North America Tire Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD6597

December 2024

98

About the Report

North America Tire Market Overview

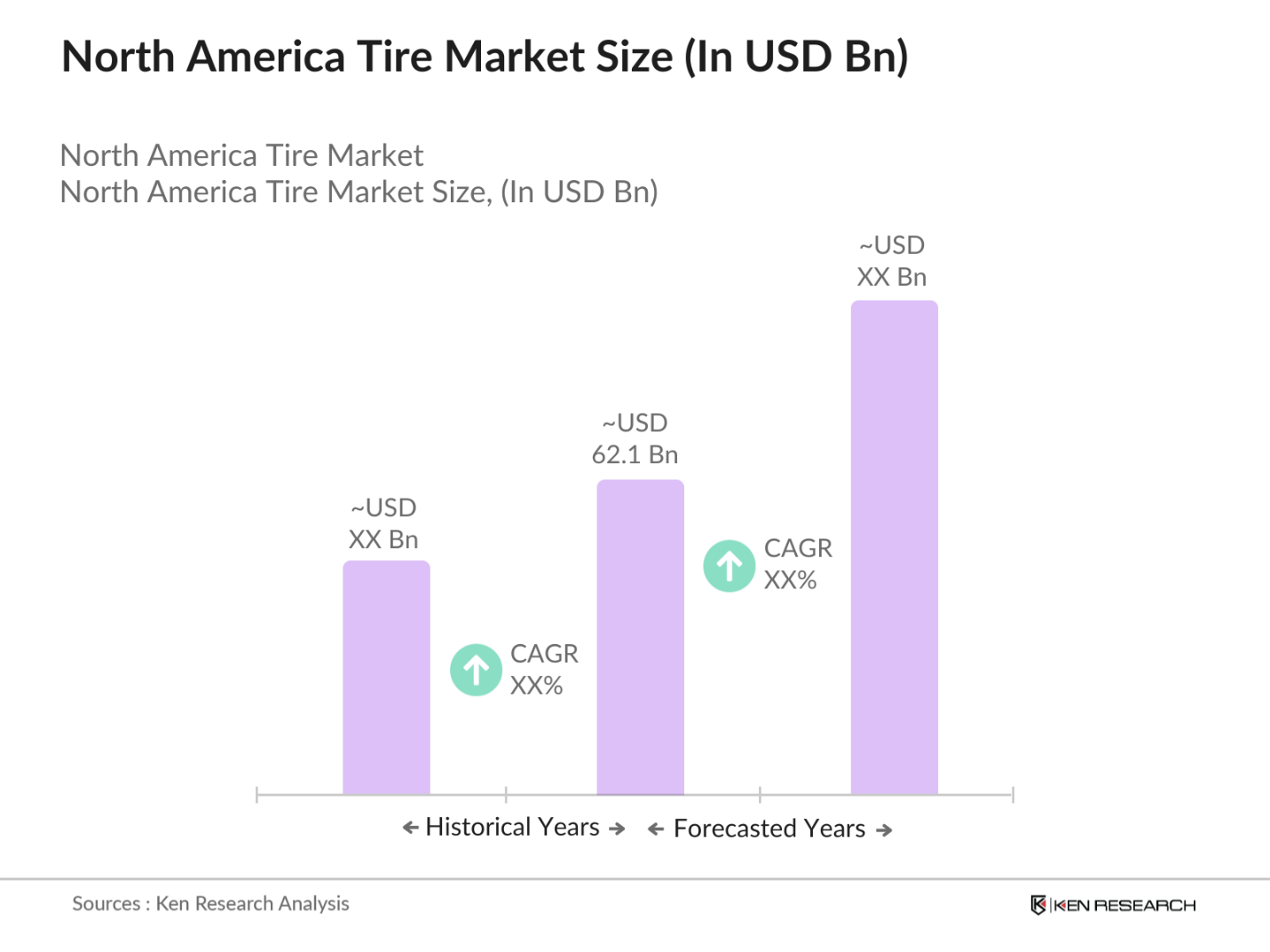

- The North America tire market is valued at USD 62.1 billion, according to historical market analysis for 2023. This market is driven primarily by the increasing vehicle fleet in the region, particularly in the United States and Canada. The surge in automotive production, along with rising demand for replacement tires, has boosted the market. Additionally, technological advancements in tire manufacturing, such as the development of low rolling resistance tires, have further stimulated market growth, enhancing fuel efficiency and environmental compliance.

