U.S. Corporate Wellness Market Outlook to 2028

Region:North America

Author(s):Abhinav kumar

Product Code:KROD10729

January 2025

96

About the Report

U.S. Corporate Wellness Market Overview

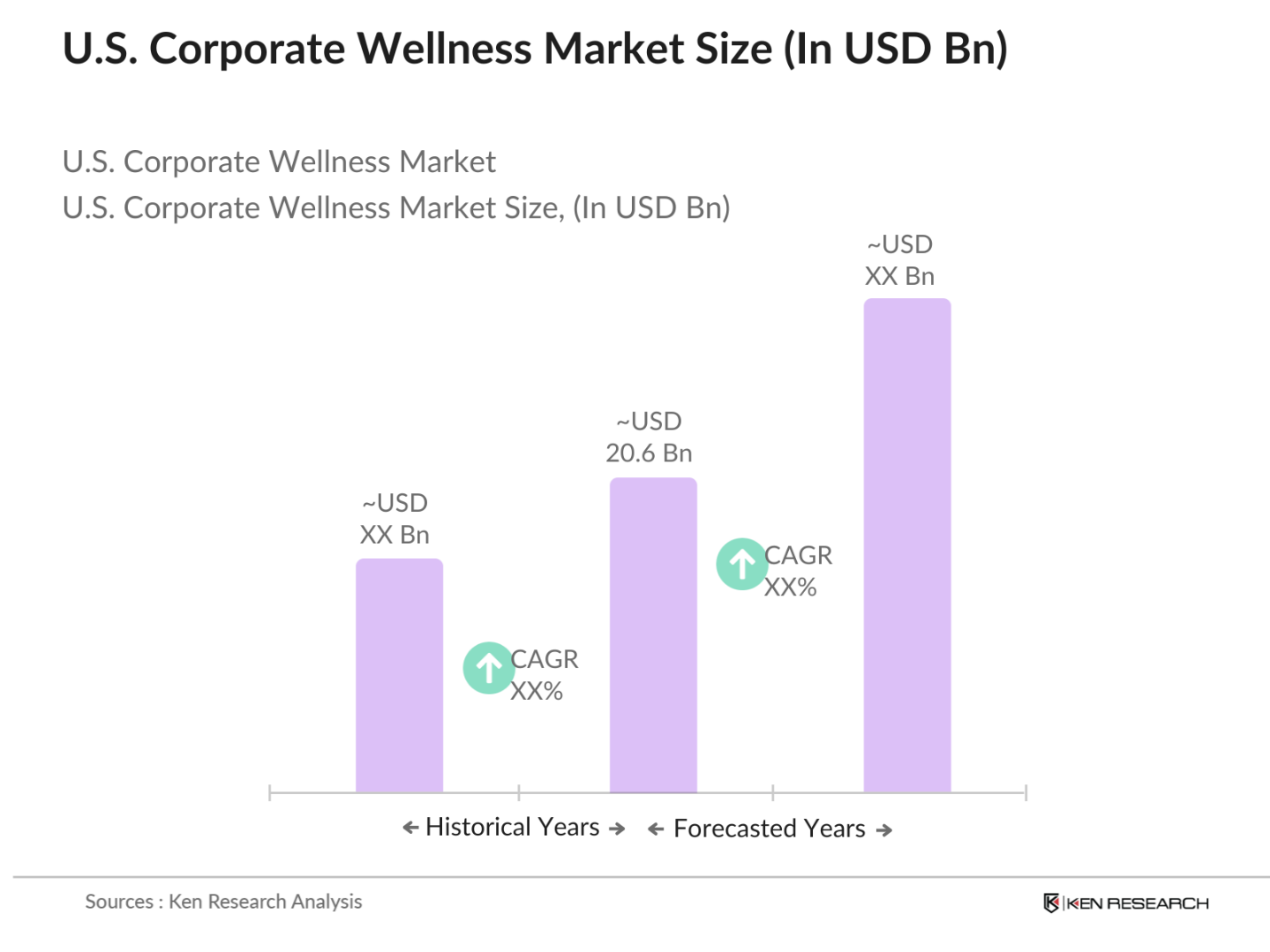

- The U.S. corporate wellness market, valued at USD 20.6 billion, is driven by the increasing prevalence of chronic diseases among employees and a growing emphasis on preventive healthcare measures. Companies are investing in wellness programs to enhance employee productivity and reduce healthcare costs, reflecting a significant shift towards holistic employee well-being.

