Saudi Arabia Kids e-Commerce Market Outlook to 2028

Region:Middle East

Author(s):Shambhavi

Product Code:KROD8017

December 2024

98

About the Report

Saudi Arabia Kids E-Commerce Market Overview

- The Saudi Arabia Kids E-Commerce Market is valued at USD 1 billion, based on an in-depth analysis of historical data and key driving factors. The markets growth is strongly driven by increasing internet penetration, which now exceeds 95% in urban regions, coupled with high smartphone usage among young parents. The rise of digital payment platforms and secure payment gateways is facilitating seamless online purchases, making e-commerce a preferred shopping mode for children's products. The government's Vision 2030 initiative, aimed at digital transformation, further strengthens the online market landscape for children's goods, creating a promising growth trajectory.

- The Saudi market is predominantly influenced by major urban centers, with Riyadh and Jeddah leading due to their high population density, tech-savvy demographics, and strong consumer demand for convenience-oriented shopping solutions. Riyadhs extensive logistics infrastructure, including well-established warehousing and distribution facilities, positions it as a primary hub for e-commerce activity. Additionally, Jeddahs strategic location as a port city supports efficient product importation and distribution, catering to the western regions demand for a wide range of childrens products.

- The E-Commerce Law enacted in 2019 continues to impact online retailers in 2023. The law requires transparent disclosure of business information and consumer rights. In 2023, over 200 e-commerce businesses were audited for compliance, with 50 receiving penalties for violations such as false advertising and inadequate disclosure of terms. Compliance ensures consumer trust but necessitates that businesses allocate resources to legal and administrative processes to meet these standards.

