USA Smart Watches Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD7011

November 2024

81

About the Report

USA Smart Watches Market Overview

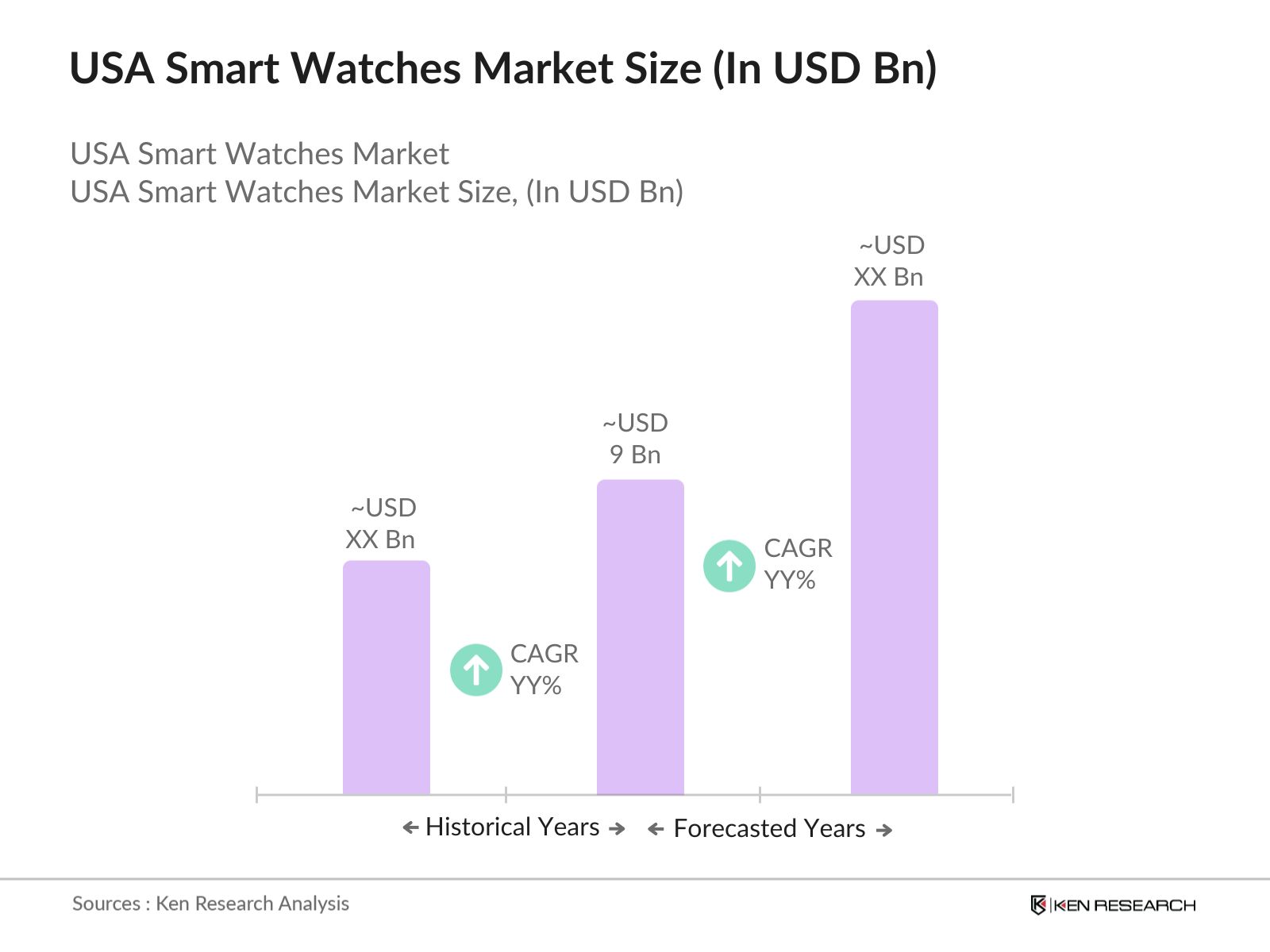

- The USA smart watches market is valued at USD 9 billion, based on a detailed analysis of the last five years, with growth driven primarily by the increasing adoption of health monitoring systems and the expansion of wearable ecosystems by major tech companies. The market has seen substantial consumer interest in devices capable of tracking fitness metrics, providing health insights, and integrating seamlessly with smartphones and IoT ecosystems.

