Thailand Car Mobility-as-a-Service (MAAS) Market Outlook to 2027

Driven by Rising tourism, technological developments and booming automotive manufacturing

Region:Asia

Author(s):Anushi Chabbra and Rishab Verma

Product Code:KR1348

July 2023

129

About the Report

The report provides a comprehensive analysis of the potential of Car Mobility-as-a-Service Market in Thailand. The report covers an overview and genesis of the industry, market size in terms of revenue generated, fleet size and average prices.

It covers sub-markets such as car rental, car leasing, ride hailing, self-drive car rental and car sharing services. The revenue in each market is segmented car type, by mode of booking, by purpose, by lease duration, by region, by commute type, by booking duration, by usage and by ownership; growth enablers and drivers; challenges and bottlenecks; trends driving adoption trends; regulatory framework; end-user analysis, industry analysis, competitive landscape including competition scenario and market shares of major players. The report concludes with future market projections of each market segmentation and analyst recommendations.

Market Overview:

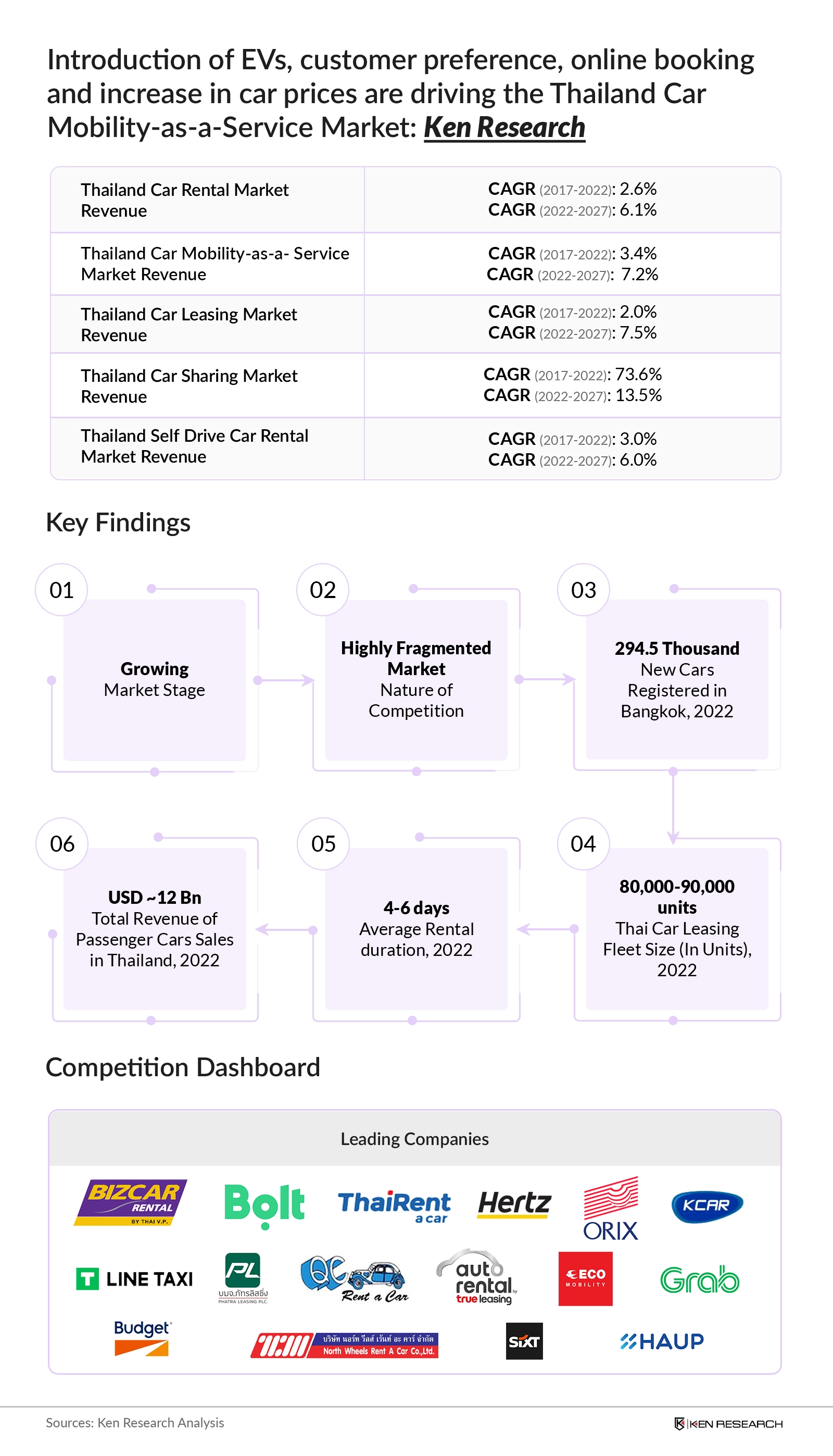

According to Ken Research estimates, the Thailand Car Mobility-as-a-Service (MaaS) Market – which grew from approximately $ ~4 Bn in 2017 to approximately $ ~4.5 Bn in 2022 – is forecasted to grow further to $ ~6 Bn by 2027, owing to introduction of EVs, booming tourism and technological advancements in the country.

- Proliferation of smartphones and low-cost internet connectivity across the country is expected to lead growth of mobile application-based business models as they expand to more cities.

- Increase in fuel prices as well as low availability of automobiles due to shortage of semiconductor chips will lead to rising ticket sizes of these services, which will give this market steady growth over the coming years.

Key Trends by Market Segment:

By Mode of Booking: Offline booking channels are opted for by domestic tourists as well as by corporate clients due to convenience and reliability. Booking desks also available on airports as major companies have their kiosks.

By Duration of Lease: From the consumer’s point of view, the life span of cars in Thailand is Thai between 8-10 years as customers tend to use their cars for this long because cost of ownership of old cars is not progressive.

Competitive Landscape

Thailand Car Mobility-as-a-Service Market is at growing stage with highly fragmented market. Top Players of Thailand Car MaaS market are Thai Rent Car, South East Capital, Grab, Haup and QC Rent a Car. Major market players differ by service with no overlap, who are competing against each other on the basis of base fare, average ticket size, waiting time, fleet size, no of drivers, daily/monthly price and revenue.

Future Outlook

Factors like younger population, internet penetration and technological development will drive the market in future. Additionally, increase in fuel prices as well as shortage of automobiles due to shortage of semiconductor chips will lead to rising ticket sizes of these services, which will give this market steady growth over the coming years.

