North America Food Storage Containers Market Outlook to 2030

Region:North America

Author(s):Sanjna Verma

Product Code:KROD10163

November 2024

98

About the Report

North America Food Storage Containers Market Overview

- The North America Food Storage Containers Market is valued at USD 56 billion, driven primarily by the rising demand for sustainable and durable food storage options. Factors such as increasing consumer awareness of food safety, alongside the growing popularity of home-cooked meals, are encouraging more people to seek high-quality storage solutions.

- In this market, cities and regions with a high density of food-processing facilities and robust e-commerce networks are at the forefront. For example, metropolitan areas in the U.S., such as Los Angeles, New York, and Chicago, lead due to the presence of numerous food retail and packaging companies that focus on sustainable, reusable containers to align with environmental standards and consumer preferences.

- The FDA enforces strict safety standards for food storage containers to ensure consumer safety. In 2023, the FDA implemented additional testing for food-grade plastics and polymers to minimize contamination risks. This regulation mandates compliance with stringent safety criteria, compelling manufacturers to adopt safer, non-toxic materials, which increases the demand for compliant food storage solutions.

North America Food Storage Containers Market Segmentation

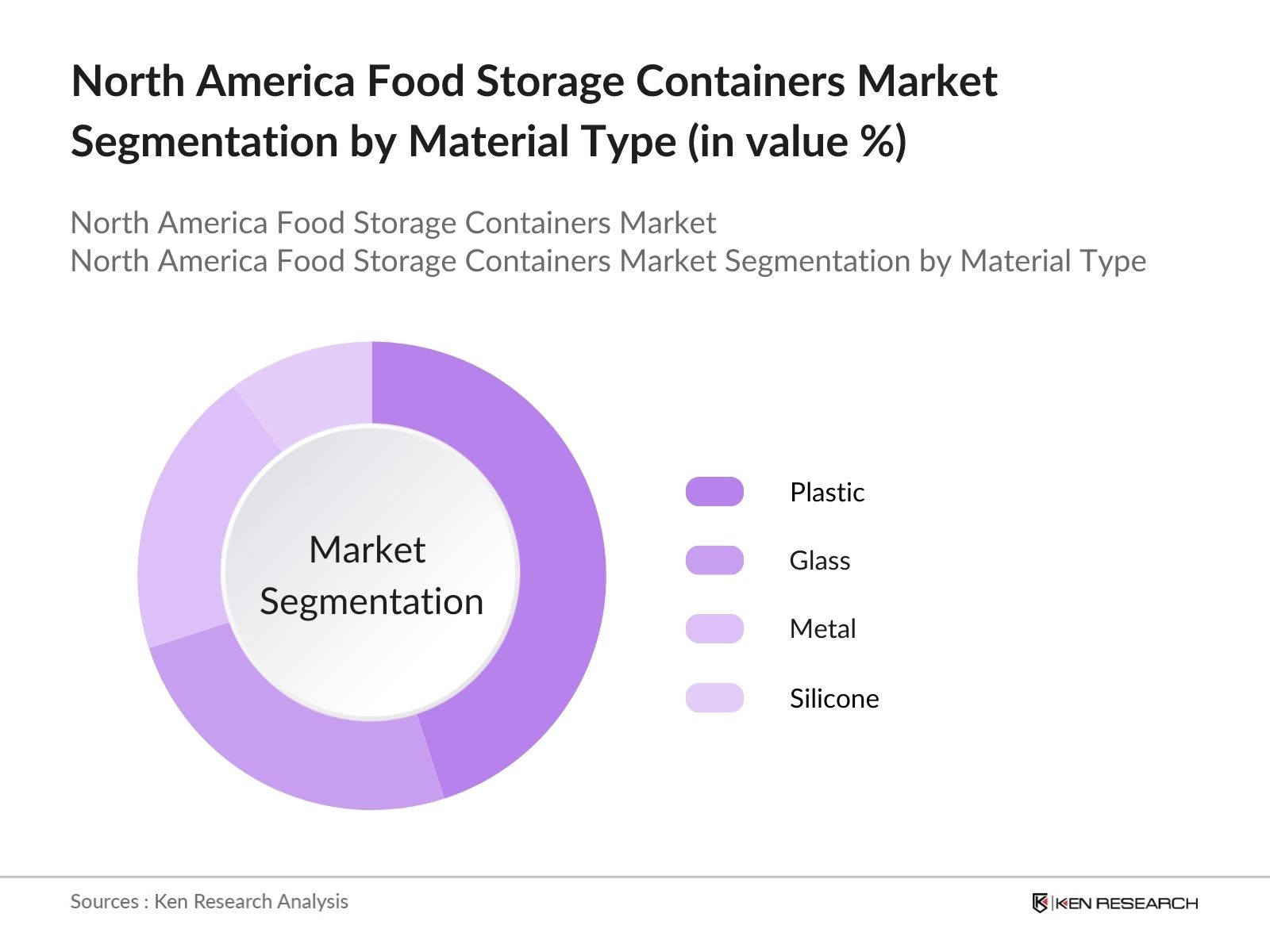

By Material Type: The market is segmented by material type, including plastic, glass, metal, and silicone. Plastic containers, especially those made from polyethylene and polypropylene, currently dominate due to their affordability, lightweight nature, and durability. Furthermore, innovations in BPA-free and recyclable plastics contribute to their continued dominance in both residential and commercial sectors.