- Dominant regions in the market include major metropolitan areas like New York, Los Angeles, and Chicago, where a combination of high-tech adoption rates, fitness-conscious populations, and strong retail networks has bolstered smart watch sales. These cities lead the market due to their population density, access to cutting-edge technology, and the proliferation of tech-savvy consumers, many of whom prioritize health monitoring and fitness tracking.

- In 2024, the U.S. Department of Health and Human Services launched a program aimed at integrating wearable devices, including smartwatches, into national healthcare programs. This initiative aims to provide wearables to chronic disease patients to reduce hospital visits and facilitate remote health monitoring, encouraging the adoption of smartwatches for health purposes.

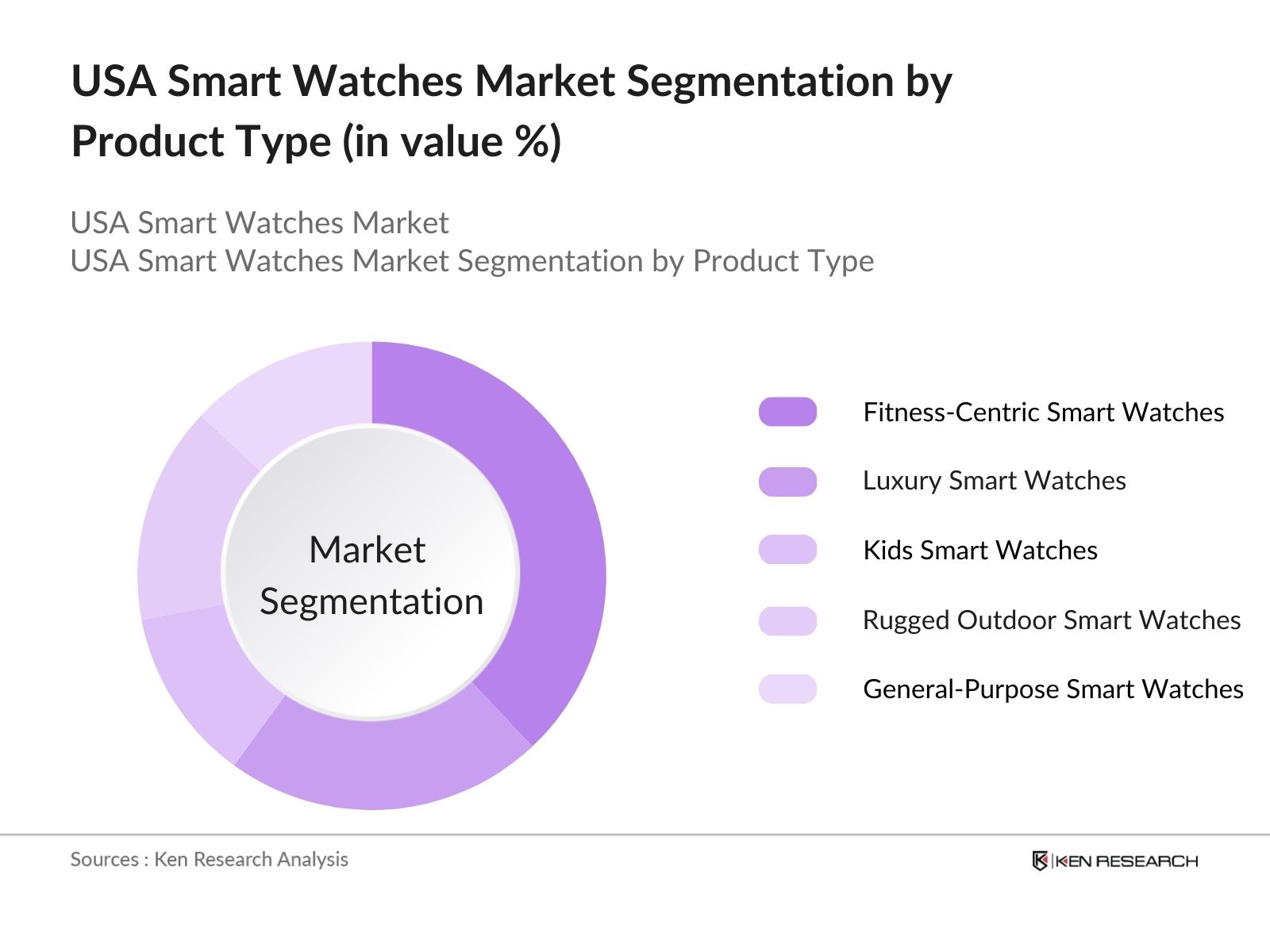

USA Smart Watches Market Segmentation

By Product Type: The market is segmented by product type into fitness-centric smart watches, luxury smart watches, kids smart watches, rugged outdoor smart watches, and general-purpose smart watches. Fitness-centric smart watches hold a dominant share due to the rising health consciousness among consumers and the integration of advanced health monitoring features like heart rate monitoring, ECG, and oxygen saturation.

