North America Natural Food Colors Market Outlook to 2030

Region:North America

Author(s):Sanjna Verma

Product Code:KROD536

December 2024

84

About the Report

North America Natural Food Colors Market Overview

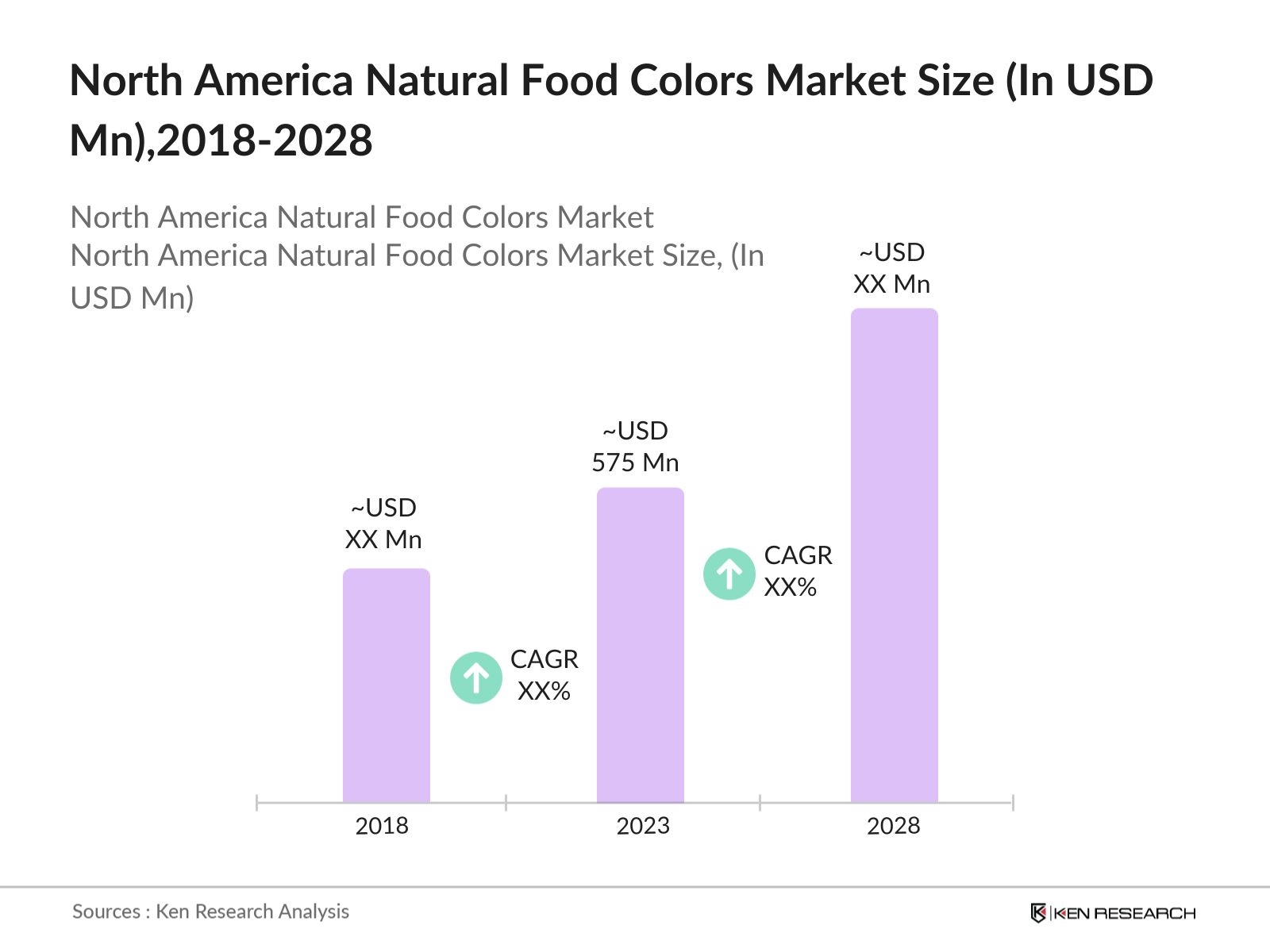

- North America Natural Food Colors Market was valued at USD 575 million in 2023, reflecting significant growth in the demand for natural food colorants over the past few years. This growth is driven by increasing consumer preference for natural ingredients, stringent regulations regarding synthetic additives, and the expanding food and beverage industry in North America.

