Nigeria Data Centre Market Outlook to 2027

Driven by launch of 5G, internet penetration, increase in investment and government initiatives

Region:Africa

Author(s):Smriddhi Agarwal and Faqiha Frozan

Product Code:KR1346

July 2023

86

About the Report

The report provides a comprehensive analysis of the potential of the data center industry in Nigeria. The report covers an overview and genesis of the industry, and market size in terms of revenue.

Its market segmentations include by vertical, by type of Co-location, by end-user; growth enablers and drivers; challenges and bottlenecks; trends driving adoption trends; regulatory framework; end-user analysis, industry analysis, competitive landscape including competition scenario and market shares of major players. The report concludes with future market projections of each market segmentation and analyst recommendations.

Market Overview:

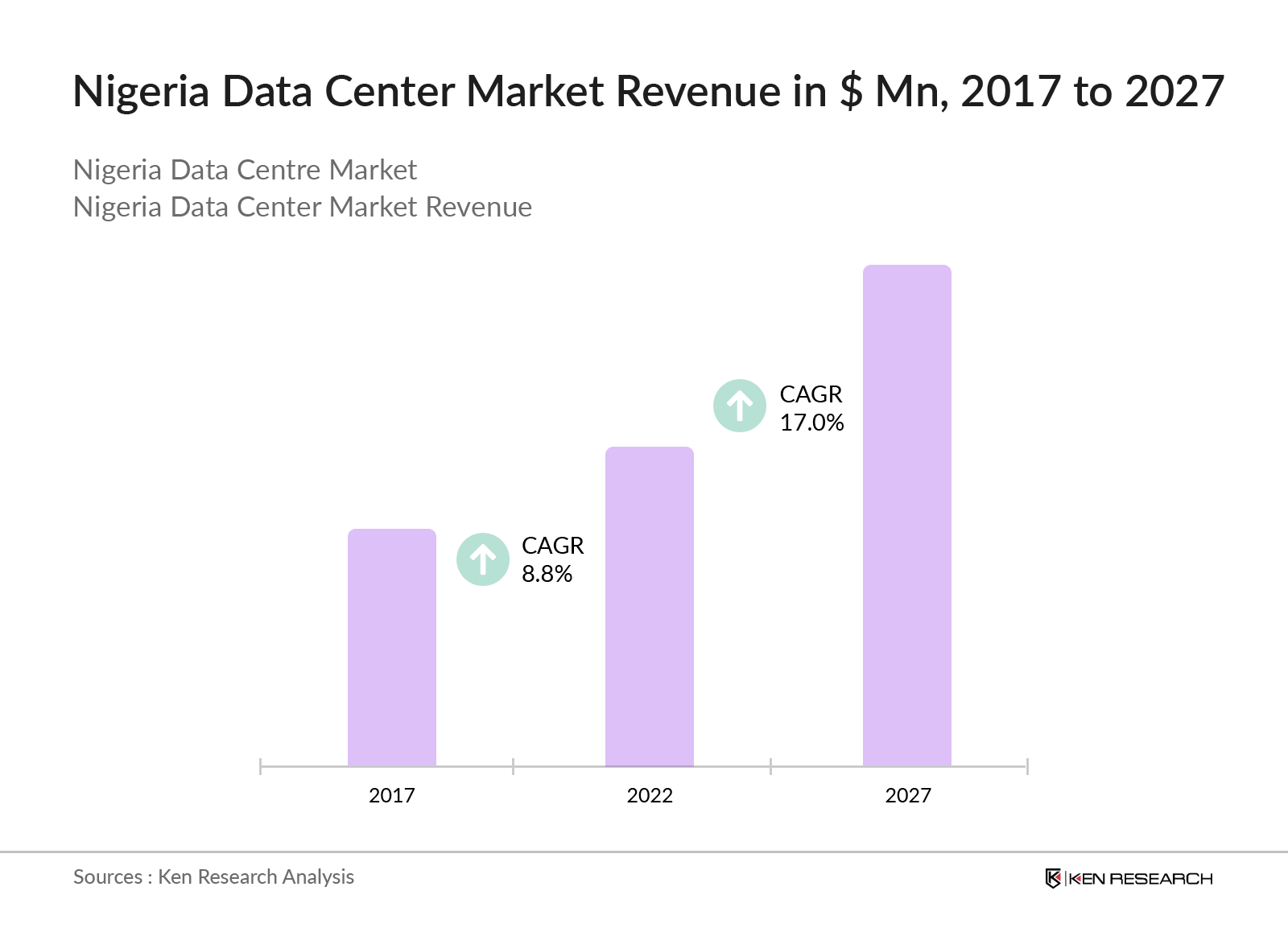

According to Ken Research estimates, the Nigeria data center market – which is at ~$131.6Mn in 2022 – is forecasted to grow further into a ~$ 288.8 Mn by 2027, owing to Launch of 5G, and increasing internet penetration

- Nigeria is promoting a fully digital economy by 2030 through the National Digital Economy Policy and Strategy (NDEPS 2020-2030).

- The growing fintech and startup ecosystem needs dynamic data centers to survive. So far, many of these companies host their data offshore, as reliability and scalability concerns have forced companies to look elsewhere.

- However, as the attention of international data center operators shifts to the country, the sector has become more robust and reliant on local hosting.

Key Trends by Market Segment:

By Vertical: The co-location accounted for the highest market share of over half of Colocation services are a major revenue contributor in the data center market in Nigeria. More and more businesses are opting for colocation because of the convenience, security of their IT infrastructure and less power cuts.

By Type of Co-location: Retail by type of co-location accounted for the highest market share. This is due to dominance of small and medium businesses in Nigeria looking forth to retail colocation spaces.

Competitive Landscape

The Nigeria Data Center Industry is consolidated with top players holding more than 70% market share. The players compete with each other on the basis of its, number of data centers, IT load, gross floor area, total white space, number of racks, geographical presence, etc.

Future Outlook

Philippines’s car rental market is projected to witness a CAGR of ~17.0% between 2022 to 2027. Data Centre market is predicted to expand owing to the internet penetration, increase in investment and government initiatives.

Scope of the Report

|

By Vertical |

Hyper Scale DC Co-location DC Managed DC |

|

By Type of Co-location |

Wholesale Co-location Retail Co-location |

|

By End User |

Telecom and IT BFSI Government E-Commerce Others |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report

- Data Center companies

- Cloud providers (Domestic and Global)

