US Corporate Training Market Outlook to 2025

Driven by Growing Skill Gap with Disrupting Technology Stack and Penetration of Self Paced, Live Instructor Led Online Training Modes

Region:North America

Author(s):Saloni Bhalotiya, Prahaladh Hariharan

Product Code:KR976

April 2020

73

About the Report

The report titled “US Corporate Training Market Outlook to 2025 – Driven by Growing Skill Gap with Disrupting Technology Stack and Penetration of Self Paced, Live Instructor Led Online Training Modes" provides a comprehensive analysis of the in the USA. The report also initiative by explaining the need and opportunity of the corporate training industry. Further, it proceeds with an explanation of current demand and demand by different segments. It also includes the trends, developments, challenges, technological stack, revenue streams, marketing strategies, and government regulations driving the industry. It gives a detailed explanation of competitive scenarios including cross-comparison between major players, Porter’s Five Force Analysis, and detailed company profiles of major players. It concludes with future scope and analyst recommendations.

Market Overview and Demand Scenario

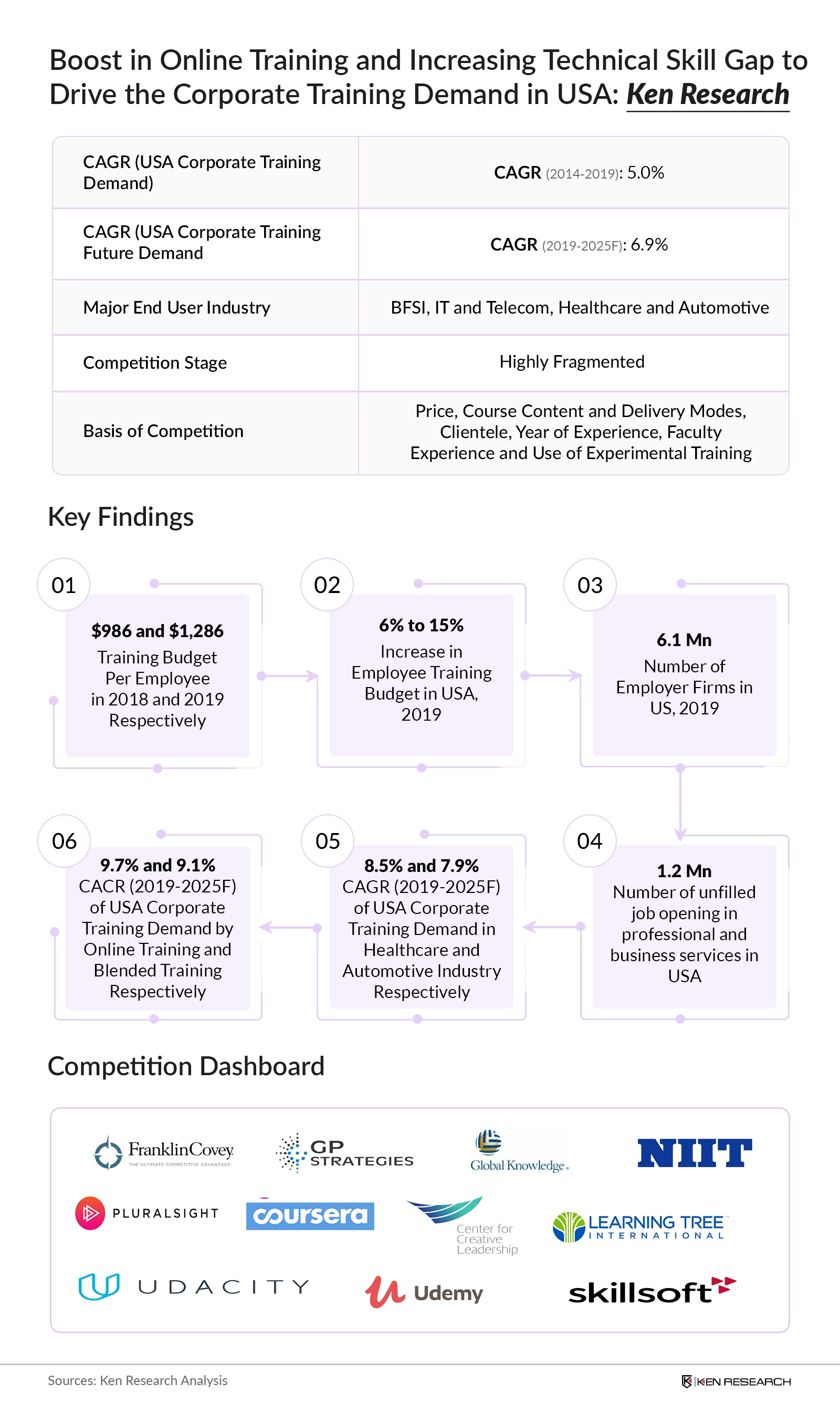

Low employee retention, growing skill gap, low college enrollment, and the increasing cost of ineffective training were some of the important pain points of companies that lead to the introduction of the . The USA Corporate training industry is currently positioned to be at a late growth stage. The demand is increasing with a CAGR close to 5% during the period 2014-2019. There is an increasing trend in the use of Microlearning modules, experimental training, and the development of customized and specific training solutions.

Demand by End-User Industry (BFSI, IT and Telecom, Healthcare, Automotive, Manufacturing, and others): The growing importance of cyber-security with the increasing use of digital banking technologies including digital banking, Blockchain, and others has to lead to the increasing demand for training in the BFSI industry. Data Science & Analytics and Big Data Programs have revolutionized the IT and telecom Industry leading to quick outdating of skills among its employees. In the healthcare industry, the training demand is driven during the need for disease prevention training such as training to deal with highly infectious diseases such as Coronavirus, Ebola, SARS, etc. Introduction of electric & automated vehicles and development in 3D Printing technology is driving the demand in the automotive and manufacturing industries respectively.

Demand By Delivery Mode (Classroom Training, Blended Training, Virtual Training, Online Training (no instructor) and others): The demand is still dominated by classroom training methodology due to inertia caused by traditional mind-set. Blended training is increasing gaining pace as it has found to provide marginally higher ROIs for global setups as compared to the only classroom or only online modules. Channing workstyle and increasing need for flexibility will eventually lead to a substitution of offline to online training.