- Key players in the North America Natural Food Colors Market include Sensient Technologies Corporation, Chr. Hansen Holding A/S, Givaudan, DDW The Color House, and International Flavors & Fragrances Inc. These companies dominate the market due to their extensive product portfolios, robust distribution networks, and continuous investments in research and development to innovate and expand their natural color offerings.

- In 2024, Sensient announced a $500,000 investment in its Sensient Colours manufacturing site in Kingston, Canada. This investment will allow the company to increase its automated production capabilities and total liquid volume of product by 25% to meet the rising demand for natural food colors across the U.S. and Canada.

- Major cities like New York, Los Angeles, and Chicago dominate the North America Natural Food Colors Market. These cities have a high concentration of food processing companies and a substantial consumer base that prefers natural and organic food products. The presence of major players' headquarters and manufacturing facilities in these cities also contributes to their dominance in the market.

North America Natural Food Colors Market Segmentation

The North America Natural Food Colors Market can be segmented based on several factors:

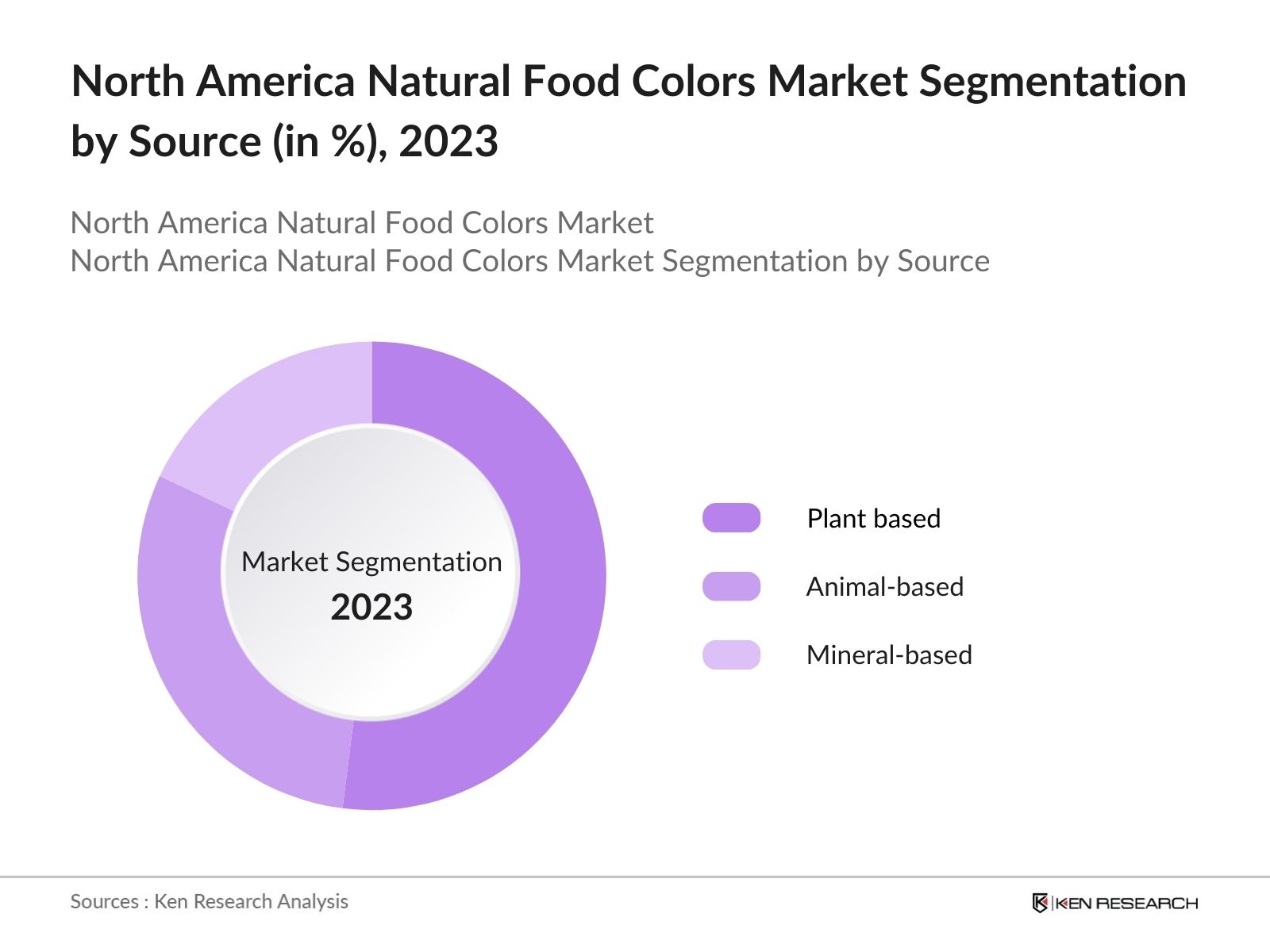

By Source: North America Natural Food Colors Market is segmented by source into Plant-Based, Animal-Based, and Mineral-Based. In 2023, the Plant-Based segment dominated the market. This dominance is attributed to the growing consumer preference for plant-based foods and beverages, which are perceived as healthier and more sustainable. Plant-based colors derived from fruits, vegetables, and spices are extensively used in the food and beverage industry, further driving the segment's growth.

