North America Corrosion Inhibitors Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD1769

December 2024

82

About the Report

North America Corrosion Inhibitors Market Overview

- The North America Corrosion Inhibitors Market was valued at USD 3.1 billion in 2023, driven primarily by the rising demand in the oil and gas industry, increased awareness regarding water treatment, and stringent government regulations aimed at reducing environmental damage caused by corrosion. The continuous industrial growth in the region, particularly in the United States and Canada, has further fueled the demand for corrosion inhibitors.

- The market is dominated by several key players, including BASF SE, Ecolab Inc., Ashland Global Holdings Inc., The Dow Chemical Company, and Solenis LLC. These companies have established strong footholds in the market through extensive R&D, strategic partnerships, and acquisitions. Their global presence and strong distribution networks have allowed them to capture significant market share, providing innovative solutions tailored to various industries.

- In 2023, BASF SE announced a significant expansion of its corrosion inhibitor production capacity at its North American facility. This move was aimed at meeting the growing demand from the oil and gas and water treatment sectors. The expansion is expected to add 30% more capacity, enhancing the companys ability to serve its customers more effectively. This development underscores the continuous investment by major players in expanding their capabilities to capture a larger market share.

- In 2023, Houston's was dominating the market, primarily due to its position as a major hub for the oil and gas industry. The city's extensive network of pipelines, refineries, and petrochemical plants creates a significant demand for corrosion inhibitors to protect infrastructure and ensure operational efficiency. This is driven by ongoing investments in oil and gas infrastructure and the critical need for corrosion protection in these facilities.

