USA Industrial Internet of Things (IIoT) Market Outlook to 2030

Region:North America

Author(s):Khushi Khatreja

Product Code:KROD483

July 2024

100

About the Report

USA Industrial Internet of Things (IIoT) Market Overview

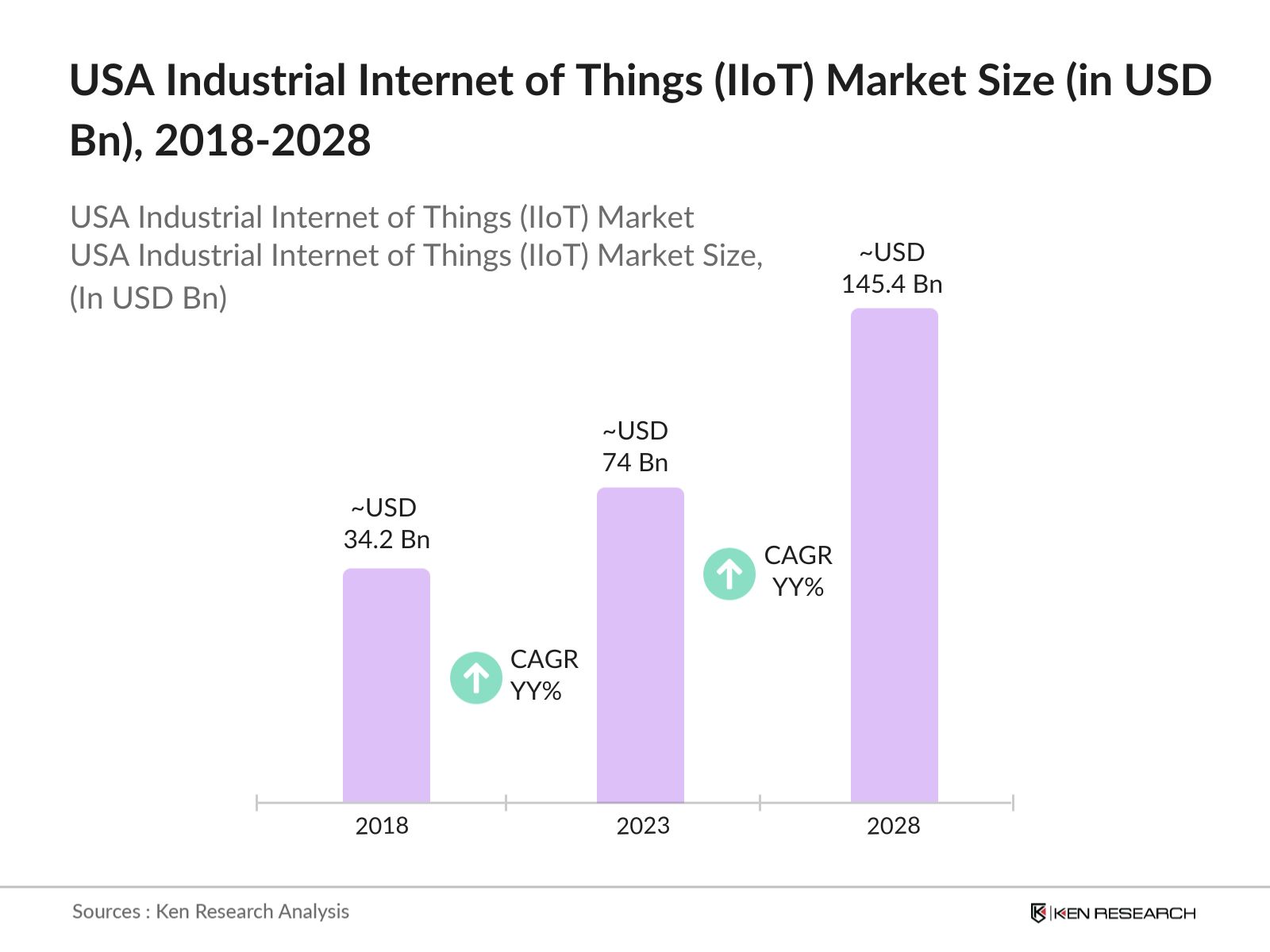

- The USA Industrial Internet of Things (IIoT) Market has experienced notable growth, this is reflected by the market reaching a valuation of USD 74 billion in 2023. This growth is fueled by advancements in sensor technologies, improved connectivity solutions, and the need for enhanced operational efficiency.

