USA Aftermarket Automotive Parts and Components Market Outlook to 2028

Region:North America

Author(s):Abhinav kumar

Product Code:KROD8725

November 2024

91

About the Report

USA Aftermarket Automotive Parts and Components Market Overview

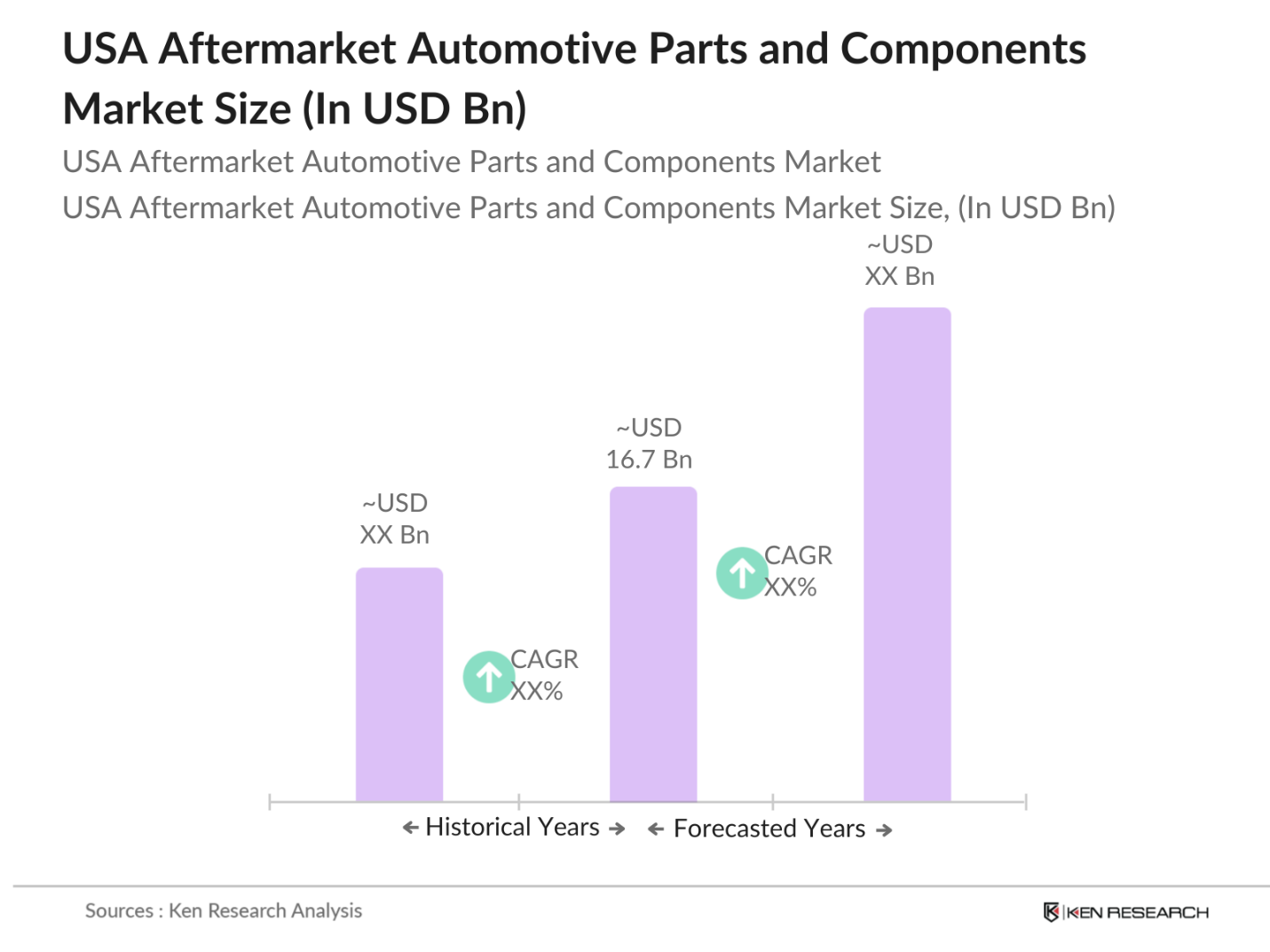

- The USA Aftermarket Automotive Parts and Components Market, currently valued at approximately USD 16.7 billion, is bolstered by several key factors including rising vehicle age, increased vehicle miles traveled, and the growth of e-commerce in the automotive aftermarket space. The market's expansion is further fueled by consumer preference for extended vehicle lifespans and high demand for replacement parts, especially among cost-conscious consumers. This demand for parts and components is predominantly driven by the need to maintain and customize vehicles without purchasing new models, as well as rising trends in do-it-yourself (DIY) automotive repairs.