- Major metropolitan areas such as New York City, Los Angeles, and Chicago dominate the corporate wellness market due to their large concentrations of corporate headquarters and diverse industries. These cities have a high density of businesses that prioritize employee health initiatives, contributing to the market's growth in these regions.

- HIPAA sets national standards for the protection of health information. The U.S. Department of Health and Human Services mandates that wellness programs must safeguard employee data to maintain compliance, emphasizing the importance of data security in program design.

U.S. Corporate Wellness Market Segmentation

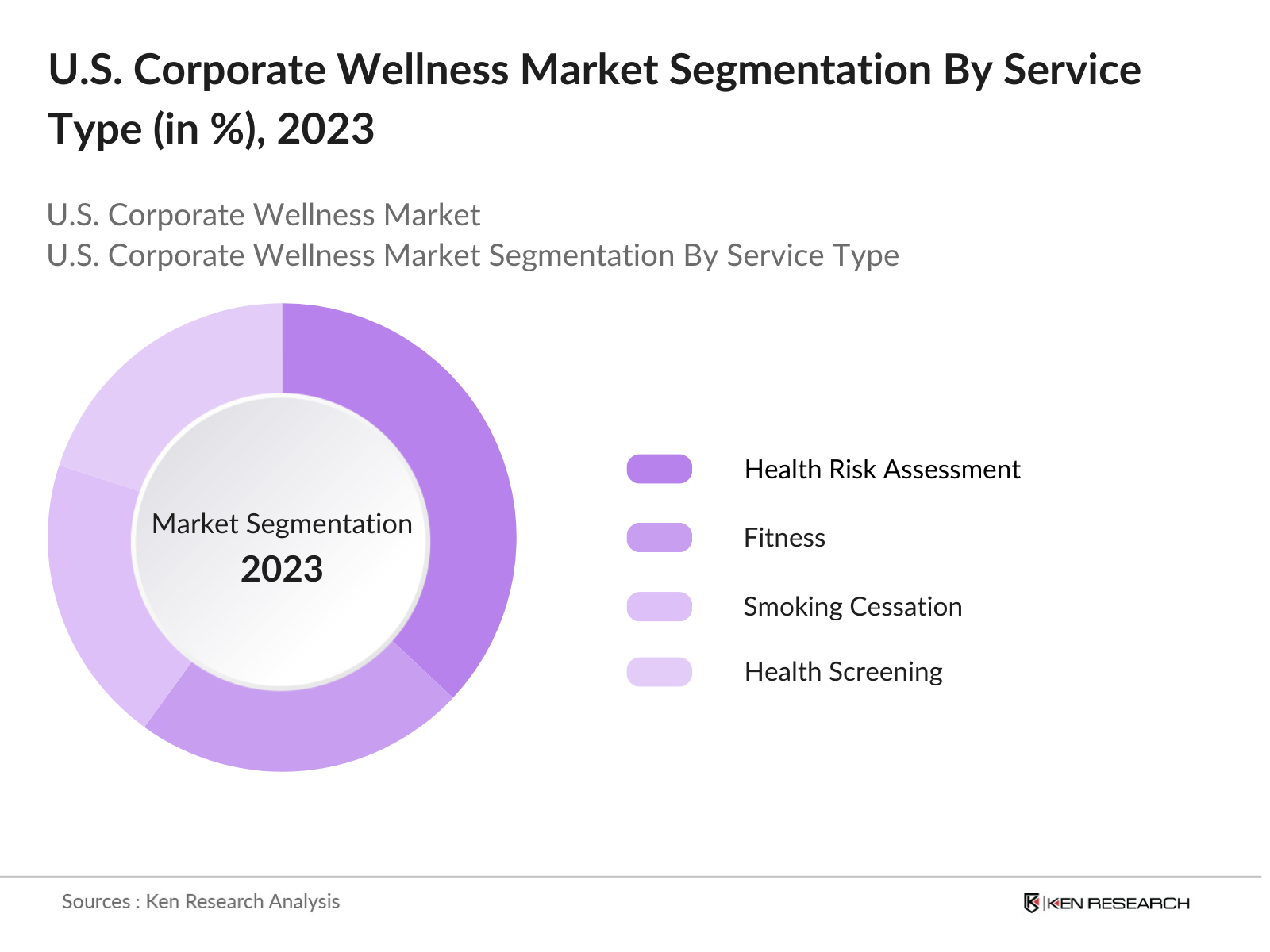

By Service Type: The U.S. corporate wellness market is segmented by service type into Health Risk Assessment, Fitness, Smoking Cessation, Health Screening, Nutrition & Weight Management, Stress Management, and Others. Health Risk Assessment services hold a dominant market share due to their role in identifying potential health issues among employees, enabling organizations to implement targeted wellness programs effectively.