- The key players in the USA IIoT market include General Electric, Cisco Systems, Intel Corporation, IBM Corporation, and Rockwell Automation. These companies are at the forefront of developing innovative IIoT solutions and have established strong market positions through strategic partnerships, mergers, and acquisitions.

- In 2023, IBM and siemens announced their collaboration. This partnership integrates IBM’s AI-driven IoT solutions with Siemens’ industrial software to boost manufacturing productivity, aiming to leverage AI for predicting maintenance needs and optimizing processes, thereby reducing downtime.

- Cities like San Francisco, San Jose, and Los Angeles in California dominate the IIoT market due to their strong tech ecosystems and high concentration of innovative companies. San Francisco leads with significant investments in R&D, San Jose is home to numerous tech giants and startups focusing on IIoT innovations, and Los Angeles benefits from its diverse industrial base and skilled workforce.

USA Industrial Internet of Things (IIoT) Market Segmentation

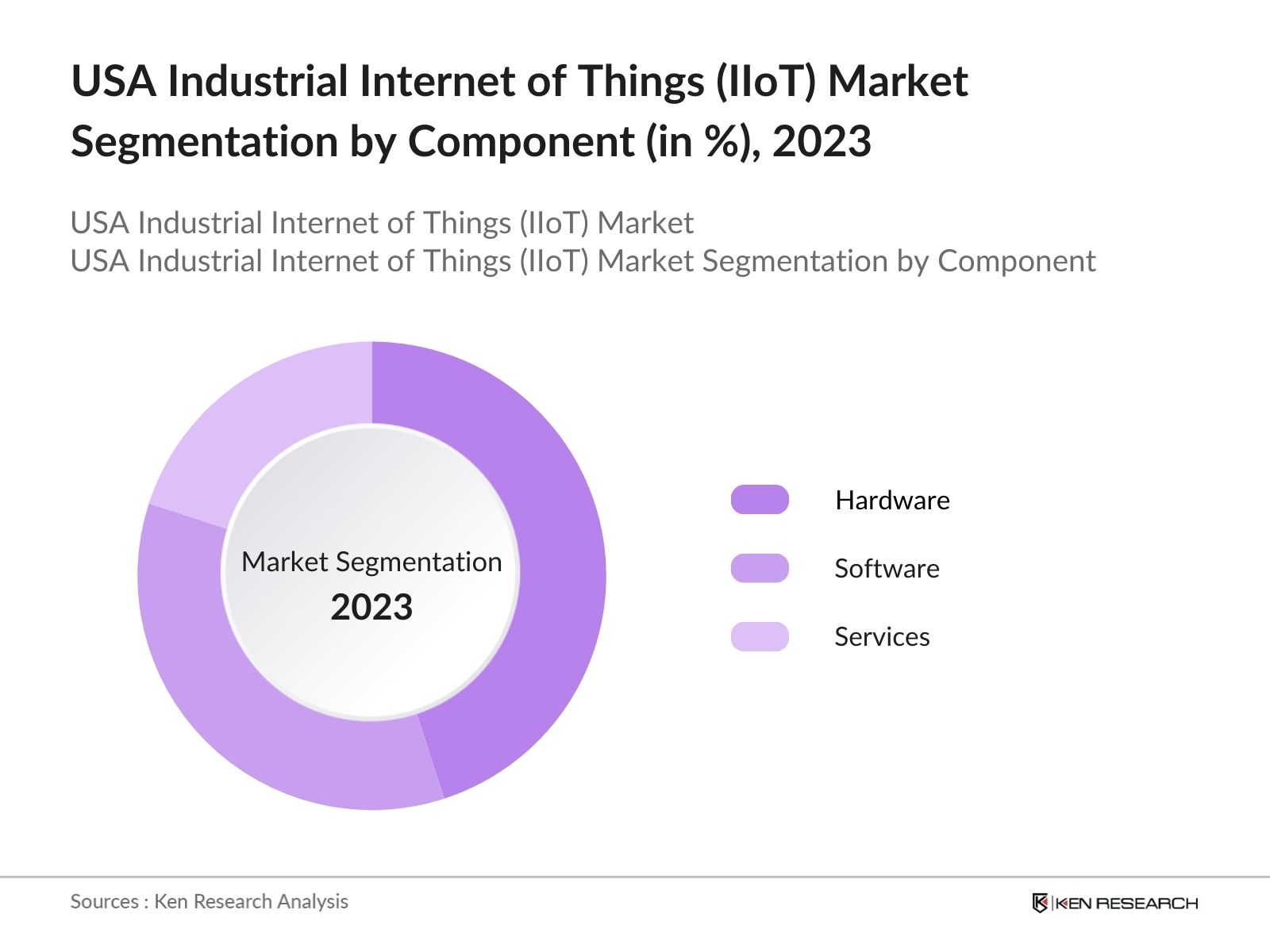

- By Component: The USA Industrial Internet of Things market is segmented by components into hardware, software, and services. In 2023, the hardware segment held the largest market share, driven by the increasing deployment of sensors, actuators, and connectivity devices. The demand for robust and reliable hardware solutions is essential for the effective implementation of IIoT systems.