- Dominant regions within the USA, such as California, Texas, and New York, play a significant role in the market due to their high vehicle ownership rates, extensive road networks, and advanced logistics infrastructure. California, in particular, leads due to its sizable population of older vehicles and established vehicle modification culture. Texas follows closely, driven by a high number of commercial vehicles and demand for heavy-duty replacement parts. New Yorks high vehicle density and the prevalence of independently owned repair shops also contribute to its dominance in this market.

- Stringent emission standards remain a regulatory focus, with the U.S. Environmental Protection Agency (EPA) introducing newer guidelines to limit vehicle emissions as of 2024. Compliance requires aftermarket parts like catalytic converters and oxygen sensors, which are essential for reducing emissions. The EPA states that these regulations drive significant aftermarket demand for parts that ensure vehicle compliance with emission standards.

USA Aftermarket Automotive Parts and Components Market Segmentation

By Product Type: The USA Aftermarket Automotive Parts and Components market is segmented by product type into Engine Components, Transmission Parts, Electrical and Electronic Components, Brake Parts, and Suspension Components. Among these, EngineComponents holds the dominant market share, largely due to the high frequency of replacements required for these parts as vehicles age. Many consumers prioritize engine maintenance, as it is directly linked to vehicle performance and longevity. Furthermore, the presence of multiple specialized aftermarket brands in the engine components segment contributes to its prevalence.

By Distribution Channel: The market is also segmented by distribution channel into Online Retailers, Brick-and-Mortar Stores, and Wholesale Distributors. Online Retailers have increasingly captured a significant market share due to the convenience of ordering parts directly to consumers and repair shops, a trend accelerated by COVID-19-related disruptions. The segments growth is attributed to rising consumer preference for digital platforms and the ease of comparing prices and availability. E-commerce giants and specialized automotive marketplaces drive this segment, making online retailers the fastest-growing channel within this market.

USA Aftermarket Automotive Parts and Components Market Competitive Landscape

The USA Aftermarket Automotive Parts and Components market is dominated by several major players, each contributing to the competitive landscape through extensive distribution networks, technological innovations, and strategic alliances. Prominent companies such as AutoZone and OReilly Automotive play crucial roles, supported by their established supply chains and a comprehensive array of aftermarket parts.

USA Aftermarket Automotive Parts and Components Industry Analysis

Growth Drivers

-

Rising Vehicle Age: The average age of vehicles on U.S. roads has steadily increased, reaching over 12 years by 2024, as per government data. This trend reflects a sustained consumer shift toward longer vehicle ownership, largely due to improved vehicle durability and rising new vehicle costs. Consequently, older vehicles require more maintenance and part replacements, driving demand in the aftermarket sector. The U.S. Department of Transportation (USDOT) indicates that the rise in vehicle age correlates with a 20% increase in demand for maintenance components such as brakes and filters.

- Expansion of E-Commerce Channels: E-commerce channels for aftermarket automotive parts have seen significant growth, with online sales for these parts rising by 15 million units in 2023. U.S. Census Bureau data shows that increased internet penetration and ease of online shopping have made aftermarket parts accessible to a broader consumer base, especially in rural regions. In 2024, over 60% of aftermarket purchases were influenced by online price comparison and availability, making e-commerce a major growth driver for the industry.

- Consumer Preference for Vehicle Customization: As of 2024, customization has become a key demand driver in the aftermarket, with approximately 30 million consumers purchasing custom parts annually, according to consumer data from the USDOT. This preference for customization spans items like body kits, performance parts, and electronic accessories. The trend is especially prominent among vehicle owners under 40, who prioritize personal expression and enhanced vehicle functionality, significantly boosting the aftermarket's growth.