- Managed data center companies

- Co-location data center companies

- Private Equity and Venture Capitalist

- Industry Associations

- Data Center Constructors

- Technology providers

Time Period Captured in the Report

- Historical Period: 2017-2022

- Base Period: 2022

- Forecast Period: 2022-2027

Companies

Major Players Mentioned in the Report

Carrier Neutral

- Africa Data Centre

- MTN

- Galaxy Backbone

- Rackcentre

- MDX-i

- CloudExchange

Carrier Specific

- Airtel

- 9 Mobile

Banking

- Access

- Standard Chartered

- UBA

- Standard Bank

Fintech

- FlutterWave

- PayStack

- Opay

- Accelerex

- Piggyvest

Telecom/IT Companies

- MTN

- 9Mobile

- Airtel

- Smile

E-commerce Companies

- JUMIA

- Kongo

- Payporte.com

- Vconnect.com

- Kara.com

Table of Contents

1. Executive Summary

1.1 Executive summary for USA e-commerce logistics market

2. Country Overview

2.1 Country demographics

2.2 Population analysis

2.3 Nigeria Digital Economy

3. Regional Analysis

3.1 CrossComparison of Data Center Market in Nigeria with Other Countries

4. Market Overview

4.1 Supply Side Ecosystem

4.2 Demand Side Ecosystem

4.3 Business Cycle of Nigeria Data Centre Market

5. Nigeria Data Centre Market Size, FY’2017-FY’2022

6. Nigeria Data Centre Market Segmentation, FY’2022

6.1 Segmentation by Vertical

6.2 Segmentation by Type of Co-Location

6.3 Segmentation by End User Industry

7. End User Analysis

7.1 Data Centre End User Analysis in Nigeria

7.2 Decision Making Parameters

7.3 Snapshot of Telecom and IT Industry in Nigeria

7.4 Snapshot of BFSI Industry in Nigeria

7.5 Snapshot of E-Commerce Industry in Nigeria

8. Industry Analysis

8.1 SWOT analysis for Data Centre Market in Nigeria

8.2 Trends and Development for Data Centre Market in Nigeria

8.3 Growth Driver for Data Centre Market in Nigeria

8.4 Bottleneck and Challenges for Data Centre Market in Nigeria

8.5 Government Initiatives and Regulation

9.Competition Scenario

9.1 Competitive Landscape of Nigeria Data Center Market

9.2 Market Positioning of Players in Nigeria Data Center Market

9.3 Gartner Magic Quadrant of Nigeria Data Centre Market

9.4 Market Share of Major Players, 2022

9.5 Market Share of Players on the basis of White space, 2022

9.6 Market Share of Players on the basis of Number of Data Centers, 2022

9.7 Market Share of Players on the basis of Number of Racks, 2022

9.8 Market Share of Players on the basis of Number of Available Racks, 2022

9.9 IT Load (MW) of Data Center Companies in Nigeria, 2022

9.10 Cross-Comparison of Players in Nigeria Data Centre Market

9.11 Strength and Weaknesses of Nigeria Data Centre Market Players

10. Pricing Analysis

11. Impact of Covid 19

12. Future Outlook

12.1 Market Size of Nigeria Data Centre Market, FY’2022-FY’2027

12.2 Segmentation by Vertical, FY’2022-FY’2027

12.3 Segmentation by Type of Co-location, FY’2022-FY’2027

12.4 Segmentation by End User Industry, FY’2022-FY’2027

13. Case Study

14. Analyst Recommendation

15. Industry Speaks

16. Research Methodology

17. Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Our team will initially create an ecosystem for all the major entities in Data Centre Market that are providing services in Nigeria.

Step 2: Market Building:

In the next step, we will refer to multiple secondary and proprietary databases to perform deck research around the market and collate industry-level information such as type of market structure, consumption in terms of value, and fleet size other areas to create an initial level hypothesis. We will also explore company-level info by referring press releases, annual reports, financial statements, and other documents to understand basic information about the companies and market level.

Stpe 3 : Validating and Finalizing:

Later our team will conduct a series of Interviews with multiple C-Level Executive and other stakeholders belonging to different companies to confirm the market hypothesis, validate statistics and seek operational and financial information from company representatives.

Step 4 : Research output:

Furthermore, to validate this data our team will pitch each company as a potential customer through a mystery shopping exercise and will confirm the operational and financial performance of Data Centre Entities which have been shared by company executives and available on secondary databases. We will be conducting another set of CATIs with the respective entities to understand customer behavior, channel preference, and other factors. We will also assess customer analysis in terms of their preferences and pain points.

Frequently Asked Questions

01 What is the Study Period of this Market Report?

Nigeria data centre market is covered from 2017–2027 in this report, including a forecast for 2022-2027.

02 What is the Future Growth Rate of the Nigeria Data Centre Market?

Nigeria data centre market is expected to witness a CAGR of 17.0% over the next five years.

03 What are the Key Factors Driving the Nigeria Data Centre Market?

Launch of 5G & electricity generation and Technological advancements.

04 Who are the Key Players in the Market?

Major market Share holders are Africa Data Centre, Rackcentre and Open Access Data Centre.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.