North America Corrosion Inhibitors Market Segmentation

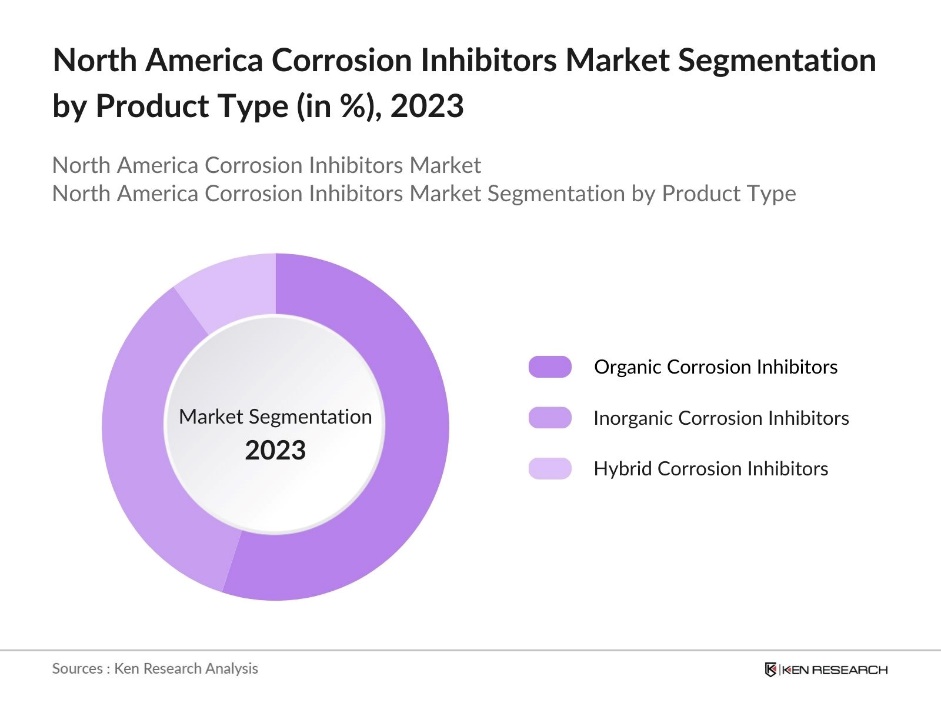

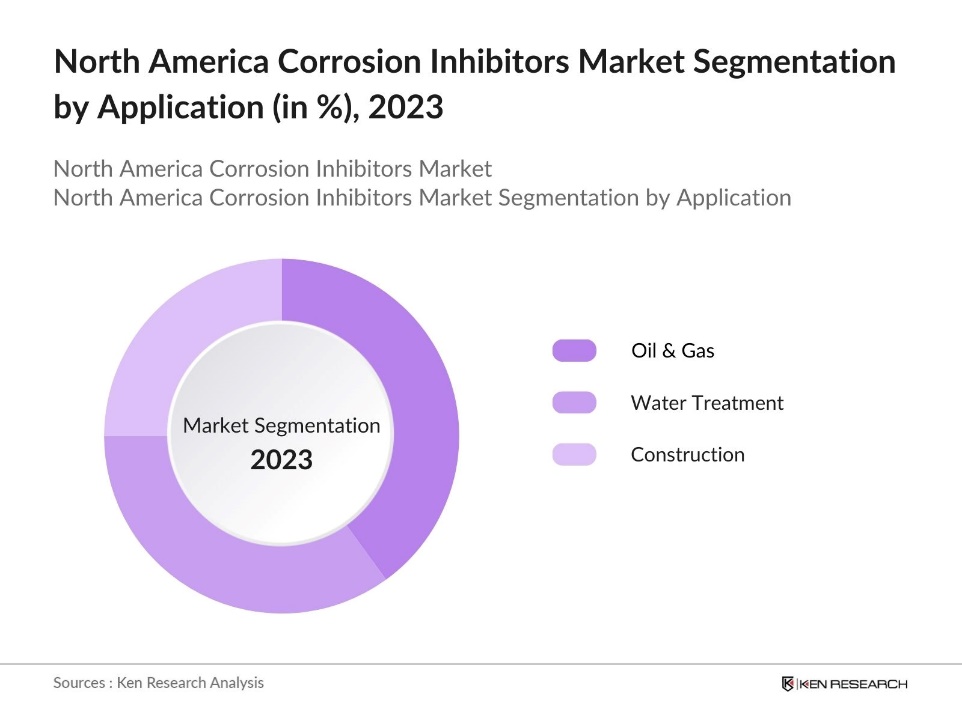

The North America Corrosion Inhibitors Market is segmented into different factors like by product type, by application and region.

By Product Type: The market is segmented by product type into Organic Corrosion Inhibitors, Inorganic Corrosion Inhibitors, and Hybrid Corrosion Inhibitors. In 2023, Organic Corrosion Inhibitors held the dominant market share, due to the increasing preference for eco-friendly and biodegradable products, particularly in industries such as water treatment and food processing. Organic Corrosion Inhibitors are favored for their effectiveness in preventing corrosion without harming the environment. Their wide applicability across various industries, combined with growing environmental regulations, contributes to their leading market position.

By Application: The market is also segmented by application into Oil & Gas, Water Treatment, and Construction. The Oil & Gas segment held the largest market share in 2023, due to the critical nature of corrosion prevention in this sector, combined with substantial investments in infrastructure, drives the demand for corrosion inhibitors. The Oil & Gas sector's dominance is due to the high stakes involved in maintaining pipeline integrity and preventing leaks, which can lead to catastrophic environmental and financial losses.

By Region: The market is segmented by region into USA and Canada. In 2023, the USA held the majority of the market share, driven by its vast industrial base and significant investments in corrosion prevention across various sectors. The USAs leadership in the market is attributed to its large-scale industrial operations, particularly in oil and gas, and stringent environmental regulations that mandate the use of corrosion inhibitors.

North America Corrosion Inhibitors Market Competitive Landscape

North America Corrosion Inhibitors Market Major Players

|

Company Name |

Establishment Year |

Headquarters |

|---|---|---|

|

BASF SE |

1865 |

Ludwigshafen, Germany |

|

Ecolab Inc. |

1923 |

St. Paul, Minnesota |

|

Ashland Global Holdings Inc. |

1924 |

Covington, Kentucky |

|

The Dow Chemical Company |

1897 |

Midland, Michigan |

|

Solenis LLC |

2014 |

Wilmington, Delaware |

- Ecolab Inc.: In 2024, Ecolab is enhancing sustainability through innovative solutions like bio-based enzymes in cleaning, reducing reliance on chemicals like chlorine. Partnering with suppliers such as Novonesis, they focus on low-carbon technologies and circular production. These advancements aim to lower waste, prevent equipment damage, and reduce their products' carbon footprint, supporting Ecolab's broader environmental objectives.

- BASF SE: In March 2024, BASF announced a price increase for select polyalcohols in North and South America, effective March 15, 2024. The price adjustments include increases of $0.09 to $0.10 per pound for products like Neopentylglycol (NPG) and 1,6-Hexanediol (HDO). These products are essential in applications such as industrial coatings, polyurethane manufacturing, and other specialized chemical processes. The price hike is driven by increased demand and rising production costs.

