UAE Used Car and Auto Classified Market Outlook to 2022

By Revenue Streams (Commission, Paid Listings, Banner Advertisement), By Export and Domestic Sales

Region:Middle East

Product Code:KR717

October 2018

79

About the Report

The report titled "UAE Used Car and Auto Classified Market Outlook to 2022 - By Revenue Streams (Commission, Paid Listings, Banner Advertisement), By Export and Domestic Sales" provides a comprehensive analysis on the UAE used car dealership and auto classified companies. The report covers various aspects including used car sales volume, transaction value and net income of dealers and classifieds; market segmentation by region (Dubai, Sharjah, Abu Dhabi, Umm Al Quwain, Ras Al Khaimah, Fujairah and Ajman), by Sales channel (B2B/B2C Dealership, Classified, C2C word of mouth) and by revenue streams, growth drivers, challenges, key regulations, market share of major dealers and classified companies, future outlook and analyst recommendation.

This report will help the readers to identify the ongoing trends in the industry and anticipated growth in future depending upon changing industry dynamics in coming years. The report is useful for UAE car dealerships, auto and horizontal classified portals, potential entrants and other stakeholders to align their market centric strategies according to ongoing and expected trends in the future.

Market Size

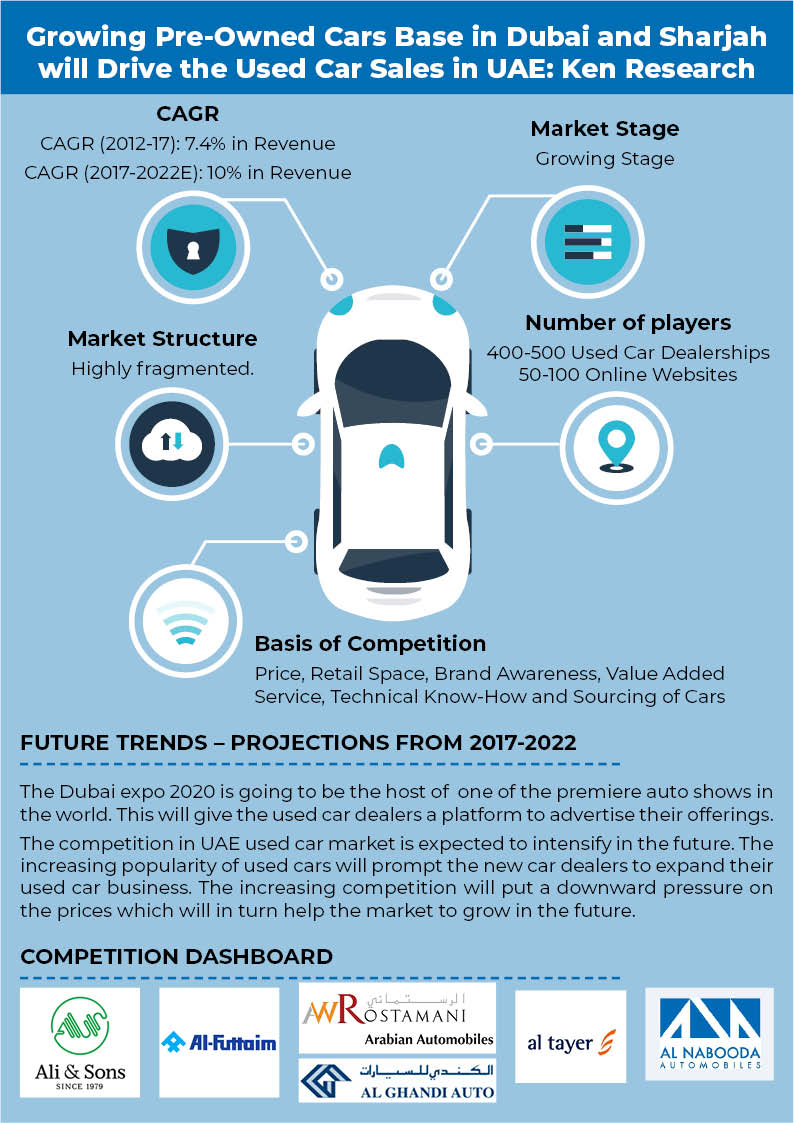

The market of used cars in UAE is in the maturity stage and has grown constantly in the last few years. The market size by transaction value has registered a single digit growth in the last 5 year with an increase in the volume and average price of the pre-owned cars and reduction in average car ownership period. The market has slowed down after 2015 as the fall in oil prices had an adverse effect on the overall economy of UAE resulting in decrease in demand for cars. Improving quality of used cars, large number of expatriates, demand for new and luxury cars along with improving economic condition are some key growth drivers in the market. There are a number of challenges that exist in the market that needs to be addressed including price discrepancy, lack of standardization and others. The passion for cars in the country is one of the biggest reasons that more dealers are entering the market. Manufactured certified cars are gaining foothold in the market as they provide reliable quality of cars.

