US Merchant Cash Advance Market Outlook to 2028

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD4351

December 2024

90

About the Report

U.S. Merchant Cash Advance (MCA) Market Overview

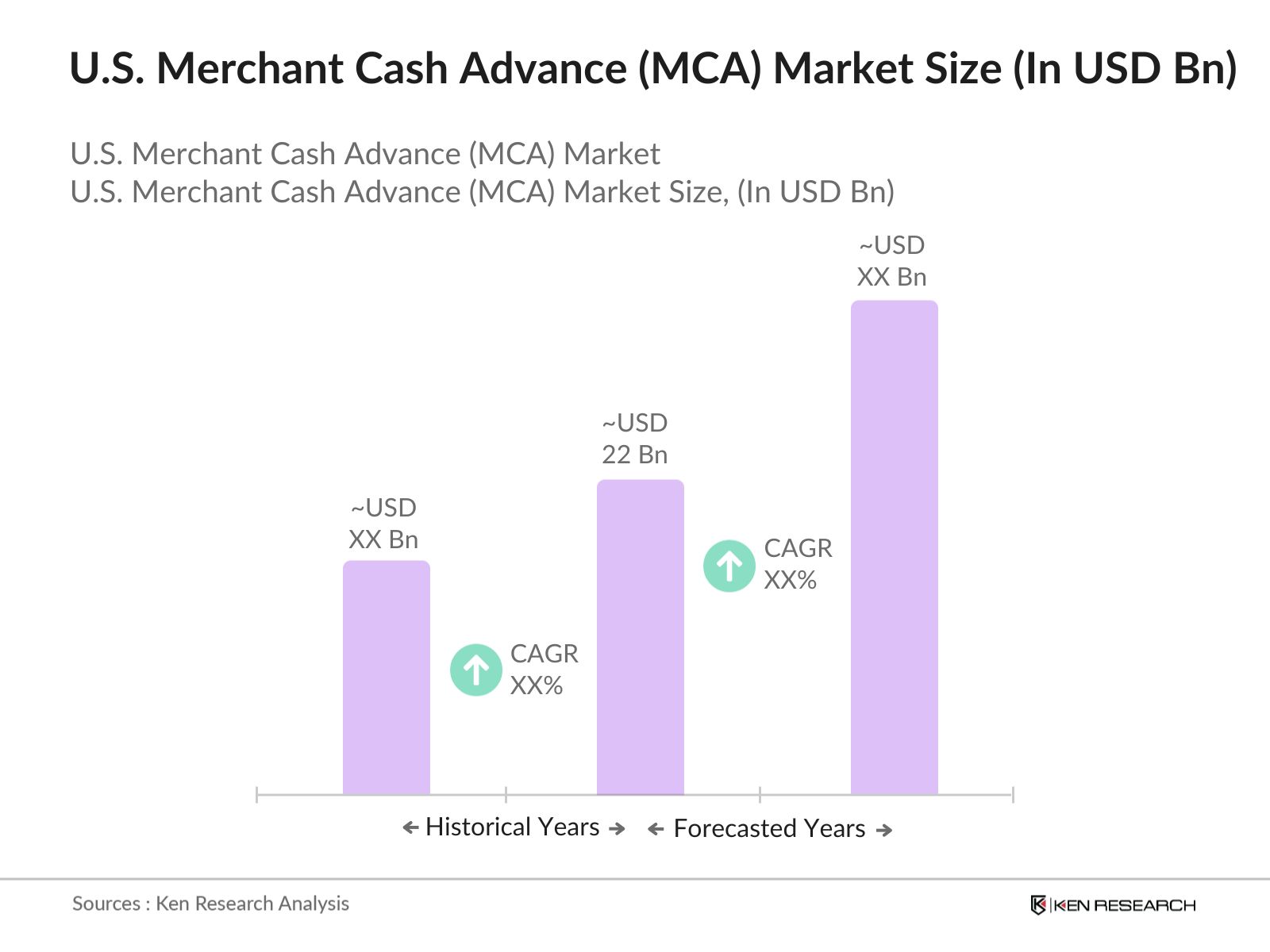

- The U.S. Merchant Cash Advance (MCA) market has grown significantly and is valued at USD 22 billion based on a five-year historical analysis. This growth is driven by increasing demand from small and medium-sized enterprises (SMEs) for alternative financing solutions, especially those with limited access to traditional bank loans. MCAs offer flexible financing options that align with business cash flow, particularly for industries with high transaction volumes like retail, restaurants, and e-commerce. This sectors growth is bolstered by the rise of digital payments and point-of-sale (POS) systems, which streamline MCA operations.