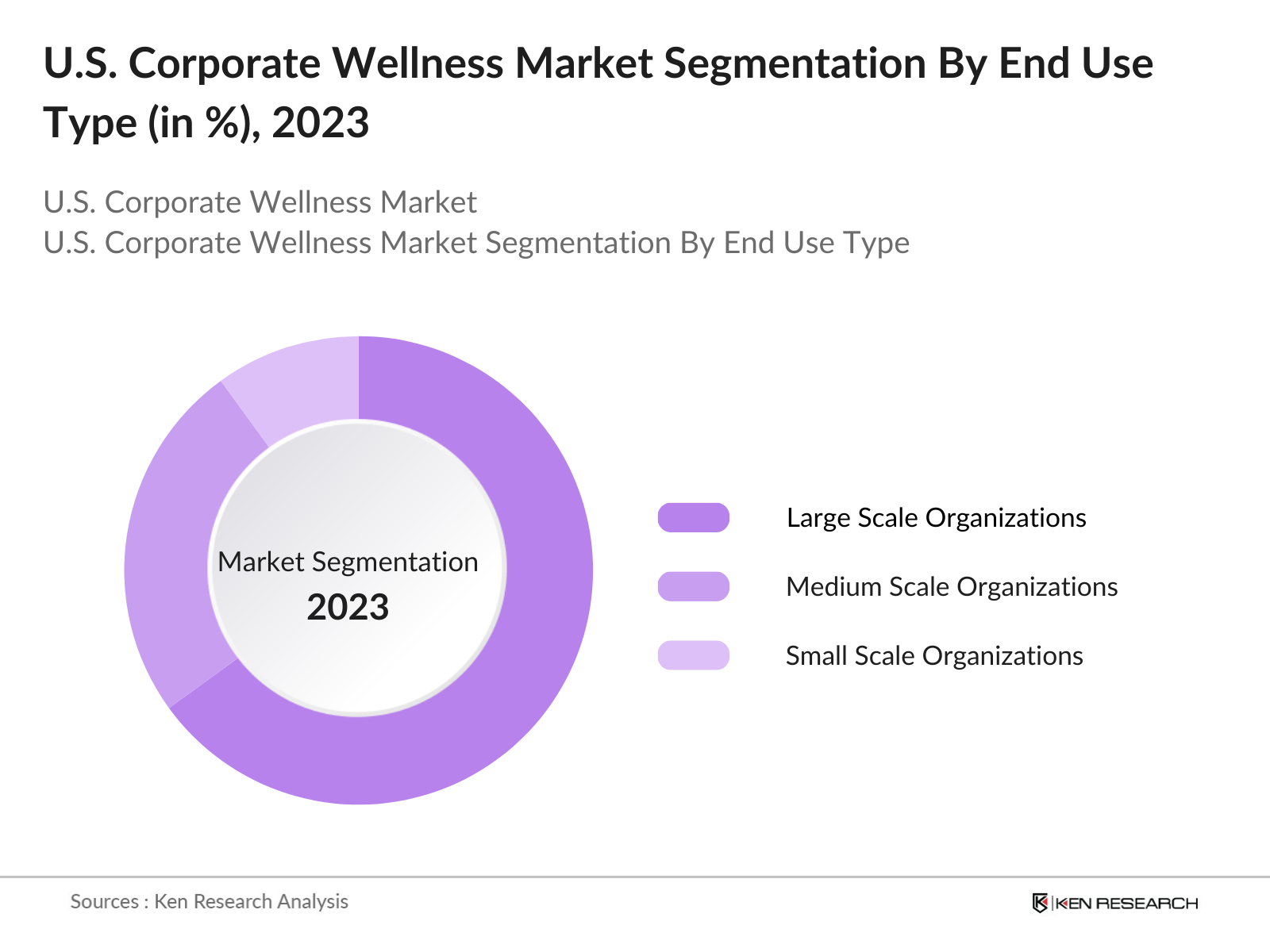

By End Use: The market is also segmented by end use into Small Scale Organizations, Medium Scale Organizations, and Large Scale Organizations. Large Scale Organizations dominate the market share as they have the resources to implement comprehensive wellness programs and recognize the long-term benefits of investing in employee health, leading to reduced absenteeism and increased productivity.

U.S. Corporate Wellness Market Competitive Landscape

The U.S. corporate wellness market is characterized by the presence of several key players offering a range of services tailored to diverse organizational needs. This competitive environment fosters innovation and the continuous development of comprehensive wellness solutions.

U.S. Corporate Wellness Industry Analysis

Growth Drivers

- Rising Adoption of Corporate Wellness Programs: In 2024, the U.S. corporate sector has increasingly embraced wellness initiatives to enhance employee health and productivity. The U.S. Bureau of Labor Statistics reports that approximately 60 million employees have access to workplace wellness programs, reflecting a significant commitment to employee well-being. This widespread adoption underscores the growing recognition of the benefits associated with such programs.

- Increasing Prevalence of Chronic Diseases: Chronic diseases continue to pose a significant challenge in the U.S. workforce. The Centers for Disease Control and Prevention (CDC) indicates that six in ten adults have a chronic disease, leading to substantial healthcare expenditures and productivity losses. This prevalence has prompted employers to implement wellness programs aimed at mitigating these health issues.

- Technological Advancements in Wellness Solutions: The integration of technology into wellness programs has transformed employee engagement. The U.S. Department of Labor highlights that over 50% of large employers now incorporate digital health platforms and wearable devices into their wellness initiatives, facilitating real-time health monitoring and personalized interventions.