Scope of the Report

|

Thailand Car Mobility-as-a-Service (MAAS) Market |

|

|

Thailand Car Rental Market Segmentation |

|

|

By Car Type |

Luxury Affordable |

|

By Mode of Booking |

Online Offline |

|

By Purpose |

Business Leisure |

|

Thailand Car Leasing Market Segmentation |

|

|

By Type Of Car |

Sedan SUV Premium |

|

By Lease Duration |

3 Years 4 Years 5 Years |

|

By Region |

Metropolitan Non-Metropolitan |

|

Thailand Car Ride-Hailing Market Segmentation |

|

|

By Region |

Metropolitan Non-Metropolitan |

|

Thailand Car Sharing Market Segmentation |

|

|

By Car Type |

Sedan and Hatchback SUV |

|

By Commute Type |

Intercity Long Distance |

|

Thailand Self Drive Market Segmentation |

|

|

By Region |

Metropolitan Non-Metropolitan |

|

By Mode of Booking |

Online Offline |

|

By Booking Duration |

1-2 day Around a Week Around a Month |

|

By Usage |

Intercity Intracity |

|

By Booking Period |

Weekend Weekdays |

|

By Type of Cars |

Sedan Hatchback SUV |

|

By Ownership |

Self-Owned Leased |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report

- Car Rental, Leasing, Sharing, Ride Hailing Service Providers

- Car Rental, Leasing, Sharing Companies Aiming to Establish in Thailand

- Thailand Automotive Industries

- Government Bodies & Regulating Authorities

- Venture Capitalist Targeting the Mobility Market

- Automotive Industry Association

- Car Manufacturers

- Existing Car Rental Companies

- OEM Dealerships

- New Market Entrants

- Investors

- Car Leasing Associations

Time Period Captured in the Report

- Historical Period: 2017-2022

- Base Year: 2022

- Forecast Period: 2022-2027

Companies

Major Players Mentioned in the Report

- Thai Rent a Car

- North Wheels Rent a Car

- Biz Car Rental

- SIXT

- Hertz

- South East Capital

- ORIX Leasing

- Krungthai Car Rent

- Pharta Leasing

- True Leasing

- Grab

- Line Taxi

- Bolt

- Haup Car

- Hamo

- QC Leasing

- Budget Car Rental

- Prop Up Car Rental

- Biz Car Rental

- Eco Car Rental

Table of Contents

1. Executive Summary

1.1 Executive Summary: Thailand Car Mobility as a Service Market

2. Country Overview of Thailand

2.1 Country Profile of Thailand, 2021

2.2 Thailand Population Analysis, 2022

2.3 Regional Analysis of Thailand

2.4 Macroeconomic Factors in Thailand

3. Thailand Automotive Market Overview

3.1 Car Manufacturing Hubs in Thailand

3.2 Thailand Automotive Market Overview

3.3 Thailand Motor Vehicles Import Export Scenario

3.4 Thailand Passenger Car Market Overview

4. Thailand Car Mobility as a Service Overview and Segmentation

4.1 Ecosystem of Thailand Car Mobility-as-a-Service Market

4.2 Thailand Car Mobility-as-a-Service Market Business Cycle

4.3 Timeline and Development of Thailand Car Mobility-as-a-Service Market Industry

4.4 Overview of Tourism in Thailand

4.5 Seasonal Trends and Covid-19 Impact on Tourism in Thailand

4.6 Thailand Car Mobility as a Service Market Size by Revenue

4.7 Thailand Car MaaS Industry Overview by Revenue and Fleet Size, 2017-2022

5. Thailand Car Rental Market Overview & Segmentation

5.1 Thailand Car Rental Market Ecosystem

5.2 Business Model of Thailand Car Rental Market