Dominant cities and countries that dominate the tire market include the United States and Canada. The dominance of the U.S. is attributed to its large vehicle fleet, extensive road infrastructure, and a well-developed aftermarket for tire replacement. Canada also plays a significant role due to its severe weather conditions, where demand for all-season and winter tires is high. The higher adoption rates of electric vehicles in urban centers like New York, Los Angeles, and Toronto are also shaping the market's future demand for specialized tires designed for EVs.

Recycling and disposal laws are becoming increasingly stringent across North America. In 2023, several states in the U.S. introduced Extended Producer Responsibility (EPR) programs that require tire manufacturers to manage the collection, recycling, and disposal of used tires. These regulations are designed to reduce landfill waste and encourage the adoption of circular economy principles. Additionally, tire recycling initiatives, such as tire-derived fuel and rubberized asphalt, are gaining traction, providing manufacturers with more sustainable options for end-of-life tires.

North America Tire Market Segmentation

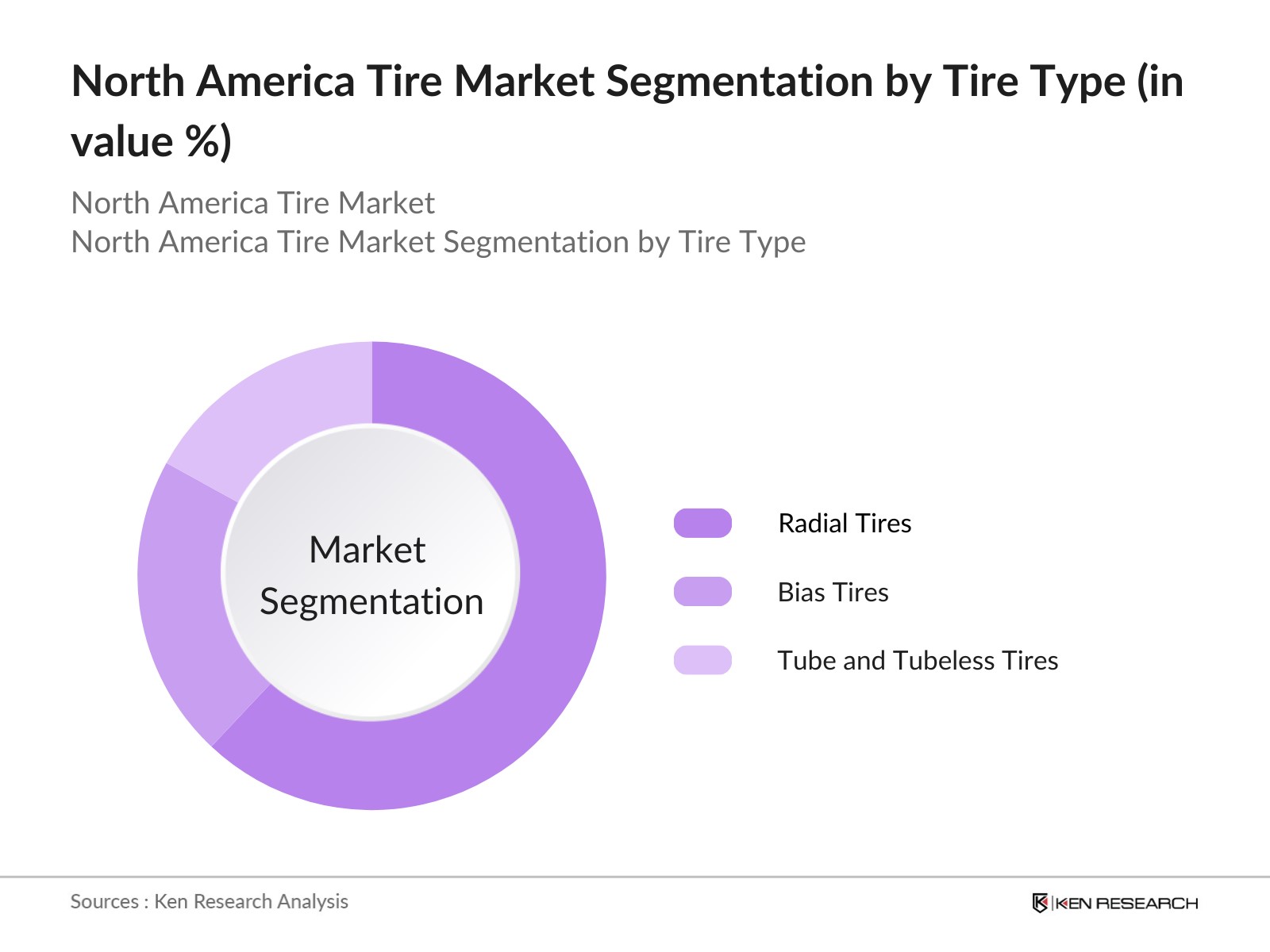

By Tire Type: The market is segmented by tire type into radial tires, bias tires, tube, and tubeless tires. Radial tires currently dominate the market due to their superior fuel efficiency, durability, and widespread usage across various vehicle types. Radial tires have become the industry standard for passenger cars and light trucks, where longer life and better fuel efficiency are highly valued by consumers. OEMs also prefer radial tires for new vehicle models, driving their dominance in this segment.

