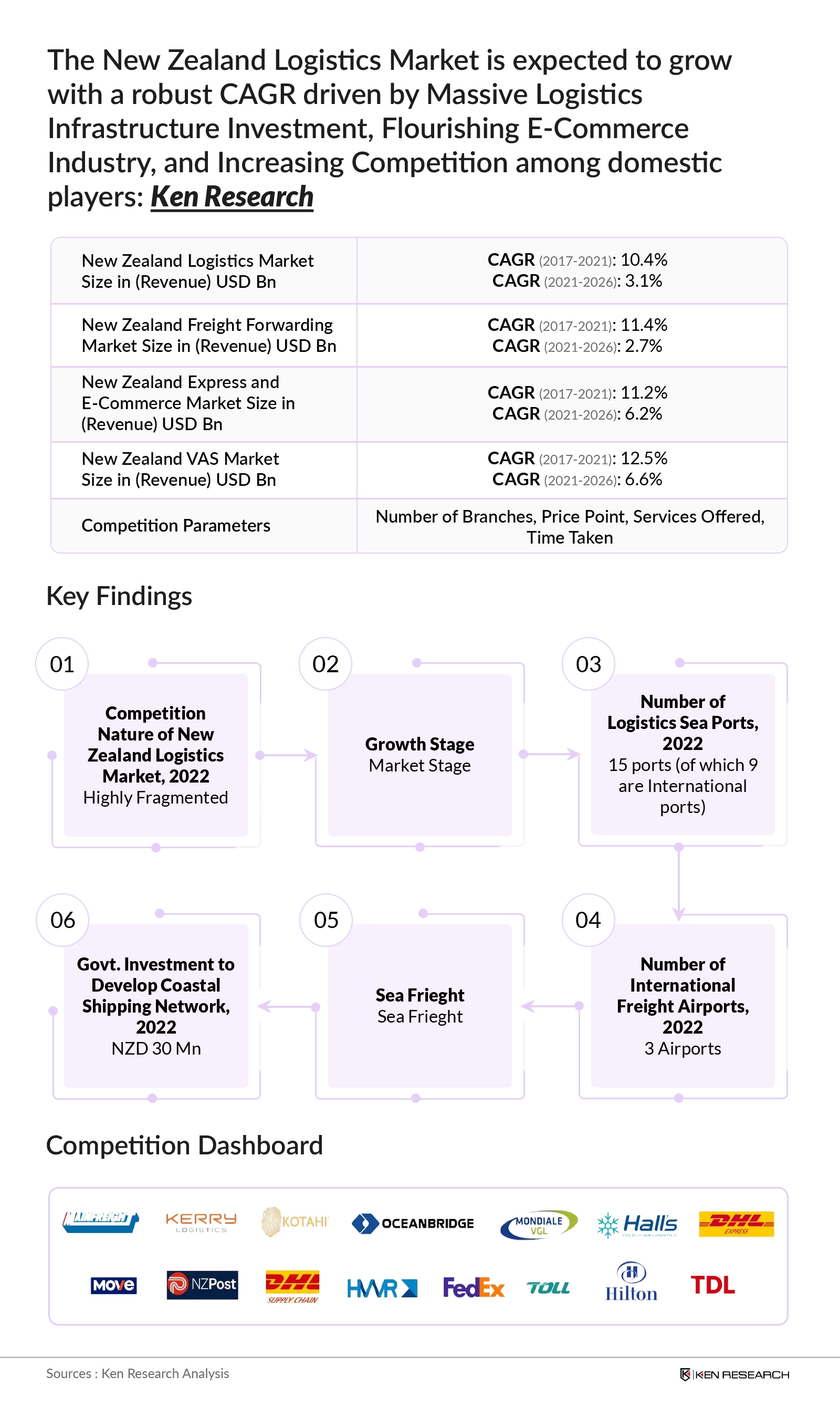

According to Ken Research estimates, the Market Size of New Zealand has shown increasing trend from 2017 to 2022. Market Size of New Zealand Logistics is expected to show increasing trend from 2022 to 2027 at CAGR of 3.1%. This is owing to its strategic location, good transport infrastructure and the initiatives taken by the government. its strategic location, good transport infrastructure and the initiatives taken by the government.

- Digital transformation in logistics, from AI-guided picking & packing wearables to blockchain-based customer order ledgers, and IoT-connected machines on ground.

-

New Zealand is focusing towards expanding its exports by establishing manufacturing within the country. Increasing import-export activities would heighten demand for VAS services.

Key Trends by Market Segment:

By Domestic/International Shipments: International Freight accounted for major share in New Zealand’s logistics Market in 2021.

By Mode of Frieght: Driven by world-class seaports, centrally located airports, and an extensive, and modern network of roads and highways, the country’s logistics infrastructure and presence of major logistics services are advantages for businesses to set their operations in the country.

Competitive Landscape:

Future Outlook:

Market Size of New Zealand Logistics is expected to show increasing trend from 2022 to 2027. This is owing to government investment and expansion of sea ports. Driven by world-class seaports, centrally located airports, and an extensive, and modern network of roads and highways the New Zealand Logistics Industry will witness growth in the coming years.