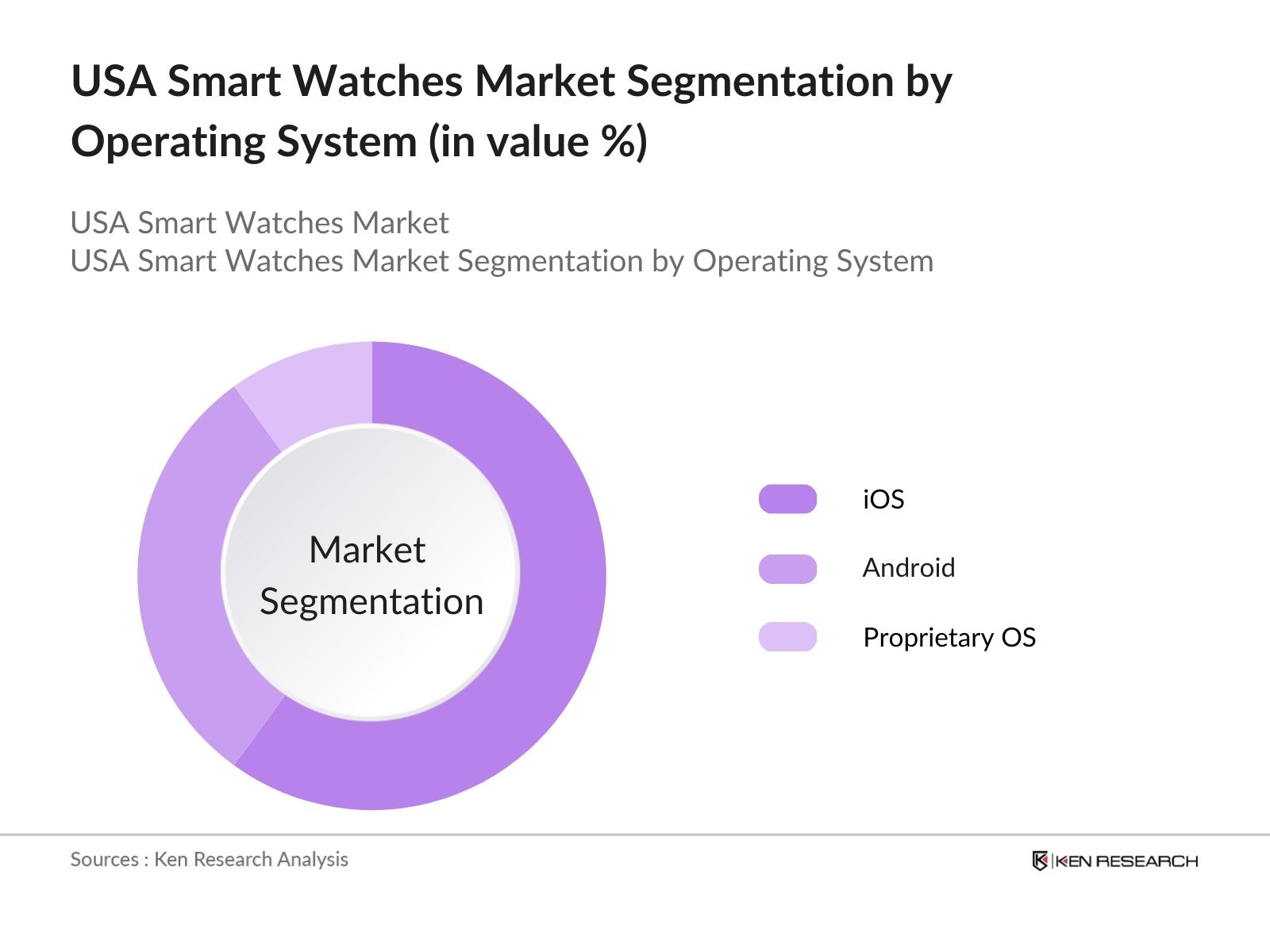

By Operating System: The market are divided by operating systems into iOS, Android, and proprietary OS devices. iOS-based smart watches dominate the market as a result of Apples overwhelming presence. The Apple Watch, with its deep integration into the Apple ecosystem, enjoys a loyal customer base that appreciates its user-friendly interface, reliable performance, and innovative features such as ECG monitoring and cellular connectivity. Apple's strategic focus on combining aesthetics with functionality ensures its continued dominance.

USA Smart Watches Market Competitive Landscape

The market is dominated by global tech giants who have leveraged their expertise in consumer electronics, software ecosystems, and fitness technology to capture market share. These companies emphasize user-centric design, advanced health monitoring, and premium-quality features to cater to both tech enthusiasts and health-conscious individuals.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

R&D Expenditure |

Product Ecosystem |

Number of Employees |

Market Penetration |

Innovation Index |

Customer Satisfaction Rating |

|

Apple Inc. |

1976 |

Cupertino, CA |

|||||||

|

Samsung Electronics Co. Ltd. |

1969 |

Suwon, South Korea |

|||||||

|

Fitbit Inc. (Google) |

2007 |

San Francisco, CA |

|||||||

|

Garmin Ltd. |

1989 |

Schaffhausen, CH |

|||||||

|

Huawei Technologies Co., Ltd. |

1987 |

Shenzhen, China |

USA Smart Watches Market Analysis

Market Growth Drivers

- Increased Health Awareness Among U.S. Consumers: The increasing focus on health and wellness has driven demand for smartwatches with health monitoring features, such as heart rate, blood oxygen levels, and sleep patterns. According to a national health survey conducted in 2024, over 50 million Americans reported regularly using technology to monitor their health.