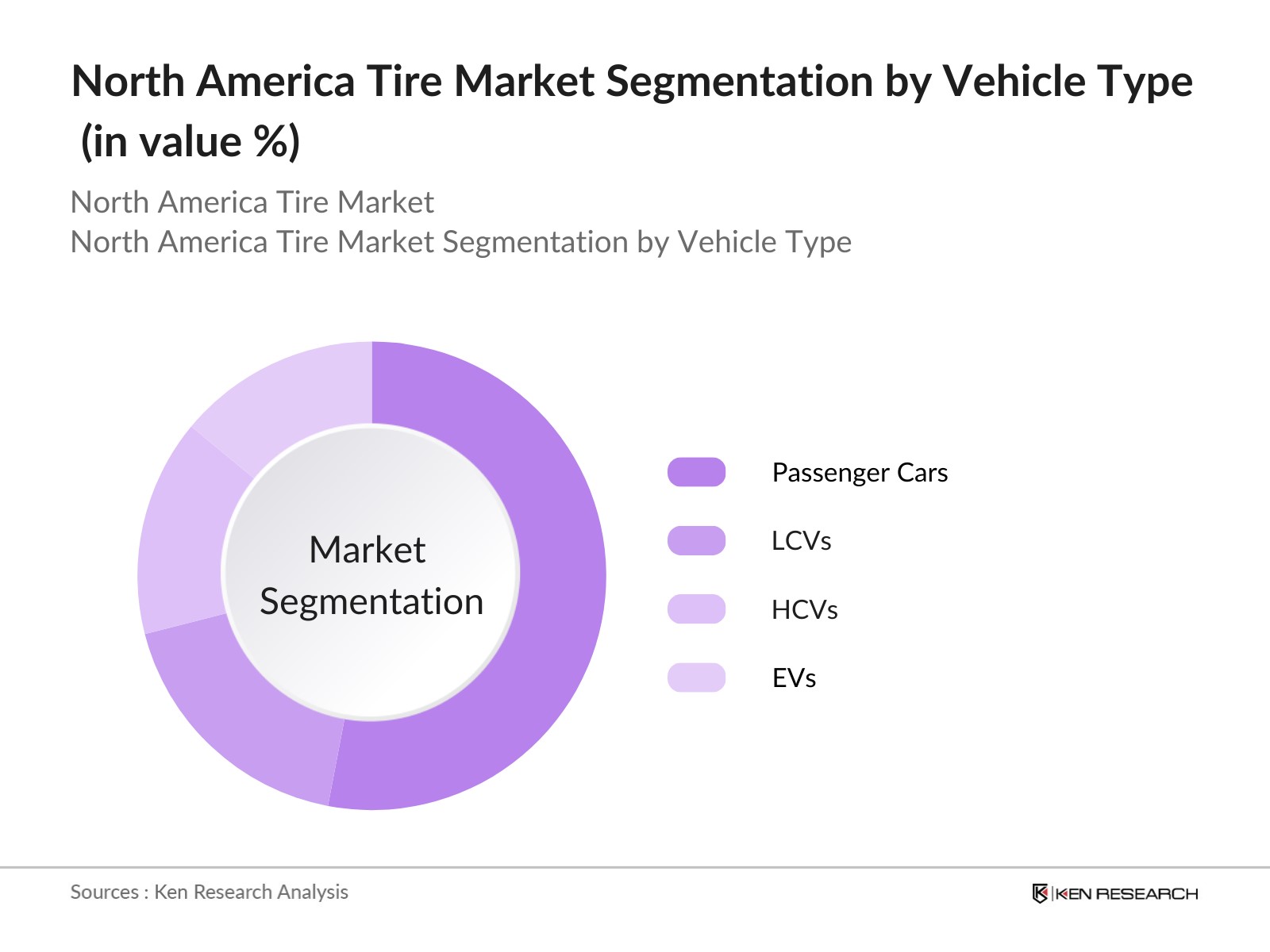

By Vehicle Type: By vehicle type, the market is divided into passenger cars, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and electric vehicles (EVs). Passenger cars account for the largest market share, driven by the high ownership rates of personal vehicles in North America. The surge in demand for replacement tires from the growing fleet of passenger cars, coupled with the frequent need for tire replacement due to road conditions and climatic variations, makes this segment the largest contributor to market revenues.

North America Tire Market Competitive Landscape

The North America tire market is characterized by strong competition among global players such as Bridgestone, Michelin, and Goodyear, which dominate the market alongside regional manufacturers. These companies have significant production capabilities, advanced research and development (R&D) departments, and extensive distribution networks, allowing them to maintain leadership positions. Additionally, these players are focusing on sustainable tire technologies and eco-friendly products in response to rising environmental regulations.

|

Company |

Establishment Year |

Headquarters |

R&D Investment |

No. of Employees |

Manufacturing Facilities |

Product Lines |

Revenue (2023) |

Market Share (2023) |

|

Bridgestone Corporation |

1931 |

Tokyo, Japan |

||||||

|

Michelin Group |

1889 |

Clermont-Ferrand, France |

||||||

|

Goodyear Tire & Rubber Co. |

1898 |

Akron, Ohio, USA |

||||||

|

Continental AG |

1871 |

Hanover, Germany |

||||||

|

Pirelli & C. S.p.A. |

1872 |

Milan, Italy |

North America Tire Industry Analysis

Growth Drivers

Increasing Vehicle Production: The North American automotive sector is showing a steady increase in vehicle production, which directly boosts the tire market. In 2023, the United States alone produced around 9.6 million vehicles, driven by high demand for both passenger and commercial vehicles. Original Equipment Manufacturer (OEM) demand for tires is closely tied to vehicle production, as each new vehicle requires a specific set of tires. With North America being one of the largest automotive markets globally, the tire demand from OEMs is substantial, underpinned by the increase in vehicle sales and production. Source: U.S. Bureau of Economic Analysis

