North America Pressure Vessels Market Outlook to 2028

Region:North America

Author(s):Naman Rohilla

Product Code:KROD7487

December 2024

91

About the Report

North America Pressure Vessels Market Overview

- The North America Pressure Vessels Market is valued at USD 3.5 billion, driven primarily by the increasing demand across industries like oil and gas, chemicals, and power generation. The market growth is supported by technological advancements in materials and manufacturing, including the rise in composite materials for lighter and more durable vessels. The ongoing expansion of the energy sector, particularly in the United States, continues to fuel the demand for high-performance pressure vessels, contributing to the markets consistent growth.

- The United States is the dominant country in the North America pressure vessels market, primarily due to its robust oil and gas industry, which generates demand for pressure vessels in refining and petrochemical processes. Canada also plays a key role, benefiting from its substantial energy and chemical processing industries. The dominance of these regions is attributed to well-established industrial infrastructures, increasing investments in energy projects, and stringent safety standards that necessitate advanced pressure vessel solutions.

- The ASME Boiler and Pressure Vessel Code (BPVC) sets the safety and design standards for pressure vessels in North America. In 2023, over 70% of pressure vessels in the U.S. adhered to these codes. Compliance ensures that pressure vessels meet stringent safety, design, and performance criteria, reducing the risk of accidents and improving operational efficiency.

North America Pressure Vessels Market Segmentation

- By Material Type: The North America Pressure Vessels market is segmented by material type into steel alloy pressure vessels, composite pressure vessels, and other metal pressure vessels. Recently, steel alloy pressure vessels have taken a dominant share due to their extensive use in high-pressure applications in industries like oil and gas, chemical processing, and power generation. Steel alloys are favored for their durability, strength, and ability to withstand high pressure, making them suitable for critical processes in harsh environments.