- Expansion of Sports and Fitness Industry: The U.S. sports and fitness industry has seen a substantial rise, with over 64 million people actively participating in fitness activities in 2024, according to data from the National Fitness and Health Foundation. The increased focus on fitness has led to a parallel rise in the demand for smartwatches, especially those that offer fitness tracking capabilities such as calorie burn, steps taken, and exercise modes.

- Telehealth Integration: The integration of smartwatches into telehealth systems is growing, with major healthcare providers in the U.S. offering smartwatch-enabled monitoring services to their patients. As of 2024, the U.S. healthcare system had over 30 million telehealth consultations, and a portion of this is supported by wearable devices, including smartwatches. This trend is increasing smartwatch adoption for health monitoring and medical consultations.

Market Challenges

- Battery Life and Charging Convenience: One of the primary challenges in the U.S. smartwatches market remains battery life. In 2024, a consumer survey showed that nearly 40 million smartwatch users in the U.S. cited frequent charging as a significant issue, especially for devices with advanced features like GPS tracking or continuous health monitoring. This challenge affects user satisfaction and leads to higher attrition rates.

- Data Privacy and Security Concerns: The increasing amount of personal health data collected by smartwatches has raised concerns about data privacy and security. In 2024, the Federal Trade Commission (FTC) received over 20,000 complaints related to breaches of personal health data from wearable devices, reflecting a growing unease among consumers. This concern may hinder the adoption of smartwatches, especially for health-related applications.

USA Smart Watches Market Future Outlook

The USA smart watches industry is expected to experience strong growth over the next five years, driven by an increasing emphasis on health monitoring and fitness tracking, along with advancements in smart wearable technology. Consumer demand is anticipated to rise as more individuals focus on health data management, biometric insights, and real-time feedback through smart watches.

