USA Defense Market Outlook to 2030

Region:North America

Author(s):Abhinav kumar

Product Code:KROD10879

November 2024

81

About the Report

USA Defense Market Overview

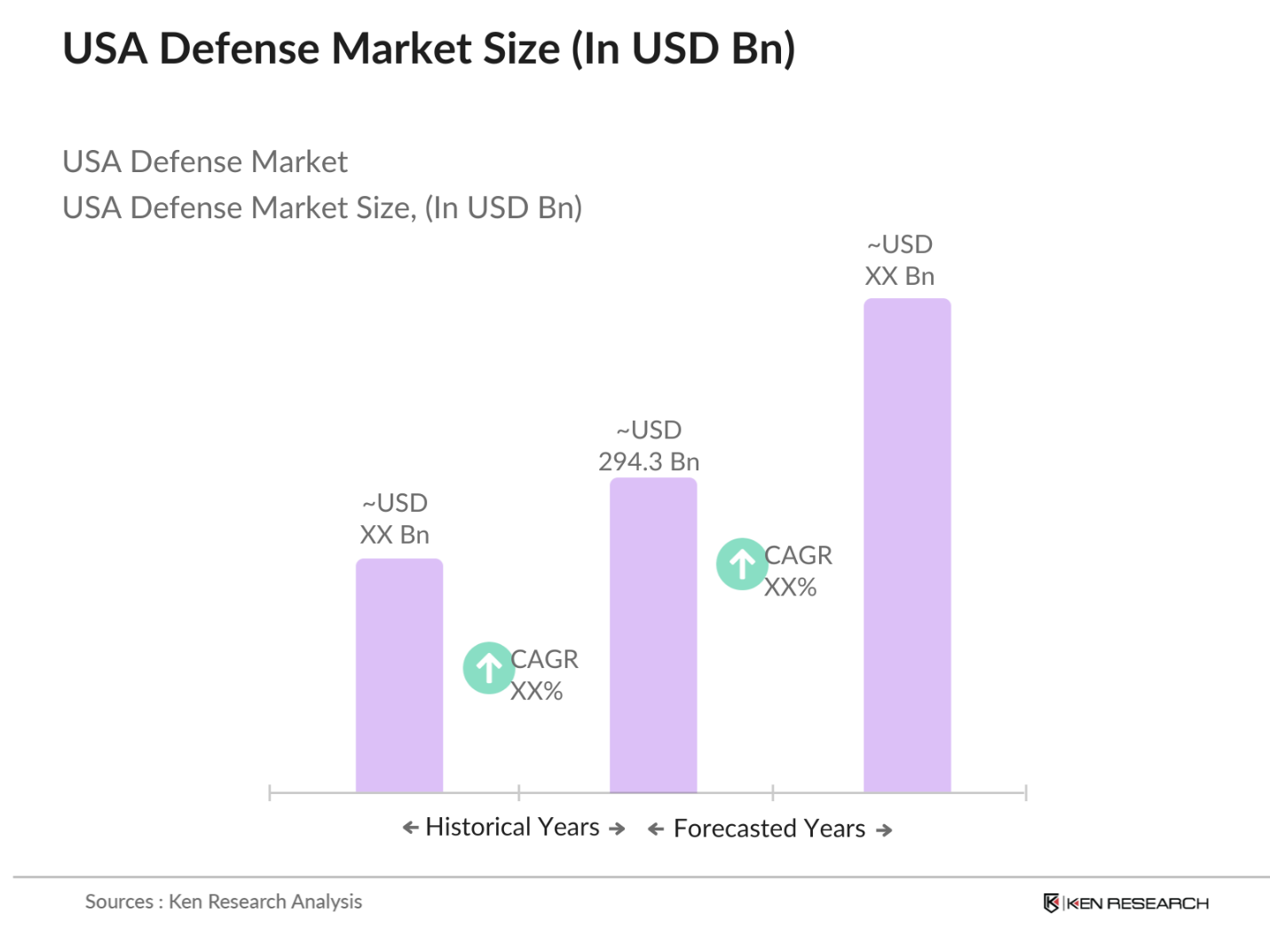

- The USA Defense Market, valued at USD 294.3 billion, is driven by extensive federal budget allocations and a focus on technological advancements in defense and security. This robust market size stems from increased investments in cybersecurity, artificial intelligence (AI), and autonomous systems, as well as the expansion of the Space Force. The market is influenced by the nation's focus on modernization, enhancing readiness, and countering emerging threats through advanced research and development programs.