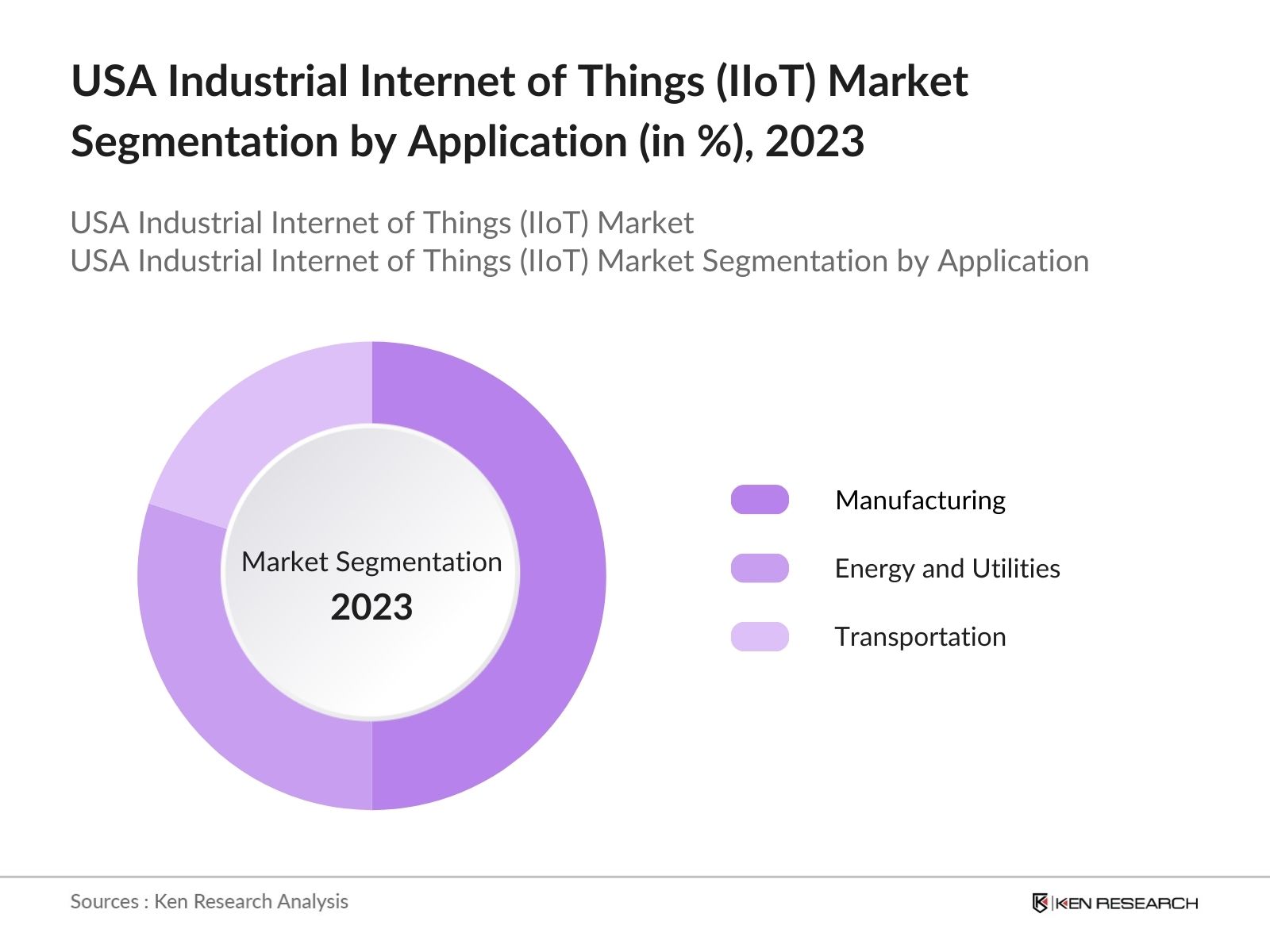

- By Application: The USA Industrial Internet of Things market is segmented by application into manufacturing, energy and utilities, and transportation. In 2023, the manufacturing segment dominated the market, as the adoption of IIoT in manufacturing is driven by the need for operational efficiency, predictive maintenance, and real-time monitoring.

- By Region: The USA Industrial Internet of Things market is segmented by region into North, South, East, and West. In 2023, the Northern region was the market leader because of the strong presence of the manufacturing industry and significant investments in smart manufacturing technologies.

USA Industrial Internet of Things (IIoT) Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

General Electric |

1892 |

Boston, MA |

|

Cisco Systems |

1984 |

San Jose, CA |

|

Intel Corporation |

1968 |

Santa Clara, CA |

|

IBM Corporation |

1911 |

Armonk, NY |

|

Rockwell Automation |

1903 |

Milwaukee, WI |

- General Electric: In recent years, GE has undergone a major restructuring. In 2021, CEO Larry Culp announced plans to split the company into three independent public companies, each focusing on specific sectors: GE Aerospace, GE HealthCare, and GE Vernova (energy). The spin-off of GE HealthCare was completed in January 2023, and GE Vernova is set to launch in April 2024.

- Cisco Systems: In 2024, Cisco partnered with Optus to provide network and data security services, and it became the Official Network Equipment Partner for the LA28 Olympic and Paralympic Games. The partnership includes Cisco-powered secure firewall and managed secure service edge services, as well as additional capabilities such as vulnerability management, advanced email security, and threat hunting.

USA Industrial Internet of Things (IIoT) Industry Analysis

USA Industrial Internet of Things (IIoT) Market Growth Drivers

- Focus on Industry 4.0: The shift towards Industry 4.0, which emphasizes smart factories and automation, is a significant driver of IIoT growth. Companies are increasingly investing in IIoT technologies to enhance operational efficiency, reduce downtime, and optimize production processes through real-time data analytics.

- Emergence of Smart Cities and Infrastructure: The development of smart cities and the integration of IoT in transportation and logistics are expanding the IIoT market. For instance: In 2021, Siemens has committed substantial resources to IIoT, with investments exceeding $1.5 billion in digitalization and smart manufacturing initiatives.