By Type of Training Services (Technical, Leadership, Managerial, Sales, Customer Support and Others): Technical training dominates the training demand due to the increasing use of technology and the growing digitalization of business operations. Dynamic business strategies, increasing organizational decentralization and growing millennial workforce drives the demand for leadership and managerial training.

By Deployment (On-Site and Off-Site): Increasing demand for skill-based training for which resources are available within office premises to boost the demand for on-site training. Large and mid-size enterprises look for managed training services (multi-year contracts) which involves multiple training programs to be conducted within their offices.

Competitive Landscape

The industry is highly fragmented with the presence of various large public and private training companies as well as thousands of small training start-ups. Price, Course Content, Year of Experience, Faculty Qualification, Use of Experimental Training, and Clientele are few of the important competition parameters. The major players include GP Strategies, Franklin Covey, Global Knowledge, Learning Tree International, Pluralsight, NIIT, Centre for Creative Leadership, Skillsoft, Udemy, Udacity, Coursera and Simplilearn

Future Outlook and Projection

The demand is expected to grow with a CAGR of 6.9% during the period 2019-2025. The demand is expected to be driven by a growing interconnected society due to the advent of AI, Blockchain, IoT, 3D Printing, and others. E-learning is gradually taking over because of low priced modules and flexibility in learning. The shift to remote workstyle and growing government support will further boost the demand in the industry.

Key Topics Covered in the Report:-

- Current Pain Points of Companies Leading to Development of Corporate Training Industry

- Target Addressable Audience

- Supply Ecosystem and Competition Parameters

- Demand Scenario

- Technological Stack

- Revenue Streams

- Marketing Strategies

- Challenges Faced by Corporate Training Companies

- Porter Five Force Analysis

- Emerging Business Strategies

- Best Practises in Business

Products

Key Target Audience

Corporate Training Companies

Education Platforms

Corporate Training Aggregators

Corporate Organizations

Management Consultants

Corporate Trainers

MHRD

Education Associations

Time Period Captured in the Report:-

Historical Period: 2014–2019

Forecast Period: 2020-2025

Companies

Key Segments Covered:

By End User Industry

BFSI

IT and Telecom

Healthcare

Automotive

Manufacturing

By Training Services

Technical

Leadership

Managerial

Sales

Customer Support

By Delivery Mode

Classroom Training

Blended Training

Virtual Training

Online Training (No Instructor)