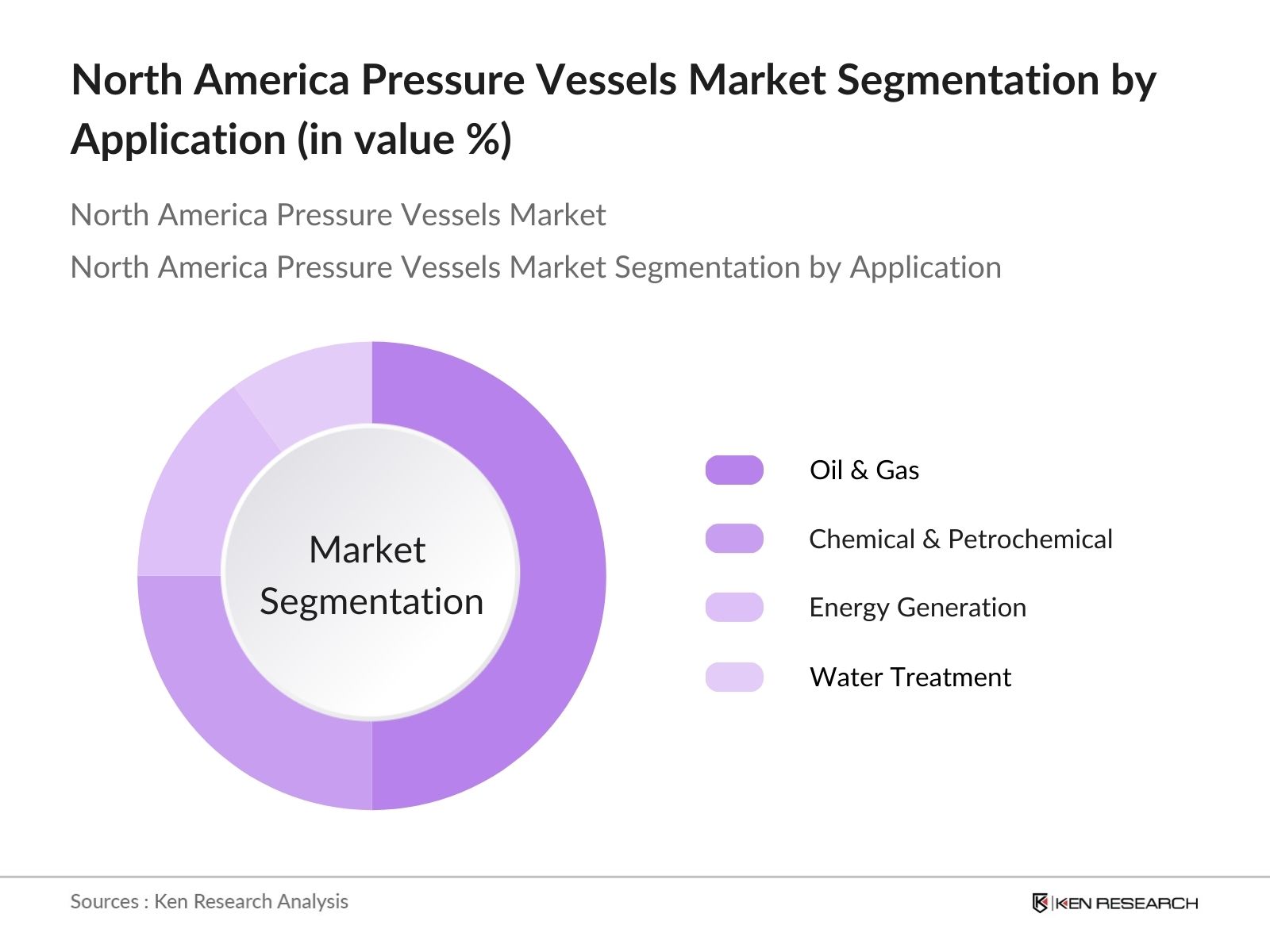

- By Application: The market is also segmented by application into oil & gas, chemical & petrochemical, energy generation, and water treatment. The oil & gas segment holds a dominant market share due to the demand for pressure vessels in refineries, natural gas processing, and chemical plants. The growing demand for liquefied natural gas (LNG) and petrochemical products is also driving the demand for specialized pressure vessels in this segment.

North America Pressure Vessels Market Competitive Landscape

The North America Pressure Vessels market is consolidated, with several key players dominating the market, leveraging their expertise in high-performance materials, advanced engineering, and strategic partnerships. Technological innovation, capacity expansions, and adherence to stringent safety regulations primarily drive the competition. Companies are also focusing on mergers and acquisitions to strengthen their market presence.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

R&D Investments |

Technology Innovation |

Global Presence |

Production Capacity |

Strategic Partnerships |

|

Doosan Heavy Industries & Construction |

1962 |

South Korea |

- |

- |

- |

- |

- |

- |

|

Babcock & Wilcox Enterprises, Inc. |

1867 |

Ohio, USA |

- |

- |

- |

- |

- |

- |

|

Mitsubishi Heavy Industries, Ltd. |

1884 |

Tokyo, Japan |

- |

- |

- |

- |

- |

- |

|

IHI Corporation |

1853 |

Tokyo, Japan |

- |

- |

- |

- |

- |

- |

|

General Electric Company |

1892 |

Massachusetts, USA |

- |

- |

- |

- |

- |

- |

North America Pressure Vessels Market Analysis

North America Pressure Vessels Market Growth Drivers

- Energy Demand and Industrial Growth: The North American pressure vessels market is driven by the growing energy demand and industrial expansion across multiple sectors. The U.S. Energy Information Administration (EIA) reports that in 2023, U.S. energy consumption reached 102.3 quadrillion British thermal units (Btu), with substantial use in the industrial sector. This surge fuels the need for pressure vessels, essential in energy production and storage. Additionally, Canada's industrial manufacturing output stood at 352 billion USD in 2023, further driving demand for pressure vessels used in heavy industrial applications.

- Expansion in Oil & Gas Sector: The oil and gas industry continues to be a driver for the pressure vessels market in North America. The U.S. produced 11.7 million barrels of oil per day in 2024, while Canada added 4.4 million barrels daily. This expansion necessitates the use of pressure vessels in refining, storage, and transportation processes. The American Petroleum Institute (API) mandates the use of pressure vessels for safe handling of volatile substances in the sector, solidifying their importance in this industry.

- Rise in Chemical and Petrochemical Industries: The chemical and petrochemical sectors in North America have seen growth, fueling demand for pressure vessels. The U.S. chemical industry saw revenues of 758 billion USD in 2023, with petrochemicals being a major contributor. Pressure vessels are critical for handling and processing raw materials and chemicals in these industries. The Canadian chemical sector, with a contribution of 41.5 billion USD in the same year, also requires high-capacity pressure vessels for its operations.