Market Challenges

- Measuring Return on Investment (ROI): Quantifying the financial benefits of wellness programs remains a challenge. The U.S. Chamber of Commerce reports that only 30% of companies have established metrics to assess the ROI of their wellness initiatives, indicating a need for more robust evaluation frameworks.

- Ensuring Employee Participation: Achieving high participation rates in wellness programs is often difficult. The National Business Group on Health found that average employee engagement in wellness initiatives stands at 40%, suggesting that more effective strategies are necessary to encourage involvement.

U.S. Corporate Wellness Market Future Outlook

Over the next five years, the U.S. corporate wellness market is expected to experience significant growth, driven by increasing awareness of employee health benefits, technological advancements in wellness solutions, and supportive government policies. Companies are anticipated to invest more in comprehensive wellness programs to enhance employee satisfaction and productivity.

Opportunities

- Integration of Digital Health Platforms: The adoption of digital health platforms presents a significant opportunity for enhancing wellness programs. The U.S. Food and Drug Administration reports that there are over 200 approved digital health applications available, offering employers a variety of tools to support employee health.

- Expansion into Small and Medium Enterprises (SMEs): While large corporations have traditionally led in wellness program implementation, SMEs are increasingly recognizing their value. The U.S. Small Business Administration notes that there are over 30 million small businesses in the U.S., representing a substantial market for wellness service providers.