By Organizational Size

Large Companies (+1000 Employees)

Medium Companies (500-1000 Employees)

Small Companies (0-500 Employees)

By Designation

Managerial

Non-Managerial

Integrated

By Deployment

On-Site

Off-Site

By Training Type

Customized

Open

Companies Covered:

GP Strategies

Franklin Covey

NIIT

Learning Tree International

Global Knowledge

Pluralsight

Centre for Creative Leadership

Skillsoft

Udemy

Udacity

Coursera

Simplilearn

Table of Contents

1. Executive Summary

USA Corporate Training Demand Flow Chart, 2019

USA Corporate Training Demand Flow Chart, 2025F

2. Need and Opportunity

Present Day Pain Points of Corporate Employees and Companies

Target Addressable Market (Number of Corporate Enterprises and Corporate Employees)

Employee Training Trend Analysis Survey

3. Supply Scenario

Supply Ecosystem (Top Blended Service Providers, Online Corporate Training Aggregator Platforms and Online Corporate Training Platforms)

Competition Parameters (Price, Clientele, Years of Experience, Course Content and Delivery Modes, Experienced Faculty and Use of Creative Methods)

4. Demand Scenario

USA Corporate Training Demand, 2014-2019 and Growth Drivers

USA Corporate Training Demand by Organisational Size (Large, Medium and Small) and By Designation (Managerial, Non-Managerial and Integrated), 2014-2019

USA Corporate Training Demand by Delivery Mode and Cross Comparison (Classroom, Blended, Online Training (no instructor), Virtual Training and Others), 2014-2019

5. End User Industry Analysis

Demand by BFSI Industry Training Expenditure (Banking Operations, Sales Support and Process, Customer Support and Relationship Management and Managerial Development), 2019

Demand by IT and Telecom Industry Training Expenditure (IT Courses, Sales and Backend Support and Customer Support)

Demand by Healthcare Industry Training Expenditure (Technical, Sales and Customer Support)

Demand by Automotive Industry Training Expenditure (Technical, Sales, Customer Support and Managerial Development)

6. Industry Analysis

Corporate Training Technological Stack

Corporate Training Revenue Streams

Challenges Faced by Corporate Training Companies (Inertia of Traditional Methods, Retaining Key Personnel, Contract Termination Uncertainty and Cost Overruns, Revenue Seasonality)

Online and Offline Marketing Strategy (Including Case Study of GP Strategies)

7. Competition Scenario

Porter’s Five Force Analysis

Business Capabilities of Major Corporate Training Companies (Content Customization, Major Clients, Major Courses and Online/Offline)

Operational and Financial Landscape (Employee Size, Number of Trainers, Training Per Month, Students Per Session and Revenue)

Cross Comparison between Online Corporate Training Players (Revenue, Number of Users, Number of Courses, Years of Experience, Focus Area and Global Enterprise Clients)

Company Profile of Major Corporate Training Companies including GP Strategies, Franklin Covey, Global Knowledge, NIIT, Centre for Creative Leadership, Learning Tree International, Pluralsight, Skillsoft, Udemy, Coursera, Udacity and Simplilearn (Company Overview, Course Structure, Business Strategies, USP, Major Clients, Recent Developments, Key Financials, M&A and Funding Rounds)

8. Future Demand Analysis

Future Corporate Training Demand, 2025F and Effect of 4th Industrial Revolution

Government Regulation Driving the Industry

Future Demand By Organizational Size (Large, Medium and Small) and By Designation (Managerial, Non-Managerial and Integrated), 2025F

Future Demand By Training Type (Customized and Open) and By Deployment (On-Site and Off-Site), 2025F

Future Demand By End User Industry (BFSI, IT and Telecom, Healthcare, Automotive, Manufacturing and Others), 2025F

Future Demand By Training Service (Technical, Leadership, Managerial, Customer Support, Sales and Others), 2025F

Future Demand By Mode of Training Delivery (Classroom, Blended, Online Training (no instructor), Virtual Training and Others), 2025F

9. Analyst Recommendations

Emerging Business Strategies

Recommended Best Practises in Business

10. Appendix

Research Methodology

Corporate Training Expenditure Survey Respondent Profile

Corporate Training Expenditure Survey Results

Disclaimer

Contact Us

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.