Expanding Electric Vehicle Market: The electric vehicle (EV) market in North America is expanding rapidly, with 1.4 million electric vehicles sold in the U.S. in 2023 alone. This rising penetration rate of EVs is contributing to a surge in demand for EV-specific tires, which are designed to handle the weight and unique torque distribution of electric cars. Given that EV tires must meet stringent safety and efficiency requirements, the demand for these specialized products is expected to increase alongside EV sales. As of 2024, the EV market accounts for about 8% of total vehicle sales in the region.

Rising Disposable Income: The rise in disposable income across North America is significantly impacting the tire market. In 2023, U.S. households reported a median income of $78,000, enabling greater expenditure on vehicle ownership and maintenance, including tire replacements. Tire replacement rates correlate with increased vehicle usage, particularly for households with multiple vehicles. Higher disposable incomes are also driving sales of premium and specialty tires, further expanding the market. This trend reflects the ability of consumers to invest more in vehicle maintenance, which translates directly into increased tire demand.

Market Challenges

Raw Material Volatility: One of the key challenges facing the North American tire market is raw material price volatility. Both natural and synthetic rubber prices are subject to fluctuations due to supply chain disruptions and geopolitical factors. In 2023, the price of natural rubber hovered around $1.50 per kilogram, reflecting volatility linked to global production shortfalls. Synthetic rubber, derived from petroleum, is also impacted by fluctuations in oil prices, which saw an average of $80 per barrel in 2023. This price instability directly affects tire production costs, creating challenges for manufacturers.

Price Sensitivity Among Consumers: The rising inflation rate in North America, which reached 5.3% in 2023, has reduced consumers' purchasing power, making them more price-sensitive when buying tires. High inflation has led to increased costs for both raw materials and tire production, which manufacturers have passed on to consumers. This has led to slower sales, particularly in the lower- to mid-range tire segments. Consumers are delaying tire purchases or opting for cheaper alternatives, which puts additional pressure on manufacturers to balance cost increases with competitive pricing.