5.3 Thailand Car Rental Market Size in Revenue Terms, 2017-2022

5.4 Thailand Car Rental Market Sizing in terms of Fleet Size and Price, 2017-2022

5.5 Segmentation of Revenue by Mode of Booking, 2022

5.6 Segmentation of Revenue by Type of Car, 2022

5.7 Segmentation of Revenue by Purpose, 2022

6. Thailand Car Leasing Market Overview & Segmentation

6.1 Thailand Car leasing Market Ecosystem

6.2 Value Chain in Thai Car leasing Market

6.3 Thailand Car Leasing Market Size in Revenue Terms, 2017-2022

6.4 Thailand Car Leasing Market Sizing in terms of Fleet Size and Price, 2017-2022

6.5 Segmentation of Revenue by Type of Car, 2022

6.6 Segmentation of Revenue by Duration of Lease, 2022

6.7 Segmentation of Revenue by Region, 2022

7. Thailand Ride Hailing Market Overview & Segmentation

7.1 Thailand Car Ride Hailing Market Ecosystem

7.2 Customer Journey in Thai Ride Hailing Market

7.3 Thailand Car Ride Hailing Market Size in Revenue Terms, 2017-2022

7.4 Thailand Ride Hailing Market Sizing in terms of Fleet Size and Price, 2017-2022

7.5 Segmentation of Revenue by Region, 2022

8. Thailand Car Sharing Market Overview & Segmentation

8.1 Thailand Car Sharing Market Snapshot

8.2 Customer Journey in Car Sharing Market of Thailand

8.3 Thailand Car Sharing Market Size in Revenue Terms, 2017-2022

8.4 Thailand Car Sharing Market Sizing in terms of Fleet Size and Price, 2017-2022

8.5 Segmentation of Revenue by Type of Car, 2022

8.6 Segmentation of Revenue by Commute Type, 2022

9. Thailand Self Drive Car Rental Market Overview & Segmentation

9.1 Thailand Self Drive Car Rental Market Ecosystem

9.2 Value Chain in Thailand Self Drive Car Rental Market

9.3 Thailand Self Drive Car Rental Market Size in Revenue Terms, 2017-2022

9.4 Thailand Self Drive Car Rental Market Sizing in terms of Fleet Size and Price, 2017-2022

9.5 Segmentation of Revenue by Region, 2022

9.6 Segmentation of Revenue by Mode of Booking, 2022

9.7 Segmentation of Revenue by Booking Duration, 2022

9.8 Segmentation of Revenue by Usage, 2022

9.9 Segmentation of Revenue by Type of Car, 2022

9.10 Segmentation by Ownership and Booking Period, 2022

10. Industry Analysis

10.1 BCG Growth Share Matrix Analysis of Thailand’s Car Mobility-as-a-Service (MaaS) Industry

10.2 SWOT Analysis of Thailand’s Car Mobility-as-a-Service (MaaS) Industry

10.3 Operating Models in Car Mobility

10.4 Growth Drivers in Thailand’s Car Mobility-as-a-Service (MaaS) Industry

10.5 Trends and Development in Thailand’s Car Mobility-as-a-Service (MaaS) Industry

10.6 Government Regulations in Thai Car Leasing Market

10.7 Issues and Challenges Thailand’s Car Mobility-as-a-Service (MaaS) Industry

11. Competition Framework

11.1 Competition Landscape in Thailand Car Mobility-as-a-Service Industry

11.2 Market Positioning Analysis of Major Car Rental Companies in Thailand

11.3 Market Positioning Analysis of Major Car Leasing Companies in Thailand

11.4 Market Share of Major Ride Hailing Players in Thailand

11.5 Competitive Analysis of Self-Drive Car Rental and Car Sharing Market

11.6 Cross Comparison of Car Rental Companies

11.7 Cross Comparison of Car Leasing Companies

11.8 Cross Comparison of Car Sharing and Ride Hailing Companies