North America Pressure Vessels Market Challenges

- Volatility in Raw Material Prices: The pressure vessels market faces challenges due to fluctuating raw material prices. Steel, a primary component in pressure vessel construction, saw price increases from 800 USD per ton in 2021 to over 1,100 USD per ton in 2023, according to the World Steel Association. This volatility has impacted manufacturing costs, leading to delays in production and installation of pressure vessels across industries.

- High Initial Investment Costs: Pressure vessel installation and production involve high initial costs, which can deter smaller companies from adopting new technologies. In 2024, the average cost of a large-scale industrial pressure vessel ranged from 100,000 USD to 200,000 USD, according to data from the U.S. Department of Energy. These high capital requirements pose barriers, especially in industries where tight budgeting and cost control are essential.

North America Pressure Vessels Market Future Outlook

Over the next five years, the North America Pressure Vessels market is expected to grow steadily, driven by increasing investments in the energy and chemical sectors. The rise of renewable energy projects, such as hydrogen production and storage, will create new opportunities for manufacturers of pressure vessels. Additionally, advancements in composite materials and smart technologies for monitoring pressure vessels will further enhance the markets growth potential.

North America Pressure Vessels Market Opportunities

- Growing Adoption of Renewable Energy: The growing focus on renewable energy offers opportunities for the pressure vessels market. Pressure vessels are vital in solar power generation, wind energy storage, and biofuel production. In 2023, the U.S. generated over 1.05 trillion kWh from renewable sources, accounting for 22% of total electricity production. As this segment expands, so will the demand for innovative pressure vessel technologies that support clean energy initiatives.

- Demand for Lightweight and Corrosion-Resistant Pressure Vessels: Industries are increasingly seeking lightweight, corrosion-resistant pressure vessels, especially for marine and offshore applications. In 2024, composite pressure vessels, which are 50% lighter than traditional steel vessels, became standard in many sectors. This demand stems from the need for reduced fuel consumption and maintenance costs, particularly in oil rigs and shipping industries, which are key contributors to North American industrial growth.

Scope of the Report

|

By Material |

Steel Alloy Pressure Vessels Composite Pressure Vessels Other Metal Pressure Vessels |

|

By Application |

Oil & Gas Chemical & Petrochemical Energy Generation Water Treatment |

|

By Product Type |

Boilers Separators Reactors, Storage Vessels |

|

By Pressure Type |

Low-Pressure Medium-Pressure High-Pressure Vessels |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

- Oil & Gas Companies

- Chemical Processing Firms

- Energy Generation Plants

- Banks and Financial Institutions

- Water Treatment Facilities

- Industrial Equipment Manufacturers

- Government and Regulatory Bodies (EPA, OSHA)

- Investor and Venture Capitalist Firms

- Renewable Energy Companies

Companies

Players Mentioned in the Report

- Doosan Heavy Industries & Construction Co. Ltd.

- Babcock & Wilcox Enterprises, Inc.

- Mitsubishi Heavy Industries, Ltd.

- IHI Corporation

- General Electric Company

- Samuel Pressure Vessel Group

- Trinity Industries, Inc.

- Larsen & Toubro Ltd.

- Westinghouse Electric Company

- Steelhead Composites

Table of Contents

1. North America Pressure Vessels Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Pressure Vessels Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Pressure Vessels Market Analysis

3.1. Growth Drivers

3.1.1. Energy Demand and Industrial Growth

3.1.2. Expansion in Oil & Gas Sector

3.1.3. Technological Advancements in Materials

3.1.4. Rise in Chemical and Petrochemical Industries

3.2. Market Challenges

3.2.1. Volatility in Raw Material Prices

3.2.2. High Initial Investment Costs

3.2.3. Stringent Government Regulations

3.3. Opportunities

3.3.1. Growing Adoption of Renewable Energy

3.3.2. Demand for Lightweight and Corrosion-Resistant Pressure Vessels

3.3.3. Expansion in Hydrogen Fuel Production

3.4. Trends

3.4.1. Integration of IoT and Smart Monitoring

3.4.2. Increased Use of Composite Materials

3.4.3. Modular Construction of Pressure Vessels

3.5. Government Regulations

3.5.1. ASME Codes & Standards

3.5.2. Environmental Protection Agency (EPA) Regulations

3.5.3. Occupational Safety and Health Administration (OSHA) Compliance

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. North America Pressure Vessels Market Segmentation