Scope of the Report

|

Service Type |

Health Risk Assessment, Fitness, Smoking Cessation, Health Screening, Nutrition & Weight Management, Stress Management, Others |

|

End Use |

Small Scale Organizations, Medium Scale Organizations, Large Scale Organizations |

|

Category |

Fitness & Nutrition Consultants, Psychological Therapists, Organizations/Employers |

|

Delivery Model |

Onsite, Offsite |

|

Region |

Northeast, Midwest, South, West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

- Corporate Human Resource Departments

- Health Insurance Providers

- Occupational Health Service Providers

- Employee Assistance Program (EAP) Providers

- Wellness Technology Companies

- Fitness and Nutrition Consultants

- Government and Regulatory Bodies (e.g., Occupational Safety and Health Administration)

- Investors and Venture Capitalist Firms

Companies

Players Mentioned in the Report

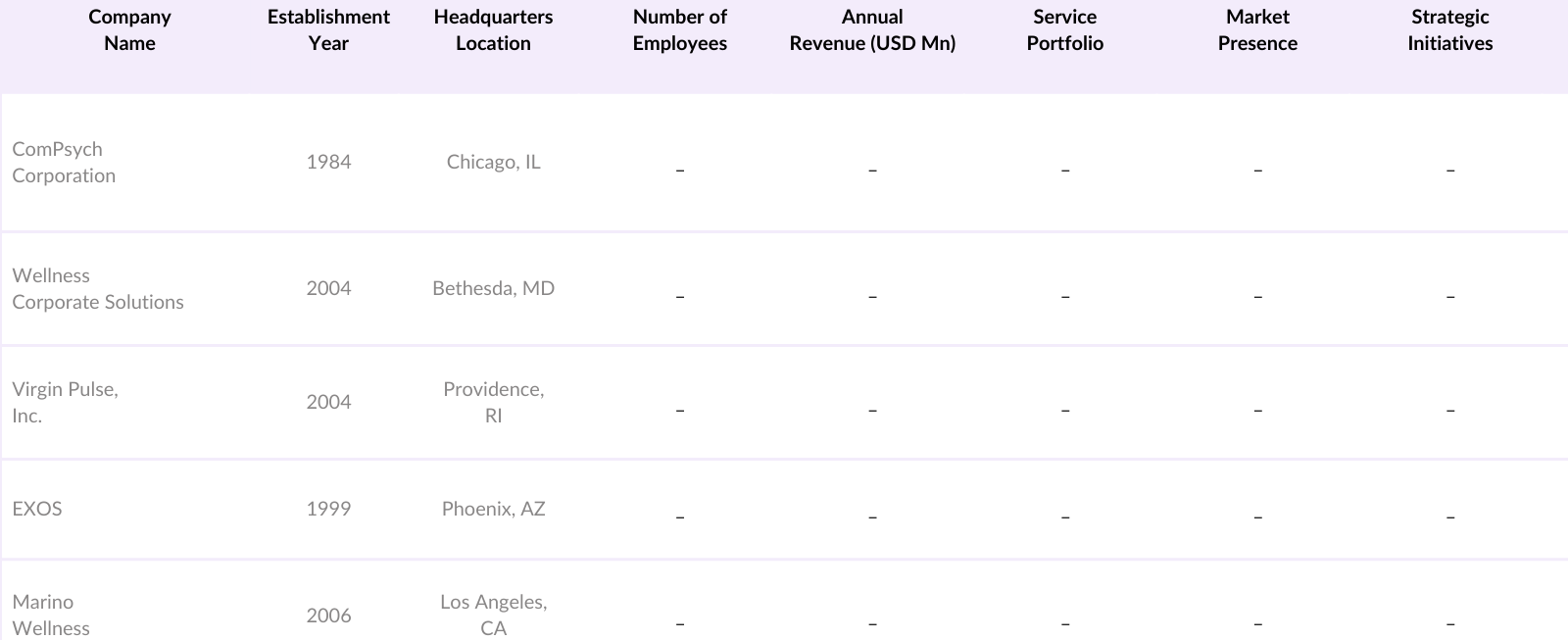

- ComPsych Corporation

- Wellness Corporate Solutions

- Virgin Pulse, Inc.

- EXOS

- Marino Wellness

- Privia Health Group, Inc.