North America Corrosion Inhibitors Market Analysis

Growth Drivers

- Expansion of the Oil and Gas Sector: The Market is driven by the expansion of the oil and gas sector, particularly in the United States. In 2024, the U.S. Energy Information Administration (EIA) reported an increase in oil production to 13.2 million barrels per day, up from 2.9 million barrels per dayin 2023. This surge in production necessitates the use of corrosion inhibitors to maintain the integrity of pipelines, storage tanks, and other infrastructure, driving market demand. The growth of shale gas production, especially in the Permian Basin, further emphasizes the need for advanced corrosion protection measures.

- Increased Investment in Water Infrastructure: According to a report, the U.S. governments Infrastructure Investment and Jobs Act (IIJA) allocated $55 billion for water and wastewater infrastructure over the next five years. This funding aims to address critical issues like aging water systems and the need for new technology to monitor and deliver clean water. The substantial investment is expected to drive demand for corrosion inhibitors, essential for maintaining and extending the lifespan of water infrastructure across North America.

- Growth in Industrial Manufacturing Activities: The industrial manufacturing sector in North America is experiencing the notable growth, which in turn is driving the demand for corrosion inhibitors. This growth is supported by increased production across key industries such as automotive, aerospace, and heavy machinery. The reliance on metals and alloys in these industries necessitates the use of corrosion inhibitors to prevent material degradation and prolong the lifespan of equipment and products. Manufacturing hubs, particularly in states like Michigan, are expected to continue fueling market demand.

Challenges

- Volatility in Raw Material Prices: The North America Corrosion Inhibitors Market faces significant challenges due to the volatility in raw material prices. Fluctuations in the cost of essential materials like phosphates and molybdates can disrupt production economics, making it difficult for manufacturers to maintain consistent pricing. This volatility often stems from global supply chain disruptions and competing demand from other industries, which can affect market stability and profitability.

- Supply Chain Disruptions: Supply chain disruptions are a persistent challenge in the North America Corrosion Inhibitors Market. Delays in the procurement of raw materials, caused by logistical issues such as port congestions and labor shortages, can lead to inefficiencies in production and distribution. These disruptions hinder the timely delivery of corrosion inhibitors to end-users, exacerbating operational challenges for manufacturers who rely heavily on international suppliers for critical inputs.

Government Initiatives

- EPAs Lead and Copper Rule Revisions: On November 30, 2023, the U.S. Environmental Protection Agency (EPA) announced the proposed Lead and Copper Rule Improvements (LCRI). requiring water utilities to replace lead service lines and use corrosion control treatment. This rule impacts over 6 million lead service lines across the U.S. and mandates the use of corrosion inhibitors to prevent lead contamination in drinking water.

- DOE Funding: The U.S. Department of Energy (DOE) has renewed funding for the Rapid Manufacturing Institute in 2024, with a focus on supporting the decarbonization of the chemical industry. This initiative aims to advance technologies that reduce carbon emissions in chemical manufacturing processes. The funding supports research and development of innovative solutions that enhance energy efficiency and sustainability within the industry, contributing to the broader goal of reducing the carbon footprint of chemical production in North America.

North America Corrosion Inhibitors Market Future Outlook

The North America Corrosion Inhibitors Market is projected to grow exponentially by 2028. This growth is anticipated to be driven by the increasing adoption of corrosion inhibitors in emerging industries, advancements in inhibitor technology, and growing environmental concerns that necessitate the use of eco-friendly corrosion inhibitors. Additionally, the continuous expansion of industries such as oil and gas, power generation, and water treatment in North America will further propel market growth.

Future Market Trends

- Technological Advancements in Corrosion Monitoring: By 2028, advancements in corrosion monitoring technologies, such as the integration of IoT and AI, are expected to transform the North America Corrosion Inhibitors Market. The adoption of smart sensors and predictive analytics will enable real-time monitoring of corrosion levels, allowing for more precise and efficient application of inhibitors. These technologies will reduce maintenance costs and extend the lifespan of infrastructure, driving the adoption of advanced corrosion inhibitors across various industries.

- Expansion of the Chemical Processing Industry: The chemical processing industry is projected to expand significantly in North America over the next five years, with new plants and facilities being established to meet growing global demand. This expansion will lead to increased usage of corrosion inhibitors to protect equipment and pipelines from harsh chemicals and prevent costly shutdowns. By 2028, the chemical processing industry is expected to be one of the largest consumers of corrosion inhibitors, contributing to overall market growth.

Scope of the Report

|

By Product Type |

Organic Corrosion Inhibitors Inorganic Corrosion Inhibitors Hybrid Corrosion Inhibitors |

|

By Application |

Oil & Gas Water Treatment Construction |

|

By Region |

USA Canada |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Oil & Gas Companies

Construction Firms

Industrial Equipment Manufacturers

Power Generation Companies

Automotive Manufacturers

Marine and Shipping Companies

Aerospace Industry

Food & Beverage Manufacturers

Investors and VC Firms

Banks and Financial Institutions (U.S. Environmental Protection Agency (EPA), Department of Energy (DOE))

Government Regulatory Bodies

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

BASF SE

Ecolab Inc.

