U.S. Education Technology (EdTech) Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD3274

December 2024

98

About the Report

U.S. Education Technology (EdTech) Market Overview

- The U.S. Education Technology (EdTech) market has experienced significant growth, reaching a valuation of $42 billion. This expansion is driven by the increasing adoption of digital learning tools, government initiatives supporting educational technology, and a growing demand for personalized learning experiences. The integration of advanced technologies such as artificial intelligence (AI) and virtual reality (VR) into educational platforms has further propelled market growth.

- Major urban centers like New York, California, and Texas dominate the U.S. EdTech market. These states have substantial investments in educational infrastructure, a high concentration of educational institutions, and a strong emphasis on integrating technology into curricula. Additionally, the presence of numerous EdTech startups and tech companies in these regions contributes to their market dominance.

- The E-Rate program, administered by the Federal Communications Commission (FCC), provides funding to schools and libraries to enhance telecommunications and internet access. In 2023, the program allocated $4.15 billion to support connectivity initiatives, benefiting over 100,000 schools and libraries nationwide. This funding is crucial for ensuring that educational institutions have the necessary infrastructure to support digital learning and bridge the digital divide.

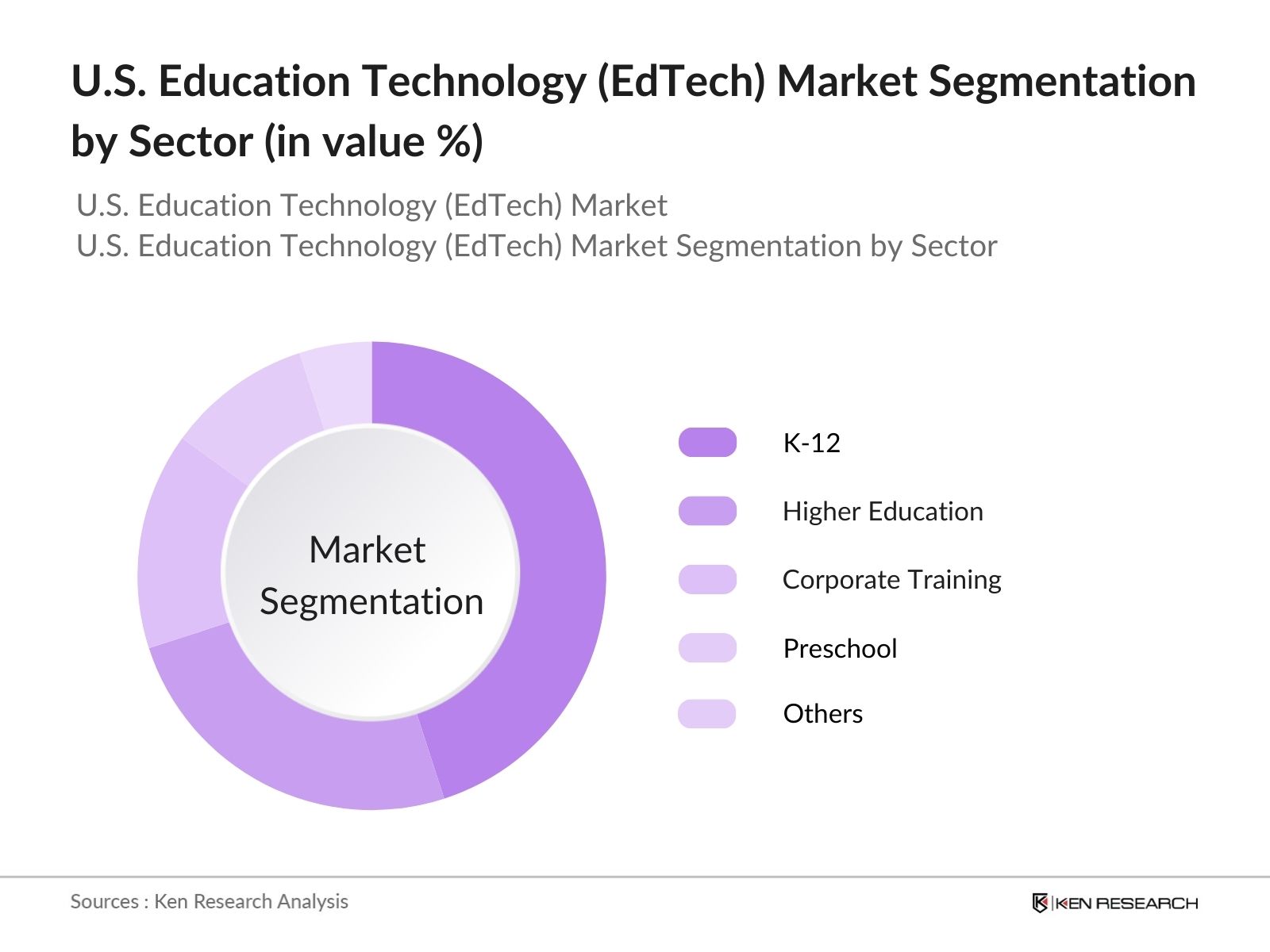

U.S. Education Technology (EdTech) Market Segmentation

By Sector: The market is segmented by sector into Preschool, K-12, Higher Education, Corporate Training, and Others. The K-12 segment holds a dominant market share due to the widespread implementation of digital learning tools in schools, supported by government funding and initiatives aimed at enhancing digital literacy among students. The adoption of interactive learning platforms and online resources has become integral to the K-12 educational framework.