- New York, California, and Florida dominate the MCA market due to the high concentration of small businesses in these regions. New York, as the financial hub, supports a vibrant ecosystem of MCA providers, while California's tech industry and Floridas thriving retail and hospitality sectors drive the demand for merchant financing. The regulatory environment in these states, combined with a large volume of business transactions, contributes to their leadership in this sector.

- The Federal Trade Commission (FTC) has begun increasing oversight of the MCA market to ensure transparency and protect small businesses from predatory lending practices. In 2024, several new guidelines were introduced to enhance the disclosure of fees and repayment terms, which will lead to improved regulatory compliance across the industry.

U.S. Merchant Cash Advance (MCA) Market Segmentation

By Industry Type: The U.S. MCA market is segmented by industry type into retail, e-commerce, restaurants, and service-based industries. Retail businesses dominate the industry segment, holding approximately 40% of the market share in 2023. This is primarily due to the nature of their business operations, which involve daily transactions and frequent credit card sales, making them ideal candidates for MCA financing. The liquidity provided by daily repayments linked to sales is well-suited for retail businesses, ensuring that they have a steady cash flow to meet operational demands. Additionally, retailers often face cash flow gaps that MCAs help bridge.

By Repayment Method: The MCA market is also segmented by repayment methods, including split percentage and fixed payment plans. The split percentage method, which accounts for 60% of the market share in 2023, is the most popular. Businesses prefer this method because it aligns repayment amounts with sales volumes. On days when sales are lower, the repayment is smaller, easing the financial burden on merchants. This flexible approach is particularly advantageous for businesses that experience seasonal fluctuations in sales, such as restaurants and retail stores.

U.S. Merchant Cash Advance (MCA) Market Competitive Landscape

The U.S. MCA market is dominated by a mix of established players and newer fintech companies. The landscape is highly competitive, with each company leveraging its technology, customer service, and flexible financing terms to capture market share. The integration of MCA services with POS systems has made it easier for small businesses to access quick financing. This consolidation of MCA offerings highlights the significant influence of key players like Rapid Finance, Fundbox, and BlueVine, who dominate the space through technology-driven solutions and extensive merchant networks.

|

Company Name |

Year of Establishment |

Headquarters |

Merchant Network |

Financing Speed |

Maximum Advance Amount |

Technology Integration |

Customer Support |

Underwriting Model |

|

Rapid Finance |

2002 |

Bethesda, MD |

- | - | - | - | - | - |

|

Fundbox |

2013 |

San Francisco, CA |

- | - | - | - | - | - |

|

BlueVine |

2013 |

Redwood City, CA |

- | - | - | - | - | - |

|

OnDeck |

2007 |

New York, NY |

- | - | - | - | - | - |

|

National Funding |

1999 |

San Diego, CA |

- | - | - | - | - | - |

U.S. Merchant Cash Advance (MCA) Market Analysis

Growth Drivers

- Increasing Demand for Alternative Financing Options: As traditional bank loans have stricter lending criteria; the U.S. has seen a rise in demand for alternative financing methods like Merchant Cash Advances (MCA). In 2024, this trend is driven by small businesses seeking quick access to capital. Over 29 million small businesses in the U.S. are the primary users of MCA, utilizing it for operational costs. The rise of alternative financing is supported by fintech innovations, making these transactions more accessible and seamless. Government data shows that over 70% of small businesses now explore non-bank financing solutions due to these factors.

- Rapid Growth of Small and Medium Enterprises: SMEs form the backbone of the U.S. economy, with more than 60 million employees working in these enterprises as of 2024. Merchant Cash Advances are particularly popular among SMEs, offering flexible financing without the lengthy approval processes typical of traditional loans. The U.S. Small Business Administration reported a significant rise in loan applications by SMEs in 2023, indicating growing demand for alternative financial products, including MCA. This surge is primarily due to the difficulty these businesses face in meeting conventional loan requirements, pushing them towards flexible MCA options.

- Technological Advancements in Financial Services: The integration of financial technology (fintech) platforms with MCA providers is reshaping the industry. Automated systems and AI-based credit scoring models have significantly reduced approval times for MCA, making the process faster and more transparent. By 2024, fintech platforms in the U.S. are processing over $20 billion in MCA applications annually. The U.S. Department of Commerce also highlights the expansion of digital payments infrastructure, which enables quicker disbursement and repayment tracking for MCA services.

Market Challenges

- Regulatory Scrutiny on MCA Agreements: The regulatory environment around MCA is tightening due to increasing concerns over transparency and the protection of small businesses. In 2024, the Consumer Financial Protection Bureau (CFPB) initiated several investigations into MCA practices, particularly focusing on the disclosure of terms and fees. The U.S. Government Accountability Office (GAO) has also raised concerns about the lack of clear regulations governing MCA, and the Federal Trade Commission (FTC) has started scrutinizing merchant agreements for fairness, adding pressure to providers.