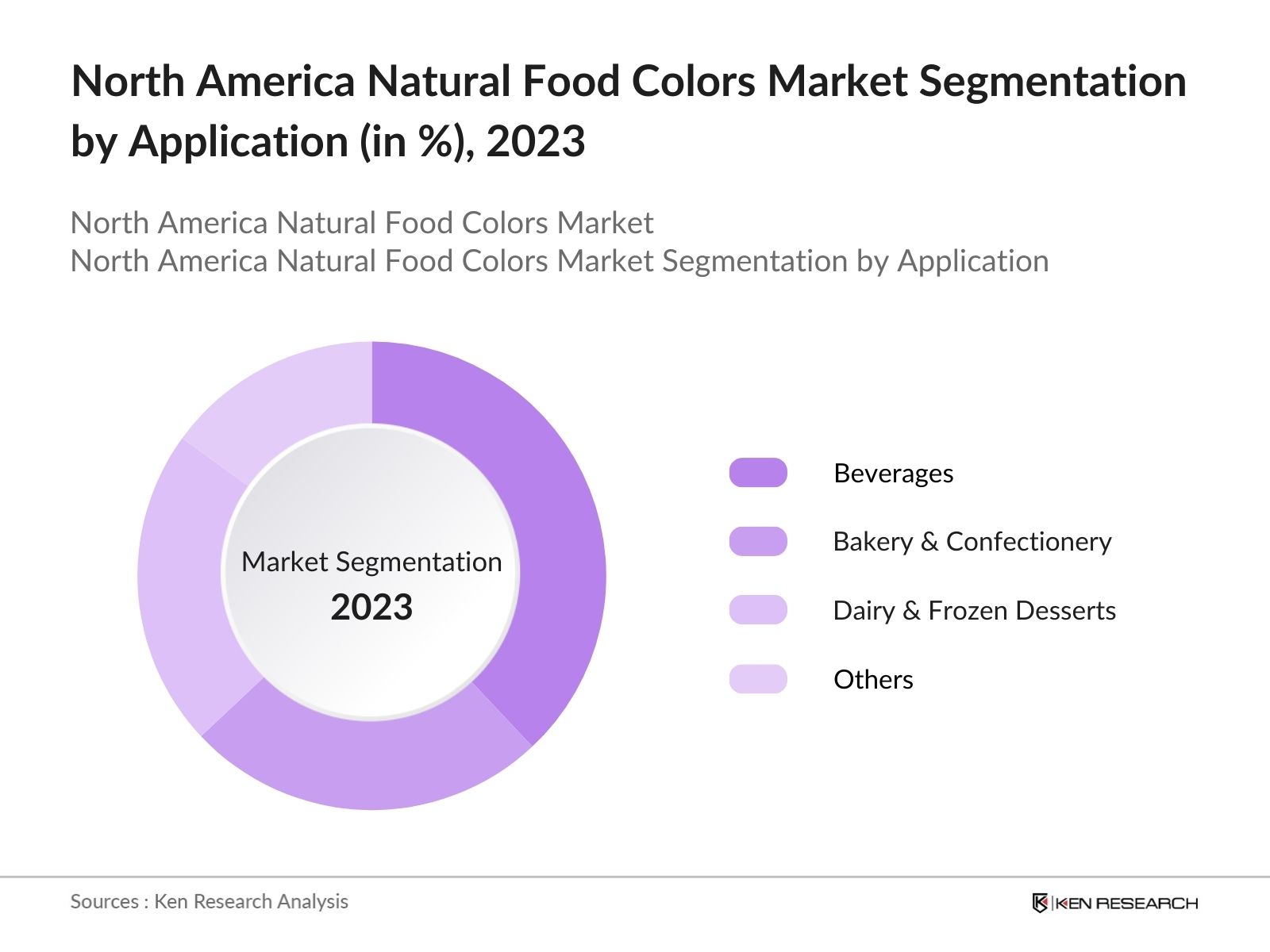

By Application: North America Natural Food Colors Market is segmented by application into Beverages, Bakery & Confectionery, Dairy & Frozen Desserts, and Others. The Beverages segment held the largest market share in 2023 due to the extensive use of natural colors in the production of juices, carbonated drinks, and alcoholic beverages. The rising demand for clean-label beverages and the increasing trend of healthy drinking habits among consumers have further propelled the segment's growth.

By Region: North America Natural Food Colors Market is segmented by region into USA and Canada. In 2023, the USA dominated the North America Natural Food Colors market. This dominance is due to the presence of major food and beverage manufacturers and a large consumer base preferring natural and clean-label products. Additionally, stringent regulations by the FDA on synthetic food additives have further driven the adoption of natural food colors in the USA.

North America Natural Food Colors Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Sensient Technologies Corporation |

1882 |

Milwaukee, USA |

|

Chr. Hansen Holding A/S |

1874 |

Hrsholm, Denmark |

|

Givaudan |

1895 |

Vernier, Switzerland |

|

DDW The Color House |

1865 |

Louisville, USA |

|

International Flavors & Fragrances Inc. |

1889 |

New York, USA |

- Chr. Hansen Holding A/S: In 2021, Chr. Hansen has formed a long-term partnership with UPL, a global agricultural solutions provider, to develop and commercialize microbial products. This collaboration aims to strengthen the existing portfolio of microbial solutions, focusing on sustainable agricultural practices, biostimulants, and biopesticides. UPL will handle the registration and commercialization of these products, leveraging its extensive distribution network.