Saudi Arabia Kids E-Commerce Market Segmentation

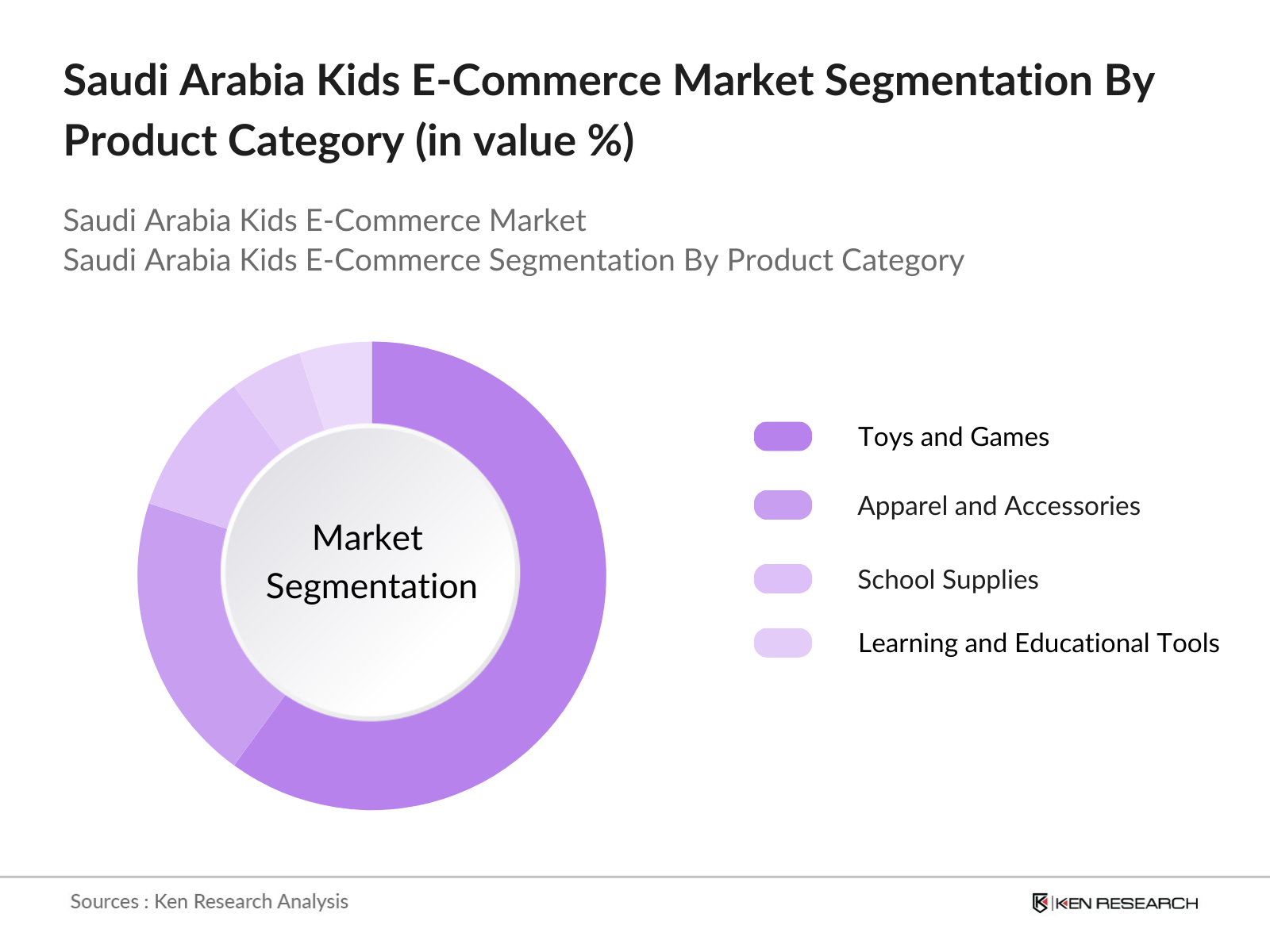

By Product Category: The Saudi Arabia Kids E-Commerce Market is segmented by product category into Toys and Games, Apparel and Accessories, School Supplies, and Learning and Educational Tools. Toys and games hold a dominant share in this segment due to their broad appeal across age groups, with top brands offering educational and interactive options that resonate with parental preferences for educational play. Online platforms like Mumzworld and BabyShop have enhanced their toy offerings, catering to diverse needs and age-appropriate learning tools, which bolsters the segments popularity among parents.

By Age Group: The market is also segmented by age group, including Infants (0-3 years), Early Childhood (4-8 years), and Pre-teens (9-12 years). The Early Childhood segment dominates due to heightened demand for developmental toys, educational resources, and age-appropriate apparel. Parents within this age bracket actively seek products that encourage skill development and creativity, making educational toys and learning tools especially popular. Retailers like FirstCry and Sprii have capitalized on this by offering age-tailored categories that ease the shopping experience, supporting this segments market share dominance.

Saudi Arabia Kids E-Commerce Market Competitive Landscape

The Saudi Arabia Kids E-Commerce Market is highly competitive, with a mix of local and global players who focus on varied strategies to capture market share. Major players, such as Mumzworld, BabyShop, and Amazon.sa, emphasize personalized shopping experiences and fast delivery options to cater to the market's specific needs. This consolidation around a few key players underscores their significant influence and market penetration, especially in high-demand categories like educational toys and childrens apparel.

Saudi Arabia Kids e-Commerce Market Analysis

Growth Drivers

1. Digital Penetration: Saudi Arabia has witnessed a significant increase in internet users, reaching approximately 34 million people in 2023. With a population of around 35 million, this indicates that nearly the entire population has internet access. The surge in internet usage is complemented by high smartphone adoption, with over 30 million smartphone users reported in 2023. This widespread digital connectivity enables parents across the country to access online platforms for purchasing children's products, thereby boosting the kids' e-commerce market. The government's investment of over SAR 15 billion in digital infrastructure since 2022 has further enhanced internet accessibility and speed.

2. Online Payment Adoption: In 2023, Saudi Arabia recorded over 1.5 billion cashless transactions, reflecting a substantial shift towards digital payments. The introduction of the national electronic wallet system, which has registered over 20 million users, has simplified online transactions. Additionally, over 90% of adults now have access to banking services, enabling them to utilize debit and credit cards for online purchases. This financial inclusion facilitates seamless transactions in the kids' e-commerce sector, as parents find it convenient and secure to shop online for children's products.

3. Mobile Commerce Growth: Mobile commerce has become a dominant force in Saudi Arabia's e-commerce landscape. In 2023, there were over 25 million mobile shoppers, accounting for a significant portion of online sales. The average Saudi consumer spends about 4 hours daily on mobile devices, with a notable portion of this time dedicated to shopping apps. The availability of high-speed 5G networks, which cover over 70% of the population, has enhanced mobile shopping experiences by enabling faster app performance and smoother transactions. This trend has directly impacted the kids' e-commerce market, as parents increasingly use mobile devices to purchase products for their children.

