North America Protein Supplement Market Outlook to 2030

Region:North America

Author(s):Mukul

Product Code:KROD7522

October 2024

97

About the Report

North America Protein Supplement Market Overview

- The North America protein supplement market, valued at USD 2.63 billion, is driven by growing consumer interest in health and fitness, particularly in urban areas where gyms, wellness centers, and fitness activities have seen substantial growth. Additionally, the rising awareness regarding muscle recovery, weight management, and overall health has led to a surge in protein supplement consumption. This demand is further boosted by the increasing popularity of plant-based and organic protein products, aligning with the global trend toward more sustainable and natural health solutions. Major drivers of the market include an increase in disposable income and a shift toward preventive healthcare practices, which continue to fuel demand across various consumer segments.

- Countries like the United States and Canada dominate the protein supplement market in North America. The U.S. remains a dominant force due to its large fitness-conscious population, robust supply chain, and high consumer spending on dietary supplements. In contrast, Canada's dominance is attributed to its rising health consciousness, increasing vegan and vegetarian populations, and the growing trend of plant-based diets. Both countries are home to key industry players, strong retail distribution networks, and an evolving health and wellness culture, which continue to push the market forward.

- In North America, regulations around advertising protein supplements are strict, particularly when it comes to health claims. The U.S. Federal Trade Commission (FTC) monitors claims made in protein supplement advertisements to ensure they are not misleading or false. In 2023, the FTC issued warnings to several companies for false claims related to health benefits. Similarly, in Canada, advertising regulations under Health Canada require that health claims made about protein supplements be substantiated with scientific evidence. These stringent advertising regulations help maintain consumer trust but can pose challenges for brands.

North America Protein Supplement Market Segmentation

- By Product Type: The North America protein supplement market is segmented by product type into Whey Protein, Casein Protein, Egg Protein, Plant-Based Protein, and Protein Blends. Whey protein continues to have a dominant market share due to its widespread use among bodybuilders, athletes, and general fitness enthusiasts. Wheys complete amino acid profile, fast digestion, and proven muscle recovery benefits make it the go-to choice for consumers aiming for immediate results. Furthermore, it is the most researched protein source with a variety of options available in different forms and flavors, making it highly versatile for consumers.