- Givaudan: In 2021, Givaudan announced the completion of its acquisition of DDW, The Color House, a U.S.-based natural color company. This acquisition enhances Givaudan's position in the natural colors market, making it the second-largest player globally. DDW, headquartered in Louisville, Kentucky, operates 12 manufacturing facilities worldwide and had approximately $140 million in sales in 2020.

North America Natural Food Colors Industry Analysis

North America Natural Food Colors Growth Drivers:

- Increasing Consumer Demand for Natural and Clean Label Products: Consumer demand for natural and clean-label food products is driving growth in the North America Natural Food Colors Market. The shift towards natural food colors is fueled by consumer preference for clean-label ingredients and the rise in lifestyle-related diseases like diabetes and obesity in the U.S. Obesity significantly increases the risk of type 2 diabetes, with adjusted hazard ratios showing a risk increase of up to 7.16 times.

- Regulatory Push Towards Natural Ingredients: Regulatory bodies such as the U.S. Food and Drug Administration (FDA) have intensified efforts to promote the use of natural ingredients in food products. The FDA has a longstanding policy regarding the use of the term "natural" on food labels. For a food product to be labeled as "natural," it must not contain any artificial or synthetic ingredients, including colors and preservatives. The product should also be minimally processed, meaning it should not be fundamentally altered from its original state.