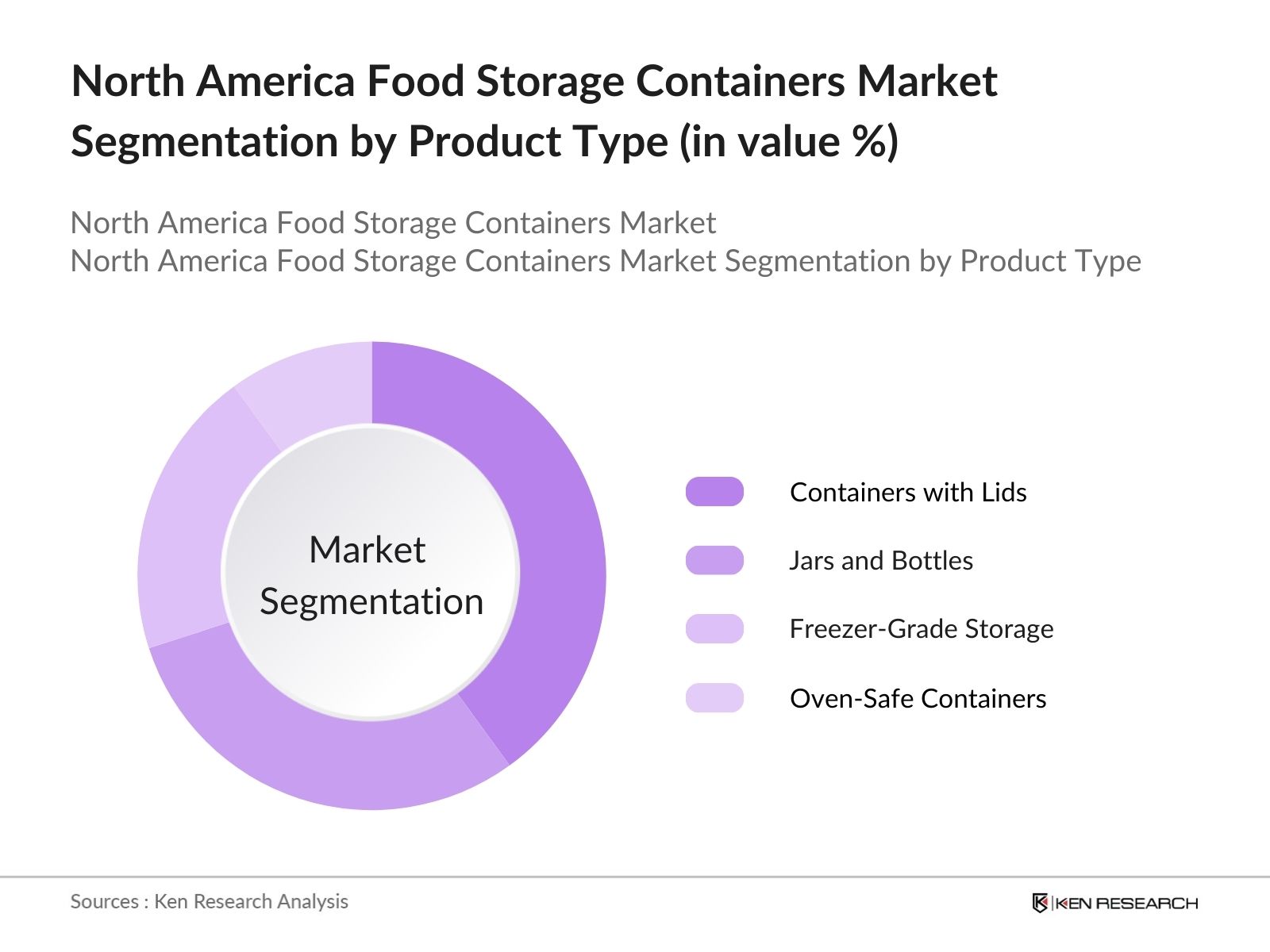

By Product Type: Segmented by product type, categories include containers with lids, jars and bottles, freezer-grade storage, and oven-safe containers. Containers with lids dominate due to their extensive application in household storage, with brands emphasizing airtight and leak-proof designs to cater to growing consumer needs for convenience in food preservation.

North America Food Storage Containers Market Competitive Landscape

The North America Food Storage Containers Market features a concentration of established players with significant market presence. These companies leverage advanced materials, regional distribution networks, and sustainability practices to maintain their dominance. Companies such as Tupperware and Rubbermaid lead in both product innovation and market reach.

North America Food Storage Containers Market Analysis

Growth Drivers

- Increasing Focus on Sustainable Packaging: According to the United States Environmental Protection Agency, in 2023, approximately 292 million tons of municipal solid waste were generated in the U.S., with a significant portion attributed to single-use packaging materials. This trend has led companies to shift towards recyclable and reusable packaging solutions. Government initiatives, like the Canada Plastics Pact, aim to make 100% of plastic packaging reusable, recyclable, or compostable by 2025, fueling the adoption of sustainable packaging within the food storage industry.