Ashland Global Holdings Inc.

The Dow Chemical Company

Solenis LLC

Henkel AG & Co. KGaA

ChemTreat, Inc.

SUEZ Water Technologies & Solutions

Cortec Corporation

Lubrizol Corporation

Baker Hughes

Schlumberger Limited

AkzoNobel N.V.

Houghton International Inc.

Lonza Group AG

Table of Contents

1. North America Corrosion Inhibitors Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

North America Corrosion Inhibitors Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Corrosion Inhibitors Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of the Oil and Gas Sector

3.1.2. Increased Investment in Water Infrastructure

3.1.3. Growth in Industrial Manufacturing Activities

3.1.4. Rising Demand for Eco-friendly Inhibitors

3.2. Restraints

3.2.1. Volatility in Raw Material Prices

3.2.2. Supply Chain Disruptions

3.2.3. High Cost of Eco-friendly Inhibitors

3.2.4. Technological Barriers in Adoption

3.3. Opportunities

3.3.1. Expansion in Emerging Markets

3.3.2. Innovations in Corrosion Monitoring Technologies

3.3.3. Growing Investments in Renewable Energy

3.3.4. Strategic Collaborations and Partnerships

3.4. Trends

3.4.1. Increasing Adoption of IoT in Corrosion Monitoring

3.4.2. Shift Towards Bio-based Corrosion Inhibitors

3.4.3. Expansion of Chemical Processing Industry

3.4.4. Integration with Smart Infrastructure Initiatives

3.5. Government Initiatives

3.5.1. EPAs Lead and Copper Rule Revisions

3.5.2. DOE Funding for Decarbonization in Chemical Manufacturing

3.5.3. Infrastructure Investment and Jobs Act (IIJA)

3.5.4. Canadian Infrastructure Program

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. North America Corrosion Inhibitors Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Organic Corrosion Inhibitors

4.1.2. Inorganic Corrosion Inhibitors

4.1.3. Hybrid Corrosion Inhibitors

4.2. By Application (in Value %)

4.2.1. Oil & Gas

4.2.2. Water Treatment

4.2.3. Construction

4.3. By Region (in Value %)

4.3.1. USA

4.3.2. Canada

4.4. By End-User Industry (in Value %)

4.4.1. Industrial Manufacturing

4.4.2. Food & Beverage

4.4.3. Automotive

4.5. By Chemical Type (in Value %)

4.5.1. Amines

4.5.2. Benzotriazoles

4.5.3. Phosphates

5. North America Corrosion Inhibitors Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. Ecolab Inc.

5.1.3. Ashland Global Holdings Inc.

5.1.4. The Dow Chemical Company

5.1.5. Solenis LLC

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. North America Corrosion Inhibitors Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. North America Corrosion Inhibitors Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. North America Corrosion Inhibitors Market Future Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. North America Corrosion Inhibitors Market Future Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By Region (in Value %)

9.4. By End-User Industry (in Value %)

9.5. By Chemical Type (in Value %)

10. North America Corrosion Inhibitors Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on North America Corrosion Inhibitors Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for North America Corrosion Inhibitors Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple chemical companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from chemical companies.

Frequently Asked Questions

01 How big is the North America Corrosion Inhibitors Market?

The North America Corrosion Inhibitors Market was valued at USD 3.1 billion in 2023, driven primarily by rising demand in the oil and gas industry, increased awareness of water treatment, and stringent environmental regulations.

02 What are the challenges in the North America Corrosion Inhibitors Market?

Challenges in North America Corrosion Inhibitors Market include volatility in raw material prices, supply chain disruptions, the high cost of eco-friendly inhibitors, and technological barriers in adopting advanced corrosion prevention methods.

03 Who are the major players in the North America Corrosion Inhibitors Market?

Key players in North America Corrosion Inhibitors Market include BASF SE, Ecolab Inc., Ashland Global Holdings Inc., The Dow Chemical Company, and Solenis LLC. These companies have established a strong market presence through R&D, partnerships, and acquisitions.

04 What are the growth drivers of the North America Corrosion Inhibitors Market?

Growth drivers in North America Corrosion Inhibitors Market include the expansion of the oil and gas sector, increased investment in water infrastructure, growth in industrial manufacturing activities, and rising demand for eco-friendly corrosion inhibitors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.