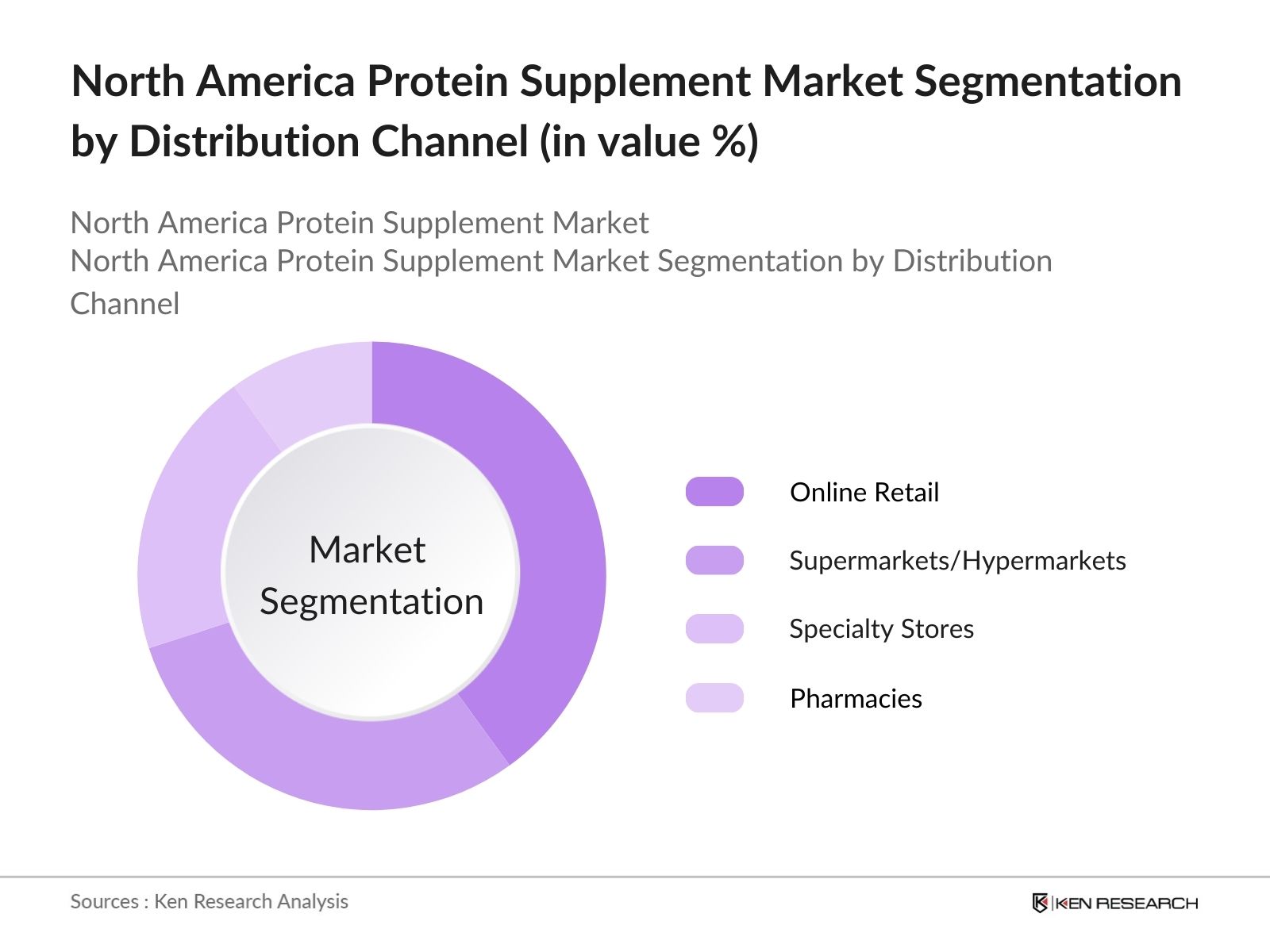

- By Distribution Channel: By distribution channel, the market is segmented into Online Retail, Supermarkets/Hypermarkets, Specialty Stores, and Pharmacies. Online retail dominates this segment due to the convenience of purchasing, access to a wide range of products, and competitive pricing. Major e-commerce platforms such as Amazon, Walmart, and niche supplement retailers provide customers with easy-to-navigate interfaces and home delivery options. Additionally, the online space facilitates product comparison, reviews, and bulk purchasing options, making it the preferred method for protein supplement buyers in the digital age.

North America Protein Supplement Market Competitive Landscape

The North America protein supplement market is dominated by a few major players that have established a strong presence through innovation, brand loyalty, and extensive distribution networks. These companies continually invest in research and development to meet the rising consumer demand for high-quality and specialized protein products. Furthermore, the competitive landscape is also shaped by the growing influence of plant-based protein brands that are quickly gaining market share.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Mn) |

Key Product Portfolio |

R&D Expenditure |

Market Share |

Geographical Presence |

Brand Portfolio |

|

Glanbia PLC |

1997 |

Kilkenny, Ireland |

|||||||

|

Abbott Laboratories |

1888 |

Illinois, USA |

|||||||

|

MusclePharm Corporation |

2006 |

California, USA |

|||||||

|

PepsiCo (Gatorade) |

1965 |

New York, USA |

|||||||

|

The Bountiful Company |

1971 |

New York, USA |

North America Protein Supplement Industry Analysis

Growth Drivers

- Increasing Health and Fitness Awareness (Rising Fitness Enthusiast Population): In North America, there has been a significant rise in health and fitness awareness, with gym memberships reaching over 62 million in the United States alone in 2023, according to the International Health, Racquet & Sportsclub Association (IHRSA). This has driven the demand for protein supplements as fitness enthusiasts seek to improve muscle recovery and performance. Additionally, Canada saw a rise in gym membership numbers, with over 8.4 million Canadians participating in regular physical activity. This growing health-conscious population directly impacts the consumption of protein supplements.

- Growing Adoption of Plant-Based Diets (Vegan and Vegetarian Protein Supplements): In 2024, plant-based diets continue to gain traction across North America. As of 2022, 10 million Americans identified as vegan or vegetarian, and 29% of the population sought to reduce their meat consumption, according to data from Statista. This has spurred demand for plant-based protein supplements like pea, hemp, and soy proteins. The Canadian market also mirrors this trend, with nearly 3.2 million Canadians adopting plant-based dietary habits. The shift toward plant-based protein sources aligns with environmental concerns and dietary preferences. Source.

- Expansion of Online Retail (E-commerce Penetration in Supplement Sales): The protein supplement market has seen rapid growth in online sales, driven by the overall e-commerce boom in North America. In the U.S., e-commerce sales grew to $1 trillion in 2023, representing a growing channel for supplement sales. Major retailers, including Amazon and Walmart, have enhanced their supplement offerings to cater to this demand. Canada experienced a similar trend, with online retail sales accounting for 8% of total retail trade in 2023, according to Statistics Canada. The increased convenience and wider product availability through e-commerce have accelerated protein supplement sales

Market Restraints

- Price Sensitivity (Impact of Pricing on Consumer Adoption): Despite the growing demand for protein supplements, price sensitivity remains a significant challenge. The average household income in the U.S. stood at $74,580 in 2023, with a noticeable variation across income brackets. This disparity impacts the purchasing power of protein supplements, particularly for premium products. In Canada, where the median household income was CAD 75,500 in 2023, similar concerns around affordability influence consumer choices. The price-sensitive nature of these markets affects the adoption rates, especially for high-end or specialized supplements. Source.