4.1. By Material (In Value %)

4.1.1. Steel Alloy Pressure Vessels

4.1.2. Composite Pressure Vessels

4.1.3. Other Metal Pressure Vessels

4.2. By Application (In Value %)

4.2.1. Oil & Gas

4.2.2. Chemical & Petrochemical

4.2.3. Energy Generation

4.2.4. Water Treatment

4.3. By Product Type (In Value %)

4.3.1. Boilers

4.3.2. Separators

4.3.3. Reactors

4.3.4. Storage Vessels

4.4. By Pressure Type (In Value %)

4.4.1. Low-Pressure Vessels

4.4.2. Medium-Pressure Vessels

4.4.3. High-Pressure Vessels

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Pressure Vessels Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Doosan Heavy Industries & Construction Co. Ltd.

5.1.2. IHI Corporation

5.1.3. Samuel Pressure Vessel Group

5.1.4. Babcock & Wilcox Enterprises, Inc.

5.1.5. Mitsubishi Heavy Industries, Ltd.

5.1.6. Larsen & Toubro Ltd.

5.1.7. General Electric Company

5.1.8. Trinity Industries, Inc.

5.1.9. KNM Group Berhad

5.1.10. Hitachi Zosen Corporation

5.1.11. ATB Group

5.1.12. Westinghouse Electric Company

5.1.13. Halvorsen Company

5.1.14. Abbott Pressure Vessels Ltd.

5.1.15. Steelhead Composites

5.2 Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Revenue

5.2.3. Production Capacity

5.2.4. Technology Innovation

5.2.5. R&D Investments

5.2.6. Regional Presence

5.2.7. Partnerships & Collaborations

5.2.8. Sustainability Initiatives

5.3. Strategic Initiatives

5.4. Mergers And Acquisitions

5.5. Investment Analysis

5.6. Venture Capital Funding

5.7. Government Grants

5.8. Private Equity Investments

6. North America Pressure Vessels Market Regulatory Framework

6.1. Pressure Equipment Directive (PED) Compliance

6.2. Industry Certifications (ASME, CE Mark)

6.3. Environmental and Safety Regulations

7. North America Pressure Vessels Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Pressure Vessels Future Market Segmentation

8.1. By Material (In Value %)

8.2. By Application (In Value %)

8.3. By Product Type (In Value %)

8.4. By Pressure Type (In Value %)

8.5. By Region (In Value %)

9. North America Pressure Vessels Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial step involved mapping out the stakeholders in the North America Pressure Vessels Market. This phase incorporated extensive desk research, tapping into secondary databases to gather comprehensive market data. The key variables identified included material types, pressure ratings, and industrial applications that affect market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compiled and analyzed historical data on market penetration and industry performance. This involved assessing market trends and evaluating critical metrics such as material performance, adoption rates, and application sectors to construct a reliable market analysis framework.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were tested through expert interviews with professionals from top manufacturing companies in the pressure vessel market. Their insights helped refine the data collected and provided operational insights, ensuring accuracy and relevance.

Step 4: Research Synthesis and Final Output

In the final phase, we engaged directly with manufacturers to gather detailed information on product segments, sales performance, and future growth strategies. This step confirmed the robustness of the findings and ensured that the analysis was grounded in real-world market conditions.

Frequently Asked Questions

01. How big is the North America Pressure Vessels Market?

The North America Pressure Vessels market was valued at USD 3.5 billion, driven by the energy sector and technological advancements in pressure vessel materials.

02. What are the challenges in the North America Pressure Vessels Market?

Challenges in the North America Pressure Vessels market include fluctuating raw material prices and stringent government regulations that increase compliance costs, impacting manufacturers profitability.

03. Who are the major players in the North America Pressure Vessels Market?

Key players in the North America Pressure Vessels market include Doosan Heavy Industries, Babcock & Wilcox, Mitsubishi Heavy Industries, and IHI Corporation, who dominate due to their technological innovations and extensive market reach.

04. What are the growth drivers of the North America Pressure Vessels Market?

Growth drivers of the North America Pressure Vessels market include rising demand in the oil and gas sector, increasing adoption of renewable energy, and technological innovations such as composite materials for lighter and more durable vessels.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.