Market Challenges

- Counterfeit Product Proliferation: Counterfeit parts remain a critical issue in the U.S. aftermarket industry, accounting for nearly 10% of all parts sold as of 2023. These counterfeit parts present safety risks, as they do not meet regulatory standards and often fail prematurely. The U.S. Customs and Border Protection reported seizing over 5 million counterfeit automotive parts in 2023, with a direct impact on consumer trust and the revenues of legitimate businesses in the market.

- Volatility in Raw Material Costs: Fluctuating raw material prices, especially for steel and aluminum, have impacted the aftermarket sector, with steel prices increasing by 30% from 2022 to 2024. This volatility strains profit margins for manufacturers and suppliers of aftermarket parts, as these materials are essential in part production. According to the Bureau of Labor Statistics, changes in metal prices are among the top factors affecting manufacturing costs in the sector.

USA Aftermarket Automotive Parts and Components Market Future Outlook

Over the next five years, the USA Aftermarket Automotive Parts and Components market is projected to exhibit steady growth. This growth trajectory is primarily driven by the increasing average age of vehicles on the road, technological advancements in auto parts, and the expansion of online distribution channels. The DIY culture and consumer interest in vehicle customization are anticipated to contribute significantly to the aftermarket segment, further spurred by innovations in electric and hybrid vehicle components.

Opportunities

- Growth of Electric Vehicle Aftermarket: Electric vehicle (EV) registrations in the U.S. reached 1.5 million units in 2024, offering new opportunities in the EV-specific aftermarket. Unlike traditional vehicles, EVs have unique maintenance requirements and components, such as battery management systems and electric powertrain parts. The U.S. Department of Energy has highlighted that as EV adoption grows, demand for specialized aftermarket components, like EV-compatible tires and advanced diagnostics, is expected to rise.

- Technological Advancements in Parts and Components: Advances in materials and design have led to the production of more durable and efficient aftermarket parts, aligning with the increasing consumer demand for quality and longevity. As of 2024, technologies like 3D printing and lightweight composite materials have become prominent in part manufacturing, enabling customized and robust components. Data from the National Institute of Standards and Technology highlights a 25% reduction in manufacturing time due to these technologies, benefiting both producers and consumers.

Scope of the Report

|

Product Type |

Engine and Exhaust Components Transmission and Drivetrain Parts Electrical and Electronic Components Brake Parts and Suspension Components Other Parts |

|

Vehicle Type |

Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles |

|

Distribution Channel |

Online Retailers Brick-and-Mortar Stores Wholesale and Distributors |

|

Service Provider Type |

Independent Repair Shops Dealership Service Centers DIY (Do-It-Yourself) Segment |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

- Automotive Manufacturing Companies

- Aftermarket Part Supplier Companies

- Automotive Repair Companies

- Online Automotive Companies

- Investor and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Department of Transportation, Environmental Protection Agency)

- Fleet Management Companies

Companies

Players Mentioned in the Report

- AutoZone, Inc.

- Advance Auto Parts, Inc.

- O'Reilly Automotive, Inc.

- Genuine Parts Company

- LKQ Corporation

- Bosch Automotive Aftermarket

- DENSO Corporation

- Bridgestone Americas, Inc.

- Tenneco Inc.

- Continental AG

Table of Contents

1. USA Aftermarket Automotive Parts and Components Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Aftermarket Automotive Parts and Components Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Aftermarket Automotive Parts and Components Market Analysis

3.1. Growth Drivers

3.1.1. Rising Vehicle Age

3.1.2. Expansion of E-Commerce Channels

3.1.3. Consumer Preference for Vehicle Customization

3.1.4. Increasing Vehicle Miles Traveled (VMT)

3.2. Market Challenges

3.2.1. Counterfeit Product Proliferation

3.2.2. Volatility in Raw Material Costs

3.2.3. Labor Shortages in the Aftermarket Service Sector

3.3. Opportunities

3.3.1. Growth of Electric Vehicle Aftermarket

3.3.2. Technological Advancements in Parts and Components

3.3.3. Integration of Digital Platforms for Service Delivery

3.4. Trends

3.4.1. Increased Adoption of Predictive Maintenance

3.4.2. Surge in Demand for Performance Parts

3.4.3. Rising Popularity of DIY Repair Culture

3.5. Government Regulations

3.5.1. Emission Standards Compliance

3.5.2. Warranty Laws and Consumer Rights

3.5.3. Data Accessibility Regulations in Automotive Telematics

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA Aftermarket Automotive Parts and Components Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Engine and Exhaust Components