- Technological Advancements in Natural Color Extraction: Recent advancements in extraction and formulation technologies have enabled the production of more stable and vibrant natural food colors. Methods such as ohmic heating and pulsed electric fields (PEF) have been developed to enhance extraction efficiency while minimizing energy and water usage. These innovations aim to produce colorants that are not only vibrant but also stable under various food processing conditions. The adoption of such technologies is expected to enhance product quality and expand the applications of natural colors across various food and beverage sectors.

Market Challenges:

- Limited Stability and Shelf Life: Natural food colors often face challenges related to stability and shelf life, particularly when exposed to varying temperatures, light, and pH levels. This instability poses a significant challenge for manufacturers looking to use natural colors in products with longer shelf lives or those that undergo various processing conditions. Consequently, the limited stability and shelf life of natural food colors can hinder their widespread adoption in certain food and beverage applications.

- Regulatory and Compliance Issues: While regulatory bodies are encouraging the use of natural food colors, the lack of uniform standards across North America poses a challenge for manufacturers. For e.g. there were discrepancies in the permissible limits and labeling requirements for natural colors between the U.S. and Canada. This regulatory inconsistency complicates the production and distribution process for manufacturers aiming to cater to both markets, leading to increased compliance costs and potential market entry barriers.

Government Initiatives:

- U.S. Department of Agriculture's Organic Certification Program: The NOP was established under the Organic Foods Production Act of 1990 and its regulations were finalized in 2000. The program's core mission is to protect the integrity of the USDA organic seal, which can only be used on products that contain at least 95% organic ingredients. As of 2023, there are about 75 USDA-accredited certifying agents that help producers achieve organic certification, which is mandatory for any operation grossing over $5,000 annually in organic sales.

- Canadian Food Inspection Agency's "Safe Food for Canadians Regulations": The "Safe Food for Canadians Regulations" (SFCR) exist and were officially implemented in 2019. The SFCR aims to modernize and streamline food safety regulations in Canada, ensuring that food imported, exported, or traded across provincial borders meets consistent safety standards. This initiative has led to increased scrutiny and compliance costs for companies, but it also promotes the use of high-quality natural ingredients, thereby supporting market growth.

North America Natural Food Colors Future Market Outlook

North America Natural Food Colors Market is expected to grow exponentially by 2028, driven by increasing consumer demand for natural and clean-label products. the market is projected to expand significantly, supported by technological advancements in extraction and formulation techniques that improve the stability and vibrancy of natural colors.

Future Trends

- Expansion of Product Portfolios: Leading companies in the natural food colors market are expected to expand their product portfolios to include a wider range of vibrant and stable colors derived from novel sources. Innovations in color extraction from fruits, vegetables, and algae will provide manufacturers with more options to create appealing products that meet consumer demands for natural ingredients.

- Growth in Plant-Based Food and Beverage Applications: The plant-based food and beverage sector is anticipated to be a major driver for the natural food colors market. As the popularity of plant-based diets continues to rise, there will be increased demand for natural colors that complement the flavors and aesthetics of these products, particularly in categories like plant-based dairy and meat alternatives.

Scope of the Report

|

By Source |

Plant-Based Animal-Based Mineral-Based |

|

By Application |

Beverages Bakery & Confectionery Dairy & Frozen Desserts Others |

|

By Region |

USA |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Food and Beverage Manufacturers

Natural Ingredients Suppliers

Health and Wellness Product Companies

Organic Product Manufacturers

Nutraceutical Companies

Cosmetics Manufacturers

Pharmaceutical Companies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Agriculture, Health Canada)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:

Sensient Technologies Corporation

Chr. Hansen Holding A/S

Givaudan

DDW The Color House

International Flavors & Fragrances Inc.

Archer Daniels Midland Company

Naturex S.A.

Symrise AG

Kalsec Inc.

Wild Flavors GmbH

ROHA Dyechem Pvt. Ltd.

FMC Corporation

San-Ei Gen F.F.I., Inc.

