Philippines Home Finance Market Outlook to 2027

Driven by the growing economy, urbanization and financing penetration in the sector

Region:Asia

Author(s):Kirti Saraswat, Sunaiyna Varma and Vrinda Garg

Product Code:KR1330

June 2023

118

About the Report

Market Overview:

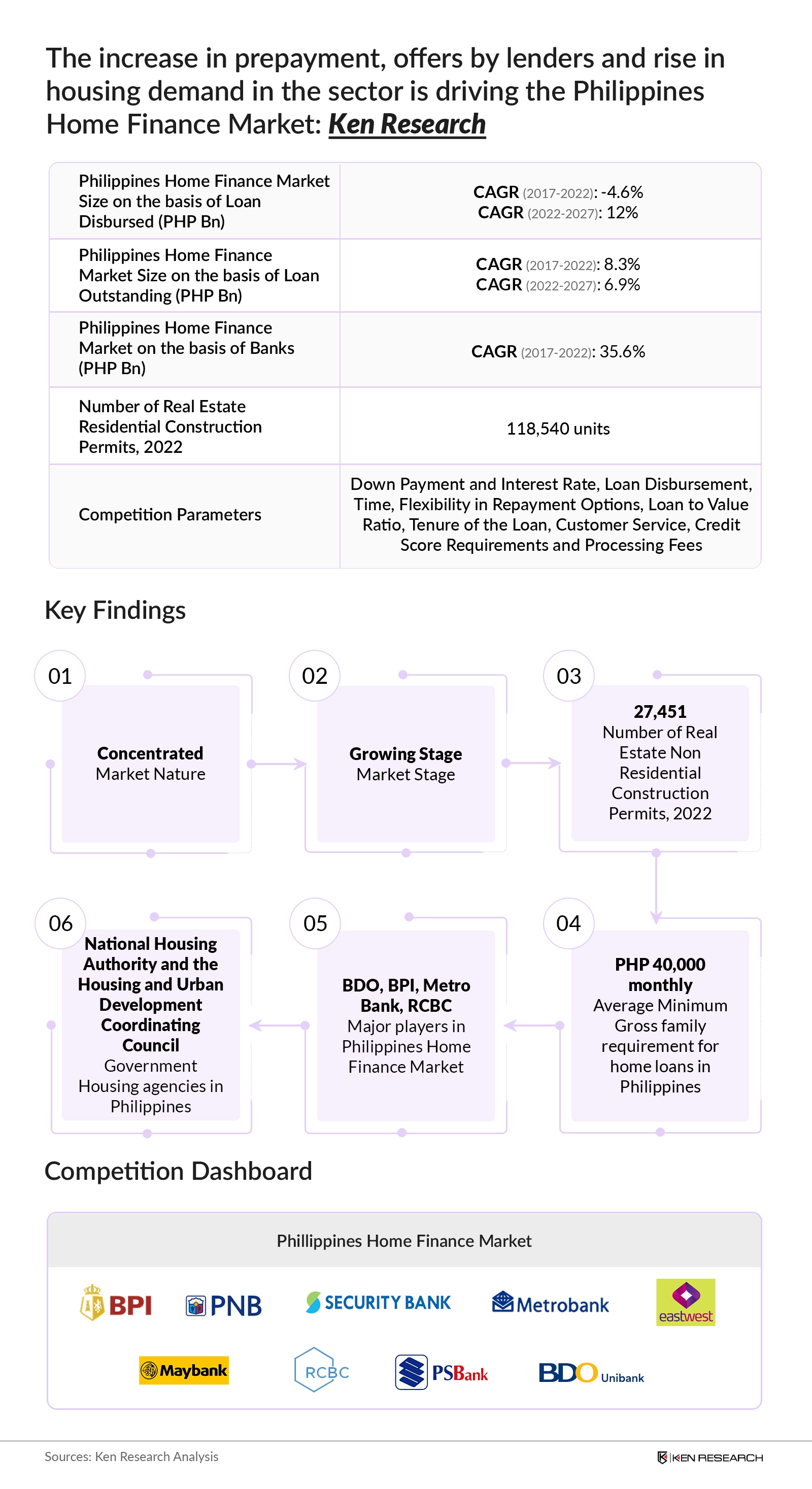

According to Ken Research estimates, the Philippines Home Finance Market –has increased in 2022 at a CAGR of 3.7% owing to growing demand for used vehicles and financing penetration in the sector.