Market Challenges

1. Logistics Infrastructure: Saudi Arabia's vast geographical area of over 2 million square kilometers poses logistical challenges for e-commerce delivery. In 2023, it was reported that delivery to remote areas could take up to 7 days, compared to 2-3 days in urban centers. The limited number of fulfillment centers outside major cities like Riyadh and Jeddah contributes to delays and higher shipping costs. For instance, shipping costs to remote regions can be 30% higher than within urban areas. These logistical hurdles can deter customers in less accessible regions from engaging with online kids' retailers.

2. Payment Security Concerns: Cybersecurity threats remain a concern for consumers in Saudi Arabia. In 2023, the country experienced over 50,000 cyberattack attempts targeting financial transactions, according to cybersecurity reports. Although not all attacks were successful, the prevalence of such threats causes apprehension among consumers. Approximately 40% of online shoppers express concern over the safety of their personal and financial information when making online purchases. This apprehension can hinder the growth of the kids' e-commerce market, as parents may be reluctant to provide payment details online.

Saudi Arabia Kids e-Commerce Market Future Outlook

Over the next few years, the Saudi Arabia Kids e-Commerce Market is poised for growth, propelled by continued digital transformation initiatives, a robust logistics infrastructure, and an expanding range of digital payment solutions. Increasing consumer demand for quality and safe childrens products online, along with technological advancements in e-commerce, is anticipated to enhance market engagement and penetration. Additionally, strategic collaborations between local brands and international partners will likely expand product variety and further boost market competitiveness.

Market Opportunities

- Rising Demand in Rural Areas: Rural regions in Saudi Arabia, home to over 8 million people, are showing increased interest in e-commerce due to limited local retail options. In 2023, online sales in rural areas grew by 15%, indicating untapped market potential. The government's investment of SAR 3 billion in expanding internet connectivity to rural communities has facilitated this growth. E-commerce platforms that can overcome logistical challenges stand to gain access to a customer base seeking children's products that are otherwise unavailable locally.

- Expanding Product Categories: There is a growing demand for diverse children's products, particularly in educational and developmental categories. Sales of educational toys increased by 25% in 2023, reaching a value of SAR 500 million. Parents are actively seeking products that promote learning and development, such as language learning tools and science kits. This trend offers e-commerce platforms the opportunity to expand their product offerings to meet these demands, potentially increasing their market share in the kids' segment.

Scope of the Report

|

Product Category |

Toys and Games |

|

Apparel and Accessories |

|

|

School Supplies |

|

|

Learning and Educational Tools |

|

|

Age Group |

Infants (0-3 years) |

|

Early Childhood (4-8 years) |

|

|

Pre-teens (9-12 years) |

|

|

Sales Channel |

Online Retailers |

|

Multi-Brand Marketplaces |

|

|

Social Commerce |

|

|

Device Used for Purchase |

Smartphones |

|

Tablets |

|

|

Desktops/Laptops |

|

|

Region |

Riyadh |

|

Jeddah |

|

|

Eastern Province |

Products

Key Target Audience

- Investor and Venture Capitalist Firms

- E-commerce Retailers and Marketplaces

- Government and Regulatory Bodies (Saudi Ministry of Commerce, Communications and Information Technology Commission)

- Logistics and Delivery Service Providers

- Toy and Educational Product Manufacturers

- Apparel Brands Targeting Childrens Segment

- Digital Payment Providers

- Parents Online Community Platforms

Companies

Players mentioned in the report

- Mumzworld

- BabyShop

- Amazon.sa

- FirstCry

- Sprii

- Noon

- Jollychic

- The Toy Store

- Extra Stores

- Jarir Bookstore

- Dragon Mart Online

- Namshi

- Redtag

- Centrepoint

- The Entertainer

Table of Contents

Saudi Arabia Kids e-Commerce Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

Saudi Arabia Kids e-Commerce Market Size (in USD MN)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Milestones and Developments

Saudi Arabia Kids e-Commerce Market Analysis

3.1. Growth Drivers (Digital Penetration, Online Payment Adoption, Mobile Commerce Growth)

3.2. Market Challenges (Logistics Infrastructure, Payment Security, Regulatory Constraints)

3.3. Opportunities (Rising Demand in Rural Areas, Expanding Product Categories, Localization of Content)

3.4. Trends (Personalized Shopping Experiences, Augmented Reality, Influencer Collaborations)

3.5. Government Regulation (E-Commerce Law Compliance, Data Privacy Standards, Product Safety Regulations)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