- Rising Consumer Awareness of Food Safety: Consumers in North America are increasingly prioritizing food safety in storage containers, with studies from the USDA indicating a rise in health-related purchasing behaviors. In 2023, foodborne illnesses impacted over 48 million people in the U.S., underscoring the importance of using food-grade materials in storage containers. This heightened awareness, supported by initiatives like the FDAs Food Safety Modernization Act, encourages manufacturers to adopt safer, non-toxic materials, bolstering demand in the food storage containers market.

- Expansion in Food Delivery Services: The rapid growth in food delivery services across North America has propelled demand for robust, leak-proof, and safe food storage containers. According to the U.S. Department of Commerce, online food delivery sales surged by 32% in 2023, driven by consumer preference for convenience. This growth necessitates reliable and safe food storage solutions, as delivery services seek containers that preserve freshness and prevent contamination. The trend is anticipated to support the sustained growth of the food storage containers market as delivery services continue to expand.

Challenges

- Stringent Environmental Regulations: Strict regulations on plastic usage and disposal are increasing compliance costs for the industry. The U.S. Environmental Protection Agencys directives on plastic reduction require costly adjustments to materials and processes. Canada also enforces strict rules on single-use plastics, and in 2023, bans on certain plastic containers were expanded. These regulations add pressure on manufacturers to innovate in sustainable packaging while balancing profitability.