- Dominant players in the USA Defense Market include cities like Washington, D.C., due to its strategic policymaking and defense contract oversight, as well as San Diego, California, known for its naval defense infrastructure. Additionally, Texas, with its defense manufacturing capabilities, plays a pivotal role. These regions dominate the market, hosting headquarters of major defense contractors, military bases, and research facilities that drive the markets growth.

- The integration of artificial intelligence (AI) and autonomous systems has become a major trend in the U.S. defense sector. The DoD's 2024 budget dedicates approximately $1.8 billion specifically for AI development, focusing on enhancing autonomous capabilities in areas such as unmanned aerial vehicles (UAVs), ground systems, and logistics automation. These AI-driven systems can analyze vast amounts of data in real time, improving decision-making in combat and operational scenarios. The Pentagons Joint Artificial Intelligence Center (JAIC) has led several initiatives to accelerate AI adoption, aiming to deploy AI solutions across intelligence, surveillance, and reconnaissance (ISR) functions.

USA Defense Market Segmentation

By Technology: The USA Defense Market is segmented by technology into cybersecurity solutions, artificial intelligence, autonomous systems, advanced radar technology, and hypersonic systems. Currently, cybersecurity solutions dominate the technology segmentation due to the rising threat of cyber warfare and increased investments in protecting sensitive defense information. The U.S. Department of Defense (DoD) prioritizes cybersecurity due to critical data protection needs and threat prevention in digital warfare, thus pushing cybersecurity solutions to the forefront.

By Application: The USA Defense Market is segmented by application into national defense, intelligence and surveillance, homeland security, crisis management, and disaster response. National defense applications hold a significant share due to their primary role in ensuring the nations security and sovereignty. The emphasis on modernizing the military and maintaining strategic global influence contributes to the substantial allocation of resources toward national defense initiatives.

USA Defense Market Competitive Landscape

The USA Defense Market is dominated by a few major players with significant influence. The following table showcases five key players in the market and details their establishment year, headquarters, and other relevant market-specific parameters. The competitive landscape of the USA Defense Market is influenced by industry giants such as Lockheed Martin, Northrop Grumman, and Raytheon Technologies. These companies possess strong R&D capabilities, established government contracts, and a comprehensive product portfolio, which solidifies their position as market leaders.

USA Defense Industry Analysis

Growth Drivers

- Rising Defense Budgets: In Fiscal Year 2024, the United States Department of Defense (DoD) requested a budget of $842 billion, marking an increase of $26 billion from the previous fiscal year. This budget allocation underscores a commitment to enhancing military capabilities and readiness. A significant portion is dedicated to capital expenditures, including the procurement of advanced weaponry and modernization of existing systems. For instance, the budget outlines investments in next-generation aircraft, naval vessels, and missile defense systems, aiming to maintain technological superiority. These allocations reflect a strategic focus on addressing emerging threats and sustaining global military dominance.

- Increasing Geopolitical Tensions: The global security landscape in 2024 is characterized by heightened geopolitical tensions, notably in regions such as Eastern Europe and the Indo-Pacific. The ongoing conflict in Ukraine has prompted the U.S. to bolster its military presence in Europe, deploying additional troops and resources to NATO allies. Simultaneously, China's assertive actions in the South China Sea and its military modernization efforts have led to increased U.S. naval deployments and joint exercises with regional partners. These developments necessitate substantial defense spending to ensure readiness and deterrence capabilities.

- Technological Advancements in Warfare: The integration of artificial intelligence (AI) and cybersecurity measures has become pivotal in modern warfare. The DoD's 2024 budget includes significant investments in AI research and development, focusing on autonomous systems, intelligence analysis, and decision-making processes. Additionally, the establishment of the Joint Artificial Intelligence Center (JAIC) aims to accelerate AI adoption across military operations. Cybersecurity initiatives are also prioritized, with funding allocated to protect critical infrastructure and counter cyber threats from adversaries. These technological advancements are essential for maintaining a competitive edge in contemporary conflict scenarios.