Saudi Arabia Kids e-Commerce Market Segmentation

4.1. By Product Category (in Value %)

4.1.1. Toys and Games

4.1.2. Apparel and Accessories

4.1.3. School Supplies

4.1.4. Learning and Educational Tools

4.2. By Age Group (in Value %)

4.2.1. Infants (0-3 years)

4.2.2. Early Childhood (4-8 years)

4.2.3. Pre-teens (9-12 years)

4.3. By Sales Channel (in Value %)

4.3.1. Online Retailers

4.3.2. Multi-Brand Marketplaces

4.3.3. Social Commerce

4.4. By Device Used for Purchase (in Value %)

4.4.1. Smartphones

4.4.2. Tablets

4.4.3. Desktops/Laptops

4.5. By Region (in Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Eastern Province

Saudi Arabia Kids e-Commerce Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Mumzworld

5.1.2. FirstCry

5.1.3. BabyShop

5.1.4. Noon

5.1.5. Amazon.sa

5.1.6. Namshi

5.1.7. Centrepoint

5.1.8. The Toy Store

5.1.9. Jollychic

5.1.10. Redtag

5.1.11. Souq (Amazon subsidiary)

5.1.12. Sprii

5.1.13. Extra Stores

5.1.14. Jarir Bookstore

5.1.15. Dragon Mart Online

5.2 Cross Comparison Parameters (Average Basket Size, Website Traffic, Delivery Speed, Return Policy, Mobile App User Ratings, Customer Support Availability, Product Variety, Pricing Strategies)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment and Funding Analysis

5.7. Government Grants and Subsidies

Saudi Arabia Kids e-Commerce Market Regulatory Framework

6.1. E-Commerce Licensing Requirements

6.2. Compliance with Digital Security Standards

6.3. Consumer Protection Laws

6.4. Taxation Policies

6.5. Advertising Regulations

Saudi Arabia Kids e-Commerce Future Market Size (in USD MN)

Saudi Arabia Kids e-Commerce Future Market Segmentation

8.1. By Product Category (in Value %)

8.2. By Age Group (in Value %)

8.3. By Sales Channel (in Value %)

8.4. By Device Used for Purchase (in Value %)

8.5. By Region (in Value %)

Saudi Arabia Kids e-Commerce Market Analysts Recommendations

9.1. Total Addressable Market (TAM) Analysis

9.2. Consumer Behavior Insights

9.3. Strategic Marketing Opportunities

9.4. Emerging White Spaces in Product Categories

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In this phase, we mapped out the ecosystem of stakeholders within the Saudi Arabia Kids e-Commerce Market. Using extensive desk research and proprietary data sources, critical variables such as consumer preferences, pricing trends, and digital payment adoption rates were identified to understand market dynamics.

Step 2: Market Analysis and Data Compilation

Historical data for the Saudi Arabia Kids e-Commerce Market was gathered and analyzed, assessing variables like product category distribution and regional demand variations. This included evaluating current online purchase trends to estimate revenue breakdowns by product type and age group.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through in-depth consultations with industry experts via CATIs. Insights into operational strategies and market shifts were gathered, aiding in the refinement of data on sales performance and consumer behavior.

Step 4: Research Synthesis and Final Reporting

The final step involved synthesizing data gathered from market participants and secondary sources to compile an accurate and verified report. Direct insights from e-commerce retailers were incorporated to validate data, ensuring a comprehensive and reliable market analysis.

Frequently Asked Questions

01. How big is the Saudi Arabia Kids e-Commerce Market?

The Saudi Arabia Kids e-Commerce Market was valued at USD 1 billion, driven by rising smartphone penetration, digital payments, and e-commerce infrastructure improvements.

02. What are the challenges in the Saudi Arabia Kids e-Commerce Market?

The market faces challenges such as logistics complexities, payment security concerns, and regulatory compliance, which can affect service quality and customer trust.

03. Who are the major players in the Saudi Arabia Kids e-Commerce Market?

Key players include Mumzworld, BabyShop, Amazon.sa, FirstCry, and Sprii. These companies lead through diverse product offerings, streamlined delivery services, and consumer trust.

04. What are the growth drivers of the Saudi Arabia Kids e-Commerce Market?

Growth is primarily driven by high internet and mobile penetration rates, increasing demand for convenience, and the governments digital transformation goals outlined in Vision 2030.

05. Which product category dominates the Saudi Arabia Kids e-Commerce Market?

Toys and games currently dominate, as they offer diverse and engaging options that meet both educational and recreational needs of children, appealing to a broad age range.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.