- Regulatory Challenges (FDA and Health Canada Approvals): The North American protein supplement market is heavily regulated, with the U.S. Food and Drug Administration (FDA) and Health Canada setting stringent guidelines. For instance, in 2022, the FDA recalled over 50 supplement products that failed to meet safety standards. In Canada, similar challenges arise with Health Canada's Natural Health Products Regulations, which require comprehensive labeling and ingredient transparency. These regulations increase the time to market and the cost of compliance for supplement manufacturers, making it difficult for new entrants to penetrate the market.

North America Protein Supplement Market Future Outlook

Over the next few years, the North America protein supplement market is expected to experience steady growth driven by several key factors. These include the increasing focus on health and wellness among younger generations, advancements in protein supplement formulations, and the rising trend of plant-based and organic protein products. Additionally, technological innovations such as personalized nutrition and convenient ready-to-drink formats are expected to fuel market expansion.

Market Opportunities

- Innovation in Supplement Formats (Protein Bars, Ready-to-Drink Shakes): Innovative product formats, such as protein bars and ready-to-drink (RTD) protein shakes, are gaining popularity due to their convenience and portability. The RTD protein market in the U.S. grew by 13% in volume between 2022 and 2023, fueled by consumer demand for on-the-go nutrition solutions. In Canada, protein bar sales have similarly surged, with sales increasing by 9% in 2023. This growing interest in convenient protein supplement formats presents opportunities for manufacturers to tap into a broader consumer base seeking quick and easy protein options. Source.

- Rising Demand in Niche Segments (Protein Supplements for Women and Seniors): Protein supplements tailored to niche segments, such as women and seniors, represent a growing market opportunity. In 2023, there were 78 million women in the U.S. aged 18-64, and many are increasingly incorporating protein into their diets for fitness and health purposes. Additionally, the aging population, with over 57 million seniors (65+) in the U.S. in 2023, has contributed to the rising demand for protein supplements that cater to muscle maintenance and overall health. This shift toward targeting specific demographics presents growth prospects for the industry

Scope of the Report

|

Product Type |

Whey Protein, Casein Protein, Egg Protein, Plant-Based Protein, Protein Blends |

|

Form |

Powder, Ready-to-Drink (RTD), Protein Bars |

|

Source |

Animal-Based, Plant-Based |

|

Distribution Channel |

Online Retail, Supermarkets/Hypermarkets, Specialty Stores, Pharmacies |

|

End-User |

Athletes and Bodybuilders, Lifestyle Users, Senior Citizens, Pregnant and Lactating Women |

Products

Key Target Audience

Protein Supplement Manufacturers

Distributors and Retailers

Online Retailers (Amazon, Walmart)

Fitness and Wellness Centers

Health and Nutrition Advisors

Government and Regulatory Bodies (FDA, CFIA)

Investments and Venture Capitalist Firms

Packaging and Raw Material Suppliers

Companies

Players Mentioned in the Report:

Glanbia PLC

Abbott Laboratories

MusclePharm Corporation

PepsiCo (Gatorade)

The Bountiful Company

Amway

Herbalife Nutrition Ltd.

NOW Foods

Optimum Nutrition, Inc.

Orgain, Inc.

Garden of Life (Nestl Health Science)

Vital Proteins LLC

Nutiva Inc.

Ancient Nutrition

Vega (Danone S.A.)

Table of Contents

1. North America Protein Supplement Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Protein Supplement Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Protein Supplement Market Analysis

3.1 Growth Drivers

3.1.1. Increasing Health and Fitness Awareness (Rising Fitness Enthusiast Population)

3.1.2. Growing Adoption of Plant-Based Diets (Vegan and Vegetarian Protein Supplements)

3.1.3. Expansion of Online Retail (E-commerce Penetration in Supplement Sales)

3.1.4. Shift Towards Preventive Healthcare (Protein Supplements for Immunity Boosting)

3.2 Market Challenges

3.2.1. Price Sensitivity (Impact of Pricing on Consumer Adoption)

3.2.2. Regulatory Challenges (FDA and Health Canada Approvals)

3.2.3. Presence of Low-Cost Substitutes (Competition from Traditional Protein Sources)

3.3 Opportunities

3.3.1. Innovation in Supplement Formats (Protein Bars, Ready-to-Drink Shakes)

3.3.2. Rising Demand in Niche Segments (Protein Supplements for Women and Seniors)

3.3.3. Increasing Sports Nutrition Segment (Athlete-Focused Protein Products)

3.4 Trends

3.4.1. Growth in Plant-Based Protein Products (Pea Protein, Hemp Protein, Soy Protein)

3.4.2. Clean Label Movement (Natural and Organic Protein Supplements)

3.4.3. Increasing Demand for Personalized Nutrition (Customizable Protein Blends)

3.5 Government Regulations

3.5.1. Health and Safety Standards (FDA, CFIA, Labeling Requirements)

3.5.2. Advertising Regulations (Guidelines for Health Claims)

3.5.3. Import Tariffs and Trade Regulations (Impact on Raw Material Prices)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Suppliers, Manufacturers, Retailers, Consumers)