DIC Corporation

Sun Chemical Corporation

Table of Contents

1. North America Natural Food Colors Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Natural Food Colors Market Size (in USD Mn), 2018-2028

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Natural Food Colors Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumer Demand for Natural and Clean Label Products

3.1.2. Regulatory Push Towards Natural Ingredients

3.1.3. Technological Advancements in Natural Color Extraction

3.1.4. Expansion of Product Portfolios

3.2. Restraints

3.2.1. Limited Stability and Shelf Life

3.2.2. Regulatory and Compliance Issues

3.2.3 High Production Costs of Natural Food Colors

3.3. Opportunities

3.3.1. Growth in Plant-Based Food and Beverage Applications

3.3.2. Increased Demand for Organic and Natural Products

3.4. Trends

3.4.1. Shift Towards Sustainable and Eco-Friendly Products

3.4.2. Rising Popularity of Plant-Based Diets

3.5. Government Regulation

3.5.1. U.S. Department of Agriculture's Organic Certification Program

3.5.2. Canadian Food Inspection Agency's "Safe Food for Canadians Regulations"

3.5.3. FDA Guidelines on Natural Ingredients

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. North America Natural Food Colors Market Segmentation, 2023

4.1. By Source (in Value %)

4.1.1. Plant-Based

4.1.2. Animal-Based

4.1.3. Mineral-Based

4.2. By Application (in Value %)

4.2.1. Beverages

4.2.2. Bakery & Confectionery

4.2.3. Dairy & Frozen Desserts

4.2.4. Others

4.3. By Region (in Value %)

4.3.1. USA

4.3.2. Canada

4.4. By Distribution Channel (in Value %)

4.4.1. Online Retail

4.4.2. Offline Retail

4.5. By End-User (in Value %)

4.5.1. Food & Beverage Manufacturers

4.5.2. Foodservice Industry

5. North America Natural Food Colors Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Sensient Technologies Corporation

5.1.2. Chr. Hansen Holding A/S

5.1.3. Givaudan

5.1.4. DDW The Color House

5.1.5. International Flavors & Fragrances Inc.

5.1.6. Archer Daniels Midland Company

5.1.7. Naturex S.A.

5.1.8. Symrise AG

5.1.9. Kalsec Inc.

5.1.10. Wild Flavors GmbH

5.1.11. ROHA Dyechem Pvt. Ltd.

5.1.12. FMC Corporation

5.1.13. San-Ei Gen F.F.I., Inc.

5.1.14. DIC Corporation

5.1.15. Sun Chemical Corporation

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. North America Natural Food Colors Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. North America Natural Food Colors Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. North America Natural Food Colors Future Market Size (in USD Mn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. North America Natural Food Colors Future Market Segmentation, 2028

9.1. By Source (in Value %)

9.2. By Application (in Value %)

9.3. By Region (in Value %)

9.4. By Distribution Channel (in Value %)

9.5. By End-User (in Value %)

10. North America Natural Food Colors Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on North America Natural Food Colors Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for North America Natural Food Colors Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple Natural Food Colors suppliers and distributors companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Natural Food Colors suppliers and distributors companies.

Frequently Asked Questions

01 How big is North America Natural Food Colors Market?

North America Natural Food Colors Market was valued at USD 750 million in 2023, reflecting significant growth in the demand for natural food colorants over the past few years. This growth is driven by increasing consumer preference for natural ingredients, stringent regulations regarding synthetic additives

02 What are the challenges in the North America Natural Food Colors market?

Challenges in the North America Natural Food Colors Market include high production costs, limited stability and shelf life of natural colors, and regulatory inconsistencies between countries. These factors can hinder the adoption of natural food colors, particularly among smaller manufacturers.

03 What are the growth drivers of North America Natural Food Colors Market?

North America Natural Food Colors Market is propelled by the increasing consumer preference for natural and clean-label products, regulatory encouragement for the use of natural ingredients, and technological advancements in color extraction and stabilization techniques, which improve the quality and application range of natural colors.

04 Who are the major players in the North America Natural Food Colors Market?

Key players in the North America Natural Food Colors Market include Sensient Technologies Corporation, Chr. Hansen Holding A/S, Givaudan, DDW The Color House, and International Flavors & Fragrances Inc. These companies lead the market due to their robust product portfolios and strong R&D capabilities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.