North America Tire Market Future Outlook

Over the next five years, the North American tire market is expected to experience substantial growth, driven by the rising adoption of electric vehicles and the growing demand for eco-friendly, sustainable tire technologies. Tire manufacturers are focusing on developing tires with lower rolling resistance to improve fuel efficiency, especially for electric vehicles, which are projected to account for a larger share of new vehicle sales. Increasing regulations on tire emissions and waste management will also prompt innovations in tire recycling and retreading, further transforming the market.

Future Market Opportunities

Aftermarket Growth: The tire aftermarket in North America continues to expand, driven by increased vehicle longevity and the growth of tire retail networks. In 2023, the average vehicle age in the U.S. reached 12.5 years, resulting in higher replacement rates for tires. This growing replacement market presents a lucrative opportunity for tire manufacturers and retailers. The expansion of online tire retail platforms and distribution networks is making it easier for consumers to access a wider variety of tire brands and services, further boosting the aftermarket.

Sustainability Initiatives: The push towards sustainability is creating new opportunities for eco-friendly tire products in North America. In 2023, over 40% of tires produced in the U.S. used recycled or retread materials, supporting the circular economy and reducing the environmental footprint. Additionally, tire manufacturers are investing in sustainable manufacturing processes that minimize waste and energy consumption, aligning with stricter government regulations. This shift towards environmentally responsible tire production is being driven by both consumer demand and regulatory mandates, offering manufacturers a pathway to differentiate their products.

Scope of the Report

|

By Tire Type |

Radial Tires Bias Tires Tube and Tubeless Tires |

|

By Vehicle Type |

Passenger Cars LCVs HCVs EVs |

|

By Distribution Channel |

OEM Aftermarket |

|

By Application |

On-Road Off-Road Specialty Tires |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Tire manufacturers

Automotive OEMs (Original Equipment Manufacturers)

Aftermarket tire distributors and retailers

Electric vehicle manufacturers

Automotive dealerships

Investor and venture capitalist firms

Government and regulatory bodies (Environmental Protection Agency, Department of Transportation)

Automotive service providers and garages

Companies

Major Players

Bridgestone Corporation

Michelin Group

Goodyear Tire & Rubber Company

Continental AG

Pirelli & C. S.p.A.

Sumitomo Rubber Industries, Ltd.

Hankook Tire & Technology Co., Ltd.

Yokohama Rubber Co., Ltd.

Cooper Tire & Rubber Company

Toyo Tire Corporation

Kumho Tire Co., Inc.

Giti Tire Pte Ltd.

Nexen Tire Corporation

Apollo Tyres Ltd.

Maxxis International

Table of Contents

North America Tire Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

North America Tire Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

North America Tire Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Vehicle Production (Automotive Sector Performance, OEM Demand)

3.1.2 Expanding Electric Vehicle Market (EV Penetration Rates, EV-Specific Tire Demand)

3.1.3 Rising Disposable Income (Household Expenditure on Vehicle Ownership, Tire Replacement Rates)

3.1.4 Environmental Regulations (Tire Recycling Mandates, Emission Standards)

3.2 Market Challenges

3.2.1 Raw Material Volatility (Natural Rubber, Synthetic Rubber Prices)

3.2.2 Supply Chain Disruptions (Global Logistics, Trade Tariffs)

3.2.3 Price Sensitivity Among Consumers (Inflation Impact, Consumer Purchasing Power)

3.3 Opportunities

3.3.1 Technological Advancements (Smart Tires, IoT Integration)

3.3.2 Aftermarket Growth (Replacement Market Expansion, Tire Retail Networks)

3.3.3 Sustainability Initiatives (Recycled and Retread Tires, Eco-Friendly Manufacturing)

3.4 Trends

3.4.1 Adoption of All-Weather Tires (Demand in Varying Climates, Consumer Preference for Durability)

3.4.2 Rise in Specialty Tires (Tires for SUVs, Performance Vehicles, and Heavy Equipment)

3.4.3 Increasing Focus on Fuel Efficiency (Low Rolling Resistance Tires, EV Tires)

3.5 Government Regulation

3.5.1 Tire Labelling Standards (Fuel Efficiency Labels, Noise Ratings)

3.5.2 Import/Export Regulations (Tariffs, Regional Trade Agreements)

3.5.3 Recycling and Disposal Laws (Extended Producer Responsibility, Circular Economy Mandates)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Manufacturers, OEMs, Aftermarket Distributors)