Majority of the pre-owned cars are exported outside UAE to nearby GCC and African nations. Domestically, B2B and B2C dealers contributed majority to the sales channel apart from sales via classified and C2C word of mouth channel.

Out of pre-owned car sales volume, Crossover contributed to the majority sales followed by luxury SUV, full size sedan and premium sedans. SUV are one of the most common types of cars that are sold in the market. Luxury SUV, Full Size Sedan, Premium Sedan, Luxury Sedan, Full Size SUV, Convertible, Super Car, Coupe, Entry Level Sedan, HatchBack, Luxury Hatchback, Pick-Up Trucks are some other popular segments.

The Japanese manufactured cars enjoy the market leadership in used car sales volume followed by German manufactured cars and American manufactured cars. Demand for cars from other parts of the world is much lower.

The country is divided into seven emirates (Dubai, Sharjah, Abu Dhabi, Umm Al Quwain, Ras Al Khaimah, Fujairah and Ajman). Dubai has the highest market share in sales volume followed by Sharjah and Abu Dhabi.

The competition in the market is highly fragmented as there are many players in the market. Most of the big dealerships use both classified portals and Word of mouth channels for promotion. There are more than 400 dealerships in the market. Al-Futtaim, Al- Naboodah, Gargash motors and Elite cars are some of the biggest players in the market. Classified portals have grown in number and currently there are more than 40 classified portals in the market. Dubizzle, DubiCars, Yalla motors, Carmudi are some of the leading classified players in the market. Sellanycar and Al Futtaim are the market leaders with majority of the market share in the region. Mostly car dealership exist in clusters however the big players in the market have expanded outside their clusters in order to reach out to the customers easily. The companies compete with each others on the basis of prices; value added service, brand reputation and others. Many companies are trying to attract the customers through sales promotion offering discounts, inspection reports and value added services. The car dealers generate revenue by buying a car at low price, refurbishing the car and selling the car at markup prices. The dealerships are expanding their retail space as the aesthetics and decorum of the retail outlet are few parameters which the dealerships are expected to use to differentiate themselves from the competitors.

The market size by transaction value is expected to grow at a faster pace at double digit growth rate as compared to volume growth in next 5 years. Rise in demand for high value cars or super cars is the key reason for higher rise in revenue as compared to volume. Revival of the country’s economy, improving quality of cars, increasing competition and declining age of used cars are some of the factors which will help the market to grow in the future both in terms of value and volume. A number of operational and marketing changes are expected to happen in the market as the companies are becoming more customers centric. The domestic market sales are expected to grow at high rate as compared to export sales between 2017 and 2022. Sharjahis is expected to register highest growth in volume sales followed by Dubai and Abu Dhabi, the demand in other emirates is expected remain constant.

By Type of Regions:

Dubai

Sharjah

Abudhabi

Umm Al Quwain

Ras Al Khaimah

Fujairah

Ajman

By Sales Channel:

B2B/B2C Dealers

C2C Classifieds

By Type of Cars:

Crossover

Luxury SUV

Full Size Sedan

Premium Sedan

Luxury Sedan

Full Size SUV

Convertible

Super Car

Coupe

Entry Level Sedan

Hatchback

Luxury Hatchback

Pick-Up Trucks

Used Cars Dealerships

Classified Used Car Retailing Websites

Used Car Buyers

Used car Sellers

2012-2017 - Historical Period

2017-2022 - Future Forecast

Used Car Dealerships:

Sellanycar.com, Al-Futtaim, Arabian Automobiles, Al Naboodah, Elite Cars, Al Tayar, Carswitch.com.