3.8 Porters Five Forces (Supplier Bargaining Power, Buyer Bargaining Power, Threat of Substitutes, Threat of New Entrants, Competitive Rivalry)

3.9 Competition Ecosystem

4. North America Protein Supplement Market Segmentation

4.1 By Product Type (In Value %)

4.1.1. Whey Protein

4.1.2. Casein Protein

4.1.3. Egg Protein

4.1.4. Plant-Based Protein

4.1.5. Protein Blends

4.2 By Form (In Value %)

4.2.1. Powder

4.2.2. RTD (Ready-to-Drink)

4.2.3. Protein Bars

4.3 By Source (In Value %)

4.3.1. Animal-Based

4.3.2. Plant-Based

4.4 By Distribution Channel (In Value %)

4.4.1. Online Retail

4.4.2. Supermarkets/Hypermarkets

4.4.3. Specialty Stores

4.4.4. Pharmacies

4.5 By End-User (In Value %)

4.5.1. Athletes and Bodybuilders

4.5.2. Lifestyle Users

4.5.3. Senior Citizens

4.5.4. Pregnant and Lactating Women

5. North America Protein Supplement Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Glanbia PLC

5.1.2. Abbott Laboratories

5.1.3. MusclePharm Corporation

5.1.4. PepsiCo, Inc. (Gatorade)

5.1.5. The Bountiful Company

5.1.6. Amway

5.1.7. Herbalife Nutrition Ltd.

5.1.8. NOW Foods

5.1.9. Optimum Nutrition, Inc.

5.1.10. Orgain, Inc.

5.1.11. Garden of Life (Nestl Health Science)

5.1.12. Vital Proteins LLC

5.1.13. Nutiva Inc.

5.1.14. Ancient Nutrition

5.1.15. Vega (Danone S.A.)

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, R&D Investments, Product Portfolio, Market Penetration, Geographical Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives (New Product Launches, Market Expansion, Collaborations)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. North America Protein Supplement Market Regulatory Framework

6.1 Safety Standards and Compliance (FDA, CFIA, Good Manufacturing Practices)

6.2 Labeling and Packaging Requirements

6.3 Supplement Ingredient Approval Processes

6.4 Export and Import Regulations (NAFTA, USMCA Impact)

7. North America Protein Supplement Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Protein Supplement Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Form (In Value %)

8.3 By Source (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By End-User (In Value %)

9. North America Protein Supplement Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase of research involved mapping the protein supplement ecosystem in North America. This step was supported by extensive desk research, leveraging both secondary and proprietary databases to gather comprehensive information on market dynamics, including consumer trends and product demand.

Step 2: Market Analysis and Construction

In this phase, we compiled and analyzed historical data to assess key trends and the performance of various protein supplement products across distribution channels. The evaluation focused on supply chain dynamics, consumer preferences, and geographical distribution to estimate the market size and revenue.

Step 3: Hypothesis Validation and Expert Consultation

We developed market hypotheses based on initial research and validated them through expert interviews conducted via CATIs with industry leaders from leading companies. These interviews helped refine our market projections and provided operational insights into consumer demand patterns.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing all collected data and cross-verifying the information through consultations with protein supplement manufacturers and distributors. The result is a thoroughly vetted analysis of the North America protein supplement market, encompassing product trends, consumer behaviors, and future growth opportunities.

Frequently Asked Questions

01. How big is the North America Protein Supplement Market?

The North America protein supplement market was valued at USD 2.63 billion in 2023, driven by increasing consumer interest in fitness and health, as well as the rising popularity of plant-based diets.

02. What are the challenges in the North America Protein Supplement Market?

Challenges in the market include price sensitivity among consumers, regulatory hurdles such as FDA approvals, and the increasing competition from low-cost protein substitutes like traditional food sources.

03. Who are the major players in the North America Protein Supplement Market?

Key players in the market include Glanbia PLC, Abbott Laboratories, MusclePharm Corporation, PepsiCo (Gatorade), and The Bountiful Company, among others.

04. What are the growth drivers of the North America Protein Supplement Market?

Growth drivers include rising consumer awareness regarding the benefits of protein supplementation, an increase in fitness and wellness activities, and innovations in protein formats such as ready-to-drink shakes and protein bars.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.