11.9 Cross Comparison of Car Self Drive Rental Companies

12. Future Outlook of Thailand Car Mobility as a Service Market

12.1 Thailand Car Mobility as a Service Market Size, 2022-2027

12.2 Thailand Car MAAS Industry Future Outlook Overview, 2022-2027

12.3 Thailand Car Rental Market Size in Revenue Terms, 2022-2027

12.4 Thailand Car Rental Market Outlook by Fleet Size and Mode of Booking, 2022-2027

12.5 Thailand Car Rental Market Outlook by Type of Car and by Purpose, 2027

12.6 Thailand Car Leasing Market Size in Revenue Terms, 2022-2027

12.7 Thailand Car Leasing Market Outlook by Fleet Size and by region, 2022-2027

12.8 Thailand Car Lease Market Revenue by Type of Car and by Duration of Lease, 2027

12.9 Thailand Ride Hailing Market Size in Revenue Terms, 2022-2027

12.10 Thailand Ride Hailing Market Outlook by Fleet Size and by region, 2022-2027

12.11 Thailand Car Sharing Market Size in Revenue Terms, 2022-2027

12.12 Thailand Car Sharing Market Sizing in terms of Fleet Size and Price, 2022-2027

12.13 Thailand Car Sharing Market by Type of Car and by Commute, 2027

12.14 Thailand Self Drive Car Rental Market Size in Revenue, 2022-2027

12.15 Thailand Self Drive Market by Cities and by Mode of Booking, 2027

12.16 Thailand Self Drive Market by Usage and by Duration, 2027

12.17 Thailand Self Drive Market by Type of Car, 2027

12.18 Thailand Self Drive Market by Ownership and Booking Period, 2027

13. Analyst Recommendations and Industry Speaks

13.1 Recommendations for Different Stakeholders in Car mobility market

13.2 Success Factors to Capture Future Market

13.3 Recommendations to Seize Incremental Opportunities

13.4 Marketing Recommendations for Car Rental Business

13.5 Industry Speaks

14. Research Methodology

14.1 Market Definitions and Assumptions

14.2 Abbreviations

14.3 Market Sizing Approach

14.4 Consolidated Research Approach

14.5 Sample Size Inclusion

14.6 Limitations and Future Conclusion

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on rental and leased car over the years, penetration of fleet size compute overall revenue generated for cars. We will also review portfolio of car company statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple car rental and leasing providing channels and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from rental car providers.

Frequently Asked Questions

01 How big is the Thailand Car Mobility-as-a-Service (MAAS) Market?

The Thailand Car Mobility-as-a-Service (MaaS) Market growing around $ ~4 Bn in 2017 to $ ~4.5 Bn in 2022.

02 What is the future of Thailand Car Mobility-as-a-Service (MAAS) Market?

The Thailand Car Mobility-as-a-Service (MAAS) Market expected to grow around $ ~6 Bn by 2027.

03 Which is most prefer mode in Thailand Car Mobility-as-a-Service (MAAS) Market?

Offline booking channels is the most prefer mode in Thailand Car Mobility-as-a-Service (MAAS) Market.

04 What are the growth driving factors of Thailand Car Mobility-as-a-Service (MAAS) Market in future ?

younger population, internet penetration and technological development are the main growth driving factorts of Thailand Car Mobility-as-a-Service (MAAS) Market in future.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.