- High Costs for Merchants: MCA financing often comes with high costs for merchants, which can significantly impact their profitability. As of 2024, the average cost of MCA financing in the U.S. ranges from $10,000 to $500,000, depending on the volume of sales, with repayment terms often stretching business cash flows. High effective interest ratestypically far higher than conventional loanshave led to rising complaints among businesses, as documented in reports from state consumer protection agencies, which track repayment issues and financial strain caused by such agreements.

U.S. Merchant Cash Advance (MCA) Market Future Outlook

Over the next five years, the U.S. Merchant Cash Advance market is expected to experience continued growth, driven by the increasing adoption of digital payment systems and the growing number of SMEs seeking flexible financing options. The rise of fintech platforms that streamline MCA processes, coupled with improvements in risk assessment technologies like AI, will likely enhance underwriting capabilities and expand the market. Regulatory oversight, however, may introduce challenges, as state and federal bodies consider stricter guidelines to protect small businesses from unfavorable financing terms. Nonetheless, the demand for alternative financing options is poised to support sustained growth in the MCA sector.

Market Opportunities

- Expansion of MCA to Non-traditional Businesses: Merchant Cash Advances, traditionally used by retail businesses, are expanding into non-traditional sectors such as healthcare, construction, and professional services. By 2024, over 12,000 non-retail businesses in the U.S. have opted for MCA, creating new revenue streams for providers. This expansion is driven by the increasing demand for flexible capital in sectors that are typically underserved by traditional banks. MCA companies are capitalizing on this trend by customizing products for specific industries, thus broadening their market base.

- Partnership with Payment Processors: MCA providers are increasingly forming partnerships with payment processors and point-of-sale system providers to streamline repayments and improve merchant engagement. By 2024, around 45% of U.S. MCA transactions are conducted through integrated POS systems, which automatically deduct repayments from card sales. Major payment processing companies, like Square and PayPal, are exploring more partnerships in this space, enhancing the appeal of MCA by reducing manual repayment processes for merchants.

Scope of the Report

|

Industry Type |

Retail E-commerce Restaurants Service-Based Industries |

|

Merchant Size |

Small-Sized Enterprises Medium-Sized Enterprises |

|

Repayment Method |

Split Percentage Fixed Payment Plans |

|

Sales Channel |

Direct Sales Partner Sales Online Platforms |

|

Geographic Location |

Northeast Midwest West Coast U.S. Southern U.S. |

Products

Key Target Audience

- Merchant Cash Advance Providers

- Payment Processors (e.g., Square, Stripe)

- Small and Medium Enterprises (SMEs)

- Venture Capital Firms and investors

- Banks and Alternative Lenders

- Government and Regulatory Bodies (U.S. Department of the Treasury, Small Business Administration)

- Fintech Companies

- Financial Advisors and Brokers

Companies

Players Mentioned in the report:

- Rapid Finance

- Fundbox

- BlueVine

- OnDeck

- National Funding

- Credibly

- CAN Capital

- Fora Financial

- Reliant Funding

- PayPal Working Capital

- Square Capital

- Kabbage

- Funding Circle

- Breakout Capital

- Lendio

Table of Contents

1. U.S. Merchant Cash Advance Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Key Stakeholders and Value Chain Analysis

1.5. Market Dynamics Overview

2. U.S. Merchant Cash Advance Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. U.S. Merchant Cash Advance Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Alternative Financing Options (Alternative Financing Trend)