Scope of the Report

|

New Zealand Logistics Market Segmentation |

|

|

By Service Mix |

Freight Forwarding Logistics CEP Value Added Services |

|

New Zealand Freight Forwarding Market Segmentation |

|

|

By Type of Freight |

Road Freight Sea Freight Air Freight |

|

By End-User |

Retail Oil and Gas Pharma Others |

|

New Zealand Warehousing Market Segmentation |

|

|

Type of Warehouse |

Industrial / Retail Warehouses CFS/ICD Warehouses Cold Storage Agriculture & Other Warehouses |

|

New Zealand Express and E-Commerce Market Segmentation |

|

|

By Domestic/ International Shipments |

International Domestic |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report

E-commerce Companies

Third-Party Logistic Providers

Potential Market Entrants

Freight Forwarding Companies

Warehousing Companies

Cold Storage Companies

Industry Associations

Consulting Agencies

Government Bodies & Regulating Authorities

Time Period Captured in the Report:

Historical Period: 2017-2021

Base Year: 2021

Forecast Period: 2021-2026

Companies

Major Players Mentioned in the Report:

Toll Group

Mondiale VGL

MOVE logistics

Kotahi Logistics

Halls Group

Mainfreight

DHL Supply Chain

Ocean bridge

DHL Supply Chain

Hilton Haulage

FedEx

DHL Express

NZ Post

Kerry Logistics

HW Richardson Group

TDL

Table of Contents

1. New Zealand Country Overview

1.1 Country Overview

1.2 Import and Export Scenario in New Zealand, 2019-2021

1.3 Export Scenario in New Zealand, 2021

1.4 Import Scenario in New Zealand, 2021

2. Infrastructure Scenario in New Zealand

2.1 Overview of New Zealand’s Logistics Infrastructure

2.2 Logistics Infrastructure in New Zealand: Road Network

2.3 Logistics Infrastructure in New Zealand: Seaports

2.4 Logistics Infrastructure in New Zealand: Airports

3. Logistics Overview in New Zealand

3.1 Executive Summary – New Zealand Logistics Market

3.2 Structure of Logistics Systems

3.3 Logistics Development Scenario in New Zealand

3.4 Trends and Developments

3.5 SWOT Analysis for New Zealand Logistics Industry

3.6 Government Initiatives in New Zealand Logistics Industry

3.7 Issues & Challenges in New Zealand Logistics Market

3.8 Impact of Covid-19 in New Zealand

3.9 New Zealand Logistics Market Size, 2017-21

3.10 New Zealand Logistics Industry Future Market Size, 2021-2026

3.11 New Zealand Value Added Services (VAS) Market Size, 2017-2026

3.12 Technological Development in New Zealand’s Sub-sector

3.13 Innovations Across Digitally Integrated Value Chain

4. Freight Forwarding Market in New Zealand

4.1 Executive Summary – New Zealand Freight Forwarding Market

4.2 Industry Ecosystem- New Zealand Freight Industry

4.3 New Zealand Freight Market Size, 2017-2021

4.4 Freight Market Segmentation, By Type of Freight, 2021

4.5 New Zealand Freight Future Market Size & Segmentation, 2021-2026

4.6 Freight Aggregator Market Value Chain Analysis

4.7 Digital Truck Aggregators Business Model

4.8 Major Challenges which have led to the rise of Digital Freight Platforms

4.9 Major Benefits of Digital Freight Aggregator Platforms

4.10 Major Digital Truck Aggregator- Freight hub

5. Warehousing Market in New Zealand

5.1 Executive Summary – New Zealand Warehousing Market

5.2 New Zealand Warehousing Ecosystem

5.3 Industry Life Cycle of New Zealand Warehousing Market

5.4 Issues & Challenges in New Zealand Warehousing Market

5.5 Government Warehouse Rules and Procedures

5.6 New Zealand Warehousing Market Size, 2017-2021

5.7 New Zealand Warehousing Market Segmentations on the basis of Type of Warehouse, 2021

5.8 Technological Innovations in Warehousing Industry

5.9 New Zealand Warehousing Market Future Projections on the Basis of Market Size, 2021-2026

5.10 New Zealand Warehousing Market Future Segmentations on the basis of Type of Warehouse. 2026

6. Express and E-Commerce Market in New Zealand

6.1 Executive Summary – Express & E-Commerce Market

6.2 New Zealand Express and E-Commerce Ecosystem

6.3 Scenario of E-Commerce in New Zealand

6.4 New Zealand CEP Market Size, 2017-2021

6.5 CEP Market Segmentation by Domestic/ International Shipments, 2021

6.6 Growth Drivers & Challenges in CEP Market

6.7 New Zealand CEP Future Market Size, 2021-2026

6.8 CEP Market Future Segmentations, 2026

7. Competitive Scenario

7.1 Cross Comparison between Major Logistics Companies in New Zealand

7.2 Competition Scenario in Logistics Companies in New Zealand

7.3 Competition Scenario in Logistics Companies, By Verticals

8. Research Methodology

8.1 Market Definitions

8.2 Methodology Used for Primary, Secondary and Sanity Checking

8.3 Primary Research Approach

8.4Research Limitations & Future Conclusion

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on logistics over the years, penetration of marketplaces and service providers ratio to compute revenue generated for logistics services. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research output:

Our team will approach multiple logistics and warehousing services providing channels and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from logistics and warehousing providers.

Frequently Asked Questions

01 How big is the New Zealand Logistics Market?

The New Zealand Logistics Market size is estimated to be USD 17.16 billion in 2023.

02 What are the factors driving the New Zealand Logistics Market?

Massive Logistics Infrastructure Investment, Flourishing E-Commerce Industry, and Increasing Competition among domestic players are the Key Factors Driving the New Zealand Logistics Market.

03 Which is the Largest Segment in the New Zealand Logistics Market?

The Sea freight type segment held the largest share of the New Zealand Logistics Market in 2022.

04 Who are the Key Players in the New Zealand Logistics Market?

FedEx, DHL Express, are the major Players in the New Zealand Logistics Market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.