3.8 Porters Five Forces

3.9 Competition Ecosystem

North America Tire Market Segmentation

4.1 By Tire Type (In Value %)

4.1.1 Radial Tires

4.1.2 Bias Tires

4.1.3 Tube and Tubeless Tires

4.2 By Vehicle Type (In Value %)

4.2.1 Passenger Cars

4.2.2 Light Commercial Vehicles (LCVs)

4.2.3 Heavy Commercial Vehicles (HCVs)

4.2.4 Electric Vehicles (EVs)

4.3 By Distribution Channel (In Value %)

4.3.1 OEM (Original Equipment Manufacturer)

4.3.2 Aftermarket (Retail, Online, Wholesale)

4.4 By Application (In Value %)

4.4.1 On-Road Tires

4.4.2 Off-Road Tires

4.4.3 Specialty Tires (Mining, Agriculture, Industrial)

4.5 By Region (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

North America Tire Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Bridgestone Corporation

5.1.2 Michelin Group

5.1.3 Goodyear Tire & Rubber Company

5.1.4 Continental AG

5.1.5 Pirelli & C. S.p.A.

5.1.6 Sumitomo Rubber Industries, Ltd.

5.1.7 Hankook Tire & Technology Co., Ltd.

5.1.8 Yokohama Rubber Co., Ltd.

5.1.9 Cooper Tire & Rubber Company

5.1.10 Toyo Tire Corporation

5.1.11 Kumho Tire Co., Inc.

5.1.12 Giti Tire Pte Ltd

5.1.13 Nexen Tire Corporation

5.1.14 Apollo Tyres Ltd.

5.1.15 Maxxis International

5.2 Cross Comparison Parameters (Production Capacity, No. of Employees, Headquarters, Manufacturing Facilities, Revenue, R&D Spending, Market Share, Distribution Network)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

North America Tire Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

North America Tire Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

North America Tire Market Future Segmentation

8.1 By Tire Type (In Value %)

8.2 By Vehicle Type (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Application (In Value %)

8.5 By Region (In Value %)

North America Tire Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping out the North American tire market ecosystem, identifying key stakeholders such as manufacturers, OEMs, and aftermarket distributors. Extensive desk research from proprietary databases, secondary research, and government sources was conducted to determine market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on market size, tire demand, and pricing trends was compiled. Analysis included segmenting the market by tire type, vehicle type, and distribution channels, ensuring a robust understanding of market penetration and revenue trends.

Step 3: Hypothesis Validation and Expert Consultation

To validate market assumptions, consultations were held with industry experts from major tire manufacturing companies and OEMs. This feedback was essential in refining the market forecasts and gaining deeper insights into emerging trends like electric vehicle tire adoption.

Step 4: Research Synthesis and Final Output

The final phase included synthesizing primary research insights with market statistics, ensuring that data from tire manufacturers was accurate and reflective of the actual market dynamics. A bottom-up approach was used to ensure precise market estimates.

Frequently Asked Questions

01 How big is the North America Tire Market?

The North America tire market is valued at USD 62.1 billion, driven by increasing vehicle ownership, demand for replacement tires, and technological advancements in tire manufacturing.

02 What are the challenges in the North America Tire Market?

Challenges in the North America tire market include raw material price volatility, particularly for natural and synthetic rubber, along with increasing regulatory requirements for sustainability and tire recycling initiatives.

03 Who are the major players in the North America Tire Market?

Key players in the North America tire market include Bridgestone, Michelin, Goodyear, Continental, and Pirelli, all of which dominate due to their global distribution networks, R&D investments, and strong brand presence.

04 What are the growth drivers of the North America Tire Market?

Growth in the North America tire market is driven by factors such as the rise in electric vehicle sales, increasing demand for all-season and specialty tires, and innovations in tire technology aimed at improving fuel efficiency.

05 How is the North America Tire Market segmented?

The North America tire market is segmented by tire type (radial, bias, tube, and tubeless) and by vehicle type (passenger cars, LCVs, HCVs, and EVs), with radial tires and passenger cars being the dominant segments in 2023.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.