3.1.2. Rapid Growth of Small and Medium Enterprises (SME Financing Needs)

3.1.3. Technological Advancements in Financial Services (Fintech Integration)

3.1.4. Rising E-commerce and Point of Sale Transactions (Digital Payments Growth)

3.2. Market Challenges

3.2.1. Regulatory Scrutiny on MCA Agreements (Regulatory Oversight)

3.2.2. High Costs for Merchants (Interest Rate Burdens)

3.2.3. Risk of Default and Non-repayment (Default Rates)

3.3. Opportunities

3.3.1. Expansion of MCA to Non-traditional Businesses (New Merchant Categories)

3.3.2. Partnership with Payment Processors (POS System Integrations)

3.3.3. Global Expansion of U.S.-based MCA Providers (International Market Penetration)

3.4. Trends

3.4.1. AI and Machine Learning for Risk Assessment (AI-driven Underwriting)

3.4.2. Increased Adoption of Split Funding Models (Flexible Repayment Models)

3.4.3. MCA Services Bundled with Payment Solutions (Bundled Financial Services)

3.5. Government Regulation

3.5.1. Federal and State MCA Regulations (State vs Federal Guidelines)

3.5.2. Disclosure Requirements for MCA Providers (Cost Transparency Rules)

3.5.3. Consumer Protection Policies (Small Business Protection Acts)

3.6. Competitive Landscape

3.6.1. Market Fragmentation and Major Players (Consolidation vs Fragmentation)

3.6.2. SWOT Analysis of Key Competitors

3.6.3. Porters Five Forces Analysis (Competitive Forces in MCA)

3.6.4. Competitive Positioning

4. U.S. Merchant Cash Advance Market Segmentation

4.1. By Industry Type (In Value %)

4.1.1. Retail

4.1.2. E-commerce

4.1.3. Restaurants

4.1.4. Service-Based Industries

4.2. By Merchant Size (In Value %)

4.2.1. Small-Sized Enterprises (SMEs)

4.2.2. Medium-Sized Enterprises

4.3. By Repayment Method (In Value %)

4.3.1. Split Percentage (Percentage of Credit Card Sales)

4.3.2. Fixed Payment Plans

4.4. By Sales Channel (In Value %)

4.4.1. Direct Sales

4.4.2. Partner Sales (Through Payment Processors)

4.4.3. Online Platforms

4.5. By Geographic Location (In Value %)

4.5.1. Northeast U.S.

4.5.2. Midwest U.S.

4.5.3. West Coast U.S.

4.5.4. Southern U.S.

5. U.S. Merchant Cash Advance Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Rapid Finance

5.1.2. Fundbox

5.1.3. OnDeck

5.1.4. BlueVine

5.1.5. Lendio

5.1.6. National Funding

5.1.7. Credibly

5.1.8. CAN Capital

5.1.9. Fora Financial

5.1.10. Reliant Funding

5.1.11. PayPal Working Capital

5.1.12. Square Capital

5.1.13. Funding Circle

5.1.14. Kabbage

5.1.15. Breakout Capital

5.2. Cross Comparison Parameters (Customer Segments, Funding Amount, Underwriting Model, Loan Repayment Terms, Technology Adoption, Customer Support Capabilities, Scalability of Business Model, Merchant Approval Speed)

5.3. Market Share Analysis

5.4. Strategic Initiatives of Competitors

5.5. Mergers and Acquisitions

5.6. Investment Analysis

6. U.S. Merchant Cash Advance Market Regulatory Framework

6.1. Licensing Requirements

6.2. Disclosure Norms and Compliance

6.3. Consumer and Merchant Protection Acts

7. U.S. Merchant Cash Advance Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. U.S. Merchant Cash Advance Future Market Segmentation

8.1. By Industry Type (In Value %)

8.2. By Merchant Size (In Value %)

8.3. By Repayment Method (In Value %)

8.4. By Sales Channel (In Value %)

8.5. By Geographic Location (In Value %)

9. U.S. Merchant Cash Advance Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunity Analysis

9.3. Partnership Opportunities

9.4. Competitive Differentiation Strategies

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase of the research involves identifying and mapping the major stakeholders in the U.S. Merchant Cash Advance market. Comprehensive desk research, leveraging a combination of secondary and proprietary data sources, will provide a foundational understanding of the market dynamics and major variables that influence the MCA ecosystem.

Step 2: Market Analysis and Construction

In this stage, historical data related to market performance is compiled and analyzed. This includes reviewing MCA adoption rates across different industries and evaluating the revenue generated through MCAs. The data is further validated by studying market penetration and service provider statistics, ensuring accurate market size estimations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed from initial data analysis are validated through consultations with industry experts, including MCA providers and fintech innovators. These expert interviews provide practical insights into market operations and help refine the data.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all gathered data and expert insights into a comprehensive market analysis. The synthesis ensures a robust understanding of the market’s performance, growth drivers, and challenges. The final report is corroborated by cross-verification with industry players, ensuring the accuracy and reliability of the findings.

Frequently Asked Questions

01. How big is the U.S. Merchant Cash Advance market?

The U.S. Merchant Cash Advance market is valued at USD 22 billion, driven by increasing demand from SMEs for flexible financing options, especially those that rely on credit card transactions for daily operations.

02. What are the challenges in the U.S. Merchant Cash Advance market?

Challenges include regulatory scrutiny over MCA agreements and high interest rates charged to merchants. Additionally, the risk of default remains high, particularly among smaller businesses with inconsistent cash flow.

03. Who are the major players in the U.S. Merchant Cash Advance market?

Key players include Rapid Finance, Fundbox, BlueVine, OnDeck, and National Funding, all of which dominate the market through a combination of technological innovation and vast merchant networks.

04. What are the growth drivers of the U.S. Merchant Cash Advance market?

Growth is driven by the increasing adoption of digital payment systems, the rise of SMEs, and the flexibility of MCA financing, which aligns with business cash flow patterns.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.