Classified Used Car Retailing Websites:

UAE Used Car Market Value Chain Analysis

UAE Used Car Market Size, 2012 - 2017

UAE Used Car Market Segmentation

SWOT Analysis

Challenges and Restraints in UAE Used Car Market

Company Profiles of Sellanycar, Al-Futtaim group, Arabian Automobiles, AL Tayer Group , Elite Cars, Al-Naboodah, Dubizzle.com, SellAnyCar.com, Carmudi, Yalla Motors

Porter Five Forces Analysis of UAE Used Car Market

Competitive landscape in UAE used car market

Analyst Recommendations

Macroeconomic Factors in UAE used car market

Products

By Type of Regions (Dubai, Sharjah, Abudhabi, Umm Al Quwain, Ras Al Khaimah, Fujairah and Ajman), By Sales Channel (B2B/B2C Dealersa and C2C Classifieds), By Type of Cars (Crossover, Luxury SUV, Full Size Sedan, Premium Sedan, Luxury Sedan, Full Size SUV, Convertible, Super Car, Coupe, Entry Level Sedan, Hatchback, Luxury Hatchback and Pick-Up Trucks)

Companies

Used Car Dealerships (Sellanycar.com, Al-Futtaim, Arabian Automobiles, Al Naboodah, Elite Cars, Al Tayar, Carswitch.com) and Classified Used Car Retailing Websites (Dubbizle, DubiCars, Yalla Motors, Carmudi)

Table of Contents

1. Executive Summary

Market Overview

Market Segmentation

Competitive Landscape

Future Analysis and Projections

2. Research Methodology

2.1. Market Definitions

2.2. Abbreviations

2.3. Market Sizing and Modeling

Approach- Market Sizing

Variables Dependent And Independent

Multifactor Based Sensitivity Model

Limitations

Final Conclusion

3. UAE Used Car Market Value Chain Analysis

3.1. UAE Used Car Market Ecosystem

3.2. Processes Involved in UAE Used Car market

3.2.1. Upstream Process

3.2.2. Downstream Process

4. Customer Profile

5. UAE Used Car Market, 2012 – 2017

5.1. UAE Used Car Market Overview

5.2. UAE Used Car Market by Transaction Value and by Sales Volume, 2012-2017

6. UAE Used Car Market Segmentation, 2017

6.1. By Domestic and Export Sales, 2017

6.1.1. UAE Used Car Market Export Sales Segmentation, 2017

By Region

6.1.2. UAE Used Car Domestic Sales Segmentation, 2017

By Sales Channel (B2B/B2C Dealers, Classified and C2C – Word of Mouth) By Sales Volume, 2017

By Sales Channel (B2B/B2C Dealers and Classified) By Net Revenue, 2018

By Type Of Car, 2017

By Type of Manufacturer

By Region

7. Competitive Landscape in UAE Used Car Market, 2017

7.1. Parameters of Competition

7.2. Competitive Scenario in UAE Used Car Market

7.2.1. Dealer’s Market Share by Net Revenue, 2018

7.2.2. Classified Companies Market Share by Net Revenue, 2018

7.3. Company Profiles of Major Dealers

7.3.1. SellAnyCar.com

7.3.2. Al-Futtaim group

7.3.3. Arabian Automobiles

7.3.4. Al-Naboodah

7.3.5. Elite Cars

7.3.6. Al Tayer Group

7.3.7. Carswitch

Company Profiles of Major Auto Classifieds

7.3.8. Dubizzle.com

7.3.9. Yalla Motors

7.3.10. Carmudi

8. Trends and Developments in UAE Used Car Market

Increasing Popularity of Used Cars

Discrepency in Prices

Value Added Service

Emergence of Car Leasing Companies

Sales Promotion

Sellers Increasing Awareness

Effect of Technology

9. Growth drivers

Emergence of Online Auto Portals

Preferance for Vintage Cars

Large Number of Expatriates

High Turnover of Cars

Import of Used Cars

10. Challenges and Restraints in UAE Used Car Market

Irregular Prices

Lack of Equitable Deal

Lack of Knowledge Regarding Transfer of Car Ownership

Value Added Tax

Electric Vehicle

Communicating Value

Restrained Financing Options

Registration Process

Presence of Substitute:

11. SWOT Analysis For UAE Used Car Market

12. Porter 5 Forces Analysis of UAE Used Car Market

13. Government Regulations in UAE Used Car Market

14. Recent Developments

15. Channels Used for Selling Cars in UAE

Dealerships

Classifieds

Word of Mouth

16. UAE Used Car Market Future Outlook, 2017-22

Probable Scenario in UAE and their Effect on Used Car Market

16.1. Market Segmentation

16.1.1. By Domestic and Export Sales, 2017-22

16.1.2. By Sales Channel (B2B/B2C, Classifieds and Word of Mouth), 2017-22

By Sales Channel (B2B/B2C Dealership and Online Classifieds) by Net Revenue

16.1.3. By Region

17. Analyst Recommendations

18. Macroeconomic Factors Affecting Used Car Market in UAE

18.1. New Car Sales

18.2. Disposable Income

18.3. Car Rental Fleet Size

19. DISCLAIMER

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.