4.1.2. Transmission and Drivetrain Parts

4.1.3. Electrical and Electronic Components

4.1.4. Brake Parts and Suspension Components

4.1.5. Other Parts (e.g., Tires, Interior Accessories)

4.2. By Vehicle Type (In Value %)

4.2.1. Passenger Cars

4.2.2. Light Commercial Vehicles

4.2.3. Heavy Commercial Vehicles

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retailers

4.3.2. Brick-and-Mortar Stores

4.3.3. Wholesale and Distributors

4.4. By Service Provider Type (In Value %)

4.4.1. Independent Repair Shops

4.4.2. Dealership Service Centers

4.4.3. DIY (Do-It-Yourself) Segment

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Aftermarket Automotive Parts and Components Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. AutoZone, Inc.

5.1.2. Advance Auto Parts, Inc.

5.1.3. O'Reilly Automotive, Inc.

5.1.4. Genuine Parts Company

5.1.5. NAPA Auto Parts

5.1.6. LKQ Corporation

5.1.7. Bosch Automotive Aftermarket

5.1.8. DENSO Corporation

5.1.9. Continental AG

5.1.10. 3M Automotive Aftermarket Division

5.1.11. Magna International Inc.

5.1.12. Tenneco Inc.

5.1.13. Valeo Service

5.1.14. Bridgestone Americas, Inc.

5.1.15. Delphi Technologies

5.2. Cross Comparison Parameters (Revenue, Product Portfolio Depth, Global Presence, R&D Spending, Market Share, Customer Reach, Service Network, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Incentives

5.9. Private Equity Investments

6. USA Aftermarket Automotive Parts and Components Market Regulatory Framework

6.1. Safety and Quality Standards

6.2. Environmental Compliance and Emissions Standards

6.3. Intellectual Property Regulations

6.4. Right to Repair Legislation

6.5. Warranty and Liability Standards

7. USA Aftermarket Automotive Parts and Components Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Aftermarket Automotive Parts and Components Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Vehicle Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Service Provider Type (In Value %)

8.5. By Region (In Value %)

9. USA Aftermarket Automotive Parts and Components Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating a comprehensive map of stakeholders within the USA Aftermarket Automotive Parts and Components Market. This map is developed through desk research and reliable secondary databases, focusing on identifying key industry influencers and variables.

Step 2: Market Analysis and Construction

This phase includes gathering and analyzing historical data from various reliable sources to understand market dynamics. Analysis covers distribution channels, product penetration, and geographic spread to provide a robust framework for revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested and validated through in-depth interviews with industry experts from key market segments. These consultations provide operational insights, allowing for refined and validated data.

Step 4: Research Synthesis and Final Output

The final phase synthesizes insights from leading aftermarket parts manufacturers and distributors, complemented by field data to confirm findings. This ensures a comprehensive, accurate, and validated analysis of the USA Aftermarket Automotive Parts and Components market.

Frequently Asked Questions

01. How big is the USA Aftermarket Automotive Parts and Components Market?

The USA Aftermarket Automotive Parts and Components Market is valued at approximately USD 16.7 billion, supported by a growing demand for replacement parts due to an aging vehicle fleet and rising consumer inclination toward vehicle customization.

02. What factors drive the USA Aftermarket Automotive Parts and Components Market?

Key drivers include increased vehicle miles traveled, growth in the DIY segment, and the rise of e-commerce platforms that make aftermarket parts easily accessible to consumers and repair shops.

03. Which cities lead the USA Aftermarket Automotive Parts and Components Market?

Major cities such as Los Angeles, New York City, and Houston lead the market due to high vehicle ownership rates, well-established infrastructure, and significant consumer interest in vehicle modifications and maintenance.

04. Who are the main players in the USA Aftermarket Automotive Parts and Components Market?

Prominent players include AutoZone, Advance Auto Parts, O'Reilly Automotive, Genuine Parts Company, and LKQ Corporation, each known for their extensive product offerings, distribution networks, and strong customer loyalty.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.