- Integration with Advanced Technologies: In the North American robotics market, total installations in manufacturing rose and reached 41,624 units in 2022, indicating a growing demand for automation. The integration of the Industrial Internet of Things with robotic systems is a transformative development in modern manufacturing and industrial operations.

USA Industrial Internet of Things (IIoT) Market Challenges

- Cybersecurity Risks: In 2024, the Cybersecurity & Infrastructure Security Agency (CISA) has highlighted the significant threat posed by cyber incidents targeting industrial control systems (ICS). CISA's ongoing initiatives emphasize the importance of defending these systems against a growing number of cyber threats, which include various forms of malware and targeted attacks. Specifically, it has been reported that 31% of malware attacks are now targeting industrial systems, indicating a rising trend in such incidents

- Interoperability Issues: A 2024 study by the Industrial Internet Consortium (IIC) revealed that 6 out of every 10 companies encounter significant challenges in integrating Industrial Internet of Things (IIoT) solutions due to compatibility issues. This lack of standardization and interoperability among devices and platforms from different vendors creates critical barriers to seamless data exchange, ultimately diminishing the overall efficiency of IIoT systems.

USA Industrial Internet of Things (IIoT) Market Government Initiatives

- Smart Manufacturing Leadership Coalition: In 2024, the U.S. government launched the Smart Manufacturing Leadership Coalition (SMLC), with a funding of $70 million, to promote the adoption of smart manufacturing technologies. This initiative aims to enhance the competitiveness of the manufacturing sector by integrating IIoT solutions to improve operational efficiency and reduce energy consumption.

- Partnerships and Innovation Centers: In May 2020, NC State University partnered with the Clean Energy Smart Manufacturing Innovation Institute (CESMII) to establish the Smart Manufacturing Innovation Center (SMIC), aimed at advancing digital transformation in manufacturing. In November 2023, the SMIC hosted a workshop that brought together industry professionals to explore advanced technologies like big data analytics, artificial intelligence (AI), and the Internet of Things (IoT).

USA Industrial Internet of Things (IIoT) Market Future Outlook

By 2028, the USA Industrial Internet of Things market will be Growing substantially. The future growth will be driven by advancements in 5G technology, increased focus on smart manufacturing, and the integration of AI and machine learning in industrial operations.

Future Market Trends

- Expansion of Predictive Maintenance Solutions: Predictive maintenance solutions, powered by IIoT, are expected to become more prevalent over the next five years. By 2028, it is estimated that over 10,000 manufacturing plants in the USA will implement predictive maintenance systems, leading to annual savings of USD 15 billion in maintenance costs and unplanned downtime.

- Integration of AI and Machine Learning in IIoT: The integration of artificial intelligence (AI) and machine learning (ML) in IIoT applications will revolutionize industrial operations. By 2028, AI and ML-powered IIoT solutions are projected to improve operational efficiency by 30%, reducing production costs by USD 20 billion annually. These technologies will enable real-time decision-making and predictive analytics, driving significant advancements in industrial automation.

Scope of the Report

|

By Component |

Hardware Software   Services |

|

By Application |

Manufacturing     Energy and Utilities         Transportation |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities who can benefit by Subscribing this Report:

Banks and Financial Institutions

Government Agencies (DOE, DOHS, Federal Communications Commission)

Industrial Equipment Manufacturers

Technology Solution Providers

Telecommunication Companies

Energy and Utility Companies

Transportation and Logistics Firms

Industrial Automation Companies

Cybersecurity Firms

System Integrators

Software Development Companies

Cloud Service Providers

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Continental AG

WABCO Holdings Inc.

Firestone Industrial Products

Hendrickson International

AccuAir Suspension

VB-Airsuspension

Dunlop Systems and Components

Arnott Inc.