- Property values in the Philippines are rising remarkably, with a sizable increase observed throughout the real estate sector. Property prices have reached unheard-of heights as demand for homes and investment options rises steadily, showing a robust and vibrant market in the nation.

- Nowhere are the effects of the Philippines’ sustained economic growth more apparent than in the construction industry, which is benefitting from pent-up demand and a positive outlook for future growth.

Key Trends by Market Segment:

By Medium: Banks tend to offer better regularities, customer services and lower interest rates, which makes it a primary choice for a homebuyer.

By Region: Being the capital region of country, Filipinos living in Manila have greater accessibility with majority of financial institutions headquartered.

Competitive Landscape

The Philippines House Finance market is consolidated. The nature of competition is high. Philippine home finance market by banks making it moderately consolidated with competitive rivalry among the competitors. Some of the popular players are Bank of the Philippine Islands, Security Bank, Banco de Oro (BDO), Metro Bank, East West Bank, LANDBANK of the Philippines, Philippine National Bank and China Bank Corporation.

Future Outlook

The Philippines Home Finance Market witnessed significant growth during the period 2017-2022, NBFCs will emerge as the major home financier in the future owing to the lack of regulatory limits on them unlike Banks in providing home loans. With the number of people in the country continuing to rise, the demand for housing will remain strong. (At the present rate, 2 million people are added to the country’s population every year)

Scope of the Report

|

Philippines Home Finance Market Segmentation |

|

|

By Category of Lenders |

Banks NBFC’s Captive Financing Companies |

|

By type of Loans |

Land Purchase Loan Home Purchase Loan Home Construction Loan Home Extension Loan Others |

|

By Region |

Luzon Visayas Mindanao |

|

By Loan Tenure |

Up to 10 years 10-15 years 15-20 years and above |

|

Mode of Transaction |

Offline Online |

|

by Types of Housing by Banks |

Single Detached Condominium Townhouses Duplex |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report

- Investors

- Home Finance Providers

- Insurance Companies

- Real Estate Developers

- Financial Service Provider

- NBFCS

- Fin-Tech Companies

- Government Bodies & Regulating Authorities

Time Period Captured in the Report

- Historical Period: 2017-2022

- Base Period: 2022

- Forecast Period: 2022-2027F

Companies

Major Players Mentioned in the Report

- Bank of the Philippine Islands

- Security Bank

- Banco de Oro (BDO)