Market Challenges

- High Cost of Advanced Technologies: Developing and deploying advanced military technologies entail substantial research and development (R&D) expenditures. For example, the F-35 Joint Strike Fighter program has experienced cost overruns, with total program costs estimated at over $1.7 trillion. Similarly, the development of hypersonic weapons requires significant investment, with the DoD allocating billions towards these initiatives. These high costs pose budgetary challenges and necessitate careful financial planning to balance innovation with fiscal responsibility.

- Skilled Workforce Shortage: The defense industry faces a shortage of skilled professionals in areas such as cybersecurity, engineering, and AI. According to a 2023 report by the National Defense Industrial Association, there is a deficit of approximately 500,000 workers in the defense sector. This gap impacts the industry's capacity to meet production and innovation demands. To address this, initiatives like the DoD's STEM education programs and partnerships with academic institutions aim to cultivate a pipeline of qualified talent.

USA Defense Market Future Outlook

Over the next five years, the USA Defense Market is expected to experience considerable growth, driven by advancements in AI and cybersecurity, as well as the integration of autonomous and space defense systems. Federal budgets will likely continue to prioritize defense spending, with an emphasis on maintaining technological superiority and addressing complex, evolving security challenges.

Opportunities

- Increasing Demand for Cybersecurity Solutions: The rise in cyber threats has led to an increased demand for robust cybersecurity solutions within the defense sector. The DoD's Cybersecurity Maturity Model Certification (CMMC) program, implemented in 2020, requires defense contractors to adhere to stringent cybersecurity standards. This initiative has created opportunities for companies specializing in cyber defense to provide services and technologies that ensure compliance and protect sensitive information.

- Collaboration with Private Sector: Public-private partnerships (PPPs) have become instrumental in accelerating defense innovation. The DoD's Other Transaction Authority (OTA) agreements facilitate collaboration with non-traditional defense contractors, enabling rapid prototyping and deployment of new technologies. For example, the Defense Innovation Unit (DIU) has partnered with tech startups to develop AI applications for military use. These collaborations leverage private sector expertise and agility, enhancing the defense industry's capacity to address emerging threats.

Scope of the Report

|

Product Type |

Land-Based Systems Naval Systems Airborne Systems Cyber and Information Warfare Space Systems |

|

Technology |

Cybersecurity Solutions AI and Machine Learning Hypersonic Technology Autonomous Vehicles and Robotics Surveillance and Intelligence Solutions |

|

Application |

National Defense Homeland Security Intelligence and Surveillance Crisis Management and Disaster Response Peacekeeping Operations |

|

End User |

Department of Defense Homeland Security Private Defense Contractors Law Enforcement Agencies Intelligence Community |

|

Region |

North America, Europe Asia-Pacific Middle East Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Department of Defense (DoD)

Homeland Security Agencies

Intelligence and Surveillance Departments

Private Defense Contractors

Research and Development Firms

Defense Manufacturing Firms

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Defense Production Act Office)