Hitachi Automotive Systems

BWI Group

Suncore Industries

ZF Friedrichshafen AG

Mando Corporation

Thyssenkrupp AG

Bilstein GmbH & Co. KG

LORD Corporation

Air Lift Company

RMT Suspension

Reyco Granning

Rubena Automotive

Table of Contents

1. USA Industrial Internet of Things (IIoT) Market Overview

1.1 USA Industrial Internet of Things (IIoT) Market Taxonomy

2. USA Industrial Internet of Things (IIoT) Market Size (in USD Bn), 2018-2023

3. USA Industrial Internet of Things (IIoT) Market Analysis

3.1 USA Industrial Internet of Things (IIoT) Market Growth Drivers

3.2 USA Industrial Internet of Things (IIoT) Market Challenges and Issues

3.3 USA Industrial Internet of Things (IIoT) Market Trends and Development

3.4 USA Industrial Internet of Things (IIoT) Market Government Regulation

3.5 USA Industrial Internet of Things (IIoT) Market SWOT Analysis

3.6 USA Industrial Internet of Things (IIoT) Market Stake Ecosystem

3.7 USA Industrial Internet of Things (IIoT) Market Competition Ecosystem

4. USA Industrial Internet of Things (IIoT) Market Segmentation, 2023

4.1 USA Industrial Internet of Things (IIoT) Market Segmentation by Component (in %), 2023

4.2 USA Industrial Internet of Things (IIoT) Market Segmentation by Application (in %), 2023

4.3 USA Industrial Internet of Things (IIoT) Market Segmentation by Region (in %), 2023

5. USA Industrial Internet of Things (IIoT) Market Competition Benchmarking

5.1 USA Industrial Internet of Things (IIoT) Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. USA Industrial Internet of Things (IIoT) Future Market Size (in USD Bn), 2023-2028

7. USA Industrial Internet of Things (IIoT) Future Market Segmentation, 2028

7.1 USA Industrial Internet of Things (IIoT) Market Segmentation by Component (in %), 2028

7.2 USA Industrial Internet of Things (IIoT) Market Segmentation by Application (in %), 2028

7.3 USA Industrial Internet of Things (IIoT) Market Segmentation by Region (in %), 2028

8. USA Industrial Internet of Things (IIoT) Market Analysts’ Recommendations

8.1 USA Industrial Internet of Things (IIoT) Market TAM/SAM/SOM Analysis

8.2 USA Industrial Internet of Things (IIoT) Market Customer Cohort Analysis

8.3 USA Industrial Internet of Things (IIoT) Market Marketing Initiatives

8.4 USA Industrial Internet of Things (IIoT) Market White Space Opportunity Analysis

Â

Research Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 2 Market Building:

Collating statistics on USA Industrial Internet of Things (IIoT) Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA Industrial Internet of Things (IIoT) industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 4 Research Output:

Our team will approach multiple Industrial Internet of things market companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Industrial Internet of Things (IIoT) industry companies.

Â

Frequently Asked Questions

01 How big is USA Industrial Internet of Things (IIoT) Market?

The U.S. industrial internet of things (IIoT) market has seen significant expansion, with the market reaching a valuation of USD 74 billion in 2023. This growth is driven by advancements in sensor technologies, improved connectivity solutions, and the increasing demand for enhanced operational efficiency across various industries.

02 Who are the major players in the USA Industrial Internet of Things (IIoT) Market?

Key players in the USA Industrial Internet of Things (IIoT) Market include General Electric, Cisco Systems, Intel Corporation, IBM Corporation, and Rockwell Automation. These companies lead the market with their technological expertise, extensive product portfolios, and strategic partnerships.

03 What are the growth drivers of USA Industrial Internet of Things (IIoT) Market?

The USA Industrial Internet of Things (IIoT) Market is driven by increased adoption of automation in manufacturing, the expansion of 5G networks, government support for smart infrastructure, and significant investments in research and development by key market players.

04 What are the challenges in USA Industrial Internet of Things (IIoT) Market?

Challenges in the USA Industrial Internet of Things (IIoT) Market include cybersecurity risks, high initial investment costs, data privacy concerns, and interoperability issues. These challenges can hinder the seamless integration and widespread adoption of IIoT technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.