- Competition from Alternative Packaging Solutions: Innovations in packaging materials, like edible and compostable alternatives, present competition to traditional plastic containers. USDA research indicates a 20% increase in adoption of bio-based and biodegradable materials in the packaging industry as of 2023. This shift offers alternatives to traditional storage solutions, potentially diverting demand from plastic-based food storage containers. Manufacturers in the food storage container market must adapt or face reduced market share.

North America Food Storage Containers Market Future Outlook

Over the next five years, the North America Food Storage Containers Market is expected to experience steady growth. Key drivers include the increasing focus on sustainable packaging solutions, heightened consumer awareness around health and food safety, and the rising demand for innovative, space-saving storage solutions. Manufacturers are likely to expand their product offerings to incorporate eco-friendly materials, catering to environmentally conscious consumers.

Market Opportunities

- Demand for Recyclable and Biodegradable Containers: With 42% of North American consumers prioritizing environmentally friendly purchases in 2023 (U.S. EPA), there is significant demand for recyclable and biodegradable food storage options. Regulations, such as Californias recent law mandating a25% reductionin single-use plastics by2032 , further drive the demand for sustainable alternatives. This trend presents manufacturers with an opportunity to capture eco-conscious consumers through innovative, eco-friendly products in the food storage container market.

- Technological Advancements in Packaging: Advancements in packaging technology, including the integration of antimicrobial properties and oxygen barrier layers, are revolutionizing food storage. As of 2023, the USDA reported a significant adoption rate for smart packaging that can extend food shelf life by 25%, offering opportunities for food storage manufacturers to appeal to health-conscious consumers. These technologies improve food preservation, safety, and reduce food wastage, aligning with consumer demands for high-performance food storage solutions.

Scope of the Report

|

Segment |

Sub-Segments |

|

Material Type |

Plastic Glass Metal Silicone |

|

Product Type |

Containers with Lids Jars and Bottles Freezer-Grade Storage Oven-Safe Containers |

|

Shape |

Round Square Rectangular Specialty Shapes |

|

Distribution Channel |

Retail Stores Online Platforms Specialty Stores Wholesale Distribution |

|

Application |

Residential Commercial Industrial Institutional |

Products

Key Target Audience

Food and Beverage Manufacturers

Retail Chains and Supermarkets

E-commerce Platforms

Packaging and Material Suppliers

Consumer Goods and Household Products Companies

Food Service Providers (Restaurant Chains, Catering Services)

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Food and Drug Administration, Environmental Protection Agency)

Companies

Players Mentioned in the Report

Tupperware Brands Corporation

Newell Brands (Rubbermaid)

Lock & Lock Co. Ltd.

OXO International Ltd.

Snapware Corporation

Glasslock Co. Ltd.

Pyrex (World Kitchen, LLC)

Sistema Plastics Ltd.

Cambro Manufacturing

Thermos L.L.C.

Table of Contents

1. North America Food Storage Containers Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Demand Drivers

1.4 Market Segmentation Overview

2. North America Food Storage Containers Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Food Storage Containers Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Focus on Sustainable Packaging

3.1.2 Rising Consumer Awareness of Food Safety

3.1.3 Expansion in Food Delivery Services

3.1.4 Regulatory Mandates for Food-Grade Materials

3.2 Market Challenges

3.2.1 High Material Costs

3.2.2 Stringent Environmental Regulations

3.2.3 Competition from Alternative Packaging Solutions

3.3 Opportunities

3.3.1 Demand for Recyclable and Biodegradable Containers

3.3.2 Technological Advancements in Packaging

3.3.3 Expansion in Ready-to-Eat and Frozen Foods Market

3.4 Trends

3.4.1 Adoption of Smart Packaging Solutions

3.4.2 Use of BPA-Free and Eco-Friendly Materials

3.4.3 Growth in E-Commerce Demand for Secure Packaging

3.5 Government Regulation

3.5.1 FDA Food Safety Standards

3.5.2 Environmental Compliance Requirements

3.5.3 Material Usage Certifications

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. North America Food Storage Containers Market Segmentation