Future Market Opportunities

- Expansion of 5G Connectivity: By 2029, smartwatches in the U.S. are expected to benefit from widespread 5G connectivity, which will enable faster data transfer and more seamless integration with other smart devices. This advancement will enhance features like real-time health monitoring, streaming, and communication capabilities, making smartwatches more versatile and integral to daily life.

- Increased Adoption of Circular Economy Practices: Smartwatch manufacturers in the U.S. will increasingly adopt circular economy models by 2029, offering recycling programs and focusing on sustainability in production. This shift will be driven by increasing regulatory pressures and consumer demand for eco-friendly products, as environmental consciousness grows among the American population.

Scope of the Report

|

By Product Type |

Fitness-Centric Smart Watches Luxury Smart Watches Kids Smart Watches Rugged Outdoor Smart Watches General-Purpose Smart Watches |

|

By Operating System |

iOS Android Proprietary OS |

|

By End-User Demographics |

Male Users Female Users Kids Seniors |

|

By Distribution Channel |

Online Channels Offline Retail (Branded Stores, Specialty) |

|

By Feature Set |

Health Monitoring Features Fitness Tracking Features Communication Capabilities Payment System Integration Environmental Sensors |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Smart Wearable Manufacturers

Healthcare Providers (Hospitals and Clinics)

Retailers (Specialty Electronics Stores, E-commerce Platforms)

Telecom Companies

Fitness Service Providers (Gyms, Personal Training Businesses)

Government and Regulatory Bodies (FDA, FCC)

Investors and Venture Capital Firms

Health Insurance Companies

Companies

Players Mentioned in the Report:

Apple Inc.

Samsung Electronics Co. Ltd.

Fitbit Inc. (Owned by Google)

Garmin Ltd.

Huawei Technologies Co., Ltd.

Fossil Group Inc.

Xiaomi Corporation

Suunto Oy

Withings

Polar Electro Oy

Table of Contents

USA Smart Watches Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Smart Wearable Penetration, Fitness Integration, Wellness Features)

1.4. Market Segmentation Overview

USA Smart Watches Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

USA Smart Watches Market Analysis

3.1. Growth Drivers (Smart Features Integration, Health Monitoring, Connected Ecosystems)

3.1.1. Rising Health Awareness

3.1.2. Expanding Consumer Electronics Ecosystem

3.1.3. Government Initiatives for Digital Health (National Health Policies, Telemedicine Growth)

3.1.4. Increasing Fitness Enthusiasm Among Millennials

3.2. Market Challenges (Technology Integration, Market Saturation)

3.2.1. Short Product Lifecycle

3.2.2. Battery Life and Charging Issues

3.2.3. Data Privacy and Cybersecurity Concerns

3.2.4. High Cost of Advanced Models

3.3. Opportunities (Health Insurance Partnerships, Enterprise Applications)

3.3.1. Adoption in Corporate Wellness Programs

3.3.2. Integration with Telemedicine Solutions

3.3.3. Potential in Elderly Care

3.3.4. Smartwatch Applications Beyond Health (Finance, Communication)

3.4. Trends (AI-Driven Health Analytics, Biometric Advancements)

3.4.1. Artificial Intelligence for Health Insights

3.4.2. Expanded Use of Wearable Payment Systems

3.4.3. Enhanced Sleep and Stress Monitoring

3.4.4. Smart Watches for Outdoor and Extreme Sports

3.5. Government Regulations (Data Protection Laws, Health Device Certifications)

3.5.1. FDA Regulations on Health Devices

3.5.2. FCC Certification for Wireless Communication Devices

3.5.3. HIPAA Compliance for Health Data

3.5.4. State-Level Privacy Regulations (e.g., CCPA)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

USA Smart Watches Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Fitness-Centric Smart Watches

4.1.2. Luxury Smart Watches

4.1.3. Kids Smart Watches

4.1.4. Rugged Outdoor Smart Watches

4.1.5. General-Purpose Smart Watches

4.2. By Operating System (In Value %)

4.2.1. iOS

4.2.2. Android

4.2.3. Proprietary OS

4.3. By End-User Demographics (In Value %)

4.3.1. Male Users

4.3.2. Female Users

4.3.3. Kids

4.3.4. Seniors

4.4. By Distribution Channel (In Value %)

4.4.1. Online Channels

4.4.2. Offline Retail (Branded Stores, Specialty Electronics)

4.5. By Feature Set (In Value %)

4.5.1. Health Monitoring Features

4.5.2. Fitness Tracking Features

4.5.3. Communication Capabilities

4.5.4. Payment System Integration

4.5.5. Environmental Sensors

4.6. By Region (In Value %)

4.6.1. North

4.6.2. East

4.6.3. Wast

4.6.4. South

USA Smart Watches Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Apple Inc.