- Quest Diagnostics Incorporated

- Sodexo SA

- SOL Integrative Wellness Centre

- Truworth Wellness

Table of Contents

1. U.S. Corporate Wellness Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. U.S. Corporate Wellness Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. U.S. Corporate Wellness Market Analysis

3.1. Growth Drivers

3.1.1. Rising Prevalence of Chronic Diseases

3.1.2. Increasing Focus on Employee Well-being

3.1.3. Technological Advancements in Wellness Programs

3.1.4. Government Initiatives and Regulations

3.2. Market Challenges

3.2.1. High Implementation Costs

3.2.2. Low Participation Rates Among Employees

3.2.3. Measuring Return on Investment (ROI)

3.3. Opportunities

3.3.1. Integration of Digital Health Platforms

3.3.2. Expansion into Small and Medium Enterprises (SMEs)

3.3.3. Personalized and Tailored Wellness Solutions

3.4. Trends

3.4.1. Adoption of Wearable Technology

3.4.2. Emphasis on Mental Health Programs

3.4.3. Shift Towards Holistic Wellness Approaches

3.5. Government Regulations

3.5.1. Affordable Care Act (ACA) Implications

3.5.2. Occupational Safety and Health Administration (OSHA) Guidelines

3.5.3. Health Insurance Portability and Accountability Act (HIPAA) Compliance

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. U.S. Corporate Wellness Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Health Risk Assessment

4.1.2. Fitness

4.1.3. Smoking Cessation

4.1.4. Health Screening

4.1.5. Nutrition & Weight Management

4.1.6. Stress Management

4.1.7. Others

4.2. By End Use (In Value %)

4.2.1. Small Scale Organizations

4.2.2. Medium Scale Organizations

4.2.3. Large Scale Organizations

4.3. By Category (In Value %)

4.3.1. Fitness & Nutrition Consultants

4.3.2. Psychological Therapists

4.3.3. Organizations/Employers

4.4. By Delivery Model (In Value %)

4.4.1. Onsite

4.4.2. Offsite

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. U.S. Corporate Wellness Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ComPsych Corporation

5.1.2. Wellness Corporate Solutions, LLC

5.1.3. Virgin Pulse, Inc.

5.1.4. EXOS

5.1.5. Marino Wellness

5.1.6. Privia Health Group, Inc.

5.1.7. Quest Diagnostics Incorporated

5.1.8. Sodexo SA

5.1.9. SOL Integrative Wellness Centre

5.1.10. Truworth Wellness

5.1.11. UnitedHealth Group Incorporated

5.1.12. Vitality Group LLC

5.1.13. WebMD Health Services Group, Inc.

5.1.14. Wellsource, Inc.

5.1.15. WellSteps.com LLC

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, R&D Investment, Strategic Initiatives, Global Presence, Client Base, Technological Capabilities)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. U.S. Corporate Wellness Market Regulatory Framework

6.1. Compliance Requirements

6.2. Certification Processes

6.3. Impact of Regulations on Market Dynamics

7. U.S. Corporate Wellness Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. U.S. Corporate Wellness Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By End Use (In Value %)

8.3. By Category (In Value %)

8.4. By Delivery Model (In Value %)

8.5. By Region (In Value %)

9. U.S. Corporate Wellness Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the U.S. Corporate Wellness Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the U.S. Corporate Wellness Market. This includes assessing market penetration, the ratio of service providers to organizations, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple corporate wellness service providers to acquire detailed insights into service segments, client engagement, program effectiveness, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the U.S. Corporate Wellness Market.

Frequently Asked Questions

01 How big is the U.S. Corporate Wellness Market?

The U.S. corporate wellness market is valued at USD 20.6 billion, driven by the increasing prevalence of chronic diseases among employees and a growing emphasis on preventive healthcare measures.

02 What are the challenges in the U.S. Corporate Wellness Market?

Challenges include high implementation costs, low participation rates among employees, and difficulties in measuring the return on investment (ROI) of wellness programs.

03 Who are the major players in the U.S. Corporate Wellness Market?

Key players in the market include ComPsych Corporation, Wellness Corporate Solutions, Virgin Pulse, Inc., EXOS, and Marino Wellness. These companies dominate due to their extensive service portfolios, technological integration, and strategic partnerships.

04 What are the growth drivers of the U.S. Corporate Wellness Market?

The U.S. corporate wellness market is propelled by factors such as the rising prevalence of chronic diseases among the workforce, increasing corporate focus on employee well-being, and advancements in wellness technology. Additionally, government support and policies encouraging health and wellness programs in workplaces further drive market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.