4.1 By Material Type (In Value %)

4.1.1 Plastic (Polypropylene, Polyethylene Terephthalate)

4.1.2 Glass (Borosilicate, Tempered)

4.1.3 Metal (Stainless Steel, Aluminum)

4.1.4 Silicone (Food-Grade, Eco-Friendly)

4.2 By Product Type (In Value %)

4.2.1 Containers with Lids

4.2.2 Jars and Bottles

4.2.3 Freezer-Grade Storage

4.2.4 Oven-Safe Containers

4.3 By Shape (In Value %)

4.3.1 Round

4.3.2 Square

4.3.3 Rectangular

4.3.4 Specialty Shapes

4.4 By Distribution Channel (In Value %)

4.4.1 Retail Stores

4.4.2 Online Platforms

4.4.3 Specialty Stores

4.4.4 Wholesale Distribution

4.5 By Application (In Value %)

4.5.1 Residential

4.5.2 Commercial (Restaurants, Cafes)

4.5.3 Industrial (Large-Scale Food Processing)

4.5.4 Institutional (Hospitals, Schools)

5. North America Food Storage Containers Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Tupperware Brands Corporation

5.1.2 Newell Brands (Rubbermaid)

5.1.3 Lock & Lock Co. Ltd.

5.1.4 OXO International Ltd.

5.1.5 Snapware Corporation

5.1.6 Glasslock Co. Ltd.

5.1.7 Pyrex (World Kitchen, LLC)

5.1.8 Sistema Plastics Ltd.

5.1.9 Cambro Manufacturing

5.1.10 Thermos L.L.C.

5.2 Cross Comparison Parameters (Production Capacity, R&D Investment, Regional Presence, Product Innovation, Sustainability Initiatives, Market Share, Pricing Strategy, Brand Loyalty)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity Funding

5.8 Government Grants and Incentives

6. North America Food Storage Containers Market Regulatory Framework

6.1 Food-Grade Material Standards

6.2 Environmental Compliance for Manufacturing

6.3 Recycling and Disposal Guidelines

7. North America Food Storage Containers Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Influencing Future Market Growth

8. North America Food Storage Containers Future Market Segmentation

8.1 By Material Type (In Value %)

8.2 By Product Type (In Value %)

8.3 By Shape (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Application (In Value %)

9. North America Food Storage Containers Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves establishing a comprehensive map of key stakeholders in the North America Food Storage Containers Market. This process relies on extensive desk research, using both secondary and proprietary data sources to outline essential variables that influence market trends.

Step 2: Market Analysis and Construction

This step focuses on aggregating historical data on market segments, revenue streams, and product usage trends, analyzing data to estimate the markets current structure. The objective is to assess the reliability of revenue projections through cross-referencing data from validated sources.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are developed and tested through industry expert consultations, with in-depth interviews providing qualitative insights into operational and financial aspects. These insights are crucial for verifying market dynamics.

Step 4: Research Synthesis and Final Output

The concluding phase involves consolidating data from multiple sources to create an exhaustive analysis, ensuring the report offers a validated and comprehensive view of the North America Food Storage Containers Market.

Frequently Asked Questions

01 How big is the North America Food Storage Containers Market?

The North America Food Storage Containers Market is valued at USD 56 billion, driven by consumer demand for eco-friendly storage options and innovations in material technology.

02 What are the major challenges in the North America Food Storage Containers Market?

Key challenges in North America Food Storage Containers Market include high production costs for sustainable materials, stringent environmental regulations, and competition from alternative packaging solutions that appeal to environmentally conscious consumers.

03 Who are the leading players in the North America Food Storage Containers Market?

Major players in North America Food Storage Containers Market include Tupperware Brands Corporation, Newell Brands (Rubbermaid), Lock & Lock Co. Ltd., OXO International Ltd., and Snapware Corporation, known for their extensive product portfolios and strong market presence.

04 What drives the North America Food Storage Containers Market?

North America Food Storage Containers Market is primarily driven by increasing consumer awareness of food safety and demand for reusable, eco-friendly containers. Innovations in BPA-free plastics and recyclable materials further bolster growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.