Companies

Players Mentioned in the Report

Lockheed Martin

Raytheon Technologies

Northrop Grumman

General Dynamics

Boeing Defense

L3Harris Technologies

BAE Systems

Huntington Ingalls Industries

Textron

SAIC

Table of Contents

1. USA Defense Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Market Segmentation Overview

2. USA Defense Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Defense Market Analysis

3.1. Growth Drivers

3.1.1. Rising Defense Budgets

3.1.2. Increasing Geopolitical Tensions

3.1.3. Technological Advancements in Warfare

3.1.4. Government Support and Policy Framework

3.2. Market Challenges

3.2.1. High Cost of Advanced Technologies

3.2.2. Skilled Workforce Shortage

3.2.3. Supply Chain Dependencies

3.3. Opportunities

3.3.1. Increasing Demand for Cybersecurity Solutions

3.3.2. Collaboration with Private Sector

3.3.3. Expansion in Defense Export Markets

3.4. Trends

3.4.1. Integration of AI and Autonomous Systems

3.4.2. Expansion of Space Force and Cyber Warfare Programs

3.4.3. Focus on Renewable Energy Solutions in Military

3.5. Government Regulation

3.5.1. Defense Acquisition Reform

3.5.2. Compliance with ITAR and EAR

3.5.3. Funding from Defense Production Act

3.5.4. Procurement Policies and Procedures

3.6. SWOT Analysis

3.7. Defense Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Landscape

4. USA Defense Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Land-Based Systems (Vehicles, Weapons)

4.1.2. Naval Systems (Vessels, Submarines)

4.1.3. Airborne Systems (Aircraft, Drones)

4.1.4. Cyber and Information Warfare (Cyber Defense)

4.1.5. Space Systems (Satellites, Rockets)

4.2. By Technology (In Value %)

4.2.1. Cybersecurity Solutions

4.2.2. AI and Machine Learning

4.2.3. Hypersonic Technology

4.2.4. Autonomous Vehicles and Robotics

4.2.5. Surveillance and Intelligence Solutions

4.3. By Application (In Value %)

4.3.1. National Defense

4.3.2. Homeland Security

4.3.3. Intelligence and Surveillance

4.3.4. Crisis Management and Disaster Response

4.3.5. Peacekeeping Operations

4.4. By End User (In Value %)

4.4.1. Department of Defense

4.4.2. Homeland Security

4.4.3. Private Defense Contractors

4.4.4. Law Enforcement Agencies

4.4.5. Intelligence Community

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East

4.5.5. Africa

5. USA Defense Market Competitive Analysis 5.1. Detailed Profiles of Major Competitors

5.1.1. Lockheed Martin

5.1.2. Raytheon Technologies

5.1.3. Northrop Grumman

5.1.4. General Dynamics

5.1.5. Boeing Defense, Space & Security

5.1.6. BAE Systems

5.1.7. L3Harris Technologies

5.1.8. Huntington Ingalls Industries

5.1.9. Textron

5.1.10. Elbit Systems

5.1.11. Leonardo DRS

5.1.12. SAIC

5.1.13. Thales Group

5.1.14. Leidos

5.1.15. Oshkosh Defense

5.2. Cross Comparison Parameters (Headquarters, Revenue, Contracts, Partnerships, R&D Spending, Global Presence, Product Portfolio, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives and Developments

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Contracts and Funding

5.8. Joint Ventures and Alliances

6. USA Defense Market Regulatory Framework

6.1. Defense Authorization Act

6.2. Procurement Policies and Standards

6.3. Compliance and Certification Processes

6.4. Export Controls and Foreign Investment Regulations

7. USA Defense Future Market Size (In USD Mn)

7.1. Projected Market Growth

7.2. Key Factors Influencing Future Market Size

8. USA Defense Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Application (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. USA Defense Market Analysts Recommendations

9.1. Total Addressable Market (TAM) and Serviceable Market (SAM) Analysis

9.2. Customer Persona and Buyer Behavior Analysis

9.3. Marketing and Sales Strategy

9.4. Emerging White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves creating an ecosystem map of all key stakeholders in the USA Defense Market. Comprehensive desk research, involving secondary and proprietary databases, supports this process. The goal is to outline the crucial factors impacting market behavior.

Step 2: Market Analysis and Construction

Historical data on defense spending, technology adoption, and product utilization are assessed to understand the market penetration and revenue patterns. This phase ensures a grounded basis for revenue and growth rate estimations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and refined through consultations with defense industry professionals. These interviews provide insights on technological trends, procurement priorities, and strategic growth areas.

Step 4: Research Synthesis and Final Output

In the final stage, in-depth interactions with industry experts and defense manufacturers verify the findings. This ensures a validated and comprehensive overview of the USA Defense Market, with particular emphasis on current and future market trends.

Frequently Asked Questions

1. How big is the USA Defense Market?

The USA Defense Market is valued at USD 294.3 billion, driven by defense budget allocations and a focus on advanced technologies such as AI and cybersecurity.

2. What are the challenges in the USA Defense Market?

Challenges include high technology costs, regulatory compliance requirements, and skilled workforce shortages in specialized defense fields.

3. Who are the major players in the USA Defense Market?

Key players include Lockheed Martin, Raytheon Technologies, Northrop Grumman, General Dynamics, and Boeing Defense, each leading with strong government contracts and technological expertise.

4. What are the growth drivers of the USA Defense Market?

Growth drivers include increasing defense budgets, technological advancements, and the emphasis on enhancing cybersecurity and space capabilities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.