5.1.2. Samsung Electronics Co. Ltd.

5.1.3. Fitbit Inc. (Owned by Google)

5.1.4. Garmin Ltd.

5.1.5. Fossil Group Inc.

5.1.6. Huawei Technologies Co., Ltd.

5.1.7. Xiaomi Corporation

5.1.8. Suunto Oy

5.1.9. Withings

5.1.10. Polar Electro Oy

5.1.11. Casio Computer Co., Ltd.

5.1.12. Mobvoi Information Technology Company Limited (TicWatch)

5.1.13. Skagen Denmark

5.1.14. Zepp Health (Amazfit)

5.1.15. Fitbit Luxe

5.2. Cross Comparison Parameters (Market Share, R&D Expenditure, Software Ecosystem, Sensor Accuracy, Product Design, Price Positioning, Innovation Index, Customer Satisfaction)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Collaborations, Product Launches)

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

USA Smart Watches Market Regulatory Framework

6.1. Data Security Requirements (GDPR, HIPAA Compliance)

6.2. Health Device Compliance (FDA, ISO Standards)

6.3. Wireless Communication Standards (FCC)

6.4. E-Waste Management Guidelines

USA Smart Watches Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

USA Smart Watches Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Operating System (In Value %)

8.3. By End-User Demographics (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Feature Set (In Value %)

8.6. By Region (In Value %)

USA Smart Watches Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this step, the research began by mapping the key stakeholders in the USA smart watches market. Desk research was conducted, gathering comprehensive data from various proprietary databases, public resources, and market research reports to determine the critical variables influencing market growth, including technological advancements, consumer behavior, and competitive strategies.

Step 2: Market Analysis and Construction

Historical market data was compiled and analyzed to assess the penetration of smart watches in the USA, particularly in fitness and healthcare. A detailed analysis of the sales channels, including both online and offline retail, was carried out to provide an accurate estimation of revenue generation. These insights were cross-validated with industry-level statistics from credible sources.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market trends, competitive positioning, and user adoption were developed. These were validated through consultations with industry experts, focusing on smartwatch product segments, user preferences, and key operational data. These consultations, conducted via CATI interviews, provided on-the-ground insights to refine the analysis.

Step 4: Research Synthesis and Final Output

The final step synthesized all collected data into a comprehensive report. This phase included direct interviews with manufacturers and suppliers to corroborate market forecasts and validate bottom-up estimates. The goal was to ensure a reliable, accurate, and detailed view of the market dynamics, ready for presentation to business professionals.

Frequently Asked Questions

01. How big is the USA Smart Watches Market?

The USA smart watches market is valued at USD 9 billion and is driven by increasing consumer demand for fitness tracking, health monitoring, and enhanced integration with smartphones.

02. What are the challenges in the USA Smart Watches Market?

Challenges in the USA smart watches market include issues related to battery life, data privacy concerns, and the high cost of premium smart watches, which can limit their accessibility to broader demographics.

03. Who are the major players in the USA Smart Watches Market?

Major players in the USA smart watches market include Apple Inc., Samsung Electronics Co. Ltd., Fitbit Inc. (Google), Garmin Ltd., and Huawei Technologies Co., Ltd. These companies lead due to their extensive product ecosystems and innovation in health monitoring features.

04. What are the growth drivers of the USA Smart Watches Market?

Growth drivers in the USA smart watches market include the rising health consciousness among consumers, increasing adoption of fitness tracking technologies, and the expansion of digital health platforms, which are being integrated into daily wearables.

05. What trends are shaping the future of the USA Smart Watches Market?

Trends in the USA smart watches market include the increasing integration of AI for health analytics, biometric advancements, and the use of wearable devices in corporate wellness programs and medical diagnostics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.