By Type: The market is further segmented by type into Hardware, Software, and Content. The Software segment leads the market, driven by the demand for learning management systems (LMS), educational apps, and virtual classrooms. These software solutions facilitate seamless communication between educators and students, offer personalized learning experiences, and provide analytics to track student progress, thereby enhancing the overall educational experience.

U.S. Education Technology (EdTech) Market Competitive Landscape

The U.S. EdTech market is characterized by the presence of several key players who contribute significantly to its growth and innovation.

U.S. Education Technology (EdTech) Industry Analysis

Growth Drivers

- Increasing Adoption of Digital Learning Tools: The U.S. education sector has witnessed a significant shift towards digital learning tools. In 2023, approximately 70 million students utilized online educational platforms, reflecting a growing preference for digital learning environments. This trend is supported by the widespread availability of high-speed internet, with 93% of households having broadband access, facilitating seamless integration of digital tools in education. Additionally, the proliferation of affordable devices, such as tablets and laptops, has made digital learning more accessible to a broader student population.

- Government Initiatives and Funding: The U.S. government has implemented several initiatives to promote educational technology. The E-Rate program, for instance, allocated $4.15 billion in 2023 to improve internet connectivity in schools and libraries, ensuring that students have access to digital learning resources. Furthermore, the Department of Education's Educational Technology State Grants provided $1.2 billion to support the integration of technology in classrooms, aiming to enhance teaching and learning experiences.

- Rising Demand for Personalized Learning: Personalized learning approaches are gaining traction, with 75% of educators reporting the use of adaptive learning technologies to tailor instruction to individual student needs. This demand is driven by the recognition that personalized learning can improve student engagement and academic performance. Educational institutions are increasingly adopting data-driven platforms that analyze student performance and provide customized learning paths, thereby addressing diverse learning styles and paces.

Market Challenges

- High Implementation Costs: The integration of advanced educational technologies often entails substantial financial investments. For instance, the average cost of implementing a comprehensive Learning Management System (LMS) in a mid-sized school district is approximately $500,000, covering software licenses, hardware, and training. These high costs can be prohibitive, particularly for underfunded schools, limiting their ability to adopt and benefit from modern educational technologies.

- Resistance to Change in Traditional Institutions: Despite the benefits of educational technology, some traditional institutions exhibit resistance to change. A survey conducted in 2023 revealed that 40% of educators were hesitant to adopt new technologies due to concerns about efficacy and a lack of training. This resistance can hinder the integration of innovative tools and impede progress towards modernized educational practices. Addressing these concerns through professional development and demonstrating the effectiveness of technology in enhancing learning outcomes is essential for overcoming this challenge.

U.S. Education Technology (EdTech) Market Future Outlook

Over the next five years, the U.S. EdTech market is expected to exhibit substantial growth, driven by continuous technological advancements, increased investment in digital learning solutions, and a growing emphasis on personalized and adaptive learning experiences. The integration of AI and machine learning to tailor educational content, along with the expansion of online and hybrid learning models, will play pivotal roles in shaping the future of the EdTech landscape.

Future Market Opportunities

- Expansion into Rural and Underserved Areas: Rural and underserved areas present significant opportunities for the expansion of educational technology. Approximately 19 million Americans in rural regions lack access to reliable high-speed internet, limiting educational opportunities. Initiatives aimed at bridging the digital divide, such as the Rural Digital Opportunity Fund, which allocated $20.4 billion to expand broadband in underserved areas, are creating avenues for EdTech companies to introduce digital learning solutions to these communities, thereby enhancing educational access and equity.

- Integration with Corporate Training Programs: The corporate sector is increasingly recognizing the value of integrating educational technologies into training programs. In 2023, U.S. companies invested over $90 billion in employee training and development, with a growing emphasis on digital learning platforms. This trend offers EdTech providers opportunities to develop tailored solutions that cater to corporate training needs, facilitating continuous learning and skill development in the workforce.