- Metro Bank

- East West Bank

- LANDBANK of the Philippines

- Philippine National Bank

- China Bank Corporation

Table of Contents

1. Executive Summary

1.1 Home Finance Market: Overview, Competition Scenario, Drivers, Challenges 2017-2027

1.2 Home Finance Market: Segmentation, 2022-2027

1.3 Home Finance Market: Analyst Recommendations

2. Country Overview of Philippines

2.1 Country Demographics, 2022

2.2 Philippines Economic Analysis, 2022

2.3 Philippines Financial Sector Analysis, 2022

3. Financial Overview of Philippines, 2021

3.1 Regulatory Authorities

3.2 Financial Access & Awareness Analysis

3.3 Account & Payment Channels

3.4 Financing Market Overview

4. Philippines Home Finance Market

A. Philippines Real Estate Market, 2022

4.1 Real Estate Market

4.2 Residential Real Estate Market

4.3 Regional Analysis on Residential Real Estate Market

4.4 Residential Construction by Sub-Region

4.5 Comparison of Major Sub-Regions

4.6 Rental Market Overview

4.7 Timeline of Residential Real Estate Developers

B. Philippines Home Finance Market Overview

4.8 Market Overview

4.9 Ecosystem

4.10 Value Chain Analysis

4.11 Cash Flow Analysis

4.12 Digital Penetration for Vender Selection and Income Analysis

4.13 Business Model canvas

C. Market Size of Home Finance Market, 2017-2022

4.14 Market size on the basis of Loan Disbursed and Number of loans provided (bank)

4.15 Market size on the basis of Loan Outstanding and Number of non-performing Loans (Banks)

D. Market Segmentation of Home Finance Market, 2022

4.16 On the basis of Medium: Banks, NBFCs & Captive Financing

4.17 On the basis of Type of loan provided:

4.18 On the Basis of Regional Division (Luzon, Visayas & Mindanao)

4.19 On the basis of Mode of transaction and loan duration

4.20 On the basis of type of house and Age of End users

E. Industry & End User Analysis of Home Finance Market

4.21 Government Initiatives

4.22 Government Programs

4.23 Swot Analysis

4.24 Growth Drivers

4.25 Property Price Analysis

4.26 Trends & Developments

4.27 Issues & Challenges

4.28 Requirements for obtaining Home Finance

4.29 End User Analysis

4.30 Decision Making Parameters in selecting a home finance partner

4.31 End user pain points

F. Competition Scenario of Home Finance Market, 2022

4.32 Market Share of Banks, 2021-2022

4.33 Competitive Scenario of Home Finance Market, 2021

4.34 Major Players and their home finance services

4.35 Interest Rate on Home loans

4.36 Major Players & Their home loan term

4.37 Strengths & Weakness Analysis

4.38 Recent Developments & Awards

4.39 Association with Real Estate Players

4.40 Major Residential Projects financed by players

4.41 Insurance Services of Players

4.42 Marketing/ Customer Acquisition Strategy

4.43 Cross Comparison

G. Future Market Analysis of Home Finance Market, 2022-2027

4.44 Market size on the basis of Loan Disbursed and Loan Outstanding, 2022-2027

4.45 On the basis of Type of loan provided & Region, 2027

4.46 On the basis of Medium, Loan Duration and Mode of Transaction, 2027

4.47 H. Analyst Recommendations of Home Finance Market

4.48 Segments/Areas to focus on

4.49 Corporate Strategy

5. Banks Competition Analysis, 2022

A. Timeline of Major Banks

B. Company Profiles of BDO, BPI, RCBC, Maybank & East West

C. Financial Analysis

5.1 Business Sustainability Test, 2021

5.2 Loan, Deposit & NPL Analysis

5.3 Relative Market Share Analysis

5.4 Financial Comparison Analysis, 2022 (Q3)

5.5 Financial Comparison Analysis, 2021

6. Research Methodology

7. Disclaimer

8. Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

The list of Philippines Home Finance companies with a presence in Philippines was compiled after extensive study. Exhaustive secondary research is done on the Philippines Home Finance Market. Gathered information on this industry from several industry articles, company websites, blogs, and industry reports.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output

Our team then conducted mystery calls to the real estate developers operating in these sectors in Philippines to verify the information obtained from the interviews. The team also made an effort to comprehend their operational and financial data, including revenue, business models, geographical presence, focus areas, business verticals, and services offered among others.

Frequently Asked Questions

01 What is the forecast for the home finance market in the Philippines for the next five years?

The philippines home finance market is expected to be valued at US$ 141.20 bn in 2027. It is expected to grow with a CAGR of 12% from 2022-2027.

02 What are the major factors driving the philippines home finance market?

The major driving factors of philippines home finance market are growing demand for used vehicles and financing penetration in the sector.

03 Which are the major players in philippines home finance market?

The major players in philippines home finance market are Bank of the Philippine Islands, Security Bank, Banco de Oro (BDO), Metro Bank, East West Bank, LANDBANK of the Philippines and Philippine National Bank

04 Which is the dominant medium in the Philippines Home Finance Market?

In the Philippines home finance market, banks emerge as the dominant medium, often providing superior regulatory compliance, customer service, and competitive interest rates.

05 Which region is dominating in philippines home finance market?

The capital of philippines, Manila has the dominating advantage in the philippines home finance market regional segmentation.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.