Scope of the Report

|

Sector |

Preschool |

|

Type |

Hardware |

|

Deployment Mode |

Cloud-Based |

|

End User |

Individual Learners |

|

Region |

Northeast |

Products

Key Target Audience

Educational Institutions (Schools, Colleges, Universities)

Corporate Training Departments

EdTech Startups and Entrepreneurs

Technology Solution Providers

Content Developers and Publishers

Government and Regulatory Bodies (U.S. Department of Education, State Education Departments)

Investors and Venture Capitalist Firms

Non-Profit Educational Organizations

Companies

Major Players

2U, Inc.

Coursera, Inc.

Udemy, Inc.

Chegg, Inc.

Instructure Holdings, Inc.

Blackboard Inc.

Knewton, Inc.

Khan Academy

Duolingo, Inc.

Edmodo

DreamBox Learning, Inc.

Age of Learning, Inc.

Newsela

Quizlet Inc.

Skillshare, Inc.

Table of Contents

U.S. EdTech Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

U.S. EdTech Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

U.S. EdTech Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Adoption of Digital Learning Tools

3.1.2 Government Initiatives and Funding

3.1.3 Rising Demand for Personalized Learning

3.1.4 Technological Advancements in AI and AR/VR

3.2 Market Challenges

3.2.1 Data Privacy and Security Concerns

3.2.2 High Implementation Costs

3.2.3 Resistance to Change in Traditional Institutions

3.3 Opportunities

3.3.1 Expansion into Rural and Underserved Areas

3.3.2 Integration with Corporate Training Programs

3.3.3 Growth in Mobile Learning Platforms

3.4 Trends

3.4.1 Gamification in Education

3.4.2 Adoption of Cloud-Based Solutions

3.4.3 Emergence of Microlearning Modules

3.5 Government Regulations

3.5.1 FERPA Compliance

3.5.2 E-Rate Program Funding

3.5.3 State-Level Digital Learning Policies

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

U.S. EdTech Market Segmentation

4.1 By Sector (In Value %)

4.1.1 Preschool

4.1.2 K-12

4.1.3 Higher Education

4.1.4 Corporate Training

4.1.5 Others

4.2 By Type (In Value %)

4.2.1 Hardware

4.2.2 Software

4.2.3 Content

4.3 By Deployment Mode (In Value %)

4.3.1 Cloud-Based

4.3.2 On-Premises

4.4 By End User (In Value %)

4.4.1 Individual Learners

4.4.2 Educational Institutions

4.4.3 Enterprises

4.5 By Region (In Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

U.S. EdTech Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 2U, Inc.

5.1.2 Coursera, Inc.

5.1.3 Udemy, Inc.

5.1.4 Chegg, Inc.

5.1.5 Instructure Holdings, Inc.

5.1.6 Blackboard Inc.

5.1.7 Knewton, Inc.

5.1.8 Khan Academy

5.1.9 Duolingo, Inc.

5.1.10 Edmodo

5.1.11 DreamBox Learning, Inc.

5.1.12 Age of Learning, Inc.

5.1.13 Newsela

5.1.14 Quizlet Inc.

5.1.15 Skillshare, Inc.

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Product Portfolio, Recent Developments, Strategic Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

U.S. EdTech Market Regulatory Framework

6.1 Data Privacy Regulations

6.2 Compliance Requirements

6.3 Certification Processes

U.S. EdTech Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

U.S. EdTech Future Market Segmentation

8.1 By Sector (In Value %)

8.2 By Type (In Value %)

8.3 By Deployment Mode (In Value %)

8.4 By End User (In Value %)

8.5 By Region (In Value %)

U.S. EdTech Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the U.S. EdTech Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the U.S. EdTech Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple EdTech companies to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the U.S. EdTech market.

Frequently Asked Questions

01. How big is the U.S. EdTech Market?

The U.S. EdTech market is valued at $42 billion, driven by the increasing adoption of digital learning tools, government initiatives supporting educational technology, and a growing demand for personalized learning experiences.

02. What are the key growth drivers for the U.S. EdTech Market?

The U.S. EdTech market is propelled by factors such as increasing digital adoption in K-12 and higher education, substantial government funding for educational technology, and the rising need for remote learning solutions. Advances in artificial intelligence and virtual learning environments also contribute significantly to market growth.

03. Who are the major players in the U.S. EdTech Market?

Key players in the U.S. EdTech market include 2U, Inc., Coursera, Inc., Udemy, Inc., Chegg, Inc., and Instructure Holdings, Inc. These companies lead due to their extensive portfolios, innovative solutions, and established relationships with educational institutions and corporate clients.

04. What challenges does the U.S. EdTech Market face?

Challenges in the U.S. EdTech market include data privacy concerns, high implementation costs, and resistance to change from traditional educational institutions. Additionally, the complexity of integrating new technologies with existing infrastructure presents obstacles for market players.

05. What are the prominent trends in the U.S. EdTech Market?

Key trends in the U.S. EdTech market include the gamification of education, adoption of cloud-based solutions, and the rise of microlearning modules for focused skill development. There is also a growing interest in AI-driven adaptive learning platforms that offer personalized content and assessments.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.